- Home

- »

- Advanced Interior Materials

- »

-

Gas Cleaning Technologies Market Size, Share Report, 2030GVR Report cover

![Gas Cleaning Technologies Market Size, Share & Trends Report]()

Gas Cleaning Technologies Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Scrubbers, Dry Sorbent Injection, Particulate/Dust Collection), By End-use (Chemical, Cement), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-097-5

- Number of Report Pages: 190

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global gas cleaning technologies market size was estimated at USD 31.83 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.9% from 2023 to 2030. The growth of the market can be attributed to a sustained rise in the number of energy and power plants, including coal and gas-fired power plants, coupled with stringent air pollution control regulations such as the Clean Air Act (CAA), and National Ambient Air Quality Standards, among others. Rising industrial activities across the world are putting pressure on governments and environmental authorities to regulate and control emissions effectively. Several governments have introduced stringent regulations related to gas emissions for industrial sectors, which is expected to drive the market over the forecast period.

Major governmental agencies such as the European Environment Agency (EEA), the United States Environmental Protection Agency (EPA), and the Central Pollution Control Board (CPCB) are playing pivotal roles in forming policies and initiatives for enhancing air quality and preventing air pollution. These factors fuel the adoption of gas cleaning technologies in the upcoming years. According to the U.S. Energy Information Administration, crude oil production in the U.S. was 11.89 million barrels per day in 2023 and is forecasted to reach 12.61 and 12.77 million barrels per day in 2023 and 2024, respectively.

The rising oil & gas production and power generation are likely to increase the utilization of air pollution control devices over the forecast period. Moreover, the Inflation Reduction Act, The CHIPS, and Science Act, which were signed into law in 2022, announced hundreds of billions of dollars for enhancing domestic semiconductor production and advancing vehicle supply chains over the next few years. The rising demand for electric vehicles is accelerating automotive manufacturing in the country, which is likely to have a positive impact on the market.

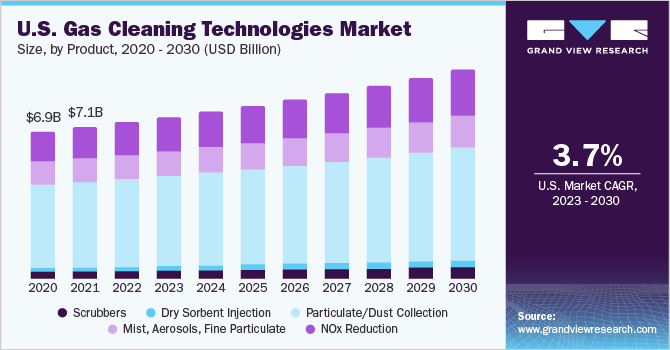

Product Insights

The particulate/dust collection segment dominated the market in 2022 with a revenue share of 56.5%. Particle dust scrubbers are a type of wet scrubber designed specifically to eliminate particulates such as 10 and 2.5 particulate matter. These particle dust scrubbers are particularly useful in operations with fine dust or sticky residues, such as food manufacturing since they prevent the buildup of biological matter during processing. Dust collection systems find applications in various end-use industries such as plasma cutting, welding, seed & grain operations, woodworking, food processing, mining, fiberglass, foundry, coatings, pharmaceuticals, and recycling facilities.

Uncontrolled dust from machinery can cause a variety of issues, including sanitation concerns, microbial contamination, worker health issues, and slip-and-fall incidents. These factors are expected to drive the demand for particulate / dust collection market over the forecast period. The dry sorbent injection segment is anticipated to grow at a CAGR of 7.1% from 2023 to 2030. Compared with other gas cleaning technologies, dry sorbent injection has several important advantages, including low capital costs and a small footprint. These lowered capital costs are due to reduced reagent utilization by these injectors, leading to their high operational expenses. These factors fuel the adoption of dry sorbent injection.

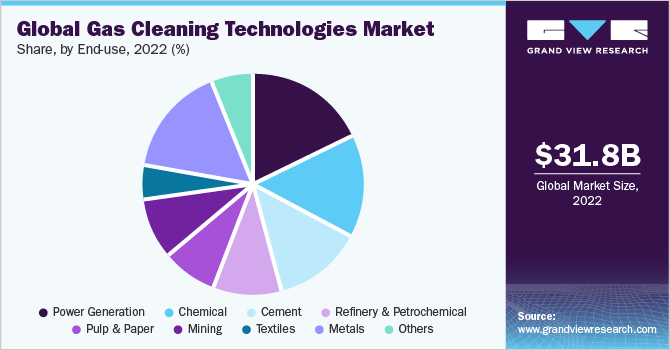

End-use Insights

The power generation segment dominated the market and accounted for a revenue share of 17.5% in 2022. Gas cleaning technologies, such as wet scrubbers and dry scrubbers, are significantly used in the power generation industry. Wet scrubbers are mostly used in the power generation sector owing to a large number of air contaminants released from fossil fuel-based power plants, especially coal-fired power plants.Wet scrubbers can also help to control SO2 as well as NO2 released from fossil fuel-based power plants. Thus, the rising adoption of wet scrubbers in such power generation plants is anticipated to fuel gas cleaning technologies market growth over the forecast period.

The chemical segment is projected to grow at CAGR of 6.1% from 2023 to 2030. Wet scrubbers are widely used in chemical plants, fertilizer plants, and acid manufacturing facilities. Rapid industrialization, expansion of chemical production facilities, increasing demand for chemicals from manufacturing industries, and innovations in product technologies of chemicals are expected to propel the chemicals industry. This is expected to trigger the demand for gas cleaning technologies such as wet, dry, semi-dry, packed towers, and jet venturi fume scrubbers over the forecast period.

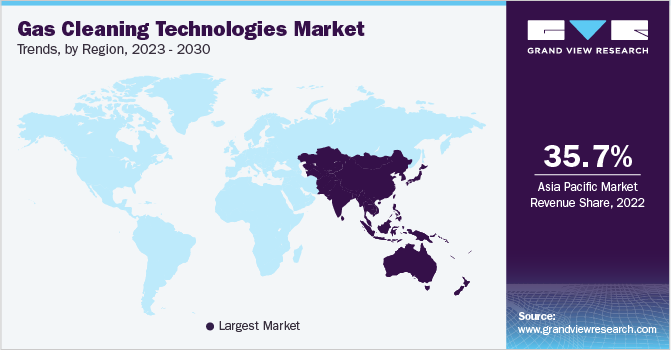

Regional Insights

Asia Pacific dominated the market and accounted for a revenue share of 35.7% in 2022 owing to alarmingly increasing air pollution levels, mainly driven by the agriculture and industrial sectors. A number of countries in the region are becoming renowned as manufacturing hubs for global companies as the trend of contract manufacturing is gaining increasing traction. This is leading to increased efforts to reduce the concentration of air-polluting substances in the ambient air by using cutting-edge technologies, such as selective catalytic reduction, wet scrubbers, filtration, and dust collectors, which positively impacts the market growth.

Europe is projected to grow at a CAGR of 4.2% over the forecast period. The expansion of industrial activities, along with the new reforms in the regulatory framework in the region, is likely to augment the demand for gas-cleaning technologies over the forecast period. For instance, in January 2023, a new environmental norm was introduced for the chemical and textile industry. Around 3,000 chemical plants and 300 textile plants in the EU will need to comply with the new legal norms which have been prescribed under EU Industrial Emission Directive, promoting the growth of the market.

Key Companies & Market Share Insights

The key players adopt various strategies such as novel expansion of production facilities, additional investments in manufacturing facilities, product launches, and collaboration to maintain a competitive edge in the market. Furthermore, the companies are also engaged in market acquisitions, mergers, expansion, and product modification approaches to ensure market domination. For instance, In June 2023, Tri-Mer Corporation launched the standard line of packed tower scrubbers for handling fumes erupting from the vents of bulk storage tanks, as well as for managing the off gases that are emitted during the filling of tanks. Moreover, this new product line also offers maximum surface contact between scrubbing liquid and gas. As such, this product line optimizes scrubbing efficiency and minimizes the packing depth required for effective operations. Some prominent players in the global gas cleaning technologies market include:

-

Babcock & Wilcox Enterprises, Inc.

-

ALFA LAVAL

-

CECO Environmental

-

Evoqua Water Technologies LLC

-

Fuji Electric Co., Ltd.

-

GEA Group Aktiengesellschaft

-

Wärtsilä

-

S.A. HAMON

-

Hitachi Zosen Inova AG

-

KCH Services Inc.

-

Nederman Holding AB

-

Tri-Mer Corporation

-

Verantis Environmental Solutions Group

-

Yara Marine Technologies

-

Elessent Clean Technologies Inc.

-

DuconEnv.com

-

Dürr Aktiengesellschaft

-

FLSmidth

-

ANDRITZ

-

John Cockerill

Gas Cleaning Technologies Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 33.23 billion

Revenue forecast in 2030

USD 46.73 billion

Growth rate

CAGR of 4.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; France; Germany; Italy; Spain; UK; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Babcock & Wilcox Enterprises, Inc.; ALFA LAVAL; CECO Environmental; Evoqua Water Technologies LLC; Fuji Electric Co., Ltd.; GEA Group Aktiengesellschaft; Wärtsilä; S.A. HAMON; Hitachi Zosen Inova AG; KCH Services Inc.; Nederman Holding AB; Tri-Mer Corporation; Verantis Environmental Solutions Group; Yara Marine Technologies; Elessent Clean Technologies Inc; DuconEnv.com; Dürr Aktiengesellschaft; FLSmidth; ANDRITZ; John Cockerill.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

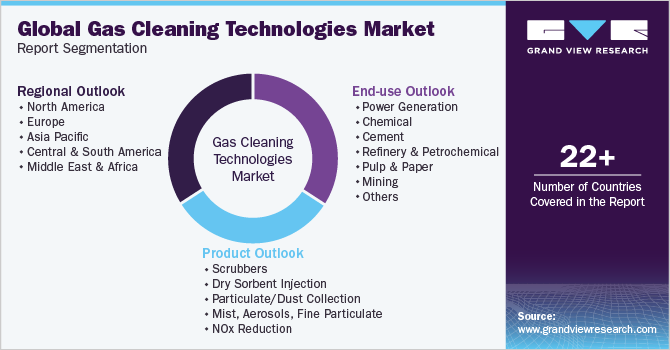

Global Gas Cleaning Technologies Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global gas cleaning technologies market report based on product, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Scrubbers

-

Wet Scrubber

-

Packed Bed Scrubber

-

Venturi Scrubber

-

Spray Scrubber

-

Others

-

-

Dry Scrubber

-

Semi-dry

-

Dry

-

-

-

Dry Sorbent Injection

-

Particulate/Dust Collection

-

Baghouse

-

Gas Filtration

-

Electrostatic Precipitators (ESP)

-

Cyclonic Separators

-

-

Mist, Aerosols, Fine Particulate

-

Wet Electrostatic Precipitator (WESP)

-

Candle Filter/Mist Eliminators

-

Glass

-

Carbon

-

Polypropylene

-

Polyester

-

Others

-

-

Others

-

-

NOx Reduction

-

SCR/SNCR

-

Low NOx Burners

-

NOx wet Scrubbing

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Power Generation

-

Coal

-

Natural Gas

-

Others

-

-

Chemical

-

Cement

-

Refinery & Petrochemical

-

Pulp & Paper

-

Mining

-

Textiles

-

Metals

-

Steel

-

Integrated (Blast Furnace/Basic Oxygen Furnace)

-

Electric Arc Furnace

-

Downstream Finishing

-

-

Aluminum

-

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global gas cleaning technologies market size was estimated at USD 31.83 billion in 2022 and is expected to be USD 33.23 billion in 2023.

b. The global gas cleaning technologies market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.9% from 2023 to 2030 to reach USD 46.73 billion by 2030.

b. Asia Pacific dominated the gas cleaning technologies market with a revenue share of 35.7% in 2022. The economies in the region are anticipated to flourish in the coming years on account of massive investments by various governments toward the development of public infrastructures and expansion of the residential construction sector, which is expected to boost the demand for cement in the region.

b. Some of the key players operating in the gas cleaning technologies market include: Babcock & Wilcox Enterprises, Inc.; ALFA LAVAL; CECO ENVIRONMENTAL.; Evoqua Water Technologies LLC; Fuji Electric Co., Ltd.; GEA Group Aktiengesellschaft; Wärtsilä; S.A. HAMON; Hitachi Zosen Inova AG; KCH Services Inc. ; Nederman Holding AB ; Tri-Mer Corporation; Verantis Environmental Solutions Group; Yara Marine Technologies; Elessent Clean Technologies Inc; DuconEnv.com; Dürr Aktiengesellschaft; FLSmidth; ANDRITZ ; John Cockerill.

b. Key factors that are driving the gas cleaning technologies is the rapid growth in industrialization, coupled with a stringent regulatory environment, especially in India, China, and Brazil.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.