- Home

- »

- Next Generation Technologies

- »

-

Gaming Peripheral Market Size, Share, Industry Report, 2030GVR Report cover

![Gaming Peripheral Market Size, Share & Trends Report]()

Gaming Peripheral Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Headsets, Keyboard), By Device (PC, Gaming Consoles), By Type, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-557-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Gaming Peripheral Market Summary

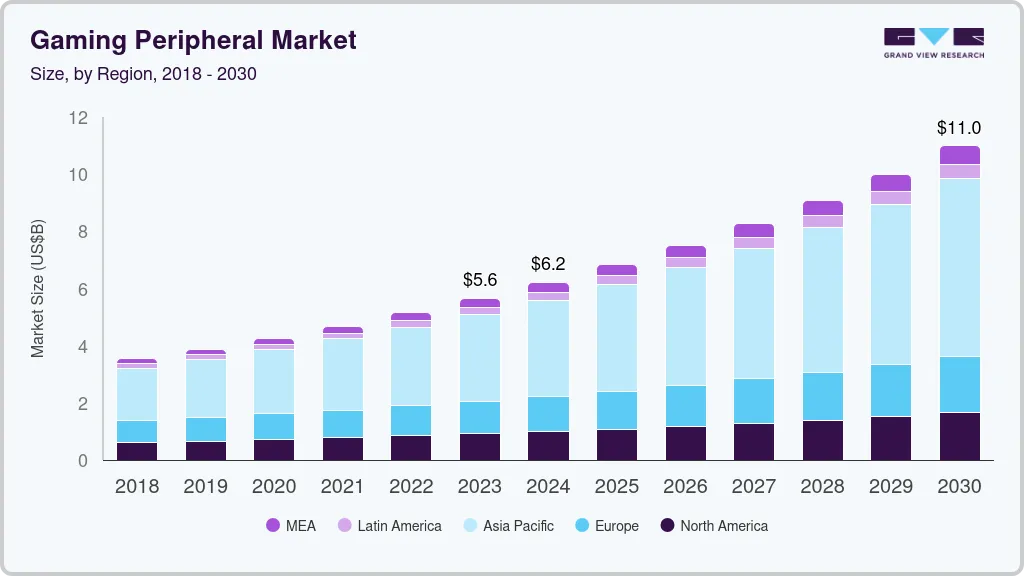

The global gaming peripheral market size was estimated at USD 6,215.0 million in 2024 and is projected to reach USD 11,545.6 million by 2030, growing at a CAGR of 11.0% from 2025 to 2030. Wireless gaming peripherals, such as mice, keyboards, and headsets, are rapidly gaining popularity due to advancements in wireless technology that ensure low latency and high reliability.

Key Market Trends & Insights

- The gaming peripheral market in the Asia Pacific region dominated and accounted for 54.24% in 2024.

- The U.S. gaming peripheral market is expected to grow at a lucrative CAGR from 2025 to 2030.

- Based on product, the mice segment will have a significant share of the market in 2024, accounting for over 23% of the global revenue.

- Based on device, the PC segment accounted for the largest market revenue share in 2024.

- Based on type, the wired segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 6,215.0 Million

- 2030 Projected Market Size: USD 11,545.6 Million

- CAGR (2025-2030): 11.0%

- Asia Pacific: Largest market in 2024

Gamers increasingly prefer the freedom of movement these devices offer, especially as wireless performance is now comparable to wired options.

Battery life and fast charging capabilities are also improving, allowing for longer play sessions without interruptions. This trend is also driven by the reduction in pricing for high-quality wireless peripherals, making them accessible to a wider audience.

Customizability is becoming a key differentiator as gamers seek peripherals that fit their unique playing styles and ergonomic preferences. Modular keyboards with customizable key switches, mice with adjustable weights, and controllers with replaceable joysticks are getting increasingly popular. Gamers appreciate the ability to swap components and adjust settings to enhance comfort and control, giving them a competitive edge in gameplay. Manufacturers are capitalizing on this trend by launching peripherals with diverse customization options, fostering a more personalized gaming experience.

RGB lighting remains a dominant trend, with gaming peripherals offering synchronized lighting that enhances the gaming environment. Gamers often sync their peripherals’ lighting with in-game events or with other RGB-enabled devices for an immersive visual experience. The trend has expanded beyond aesthetics, as some gamers use color cues to track game mechanics or in-game statuses. With software support becoming more intuitive, RGB lighting setups are easier to manage, leading to further adoption across both amateur and professional gaming circles.

Ergonomic design in gaming peripherals is increasingly emphasized as manufacturers aim to provide comfort during extended gaming sessions. This focus has led to the development of peripherals with ergonomic shapes, wrist supports, and adjustable designs, especially in gaming chairs and keyboards. Gamers are also drawn to materials that minimize wear and tear on the skin and prevent strain on the hands, wrists, and fingers. Companies are investing in research to develop peripherals that cater to diverse hand sizes and grips, making gaming safer and more enjoyable.

AI and machine learning are being integrated into gaming peripherals, allowing for adaptive responses based on a player’s habits and preferences. For example, AI-driven mice can adjust sensitivity settings based on in-game movements, while smart keyboards can predict and execute complex key combinations. Headsets with AI-powered noise-canceling technology can optimize audio settings to enhance in-game soundscapes based on individual playstyles. These innovations not only improve performance but also provide a more intuitive and responsive gaming experience.

Product Insights

The mice segment will have a significant share of the market in 2024, accounting for over 23% of the global revenue. Among the primary factors gamers look for in gaming mice is precision, which is determined by the sensor and DPI (dots per inch) capabilities. High DPI sensors provide greater accuracy and smoother tracking, which is essential for competitive gaming, particularly in fast-paced genres like FPS (first-person shooters). Many gaming mice now feature sensors with DPI levels up to 20,000 or higher, offering unparalleled sensitivity for advanced gameplay. Along with DPI, these sensors also improve responsiveness and allow gamers to adjust sensitivity on the fly, catering to a variety of gaming styles and environments.

The headsets segment is predicted to foresee the fastest CAGR in the coming years. Active noise cancellation (ANC) and high-quality microphones have become essential features for gaming headsets, enhancing communication clarity and reducing background noise. ANC technology blocks external sounds, allowing players to focus entirely on the game, which is especially useful in loud environments or during LAN parties. In addition, manufacturers are equipping headsets with unidirectional or boom microphones, some featuring noise-canceling capabilities to capture clear, high-quality voice communication. These improvements in microphone and ANC technology benefit not only gamers but also streamers and eSports players who require crisp audio for effective communication.

Device Insights

The PC segment accounted for the largest market revenue share in 2024. High refresh rates and low response times have become essential in gaming monitors, allowing for smoother visuals and a competitive edge in fast-paced games. Monitors with 144Hz, 240Hz, and even 360Hz refresh rates are becoming standard for serious PC gamers, especially those focused on eSports and FPS games. Combined with high resolutions (1440p and 4K), these monitors offer both clarity and responsiveness, ensuring immersive visuals without sacrificing speed. Adaptive sync technologies like NVIDIA G-Sync and AMD FreeSync reduce screen tearing and input lag, further enhancing the gameplay experience.

The gaming consoles segment is predicted to foresee significant growth in the coming years. Controllers have evolved significantly with features that improve immersion and gameplay precision, especially with innovations in haptic feedback and adaptive triggers. For example, Sony’s DualSense controller for the PlayStation 5 introduced adaptive triggers that adjust resistance based on in-game actions, enhancing realism by simulating tension, like pulling a bowstring. Haptic feedback offers dynamic vibrations that respond to various in-game scenarios, providing a richer sensory experience compared to traditional rumble. Other manufacturers are adopting similar technologies, making advanced controllers a focal point for game immersion in the console market.

Type Insights

The wired segment accounted for the largest market revenue share in 2024. Wired gaming mice and keyboards are highly regarded for their minimal latency, making them the preferred choice for competitive gamers who demand immediate responsiveness. With a direct connection to the gaming system, wired devices eliminate the potential delays associated with wireless connections, ensuring precise input during critical moments. Many high-performance gaming peripherals now feature advanced sensors and polling rates, allowing for quick movements and actions that can make a significant difference in gameplay. As competitive gaming and eSports continue to grow, the demand for wired peripherals with optimal performance remains strong.

The wireless segment is predicted to foresee the fastest CAGR in the coming years. Modern wireless gaming peripherals utilize advanced technologies that minimize latency and enhance performance, making them competitive with wired devices. Innovations such as 2.4GHz wireless technology and Bluetooth 5.0 have drastically improved the reliability and responsiveness of wireless connections. Many manufacturers now incorporate low-latency features to ensure that input delays are virtually eliminated, allowing gamers to enjoy seamless gameplay without sacrificing speed. As competitive gaming continues to thrive, the demand for high-performance wireless peripherals is expected to grow, providing players with the responsiveness they need.

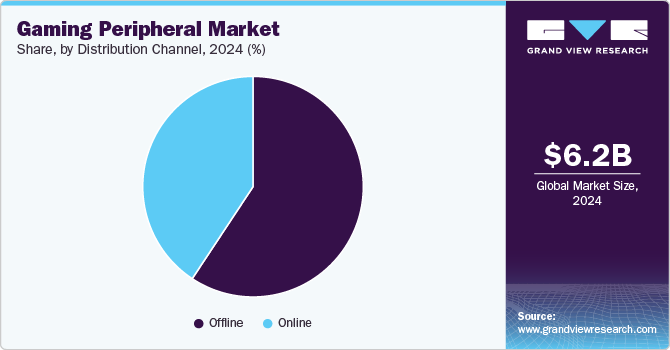

Distribution Channel Insights

The offline segment held the largest market revenue share in 2024. The offline gaming peripheral segment thrives on providing consumers with hands-on experiences before making a purchase. Retailers often set up gaming stations where customers can test peripherals such as mice, keyboards, and headsets, allowing them to assess comfort, performance, and suitability. This direct interaction is particularly valuable for high-investment items such as gaming chairs or mechanical keyboards, where tactile feedback can significantly influence a buying decision. In addition, knowledgeable sales staff can offer personal recommendations and demonstrations, enhancing the consumer experience and fostering brand loyalty.

The online segment is expected to exhibit a significant CAGR over the forecast period. The shift towards e-commerce has transformed how gamers purchase peripherals, with many consumers preferring the convenience of online shopping. Major e-commerce platforms such as Amazon, Newegg, and specialized gaming retailers offer a vast selection of products, often at competitive prices. This trend has been further accelerated by the COVID-19 pandemic, which prompted many consumers to turn to online shopping for both essentials and leisure products. The ability to easily compare prices, read reviews, and access detailed product information makes online platforms increasingly attractive to gamers.

Regional Insights

North America gaming peripherals market held a significant revenue share of over 16% in 2024. Competitive gaming (esports) and the popularity of PC gaming drive demand, supported by rising disposable incomes and widespread console ownership. There is a strong preference for customizable, high-performance peripherals such as mechanical keyboards with RGB lighting and programmable mice. Wireless and VR-compatible peripherals are also in high demand as players seek immersive gaming experiences and flexibility.

U.S. Gaming Peripheral Market Trends

The U.S. gaming peripheral market is expected to grow at a lucrative CAGR from 2025 to 2030. High internet penetration, a large gaming community, and the popularity of streaming boost demand for advanced gaming peripherals. Ergonomics-focused peripherals are increasingly popular as gamers prioritize health during extended play sessions. The expansion of esports and cloud gaming has led to a need for low-latency wireless peripherals optimized for online and cloud-based gaming platforms.

Asia Pacific Gaming Peripheral Market Trends

The gaming peripheral market in the Asia Pacific region dominated and accounted for 54.24% in 2024 and is expected to register the fastest CAGR over the forecast period. The APAC region is seeing massive growth due to booming online gaming, particularly in China, Japan, and South Korea. Price-sensitive markets prefer budget-friendly peripherals with popular features like RGB lighting and customization options. The dominance of mobile gaming has created demand for mobile-compatible controllers and low-latency gaming earbuds.

Europe Gaming Peripheral Market Trends

The gaming peripheral market in the Europe region is expected to witness significant growth over the forecast period. Growth is driven by the rise in esports viewership, local game development, and the increasing adoption of high-end gaming setups. Sustainability trends are influencing demand for eco-friendly gaming peripherals made from recyclable materials, with wireless devices gaining traction. Interest in VR and AR is growing, leading to a surge in demand for peripherals designed to enhance immersive gameplay.

Key Gaming Peripheral Company Insights

Several prominent players in the market for gaming peripherals, including Anker Innovations Limited, Cooler Master Technology Inc., Dell Inc. (Alienware), CORSAIR, HyperX/Kingston Technology Company, Inc., and Logitech, are actively striving to broaden their customer base and secure a competitive edge. To accomplish this, they are engaging in various strategic initiatives such as forming partnerships, pursuing mergers and acquisitions, collaborating with other entities, and innovating new products and technologies. This proactive strategy enables them to enhance their market presence while adapting to the evolving demands of consumers. Ultimately, these efforts are aimed at fostering innovation and addressing the changing needs within the gaming industry.

-

Anker Innovations Limited is a Chinese electronics manufacturer headquartered in Changsha, Hunan. The company focuses on the research, development, design, and sales of consumer electronic products, including charging devices, wireless audio products, and smart home innovations. Anker has expanded its market presence both domestically and internationally, with significant sales in North America, Europe, and Japan. Its strategic approach includes diversifying product lines and enhancing distribution channels to meet the evolving demands of consumers.

-

Logitech is a Swiss company renowned for its innovative computer peripherals and software solutions. Logitech offers a diverse range of products, including mice, keyboards, webcams, and gaming accessories. The company emphasizes sustainability in its operations, integrating eco-friendly materials into its product designs while expanding its global footprint through both online and offline sales channels. Logitech's commitment to innovation and quality positions it as a leader in the competitive gaming peripheral market.

Key Gaming Peripheral Companies:

The following are the leading companies in the gaming peripheral market. These companies collectively hold the largest market share and dictate industry trends.

- Anker Innovations Limited

- Cooler Master Technology Inc.

- Dell Inc. (Alienware)

- CORSAIR

- HyperX/Kingston Technology Company, Inc.

- Logitech

- Plantronics Inc.

- Rapoo Corporation

- Razer Inc.

- Redragon USA

- Turtle Beach

Recent Developments

-

In March 2023, Alienware launched a range of gaming peripherals, including a Tenkeyless Gaming Keyboard, a dual-mode wireless gaming headset, a wired gaming headset, and a wireless gaming mouse. These products feature advanced technology designed to enhance user experience and provide comfort during extended gaming sessions. The dual-mode headset allows for seamless switching between wired and wireless connectivity, while the wired headset offers reliable audio at an accessible price. Overall, Alienware's new lineup focuses on performance and comfort, catering to serious gamers seeking to improve their gameplay.

-

In September 2023, Logitech expanded its popular portable Bluetooth speaker lineup with the introduction of EPICBOOM. This new speaker features a unique oval design that enhances acoustic performance while delivering powerful 360° sound. It is constructed from sustainable materials, including 100% post-consumer recycled polyester fabric and a minimum of 59% recycled plastic, reflecting Logitech's commitment to environmental responsibility. With an impressive battery life of up to 17 hours and an IP67 rating for water and dust resistance, the EPICBOOM is designed for both indoor and outdoor use, making it an ideal choice for various audio experiences.

Gaming Peripheral Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6,837.2 million

Revenue forecast in 2030

USD 11,545.6 million

Growth Rate

CAGR of 11.0% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2030

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, device, type, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Anker Innovations Limited; Cooler Master Technology Inc.; Dell Inc. (Alienware); CORSAIR; HyperX/Kingston Technology Company, Inc.; Logitech; Plantronics Inc.; Rapoo Corporation; Razer Inc.; Redragon USA; Turtle Beach.

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Gaming Peripheral Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global gaming peripheral market based on product, distribution channel, type, device, and region:

-

Product Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Headsets

-

Keyboard

-

Controller

-

Mice

-

Others

-

-

Device Outlook (Revenue, USD Million, 2018 - 2030)

-

PC

-

Gaming Consoles

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Wired

-

Wireless

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global gaming peripheral market size was estimated at USD 6,215.0 million in 2024 and is expected to reach USD 6,837.2 million in 2025.

b. The global gaming peripheral market is expected to grow at a compound annual growth rate of 11.0% from 2025 to 2030 to reach USD 11,545.6 million by 2030.

b. Asia Pacific dominated the gaming peripherals market with a share of over 54% in 2024. This is attributable to the increasing popularity of online gaming, esports, and the rising number of gamers.

b. Some key players operating in the gaming peripheral market include Anker Innovations Limited, Cooler Master Technology Inc., Dell Inc. (Alienware), CORSAIR, HyperX/Kingston Technology Company, Inc., Logitech, Plantronics Inc., Rapoo Corporation, Razer Inc., Redragon USA, Turtle Beach.

b. Key factors driving the gaming peripheral market growth include rising popularity of virtual games, introduction of high-end displays and virtual reality headsets, and growing demand for enhanced gaming experience.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.