- Home

- »

- Consumer F&B

- »

-

Functional Protein Market Size, Share & Trends Report, 2030GVR Report cover

![Functional Protein Market Size, Share & Trends Report]()

Functional Protein Market (2024 - 2030) Size, Share & Trends Analysis Report, By Product, By Source (Animal Based, Plant Based), By Form (Dry, Liquid), By Application, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-894-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Functional Protein Market Summary

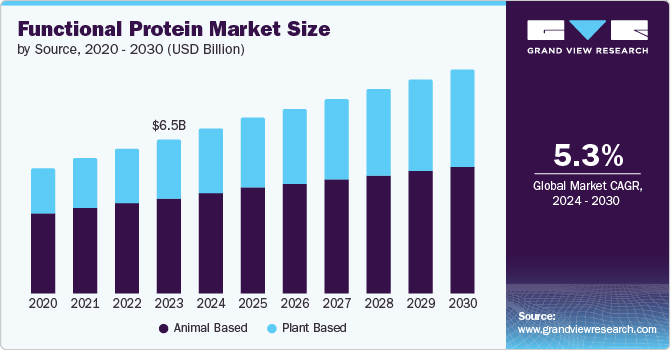

The global functional protein market size was estimated at USD 6.5 billion in 2023 and is projected to reach USD 9.48 billion by 2030, growing at a CAGR of 5.3% from 2024 to 2030. The demand for functional proteins is increasing as food and beverage manufacturers create products with targeted health advantages, such as boosting the immune system and aiding muscle recovery.

Key Market Trends & Insights

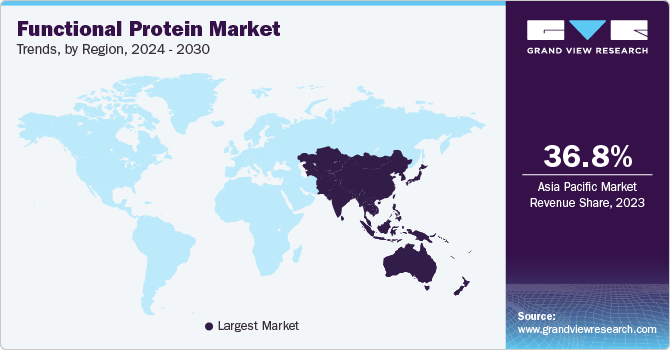

- Asia Pacific region accounted for the largest revenue share of 36.8% in 2023.

- Indian market is expected to witness significant growth over the forecast period.

- Based on product, the whey protein concentrates segment dominated the market and accounted for a share of 28.9% in 2023.

- Based on source, the animal-based segment held the largest revenue share in 2023.

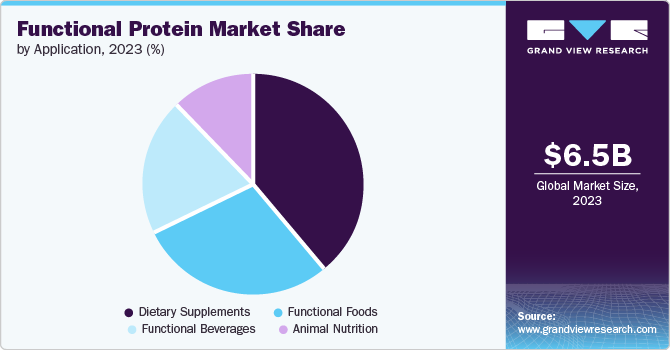

- Based on application, dietary supplements segment accounted for the largest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 6.5 Billion

- 2030 Projected Market Size: USD 9.48 Billion

- CAGR (2024-2030): 5.3%

- Asia Pacific: Largest market in 2023

The rising awareness regarding proper digestion and fitness contributes to improved diet and overall health, driving the demand for the global functional protein market.

The increasing occurrence of long-term conditions such as diabetes, hypertension, and obesity is leading to greater focus on preventive healthcare. In 2021, the adult population from 20-79 years had diabetes, and in 2022, 2.5 billion adults above 18 years were overweight. Foods containing functional proteins can improve health conditions, increasing consumer interest in proactive health solutions. The growing interest in fitness and active lifestyles fuels the demand for high-protein and fiber-containing products. Functional proteins, particularly whey protein and plant-based alternatives, are suitable for athletes and fitness enthusiasts seeking to achieve their fitness goals.

Vegetarianism is a dietary choice driven by various factors, including environmental concerns and health benefits. Vegetarians avoid meat and sometimes other animal products, such as dairy and eggs, while some vegans also exclude all animal-derived foods and products. These dietary lifestyles have gained significant global attention, driven by growing awareness of animal welfare issues, sustainability challenges in animal agriculture, and concerns about the environmental footprint of meat production. Additionally, the rise of protein-integrated beverages, cookies, and bars has created convenient ways for consumers to integrate functional proteins into their daily routines. For instance, in June 2024, Strive Nutrition partnered with Singapore’s TurtleTree and announced an animal-free lactoferrin called LF+ through precision fermentation. This protein is a certified vegan and can bind iron, which improves red blood cell production.

Product Insights

The whey protein concentrates segment dominated the market and accounted for a share of 28.9% in 2023. Whey protein concentrates are valued for their high nutritional value and excellent amino acid profile, driving the demand for athletes, fitness enthusiasts, and individuals seeking to enhance muscle growth and recovery. Additionally, the growing trend towards convenience and functional foods has increased the innovation in whey protein-based products. Ready-to-drink protein beverages, protein-enriched snacks, and compact protein solutions are gaining adoption by busy consumers looking for convenient ways to meet their daily protein needs. For instance, in February 2024, Vivici launched nature-identical whey protein using precision fermentation. The protein is an isolate of beta-lactoglobulin, the primary whey protein in cow’s milk. It includes all amino acids the human body requires and has high leucine and branched-chain amino acids. It is free of lactose, hormones, cholesterol, and antibiotics.

Soy Protein is anticipated to witness the fastest CAGR over the forecast period. Compared to animal-derived proteins, soy protein contains high-quality protein content and excellent amino acids, necessary for human health, making it a complete protein source suitable for individuals following vegetarian, vegan, or plant-based diets. This nutritional value positions soy protein as a beneficial option for meeting protein needs across various consumer demographics, including athletes, vegetarians, and health-conscious individuals. These combined factors are driving the demand for soy protein in the global market.

Source Insights

Based on the source, the animal-based segment held the largest revenue share in 2023. Animal-based proteins, such as whey protein, casein, collagen, and egg white protein, are rich sources of bioavailable nutrients, including minerals and vitamins such as B12, riboflavin, calcium, and iron. These nutrients are essential for various physiological functions, including energy metabolism, immune support, and bone health. Animal-based functional foods, such as protein-enriched dairy beverages or collagen-infused snacks, fulfill consumers' demand for balanced nutrition without compromising taste or convenience, resulting in market growth.

The plant-based protein segment is anticipated to witness the fastest CAGR over the forecast period. Proteins extracted from sources such as soy, peas, rice, hemp, and chickpeas offer vegetarian consumers a possible alternative to animal-based proteins. These proteins are often lower in saturated fat and cholesterol, providing essential nutrients, fiber, and phytonutrients beneficial for overall health. For instance, in November 2023, Relsus, a Singapore-based food technology company, launched its premium plant-based protein powders in India. The launch aims to combat India’s protein deficiency and reduce dependence on imported protein by facilitating high-quality local production.

Form Insights

Dry form held the largest revenue share in 2023. Dry protein powders are less expensive to manufacture, package, and transport, reducing costs for producers and distributors and making dry protein a convenient form of protein in terms of logistics. The dry form comes with a longer shelf life, minimizing spoilage and waste throughout the supply chain, enhancing product viability for manufacturers, and ensuring a wider availability for consumers. Dry protein powder offers versatility by incorporating it into various food and beverage products. It can be easily added to shakes and cookies, allowing for innovation and application in the functional food and beverage industry.

The liquid protein segment is anticipated to witness the fastest CAGR over the forecast period. Liquid protein is incorporated into smoothies, protein shakes, yogurt, and baking applications, providing convenient and easily digestible sources of high-quality protein. The convenience of liquid protein products makes them ideal for busy lifestyles, health-conscious individuals, and older adults who require protein for muscle maintenance and recovery, contributing to their market growth. In January 2024, Suja Organic announced the launch of Suja Organic Protein Shakes, including three flavors such as vanilla cinnamon, chocolate, and coffee beans. This new line of ready-to-drink (RTD) beverages offers 16g of plant-based pea, rice, and hemp protein, providing convenient and transparent nutrition from plants.

Application Insights

Dietary supplements accounted for the largest revenue share in 2023. Dietary supplements contain specific amounts of vitamins, herbs, minerals, enzymes, amino acids, and other essential macro- and micronutrients. As people become more aware of the benefits of maintaining a balanced diet and regular exercise, there is a growing interest in dietary supplements supporting overall health. Functional protein supplements aid in muscle building, weight management, and recovery. Dietary supplements provide a concentrated source of protein, allowing targeted intake of specific protein types and desired quantities. Compact and portable forms of protein supplements, such as protein bars, ready-to-drink shakes, and single-serving sachets, are driving its demand in the market.

The functional beverage segment is expected to witness the fastest CAGR over the forecast period. Functional beverages, including protein, are in demand among health-conscious individuals, enhancing their nutritional intake without compromising convenience. Consumers are increasingly turning to protein-included beverages such as protein shakes, smoothies, and ready-to-drink (RTD) protein drinks as a convenient way to meet their daily protein requirements. In March 2024, REBBL introduced AWAKE+ PROTEIN. This new lineup has three flavors, each with 10 grams of plant-powered protein. These caffeine-fueled functional lattes also include the benefits of Lion's Mane mushroom extract.

Regional Insights

North America is expected to witness significant CAGR over the forecast period. The North American functional protein market is well-established, as consumers greatly emphasize health and preventive measures daily. This leads to a strong interest in functional foods and dietary supplements that offer benefits beyond essential nutrition, including protein sources that support weight management, muscle health, and overall healthy life. North America has leading manufacturers and distributors of functional protein ingredients and finished products, such as Cargill, Amway, and Abbott Nutrition. This established industry base enables innovation and product development, keeping the region at the forefront of the functional protein market.

The U.S. market is expected to witness significant growth over the forecast period. Increasing consumer awareness and demand for products with health benefits, such as functional foods, dietary supplements, and proteins, drive market growth. Functional proteins aid athletes and fitness enthusiasts by building muscle health, supporting immunity, and weight management, aligning with consumer preferences for natural and functional ingredients. For instance, in November 2023, Barebells launched a banana flavor protein bar in the U.S. market. The protein bar contains no added sugar and provides 16g of protein per serving. Additionally, celebrities often endorse functional protein products, leveraging their influence and popularity to endorse specific brands or products. Their endorsement can significantly enhance brand visibility and credibility among their fan base and the general public.

Asia Pacific Functional Protein Market Trends

Asia Pacific region accounted for the largest revenue share of 36.8% in 2023. Asia Pacific functional protein market growth is attributed to the rapid economic growth in the region, leading to urbanization and health awareness. Growing awareness is driven by various factors, including increased access to information through the Internet and social media, government health campaigns, and the influence of global health and wellness trends, fueling the demand for functional protein products. Additionally, the awareness and shift towards fitness are leading to the region's large population increase in the demand for food and nutritional products, including functional proteins.

Indian market is expected to witness significant growth over the forecast period. Indian consumers are becoming more conscious of the importance of a balanced diet and regular exercise. Functional protein beverages, which can be easily consumed while commuting, at work, or post-workout, provide a practical solution for busy individuals. These beverages' portability and ease of consumption make them a reliable option for a quick and nutritious boost during their busy schedules, further driving the market growth.

The Chinese market is expected to witness significant growth over the forecast period. In China, E-commerce and digital platforms have changed consumer access to functional protein products. The country's e-commerce sector, including platforms such as Alibaba's Tmall and JD.com, provides consumers convenient access to various protein supplements and fortified foods. This digital infrastructure facilitates direct-to-consumer sales, enabling brands to reach a broader audience and educate consumers about the benefits of functional proteins through targeted marketing campaigns and online influencers.

Middle East And Africa Functional Protein Market Trends

The Middle East and Africa region is expected to witness the fastest CAGR over the forecast period. The functional protein market is experiencing growth in the Middle East region, driven by increasing consumer awareness of health and wellness benefits associated with protein consumption. As lifestyles shift towards healthier choices, there's a rising demand for protein-rich foods and supplements. This trend is particularly pronounced in countries with a growing middle class with disposable income, leading to greater spending on dietary supplements and functional foods that promote fitness and healthy life.

UAE is expected to witness significant CAGR over the forecast period. The UAE, facing limited agricultural resources and a growing population, is increasingly focused on ensuring food security by adopting alternative protein sources. This concern drives toward functional proteins, which offer a sustainable and efficient solution to fulfill the country's nutritional needs. Additionally, international companies entering the UAE market for functional proteins are significantly driving its growth. These companies bring advanced technologies and innovative products, catering to the rising consumer demand for high-quality protein supplements and functional foods. Introducing various protein sources, including plant-based and lab-grown proteins, enhances the market's diversity and growth. For instance, in November 2023, Planted, a Swiss-based alternative protein startup, is set to launch in the UAE food service market following its success in Dubai. Its product will be served in the market, including hotels, restaurants, cafes, QSRs, sub-distributors, wholesalers, and entertainment.

Key Functional Protein Company Insights

Some key companies in the functional protein market include Abbott Nutrition; Kerry Group; and Fonterra Co-operative Group.

-

Abbott Nutrition offers a broad spectrum of products under various categories such as based on age, feeding route, product form (bar, liquid, powder), and dietary considerations. They offer medical food recipes catering to the needs of individuals with specific conditions.

-

Kerry Group offers functional foods in the dairy and non-dairy segment. Its broad spectrum of products includes plant-based as well as dairy-based food solutions, readymade and frozen foods, and meat and meat-based foods. Besides human consumption needs, they also operate in the animal and pet nutrition segment.

Key Functional Protein Companies:

The following are the leading companies in the functional protein market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott Nutrition

- Amway Corporation

- Archer Daniels Midland Company

- Arla Foods Ingredients Group P/S

- Cargill, Incorporated

- DuPont de Nemours, Inc.

- Fonterra Co-operative Group

- FrieslandCampina

- Glanbia plc

- Kerry Group

Recent Developments

-

In May 2024, REBBL, the organic and plant-based functional beverage brand, launched a new category called "Smoothie Starter." It is available in oat milk and coconut milk varieties and provides 20g of plant-based protein, along with zinc and postbiotics to support gut health.

-

In June 2024, the Food Innovation Laboratory at the University of the Free State (UFS) in South Africa launched a new range of protein-based products, including soy-based dairy alternatives. This initiative is a major effort to address food insecurity in the country by offering high-protein and affordable snacks and dairy substitutes made from locally sourced soybeans.

-

In December 2022, Mars launched a protein bar that combines the classic SNICKERS flavors with 20 grams of added protein. The bar is designed to provide a convenient and tasty way to incorporate protein into a consumer's diet.

Functional Protein Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.97 billion

Revenue Forecast in 2030

USD 9.48 billion

Growth Rate

CAGR of 5.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, source, form, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; Australia; South Korea; India; New Zealand; Brazil; Argentina; South Africa; UAE

Key companies profiled

Abbott Nutrition; AMCO Proteins; Amway Corporation; Archer Daniels Midland Company; Arla Foods Ingredients Group P/S; Cargill, Incorporated; DuPont de Nemours, Inc.; Fonterra Co-operative Group; FrieslandCampina; Glanbia plc; Kerry Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Functional Protein Market Report Segmentation

This report forecasts revenue growth at global, regional, & country levels, and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global functional protein market based on product, source, form, application, and region.

-

Product Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Hydrolysates

-

Whey Protein Concentrates

-

Whey Protein Isolates

-

Casein & Caseinates

-

Soy Protein

-

Others

-

-

Source Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Animal Based

-

Plant Based

-

-

Form Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Dry

-

Liquid

-

-

Application Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Functional Foods

-

Functional Beverages

-

Dietary Supplements

-

Animal Nutrition

-

-

Regional Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

India

-

China

-

Australia

-

New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.