- Home

- »

- Biotechnology

- »

-

Viral Vector Market Size And Share, Industry Report, 2033GVR Report cover

![Viral Vector Market Size, Share & Trends Report]()

Viral Vector Market (2026 - 2033) Size, Share & Trends Analysis Report By Vector Type (AAV, Adenovirus, Lentivirus, Retrovirus), By Application (Cell & Gene Therapy, Vaccine), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-072-3

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Viral Vector Market Summary

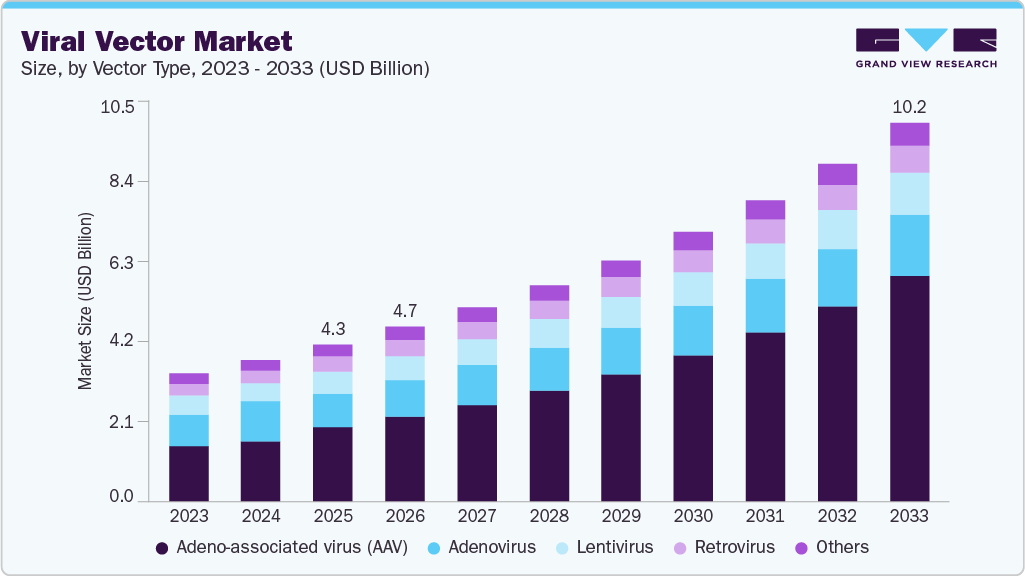

The global viral vector market size was estimated at USD 4.25 billion in 2025 and is projected to reach USD 10.22 billion by 2033, growing at a CAGR of 11.69% from 2026 to 2033. The increasing prevalence of target diseases and genetic disorders, along with technological advancements in digital diagnostics, is expected to support the market growth for viral vectors.

Key Market Trends & Insights

- North America viral vector market held the largest share of 48.31% of the global market in 2025.

- The viral vector industry in the U.S. is expected to grow significantly over the forecast period.

- By vector type, the adeno-associated virus (AAV) segment held the largest market share in 2025.

- Based on application, the cell & gene therapy segment held the highest market share in 2025.

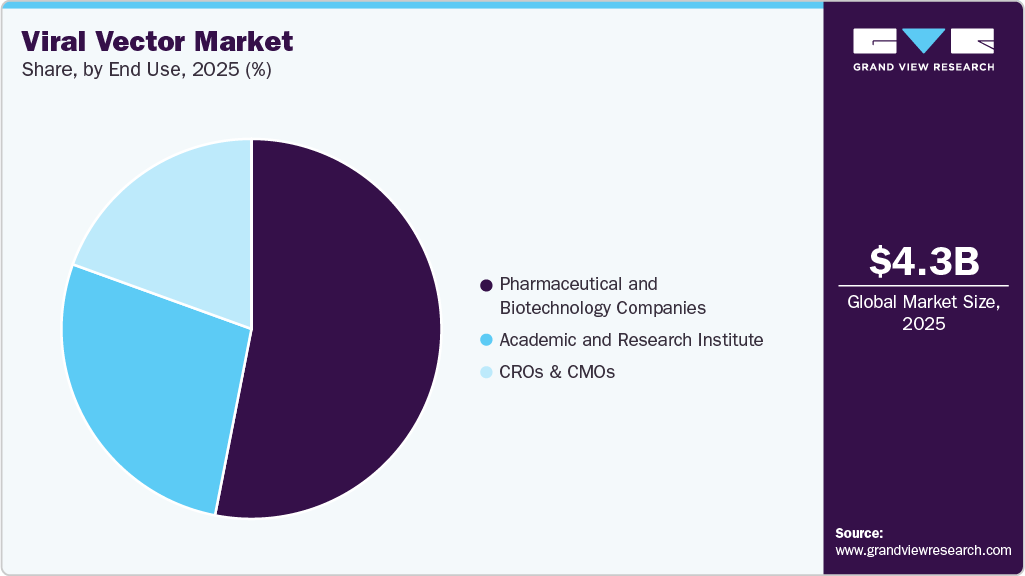

- Based on end use, the pharmaceutical and biotechnology companies segment held the highest market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 4.25 Billion

- 2033 Projected Market Size: USD 10.22 Billion

- CAGR (2026-2033): 11.69%

- North America: Largest market in 2025

- Asia Pacific: Fastest-growing market

Furthermore, increasing the effectiveness of viral vectors in gene therapy delivery is contributing to the market growth. The rising prevalence of genetic disorders and contagious diseases is anticipated to boost the demand for viral vectors. For instance, according to the Joint United Nations Programme on HIV/AIDS (UNAIDS) data, around 40.8 million people were living with HIV in 2024. This is fueling market growth. Furthermore, government initiatives such as direct growing demand for innovative clinical therapies, funding for viral vector manufacturing, and an increasing focus on the emerging area of medicine for genetic disorders, which has been helped by transforming techniques, are driving market expansion.

The market continues to expand rapidly, underpinned by strong momentum in gene and cell therapy development, vaccine innovation, and advanced biologics manufacturing. Within this landscape, the viral vector manufacturing market and viral vector production market are seeing sustained demand as more therapies transition from clinical trials to commercialization, creating pressure on scalable, GMP-compliant capacity. At the same time, the viral vector and plasmid DNA manufacturing market is gaining strategic importance, as plasmid DNA remains a critical raw material for viral vector production, directly influencing yield, quality, and timelines. In parallel, while viral vectors dominate clinical pipelines, the non-viral vector industry is emerging as a complementary space, driven by interest in alternative delivery technologies that offer advantages in safety, repeat dosing, and manufacturing simplicity for certain applications.

From a business model perspective, the viral vector CDMO market has become a central pillar of industry growth, as biopharma companies increasingly outsource development and manufacturing to specialized partners to reduce capital risk and accelerate time to market. CDMOs are expanding capabilities across multiple vector types, integrating plasmid DNA supply, upstream and downstream processing, and analytical services to offer end-to-end solutions. In addition, the viral vector vaccines market continues to contribute to overall demand, supported by platform validation during recent global health initiatives and ongoing development of vaccines for infectious diseases and oncology indications. Together, these interconnected segments are shaping a dynamic and capital-intensive market, where capacity expansion, technological innovation, and strategic partnerships remain critical to long-term growth.

Investment and Funding in Biomanufacturing Infrastructure:

Investment and funding in biomanufacturing infrastructure is a major driver accelerating the market, as demand from gene and cell therapy pipelines continues to outpace existing manufacturing capacity. Biopharmaceutical companies, CDMOs, and governments are committing significant capital toward building new GMP facilities, expanding cleanroom space, and upgrading upstream and downstream processing capabilities. These investments are aimed at overcoming long-standing bottlenecks in viral vector supply, particularly for AAV and lentiviral vectors, which are critical for late-stage clinical trials and commercial launches. As more therapies move closer to approval, the need for reliable, large-scale, and compliant manufacturing infrastructure becomes a strategic priority rather than an optional capability.

At the same time, funding is increasingly being directed toward advanced and flexible manufacturing platforms, including single-use bioreactors, modular facilities, automation, and closed-system processing. These technologies help manufacturers reduce contamination risks, improve batch consistency, and scale production more efficiently while meeting evolving regulatory expectations. Venture capital and strategic partnerships are also playing a role, enabling smaller biotech firms and specialized CDMOs to expand capacity without bearing the full financial burden alone. Collectively, this sustained flow of investment is strengthening the viral vector manufacturing ecosystem, supporting faster clinical timelines and enabling the long-term commercialization of gene and cell therapies.

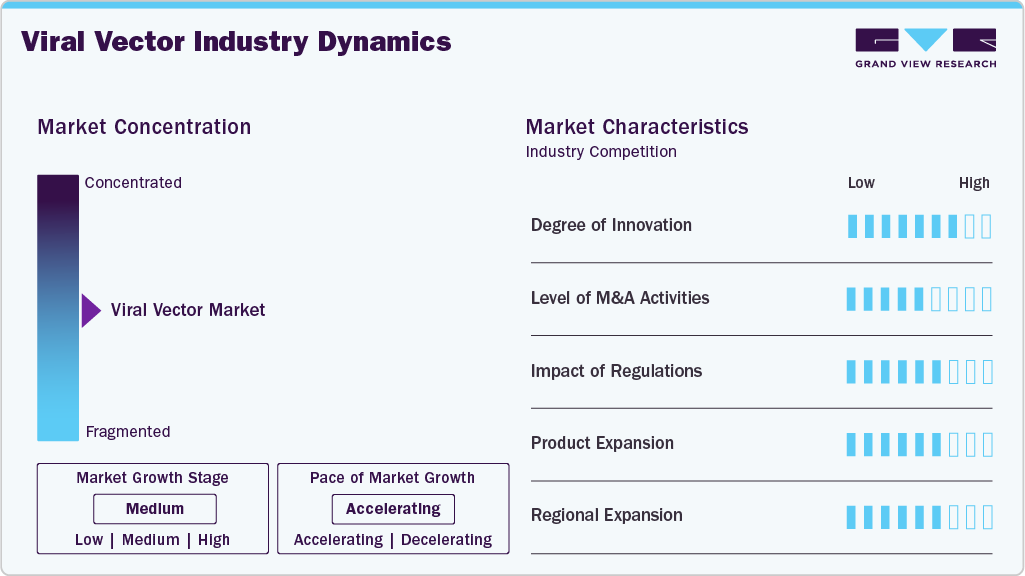

Market Concentration & Characteristics

The viral vector industry is highly innovative, driven by continuous advancements in vector design (e.g., AAV capsid engineering), scalable production technologies, and next-generation processing platforms that improve yield, safety, and manufacturability. Patents in vector engineering and bioprocessing are growing rapidly, and new manufacturing techniques such as single-use bioreactors, closed systems, and AI-assisted analytics are enhancing production precision and flexibility.

Mergers and acquisitions are an active theme in the viral vector space as established biopharma and CDMOs seek to broaden capabilities and accelerate market entry. Strategic deals from capacity-adding acquisitions by major players to targeted purchases of specialized technology firms are consolidating expertise and infrastructure, expanding product portfolios, and capturing emerging demand.

Regulatory frameworks exert a strong influence on the viral vector industry, with agencies like the FDA and EMA shaping quality standards, approval pathways, and compliance requirements for viral vector products. Harmonization efforts and adaptive frameworks such as accelerated approval designations for advanced therapies are helping streamline development timelines, but regional variations in regulations still require tailored compliance strategies.

Product and service offerings are expanding as demand diversifies beyond traditional vectors to include specialized production platforms, analytical services, and tailored manufacturing solutions for different therapeutic modalities. Market participants are launching enhanced vector types, broadening their capabilities across AAV, lentiviral, and adenoviral platforms, and integrating upstream and downstream services to address both early-stage research and large-scale commercial needs.

Geographically, North America continues to lead the viral vector industry with the largest share backed by robust R&D infrastructure and high clinical activity, while Europe maintains strength through collaborative innovation ecosystems and supportive policy frameworks. The Asia-Pacific region is emerging as the fastest-growing market, with substantial investments in biomanufacturing capacity and regulatory reforms that are attracting both local and multinational players. Other regions, including Latin America, the Middle East, and Africa, are in earlier stages of development but are seeing increasing interest in infrastructure upgrades and clinical trial participation, supporting broader global footprint growth.

Vector Type Insights

In 2025, the adeno-associated virus (AAV) segment dominated the market with the highest share of 47.51%. AAV vectors provide a high degree of safety and efficacy, while also allowing for targeting specific cell types in the body. Gene therapy via adeno-associated virus offers a permanent correction of genetic diseases such as spinal muscular atrophy (SMA). In addition, AAV vectors are highly stable when compared to other forms of viral vectors, and manufacturers can produce them in large quantities for large-scale manufacturing, thereby allowing for market expansion.

Lentivirus is expected to grow at a significant CAGR over the forecast period. Lentiviral vector offers a larger capacity for genetic material than other forms of vectors, allowing them to carry larger genes or multiple genes at once. Furthermore, lentivirus can infect both dividing and non-dividing cells, allowing them to be used as a therapeutic gene for different cell types in the human body. Moreover, the FDA has recognized lentiviral-based therapy owing to its capability to provide patients with an alternative to the pre-existing medications that are highly prone to complications.

Application Insights

The cell and gene therapy segment held the highest share of 65.18% in 2025 and is estimated to grow at the fastest CAGR of 12.91% over the forecast period of 2026-2033. Cell and gene therapy utilizes viral vectors to deliver therapeutic genes to the patient's cells, primarily those suffering from genetic disorders. In addition, an increase in the number of clinical trials and overall regulatory approval has allowed for a fast-paced growth in the therapeutic segment.

Biopharmaceutical & pharmaceutical discovery segment is expected to grow at a significant CAGR over the forecast period of 2026-2033. Researchers utilize viral vectors as a tool to deliver genes into cells to understand the function, which in turn helps in the understanding of disease mechanisms and potential targets for drug development. For example, researchers can use viral vectors to create knockout or knock-in models of genes to study their function and investigate their potential as therapeutic targets. In addition, viral vectors can be used to deliver RNAi or CRISPR/Cas9 gene editing tools to investigate gene function and validate drug targets. For instance, as per Nature’s Article published in February 2023, adenoviral structural proteins are manipulatable, allowing it to be advantageous in tissue-specific tropism. Thereby, adenoviral vector becomes indispensable for CRISPR and Cas delivery.

End Use Insights

Pharmaceutical and biotechnology companies held the highest share of 53.07% in 2025. The dominant share is due to the extensive usage of viral vectors by these end uses for drug discovery and development, gene therapy manufacturing, vaccines, and other forms of biologics. The following firms have a larger access to generate funds from various public and private sources for different social causes.

CROs and CMOs is anticipated to register a significant CAGR during the forecast years. CROs and CMOs allow a faster turnaround time and overall flexibility in the development and manufacturing of viral vectors. In addition, viral vectors can be provided on demand by such companies that act as an essentiality for larger healthcare firms looking to accelerate the drug development timelines. Lastly, various strategic moves are being made by the contract manufacturing firms to assist in the expansion of viral vectors.

Regional Insights

North America dominated the global market with a share of 48.31% in 2025. North America leads the market due to a strong biopharmaceutical industry, with leading pharma and biotech companies operating in the region. In addition, the following firms engage in the development and commercialization of gene therapies and other biologics, which propels the viral vector usage. Moreover, North America’s ease of funding has had a positive impact on the viral vector industry, as various venture capitalists, government-sponsored programs, and other investors propel the market forward.

U.S. Viral Vector Market Trends

The viral vector market in the U.S. leads as the largest globally due to its deep biotech ecosystem, significant R&D spending, strong venture investment, and a robust pipeline of gene and cell therapies progressing through clinical and approval stages. The presence of major biopharma companies, advanced GMP vector manufacturing infrastructure, and supportive regulatory pathways (including accelerated designations) sustains ongoing commercialization momentum.

Europe Viral Vector Market Trends

The viral vector market in Europe is expected to grow significantly over the forecast period. Across Europe, integrated funding mechanisms, cross-border collaborations, and a strong network of research institutions are expanding viral vector development and production. The region’s established pharmaceutical base and coordinated regulatory environment help drive adoption of advanced therapies and technology transfer between countries, supporting both regional clinical demand and manufacturing excellence.

The UK viral vector market benefits from strong academic-industry links and government initiatives that prioritize gene therapy research, making it a hub for early-stage innovation. Investments in manufacturing capacity and translational research centres further support market expansion, positioning the UK to attract global partnerships in viral vector production and application development.

The viral vector market in France is underpinned by expanding gene therapy and biotech research programs, strong academic expertise in molecular biology, and public and private investment in advanced bioproduction. This ecosystem encourages the adoption of viral vector technologies and helps integrate French capabilities into broader European supply and innovation networks.

Germany viral vector marketis driven by its advanced manufacturing infrastructure, high concentration of biotech and CDMO facilities, and significant gene-therapy research within leading academic hospitals and biotech clusters. These strengths support both domestic needs and EU-wide partnerships, reinforcing Germany’s leading market position.

Asia Pacific Viral Vector Market Trends

The viral vector market in the Asia Pacific is emerging as the fastest-growing market, propelled by rapid expansion in biotechnology R&D, increasing government investments in healthcare infrastructure, and rising clinical activities across major markets. Countries such as China, Japan, and India are scaling up vector production capabilities and participating in global development efforts, attracting multinational investments and partnerships.

China viral vector market is driven by government incentives for biotech development, expanding manufacturing clusters, and cost-competitive production, which together stimulate both domestic therapy pipelines and global contract manufacturing demand. Regulatory support for clinical trials and infrastructure upgrades further propel growth.

The viral vector market in Japan is growing, and sustained focus on regenerative medicine and advanced therapies, backed by government research support and industry-academic collaboration, is boosting viral vector development. Regulatory frameworks that balance innovation and safety encourage investment from local and international biotech firms.

India viral vector market is gaining traction due to rising biotechnology research activities, expanding clinical development in gene-based therapies, and increasing investment in biomanufacturing infrastructure. Lower cost of operations and a growing skilled workforce make it an attractive location for both domestic and outsourced viral vector production.

Middle East & Africa Viral Vector Market Trends

The viral vector market in the Middle East is an emerging market where healthcare modernization initiatives, government funding, and strategic biotech park developments are promoting viral vector capabilities. Efforts to align local manufacturing with global standards and attract international collaborations are key regional growth drivers.

Saudi Arabia viral vector market is supported by major healthcare spending and Vision 2030 initiatives that prioritize biotech and advanced therapeutics infrastructure. With strategic investments and policy reforms, the country aims to build self-sufficient high-tech manufacturing capacity and engage with global value chains.

The viral vector market in the UAE is growing significantly. Diversification of healthcare and biotech sectors, investments in research infrastructure, and partnerships with global pharmaceutical and biotech players are driving nascent but accelerating demand for viral vector technology and manufacturing. Efforts to establish regional hubs for advanced therapies underpin long-term market growth.

Key Viral Vector Company Insights

Thermo Fisher Scientific, Lonza, Oxford Biomedica, and Biogen occupy distinct but complementary positions within the viral vector ecosystem. Thermo Fisher Scientific is positioned as a highly integrated enabler, leveraging its broad bioprocessing portfolio, GMP manufacturing capabilities, and global CDMO footprint to support viral vector development from research through commercialization, making it a preferred partner for biopharma companies seeking end-to-end solutions. Lonza stands out as a leading pure-play CDMO, differentiated by its deep process development expertise, regulatory know-how, and large-scale manufacturing capacity across multiple viral vector platforms, particularly for late-stage and commercial gene and cell therapies.

Oxford Biomedica holds a strong specialist position, with proprietary viral vector technologies and a focused CDMO model that appeals to clients requiring customized, high-quality lentiviral and viral vector production. In contrast, Biogen’s role is more application-driven, with viral vectors primarily supporting its internal gene therapy and biologics pipeline through partnerships, rather than competing directly in contract manufacturing, positioning it as a therapy innovator reliant on external vector manufacturing expertise.

The high demand for viral vectors for multiple applications has led to numerous market opportunities for major players to capitalize on. Key players are involved in strategic initiatives such as mergers, acquisitions, and collaborations to maximize their market share.

Key Viral Vector Companies:

The following key companies have been profiled for this study on the viral vector market.

- Oxford Biomedica

- Lonza

- Thermo Fisher Scientific Inc

- Batavia Biosciences B.V.

- Biogen

- Asklepios BioPharmaceutical, Inc. (AskBio)

- Sanofi

- Spark Therapeutics, Inc.

- Regenxbio Inc.

- uniQURE N.V.

Viral Vector Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 4.71 billion

Revenue forecast in 2033

USD 10.22 billion

Growth rate

CAGR of 11.69% from 2026 to 2033

Historical data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Vector type, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Oxford Biomedica; Lonza; Thermo Fisher Scientific Inc.; Batavia Biosciences B.V.; Biogen; Asklepios BioPharmaceuticals, Inc.; Sanofi; Spark Therapeutics; Regenxbio Inc.; uniQURE N.V.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Viral Vector Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the global viral vector market based on vector type, application, end use, and region:

-

Vector Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Adeno-associated virus (AAV)

-

Adenovirus

-

Lentivirus

-

Retrovirus

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Cell & Gene Therapy

-

Vaccine

-

Biopharmaceutical & Pharmaceutical Discovery

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceutical and Biotechnology Companies

-

Academics and Research Institutes

-

CROs & CMOs

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the viral vector market include Oxford Biomedica; Lonza; Thermo Fisher Scientific Inc.; Cell and Gene Therapy Catapult; Genezen Laboratories; Sarepta Therapeutics; Spark Therapeutics; Genprex

b. Key factors that are driving the viral vector market growth include an increasing number of pipeline gene therapy candidates along with rising demand for viral vectors from vaccine manufacturers

b. The global viral vector market size was estimated at USD 4.25 billion in 2025 and is expected to reach USD 4.71 billion in 2026.

b. The global viral vector market is expected to grow at a compound annual growth rate of 11.69% from 2026 to 2033 to reach USD 10.22 billion by 2033.

b. North America dominated the viral vector market with a share of 48.31% in 2025. This is attributable to the increasing number of vaccine manufacturing locations and the high number of approved gene therapies

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.