- Home

- »

- Next Generation Technologies

- »

-

Generative AI In Financial Services Market Size Report, 2030GVR Report cover

![Generative AI In Financial Services Market Size, Share & Trends Report]()

Generative AI In Financial Services Market (2025 - 2033) Size, Share & Trends Analysis Report By Component, By Deployment (Cloud and On-Premises), End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-432-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Generative AI in Financial Services Market Summary

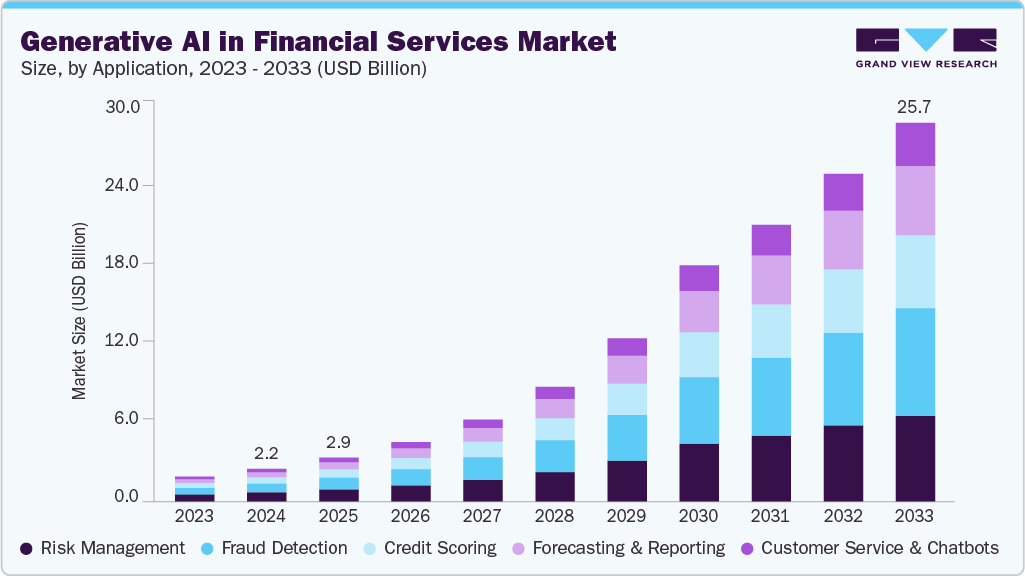

The global Generative AI in financial services market size was estimated at USD 2.21 billion in 2024 and is projected to reach USD 25.71 billion by 2033, growing at a CAGR of 31.0% from 2025 to 2033. The market is driven by the increasing demand for intelligent automation, personalized financial solutions, and advanced risk analytics.

Key Market Trends & Insights

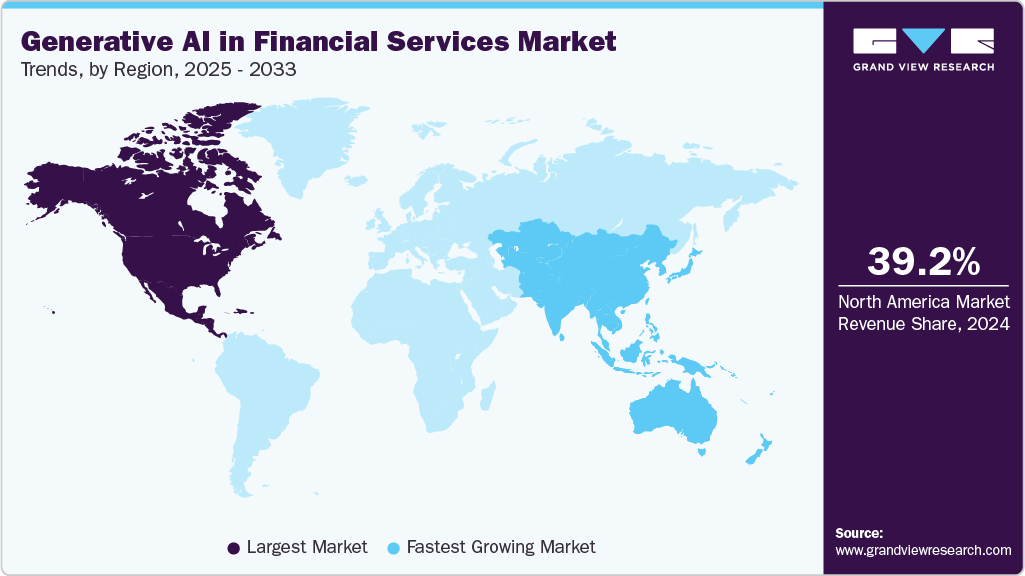

- North America dominated the global Generative AI in Financial Services market with the largest revenue share of 39.2% in 2024.

- The Generative AI in Financial Services market in the U.S. led the North America market and held the largest revenue share in 2024.

- By application, risk management segment led the market, holding the largest revenue share of 27.9% in 2024.

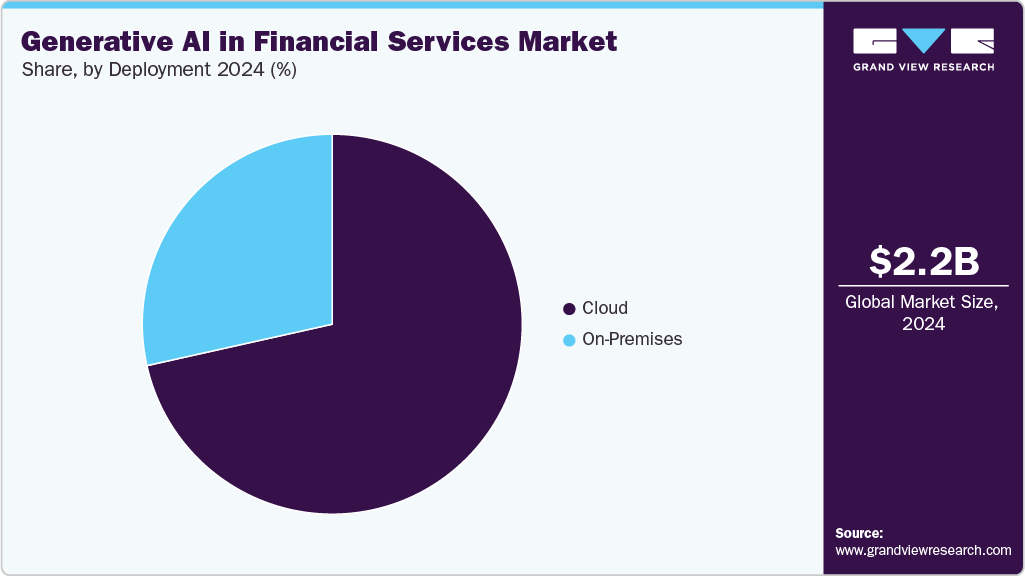

- By deployment mode, Cloud segment held the dominant position in the market.

- By end use, retail banking segment held the dominant position in the market.

Market Size & Forecast

- 2024 Market Size: USD 2.21 Billion

- 2033 Projected Market Size: USD 25.71 Billion

- CAGR (2025-2033): 31.0%

- North America: Largest Market in 2024

- Asia Pacific: Fastest Growing Market

Financial institutions are adopting GenAI to enhance operational efficiency, improve decision-making, and deliver tailored customer experiences through natural language processing, predictive analytics, and synthetic data generation, driving significant transformation across banking, insurance, and investment services.One of the key drivers for the adoption of generative AI in financial services is the need for hyper-personalized customer engagement. Banks and fintech firms are leveraging AI-driven chatbots, virtual assistants, and recommendation engines to provide context-aware interactions and real-time financial advice. These tools analyze customer behavior, transaction patterns, and preferences to generate personalized investment insights, loan recommendations, or risk alerts. This enhances customer satisfaction and retention and enables cross-selling and upselling opportunities. Moreover, the growing consumer expectation for seamless, AI-powered digital banking experiences is compelling institutions to invest heavily in generative AI tools for improving customer acquisition and service automation.

The growing emphasis on risk management and fraud prevention is another essential factor propelling market growth. Generative AI models can simulate complex financial scenarios, identify anomalies, and generate synthetic datasets to train predictive models without exposing sensitive information. This capability helps institutions detect fraudulent patterns, evaluate credit risks, and comply with stringent regulatory frameworks such as Basel III and GDPR. In addition, AI-driven generative modeling supports financial forecasting and stress testing by generating realistic and varied datasets, improving risk resilience. As financial ecosystems expand digitally, the integration of GenAI for adaptive risk intelligence and compliance automation is becoming a strategic priority for global financial institutions.

The rise in AI-driven innovation and ecosystem partnerships is also fueling market expansion. Numerous technology providers and financial institutions are collaborating to co-develop GenAI platforms tailored for trading strategies, portfolio optimization, and document automation. For instance, AI-powered tools are now generating financial reports, investment summaries, and regulatory filings with improved accuracy and reduced turnaround time. Furthermore, the proliferation of cloud computing and API-based architectures enables seamless deployment and scalability of GenAI applications across diverse financial operations. Due to continuous advancements in foundation models and multimodal AI, the financial services industry is witnessing a paradigm shift toward data-driven, predictive, and generative decision-making frameworks that enhance productivity and innovation.

Application Insights

Risk management segment dominated the market with a share of 27.9% in 2024. The risk-management application segment in the Generative AI in Financial Services market is being fuelled by various factors. Rising volumes and varieties of financial, transactional and behavioural data enables generative models to simulate adverse scenarios, detect anomalies and enhance stress-testing frameworks more effectively. In addition, regulatory and compliance pressures prompt financial institutions to adopt smarter, real-time monitoring and reporting engines. Generative AI helps automate monitoring of credit, market, operational and compliance risks, reducing manual effort and error. Furthermore, the imperative to reduce cost, increase speed and improve decision-quality in risk operations drives demand: generative AI’s ability to generate synthetic data, anticipate emerging threats and optimize model performance offers a competitive advantage.

The forecasting & reporting segment is expected to register the fastest CAGR over the forecast period. Financial institutions are under growing pressure to navigate increasingly volatile markets and regulatory landscapes; generative AI enables advanced pattern-recognition across massive datasets, delivering more accurate forecasts and automated reporting at scale. Moreover, the demand for real-time insights and dynamic decision-making is rising, banks and investment firms are embracing generative models to optimize resource allocation, predict customer behavior, and streamline internal disclosures. Collectively, these drivers accelerate adoption of forecasting & reporting tools, reinforcing this segment as a major growth engine within the overall market.

Deployment Insights

Cloud segment dominated the market in 2024. The increasing demand for secure and compliant cloud-based solutions is driving cloud providers to invest heavily in advanced security measures, making generative AI applications more robust. These enhanced security protocols enable financial institutions to safeguard sensitive data and adhere to industry regulations such as GDPR and PCI DSS. By leveraging cloud-based AI, organizations can also improve their data management practices, allowing for effective monitoring, auditing, and control of data access. The integration of AI with cloud security features is essential for financial institutions to maintain trust and compliance in an increasingly complex regulatory environment. As these technologies evolve, they are likely to play a crucial role in ensuring that financial services can operate securely and efficiently while meeting stringent compliance requirements.

The on-premises segment is expected to register a significant CAGR over the forecast period. The on-premises deployment segment is being propelled primarily by stringent data-security, regulatory compliance and infrastructure control imperatives within financial institutions. Many banks, insurers and asset-managers favour on-premises solutions because they enable full sovereignty over sensitive data, mitigate risks of third-party cloud exposure and align with jurisdictional data-residency mandates. Concurrently, the need for high-performance, low-latency computing, in latency-sensitive use cases such as algorithmic trading and real-time fraud detection reinforces this preference. Furthermore, established IT ecosystems and legacy infrastructure in large financial firms make on-premises deployment economically and operationally viable, thereby sustaining its growth trajectory.

End Use Insights

The retail banking segment dominated the market in 2024. The increasing demand for faster and more efficient loan processing is driving the adoption of generative AI in retail banking. AI models are streamlining the underwriting and approval process by automating key aspects of the loan processing experience. By analyzing a wide range of data points, from credit scores to alternative data sources such as social media activity, AI can quickly assess creditworthiness and make informed lending decisions. This efficiency enhances customer experience by reducing the time it takes to approve loans and allows banks to process more loan applications with greater accuracy. The use of AI in loan processing is becoming a competitive advantage in the retail banking sector, where speed and precision are critical to staying ahead in a rapidly evolving market. As technology continues to advance, the integration of generative AI will be essential for banks looking to meet the growing expectations of their customers and maintain a strong position in the industry.

Investment firms’ segment is expected to register the fastest CAGR over the forecast period. The exponential growth in alternative data from market sentiment, news flows, to unstructured text and the consequent demand for advanced analytics made generative AI tools indispensable for delivering real-time insights and predictive capability. Moreover, investment firms are under intense pressure to streamline operations. Generative AI enables automation of research workflows, rapid scenario modelling and personalized investment narratives, thus cutting costs and accelerating decision-making. These twin forces data proliferation and the need for operational/strategic efficiency underpin the accelerating deployment of generative AI in the investment segment.

Regional Insights

North America dominated the Generative AI in Financial Services industry with a revenue share of over 39.2% in 2024. A prominent trend in North America is the automation of compliance and reporting processes through generative AI. Financial institutions are leveraging AI systems to monitor regulatory changes and assess their implications on business operations, significantly reducing the time and effort required for manual compliance tasks.

U.S. Generative AI in Financial Services Market Trends

Generative AI in Financial Services market in the U.S. is expected to grow significantly in 2024. The growing advancement of financial fraud is driving the adoption of Generative AI for advanced fraud detection in the U.S. financial sector. AI systems are leveraging machine learning algorithms to analyze transaction patterns and identify anomalies in real time. This capability enables financial institutions to detect and prevent fraudulent activities more effectively, reducing potential losses and maintaining customer trust. The increasing complexity of fraud schemes is pushing firms to invest in AI-driven solutions for robust fraud prevention.

Europe Generative AI in Financial Services Market Trends

Generative AI in Financial Services market in Europe is expected to grow significantly over the forecast period driven by the thriving fintech landscape, with Generative AI playing a pivotal role in driving innovation. Financial institutions are leveraging AI to develop new products and services, such as personalized financial advice, automated trading platforms, and advanced fraud detection systems. The region's strong fintech ecosystem, supported by favorable regulations and a culture of innovation, is accelerating the integration of AI into mainstream financial services, enhancing competitiveness and customer experiences.

Asia Pacific Generative AI in Financial Services Market Trends

Generative AI in Financial Services industry in the Asia Pacific region is anticipated to be at the fastest CAGR over the forecast period. Generative AI is playing a crucial role in strengthening fraud prevention measures across the Asia Pacific financial sector. AI systems analyze vast amounts of transaction data to detect and prevent fraudulent activities in real time. This advanced capability is particularly important in the region, where rapid digital transformation and increasing financial transactions are creating new opportunities for fraud. The implementation of AI for fraud detection is helping institutions safeguard their assets and maintain customer trust.

Key Generative AI in Financial Services Company Insights

Some key companies in the Generative AI in Financial Services market areOpenAI and AlphaSense Inc.

-

OpenAI is an artificial intelligence research and deployment company, operating a hybrid structure of a nonprofit arm and a capped-profit for-profit entity. It offers products such as the GPT-series large-language models, DALL-E image-generation, Codex code assistant, and enterprise API access. OpenAI provides models and APIs that enable automation of document processing, research summarization, knowledge-retrieval for advisors, risk analysis and client-service applications, helping banks and investment firms accelerate workflows while maintaining data security and regulatory control.

-

AlphaSense Inc. is a market intelligence and research platform provider specializing in AI and NLP-driven insights for financial services, corporates, and investment firms. Its products include Generative Search, Deep Research, and Generative Grid, which leverage generative AI to summarize, analyze, and extract insights from filings, earnings transcripts, and research reports. Through its cloud-based, subscription-driven distribution model, AlphaSense Inc. integrates structured financial data with unstructured content, enabling faster and more accurate decision-making. It enhances investment research, risk assessment, and strategy formulation with domain-specific, secure, and explainable AI tools.

Key Generative AI in Financial Services Companies:

The following are the leading companies in the generative AI in financial services market. These companies collectively hold the largest market share and dictate industry trends.

- AlphaSense Inc.

- Amazon Web Services, Inc.

- Ernst & Young Global Limited

- Google LLC

- HCL Technologies Limited

- IBM Corporation

- Intel Corporation

- Mastercard

- Microsoft

- Narrative Science

- OpenAI

- Salesforce, Inc.

- SAP SE

Recent Developments

-

In October 2025, Amazon Web Services, Inc. (AWS) collaborated with Biz2X, a financial-technology company, to launch an Agentic AI Digital Lending Solution built on AWS’s Amazon Bedrock, targeting banks, NBFCs, and fintech lenders and accelerating SME loan origination and servicing. The platform is designed to streamline application workflows, enable conversational AI engagements with borrowers and deliver real-time decision-making, positioning lenders to boost volumes and cut approval times within the SME credit segment.

-

In October 2025, AlphaSense Inc. launched Financial Data, a new product combining structured quantitative datasets with qualitative insights in one GenAI-enabled workflow, aimed squarely at hedge funds, investment banks, asset managers, and PE/VC firms. The launch enhances AlphaSense, Inc.’s market intelligence platform by integrating financial fundamentals, consensus estimates, and ownership data, enabling users to generate faster, data-driven investment insights and improve decision-making efficiency.

-

In May 2025, Google LLC announced a Memorandum of Understanding with UniCredit, a pan-European commercial bank, to accelerate UniCredit’s digital transformation across 13 core markets, using Google Cloud’s infrastructure, AI and data analytics. The ten-year partnership will enable UniCredit to migrate key applications to the cloud, modernize its IT architecture and deploy advanced AI workloads, including the Vertex AI platform and Gemini models, to enhance service offerings, operational efficiency and customer experience. The collaboration also encompasses a group-wide digital skill training Programme to build internal capabilities and support future growth initiatives.

Generative AI in Financial Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.96 billion

Revenue forecast in 2033

USD 25.71 billion

Growth rate

CAGR of 31.0% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, deployment, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

AlphaSense Inc.; Amazon Web Services, Inc.; Ernst & Young Global Limited; Google LLC; HCL Technologies Limited; IBM Corporation; Intel Corporation; Mastercard; Microsoft; Narrative Science; OpenAI; Salesforce, Inc.; SAP SE

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

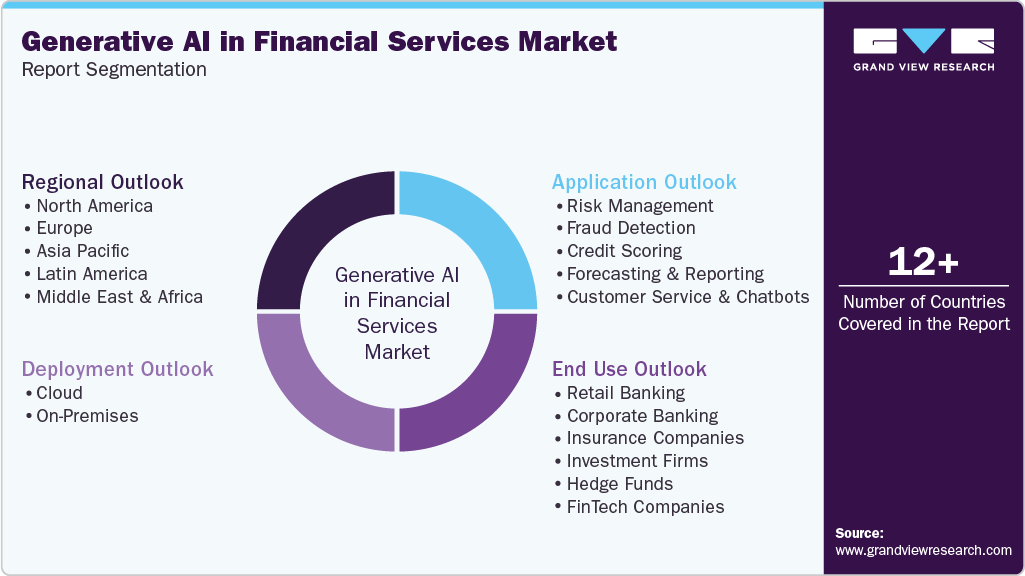

Global Generative AI in Financial Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented global Generative AI in Financial Services market report based on application, deployment, end use, and region.

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Risk Management

-

Fraud Detection

-

Credit Scoring

-

Forecasting & Reporting

-

Customer Service and Chatbots

-

-

Deployment Outlook (Revenue, USD Billion, 2021 - 2033)

-

Cloud

-

On-Premises

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Retail Banking

-

Corporate Banking

-

Insurance Companies

-

Investment Firms

-

Hedge Funds

-

FinTech Companies

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global generative AI in financial services market was estimated at USD 2.21 billion in 2024 and is expected to reach USD 2.96 billion in 2025.

b. The global generative AI in financial services market is expected to grow at a compound annual growth rate of 31.0% from 2025 to 2033, reaching USD 25.71 billion by 2033.

b. North America dominated the generative AI in financial services market with a share of 39.2% in 2024. A prominent trend in North America is the automation of compliance and reporting processes through generative AI. Financial institutions are leveraging AI systems to monitor regulatory changes and assess their implications on business operations, significantly reducing the time and effort required for manual compliance tasks.

b. Some key players operating in the generative AI in financial services market include AlphaSense Inc.; Amazon Web Services, Inc.; Ernst & Young Global Limited; Google LLC; HCL Technologies Limited; IBM Corporation; Intel Corporation; Mastercard; Microsoft; Narrative Science; OpenAI; Salesforce, Inc.; and SAP SE.

b. Key factors driving market growth include cost reduction through automation and resource optimization, a data explosion driving AI integration, and enhanced predictive capabilities through advanced machine learning algorithms.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.