Germany Fruit Juice Market Size & Trends

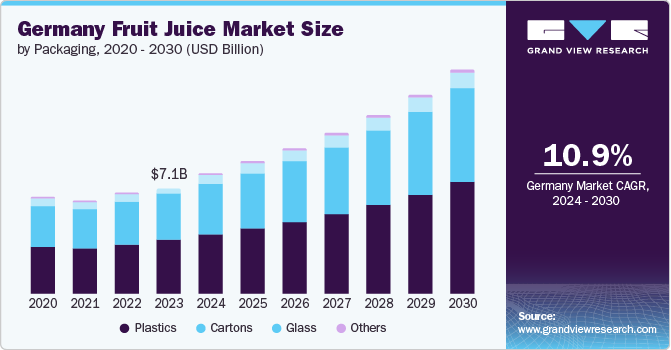

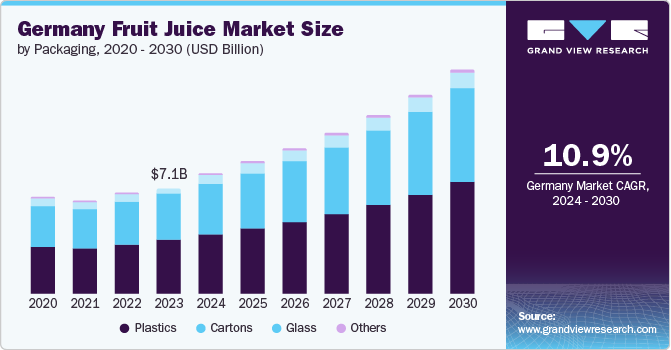

The Germany fruit juice market size was valued at USD 7.08 billion in 2023 and is expected to grow at a CAGR of 10.9% from 2024 to 2030. The juice market is a constantly growing industry, offering a wide range of fruit and vegetable drinks to the common population. The juice industry encompasses producers, suppliers, and consumers. The producer, and supplier category mainly caters to consumer preferences focusing on supplying healthy foods. This growth is attributed to the health-conscious consumers in Germany as there is a huge demand for organic drinks. Moreover, the fast-growing food and beverage market in Germany is fuelling product diversification whereby the consumer is presented with a wide range of fruit juices.

Another prominent factor is the smart marketing strategy. Nowadays, it is common to see producers directing their advertisements to selected groups of consumers. It entails showing the value of fruit juice and supporting it with vital ingredients for health-conscious consumers. Moreover, celebrity endorsements for local and fashionable flavor combinations target middle-income groups with juice as a portable diet.

Consumers are also willing to pay for high-quality fruit juices that seem natural and healthy. This trend is gradually contributing to developing the application of organic and cold-pressed juices. Also, the issue of environmental conservation is now determining the buying patterns of consumers. Manufacturers use packaging solutions that are environmentally friendly and organically produced.

Packaging Insights

The plastics segment dominated the market and accounted for a share of 48.9% in 2023 This can be attributed to the use of plastics during the manufacturing process. The manufacturers use plastics as a packaging material; distribution and marketing thus become feasible. Additionally, the portable design allows easy shipment and other physical movements through the different stages of the supply chain. Furthermore, material transparency also helps the consumer to evaluate the product quality by the looks.

The cartons segment is anticipated to witness significant growth. This element can be attributed to factors such as increased focus on environmental sustainability as cartons are considered more environmentally friendly than plastics. Additionally, improvements in the features of cartons such as lightweight, and durability allow them to compete with juice makers.

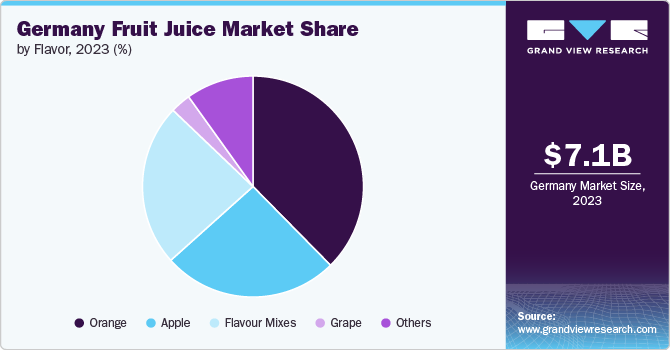

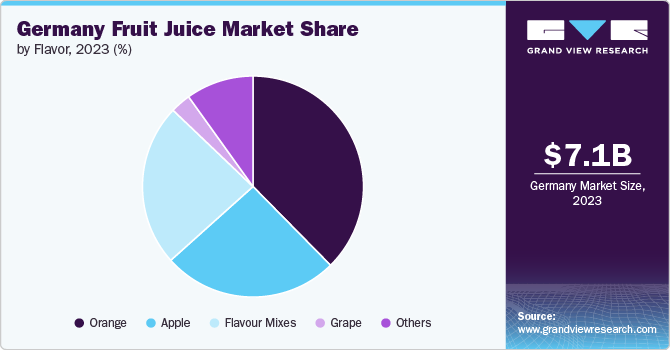

Flavor Insights

Orange flavor accounted for the market revenue share of 38.0% in 2023. This dominance can be attributed to the easy accessibility of oranges in retail markets and a strong consumer preference for the fresh taste and health benefits of orange juice. In addition, successful marketing strategies by industry giants and a product portfolio comprising organic and premium juices are anticipated to drive market growth. Furthermore, orange juice is the common beverage with breakfast and is perceived for health benefits such as vitamin C, and other minerals.

The flavor mixes segment is expected to register a CAGR of 11.4% during the forecast period. The category offers exciting flavor combinations that suit a wide range of consumer needs by satisfying the need for novelty and variety. Furthermore, these blends also typically include products, which consist of vitamins, that play an important role in developing a healthy lifestyle.

Distribution Channel Insights

Take home segment accounted for the largest share accounting for 75.8% in 2023. Take home juices are more economical for a large order quantity. Furthermore, large volumes are available for large parties, families, or individuals who prefer indoor storage. Besides, the wider availability of multiple flavors and variations contributes to their popularity.

On premise segment is expected to register a CAGR of 10.4% during the forecast period. This is attributed to serving fresh premium juices in small to large restaurants, and cafes. Furthermore, it expands the need for a better choice of healthy options while eating out and clients’ desire to find proper beverages and snacks for meals. The social aspect of being able to grab and enjoy a glass of freshly squeezed juice is an added value for the segment.

Key Germany Fruit Juice Market Company Insights

Some key companies in the Germany fruit juice marketi nclude The Coca-Cola Company, Del Monte Fresh Produce Company, ECKES Granini Group, Asahi Group Foods, Ltd, and others. Vendors in the market are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

Coca-Cola is a global beverage company known for its wide range of products. Its juice offerings include Minute Maid, Simply Orange, and more. These products help Coca-Cola to gain a prominent place in the market and cater to the demands of diversified customers worldwide.

-

Kraft Heinz is a global food and beverage leader that offers a wide range of products including liquid beverages. Their offerings in the juice market include the popular Capri Sun brand, which offers fruit juice blends and beverages targeting children and families.

Key Germany Fruit Juice Companies:

- The Kraft Heinz Company

- Hain Celestial

- Campbell Soup Company

- Nestlé S.A.

- The Coca-Cola Company

- ECKES Granini Group

- Frucor Suntory (Just Juice)

- The Green Line Società Agricola S.p.A.

- Del Monte Fresh Produce Company

- Asahi Group Foods, Ltd

Recent Developments

-

In November 2023, Del Monte incorporated reusable plastic banana containers, helping to cut on wastage while increasing the shelf life of the fruit. This complements the company’s sustainability efforts and facilitates consumers with more storage options for bananas.

-

In February 2023, Coca-Cola bought the refillable bottling system in Germany to add sustainability and use of refillable bottles. This action highlights the company’s strategies on ways to implement the circular economy, and in response to the increase in market demand for environmentally friendly products for packaging.

Germany Fruit Juice Market Report Scope

|

Report Attribute

|

Details

|

|

Revenue forecast in 2030

|

USD 14.39 billion

|

|

Growth rate

|

CAGR of 10.9% from 2024 to 2030

|

|

Historical data

|

2018 - 2023

|

|

Forecast period

|

2024 - 2030

|

|

Quantitative units

|

Revenue in USD million and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Packaging, flavor, distribution channel

|

|

Country scope

|

Germany

|

|

Key companies profiled

|

The Kraft Heinz Company; Hain Celestial; Campbell Soup Company; Nestlé S.A.; The Coca-Cola Company; ECKES Granini Group; Frucor Suntory (Just Juice); The Green Line Società Agricola S.p.A.; Del Monte Fresh Produce Company; Asahi Group Foods, Ltd

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Germany Fruit Juice Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Germany fruit juice market report based on packaging, flavor, and distribution channel:

-

Packaging Outlook (Revenue, USD Million, 2018 - 2030)

-

Plastics

-

Cartons

-

Glass

-

Others

-

Flavor Outlook (Revenue, USD Million, 2018 - 2030)

-

Orange

-

Apple

-

Flavor Mixes

-

Grape

-

Others

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Take Home

-

On Premise

-

Impulse