- Home

- »

- Homecare & Decor

- »

-

Garage Organization And Storage Market Size Report, 2033GVR Report cover

![Garage Organization And Storage Market Size, Share & Trends Report]()

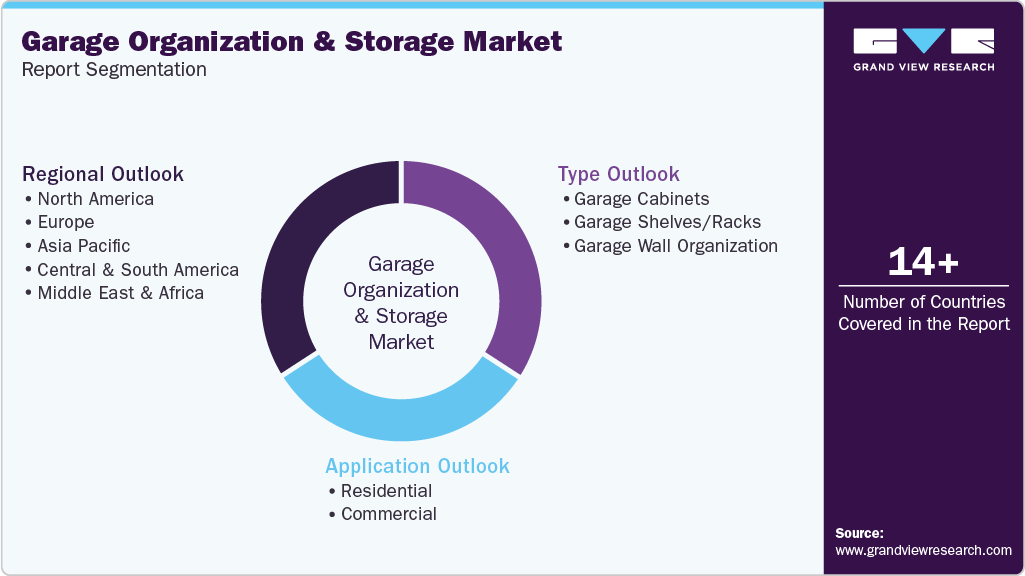

Garage Organization And Storage Market (2026 - 2033) Size, Share & Trends Analysis Report By Type (Garage Cabinets, Garage Shelves/Racks, Garage Wall Organization), By Application (Residential, Commercial), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-027-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Garage Organization And Storage Market Summary

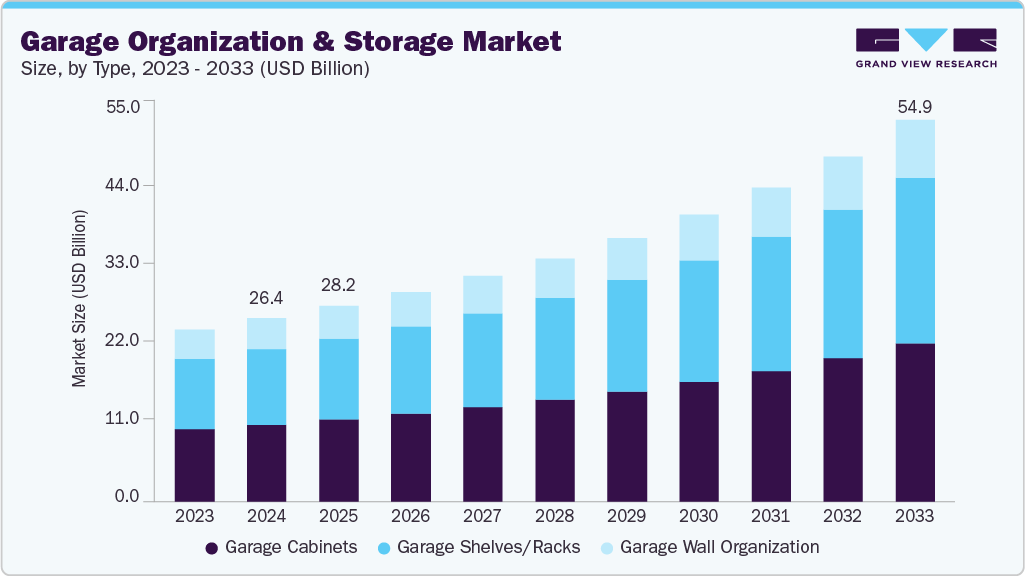

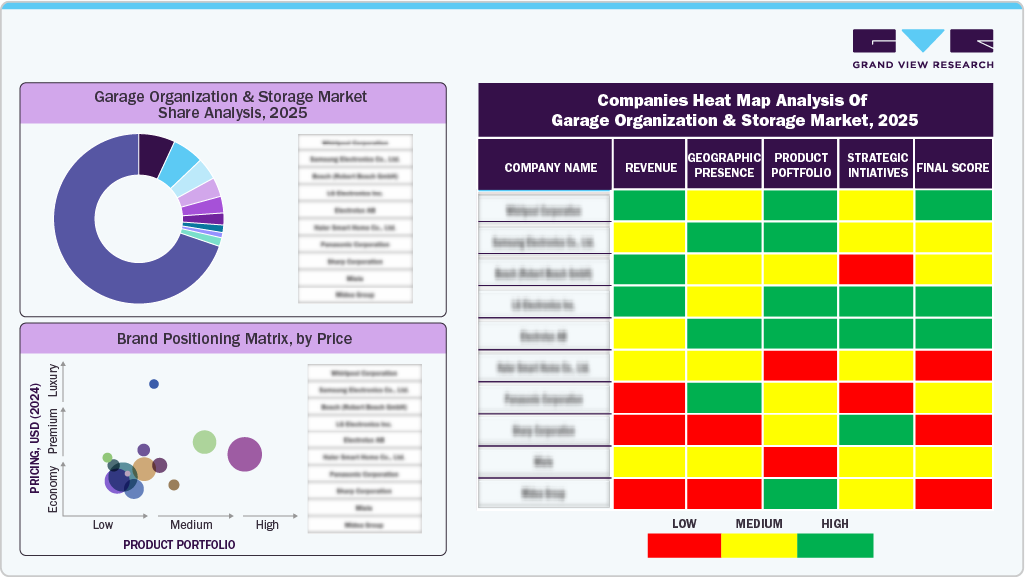

The global garage organization and storage market size was valued at USD 28.17 billion in 2025 and is projected to reach USD 54.97 billion by 2033, growing at a CAGR of 8.9% from 2026 to 2033. The global market is primarily driven by an increase in the number of vehicle owners, rising disposable income, and especially in high-income countries.

Key Market Trends & Insights

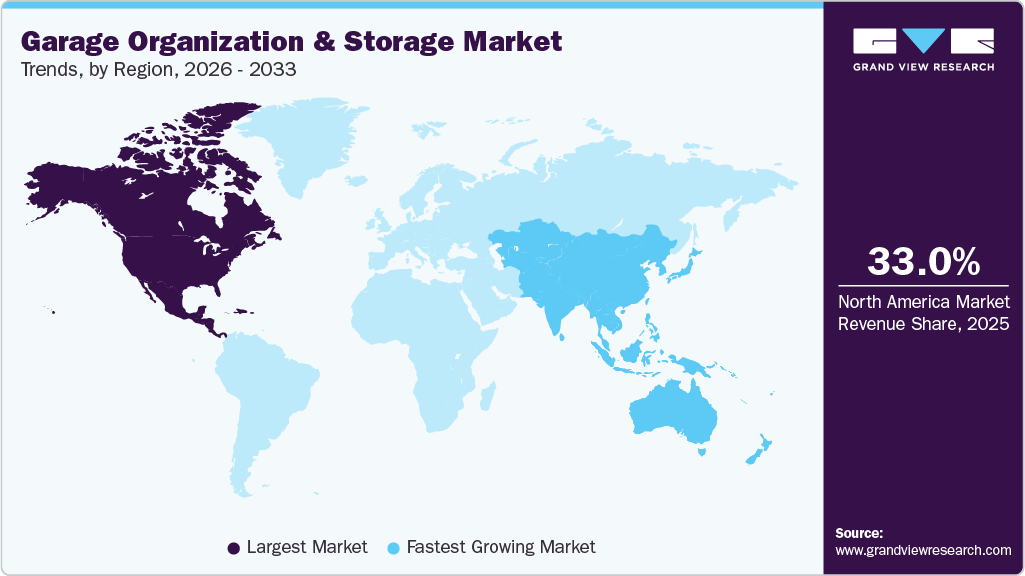

- By region, North America led the market with a share of 33.0% in 2025.

- The Asia Pacific garage organization and storage market is expected to grow at the fastest CAGR of 16.3% from 2026 to 2033.

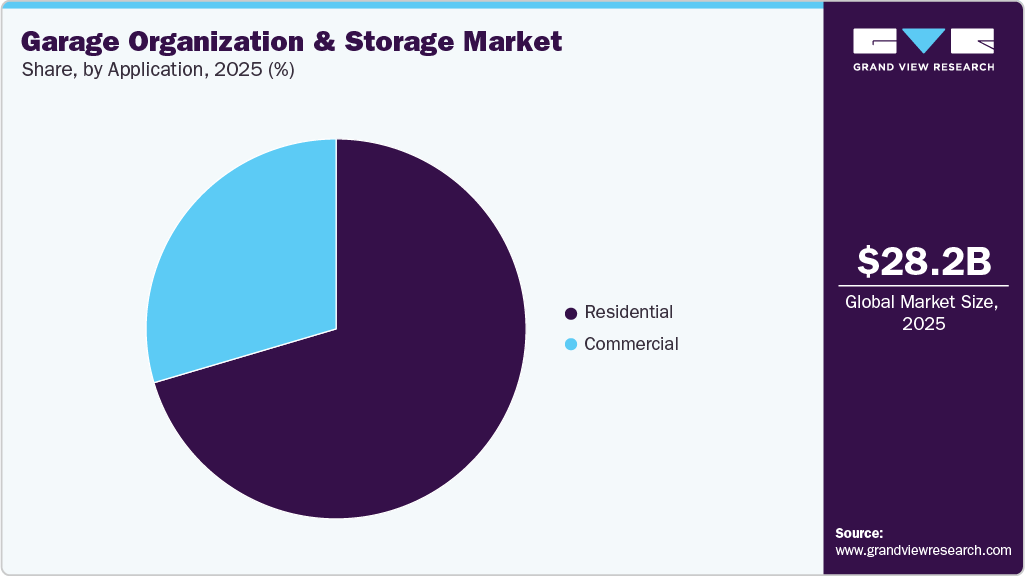

- By application, residential segment led the market and accounted for a share of 70.4% in 2025.

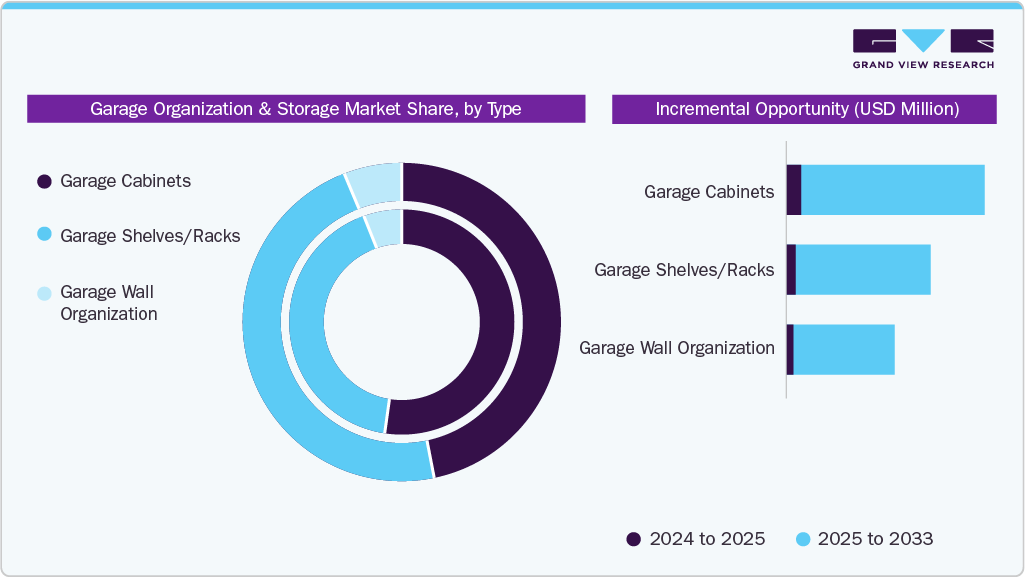

- By type, garage cabinets segment led the market and accounted for a share of 41.9% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 28.17 Billion

- 2033 Projected Market Size: USD 54.97 Billion

- CAGR (2026-2033): 8.9%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

The garage organization and storage systems allow customers to neatly and conveniently segregate their belongings. Garage organization and storage systems enable end customers to store and manage their belongings within their garage space efficiently. The garage area within freestanding households has evolved from a basic parking space to a vast storage room that can store a variety of vehicles, tools, and equipment used for both leisure and occupational purposes.Many consumers have witnessed a regular pace of new developments as businesses sought to capitalize on a stable and rising demand for these products. With the increasing number of family heads in the house and the multi-use of garages, the garage is also becoming an important part of houses. Keeping the multi-use of storage units in mind, industry players are developing large storage units that can serve as both garage storage and other domestic storage needs.

The demand for extra storage space as families acquire and grow more material items is the main factor influencing the performance of garage storage properties. In addition, as baby boomers downsize, a greater need for storage facilities is anticipated. An increasingly urban population results in a higher proportion of renters who move around more frequently, as well as smaller, more expensive living spaces in cities.

The storage companies have continued to get frequent warnings from the Department of Homeland Security (DHS) that their facilities could be used to keep materials that could be utilized in a terrorist attack. People often use garage storage products to store pesticides, pool products, commercial cleaning products and equipment, paints, paint thinners, and industrial cleaners. According to the U.S. Fire Administration, some of these products are highly flammable and can cause severe fire incidents. Thus, governments worldwide have imposed limitations on the use of garage products.

Advancements in materials have played a critical role in shaping the modern garage storage market. Manufacturers are increasingly adopting high-density plastics, powder-coated metals, aluminum, and sustainable wood composites to provide durable, long-lasting, and environmentally responsible solutions. These materials not only improve structural integrity but also allow for enhanced aesthetic appeal, enabling storage systems to blend seamlessly with home interiors. Product innovations now emphasize modularity and flexibility, allowing consumers to combine cabinets, wall-mounted panels, overhead storage, and bins into cohesive systems tailored to their individual garage layouts. Moreover, custom finishes, ergonomic design, and adjustable shelving are emerging as differentiating factors that drive consumer preference.

Consumer Insights

Consumers are increasingly adopting modular and customizable garage storage solutions, allowing them to organize items based on their needs. Products such as adjustable shelving units, wall-mounted racks, and overhead storage systems let homeowners tailor their garages for tools, sports gear, or seasonal items. For instance, ClosetMaid's customizable shelving systems enable users to mix and match shelves, drawers, and cabinets for an optimized layout. This flexibility appeals to those seeking efficiency and a neat, organized space.

Smart garage solutions are gaining traction as homeowners seek convenience and automation. Products such as app-controlled garage storage, automated shelving, and motion-sensor lighting allow better organization while saving time. For instance, the E-Z Garage Storage Lift is a motorized ceiling storage solution that enables users to raise heavy items easily to 700 lbs. Such technology-driven solutions appeal especially to tech-savvy homeowners and those looking to transform their garages into highly functional, user-friendly spaces.

Most homes come with attached or detached garages, providing homeowners with a dedicated space that often becomes cluttered over time. The DIY culture adds a strong layer to this trend. Many homeowners now prefer to take on projects themselves rather than hiring professionals. DIY projects offer cost efficiency, but equally important, they allow for personalization; consumers can customize layouts, finishes, and systems to suit their lifestyles. The widespread availability of modular products, detailed tutorials, and step-by-step guides online makes these projects more accessible than ever. Retailers and manufacturers are also targeting this audience with easy-to-install, customizable solutions.

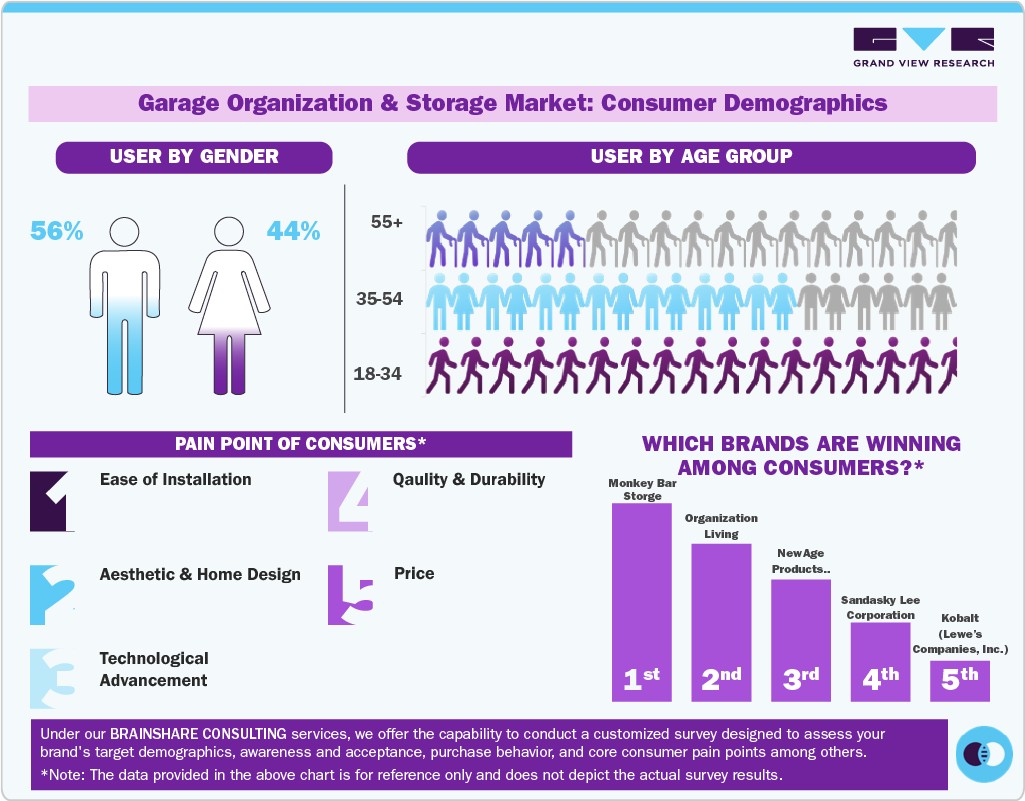

According to a nationwide survey on American women's DIY home improvement habits and trends in 2023, over 900 women shared insights into their habits and preferences for DIY and home improvement projects. The survey highlights how they approach various tasks, navigate home improvement stores, work with partners, and interact with contractors. A striking 93% of the women surveyed have completed at least one DIY project in their home, with an average spend of around USD 2,300 on those efforts. The survey also explores how women engage with contractors and their inherent safety or comfort concerns. Among respondents, 39% have worked with contractors, and of these, 60% felt they were treated differently compared to men. A notable 27% of women said they didn’t feel comfortable being home alone with contractors present, and 30% even asked someone else to be home while the contractor was working.

In addition to residential adoption, strong demand from workshops, auto-repair centers, and small industrial facilities supports market growth.

As urban spaces continue to shrink, space optimization has become a key driver for garage storage solutions. Many homeowners are transforming their garages into multifunctional spaces, such as home offices or gyms, which require innovative storage designs. This presents an opportunity for businesses to create space-efficient products that maximize storage capacity in limited areas.

Type Insights

The garage cabinets segment dominated the global market, accounting for a 41.9% share in 2025. Demand for garage cabinets within the broader garage organization and storage market is increasing as homeowners increasingly view the garage as an extension of their living space, rather than a purely functional area. Garage cabinets offer a clean, secure, and space-efficient way to manage tools, seasonal items, sports equipment, and household supplies, addressing the rising need for clutter reduction and efficient space utilization. In addition, the shift toward home improvement spending, coupled with the popularity of modular, customizable, and premium cabinetry systems, is driving strong adoption across U.S. and international markets.

The shelves/racks segment is expected to witness strong consumer demand and register a CAGR of 9.6% from 2026 to 2033. With more people using garages as multipurpose areas serving not only as parking spaces but also as workshops, fitness zones, hobby rooms, and storage extensions there is a growing need for durable, high-capacity shelving that maximizes vertical space. The surge in home improvement spending, driven by hybrid work lifestyles and rising DIY culture, is further accelerating adoption. Consumers are also purchasing more outdoor gear, tools, seasonal décor, and bulk household items, creating a higher need for structured storage solutions. As a result, garage shelves and racks have become essential for improving accessibility, safety, and overall home functionality.

Application Insights

The residential application segment captured the largest market share of 70.4% in 2025. Growing suburban homeownership, larger vehicle ownership, and the shift toward multipurpose garages used for hobbies, home gyms, DIY projects, and seasonal storage-are driving demand for structured storage solutions. Additionally, the rise of e-commerce has led to greater household inventory, prompting consumers to seek shelving, cabinets, wall-mounted systems, and customizable modular units to manage clutter efficiently. Higher disposable incomes and a growing preference for clean, organized, and aesthetically pleasing home environments are further accelerating adoption, supported by trends in home-improvement media, social platforms, and professional organizing services.

The commercial application segment is anticipated to have the fastest CAGR of 10.9% from 2026 to 2033. Many rental and commercial parking garages use organization and storage products to provide convenience and ease of storage to their customers. According to statistics published by the U.S. Census Bureau, construction spending on commercial parking lots and garages is expected to increase over the forecast period due to rising vehicle sales nationwide. This is expected to increase demand for these products in commercial settings.

Regional Insights

The North American garage organization and storage market accounted for a share of 33.0% in 2025. Garage organization and storage solutions are rising in North America as households increasingly prioritize space optimization, home improvement, and clutter-free living. With growing suburban homeownership and a strong DIY culture, consumers are converting garages into multifunctional spaces such as workshops, hobby areas, fitness zones, or secondary storage rooms, driving demand for shelving systems, cabinets, wall-mounted racks, and modular storage units. The rise of e-commerce and bulk purchasing has also increased the need for organized storage at home.

Europe Garage Organization And Storage Market Trends

The garage organization and storage market in Europe accounted for a share of 27.3% in 2025. The rising adoption of home improvement and DIY culture, accelerated post-pandemic, has led consumers to convert garages into multifunctional spaces, such as workshops, fitness areas, hobby rooms, and secondary storage units. The growth of e-commerce has also led to an increase in in-home product accumulation, prompting homeowners to seek structured shelving, wall-mounted systems, and modular storage solutions. Additionally, higher car ownership in suburban areas, rising interest in home value enhancement, and increased spending on premium organization systems are further contributing to strong, sustained demand across European markets.

Asia Pacific Garage Organization And Storage Market Trends

The Asia Pacific garage organization and storage market is expected to grow at the fastest CAGR of 16.3% from 2026 to 2033. The growth can attributed to the rapid urbanization, shrinking residential spaces, and growing vehicle ownership across major markets such as China, India, Japan, and Southeast Asia. As apartments and compact homes become more common, consumers increasingly seek efficient ways to maximize limited space, leading to higher adoption of wall-mounted racks, modular cabinets, and multifunctional storage systems. Additionally, the shift toward organized, clutter-free living and the rise of recreational equipment ownership (bikes, sports gear, tools) have strengthened the need for structured garage storage solutions across the region.

Central & South America Garage Organization And Storage Market Trends

The Central & South America garage organization and storage market is expected to grow at a CAGR of 8.3% from 2026 to 2033. As households in major cities face limited square footage, consumers are increasingly turning to modular shelving, wall-mounted racks, and compact storage systems to maximize available space. Rising car ownership and the use of garages as hybrid areas serving simultaneously as parking, storage, hobby, and workspace zones are reinforcing the need for structured organization.

Middle East & Africa Garage Organization And Storage Market Trends

In the Middle East and Africa, the garage organization and storage market is expected to grow at a CAGR of 13.1% from 2026 to 2033, driven by increasing residential construction and a rise in disposable incomes, particularly in Gulf Cooperation Council (GCC) states such as the UAE and Saudi Arabia. As more homes incorporate integrated garages and real estate development emphasizes premium living spaces, homeowners are placing greater emphasis on efficient storage solutions and space optimization. Additionally, the expanding automotive sector, paired with wealthier consumer lifestyles seeking neat, high-end organisational systems, underpins demand for specialty cabinets, shelving, and wall-mounted systems.

Key Garage Organization And Storage Company Insights

The market is defined by several large companies and a few startups and small-scale companies trying to penetrate the global market. Many big players are increasing their focus on the growing trend in the global industry. Players in the market are diversifying their service offerings to maintain market share.

Key Garage Organization And Storage Companies:

The following are the leading companies in the garage organization and storage market. These companies collectively hold the largest market share and dictate industry trends.

- Gladiator

- GarageTek Inc.

- Sterilite Corporation

- Stanley Black & Decker

- Lowe's Companies Inc.

- ClosetMaid Corporation

- Monkey Bars Storage Company

- Rubbermaid Commercial Products LLC

- Alpha Guardian

- Cannon Security Products

Recent Developments

-

In July 2025, SafeRacks launched its new Bin Storage Rack, designed with durability, efficiency, and smart organization in mind. It serves a variety of spaces, including garages and utility rooms, and is now available online and at select retailers such as Costco. This release marks SafeRacks' expansion from garage-focused products to broader home storage solutions, highlighted by positive early reviews for its strength, easy access, and versatile design.

-

In June 2025, Guild Garage Group announced its partnership with Garage Door Medics, a respected residential garage door service company based in San Diego, as part of Guild's ongoing national expansion and acquisition strategy. The partnership aims to foster growth for Garage Door Medics without changing its core values, focusing on trust, culture, and long-term success for both companies.

-

In April 2024, Bulldog Garage Products launched the availability of its epoxy, epoxy chips, and garage cabinet storage systems for residential and commercial consumers at Lowe's.

Garage Organization And Storage Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 30.20 billion

Revenue forecast in 2033

USD 54.97 billion

Growth rate

CAGR of 8.9% from 2026 to 2033

Base year for estimation

2025

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD Million/Billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Gladiator; GarageTek Inc.; Sterilite Corporation; Stanley Black & Decker; Lowe's Companies Inc.; ClosetMaid Corporation; Monkey Bars Storage Company; Rubbermaid Commercial Products LLC; Alpha Guardian; Cannon Security Products

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Garage Organization And Storage Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the garage organization and storage market based on type, application, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Garage Cabinets

-

Garage Shelves/Racks

-

Garage Wall Organization

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Residential

-

Commercial

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Some of the key players operating in the garage organization and storage market include Gladiator, GarageTek Inc., Sterilite Corporation, Stanley Black & Decker, Lowe's Companies Inc., ClosetMaid Corporation, Monkey Bars Storage Company, Rubbermaid Commercial Products LLC, Alpha Guardian, and Cannon Security Products.

b. Key factors that are driving the garage organization & storage market growth include an increase in the number of vehicle ownership, rising disposable income, and especially in high-income countries.

b. The global garage organization and storage market was estimated at USD 28.17 billion in 2025 and is expected to reach USD 30.20 billion in 2026.

b. The global garage organization and storage market is expected to grow at a compound annual growth rate of 8.9% from 2026 to 2033 to reach USD 54.97 billion by 2033.

b. The garage cabinets segment dominated the global market, accounting for a 41.9% share in 2025. Demand for garage cabinets within the broader garage organization and storage market is increasing as homeowners increasingly view the garage as an extension of their living space, rather than a purely functional area.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.