- Home

- »

- Biotechnology

- »

-

Gene Therapy Media Market Size, Industry Report, 2033GVR Report cover

![Gene Therapy Media Market Size, Share & Trends Report]()

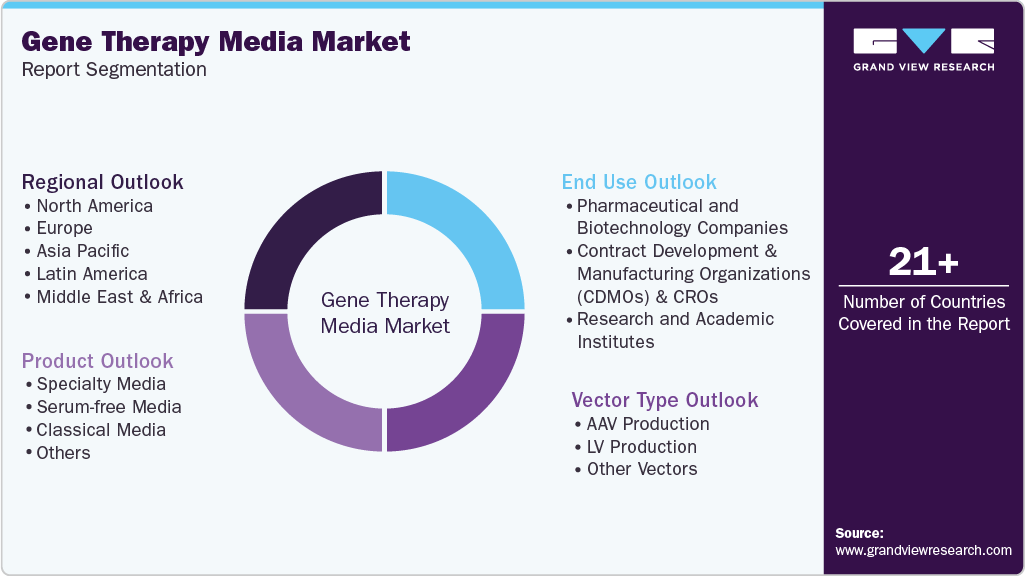

Gene Therapy Media Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Specialty Media, Serum-free Media), By Vector Type (AAV, LV), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-753-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Gene Therapy Media Market Summary

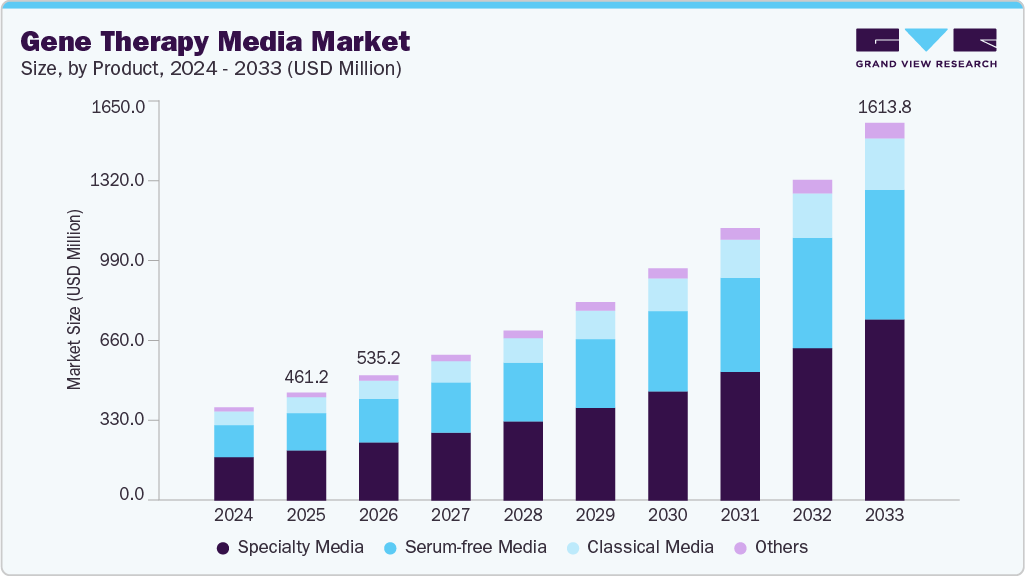

The global gene therapy media market size was estimated at USD 461.2 million in 2025 and is projected to reach USD 1,613.8 million by 2033, growing at a CAGR of 17.1% from 2026 to 2033. This growth is driven by increasing investments in gene therapy research, the rising prevalence of genetic disorders and chronic diseases, and the expanding pipeline of cell and gene-based therapies.

Key Market Trends & Insights

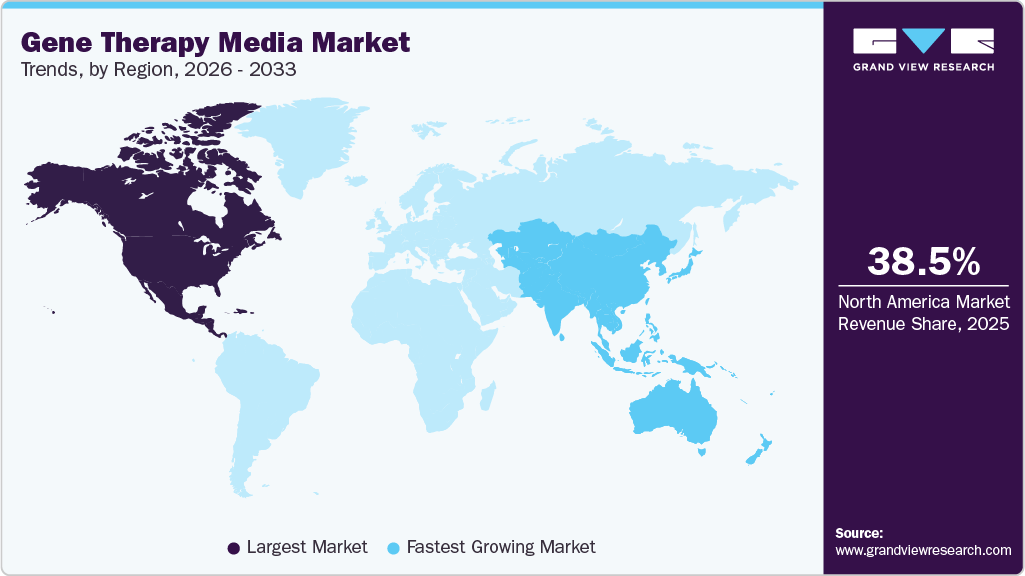

- The North America gene therapy media market held the largest share of 38.47% of the global market in 2025.

- The gene therapy media industry in the U.S. is expected to grow significantly over the forecast period.

- By product, the specialty media segment held the largest market share of 46.48% in 2025.

- By vector type, the AAV production segment held the largest market share in 2025.

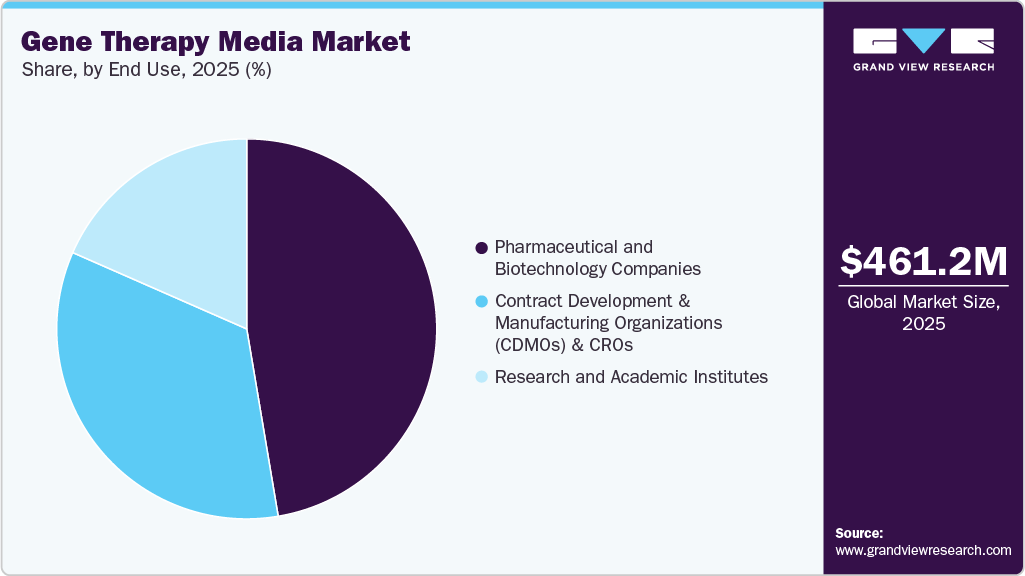

- By end use, the pharmaceutical and biotechnology companies segment held the largest market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 461.2 Million

- 2033 Projected Market Size: USD 1,613.8 Million

- CAGR (2026-2033): 17.1%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Strategic collaborations between biopharmaceutical companies and research institutions and favorable regulatory support for innovative therapies further contribute to the strong market outlook.

Growth in Rare Genetic Disease Therapies & Regulatory Support

One of the main factors propelling the gene therapy media industry is the growing emphasis on creating treatments for uncommon and orphan genetic illnesses. Millions of people worldwide suffer from more than 7,000 rare diseases, the majority of which do not yet have adequate therapies. The rising number of clinical trials targeting conditions such as spinal muscular atrophy, hemophilia, and inherited retinal disorders creates substantial demand for high-quality, consistent, scalable gene therapy media to support research and commercial manufacturing.

Summary of Rare Disease Development Incentives, by Key Region

Benefits

US

EU

Criteria

Cost not reasonably recoverable

Life threatening & chronically

Definition

<200,000

<5/10,000

Approval

Accelerated

Expected review

Exclusivity (years)

7

10

Tax Incentives

Tax Credits

Tax Credits

Research Subsidies

NIH Grants

Numerous

Other Incentive

Priority review voucher, fee waivers

Fee reductions, protocol assistance, guidance

Source: American Gene Technologies, Secondary research, Grand View Research

At the same time, regulatory agencies such as the U.S. FDA and the European Medicines Agency (EMA) are providing accelerated pathways, orphan drug designations, and incentives to encourage innovation in rare disease therapies. This supportive regulatory framework reduces time-to-market and increases investment and partnerships across the gene therapy ecosystem. The demand for robust, GMP-compliant media formulations is expected to rise as more therapies gain approval and enter the market, positioning gene therapy media as a vital component in advancing treatments for rare genetic diseases.

Increasing Capacity for Viral Vector Production

The expansion of viral vector production capabilities is a key driver of the gene therapy media market. As the number of gene therapy programs grows, manufacturers invest heavily in large-scale production facilities to meet the increasing demand for viral vectors, such as adeno-associated virus (AAV), lentivirus, and retrovirus. These vectors require highly specialized and optimized cell culture media to ensure high yield, consistency, and safety.

The shift from small-scale laboratory production to commercial-scale manufacturing necessitates media formulations that support robust cell growth, high transfection efficiency, and stable viral titers. The need for scalable, GMP-compliant viral vector production platforms and the specialized media that support them is anticipated to increase dramatically as more gene therapies move from clinical trials to commercialization. This is expected to directly contribute to the growth of the gene therapy media market.

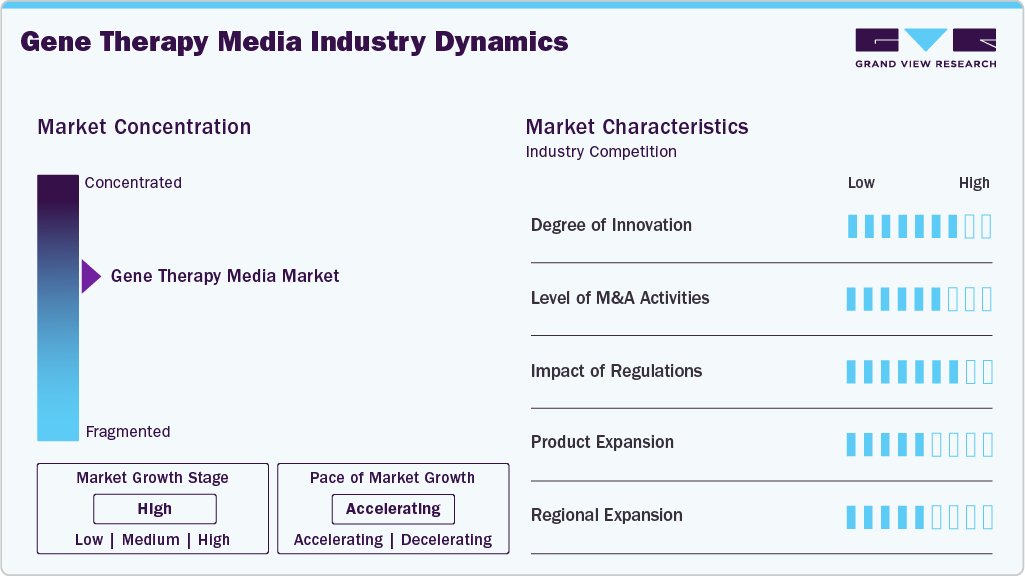

Market Concentration & Characteristics

The high degree of innovation in both media formulations and manufacturing technologies strongly influences the gene therapy media industry. Companies continuously develop advanced chemically defined and animal-free media that enhance cell growth, viral vector production, and efficiency. More reliable and consistent gene therapy production is made possible by innovations such as enhanced stability, optimized nutrient compositions, and compatibility with scalable bioreactor systems. For instance, in September 2025, Fujifilm Biosciences introduced the BalanCD HEK293 Perfusion A medium worldwide. This medium supports scalable, high-density production of viral vectors for gene therapies by utilizing suspension HEK293 cells, perfusion technology, and compatibility with a wide range of workflows.

The gene therapy media industry is witnessing significant growth fueled by high mergers and acquisitions (M&A) across the biotechnology and life sciences sectors. Businesses are proactively purchasing or collaborating with specialized media and bioprocessing companies to broaden their product offerings, improve their technological prowess, and fortify their position in the rapidly expanding gene therapy market. Companies are proactively purchasing or collaborating with specialized media and bioprocessing companies. For instance, in September 2022, Danaher announced the merger of Cytiva and Pall Life Sciences to form its Biotechnology Group, creating a USD 7.5 billion bioprocessing leader with the industry’s broadest end-to-end product portfolio. Global market expansion and the quicker commercialization of gene therapies are made possible by these M&A activities, which also enhance access to scalable, high-quality production solutions and spur innovation in media formulations.

Regulatory frameworks, including those from the U.S. FDA, EMA, and other authorities, play a key role in the gene therapy media industry by setting strict safety, quality, and GMP compliance requirements. These guidelines drive demand for specialized, validated media solutions, encouraging manufacturers to adopt reliable and innovative products that support safe therapeutic outcomes and regulatory approval.

Continuous product expansion drives growth in the gene therapy media industry as companies develop new and improved media formulations to meet the evolving needs of gene therapy research and manufacturing. Innovations include chemically defined, serum-free, and animal-free media that enhance cell growth, viral vector production, and process scalability. By broadening product portfolios to cater to diverse cell types, production scales, and therapeutic applications, companies can capture a larger market share, address emerging customer requirements, and support the rapid commercialization of gene therapies globally.

Regional expansion is helping the gene therapy media industry as businesses expand into high-growth and emerging markets in the Middle East, Asia-Pacific, and Latin America. The demand for high-quality cell culture media is driven by growing investments in biopharmaceutical infrastructure, an increase in gene therapy research initiatives, and supportive government policies in these regions. Geographical expansion enables producers to reach new markets, fortify supply chains, and seize unexplored prospects, all of which contribute to the expansion of the market.

Product Insights

The specialty media segment accounted for the largest market share of 46.48% in 2025 and expected to grow at the fastest CAGR throughout the forecast period. Frequently chemically defined and optimized for high-performance cell growth, transfection efficiency, and viral vector yield, these formulations support the demanding scalability and reproducibility requirements of commercial and clinical manufacturing. Specialty media that can sustain consistent performance under controlled conditions are in greater demand due to the growing use of automated closed-system workflows and single-use bioreactors, which is likely to improve regulatory compliance and reduce process variability.

The serum-free media segment is expected to grow significantly over the forecast period. Serum-free formulations eliminate the variability associated with animal-derived components, providing a more defined and reproducible environment for cell growth and viral vector production. The growing emphasis on ethical sourcing, animal-free manufacturing, and minimizing contamination risks further accelerates the transition toward SFM.

Vector Type Insights

The AAV production segment dominated the market in 2025 and is expected to grow at the fastest CAGR over the forecast period, due to its extensive use in in vivo gene therapy applications that target rare genetic disorders, ocular diseases, and neuromuscular conditions. AAVs are the preferred delivery method for several FDA- and EMA-approved treatments, such as Luxturna (Spark Therapeutics) and Zolgensma (Novartis), due to their favorable safety profile compared to integrating vectors. Due to the increase in pipeline programs brought about by this clinical success, there is an increasing demand for specialized media that facilitate the high-yield, scalable production of AAV vectors using producer cell systems, HEK293, or Sf9.

The LV production segment is expected to grow significantly during the forecast period, as LV vectors are widely used to engineer patient-derived T cells in CAR-T, TCR-T, and NK cell therapies, which require robust, scalable, and reproducible production systems. The move from small academic batches to large-scale GMP manufacturing, where chemically defined, serum-free, and animal-origin-free media are preferred to minimize variability and expedite regulatory approvals, drives demand for LV production media.

End Use Insights

The pharmaceutical and biotechnological companies segment captured the largest market share of 47.35% in 2025, as they are at the forefront of developing and commercializing gene-based therapies. These players are driving the market by scaling their programs from early R&D to commercial manufacturing, which requires reliable, GMP-compliant media solutions that can support large-scale production of viral vectors and engineered cells.

The Contract Development and Manufacturing Organizations (CDMOs) and CROs segment is projected to grow significantly during the forecast period. CDMOs are key demand drivers in the gene therapy cell culture media market and serve as the backbone of outsourced manufacturing and development for biopharma companies. With a growing number of small and mid-sized biotechs developing gene therapies, CDMOs provide the required expertise, infrastructure, and scalable production capacity for viral vectors and engineered cell therapies.

Regional Insights

North America gene therapy media market dominated the global market, accounting for the largest revenue share of 38.47% in 2025. A strong biotechnology ecosystem with ongoing clinical trials and partnerships between pharmaceutical companies, biotechnology firms, and contract development and manufacturing organizations (CDMOs) is driving the growth in the region's market.

U.S. Gene Therapy Media Market Trends

The U.S. gene therapy media market is the largest globally, supported by leading biotechnology hubs and extensive clinical trial activity. Market growth is driven by the high adoption of advanced viral vector production technologies, strong private and public R&D funding, and a well-established CDMO network. For instance, in April 2025, Thermo Fisher Scientific inaugurated its first American Advanced Therapies Collaboration Center in Carlsbad, California, strengthening cell therapy development capabilities and expanding its global collaboration network.

Europe Gene Therapy Media Market Trends

The market for gene therapy media in Europe is anticipated to expand gradually because of robust regulatory backing, public-private research partnerships, and targeted funding programs. Through programs such as "Industrie 4.0" and R&D grants, Germany is still advancing biotechnology infrastructure, allowing domestic players to advance gene therapy applications and draw in foreign investment.

The UK gene therapy media market growth is driven by its strong focus on translational research, innovation in viral vector technology, and supportive government frameworks such as Innovate UK grants. Academic and industrial collaborations have accelerated the development of specialized media for gene therapy applications.

Gene therapy media market in Germany is supported by a strong industrial biotechnology infrastructure and government-supported R&D programs. Businesses use automated production platforms and sophisticated bioreactor systems to maximize viral vector yields. Regulatory initiatives such as the Federal Ministry of Education and Research (BMBF) funding programs encourage innovation in viral vector and gene cell culture media development.

Asia Pacific Gene Therapy Media Market Trends

Asia-Pacific is projected to grow with the fastest CAGR of 19.3% throughout the forecast period, driven by rising gene therapy research, increasing prevalence of genetic disorders, and growing investments in biopharmaceutical infrastructure. For instance, in March 2025, Sartorius announced construction of a new site in Songdo, South Korea, to produce cell culture media and consumables, further supporting the expansion of the gene therapy media.

China gene therapy media market is rapidly expanding due to large-scale government investments, a thriving biotech startup ecosystem, national initiatives such as “Made in China 2025” and precision medicine programs. Domestic companies such as GenScript are scaling production facilities and enhancing purification processes for GMP-grade viral vector media. Collaborations with international biotech firms also strengthen China’s capabilities in gene therapy manufacturing, making it a key player in the Asia-Pacific region.

Gene therapy media market in Japan is shaped by an aging population, high demand for personalized medicine, and significant biotech research capabilities. The nation invests in technologies that increase the production of viral vectors for clinical use and the efficiency of cell growth, further increasing gene therapy production in the country and supporting the market demand for gene therapy media.

MEA Gene Therapy Media Market Trends

The Middle East and Africa gene therapy media market is developing but is expected to grow significantly, supported by rising investment in biotechnology, genomics, and healthcare modernization. Countries such as Kuwait are also investing in knowledge-based healthcare sectors, fostering opportunities to introduce gene therapy media and related bioprocessing technologies and media.

The gene therapy media market in Kuwait is still emerging, but it is gradually expanding owing to national initiatives to build biotechnology infrastructure and modernize healthcare. International partnerships bring specialized cell culture media and cutting-edge viral vector production technologies to the nation. Government efforts to build knowledge-based healthcare sectors, coupled with partnerships with research institutions, are positioning Kuwait as a future regional hub for gene therapy production.

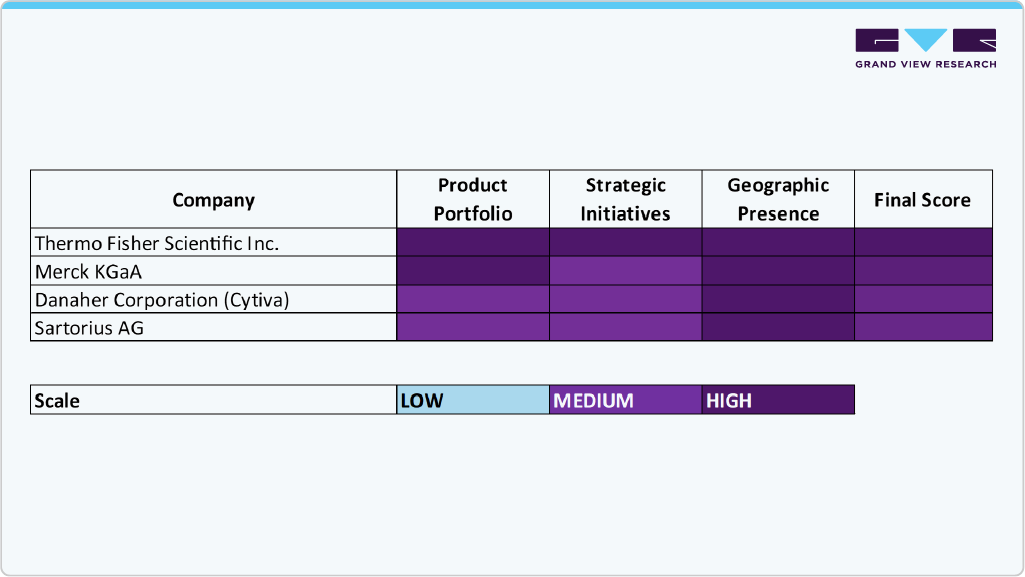

Key Gene Therapy Media Company Insights

The gene therapy media market is characterized by several established players who maintain strong market positions through extensive product portfolios, technological innovation, and global distribution networks. Leading firms such as Thermo Fisher Scientific Inc., Sartorius AG, Merck KGaA, Lonza, and Danaher Corporation (Cytiva) hold significant market share due to their advanced gene therapy cell culture media technologies, scalable production solutions, and global distribution networks.

Companies such as FUJIFILM Holdings Corporation, MP Biomedicals, Corning Incorporated, PAN-Biotech, Bio-Techne, InVitria Inc., Florabio AS, Revvity, and Virica are expanding by offering innovative, specialized media, including chemically defined, serum-free, and GMP-compliant solutions that support viral vector production, cell growth, and clinical-scale gene therapy manufacturing.

Mergers and acquisitions, strategic partnerships, and advancements in media optimization and production efficiency fuel competition. Players that effectively combine scientific advancement with customer-focused solutions will be in a strong position to generate long-term growth and value in this quickly changing industry, assisting in the global commercialization of safe and efficient gene therapies.

Key Gene Therapy Media Companies:

The following are the leading companies in the gene therapy media market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific Inc.

- Sartorius AG

- Merck KGaA

- Lonza

- Danaher Corporation (Cytiva)

- FUJIFILM Holdings Corporation

- MP Biomedicals

- Corning Incorporated

- PAN-Biotech

- Bio-Techne (R&D Systems, Inc.)

- InVitria Inc.

- Florabio AS

- Revvity

- Virica

Recent Developments

-

In May 2025, PL BioScience and South Korea-based DewCell Biotherapeutics aims to jointly develop artificial human platelet sources for scalable cell culture media.

-

In August 2024, Nucleus Biologics launched QuickStart Media in the U.S., offering customizable, high-performance cell culture media to accelerate therapy development and streamline cell and gene therapy research.

Gene Therapy Media Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 535.2 million

Revenue forecast in 2033

USD 1,613.8 million

Growth rate

CAGR of 17.1% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, vector type, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Thermo Fisher Scientific Inc.; Sartorius AG; Merck KGaA; Lonza; Danaher Corporation (Cytiva); FUJIFILM Holdings Corporation; MP Biomedicals; Corning Incorporated; PAN-Biotech; Bio-Techne (R&D Systems, Inc.); InVitria Inc.; Florabio AS; Revvity; Virica

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Gene Therapy Media Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the global gene therapy media market based on product, vector type, end use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Specialty Media

-

Serum-free Media

-

Classical Media

-

Others

-

-

Vector Type Outlook (Revenue, USD Million, 2021 - 2033)

-

AAV Production

-

LV Production

-

Other Vectors

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceutical and Biotechnology Companies

-

Contract Development & Manufacturing Organizations (CDMOs) & CROs

-

Research and Academic Institutes

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global gene therapy media market was estimated at USD 461.2 million in 2025 and is expected to reach USD 535.2 million in 2026.

b. The global gene therapy media market is projected to reach USD 1,613.8 million by 2033, growing at a CAGR of 17.08% from 2026 to 2033.

b. The AAV production segment dominated the market in 2025 and expected to grow at the fastest rate over the forecast period, due to its extensive use in in vivo gene therapy applications that target rare genetic disorders, ocular diseases, and neuromuscular conditions

b. Some of the prominant players of the market include Thermo Fisher Scientific Inc.; Sartorius AG; Merck KGaA; Lonza; Danaher Corporation (Cytiva); FUJIFILM Holdings Corporation; MP Biomedicals; Corning Incorporated; PAN-Biotech; Bio-Techne (R&D Systems, Inc.); InVitria Inc.; Florabio AS; Revvity; Virica

b. The growth of the market is driven by increasing investments in gene therapy research, the rising prevalence of genetic disorders and chronic diseases, and the expanding pipeline of cell and gene-based therapies. Strategic collaborations between biopharmaceutical companies and research institutions and favorable regulatory support for innovative therapies further contribute to the strong market outlook.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.