- Home

- »

- Alcohol & Tobacco

- »

-

Germany CBD Pouches Market Size, Industry Report, 2033GVR Report cover

![Germany CBD Pouches Market Size, Share & Trends Report]()

Germany CBD Pouches Market (2025 - 2033) Size, Share & Trends Analysis Report By Content (Up To 10 Mg, 10 Mg -20 Mg), By Type (Flavored, Unflavored), By Distribution Channel (Offline, Online), And Segment Forecasts

- Report ID: GVR-4-68040-675-4

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Germany CBD Pouches Market Summary

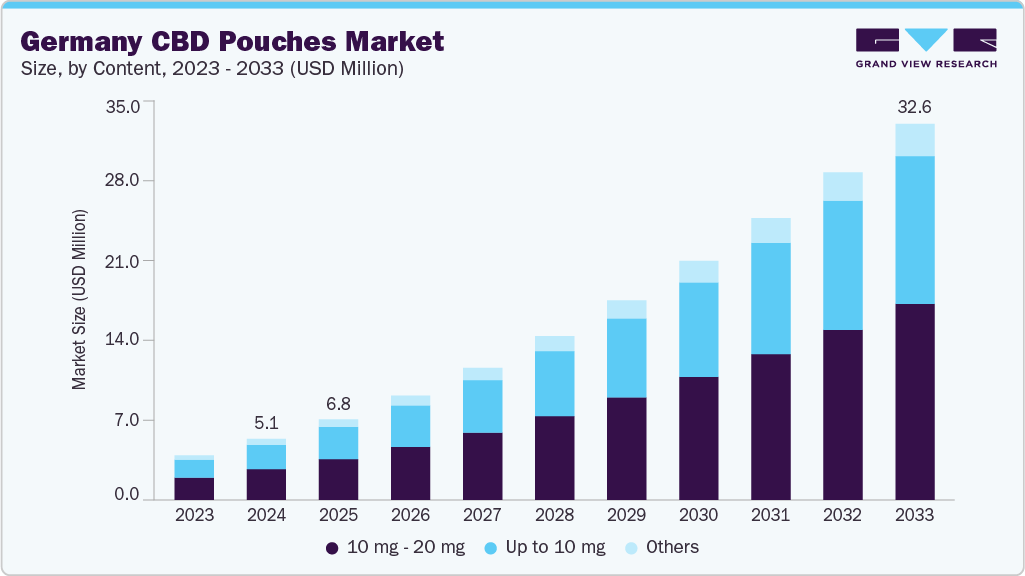

The Germany CBD pouches market size was estimated at USD 5.08 million in 2024 and is expected to reach USD 32.61 million by 2033, growing at a CAGR of 21.7% from 2025 to 2033. The market is growing rapidly due to rising demand for smoke-free, wellness-oriented CBD formats and increasing consumer preference for discreet, on-the-go use.

Key Market Trends & Insights

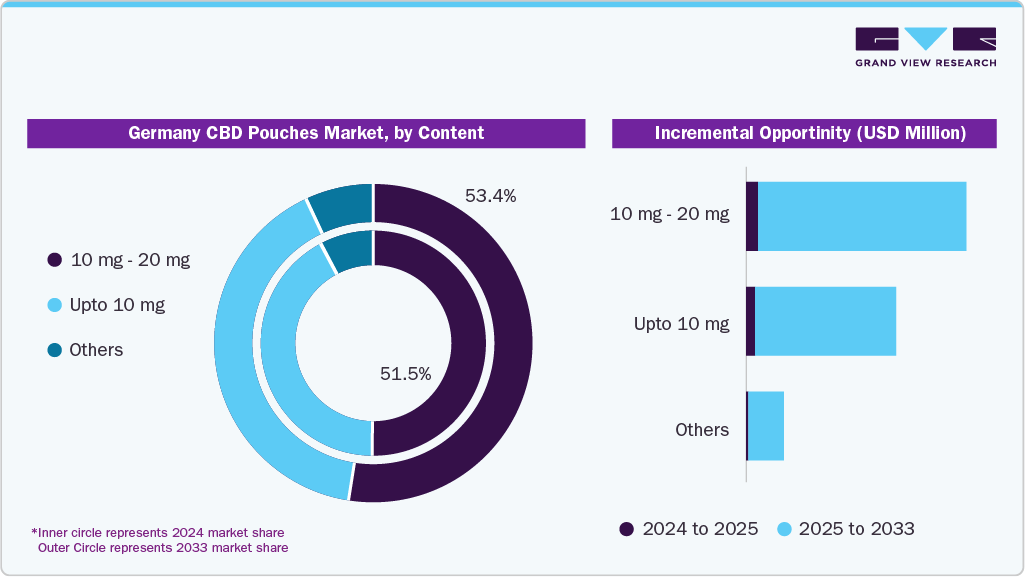

- By content, 10 mg -20 mg CBD pouches led the market and accounted for a share of 51.54% in 2024.

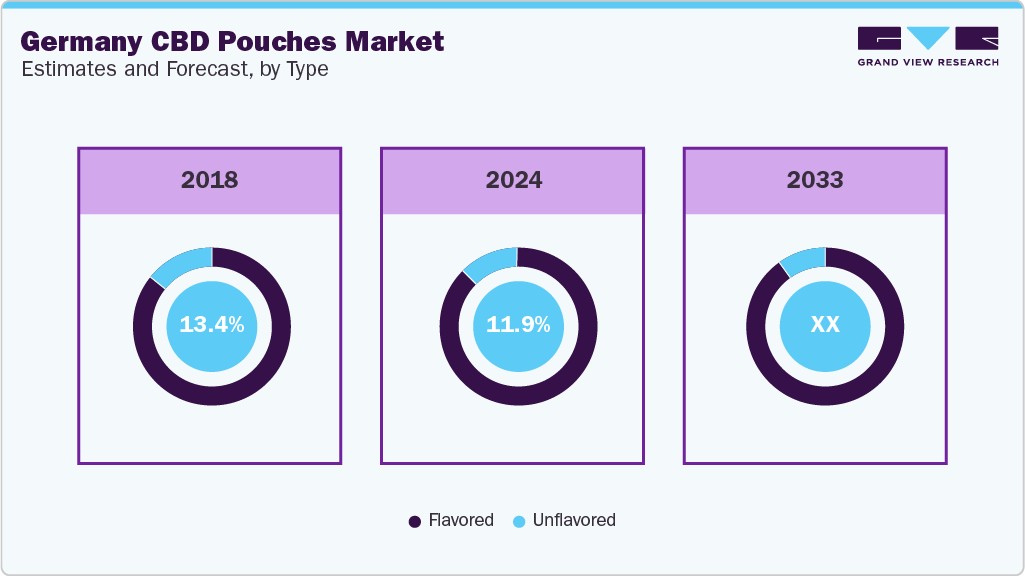

- By type, flavored CBD pouches dominated the market in Germany, with a share of 88.04% in 2024.

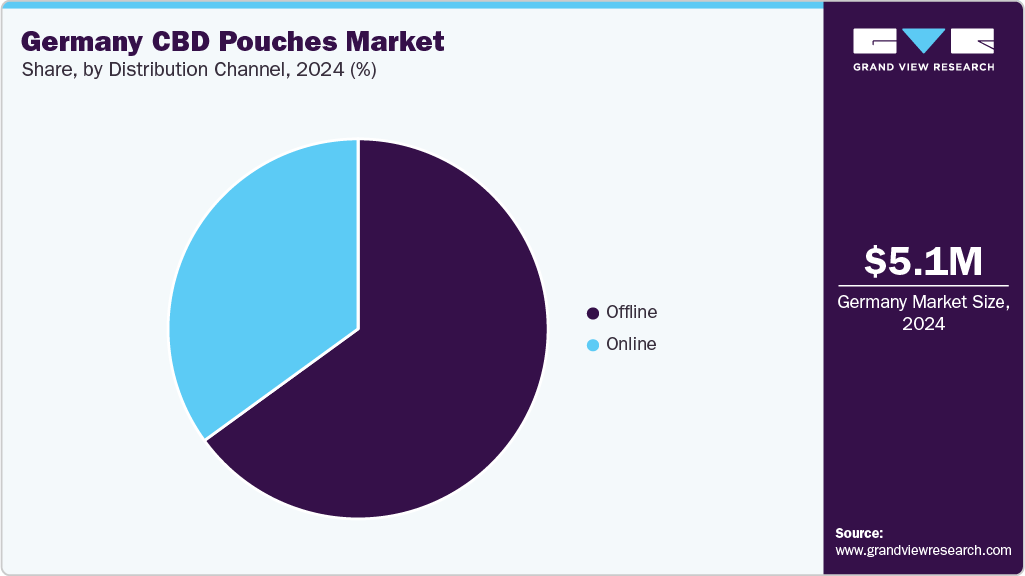

- By distribution channel, the sales of CBD pouches through offline channels accounted for a share of around 64.44% of the revenue in Germany in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.08 Million

- 2033 Projected Market Size: USD 32.61 Million

- CAGR (2025-2033): 21.7%

Greater product availability and awareness also drive adoption across younger and health-focused demographics. The accelerating growth of Germany’s CBD pouches market is underpinned by a convergence of health-conscious consumer behavior, regulatory liberalization, and evolving preferences for discreet, non-combustible cannabinoid delivery systems. As German consumers increasingly seek plant-based alternatives for stress relief, sleep regulation, and everyday wellness, CBD pouches offer an appealing solution, combining precision dosing, portability, and a smoke-free experience that aligns with public health sensibilities and urban lifestyles. Unlike traditional CBD oils or edibles, pouches minimize stigma and maximize convenience, making them particularly attractive to new adopters and professionals seeking functional wellness without psychoactive effects. This shift is further reinforced by the broader European trend toward cannabinoid normalization and the entry of well-positioned domestic and Nordic brands offering compliant, lab-tested, and flavor-enhanced formulations tailored to a discerning, quality-driven consumer base.

The increasing demand for discreet, smoke-free ways to deliver cannabinoids that align with modern wellness and health-conscious lifestyles is essential in boosting market growth. CBD pouches provide a convenient, portable alternative to oils, edibles, and vape products formats that may carry social stigma or require more deliberate use. The pouch format is particularly appealing among working professionals and urban users for its precision dosing, odorless use, and easy integration into daily routines such as stress management, focus enhancement, or sleep support.

Another key driver is the expanding availability of compliant, high-quality products from both domestic and Nordic-European brands. These companies are capitalizing on Germany’s regulatory openness to non-psychoactive cannabinoids by offering lab-tested, flavor-enhanced CBD pouches with clear labeling and consistent dosing. This product reliability-combined with growing online retail infrastructure and health-store placements-has helped build consumer trust, making pouches an increasingly preferred format among both first-time users and CBD regulars.

Consumer Insights for Germany CBD Pouches Market

In Germany, women slightly lead in CBD pouch usage due to the format’s appeal for stress relief, sleep, and wellness. Men also use them but are more drawn to higher-strength or functional use cases. The discreet, smoke-free delivery makes pouches attractive to both genders seeking convenience.

The 25–44 age group forms the core user base, integrating CBD into daily routines. Younger adults (18–29) are early adopters, drawn by curiosity and wellness trends. Older adults (45+) are slower to adopt, but there is a growing tendency to utilize pouches for sleep and pain management relief.

Top consumer pain points include regulatory uncertainty, inconsistent quality, high prices, limited flavor options, and low offline availability, especially outside urban areas.

Brands winning among German consumers include Canndid, FlowBlend, Nicopods, SNUSSIE, and V&YOU, thanks to their clean formulations, flavor variety, strong online presence, and lab-tested transparency.

Content Insights

CBD pouches with 10 mg -20 mg content accounted for a revenue share of 51.54% in 2024 in Germany, due to their effective yet non-overwhelming dosage. This range is particularly suited for users seeking relief from daily stress, anxiety, or mild discomfort without sedation. Brands such as SNUSSIE and Canndid have gained traction by offering clearly labeled, mid-strength pouches in consumer-friendly flavors, appealing to both new and regular users looking for balance between potency and functionality.

CBD pouches with up to 10 mg of content are anticipated to witness a CAGR of 21.4% from 2025 to 2033, as micro-dosing becomes more mainstream among younger and wellness-oriented users. These lower-strength pouches are ideal for daytime use or first-time consumers seeking gentle calming effects. Brands such as FlowBlend are tapping into this segment by offering low-dose options that fit into productivity and focus routines, with discrete packaging and light flavor profiles tailored to urban professionals.

Type Insights

The flavored CBD pouches market held the largest segment, accounting for a share of 88.04% in 2024. Flavored pouches dominate the German market because they mask the natural bitterness of hemp and enhance the user experience. Popular flavors such as mint, citrus, and wild berry make CBD more approachable for newcomers and more pleasant for regular users. Nicopods ehf. and V&YOU are popular in Germany for offering Scandinavian-style flavor innovation, catering to consumers who value both taste and functionality in wellness products.

The unflavored CBD pouches market is the fastest-growing segment, expected to grow at a CAGR of 19.0% from 2025 to 2033. Although a smaller segment, unflavored CBD pouches are rapidly gaining popularity as more consumers in Germany seek natural, additive-free options. Wellness users who prioritize ingredient purity and transparency drive this growth. Smaller boutique or organic-focused brands are responding by launching "raw" or "clean-label" products that emphasize full-spectrum hemp without artificial flavoring, appealing to health-conscious shoppers in cities such as Berlin and Hamburg.

Distribution Channel Insights

The sales of CBD pouches through offline channels accounted for a share of around 64.44% of the revenue in Germany in 2024. CBD pouch sales in Germany rely heavily on offline channels, including health shops, pharmacies, and cannabis specialty retailers. German consumers often prefer to see and understand a product in person, especially when it relates to cannabinoids, before making a purchase. This behavior is reinforced by the presence of knowledgeable retail staff and regulated environments, which boost consumer confidence, particularly for those unfamiliar with CBD.

Sales of CBD pouches through online channels are the fastest-growing segment, expected to grow at a CAGR of 22.4% from 2025 to 2033. Online sales are the fastest-growing distribution channel in Germany’s CBD pouch market, driven by the convenience of home delivery, broader product selection, and easier access to imported brands. E-commerce platforms allow consumers to compare formulations, access third-party lab reports, and explore subscription models. Companies such as Canndid and Chill.com leverage their digital presence to offer targeted promotions and education, capturing a growing audience of tech-savvy, wellness-focused buyers.

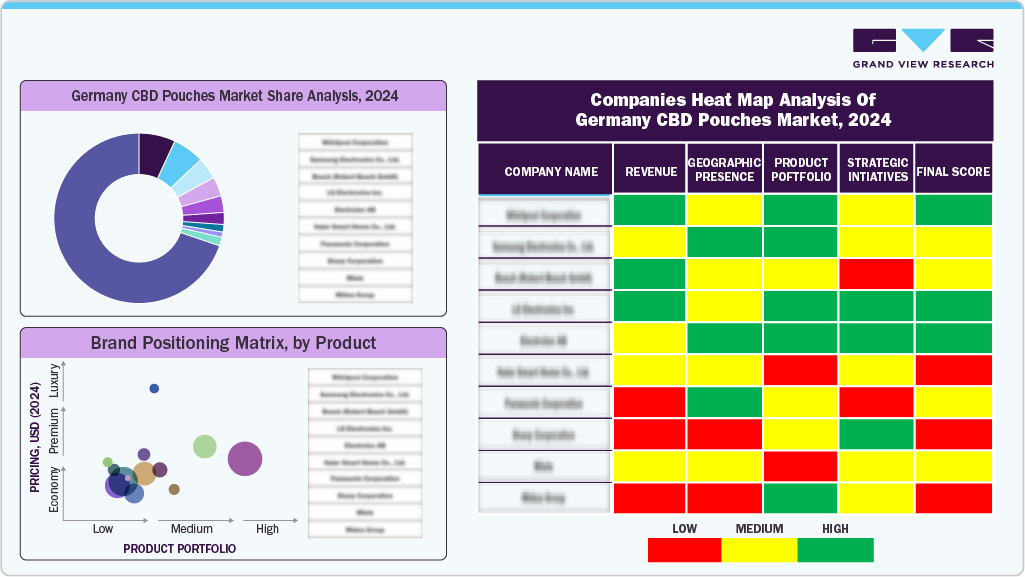

Key Germany CBD Pouches Company Insights

The Germany CBD pouches market is becoming increasingly competitive as both established brands and new entrants focus on product innovation, quality improvements, and competitive pricing. Leading manufacturers are actively expanding their presence across both offline retail and online platforms to improve accessibility and consumer reach. In addition, companies are investing in advanced delivery technologies to boost the bioavailability and effectiveness of CBD. The entry of major tobacco companies is further reshaping the landscape, bringing deep resources, extensive distribution networks, and regulatory expertise to the sector. As consumer demand grows for discreet, smoke-free CBD formats, and regulatory clarity continues to improve, the market is poised for sustained growth in the coming years.

Key Germany CBD Pouches Companies:

- Canndid

- Nicopods ehf.

- SNUSSIE

- FlowBlend

- Chill.com

- V&YOU

- Chillbar

- Cannadips Europe

- The Snus Brothers

- Vibe CBD+CBG

Recent Developments

- In January 2023, Cannadips Europe partnered with Snushus AG to introduce all-natural CBD snus pouches. This collaboration aims to expand the availability of Cannadips' CBD products within the European market. The partnership signifies a strategic move to capitalize on the growing demand for CBD-infused products in Europe, providing consumers with a new option for CBD consumption.

Germany CBD Pouches Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.76 million

Revenue forecast in 2033

USD 32.61 million

Growth rate

CAGR of 21.7% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Content, type, distribution channel

Key companies profiled

Canndid; Nicopods ehf.; SNUSSIE; FlowBlend; Chill.com; V&YOU; Chillbar; Cannadips Europe; The Snus Brothers; Vibe CBD+CBG

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Germany CBD Pouches Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest trends and opportunities in each sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the Germany CBD pouches market report based on content, type, and distribution channel:

-

Content Outlook (Revenue, USD Million, 2021 - 2033)

-

Up to 10 mg

-

10 mg -20 mg

-

Others

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Flavored

-

Unflavored

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Offline

-

Online

-

Frequently Asked Questions About This Report

b. The Germany CBD pouches market size was estimated at USD 5.08 million in 2024 and is expected to reach USD 6.76 million in 2025.

b. The Germany CBD pouches market is expected to grow at a compound annual growth rate (CAGR) of 21.7 % from 2025 to 2033 to reach USD 32.61 million by 2033.

b. CBD pouches with 10 mg -20 mg content accounted for a revenue share of 51.54% in 2024 in Germany, due to their effective yet non-overwhelming dosage. This range is particularly suited for users seeking relief from daily stress, anxiety, or mild discomfort without sedation.

b. Some key players operating in the Germany CBD pouches market include Nicopods ehf., SNUSSIE, Canndid, FlowBlend, Chill.com, V&YOU, The Snus Brothers, CBD Pouches Nordic, Cannadips Europe, Generalens.

b. The growth of the market is primarily driven by a rising demand for smoke-free, wellness-oriented CBD formats and increasing consumer preference for discreet, on-the-go use. Greater product availability and awareness also drive adoption across younger and health-focused demographics.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.