- Home

- »

- Renewable Chemicals

- »

-

Furfuryl Alcohol Market Size & Share, Industry Report, 2030GVR Report cover

![Furfuryl Alcohol Market Size, Share & Trends Report]()

Furfuryl Alcohol Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Resins, Solvents, Corrosion Inhibitors), By End-use (Foundry, Agriculture, Food & Beverages), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-483-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Furfuryl Alcohol Market Size & Trends

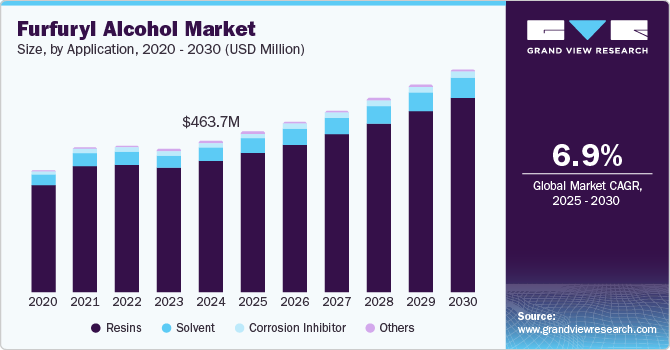

The global furfuryl alcohol market size was estimated at USD 463.7 million in 2024 and is expected to grow at a CAGR of 6.9% from 2025 to 2030. This growth is attributed to the increasing demand from diverse industries, particularly in foundry applications, and the production of eco-friendly resins is a primary catalyst. In addition, the shift towards sustainable practices and using renewable agricultural byproducts, such as sugarcane bagasse and corn cobs, enhance its appeal. Furthermore, the pharmaceutical sector's rising use of furfuryl alcohol for synthesizing intermediates further supports market expansion. This combination of industrial demand and sustainability trends positions furfuryl alcohol as vital in various applications.

Furfuryl alcohol is an organic compound derived from furfural obtained from agricultural residues such as corncobs and rice husks. Owing to its versatile applications, furfuryl alcohol is gaining traction in various industries. Its primary use lies in producing furan resins, which are crucial for crafting foundry molds and cores for precision metal casting. The automotive and aerospace sectors particularly drive this demand, requiring lightweight and durable metal components.

In addition, the burgeoning construction industry significantly contributes to the market, as increased infrastructure development necessitates a higher volume of metal castings that utilize furfuryl alcohol-based resins. Furthermore, the growing emphasis on eco-friendly products presents new opportunities for furfuryl alcohol, given its renewable origins. As industries seek sustainable alternatives to traditional petrochemical materials, furfuryl alcohol aligns perfectly with this trend.

Moreover, advancements in resin technology enhance its appeal across various sectors by improving performance characteristics such as thermal stability and durability. This innovation opens doors for furfuryl alcohol in demanding applications within the aerospace and automotive industries, where efficiency and performance are paramount.

Application Insights

The resin applications segment dominated the market and accounted for the largest revenue share of 86.9% in 2024 attributed to the increased demand for plastics across various sectors, including automotive, construction, and packaging. In addition, as industries strive for lightweight and durable materials, furfuryl alcohol-based resins are increasingly utilized to produce high-performance components. Furthermore, the construction industry's expansion necessitates robust adhesives and coatings, further boosting the demand for these resins.

The solvents segment is expected to grow at a CAGR of 7.4% from 2025 to 2030, owing to increasing environmental awareness and a shift towards sustainable solutions. In addition, as industries seek eco-friendly alternatives to traditional solvents, furfuryl alcohol's bio-based origins make it an attractive option. Furthermore, the increased focus on regulatory compliance regarding volatile organic compounds (VOCs) drives demand for low-emission solvents.

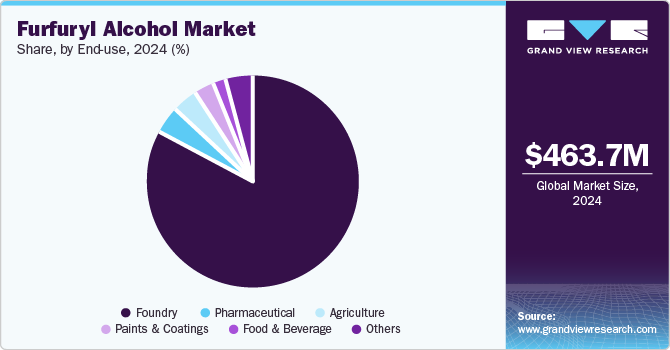

End-use Insights

The foundry segment dominated the market and accounted for the largest revenue share of 83.2% in 2024 attributed to its crucial role in producing high-performance furan resins for making sand molds and cores. In addition, these molds are essential for precision metal casting, which is vital in industries such as automotive and aerospace. As these sectors expand, the demand for durable and lightweight metal components increases, leading to a higher consumption of furfuryl alcohol. Furthermore, the trend towards sustainable manufacturing practices enhances its appeal as a renewable resource, further propelling market growth.

The pharmaceutical segment is expected to grow at a CAGR of 6.6% over the forecast period, owing to its applications in synthesizing various chemical intermediates and active pharmaceutical ingredients. In addition, the increasing focus on developing innovative drug formulations and the rise in healthcare expenditures drive this growth. Furthermore, as the pharmaceutical industry seeks more eco-friendly and bio-based alternatives, furfuryl alcohol's renewable nature makes it an attractive option.

Regional Insights

Asia Pacific furfuryl alcohol market dominated the global market and accounted for the largest revenue share of 69.1% in 2024 attributed to its robust industrial landscape and increasing demand from various sectors. In addition, the region's strong automotive industry drives the need for high-performance furan resins used in metal casting applications. Furthermore, abundant agricultural byproducts, such as corncobs and rice husks, support the production of furfuryl alcohol.

The furfuryl alcohol market in China led the Asia Pacific market and accounted for the largest revenue share in 2024. The country's extensive manufacturing base and rapid industrialization contributed to the rising demand for furfuryl alcohol, particularly in the foundry and pharmaceutical sectors. Furthermore, China's focus on developing eco-friendly materials aligns with the increasing adoption of bio-based chemicals. Moreover, the combination of high production capacity and growing industries solidifies China's position as a key player in driving market growth.

Middle East & Africa Furfuryl Alcohol Market Trends

The Middle East and Africa furfuryl alcohol market is expected to grow at the fastest CAGR of 6.3% from 2025 to 2030, owing to increasing industrial activities and investments in chemical manufacturing. In addition, the region's growing construction and automotive sectors drive demand for durable materials, including furan resins. Furthermore, the emphasis on sustainable practices also prompts manufacturers to explore bio-based alternatives such as furfuryl alcohol.

Europe Furfuryl Alcohol Market Trends

The furfuryl alcohol market growth in Europe accounted for a significant revenue share of in 2024, driven by stringent environmental regulations and a shift towards sustainable products. The region's established chemical industry is increasingly adopting bio-based materials, with furfuryl alcohol being preferred owing to its renewable nature. Furthermore, rising demand from automotive, construction, and pharmaceutical industries supports market expansion. Moreover, European manufacturers are also investing in research and development to enhance resin technologies, further driving the adoption of furfuryl alcohol.

Germany furfuryl alcohol market led the European market and is expected to grow significantly over the forecast period, owing to the country's strong automotive sector demands for lightweight materials, increasing the use of furan resins for metal casting applications. Furthermore, Germany's commitment to sustainability and innovation encourages the adoption of bio-based chemicals such as furfuryl alcohol. Moreover, as manufacturers seek to comply with environmental regulations while maintaining high-performance standards, Germany's market for furfuryl alcohol is poised for growth.

North America Furfuryl Alcohol Market Trends

The furfuryl alcohol market in North America is expected to experience notable growth, driven by an increasing focus on sustainability and eco-friendly practices. In addition, the region's automotive industry is shifting towards lightweight materials that enhance fuel efficiency, thereby boosting demand for furan resins derived from furfuryl alcohol. Moreover, regulatory pressures regarding volatile organic compounds (VOCs) encourage manufacturers to adopt bio-based alternatives. This trend positions furfuryl alcohol as a viable solution across various applications, fostering its growth in North America.

U.S. Furfuryl Alcohol Market Trends

The growth of U.S. furfuryl alcohol market is fueled by its applications in pharmaceuticals and foundry industries. In addition, the country’s emphasis on innovation and sustainability drives interest in bio-based chemicals that align with environmental goals. Moreover, ongoing advancements in resin technologies are expanding the scope of furfuryl alcohol usage across multiple sectors. As U.S. manufacturers increasingly prioritize eco-friendly solutions, the market for furfuryl alcohol is set to expand significantly in response to these trends.

Key Furfuryl Alcohol Company Insights

Some of the key players in the market include Linzi Organic Chemical Inc. Ltd., TransFurans Chemicals bvba, DalinYebo, and others. These companies are adopting various strategies to enhance their competitive edge. Strategies include new product development and innovative formulations that meet evolving industry standards and customer needs. In addition, strategic partnerships and agreements are also crucial, enabling companies to leverage complementary strengths, share resources, and expand their market reach. Furthermore, mergers and acquisitions are employed to consolidate market presence, diversify product portfolios, and improve operational efficiencies.

-

TransFurans Chemicals bvba specializes in producing furfuryl alcohol, focusing on sustainable and innovative chemical solutions derived from agricultural byproducts. The company operates primarily in the chemical manufacturing segment, providing high-quality furfuryl alcohol for various applications, including resins and adhesives.

-

DalinYebo produces furfuryl alcohol through innovative processes that emphasize efficiency and sustainability. The company operates in the chemical sector, specifically synthesizing furfuryl alcohol from renewable resources such as xylose. DalinYebo's offerings cater to diverse industries, including pharmaceuticals and foundry applications, where furfuryl alcohol is utilized as a key ingredient in resin formulations and chemical intermediates.

Key Furfuryl Alcohol Companies:

The following are the leading companies in the furfuryl alcohol market. These companies collectively hold the largest market share and dictate industry trends.

- ILLOVO SUGAR AFRICA (PTY) LTD.

- Linzi Organic Chemical Inc. Ltd.

- TransFurans Chemicals bvba

- DalinYebo

- Hebeichem

- SilvateamS.p.a.

- Shandong Crownchem Industries Co., Ltd.

- Hongye Holdings Group Corp., Ltd.

- Xian Welldon Trading Co., Ltd.

- Furnova Polymers Ltd.

- NC Nature Chemicals

Furfuryl Alcohol Industry Report Scope

Report Attribute

Details

Market size value in 2025

USD 491.4 million

Revenue forecast in 2030

USD 685.1 million

Growth rate

CAGR of 6.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in Tons, Revenue in USD Thousand, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa.

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, India, Japan, South Korea, Brazil, Saudi Arabia, South Africa, Turkey

Key companies profiled

ILLOVO SUGAR AFRICA (PTY) LTD.; Linzi Organic Chemical Inc. Ltd.; TransFurans Chemicals bvba; DalinYebo; Hebeichem; SilvateamS.p.a.; Shandong Crownchem Industries Co., Ltd.; Hongye Holdings Group Corp., Ltd.; Xian Welldon Trading Co., Ltd.; Furnova Polymers Ltd.; NC Nature Chemicals.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

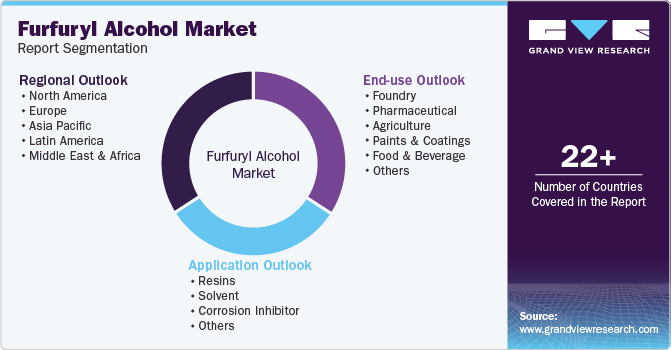

Global Furfuryl Alcohol Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global furfuryl alcohol market report based on application, end-use, and region.

-

Application Outlook (Volume, Tons; Revenue, USD Thousand, 2018 - 2030)

-

Resins

-

Solvent

-

Corrosion Inhibitor

-

Other

-

-

End-use Outlook (Volume, Tons; Revenue, USD Thousand, 2018 - 2030)

-

Foundry

-

Pharmaceutical

-

Agriculture

-

Paints & Coatings

-

Food & Beverage

-

Other

-

-

Regional Outlook (Volume, Tons; Revenue, USD Thousand, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

Turkey

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.