- Home

- »

- Next Generation Technologies

- »

-

Generative AI in Packaging Market, Industry Report, 2033GVR Report cover

![Generative AI in Packaging Market Size, Share & Trends Report]()

Generative AI in Packaging Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Software, Services), By Technology (ML, NLP), By Application, By Deployment, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-696-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Generative AI in Packaging Market Summary

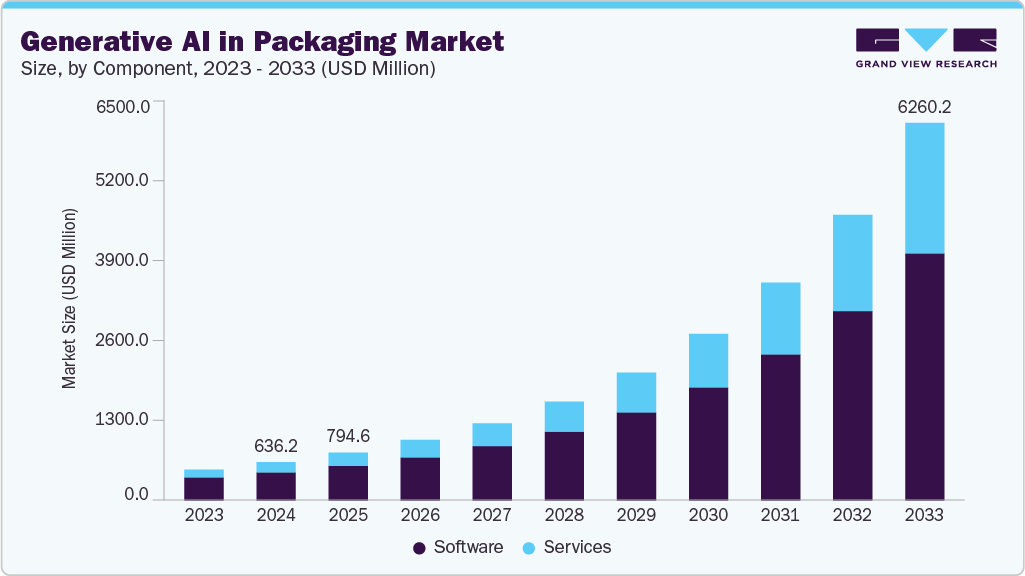

The global generative AI in packaging market size was estimated at USD 636.2 million in 2024 and is projected to reach USD 6,260.2 million by 2033, growing at a CAGR of 29.4% from 2025 to 2033. This market growth is driven by various factors such as faster design and prototyping cycles, growing adoption of smart and sustainable packaging, cost reduction through automation, integration with advanced 3D design tools, and increased use of AI for predictive consumer behavior analysis.

Key Market Trends & Insights

- North America dominated the global generative AI in packaging market with the largest revenue share of 38.1% in 2024.

- The generative AI in packaging market in the U.S. led the North America market and held the largest revenue share in 2024.

- By application, structural design led the market, holding the largest revenue share of 34.3% in 2024.

- By component, software segment held the dominant position in the market.

- By end use, food & beverages segment held the dominant position in the market.

Market Size & Forecast

- 2024 Market Size: USD 636.2 Million

- 2033 Projected Market Size: USD 6,260.2 Million

- CAGR (2025-2033): 29.4%

- North America: Largest Market in 2024

- Asia Pacific: Fastest Growing Market

The generative AI significantly enhances the intelligence and interactivity of packaging solutions across industries. By enabling the seamless integration of smart features such as QR codes, NFC tags, and dynamic visuals, AI helps brands deliver personalized and engaging experiences. These technologies improve consumer interaction and provide valuable data on usage patterns and preferences. Generative AI allows brands to adapt real-time packaging based on customer behavior, enhancing engagement across retail, cosmetics, and food & beverages sectors. The ability to embed tailored content and interactive elements gives businesses a competitive edge in increasingly experience-driven markets.

Sustainability and cost efficiency are major forces propelling market adoption. AI-driven tools help brands minimize material waste by suggesting optimal structural designs and identifying eco-friendly alternatives. It aligns with increasing regulatory pressure and consumer demand for green solutions, but also drives down operational costs through resource optimization. Generative design reduces the need for excessive physical prototypes by simulating multiple iterations digitally. In addition, AI ensures packaging meets performance, safety, and sustainability requirements efficiently. This strategic use of AI allows companies to meet environmental targets while achieving long-term cost savings and operational resilience.

The need for speed, personalization, and digital optimization is reshaping packaging strategies with the help of generative AI. As e-commerce continues to dominate, businesses focus on digital-first packaging that maintains visual appeal and brand consistency across online platforms. AI supports rapid prototyping, enabling companies to test and launch packaging designs faster. Simultaneously, AI enables hyper-personalized packaging tailored to individual customer segments or even single users, making it suitable for limited editions, promotional campaigns, and targeted marketing. By combining consumer insights, automation, and design intelligence, generative AI enhances shelf visibility, drives customer engagement, and accelerates time-to-market in competitive retail environments.

Application Insights

The structural design segment led the market in 2024, accounting for over 34% of global revenue. Due to rising demand for cost-efficient, functional, and sustainable packaging solutions, the segment is witnessing strong market growth. Generative AI enables automated design of complex packaging structures by simulating numerous configurations based on product dimensions, weight, and fragility. This reduces dependency on manual design iterations and accelerates the development process. In addition, AI-driven structural optimization helps minimize material usage without compromising durability, contributing to cost savings and environmental compliance. The need for innovative structural formats in e-commerce, where packaging must protect products in transit while being lightweight and visually appealing, further fuels adoption in this segment.

The consumer personalization segment is predicted to experience the fastest growth in the forecast years. The market growth is fueled by rising demand for unique, customer-centric packaging experiences. Brands leverage generative AI to create hyper-personalized designs that reflect individual consumer preferences, purchase behavior, and regional trends. This approach enhances brand loyalty, drives customer engagement, and differentiates products in competitive retail and e-commerce environments. AI enables scalable customization at speed, allowing businesses to launch targeted campaigns, limited editions, and seasonal packaging with minimal turnaround time. As consumers increasingly seek personalized experiences, companies adopting AI-driven design strategies gain a competitive advantage in physical and digital marketplaces.

Component Insights

The software segment led the market in 2024. This growth is driven by increasing demand for advanced design automation, personalization, and simulation capabilities. AI-powered software platforms streamline packaging development by generating data-driven designs, optimizing structural configurations, and enabling real-time customization. These tools allow businesses to reduce design cycles, lower prototyping costs, and accelerate time-to-market. Cloud-based deployment and user-friendly interfaces further boost adoption among packaging designers, marketers, and product teams. In addition, integration with digital asset management and smart packaging systems enhances scalability and cross-functional collaboration, making software a cornerstone for innovation in AI-enabled packaging solutions.

The services segment is predicted to experience the fastest growth in the forecast years. Service providers offer strategic consulting, training, and technical assistance to help packaging firms adopt AI-driven tools efficiently. Growing demand for tailored design services, sustainability audits, and end-to-end project execution further drives this segment. Furthermore, small and mid-sized enterprises rely on third-party service providers to access AI capabilities without building in-house infrastructure. As generative AI adoption accelerates, the need for ongoing maintenance, updates, and optimization services is expanding, making services a vital component of market growth.

Technology Insights

The machine learning (ML) segment accounted for the largest market revenue share in 2024. The ML segment plays a foundational role in the market, driven by its ability to automate complex design decisions and optimize packaging processes. ML algorithms analyze vast datasets ranging from consumer behavior and product specifications to supply chain dynamics to generate intelligent, data-driven packaging solutions. These systems enable real-time personalization, structural optimization, and sustainability modeling at scale. ML also enhances packaging efficiency by reducing design time, minimizing waste, and improving cost-effectiveness. As packaging becomes more data-intensive and outcome-driven, ML remains the core enabler of smart packaging innovation across retail, food, and e-commerce industries.

The Generative Adversarial Networks (GANs) segment is expected to grow at the highest CAGR during the forecast period. Its unique ability to generate high-quality, original visual content drives the market. GANs enable automated creation of diverse label designs, brand imagery, and packaging artwork, making them ideal for mass customization and limited-edition product campaigns. These capabilities significantly reduce reliance on manual creative processes, lowering design costs and speeding up time-to-market. As brands increasingly prioritize personalized and visually engaging packaging, especially in e-commerce, GANs provide a competitive edge by producing aesthetically compelling designs that are highly adaptable to consumer preferences and market trends.

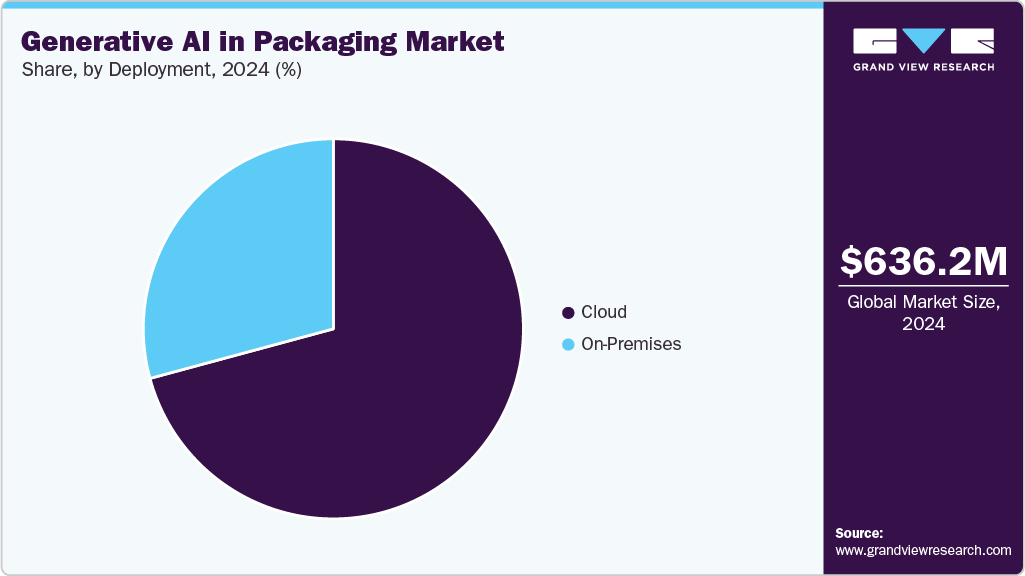

Deployment Insights

The cloud segment accounted for the prominent market revenue share in 2024 due to the scalable, cost-effective, and collaborative design environments. Cloud-based generative AI platforms allow packaging teams to access advanced tools, data, and real-time updates from any location, enabling seamless collaboration across design, marketing, and production functions. These solutions reduce the need for heavy on-premise infrastructure, lowering capital expenditures and accelerating deployment. Moreover, cloud platforms offer enhanced storage capacity, faster computing power, and integration with enterprise systems, suitable for supporting dynamic design workflows, continuous iteration, and AI-driven personalization across large-scale packaging operations.

The on-premises segment is anticipated to grow significantly during the forecast period. The segment is driven by organizations prioritizing data security, IP protection, and full control over infrastructure. Packaging companies handling sensitive customer data, proprietary designs, or regulated product categories such as pharmaceuticals and defense often prefer on-premises deployment to comply with internal and external governance standards. It also offers lower latency and improved performance for compute-intensive design tasks in environments with limited cloud connectivity. Moreover, firms with existing IT infrastructure investments find on-premises deployment more cost-effective over the long term.

End Use Insights

The food & beverages segment accounted for the largest market revenue share in 2024. Multiple strategic and operational factors drive the market. The demand for rapid product turnover and seasonal packaging variations pushes companies to adopt AI-powered structural and visual design automation to reduce time-to-market. In addition, rising consumer expectations for personalized packaging experiences, such as localized branding and limited-edition designs, fuel the integration of generative AI for scalable customization. The growing emphasis on sustainability further promotes the use of AI to optimize packaging materials and minimize waste. Moreover, stringent regulatory requirements around food labeling and safety make AI-driven compliance tools increasingly valuable, reinforcing adoption in this segment.

The retail & e-commerce segment is expected to grow at the highest CAGR during the forecast period. Retailers and e-commerce platforms leverage generative AI to create highly personalized packaging that aligns with individual customer preferences, seasonal campaigns, and behavioral data, enhancing customer engagement and loyalty. With constant new product introductions in online retail, generative AI streamlines packaging design and prototyping, reducing time-to-market and enabling brands to respond faster to trends and customer feedback. E-commerce companies utilize generative AI to design eco-friendly and material-efficient packaging, addressing sustainability goals while minimizing shipping and logistics costs.

Regional Insights

North America dominated the generative AI in packaging industry with a revenue share of over 38.1% in 2024. Advancements in technologies, high consumer expectations, and the rapid digitalization of retail and manufacturing operations drive the market growth. Businesses across sectors leverage generative AI to accelerate packaging innovation, enabling faster design cycles, enhanced personalization, and improved supply chain efficiency. The region’s strong presence of e-commerce and consumer goods companies fuels demand for AI-driven packaging solutions that offer visual differentiation and brand recall.

U.S. Generative AI in Packaging Market Trends

The generative AI in packaging market in the U.S. is expected to grow significantly in 2024. Various factors, such as advanced digital infrastructure, strong R&D investments, and a growing emphasis on sustainable packaging solutions, drive market growth. Numerous packaging and tech firms such as IBM Corporation, Microsoft, and Amcor are deploying generative AI for smart design, real-time quality control, and predictive prototyping to reduce waste and accelerate time-to-market. Consumer demand for eco-friendly, customized packaging paired with regulatory pressure from initiatives such as the U.S. Plastic Pact further drives innovation toward AI-enabled material optimization and circular economy models.

Europe Generative AI in Packaging Market Trends

The generative AI in packaging market in Europe is expected to grow significantly over the forecast period. Europe’s market is accelerating, fueled by stringent regulations such as the EU Green Deal and the Packaging and Packaging Waste Regulation, which demand recyclable, reusable, and minimalist design by 2030. Companies are deploying generative AI to optimize materials, reduce waste, and enhance life-cycle analysis in line with circular economy goals. Smart packaging, including near field communication (NFC), QR, and RFID-enabled interactive formats, is gaining traction across the FMCG and logistics sectors. Moreover, EU investments in AI infrastructure and regulatory streamlining pave the way for broader industrial adoption and innovation across Europe.

Asia Pacific Generative AI in Packaging Market Trends

The generative AI in packaging market in the Asia Pacific is emerging as the fastest-growing regional segment, due to the booming e-commerce, rapid industrialization, and widespread adoption of digital technologies across China, India, Japan, and Southeast Asia. Governments actively promote circular economy policies and sustainable packaging, while manufacturers deploy AI to optimize design, minimize material use, and enhance recyclability. Brands use generative design tools to rapidly produce personalized packaging concepts aligned with consumer preferences and regulatory standards. Furthermore, investments in automation and cloud-based AI platforms accelerate scalability, pushing AI-enabled packaging innovations into mainstream adoption across the region.

Key Generative AI in Packaging Company Insights

Some key companies in the generative AI in packaging industry are Adobe and Amazon.

-

Adobe, which provides various products such as Adobe Firefly and Adobe Illustrator with generative AI tools, is at the forefront of packaging design. It enables scalable, automated, and hyper-personalized visuals used by major CPG and retail brands globally. Adobe’s Creative Cloud suite, including Illustrator, Photoshop, and InDesign, is a preferred platform for graphic and packaging design across diverse industries. Its widespread adoption by design professionals and brands underscores its crucial role in enabling high-quality, scalable, innovative packaging solutions.

-

Amazon uses generative AI in real-world packaging operations, optimizing box sizes, reducing materials, and streamlining logistics through its Package Decision Engine. As one of the largest e-commerce companies, it has internal innovations in packaging AI that set industry benchmarks and influence the broader supply chain. Moreover, Amazon’s "Climate Pledge" commits to net-zero carbon by 2040. Generative AI supports eco-conscious packaging design using minimal material, simulations to optimize package structure and reduce waste, and data-driven selection of recyclable and biodegradable materials

Key Generative AI in Packaging Companies:

The following are the leading companies in the generative AI in packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Adobe

- Amazon

- NVIDIA Corporation

- Microsoft

- Clarifai

- PackageX Inc.

- Smurfit Westrock

- Dassault Systemes

- Accenture

- Kebotix, Inc.

Recent Developments

-

In July 2025, Nestle, a food and beverage company, partnered with IBM Corporation, a technology company, to develop generative AI tools for packaging. These tools will support identifying potential new packaging materials, focusing on optimizing cost-efficiency, recyclability, and functional performance. To enable this, Nestle and IBM Corporation scientists have applied AI-driven processing methods to compile a comprehensive database of material properties, drawing from both public and proprietary sources. They customized a specialized chemical language model trained on this dataset, allowing it to effectively interpret and generate molecular structure representations suited to packaging applications.

-

In June 2025, L'Oréal Group collaborated with NVIDIA Corporation, an AI technology provider, to accelerate the development and deployment of AI-driven solutions, including the large-scale generation of 3D digital renderings of its product lines. Integrating physical modeling with generative AI enables the company to enhance creative workflows and expand the boundaries of digital product innovation.

-

In March 2025, Diageo, an alcoholic beverage company, launched its First Bottle Personalisation Experience, Fueled by Generative AI. The launch aligns with a growing demand for distinctive experiences and products that reflect identity, social belonging, and individual status.

Generative AI in Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 794.6 million

Revenue forecast in 2033

USD 6,260.2 million

Growth rate

CAGR of 29.4% from 2025 to 2033

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, technology, deployment, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Adobe; Amazon; NVIDIA Corporation; Microsoft; Clarifai; PackageX Inc.; Smurfit Westrock; Dassault Systèmes; Accenture; Kebotix, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Generative AI in Packaging Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global generative AI in packaging market report based on component, technology, application, deployment, end use, and region:

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Software

-

Services

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Generative Adversarial Networks (GANs)

-

Natural Language Processing (NLP)

-

Machine Learning (ML)

-

3D Generative Design Tools

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Structural Design

-

Label & Artwork Generation

-

Sustainability Optimization

-

Consumer Personalization

-

Marketing Visualization

-

Simulation & Testing

-

-

Deployment Outlook (Revenue, USD Million, 2021 - 2033)

-

On-premises

-

Cloud

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Food & Beverages

-

Consumer Goods

-

Pharmaceuticals

-

Retail & E-commerce

-

Cosmetics & Personal Care

-

Industrial Goods

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global generative AI in packaging market size was estimated at USD 636.2 million in 2024 and is expected to reach USD 794.6 million in 2025.

b. The global generative AI in packaging market is expected to grow at a compound annual growth rate of 29.4% from 2025 to 2033 to reach USD 6,260.2 million by 2033.

b. North America dominated the generative AI in packaging market with a share of 38.1% in 2024. This is attributable to the advancement in technologies, high consumer expectations, and the rapid digitalization of retail and manufacturing operations. Businesses across sectors are leveraging generative AI to accelerate packaging innovation, enabling faster design cycles, enhanced personalization, and improved supply chain efficiency. The region’s strong presence of e-commerce and consumer goods companies is fueling demand for AI-driven packaging solutions that offer visual differentiation and brand recall.

b. Some key players operating in the generative AI in packaging market include Adobe; Amazon; NVIDIA Corporation; Microsoft; Clarifail; PackageX Inc.; Smurfit Westrock; Dassault Systemes; Accenture; and Kebotix, Inc.

b. The generative AI in packaging market growth is driven by various factors such as, faster design and prototyping cycles, growing adoption of smart and sustainable packaging, cost reduction through automation, integration with advanced 3D design tools, and increased use of AI for predictive consumer behavior analysis.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.