- Home

- »

- Next Generation Technologies

- »

-

Gaming Console Market Size & Share, Industry Report, 2033GVR Report cover

![Gaming Console Market Size, Share & Trends Report]()

Gaming Console Market (2025 - 2033) Size, Share & Trends Analysis Report, By Product, By Application (Gaming, Non-gaming), By Distribution Channel (Online, Offline), By Type, By Component, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-089-5

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Gaming Console Market Summary

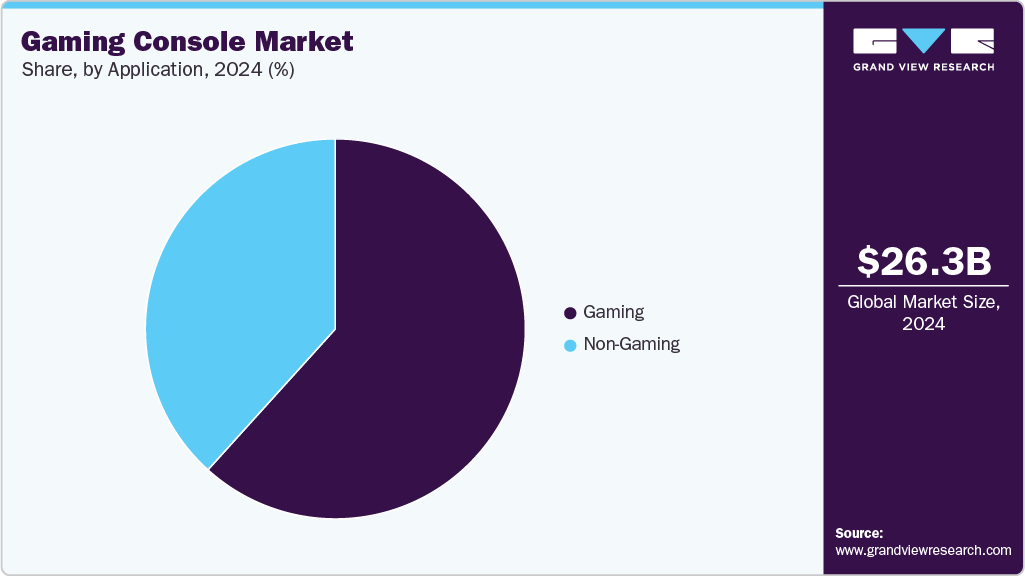

The global gaming console market size was estimated at USD 26.32 billion in 2024 and is projected to reach USD 47.58 billion by 2033, growing at a CAGR of 6.7% from 2025 to 2033. The market growth is primarily driven by the rising global demand for immersive gaming experiences, increasing adoption of advanced gaming technologies, continuous innovation in console hardware and performance capabilities, growing popularity of online multiplayer and cross-platform gaming, and the expansion of digital game distribution platforms.

Key Market Trends & Insights

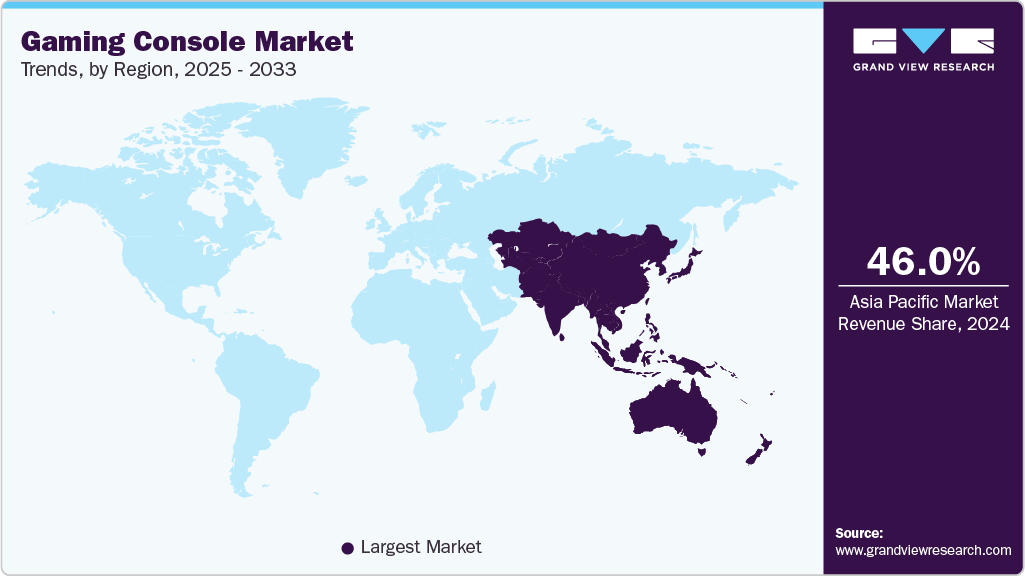

- Asia Pacific dominated the global gaming console market with the largest revenue share of over 46% in 2024.

- The gaming console market in China led the Asia Pacific market and held the largest revenue share in 2024.

- By product, the PlayStation segment is expected to grow at significant market share of over 25 % in 2024.

- By application, the gaming application segment dominates the market and holds the largest revenue share of over 61% in 2024.

- By distribution channel, the offline distribution channel segment accounted for the largest revenue share of over 52% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 26.32 billion

- 2033 Projected Market Size: USD 47.58 billion

- CAGR (2025-2033): 6.7%

- Asia Pacific: Largest market in 2024

- Middle East & Africa: Fastest growing market.

The market growth is primarily driven by continuous technological advancements that enhance performance, visual fidelity, and user experience of gaming consoles. Significant improvements in graphics technology from early 8-bit visuals to today’s 4K resolutions have revolutionized the level of immersion and realism in gameplay. Innovations in hardware architecture, faster processing power, and integrated software ecosystems are enabling more dynamic, responsive, and engaging gaming experiences. These developments, along with growing support for cloud-based gaming, virtual reality integration, and seamless digital content delivery, are expected to drive the expansion of the gaming console market.

The advancement of high-performance hardware components is significantly fueling the growth of the gaming console market. The integration of multicore processors and powerful graphics processing units (GPUs) allows consoles to support complex game mechanics, detailed environments, and faster load times. These enhancements enable developers to create more immersive and realistic game experiences, elevating user engagement and satisfaction. Gaming content becomes increasingly sophisticated, demand for consoles with advanced computing and rendering capabilities continues to rise, driving market growth.

In addition, the rapid development and adoption of virtual reality (VR) and augmented reality (AR) technologies are emerging as major growth drivers in the gaming console industry. VR headsets and AR functionalities enable players to enter more interactive and lifelike virtual worlds, transforming traditional gameplay into a fully immersive experience. Developers innovate new ways to integrate VR/AR into console gaming, consumer interest in next-generation experiences is accelerating console adoption and fueling industry expansion.

Furthermore, the surge in online multiplayer gaming and digital connectivity is revolutionizing how users engage with the gaming console industry. Widespread access to high-speed internet and online platforms such as Xbox Live and PlayStation Network, gamers can easily connect, compete, and collaborate globally. Features such as matchmaking, voice chat, and social networking have made online gaming more social and engaging, significantly contributing to market growth. Popular titles such as Fortnite, FIFA, and Call of Duty exemplify how the demand for online, competitive, and cooperative gameplay continues to propel console sales and software subscriptions.

Moreover, the rising influence of game developers is reshaping the gaming console ecosystem. Developers push creative boundaries with innovative mechanics, captivating narratives, and cinematic visuals, the demand for hardware capable of supporting such advancements grows. Cross-platform game development is also expanding the console market by allowing developers to reach broader audiences. The push for high-quality engaging games encourages both new buyers and existing users to invest in the latest consoles, thereby accelerating the growth of the gaming console industry.

Product Insights

The PlayStation product segment held a significant market share of over 25% in 2024, owing to its continuous hardware evolution across console generations, offering significant improvements in processing power, graphics capabilities, and overall user experience. This technological advancement has enabled more immersive and engaging gameplay, attracting a large and loyal consumer base. The segment’s dominance is further strengthened by a strong portfolio of exclusive titles developed by first-party studios with blockbuster franchises such as The Last of Us, God of War, and Horizon Zero Dawn driving consistent demand and brand loyalty within the global gaming community.

The Nintendo's product segment is expected to witness a significant CAGR of over 8% from 2025 to 2033. This growth is attributed to the company's ability to innovate and create unique gaming experiences. Nintendo has a reputation for developing consoles and games that are both accessible and fun, with a focus on innovation and creativity. Nintendo has also successfully built a strong lineup of exclusive game titles, leading to a high demand for its consoles. The company's first-party studios, including Nintendo EAD and Retro Studios, have produced some of the most popular and critically acclaimed games of recent years, including titles such as Super Mario and The Legend of Zelda.

Application Insights

The gaming segment accounted for the largest market share in 2024, owing to the growing integration of diverse applications beyond traditional gaming within consoles. Console manufacturers and game developers are increasingly leveraging apps to offer innovative user experiences, ranging from fitness and media streaming services to social media connectivity. This trend reflects a broader shift toward multifunctional entertainment systems, where mobile companion apps enhance interactivity and extend gameplay beyond the console. The rising demand for cross-platform engagement and value-added services is propelling growth in this segment as console ecosystems evolve into comprehensive digital hubs.

The non-gaming segment is expected to witness the highest CAGR from 2025 to 2033. This growth is driven by the increasing demand for multifunctional entertainment experiences beyond traditional gameplay. Gaming consoles are evolving into all-in-one media hubs, offering access to streaming services, fitness applications, web browsing, and social networking platforms. The rise of smart TVs and the integration of cloud-based services have fueled user expectations for broader console capabilities. Advancements in app ecosystems and voice-controlled interfaces are enhancing user convenience. This diversification of console utility is encouraging both consumers and manufacturers to prioritize non-gaming functionalities, leading to sustained growth in this segment.

Distribution Channel Insights

The offline distribution channel segment accounted for the largest market share in 2024, driven by the continued consumer preference for physical game ownership, bundled console packages, and in-store promotional offers. Many users value the tangible aspect of physical discs and the ability to trade, resell, or collect game titles. Offline retail channels also provide hands-on experiences, immediate product access, and personalized customer service, which contribute to higher purchase confidence, especially among casual or first-time gamers. In regions with limited or inconsistent internet connection, offline channels remain a crucial point of access for console hardware and software, supporting their sustained growth over the forecast period.

The online distribution channel segment expected to witness the highest CAGR from 2025 to 2033, owing to the rapid growth of digital distribution platforms, increasing internet penetration, and the widespread adoption of high-speed broadband and 5G networks. Gamers are increasingly favoring the convenience of downloading or streaming games directly to their consoles, eliminating the need for physical media. Subscription-based services, cloud gaming platforms, and frequent digital-only game releases are further fueling the shift toward online channels. The growing popularity of multiplayer and live-service games, which require constant online connectivity and regular content updates, supporting their sustained growth over the forecast period.

Type Insights

The handheld game console segment accounted for the largest market share in 2024, driven by the rising popularity of mobile and on-the-go gaming experiences. The widespread adoption of smartphones and tablets, consumers have become more inclined toward portable gaming, creating strong demand for dedicated handheld consoles that offer superior performance, tactile controls, and enhanced battery life. These devices are specifically engineered for immersive gameplay, offering an edge over general-purpose mobile devices. The growing need for convenient, travel-friendly gaming solutions particularly among commuters is fueling this segment’s growth and continues to dominate the gaming console industry.

The hybrid game console segment is expected to witness the highest CAGR from 2025 to 2033. This growth is driven by the increasing demand for portable yet powerful gaming experiences that combine the benefits of both home consoles and handheld devices. Hybrid consoles provide flexibility for gamers to switch seamlessly between on-the-go and traditional TV-connected gameplay. Technological advancements in graphics processing, battery life, and display quality are enhancing the performance of these devices. The rising popularity of mobile gaming and consumer preference for versatile entertainment solutions are further boosting adoption. Leading players continue to innovate in this space, setting benchmarks for hybrid gaming experiences that cater to diverse user needs.

Component Insights

The console unit segment accounted for the largest market share in 2024, driven by the rise of esports and a growing number of developers producing high-quality, performance-intensive games. Gamers are increasingly demanding consoles with superior graphics, processing power, and overall performance, prompting manufacturers to launch more advanced models. Emerging markets such are witnessing a surge in console adoption due to a growing middle-class population with increased disposable income. Many consumers turn to gaming as a primary form of at-home entertainment, significantly boosting console unit sales and driving the market growth.

The controller segment is expected to witness the highest CAGR from 2025 to 2033, driven by the increasing technological advancements and demand for more immersive gaming experiences. The controller, such as gamepads, joysticks, and steering wheels, controls and interacts with games on consoles. These controllers play a critical role in providing a seamless and enjoyable gaming experience for users, and as a result, they have become a key component of the market. The growth is attributed to the increasing demand for more advanced and feature-rich controllers. Modern controllers come with various features, such as motion sensors, touchpads, and haptic feedback, which enhance the gaming experience and provide greater immersion for players. As game developers continue producing more sophisticated games, the demand for controllers supporting these games has also increased.

Regional Insights

The North America gaming console market accounted for a significant market share of over 24% in 2024, driven by the region’s high concentration of major gaming companies, strong consumer purchasing power, and early adoption of next-generation gaming technologies. The growing popularity of esports tournaments, increasing demand for immersive gaming experiences, and widespread availability of high-speed internet have fueled console gaming industry in the region. The presence of a large and engaged gaming community, coupled with the success of exclusive game titles and subscription-based gaming services, continues to drive console sales and user engagement across North America.

U.S. Gaming Console Market Trends

The U.S. gaming console market accounted for the largest market share of over 63% in 2024, driven by the country's robust gaming ecosystem and strong presence of major console manufacturers and game developers. The widespread availability of high-speed internet and early adoption of emerging technologies such as virtual reality (VR), augmented reality (AR), and cloud gaming are further accelerating growth. The U.S. market also benefits from strong retail infrastructure and high demand for next-generation consoles with enhanced graphics and performance capabilities.

Europe Gaming Console Market Trends

The Europe gaming console market is expected to grow at a significant CAGR of over 8% from 2025 to 2033. In Europe, the market is driven by a strong gaming culture, increasing popularity of esports tournaments, and growing adoption of next-generation consoles featuring. The rise of digital gaming and high-speed internet penetration across countries are supporting the shift toward online multiplayer and cloud gaming experiences. Favorable government policies and tax incentives aimed at supporting the gaming industry, coupled with a thriving community of independent game developers, are further fueling demand for gaming console industry.

The UK gaming console market is expected to grow at a significant rate in the coming years. The country benefits from a well-established gaming console industry, a strong network of game developers, and consistent government support through tax relief programs such as the Video Games Tax Relief (VGTR). High consumer spending on entertainment, combined with early adoption of cutting-edge technologies such as 5G and cloud gaming, is driving console sales. Increased investment in interactive media, digital infrastructure, and gaming-focused education programs is fostering innovation and accelerating the market's expansion in the UK

The Germany gaming console market is fueled by the country’s robust gaming culture, high penetration of broadband internet, and strong consumer appetite. Germany's well-established eSports ecosystem promotes the gaming industry as part of the digital economy is fostering rapid market growth. The increasing popularity of cross-platform gaming, localized game content, and console-based multiplayer titles is driving console adoption among German youth and families. The expansion of digital distribution channels and rising demand for immersive gaming experiences, including VR and AR integration, are encouraging both local and international console manufacturers to strengthen their presence in the German market.

Asia Pacific Gaming Console Market Trends

The Asia Pacific gaming console market dominates the market with a market share of over 46% in 2024, driven by the region’s rapidly expanding gaming population, increasing disposable incomes, and strong presence of local game developers. The widespread availability of affordable broadband and mobile internet services is enhancing access to online gaming content. The cultural popularity of competitive gaming and character-based franchises, along with strategic partnerships between console makers and regional content creators, are further propelling demand. Government support for the digital economy and the emergence of tech-savvy youth is also contributing to the region’s dynamic growth in the gaming console industry.

The Japan gaming console market is gaining traction, driven by the country’s long-standing gaming heritage, cutting-edge technology ecosystem, and a highly engaged consumer base. Japan is home to some of the world’s leading gaming console manufacturers and game developers. The strong domestic demand for immersive and story-rich gaming experiences, coupled with a cultural affinity for both console and handheld gaming, fuels market growth. Japan’s rising adoption of cloud gaming and digital distribution platforms are further accelerating the expansion of the gaming console market in the country.

The China gaming console market is rapidly expanding. China's strong focus on technological innovation and advancements in hardware capabilities is driving the demand for high-performance gaming consoles. The lifting of the console ban in recent years has opened up the market, encouraging global and domestic brands to introduce advanced consoles tailored for Chinese consumers. The rising popularity of online multiplayer games and esports, combined with the country’s robust internet infrastructure and growing middle-class population, is significantly boosting console adoption.

Key Gaming Console Company Insights

Some of the key players operating in the market include Sony Corporation and Microsoft among others

-

Sony Corporation is a global leader in the gaming console market, best known for its PlayStation series. The PlayStation 5 (PS5) has set new standards in gaming performance with ultra-fast SSD storage, ray tracing, and adaptive triggers. Sony’s strong portfolio of exclusive titles and its PlayStation Network ecosystem, which includes PlayStation Plus and cloud gaming services, enhance user engagement and drive recurring revenue. With a loyal global user base and continued hardware innovation, Sony remains a dominant force in the gaming console industry.

-

Microsoft is a top-tier gaming console manufacturer, recognized for its Xbox Series X and Series S platforms. Through its Xbox Game Pass subscription service, cloud gaming via Xbox Cloud Gaming (xCloud), and aggressive content acquisitions like Bethesda and Activision Blizzard, Microsoft is reshaping the future of console gaming. Its emphasis on backward compatibility, cross-platform play, and integration with Windows PCs ensures a seamless gaming experience, reinforcing its leadership position in the global console ecosystem.

ASUSTeK Computer Inc. and Logitech are some of the emerging market participants in the gaming console market.

-

ASUSTeK Computer Inc. is an emerging player in the gaming console space, gaining traction with its handheld gaming device, the ROG Ally. Designed to cater to PC and console gamers alike, the ROG Ally offers high-end AMD processors, a full Windows OS, and compatibility with multiple game launchers, including Steam and Xbox Game Pass. ASUS leverages its strong reputation in gaming hardware to deliver a portable yet powerful experience, aligning with the rising demand for hybrid gaming solutions.

-

Logitech is gradually entering the gaming console segment with its cloud-focused handheld device, the Logitech G Cloud. Tailored for cloud gaming services like Xbox Cloud Gaming and NVIDIA GeForce NOW, the G Cloud emphasizes portability, long battery life, and access to titles without local hardware constraints. Focusing on the growing cloud-based gaming segment, Logitech is positioning itself as a next-gen gaming device provider aimed at casual and mobile-first gamers.

Key Gaming Console Companies:

The following are the leading companies in the gaming console market. These companies collectively hold the largest market share and dictate industry trends.

- Sony Corporation

- Microsoft

- Nintendo

- ASUSTeK Computer Inc.

- NVIDIA Corporation

- Atari, Inc.

- Tencent.

- SEGA.

- Logitech.

- Mad Catz Global Limited.

Recent Developments

-

In June 2025, Microsoft announced a strategic multi-year partnership with AMD to co-engineer custom silicon for its next-generation Xbox consoles. The new platform will support a broader ecosystem by offering an Xbox experience that is not locked to a single store or limited to one device. Designed to work seamlessly across living room consoles, handheld devices, and the cloud, this initiative reflects Microsoft’s vision of a unified, device-agnostic gaming platform. The company is also collaborating closely with the Windows team to position Windows as the leading platform for gaming, further reinforcing its commitment to cross-device gameplay and accessibility in the gaming console market.

-

In June 2025, Microsoft and ASUS announced the launch of the ROG Xbox Ally and ROG Xbox Ally X, two new handheld gaming consoles developed in collaboration to bring the power of Xbox to portable devices. Designed to support Xbox Play Anywhere, Game Pass, Xbox Cloud Gaming (Beta), and Remote Play, these handhelds allow gamers to enjoy high-performance console experiences on the go. Set to launch during the holiday season in select markets, the ROG Xbox Ally series combines ASUS’s hardware innovation with Microsoft’s expansive gaming ecosystem, marking a significant step forward in the gaming console industry.

-

In June 2025, Nintendo launched the Nintendo Switch 2. The new console features enhanced hardware performance and a broader content library. The launch of Nintendo rolled out a firmware update, introducing system stability improvements and expanding the Nintendo Classics catalog with legacy GameCube titles. This release reinforces Nintendo’s commitment to innovation and backward compatibility in the evolving gaming console market.

Gaming Console Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 28.28 billion

Revenue forecast in 2033

USD 47.58 billion

Growth rate

CAGR of 6.7% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, volume in million units, and CAGR from 2025 to 2033

Report product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution channel, type, component, and region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Brazil; Mexico; Saudi Arabia; UAE; South Africa

Key companies profiled

Sony Corporation; Microsoft; Nintendo; ASUSTeK Computer Inc.; NVIDIA Corporation; Atari, Inc.; Tencent.; SEGA.; Logitech.; Mad Catz Global Limited.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

Global Gaming Console Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technological trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the gaming consolemarket report based on product, application, distribution channel, type, component, and region:

-

Product Outlook (Volume, Million Units; Revenue, USD Million, 2021 - 2033)

-

Nintendo

-

PlayStation

-

Xbox

-

Others

-

-

Application Outlook (Volume, Million Units; Revenue, USD Million, 2021 - 2033)

-

Gaming

-

Non-gaming

-

-

Distribution Channel Outlook (Volume, Million Units; Revenue, USD Million, 2021 - 2033)

-

Online Distribution Channel

-

Offline Distribution Channel

-

-

Type Outlook (Volume, Million Units; Revenue, USD Million, 2021 - 2033)

-

Home Video Game Console

-

Handheld Game Console

-

Portable

-

Non-Portable

-

-

Hybrid Video Game Console

-

Plug and Play/Retro Console

-

-

Component Outlook (Volume, Million Units; Revenue, USD Million, 2021 - 2033)

-

Console Unit

-

Controller

-

Paddle

-

Joystick

-

Gamepad

-

-

Game Media

-

Game Cartridge

-

Optical Media

-

Digital Distribution

-

Cloud Gaming

-

-

External Storage

-

-

Regional Outlook (Volume, Million Units; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global gaming console market size was estimated at USD 26.32 billion in 2024 and is expected to reach USD 28.28 billion in 2025.

b. The global gaming console market is expected to grow at a compound annual growth rate of 6.7% from 2025 to 2033 to reach USD 47.58 billion by 2033.

b. The Asia Pacific region dominated the global market in 2024 and accounted for more than 47.3% of the revenue for the same year. Ever-increasing smartphone penetration and rising demand for entertainment in the countries such as China, India, and South Korea is a key factor driving regional growth.

b. Key market participants include Sony Corporation, Microsoft, Nintendo, ASUSTeK Computer Inc., NVIDIA Corporation, Atari, Inc., Tencent., SEGA., Logitech., Mad Catz Global Limited. among others.

b. Growing penetration of internet services across the globe, coupled with easy availability and access to games on the Internet, is also expected to keep growth prospects upbeat over the coming years.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.