- Home

- »

- Pharmaceuticals

- »

-

Generic Pharmaceuticals Market Size & Share Report, 2030GVR Report cover

![Generic Pharmaceuticals Market Size, Share & Trends Report]()

Generic Pharmaceuticals Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Simple Generics, Specialty Generics, Biosimilars), By Route Of Administration, By Product, By Application, By Distribution Channel, By Region And Segment Forecasts

- Report ID: GVR-4-68040-031-8

- Number of Report Pages: 220

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Generic Pharmaceuticals Market Summary

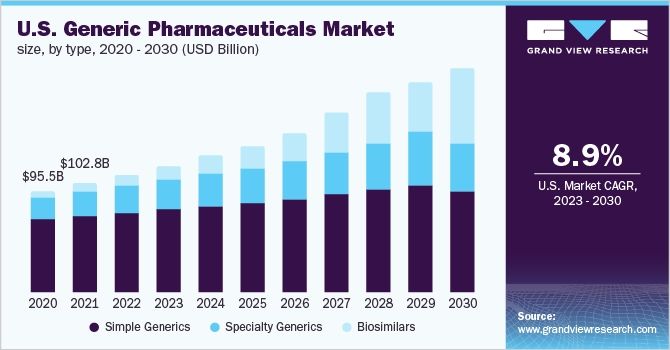

The global generic pharmaceuticals market size was estimated at USD 361.7 billion in 2022 and is projected to reach USD 682.9 billion by 2030, growing at a CAGR of 8.3% from 2023 to 2030. The growth can be attributed to the number of ANDA approvals and launches of generic drugs products is increasing constantly.

Key Market Trends & Insights

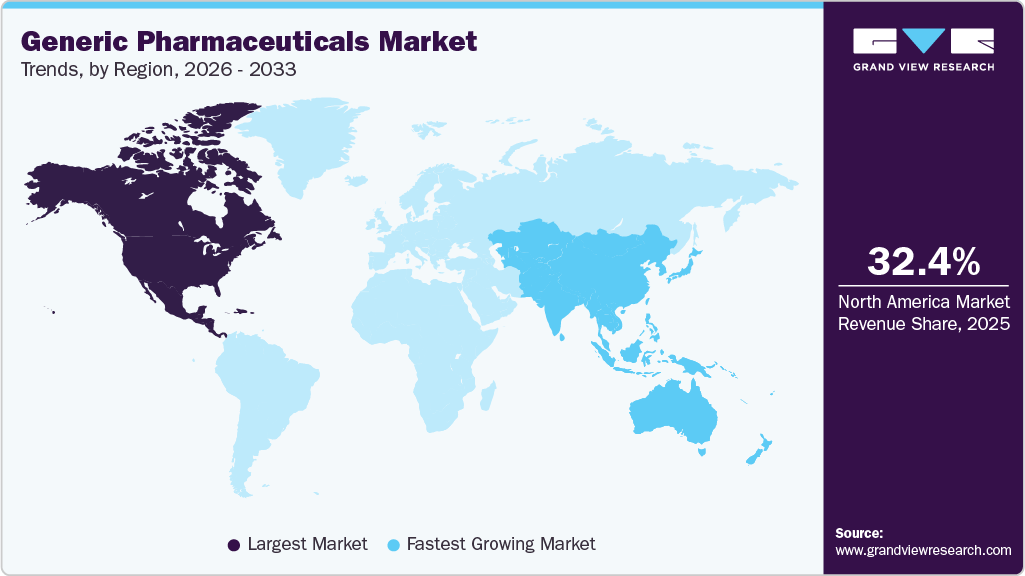

- North America accounted for the largest revenue share 32.71% of the generic pharmaceuticals market in 2022.

- By type, the simple generic segment dominated the drugs market with a revenue share of 68.36% in 2022.

- By application, cardiovascular diseases accounted for the largest revenue share of the generic pharmaceuticals market in 2022.

- By product, small molecule segment accounted for the largest revenue share of the generic pharmaceuticals market in 2022.

Market Size & Forecast

- 2022 Market Size: USD 361.7 Billion

- 2030 Projected Market Size: USD 682.9 Billion

- CAGR (2023-2030): 8.3%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

According to the U.S. FDA’s Generic Drugs Annual report, the number of ANDA approvals increased from 948 in 2020 to 776 in 2021. In addition, by the end 2021, the total ANDA approvals were reported to be 100. Due to the COVID-19 pandemic, there has been a sudden increase in the demand for antibiotics and other drugs required for the treatment of COVID. Branded drugs such as Eliquis, Restasis, and Lyrica among others may cost up to USD 500 for a month of treatment. This affects the overall healthcare expenditure of patients suffering from chronic diseases. The expiry of patent exclusivity of innovator drugs provides the opportunity for generic drugs manufacturers to introduce low-cost products in the market.

The Ministry of Food and Drug Safety (MFDS)’s estimated that a total of 62 patents drug associated patents protection of 158 products expired in 2021 and 14 of these already have been removed due to expired marketing authorization and patent invalidation. The low cost of generic drugs increases patient affordability and helps in the reduction of healthcare expenditure per capita. This is one of the major factors driving the growth of the market.

In order to reduce pharmaceutical spending, governments have introduced initiatives that provide various opportunities for key generic drugs players. For instance, the U.S. government saved USD 373 million on drugs in 2021 due to the usage of generic drugs. 91% of the prescriptions are filled by generic drugs product which accounts for 18.2% of the prescription drug expenses according to AAM Generic Drug & Biosimilars Access & Savings Report 2021.

Furthermore, the key players are focusing on the development of specialty generics and strategies like first-to-file and first-to-market in order to make additional profits and strengthen their position in the market. In 2022, around 106 drugs received their first-time generic drug approvals in the U.S.

However, despite generic entry driving down prices relatively to branded drugs, patients are not benefitting from the cheap price because of middlemen pharmacy benefit managers (PBMs) such as Express Scripts, CVS Caremark, and OptumRx and insurers like United Health Group, Cigna, and CVS Health. These middlemen practices activities such as spread pricing, profit-oriented formulary design, and copay drawback enable overpayment on generic drugs. These activities are earning financial benefits rather than passing full savings to consumers and leading to a decline in generic drug prescriptions.

As per a 2021 research study, the direct out-of-pocket payments by insured patients to pharmacies for generic drug prescriptions fell by nearly 50% from 2007 to 2016, while total costs that include the price paid by the insurer to the pharmacy and out-of-pocket consumer payment declined by 80% during the same period. Thus, a lack of transparency about the actual price of generic drugs may restrain the market growth.

Type Insights

The simple generic segment dominated the drugs market with a revenue share of 68.36% in 2022. The simple generic products have a clear development roadmap and regulatory pathway for filing ANDA and require bioequivalence studies. These products are chemically identical to its reference product and the market is becoming saturated with simple generic products. However, the market is expected to grow due to government initiatives for reducing the healthcare expenditure on pharmaceuticals and increasing approvals & product launches.

Biosimilars segment is projected to attain the fastest CAGR of 24.2% over the forecast period. The U.S. FDA approved 7 new biosimilars in 2022 including biosimilars for Neupogen, Neulasta, and Lucentis. In August 2020, a biopharmaceutical company Alvotech and Teva Pharmaceutical Industries Ltd. partnered for the distribution of five biosimilar product candidates in the U.S. Under the agreement, both companies will share the profit from the commercialization of the biosimilar. This partnership was expected to further fuel market expansion during the forecast period.

Application Insights

Cardiovascular diseases accounted for the largest revenue share of the generic pharmaceuticals market in 2022. According to WHO, around 17.5 million deaths every year can be attributed to cardiovascular diseases, which account for 32% of all deaths across the globe. Heart attack and stroke cause 85% of those deaths. In addition, men are at a higher risk of developing the condition when compared to women.

Infectious diseases include Human Papillomavirus (HPV), malaria, hepatitis, HIV, influenza, and tuberculosis among others. The disease burden and increasing demand of the population may propel the market growth in the coming years. According to WHO, around 73 countries are on the verge of stock out of antiretroviral medication as a result of the COVID-19 pandemic. Moreover, 24 countries have reported critically low stocks of ARVs and disruptions in the supply. These countries account for about 8.3 million general population that represents about one-third (33%) of all population on HIV treatment worldwide.

Cancer is anticipated to witness the fastest growth over the forecast growth. According to WCRF International, in 2020, there were an estimated 18.1 million new cancer cases globally, out of which 8.8 million cases were among women and 9.3 million cases were among men. The loss of exclusivity of oncology products is anticipated to be another factor supporting the growth of the market. The key manufacturers are providing biosimilar oncology products of blockbuster drugs such as trastuzumab, bevacizumab, and rituximab.

Product Insights

Small molecule segment accounted for the largest revenue share of the generic pharmaceuticals market in 2022. According to an article, small molecule drugs accounted for over 90% of the top 200 prescribed drugs in the U.S. Rising ANDA approvals & product launches coupled with increasing demand for these products may drive the market growth. In 2022 the U.S. FDA approved 106 first generics, i.e., drugs for which there is no generic competition.

Large molecule segment will witness significant growth over the forecast period due to increasing demand for targeted therapy and increasing disease burden of chronic diseases. As of January 2023, there are 40 biosimilars approved by the U.S. FDA. The efforts to bring down healthcare expenditures is a major factor driving the large molecules segment. Additionally, the approval of insulin biosimilars is expected to further drive the growth of the large molecule market segment.

Route of Administration

The oral segment dominated the generic pharmaceutical market with a revenue share of 61.42% in 2022. The several advantages of oral dosage such as ease of administration and no nursing requirements lead to higher patient acceptability and compliance. In September 2022, Zenera Pharma launched generic version of a Pfizer’s drug Paxlovid for the treatment of patients with COVID-19. These orally administered drugs cost USD 63.74 per box, containing 20 Nirmatrelvir tablets.

Injectable segment is expected to grow at a significant growth rate over the forecast period. In May 2022, Gland Pharma launched Bortezomib injection in the U.S. This was a generic version injectable drug used for the treatment of cancer. Thus, the introduction of such generic injectables is anticipated to drive segment growth.

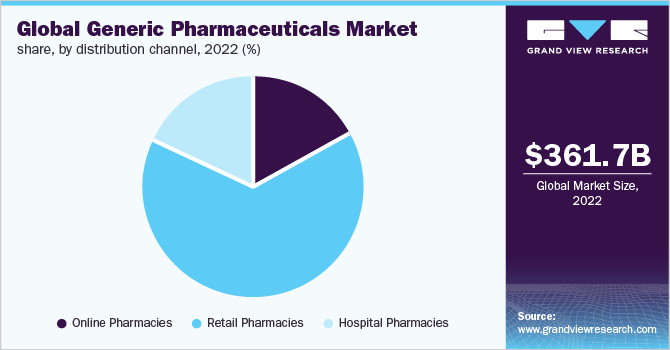

Distribution Channel Insights

Retail pharmacy accounted for the largest revenue share of the generic pharmaceuticals market in 2022. The availability of pharmaceutical products including generic drugs, biosimilar insulin, and others in the retail pharmacy chains, such as Walgreens and Walmart Stores, Inc. supports the market growth. In addition, the tie-ups of hospitals with these chains contribute to the growth of the market space. The majority of the prescriptions filled in retail pharmacies are for generic drugs. This is a major factor contributing to the growth of this segment.

In addition, the online pharmacy segment is projected to witness the fastest growth during the forecast period. In January 2022, the Mark Cuban Cost Plus Drugs Company (MCCPDC) launched online pharmacy that offers more than 100 generic drugs at low cost to patients. The comfort, flexibility, and convenience provided by online purchase of medications is a major factor driving the segment.

Regional Insights

North America accounted for the largest revenue share 32.71% of the generic pharmaceuticals market in 2022. An increasing number of favorable government initiatives coupled with the rising number of product launches and demand for generic drugs is a key revenue driver. Furthermore, an increasing number of ANDA approvals and first-to-file benefits such as Paragraph IV (PIV) certification. Key players such as Teva Pharmaceutical Industries Ltd. filed 160 PIVs followed by Mylan N.V. with 81 PIVs. In addition, Apotex, Inc.; Amneal Pharmaceuticals LLC; and Endo International plc filed for 57, 53, and 45 PIV certifications, respectively between 2018 and August 2019.

Asia Pacific, on the other hand, is anticipated to be the fastest-growing region over the forecast period due to the increasing population and growing pharmaceutical industry. In July 2021, Lupin announced the acquisition of southern cross pharma Pty Ltd (SCP) located in Melbourne, Australia. The SCP is specialized in manufacturing generic drugs used for the treatment of various diseases.

Key Companies & Market Share Insights

In the generic pharmaceuticals market companies are adopting strategies such as mergers & acquisitions and partnerships, to acquire a larger market share. For instance, in November 2020, Mylan and Pfizer’s Upjohn unit completed a merger to form Viatris, Inc. This merger was expected to drive the generic pharmaceuticals market in the coming years. Some of the major players operating in the global generic pharmaceuticals market are:

-

Teva Pharmaceutical Industries Ltd.

-

Viatris Inc.

-

Novartis AG

-

Sun Pharmaceutical Industries Ltd.

-

LUPIN

-

AbbVie Inc. (Allergan)

-

AstraZeneca

-

Sawai Pharmaceutical Co., Ltd.

-

Hikma Pharmaceuticals PLC

-

Dr. Reddy’s Laboratories Ltd.

-

Cipla Inc.

-

Sanofi

-

Aurobindo Pharma

-

Endo International plc.

Generic Pharmaceuticals Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 391.5 billion

Revenue forecast in 2030

USD 682.9 billion

Growth Rate

CAGR of 8.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, product, route of administration, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Spain; Italy; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Teva Pharmaceutical Industries Ltd.; Viatris Inc. Novartis AG; Sun Pharmaceutical Industries Ltd.; LUPIN, AbbVie Inc. (Allergan); AstraZeneca; Sawai Pharmaceutical Co., Ltd.; Hikma Pharmaceuticals PLC; Dr. Reddy’s Laboratories Ltd.; Cipla Inc.; Sanofi; Aurobindo Pharma; Endo International plc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Generic Pharmaceuticals Market Segmentation

This report forecasts revenue growth and provides an analysis of the market trends in each of the sub-markets from 2018 to 2030. For this study, Grand View Research has segmented the global generic pharmaceuticals market report based on type, application, product, route of administration, distribution channel, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Simple Generics

-

Specialty Generics

-

Biosimilars

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Central Nervous System Disorders

-

Respiratory Diseases

-

Hormones & Related Diseases

-

Gastrointestinal Diseases

-

Cardiovascular Diseases

-

Infectious Diseases

-

Cancer

-

Diabetes

-

Others

-

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Small Molecule

-

Large Molecule

-

-

Route of Administration Outlook (Revenue, USD Billion, 2018 - 2030)

-

Oral

-

Injectable

-

Inhalable

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Online Pharmacies

-

Retail Pharmacies

-

Hospital Pharmacies

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Rest of Europe

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Thailand

-

Rest of APAC

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Rest of LATAM

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of MEA

-

-

Frequently Asked Questions About This Report

b. The global generic pharmaceuticals market is expected to witness a compound annual growth rate of 8.9% from 2023 to 2030 to reach USD 682.9 billion in 2030.

b. Based on type, the simple generics segment held the largest share of 68.36% in 2022, owing to a high number of approved products.

b. Some key players operating in the generic pharmaceuticals market include Teva Pharmaceutical Industries Ltd., Mylan N.V., Pfizer Inc., Sun Pharmaceutical Industries Ltd, LUPIN, Novartis AG (Sandoz), Allergan, AstraZeneca, and Dr. Reddy’s Laboratories Ltd.

b. The major factors driving the market growth are the rising prevalence of chronic diseases, rising number of generic approvals, and an increasing need to reduce overall healthcare expenditure.

b. The global generic pharmaceuticals market size was estimated at USD 361.7 billion in 2022 and is expected to reach USD 391.5 billion in 2023.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.