- Home

- »

- Advanced Interior Materials

- »

-

Global Geotextiles Market Size & Share Analysis Report, 2030GVR Report cover

![Geotextiles Market Size, Share & Trends Report]()

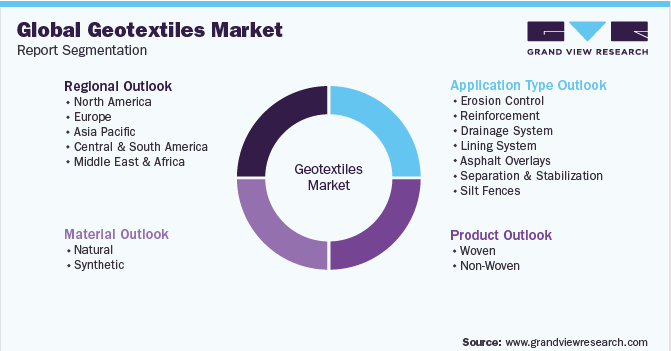

Geotextiles Market Size, Share & Trends Analysis Report By Material (Natural, Synthetic), Product (Woven, Non-woven), By Application (Erosion Control, Reinforcement), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-023-1

- Number of Report Pages: 109

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

Report Overview

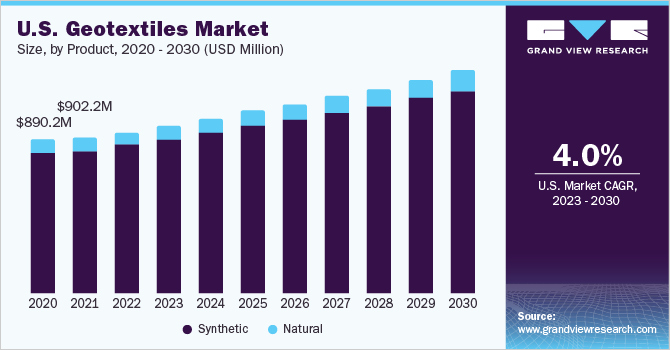

The geotextiles market size was valued at USD 7.10 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.6% from 2023 to 2030. The market is expected to be driven by rising civil engineering activities due to rapid urbanization and industrialization in developing countries. Cost-effectiveness and longer lifespan of geotextiles, as compared to other materials, and the growing environmental concerns regarding soil erosion are projected to drive product demand across the globe. The increase in the usage of geotextiles in a wide range of construction applications in the U.S. such as drainage structures, harbors roads, and landfills to enhance soil stabilization. In addition, the rise in adoption of the product owing to the extended lifespan and cost-effectiveness accelerates the market growth.

Woven geotextiles are manufactured from individual threads including fibrillated yarns, monofilaments, or slit films that are woven together to provide high-load capacity for road construction applications. The long lifespan of these fabrics, coupled with their corrosion resistance, drives their use for long-term applications.

In European economies such as Germany and the U.K., manufacturers are required to comply with the stringent regulations established by governing bodies, which state the specific characteristics of the types of geotextiles and the applications they are most suitable for. The favorable regulatory framework for the application of these products, especially in erosion prevention applications, is likely to drive market growth.

The increased government spending on the One Belt, One Road (OBOR) project in China is likely to have a positive impact on the infrastructural development in the country. The ample availability of usable land is expected to increase infrastructural activities in the country. The Chinese government has made considerable investments in infrastructure projects, which would subsequently drive the demand for geotextiles in the country.

Material Insights

Based on material, the geotextiles industry is categorized into natural and synthetic materials. The synthetic material segment dominated the market with a revenue share of 91.5% in 2022. The demand for synthetic materials is further expected to grow at a CAGR of 6.6% over the forecast period.

The synthetic materials used to produce geotextiles majorly include polyester, polypropylene, and polyethylene. Geotextiles made from materials such as polypropylene and polyester offer excellent water flow rates and are mainly used for the filtration of soil fines, wrapping of perforated pipes, and erosion protection. Geotextiles offer several performance advantages such as better longevity and cost savings over traditional building materials such as layers of soil, rock aggregates, and concrete.

The high-heat resistance offered by polyethylene fibers is likely to fuel their demand for polyethylene-based geotextiles in the construction industry in areas with high-heat applications. The demand for high-density polyethylene (HDPE) in a wide range of industrial applications is expected to limit its availability as fiber for the textile industry, thereby impacting industry trends.

Product Insights

Nonwoven geotextiles led the market and accounted for about 65.5% share of the revenue in 2022. The segment dominated the segment on account of its high adoption in a wide range of applications such as construction, furniture, hygiene products, automobiles, medical products, agriculture, and packaging.

Nonwoven geotextiles are witnessing a significant demand for transport infrastructure projects on account of their high tensile strength and low cost. Furthermore, infrastructural developments in Asia Pacific economies such as China and India are expected to drive the demand for nonwoven geotextiles in the region over the forecast period.

Woven geotextiles are anticipated to witness a CAGR of over 6.3% from 2023 to 2030 in terms of revenue. Increasing product penetration in erosion prevention applications owing to their favorable characteristics such as excellent filtration and high tensile strength are expected to fuel their demand over the forecast period.

Woven geotextiles are widely used in the construction of roads for soil separation to ensure the functioning of each soil layer individually by preventing dissimilar soil mixtures. These products are woven from high-modulus, durable polypropylene yarns into strong and dimensionally stable geotextiles.

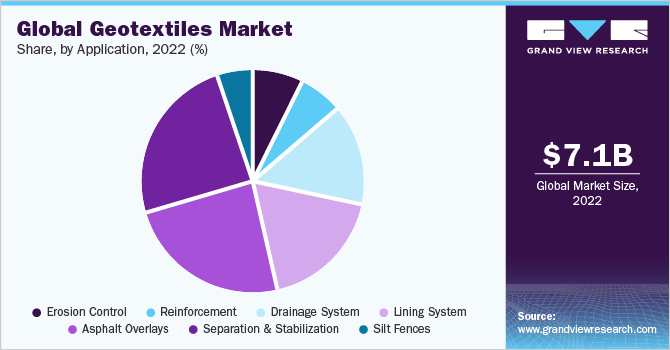

Application Insights

The asphalt overlays segment led the market and accounted for the highest revenue share of 24.1% in 2022. As construction activities continue to increase, especially in the Asia Pacific region, thanks to the rising construction activities in developing countries such as China and India. The National Green Highway mission in India is expected to drive the demand for geotextiles in the country owing to the product’s properties of soil retention.

Non-woven geotextiles are increasingly being employed in the construction of roads, and drainages, and for the prevention of erosion on account of their function to provide an avenue for water flow. Furthermore, increasing product demand for infrastructure developments including roadways, railways, and bridges is expected to drive the demand over the forecast period.

Geotextiles help prevent soil erosion as they are used for reinforcing soil. The product helps hold soil particles together and promote vegetation growth, which reduces erosion in the long run. In addition, clogging due to the washing away of soil is one of the major problems in drainage systems. The use of geotextiles in drainage systems helps create a channel for the consistent flow of water.

Drainage geotextiles are mainly used in the developed regions of Europe and North America to improve the efficiency of drainage systems and increase their life span. Infrastructural development in developing countries includes the development of drainage systems. Thus, the demand for geotextiles is witnessing significant growth in these countries.

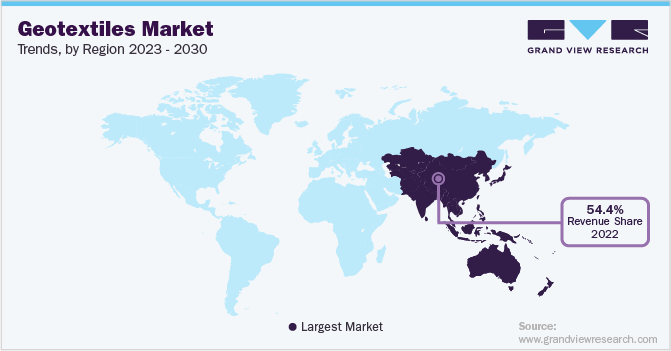

Regional Insights

Asia Pacific dominated the market and accounted for about 54.4% share of the revenue share in 2022. The increased foreign investments in the emerging economies of the region including China and India are anticipated to have a positive impact on economic growth. Furthermore, the rising megacities in China and India are expected to drive the demand for geotextiles.

The presence of numerous riverbeds and other water bodies in Europe has resulted in soil erosion and encroachment of water into landmasses. Some of these water bodies pass through large cities and erosion of the shorelines of these rivers impacts the overall infrastructural integrity around the area. Therefore, to protect landmasses, knitted geotextiles are used to prevent corrosion.

In the Middle East and Africa, geotextiles are widely used in road construction to increase tensile strength in the earth's mass, which aids in improved water permeability of constructed infrastructures. Increasing product demand for improving groundwater levels and reducing the risk of road damage is expected to drive market growth.

Increasing foreign investments in the industrial sector of Asian economies such as China, India, Thailand, and Indonesia are expected to impact the market positively. Furthermore, increasing megacities in China and India, coupled with robust infrastructure development, are expected to drive product demand over the forecast period.

Key Companies & Market Share Insights

Major players in the market are entering into agreements with emerging and small-scale players to expand their distribution capacities and increase the market reach of their products. Furthermore, manufacturers are focusing on new efficient and effective distribution channels, to ensure that buyers have timely access to products.

Prominent market players have been benchmarked based on their geographical reach, distribution networks, product portfolio, innovation, strategic developments, operational capabilities, and the market presence of their brands. Some prominent players in the global geotextiles market include:

-

Koninklijke Ten Cate B.V.

-

GSE Holdings, Inc.

-

NAUE GmbH & Co. KG

-

Officine Maccaferri S.p.A.

-

Low and Bonar PLC

-

Propex Operating Company, LLC

-

Fibertex Nonwovens A/S

-

TENAX Group

-

AGRU America

-

Global Synthetics

-

HUESKER Group

-

TYPAR

-

Machina-TST

-

Gayatri Polymers & Geo-synthetics

Geotextiles Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 7.52 billion

Revenue forecast in 2030

USD 11.82 billion

Growth rate

CAGR of 6.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in million square meters, revenue in USD million, CAGR from 2023 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, trends

Segments covered

Material, product, application, region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa; Central & South America

Country scope

U.S.; Canada; Mexico; Germany; France; Italy; U.K.; Netherlands; Poland; China; Japan; Australia; Indonesia; Malaysia; Philippines; Brazil

Key companies profiled

Koninklijke Ten Cate B.V.; GSE Holdings, Inc.; NAUE GmbH & Co. KG; Officine Maccaferri S.p.A.; Low and Bonar PLC; Propex Operating Company, LLC; Fibertex Nonwovens A/S; TENAX Group; AGRU America; Global Synthetics; HUESKER Group; TYPAR; Machina-TST; Gayatri Polymers & Geo-synthetics

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Geotextiles Market Report Segmentation

This report forecasts volume & revenue growth at global, regional & country levels and provides an analysis of the latest industry trends in each of the segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global geotextiles market report based on material, product, application, and region:

-

Material Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Natural

-

Jute

-

Others

-

-

Synthetic

-

Polypropylene

-

Polyester

-

Polyethylene

-

-

-

Product Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Woven

-

Slit Tape Woven

-

High Strength Woven

-

-

Non-Woven

-

Light Weight

-

Medium Weight

-

Heavy Weight

-

Paving Fabrics

-

-

Knitted

-

-

Application Type Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Erosion Control

-

Reinforcement

-

Drainage System

-

Lining System

-

Asphalt Overlays

-

Separation & Stabilization

-

Silt Fences

-

-

Regional Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

France

-

Germany

-

U.K.

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

New Zealand

-

Australia

-

Malaysia

-

Thailand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global geotextiles market size was estimated at USD 7.10 billion in 2022 and is expected to reach USD 7.52 billion in 2023.

b. The global geotextiles market is expected to grow at a compound annual growth rate a CAGR of 6.6% from 2023 to 2030 to reach USD 11.82 billion by 2030.

b. The U.S. geotextiles market accounted for the largest revenue share in 2022 and this is attributed to the growing applications of geotextiles in infrastructural development projects in the country.

b. Some key players operating in the geotextiles market include Koninklijke Ten Cate B.V., GSE Holdings, Inc., NAUE GmbH & Co. KG, Officine Maccaferri S.p.A., Low and Bonar PLC, Propex Operating Company, LLC, Fibertex Nonwovens A/S, TENAX Group, AGRU America, Global Synthetics, HUESKER Group, TYPAR, Machina-TST, and Gayatri Polymers & Geo-synthetics.

b. The growing infrastructural development around the world is triggering the demand for geotextiles in the global market. Innovation backed by government initiatives and other regulatory bodies is another major factor that is positively contributing to market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."