- Home

- »

- Next Generation Technologies

- »

-

Game-based Learning Market Size & Share Report, 2030GVR Report cover

![Game-based Learning Market Size, Share & Trends Report]()

Game-based Learning Market (2024 - 2030) Size, Share & Trends Analysis Report By Component, By Deployment Mode, By Platform, By Game Type, By Application, By End-user, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-269-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Game-based Learning Market Summary

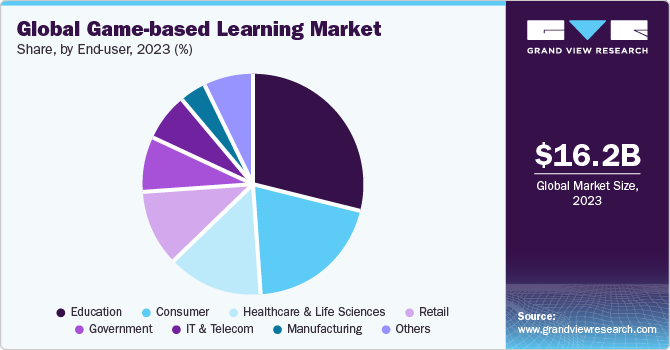

The global game-based learning market size was estimated at USD 16.16 billion in 2023 and is projected to reach USD 64.54 billion by 2030, growing at a CAGR of 22.0% from 2024 to 2030. The market growth is driven by the rising demand for interactive and immersive learning and the advent of technology such as artificial intelligence (AI), augmented reality, and virtual reality.

Key Market Trends & Insights

- North America dominated the game-based learning market with the largest revenue share of 43.10% in 2023.

- The game-based learning market in U.S. accounted for the largest revenue share of more than 30% in 2023.

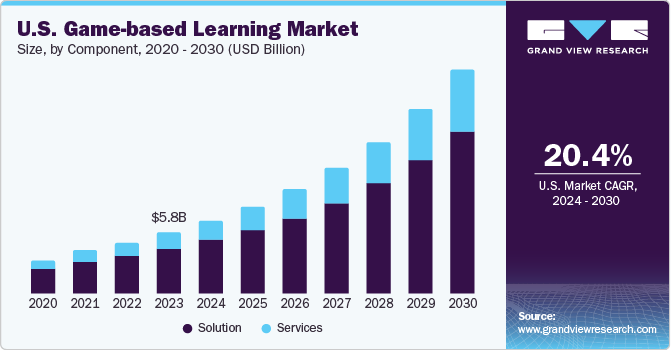

- By component, the solution segment led the market with the largest revenue share of 73.2% in 2023.

- Based on deployment mode, the on-premise segment held the market with the largest revenue share of 50.9% in 2023.

- Based on platform, the offline segment led the market with the largest revenue share of 52.6% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 16.16 Billion

- 2030 Projected Market Size: USD 64.54 Billion

- CAGR (2024-2030): 22.0%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Game-based learning refers to the use of games to facilitate learning and educational processes. It involves incorporating game elements, mechanics, and design into educational activities to engage learners, enhance motivation, and improve learning outcomes.

Game-based learning (GBL) offers a dynamic and engaging way for learners to interact with educational content, leading to improved retention and understanding of the material and driving the market. By incorporating elements of play and competition, learners are motivated to actively participate in the learning process. According to a study by the National Library of Medicine 2023, GBL positively impacted students when they were learning mathematics by increasing their interest and motivation while improving the academic achievements and attitudes of students, indicating the efficacy of GBL amongst learners.

The rapid advancement of technology, particularly the integration of artificial intelligence (AI), augmented reality (AR), and virtual reality (VR), significantly transformed the landscape of game-based learning. These cutting-edge technologies have enabled the creation of more sophisticated and realistic learning environments that offer learners a truly immersive educational experience. AI algorithms personalize learning paths based on individual progress and performance, while AR and VR technologies simulate real-world scenarios, providing learners with hands-on learning opportunities in virtual settings.

The COVID-19 pandemic had a positive impact on the game-based learning market, accelerating its growth and adoption across various sectors. With the widespread closure of schools, universities, and training centers, there was a significant shift towards online and remote learning solutions, that led to an increased demand for digital educational tools, including game-based learning platforms.

Many companies experienced a lucrative growth post-pandemic owing to the rising demand. To cater to this need, organizations expanded their offerings to newer regions. For instance, in March 2023, Duolingo launched its free-to-use app, Duolingo ABC, to teach English to kids aged 3-8 years in India in a fun and gamified way. The app includes more than 700 bite-sized modules teaching phonics, alphabet, and sight words and is built on a child-friendly interface with no ads and in-app purchases. The app also allows guardians, parents, and educators to track their pupil’s learning progress. The app aims to encourage and motivate kids to build a strong literacy groundwork with gamification.

Market Concentration & Characteristics

The market growth stage is high, and the pace is accelerating. The global game-based learning industry is fragmented nature, featuring several global and regional players. The industry players are investing in research & development (R&D) to develop advanced solutions and gain a competitive edge in the market.

The market is characterized by a high degree of innovation, with companies continually striving to develop cutting-edge solutions that offer engaging and interactive learning experiences for users. This focus on innovation drives market differentiation and fosters the introduction of new products and services to meet evolving learning requirements.

Regulations play a significant role in influencing the market. Regulatory frameworks related to data privacy, content standards, and educational compliance, such as the Children’s Online Privacy Protection Act, the Family Educational Rights and Privacy Act, and the General Data Protection Regulation, impact the development and deployment of GBL solutions. Compliance with regulations is essential for ensuring the quality and integrity of educational content, as well as safeguarding user data and privacy.

The market has witnessed a substantial level of consolidation as companies expand their market presence, acquire new technologies, or access a broader customer base. The End-user concentration is low as the market serves a broad spectrum of End-users, including students, educators, corporate learners, and training professionals.

Component Insights

Based on component, the market is bifurcated into solution and services. The solution segment led the market with the largest revenue share of 73.2% in 2023. The increasing demand for personalized and adaptive learning experiences is propelling the need for GBL solutions. Game-based learning solutions offer the ability to tailor educational content to individual learner needs, preferences, and skill levels, providing a more personalized and engaging learning experience. By leveraging technologies such as artificial intelligence (AI) and machine learning algorithms, these solutions can analyze learner data and behavior to deliver customized learning paths and content recommendations.

The service segment is anticipated to grow at the fastest CAGR over the forecast period. The complexity of integrating technology-driven learning solutions into existing educational or training environments is promoting market growth. Educational institutions and organizations often require specialized expertise and support to implement game-based learning solutions seamlessly. Service providers play a crucial role in offering consulting services, technical assistance, and training programs to ensure the successful deployment and utilization of game-based learning platforms.

Deployment Mode Insights

Based on deployment mode, the on-premise segment held the market with the largest revenue share of 50.9% in 2023. The need for data security and compliance with regulatory requirements is driving the market. In certain industries and institutions, such as government agencies, healthcare organizations, and financial institutions, data privacy and security are crucial. On-premise solutions offer control over data management and security, allowing organizations to ensure compliance with regulations such as the General Data Protection Regulation (GDPR) and industry-specific data protection standards.

The cloud segment is expected to witness at a significant CAGR over the forecast period, owing to the scalability and flexibility offered by cloud-based solutions. Cloud platforms enable educational institutions, corporate training programs, and individual learners to access game-based learning content from anywhere, at any time, using a variety of devices. This flexibility allows for the seamless integration of learning activities into diverse environments and caters to the evolving needs of modern learners who seek on-demand access to educational resources.

In August 2022, Amazon Web Services (AWS) announced two initiatives aimed at supporting individuals in gaining cloud computing skills. The first initiative is the AWS Cloud Quest: Cloud Practitioner game-based learning cloud platform, which utilizes interactive and engaging activities to teach foundational concepts in cloud computing. The second initiative is an enhanced version of AWS Educate, which provides hundreds of hours of free training resources for learners of all ages to enhance their cloud computing knowledge. These initiatives aim to increase the accessibility of cloud computing skills and provide learners with the resources necessary to advance their careers.

Platform Insights

Based on platform, the offline segment led the market with the largest revenue share of 52.6% in 2023. Concerns related to cost-effectiveness and resource optimization influence the adoption of offline game-based learning solutions. By eliminating the need for continuous internet connectivity and reducing reliance on cloud-based infrastructure, offline solutions can offer a more cost-efficient alternative for delivering educational content through games. Organizations save on data costs, server maintenance expenses, and subscription fees associated with online platforms.

The online segment is expected to grow at the fastest CAGR over the forecast period. The focus on data analytics and performance tracking influences the adoption of online game-based learning solutions is propelling the demand for the segment. Online platforms collect valuable data on learner interactions, progress, and performance, allowing organizations to track learner engagement, assess learning outcomes, and measure the effectiveness of educational programs. By leveraging data analytics and reporting tools, online game-based learning solutions provide insights that help educators and trainers optimize content delivery, personalize learning experiences, and improve overall learning outcomes for users.

Game Type Insights

Based on game type, the location-based games segment led the market with the largest revenue share of 39.6% in 2023, owing to the rising demand for experiential and practical learning opportunities. Location-based solutions allow learners to explore physical spaces, interact with their surroundings, and engage in collaborative activities that blend virtual content with real-world environments. This experiential learning approach fosters active participation, problem-solving skills, and critical thinking abilities, making learning more engaging. Furthermore, the increasing popularity of location-based technologies, such as GPS and augmented reality (AR), drives the segment growth. These technologies enable the integration of real-world locations and physical environments into educational games, creating immersive and interactive learning experiences.

The AI-based games segment is expected to witness at the fastest CAGR over the forecast period. The integration of AI technologies, such as machine learning and predictive analytics, drives the implementation of AI-based GBL solutions. Machine learning algorithms analyze large datasets to identify patterns, predict learner behavior, and optimize content delivery based on learner performance. Predictive analytics enable educators and trainers to forecast learning outcomes, identify at-risk learners, and tailor interventions to improve learning effectiveness and engagement, ultimately enhancing the quality of educational experiences.

Application Insights

Based on application, the training & development segment led the market with the largest revenue share of 44.8% in 2023. This can be attributed to the growing focus on skills development and continuous learning. Organizations are increasingly turning to game-based training solutions to upskill their workforce, enhance employee competencies, and foster a culture of lifelong learning. Game-based training programs offer a hands-on and practical approach to skill development, allowing employees to practice new skills, apply knowledge in real-world scenarios, and receive immediate feedback on their performance, leading to enhanced skill acquisition and proficiency.

The critical thinking & problem-solving segment is anticipated to witness at the fastest CAGR over the forecast period, owing to the increasing recognition of the importance of critical thinking and problem-solving skills in today's complex and fast-paced world. Game-based learning offers a unique platform for learners to engage in challenging scenarios, analyze information, make decisions, and solve problems in a risk-free and interactive environment. By immersing learners in simulated situations that require critical thinking and problem-solving, game-based solutions help develop essential cognitive skills that are crucial for success in academic, professional, and everyday life contexts.

End-user Insights

Based on end-user, the education segment accounted for the largest revenue share in 2023, owing to the increasing recognition of the effectiveness of game-based learning in engaging students, promoting active learning, and improving academic outcomes. Game-based learning offers a dynamic and interactive approach to education that captures students' attention, motivates participation, and enhances knowledge retention through immersive gameplay experiences. By integrating game elements such as challenges, rewards, competition, and storytelling into educational content, game-based learning solutions cater to diverse learning styles and promote creativity, critical thinking, and collaboration among students.

The retail segment is expected to witness at the fastest CAGR over the forecast period, owing to the emerging focus on enhancing customer engagement and loyalty through interactive experiences. Retailers are increasingly turning to game-based solutions to create immersive and personalized experiences for customers, such as gamified loyalty programs, interactive product demonstrations, and virtual shopping experiences. By leveraging game mechanics such as rewards, competitions, and challenges, retailers drive customer participation, promote brand awareness, and increase customer retention by offering unique and entertaining ways to interact with their products and services.

Regional Insights

North America dominated the game-based learning market with the largest revenue share of 43.10% in 2023, owing to the strong emphasis on innovation and technology adoption in education and training. North America has a robust tech ecosystem and a culture of embracing new technologies, making it a productive ground for the development and adoption of game-based learning solutions. In addition, the focus on personalized learning experiences, the demand for workforce development programs, and the need for engaging educational content drive the market growth in North America.

U.S. Game-based Learning Market Trends

The game-based learning market in U.S. accounted for the largest revenue share of more than 30% in 2023. The market is driven by factors such as the emphasis on continuous learning and skills development, the presence of a large tech-savvy population, and the strong demand for interactive and engaging educational tools. The U.S. education and corporate training sectors are increasingly turning to game-based learning solutions to enhance learning outcomes, improve employee performance, and drive innovation in teaching practices.

Asia Pacific Game-based Learning Market Trends

The game-based learning market in Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period. Countries in Asia Pacific are investing heavily in education technology and digital infrastructure to improve access to quality education and training opportunities. The diverse cultural landscape, large youth population, and increasing adoption of technology-driven solutions in education contribute to the market growth in the region.

The China game-based learning market dominated in Asia Pacific in 2023. China is one of the largest manufacturers and exporters of many different goods, leading to an increased focus on enhancing workforce productivity and efficiency through innovative training methods. Game-based learning offers a dynamic and engaging approach to training employees in manufacturing processes, equipment operation, quality control procedures, and safety protocols. By simulating real-world scenarios, interactive challenges, and virtual simulations, game-based learning solutions help manufacturing workers acquire new skills, improve performance, and enhance operational effectiveness.

The game-based learning market in India is expected to grow at a significant CAGR over the forecast period, owing to the growing IT industry. Game-based learning offers a dynamic and interactive approach to training IT professionals on emerging technologies, programming languages, cybersecurity practices, and project management methodologies. By incorporating gamification elements, simulations, and interactive challenges, game-based learning solutions help IT professionals acquire new skills, stay well-informed about industry trends, and enhance their technical competencies in a fun and engaging manner.

Middle East & Africa Game-based Learning Market Trends

The game-based learning market in Middle East & Africa market is expected to grow at a significant CAGR over the forecast period. The integration of advanced technologies such as virtual reality (VR), augmented reality (AR), and artificial intelligence (AI) drives the adoption of game-based learning solutions in the MEA. VR and AR technologies can offer immersive and interactive training experiences for learners, allowing them to practice real-world skills, conduct virtual experiments, and engage in hands-on learning activities. AI algorithms can analyze learner data, personalize learning experiences, and provide adaptive feedback to support individualized learning pathways in game-based learning platforms.

Key Game-based Learning Company Insights

Some of the key players operating in the market include Google LLC, Duolingo, Inc., and Mojang Studios, Tangible Play, Inc., Quizizz, Inc. and others.

-

Duolingo is a popular language-learning platform that offers courses in various languages. The platform uses a gamified approach to make learning a new language engaging and fun for users. Duolingo has gained immense popularity due to its user-friendly interface, accessibility, and effectiveness in teaching languages

-

Tangible Play focuses on creating game-based learning solutions. It focuses on developing educational products that combine physical and digital play, making learning more engaging, interactive, and fun for children. The company’s primary product is the Osmo system, which uses a tablet and various physical accessories to create a unique and immersive learning experience

-

Quizizz is an interactive, game-based learning platform that allows teachers and students to engage in a fun and competitive learning environment. The platform offers a variety of features, including the ability to create custom quizzes, access pre-made quizzes, and participate in live quiz games

Key Game-based Learning Companies:

The following are the leading companies in the game-based learning market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon Web Services, Inc.

- Google LLC

- Duolingo, Inc.

- Mojang Studios

- Kahoot! ASA

- Epic Games

- Age of Learning, Inc.

- Breakaway Games

- Filament Games

- Lumos Labs

- Tangible Play, Inc.

- Quizizz, Inc.

Recent Developments

-

In February 2024, Kahoot! announced plans to broaden its mobile apps and online platform to include the Indonesian language. This initiative seeks to provide enjoyable and enriching educational experiences to individuals of all ages in the area while also reaching out to emerging markets. With more than 15 million participants, engaging in gameplay over the past year, Kahoot! has solidified its position as a favored platform for interactive learning in Indonesia

-

In January 2024, Minecraft Education, the game-based learning platform developed by Mojang Studios, launched Level Up Learning, a digital event series developed in collaboration with the International Society for Technology in Education (ISTE). This initiative is designed to address the changing challenges in education and advocate for the platform's game-based learning approach

-

In August 2023, CyberCatch Holdings, Inc., a cybersecurity firm, collaborated with ELB Learning, a company specializing in learning products and services, to distribute CyberCatch's innovative next generation learning game solution worldwide. Developed in collaboration with ELB Learning, CyberCatch's CyberSavvyIQ comprises a series of security awareness learning games that blend elements from both movies and games. These offerings aim to empower employees to enhance their cyber awareness and serve as more effective barriers against cyber threats

Game-based Learning Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 19.55 billion

Revenue forecast in 2030

USD 64.54 billion

Growth rate

CAGR of 22.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment mode, platform, game type, application, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Mexico; UAE; South Africa

Key companies profiled

Amazon Web Services, Inc.; Google LLC; Duolingo, Inc.; Mojang Studios; Kahoot! ASA; Epic Games; Age of Learning, Inc.; Breakaway Games; Filament Games; Lumos Labs; Tangible Play, Inc.; Quizizz, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Game-based Learning Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the game-based learning market research report based on the component, deployment mode, platform, game type, application, end-user, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solution

-

Services

-

-

Deployment Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Platform Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Game Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Location-Based Games

-

AR/VR Games

-

AI-Based Games

-

Language Learning

-

Skill-Based Learning

-

Simulation

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Critical Thinking & Problem-Solving

-

Training & Development

-

Evaluation

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

IT & Telecom

-

Retail

-

Consumer

-

Manufacturing

-

Government

-

Education

-

Healthcare & Life Sciences

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

Italy

-

France

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global game-based learning market size was estimated at USD 16.16 billion in 2023 and is expected to reach USD 19.55 billion in 2024

b. The global game-based learning market is expected to grow at a compound annual growth rate of 22.0% from 2024 to 2030, reaching USD 64.54 billion by 2030

b. North America dominated the game-based learning market with a revenue share of 43.10% in 2023. Regional growth is attributed to the strong emphasis on innovation and technology adoption in education and training.

b. Some key players operating in the game-based learning market include Amazon Web Services, Inc.; Google LLC; Duolingo, Inc.; Mojang Studios; Kahoot! ASA; Epic Games; Age of Learning, Inc.; Breakaway Games; Filament Games; Lumos Labs; Tangible Play, Inc.; Quizizz, Inc.

b. Factors such as the rising demand for interactive and immersive learning and the advent of technology such as artificial intelligence (AI), augmented reality, and virtual reality are driving the growth of the game-based learning market

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.