- Home

- »

- Advanced Interior Materials

- »

-

Gas Analyzers Market Size And Share, Industry Report, 2030GVR Report cover

![Gas Analyzers Market Size, Share & Trends Report]()

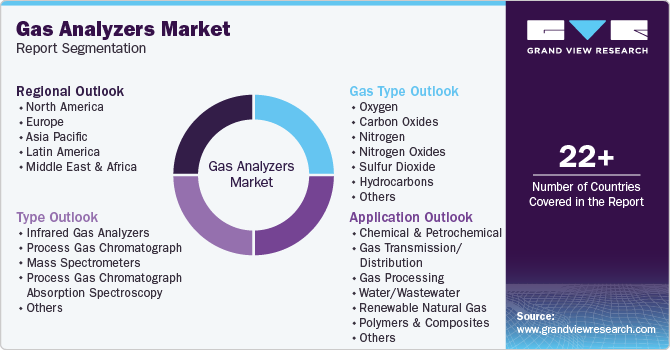

Gas Analyzers Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Infrared Gas Analyzers, Process Gas Chromatograph, Mass Spectrometers, Laser Absorption Spectroscopy), By Gas Type, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-528-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Gas Analyzers Market Summary

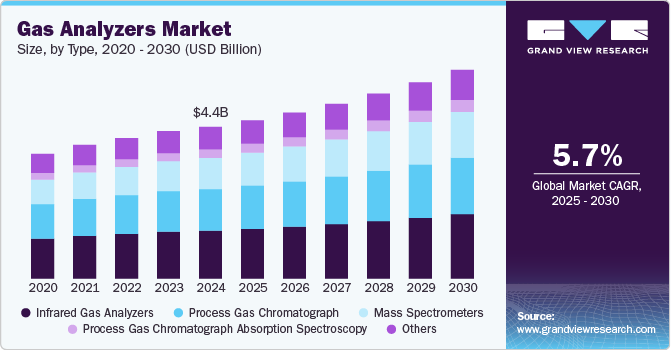

The global gas analyzers market size was estimated at USD 4,393.4 million in 2024 and is projected to reach USD 6,045.8 million by 2030, growing at a CAGR of 5.7% from 2025 to 2030. The global gas analyzers industry is experiencing significant growth due to several key factors.

Key Market Trends & Insights

- Asia Pacific dominated the gas analyzers market with the largest revenue share of 32.5% in 2024.

- The gas analyzers market in China is expected to grow at a significant CAGR of 6.7% over the forecast period.

- Based on type, the infrared gas analyzers segment led the market with the largest revenue share in 31.6% in 2024.

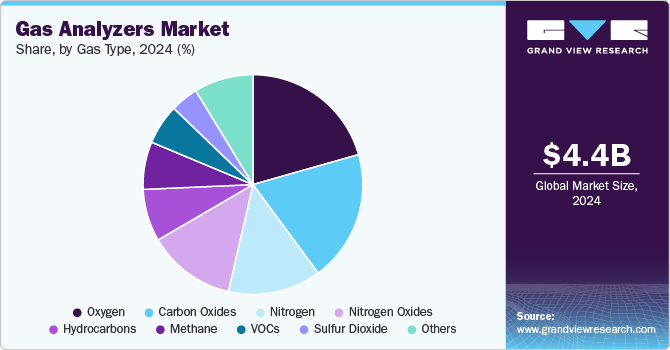

- Based on gas type, the oxygen segment led the market with the largest revenue share of 20.6% in 2024.

- Based on application, the chemical & petrochemical segment led the market with the largest revenue share of 25.7% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4,393.4 Million

- 2030 Projected Market Size: USD 6,045.8 Million

- CAGR (2025-2030): 5.7%

- Asia Pacific: Largest market in 2024

Increasing industrialization and the need for advanced technologies to monitor air quality are leading to the high demand for gas analyzers. Stringent environmental regulations and standards, especially for monitoring air pollution, are also pushing the adoption of these devices.

The rising awareness about health and safety, coupled with advancements in sensor technology, is driving the development of more precise and efficient gas analyzers. The demand in sectors like oil and gas, pharmaceuticals, and food & beverage is also contributing to the market expansion, as these industries require accurate gas detection for operational safety.

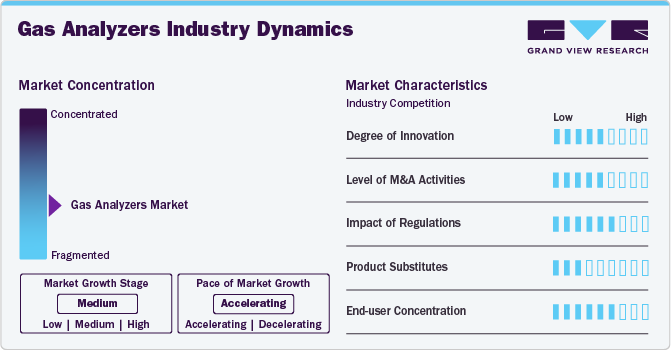

Market Concentration & Characteristics

The global gas analyzers industry is moderately fragmented, with a mix of large multinational corporations and regional players competing for market share. Leading manufacturers are increasingly focused on developing advanced, high-precision gas analyzers designed for a wide range of applications, including industrial safety, environmental monitoring, and process control in industries such as oil and gas, pharmaceuticals, and food & beverage. Innovation in the market is primarily driven by the increasing demand for real-time data, greater accuracy, and compliance with stringent environmental and health regulations. As industries push for more sustainable operations, there is a rising demand for gas analyzers that offer higher sensitivity, lower operational costs, and enhanced reliability.

Regulatory pressures from organizations like the EU, EPA, and local environmental authorities are significantly shaping the market, with a strong focus on monitoring harmful emissions, air quality, and compliance with safety standards. Companies must comply with these regulations to stay competitive, as governments around the world introduce stricter measures to mitigate pollution and protect public health. With industries becoming more conscious of their environmental impact, the demand for eco-friendly gas detection technologies that support regulatory compliance is increasing, particularly in sectors like manufacturing, healthcare, and energy.

While there are ample opportunities for growth, the market also faces competition from alternative technologies such as infrared and photoionization detectors, which can offer lower-cost solutions in certain applications. To maintain a competitive edge, manufacturers must focus on continuous innovation, including the integration of digital technologies like Internet of Things (IoT) for real-time monitoring and predictive analytics. Emphasizing sustainability, enhanced accuracy, and compliance with global regulatory frameworks will be crucial for manufacturers to capture the expanding market for advanced, eco-friendly gas analysis solutions.

Drivers, Opportunities & Restraints

The gas analyzers industry is primarily driven by the increasing enforcement of stringent environmental regulations and the rising demand for precise air quality monitoring across industries such as oil and gas, pharmaceuticals, and manufacturing. In addition, technological advancements in sensor capabilities and the growing emphasis on industrial safety and compliance with health and environmental standards further fuel the demand for advanced gas detection solutions. As industries strive to meet regulatory requirements and improve operational safety, the market is poised for continued growth.

One of the main restraints for the growth of the gas analyzers industry is the high cost of advanced analyzer systems, which may limit their adoption, especially in smaller businesses or developing regions. In addition, the maintenance costs and the need for frequent calibration of gas analyzers can deter potential buyers.

The market presents opportunities through technological advancements, such as the integration of IoT and Artificial Intelligence (AI) for real-time monitoring and predictive maintenance. As industries continue to focus on sustainability and compliance with stricter emission regulations, there is a growing opportunity for manufacturers to innovate and create cost-effective and efficient solutions.

Type Insights

Based on type, the infrared gas analyzers segment led the market with the largest revenue share in 31.6% in 2024, due to their reliability and accuracy in detecting gases in real time. As environmental regulations around air quality become more stringent, industries are adopting these analyzers to ensure compliance.

The mass spectrometer segment is growing steadily, driven by the increasing need for precise and high-sensitivity gas analysis in industries including environmental monitoring, pharmaceutical, food, and particularly the semiconductor industry. The surge in semiconductor fabrication is expected to drive the need for mass spectrometers.

Gas Type Insights

Based on gas type, the oxygen segment led the market with the largest revenue share of 20.6% in 2024, supported by a focus on maintaining health standards and ensuring operational safety in multiple sectors. As industrial and healthcare sectors evolve, the requirement for reliable oxygen level detection is expected to remain a priority, albeit with moderate growth due to the maturity of the technology.

The methane analyzer market is expected to grow at a steady CAGR during the forecast period, primarily driven by the need for real-time monitoring and detection technologies in industries like oil and gas, agriculture, and waste management. Stringent regulations to limit methane emissions and the increasing focus on sustainability will contribute to the heightened demand for these analyzers.

Application Insights

Based on application, the chemical & petrochemical segment led the market with the largest revenue share of 25.7% in 2024, primarily driven by the need for efficient monitoring and control of gas emissions and process conditions. These industries handle hazardous gases and require precise gas measurements to ensure safety and optimize production processes.

The need for accurate gas analysis remains steady to maintain system efficiency, meet regulatory standards, and support sustainability goals, as methane is captured from landfills, wastewater treatment plants, and agricultural waste. The established infrastructure and regulatory frameworks surrounding RNG create ongoing demand for advanced gas analyzers.

Regional Insights

Asia Pacific dominated the gas analyzers market with the largest revenue share of 32.5% in 2024. The region rapid industrialization and growing concerns about air pollution are driving the demand for gas analyzers. Countries like China and India are focusing heavily on environmental monitoring due to high levels of industrial activity and urbanization. In addition, the growing pharmaceutical and chemical industries in this region are contributing to the market growth.

China Gas Analyzers Market Trends

The gas analyzers market in China is expected to grow at a significant CAGR of 6.7% over the forecast period, due to rapid industrialization and growing concerns over air pollution. Government initiatives and strict environmental regulations aimed at reducing industrial emissions are a major driver. The rising demand for advanced technologies in manufacturing, automotive, and healthcare sectors is also supporting market growth.

The India gas analyzers market is expected to grow at the fastest CAGR of 7.4% over the forecast period, driven by the country’s booming industrial sector, including the oil and gas, chemicals, and pharmaceuticals industries. Increasing air pollution concerns and the push for compliance with international environmental standards are also key factors. In addition, urbanization and government regulations on emissions are fueling market demand.

North America Gas Analyzers Market Trends

The gas analyzers market in North America accounted for the second largest revenue share in North America in 2024. The demand for gas analyzers is being driven by stringent government regulations related to environmental safety and industrial emissions. The oil and gas sector is a major contributor to market growth, along with the growing need for real-time air quality monitoring in urban areas. Technological advancements and innovations, especially in the U.S., are also propelling market demand.

The gas analyzers market in the U.S. is projected to grow at a significant CAGR of 5.2% over the forecast period, driven by stringent environmental regulations, especially in industries like oil and gas, healthcare, and manufacturing. The increasing demand for air quality monitoring in both urban and industrial areas, alongside technological advancements in gas sensor technology, contributes to market growth.

Europe Gas Analyzers Market Trends

The gas analyzer market in Europe is fueled by the region’s commitment to environmental sustainability, with stringent emission standards and regulations. The increasing focus on industrial safety and advancements in analytical technologies across various industries, such as automotive and energy, is also contributing to market growth. Furthermore, strong investments in research and development are pushing innovation in gas analysis solutions.

The Germany gas analyzers market is projected to grow at the fastest CAGR of 6.0% over the forecast period, driven by its industrial and automotive sectors, which are heavily regulated for emissions monitoring. Germany’s focus on sustainability, clean energy, and industry 4.0 is creating opportunities for the growth of advanced gas analyzers, particularly in manufacturing and environmental monitoring.

The gas analyzers market in Spain is projected to expand at a significant CAGR of 5.3% over the forecast period due to increasing government regulations on air quality monitoring and industrial emissions. The demand from industries like pharmaceuticals, food & beverage, and oil & gas for accurate gas analysis technologies is also contributing to growth, along with Spain's push for renewable energy solutions.

Latin America Gas Analyzers Market Trends

The gas analyzers market in Latin America is growing due to increasing industrial activity, especially in the oil and gas sector. The rising awareness of environmental issues and the need to comply with international environmental standards are also propelling market demand. Countries like Brazil are focusing on improving air quality and emissions monitoring, further driving growth.

The Argentina gas analyzers market is projected to grow at a significant CAGR of 5.5% over the forecast period, supported by the growing oil and gas sector and the increasing need for environmental monitoring due to industrial emissions. The government’s focus on environmental safety regulations and the rise in industrial activities are key factors propelling the market growth in the region.

Middle East & Africa Gas Analyzers Market Trends

The gas analyzers market in Middle East and Africa is anticipated to grow at a significant CAGR during the forecast period. The demand for gas analyzers is driven by the oil and gas industry, which is one of the largest sectors in the region. In addition, increasing industrialization, coupled with government regulations focused on environmental protection and health safety, is fostering the market for gas analyzers. Rising investments in renewable energy and infrastructure projects are also contributing to market expansion.

The UAE gas analyzers market is projected to expand at a substantial CAGR of 6.9% over the forecast period, largely driven by the oil and gas industry, a critical sector for the country. There is a growing demand for air quality and environmental monitoring due to urbanization and industrial development. The UAE’s focus on sustainable practices and compliance with international environmental standards is also contributing to the market expansion.

Key Gas Analyzers Company Insights

Some of the key players operating in the market include HORIBA, Ltdand Emerson Electric Co.among others.

-

HORIBA, Ltd specializes in a diverse range of products and services across multiple sectors including Carbon Oxides emission measurement systems, environmental monitoring instruments, scientific analyzers, medical diagnostic analyzers, and semiconductor manufacturing equipment.

-

Emerson Electric Co. is a global technology and engineering company engaged in offering solutions pertaining to automation, climate technologies, and commercial and residential solutions. The company operates across a wide range of industries, including oil and gas, chemicals, power, food and beverage, and industrial manufacturing.

Key Gas Analyzers Companies:

The following are the leading companies in the gas analyzers market. These companies collectively hold the largest market share and dictate industry trends.

- Nova Analytical Systems (Tenova S.p.A.)

- Mettler-Toledo International Inc.

- HORIBA, Ltd

- Emerson Electric Co.

- ENVEA & California Analytical Instruments, Inc.

- Met One Instruments Inc.

- Honeywell International Inc.

- Advanced Micro Instruments, Inc. (Enpro Inc)

- Servomex

- AMETEK MOCON

Recent Developments

-

In December 2024, Emerson Electric Co. launched the Rosemount 470XA Gas Chromatograph, a cost-effective and compact solution for natural gas analysis in custody transfer and other applications, including emerging areas such as carbon capture and renewable natural gas.

-

In December 2024, Servomex introduced its newest ultra-trace oxygen analyzer, the Gen 7 SERVOPRO DF-500 Series, designed to achieve exceptional performance levels. Tailored for ultra-high-purity (UHP) gas analysis in the Semiconductor and Industrial Gas sectors, the DF-500 Series analyzers utilize Servomex’s digital sensing technologies, ensuring reliability, user-friendliness, and low maintenance requirements.

Gas Analyzers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4,582.6 million

Revenue forecast in 2030

USD 6,045.8 million

Growth rate

CAGR of 5.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Type, gas type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Nova Analytical Systems (Tenova S.p.A.); Mettler-Toledo International Inc.; HORIBA, Ltd; Emerson Electric Co.; ENVEA & California Analytical Instruments, Inc.; Met One Instruments Inc.; Honeywell International Inc.; Advanced Micro Instruments, Inc. (Enpro Inc); Servomex; AMETEK MOCON.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Gas Analyzers Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global gas analyzers market report based on the type, gas type, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Infrared Gas Analyzers

-

Process Gas Chromatograph

-

Mass Spectrometers

-

Process Gas Chromatograph Absorption Spectroscopy

-

Others

-

-

Gas Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Oxygen

-

Carbon Oxides

-

Nitrogen

-

Nitrogen Oxides

-

Sulfur Dioxide

-

Hydrocarbons

-

Methane

-

VOCs

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Chemical & Petrochemical

-

Gas Transmission/Distribution

-

Gas Processing

-

Water/Wastewater

-

Renewable Natural Gas

-

Polymers & Composites

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global gas analyzers market size was estimated at USD 4,393.4 million in 2024 and is expected to reach USD 4,582.6 million in 2025.

b. The global gas analyzers market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.7% from 2025 to 2030 to reach USD 6,045.8 million by 2030.

b. The market in Asia Pacific dominated the market in 2024 accounting for 32.5% of the global revenue share due to industrialization, urbanization, and heightened environmental concerns, particularly in countries like China and India. Increased government regulations on emissions and air quality monitoring further accelerate the demand for gas analyzers in the region.

b. Some of the key players operating in the gas analyzers market are Nova Analytical Systems (Tenova S.p.A.), Mettler-Toledo International Inc., HORIBA, Ltd, Emerson Electric Co., ENVEA & California Analytical Instruments, Inc., Met One Instruments Inc., Honeywell International Inc., Advanced Micro Instruments, Inc. (Enpro Inc), Servomex, and AMETEK MOCON.

b. Key factors driving the gas analyzers market include stringent environmental regulations and the growing demand for accurate air quality monitoring across various industries. Additionally, advancements in sensor technology and increased industrial safety concerns contribute to market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.