- Home

- »

- Medical Devices

- »

-

Generic Pharmaceuticals Contract Manufacturing Market Report, 2030GVR Report cover

![Generic Pharmaceuticals Contract Manufacturing Market Size, Share & Trends Report]()

Generic Pharmaceuticals Contract Manufacturing Market (2025 - 2030) Size, Share & Trends Analysis Report By Drug Type (Branded, Unbranded), By Product (API, Drug Product), By Route Of Administration, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-997-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Generic Pharmaceuticals Contract Manufacturing Market Summary

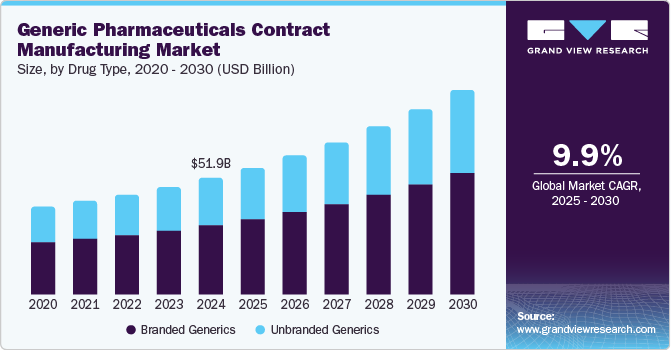

The global generic pharmaceuticals contract manufacturing market size was estimated at USD 51.96 billion in 2024 and is projected to reach USD 90.95 billion by 2030, growing at a CAGR of 9.98% from 2025 to 2030. Pharmaceutical drugs have become increasingly important as it provides people with various treatments and cures, helping to improve health and extend life expectancy.

Key Market Trends & Insights

- North America accounted for the largest market share of 38.90% in 2024.

- The generic pharmaceuticals contract manufacturing market in the U.S. accounted for the highest share of the North America.

- On the basis of drug type segment, the branded generics segment dominated the market, accounting for a revenue share of 59.40%.

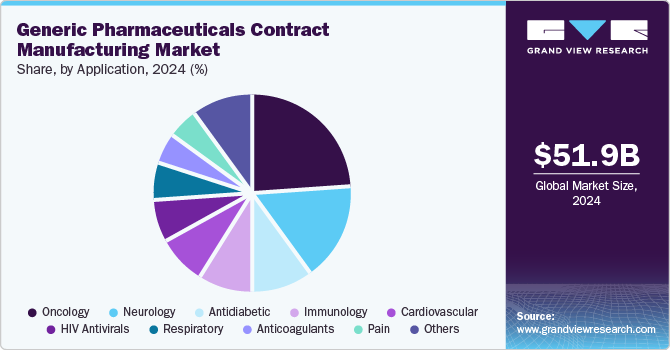

- On the basis of application, the oncology segment dominated the market, accounting for a revenue share of 24.26%.

- On the basis of route of administration segment, the oral segment dominated the market, accounting for a revenue share of 63.73%.

Market Size & Forecast

- 2024 Market Size: USD 51.96 Billion

- 2030 Projected Market Size: USD 90.95 Billion

- CAGR (2025-2030): 9.98%

- North America: Largest market in 2024

Moreover, patents on a significant number of drugs have expired and lost patent protection leading to increased availability of generic injectable drugs and generic competition in the pharmaceutical market. According to Solici, from 2020 - 24, the opportunity for generic players is rising as around 95 injectables brands are losing exclusivity, & 27% in small volume parenterals and 46% of brands are complex & challenging to develop.

Furthermore, several big pharmaceutical companies have realized that generics will be the major solution in the coming years and that a generic version of their off-patient medication is the only way to success. Therefore, a number of manufacturers are shifting their business strategy by outsourcing to contract manufacturing further increasing the production of generic injectable products that often can help to penetrate the pharmaceutical market and gain major market share.

In addition, to address the growing demand for healthcare, regulatory authorities, such as the FDA, are improving access to generic drugs. For instance, the U.S. FDA, in 2020, signed a five-year grant with the University of Maryland and the University of Michigan to establish the Center for Research on Complex Generics. Such initiatives are expected to improve the development of generics and thus are expected to increase the demand for contract manufacturing in the upcoming years. The growing demand for cost-effective drugs has improved generic drug sales worldwide.

Opportunity Analysis

The market presents significant opportunities driven by the increasing demand for affordable drugs, patent expirations of branded drugs, and cost-cutting measures in healthcare. Most pharmaceutical companies are increasingly outsourcing production to specialized generic contract manufacturers to enhance efficiency, ensure standard regulatory compliance, and further launch new products. Besides, the market has witnessed increased opportunities for cost-efficient generic medication due to the rising incidence of chronic diseases such as cardiovascular disorders, diabetes, and respiratory conditions. In addition, expanding healthcare access and growing government support offer new market growth opportunities. Thus, the growing focus of pharmaceutical companies to capitalize growing demand for generic market has increased the need for contract manufacturers for cost-efficient production, regulatory excellence, and advanced technologies, further ensuring a competitive edge in the global pharmaceutical landscape.

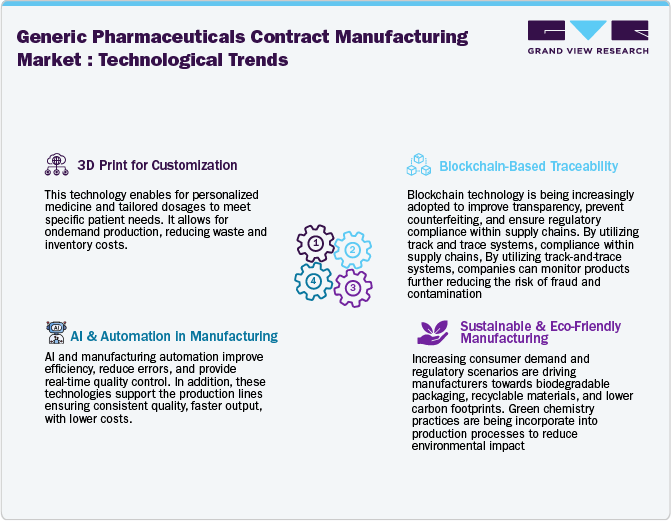

Technological Advancements

The generic pharmaceutical contract manufacturing market is evolving with rapid technological transformation, driven by automation, artificial intelligence (AI), and advanced manufacturing processes. These technological advancements are streamlining manufacturing efficiency, improving quality control, and reducing operational costs, allowing pharmaceutical/biopharmaceutical manufacturers to meet the growing global demand for generic medications while adhering to regulatory standards. Besides, increased requirements for continuous manufacturing (CM) enhance production capabilities by minimizing batch processing time, supporting consistency, and reducing material waste. Moreover, AI-driven predictive analytics and real-time monitoring optimize operations, ensuring the early detection of quality deviations and maximizing efficiency. In addition, blockchain technology is strengthening supply chain security by enhancing traceability, preventing counterfeit drugs, and improving overall transparency.

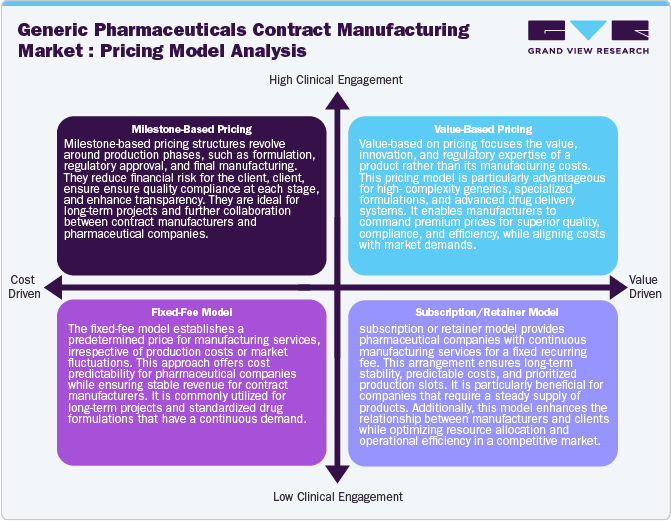

Pricing Model Analysis

The pricing models in generic pharmaceuticals contract manufacturing operate under various pricing models to balance cost efficiency, quality, and regulatory compliance while ensuring profitability for manufacturers and affordability. The generic pharmaceuticals contract manufacturing pricing models include cost-plus pricing, where manufacturers charge production costs plus a fixed margin, ensuring transparency. In addition, volume-based pricing offers bulk order discounts, benefiting large-scale pharmaceutical companies. Moreover, milestone-based pricing aligns payments with specific production stages, reducing financial risks. Value-based pricing is emerging, especially for high-complexity generics, where prices reflect product differentiation and regulatory expertise.

Market Concentration & Characteristics

The generic pharmaceuticals contract manufacturing market growth stage is medium, and growth is accelerating. The market is characterized by the degree of innovation, level of M&A activities, regulatory impact, product expansion, and regional expansion.

The large number of drugs to go off-patent drives the demand. Drug shortages & rising investment in complex manufacturing processes for generic injectables provide the market with new opportunities.

The shifting of old drug production to low-cost countries and stringent action by the US FDA regarding compliance with GMP has led to a rising drug shortage, creating a requirement for generic drugs. Thus, the growing FDA drug shortage is a significant factor that has created a rise in demand for market production.

The competition among market players is due to the demand for generic drugs in oncology, expanding product portfolio by market players, and the burden of different diseases contributing to market earnings. Hence, the key market players increasingly focus on new mergers and acquisitions, partnerships, and collaboration.

Service expansion in the generic pharmaceuticals contract manufacturing market is being driven by increasing demand for end-to-end solutions, including, regulatory support, advanced manufacturing technologies, and packaging services.

The continuous strong demand for generic pharmaceutical contract manufacturing owing to increasing sales of generics growing pharmaceutical & medical sectors are expected to drive the growth of the generic pharmaceuticals contract manufacturing market.

Drug Type Insights

On the basis of drug type segment, the market is segmented into branded generics, and unbranded generics. In 2024, the branded generics segment dominated the market, accounting for a revenue share of 59.40%. This growth can be attributed to the high penetration of branded generic drugs and the growing disease burden, among the factors driving growth. In addition, patent expiration for innovator drugs has provided new growth opportunities for generic pharmaceutical contract manufacturing to introduce low-cost generic drugs. This makes medications more affordable for patients and helps to reduce overall healthcare costs. Furthermore, increasing product launches, including biosimilars, is a prominent factor supporting the segment's growth. For instance, In March 2023, the United Nations-backed Medicines Patent Pool (MPP) granted Viatris, Inc., Aurobindo Pharma, and Cipla Inc. sublicenses to make low-cost branded generic versions of Apretude, an HIV drug manufactured by GSK plc. ViiV, a company established by a joint venture of GSK plc. and Pfizer Inc., will help the companies develop, produce, and supply branded generic versions.

The unbranded generics segment is expected to grow at the fastest CAGR during the forecast period. Unbranded generics are generally cheaper than branded ones. According to NCBI, branded generics are over 13 times more expensive than unbranded generics, which is one of the key factors supporting the demand for unbranded generics. Unbranded generic drugs are equally safe and effective as branded generics. This is expected to boost their demand over the forecast period.

Product Insights

On the basis of the product segment, the market is segmented to API, and Drug Product. API segment accounted for the largest market share in 2024. Growing requirement for new geriatric drugs and patent expiry of exclusive small-molecule drugs are driving the segment growth. Increased interest of public organizations in improving the production of API is further supporting segment growth. Such initiatives are expected to improve generic API contract manufacturing activities and hence contribute to segment growth.

The drug product segment is expected to grow at a significant CAGR during the forecast period. Small molecule drug substances have become more complex, with manufacturing methods becoming more specialized. This supports the demand for a CMO for manufacturing drug products. The adoption of the expansion agreements by the CMO for drug product manufacturing is expected to further support segment growth in the coming years.

Application Insights

On the basis of application segment, the market includes oncology, immunology, antidiabetic, neurology, anticoagulants, cardiovascular, respiratory, pain, HIV antivirals, and others. In 2024, the oncology segment dominated the market, accounting for a revenue share of 24.26%. This growth can be attributed to increasing incidence of cancer, high demand for potency generic injectable products, growing generic product launches and growing number of CMOs focusing on the development of generic drugs for anti-cancer treatment. In oncology, generic drugs are widely used for various cancers such as ovarian, breast, and lung as these injectables are relatively cheaper and affordable. In addition, approximately, 60% of all oncology drugs are classified as highly potent and therefore the oncology segment holds a strong growth demand to facilitate generics pharmaceuticals contract manufacturing. For instance, according to the American Cancer Society states that National Cancer Costs are expected to increase in the coming years. It states that spending on cancer care accounted for USD 200.7 billion in 2020 and is expected to rise to USD 245.6 billion by 2030 in America.

The immunology segment is anticipated to register a CAGR of 9.86% during the forecast period. Immunological disorders include rheumatoid arthritis, Addison disease, psoriasis, Alzheimer's disease, and others. One of the major causes of these diseases is the growing geriatric population. Furthermore, immunological diseases require treatment for a long period. This increases the cost of medications and thus supports the demand for generic medications for treating immunological disorders. Such factors are anticipated to drive the segment.

Route of Administration Insights

On the basis of route of administration segment, the market includes oral, parenteral, topical, and others. In 2024, the oral segment dominated the market, accounting for a revenue share of 63.73%. The oral route is the most preferred route of administration. It does not require any physician to administer the drug, which is one of the primary reasons for the high acceptance of oral formulations. Oral formulations are also considered more flexible in design and are majorly used in treating common diseases, such as fever, infectious diseases, migraines, and diabetes. These factors support the demand for the oral route of administration.

The parenteral segment is anticipated to register the fastest CAGR during the forecast period. The increased bioavailability of injectable formulations, which leads to the immediate onset of action, is the primary factor for segment growth. Besides, injectable formulations are preferred if the drugs are poorly absorbed. Moreover, parenteral formulation is also primarily preferred in medical emergencies, further driving the segment growth.

Regional Insights

North America accounted for the largest market share of 38.90% in 2024. This can be attributed to the growth of the pharmaceutical industries in the U.S. and Canada. The presence of a large number of major players in this region is expected to contribute significantly to its growth. The growing focus of pharmaceutical companies in the region to outsource non-core operations, such as manufacturing, is further supporting the region’s growth.

U.S. Generic Pharmaceuticals Contract Manufacturing Market Trends

The generic pharmaceuticals contract manufacturing market in the U.S. accounted for the highest share of the North America generic pharmaceuticals contract manufacturing market owing to the presence of established market players, increasing demand for cost-effective generic drugs. The significant presence of market players offering contract manufacturing services contributing to new innovation and product launches of new generics across the U.S. market.

The generic pharmaceuticals contract manufacturing market in Canada is driven by growing expansion of capabilities and services leveraged by the companies drive the. In addition, the rising number of clinical trials and increasing generic drug innovation is anticipated to fuel the market over the estimated time period.

Europe Generic Pharmaceuticals Contract Manufacturing Market Trends

Europe generic pharmaceuticals contract manufacturing market is driven by growing pharmaceutical industry, rising demand for outsourcing services, emerging research and development activities and increasing number of drug candidates in the pipeline are expected to drive the market growth.

The generic pharmaceuticals contract manufacturing market in Germany held a highest share in 2024. The market is driven by growing number of clinical trials in the country, rising R&D investment, and growing continuous demand for pharmaceutical products

The UK's generic pharmaceuticals contract manufacturing market is anticipated to grow significantly over the forecast period. The generic pharmaceuticals contract manufacturing market in the UK is driven by cost-effective research services, increasing trend of outsourcing among pharmaceutical companies, requirement for generic drugs, technological advancements. Such factors are expected to drive the country's growth.

Asia Pacific Generic Pharmaceuticals Contract Manufacturing Market Trends

Asia Pacific is expected to grow at a CAGR of 10.94% during the forecast period. The region’s growth is driven by low costs of manufacturing encouraging various pharmaceutical companies in developed economies, such as the U.S., to outsource their manufacturing activities in Asia Pacific region.

The generic pharmaceuticals contract manufacturing market in Japan is driven by increasing focusing on the development of generic drugs to tackle the shortage of life-saving medicines, addressing the unmet needs.

The generic pharmaceuticals contract manufacturing market in China is driven by increase in clinical trials, low cost of trials, the vast patient pool, developed clinical research infrastructure, growing approval of new drugs, technological advancement, and the availability of medical practitioners are further boosting the growth of the Asia Pacific market.

India's generic pharmaceuticals contract manufacturing market is driven by the presence of key players offering outsourcing services, the presence of CDMO’s and CMO’s has led to the rise in the requirement for various outsourcing services for the production of generics.

Key Generic Pharmaceuticals Contract Manufacturing Company Insights

The key players operating across the U.S. market are adopting in-organic strategic initiatives such as partnerships, mergers, and acquisitions, etc. The strategies adopted by companies are mergers & acquisitions/joint ventures merger, service launches, partnership & agreements, expansions, and others to increase market presence & revenue and gain a competitive edge drives the market growth. Hence, increasing adoption of in-organic strategic initiatives is highly anticipated to boost market share of prominent players operating across the market. For instance, in January 2024, Fresenius Kabi launched the Posaconazole Injection. These injections are a generic substitute for Noxafil and can be used to treat and prevent fungal infections in children and adults. Posaconazole injection is a new addition to the company’s product portfolio of 30+ anti-infective molecules and is available in the U.S. market.

Key Generic Pharmaceuticals Contract Manufacturing Companies:

The following are the leading companies in the generic pharmaceuticals contract manufacturing market. These companies collectively hold the largest market share and dictate industry trends.

- Jubilant Generics Ltd.

- Recipharm AB

- Siegfried Holding AG

- Aurobindo Pharma

- Cambrex Corp.

- Alcami Corp., Inc.

- Catalent, Inc.

- Acme Generics Pvt Ltd.

- Syngene International Ltd.

- Pfizer CentreOne

- Curia Global, Inc.

- Metric Contract Services

Recent Developments

-

In April 2024, Baxter International Inc. mentioned the pharmaceutical portfolio expansion with five injectable product launches in the U.S. market. The new products include Vasopressin in 0.9% Sodium Chloride Injection, Norepinephrine Bitartrate in 5% Dextrose Injection, Vancomycin Injection, Regadenoson Injection pre-filled syringe and Ropivacaine Hydrochloride Injection.

-

In October 2023, Egis Pharmaceuticals mentioned the portfolio expansion with API contract development and contract manufacturing. The company will offer services under Egis Pharma Services to existing and new pharmaceutical partners.

Generic Pharmaceuticals Contract Manufacturing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 56.53 billion

Revenue forecast in 2030

USD 90.95 billion

Growth rate

CAGR of 9.98% from 2025 to 2030

Base year for estimation

2024

Historical year

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Drug type, product, route of administration, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Thailand; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Jubilant Generics Ltd.; Recipharm AB; Siegfried Holding AG; Aurobindo Pharma; Cambrex Corp.; Alcami Corp., Inc.; Catalent, Inc.; Acme Generics Pvt Ltd.; Syngene International Ltd.; Pfizer CentreOne,; Curia Global, Inc.; Metric Contract Services

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Generic Pharmaceuticals Contract Manufacturing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global generic pharmaceuticals contract manufacturing market report based on drug type, product, route of administration, application and region.

-

Drug Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Branded Generics

-

Unbranded Generics

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

API

-

Drug Product

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral

-

Parenteral

-

Topical

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Immunology

-

Antidiabetic

-

Neurology

-

Anticoagulants

-

Cardiovascular

-

Respiratory

-

Pain

-

HIV Antivirals

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global generic pharmaceuticals contract manufacturing market size was estimated at USD 51.96 billion in 2024 and is expected to reach USD 56.53 billion in 2025.

b. The global generic pharmaceuticals contract manufacturing market is expected to grow at a compound annual growth rate of 9.98% from 2025 to 2030 to reach USD 90.95 billion by 2030.

b. North America dominated the generic pharmaceuticals contract manufacturing market, with a share of 38.90% in 2024. This is attributable to the strong presence of CMOs and increasing demand for cost-effective generic drugs. In addition, emerging research and development activities, increasing drug candidates, and rising product launches of new generics across the U.S. drive the market growth.

b. Some key players operating in the generic pharmaceuticals contract manufacturing market include Jubilant Generics Ltd., Recipharm AB, Siegfried Holding AG, Aurobindo Pharma, Cambrex Corp., Alcami Corp., Inc., Catalent, Inc., Acme Generics Pvt Ltd., Syngene International Ltd., Pfizer CentreOne, Curia Global, Inc., Metric Contract Services

b. Key factors driving the generic pharmaceuticals contract manufacturing market growth include emerging outsourcing trends, rising patent expirations of branded drugs, increasing stringent regulatory requirements, and growing demand for cost-effective manufacturing processes.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.