- Home

- »

- Pharmaceuticals

- »

-

Germany And Netherlands Medical Marijuana Market, Report 2030GVR Report cover

![Germany And Netherlands Medical Marijuana Market Size, Share & Trends Report]()

Germany And Netherlands Medical Marijuana Market Size, Share & Trends Analysis Report By Product (Flower, Oil), By Application (Chronic Pain, Mental Disorder, Cancer), By Country, And Segment Forecasts, 2025 - 2030

- Report ID: 978-1-68038-941-8

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

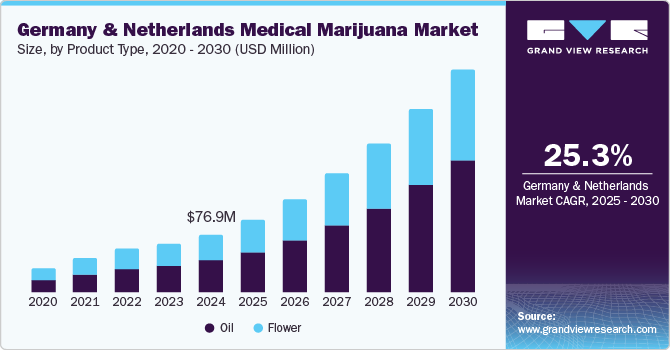

The Germany and Netherlands medical marijuana marketsize was valued at USD 76.9 million in 2024 and is expected to grow at a CAGR of 25.3% from 2025 to 2030. This growth is attributed to the increasing acceptance of cannabis for therapeutic use, coupled with evolving regulatory frameworks. In addition, the removal of cannabis from the Narcotics List has facilitated easier prescriptions by doctors, dramatically increasing patient numbers and thereby boosting the market growth. Furthermore, rising chronic disease prevalence and a growing demand for alternative treatments further propel market expansion in both countries.

Medical marijuana, or medical cannabis, has a long history of use for therapeutic purposes, dating back centuries. However, its potential has been limited by governmental restrictions and production challenges, which have hindered extensive clinical research on its efficacy and safety. The demand for medical cannabis is expected to rise due to its recognized medicinal benefits, particularly in treating chronic diseases and alleviating symptoms such as pain and nausea. Cannabidiol (CBD), a non-psychoactive compound found in cannabis, is gaining attention for its therapeutic properties. In addition, increased clinical trials and research initiatives are likely to enhance understanding and acceptance of medical marijuana, driving market growth.

Furthermore, the legalization of cannabis for medical use in various countries is also contributing to its rising popularity as an alternative treatment option. As awareness of its benefits continues to spread, the medical marijuana market is poised for significant expansion, with a focus on developing new therapeutic products to meet growing consumer needs.

Product Type Insights

Oil products dominated the market and accounted for the largest revenue share of 55.3% in 2024. This growth is attributed to established clear regulations by both countries that facilitate the production and distribution of cannabis oil, making it more accessible to patients. Furthermore, there is a rising demand for oil-based products due to their concentrated medicinal properties, particularly for conditions such as chronic pain and anxiety. Moreover, increased public awareness and education about the benefits of cannabis oil have also led to greater acceptance among healthcare providers and patients alike, driving market growth.

The flower product segment is expected to grow at a CAGR of 23.0% over the forecast period, owing to the historical use of cannabis in these Germany and Netherlands, which has fostered a cultural acceptance encouraging its use for medical purposes. In addition, a wide range of cannabis strains available in flower form allows patients to select specific profiles tailored to their therapeutic needs, enhancing user experience. Many patients prefer flower products for their traditional use and perceived efficacy, contributing to sustained demand. Furthermore, ongoing clinical research validates the benefits of whole-plant therapies, further solidifying this segment's growth.

Application Insights

Chronic pain led the market and accounted for the largest revenue share in 2024. This growth is attributed to the growing body of scientific literature supporting its efficacy. Legal frameworks in both countries have facilitated access to cannabis for pain management, particularly for patients who do not respond well to traditional medications. In addition, the increasing acceptance of medical marijuana as a treatment for various chronic conditions, combined with a rising patient population seeking relief from debilitating pain, has significantly boosted market growth. This trend reflects a broader shift toward recognizing alternative therapies in managing chronic pain effectively.

The mental disorders segment is expected to grow at the fastest CAGR over the forecast period, owing to increasing recognition of cannabis as a viable treatment option. As societal attitudes shift, more healthcare providers are open to prescribing medical cannabis for conditions such as anxiety, depression, and PTSD. Furthermore, regulatory changes have made it easier for patients to access these treatments. Moreover, the rising prevalence of mental health issues has further amplified the demand for effective therapeutic alternatives, solidifying cannabis's role in mental health care.

Country Insights

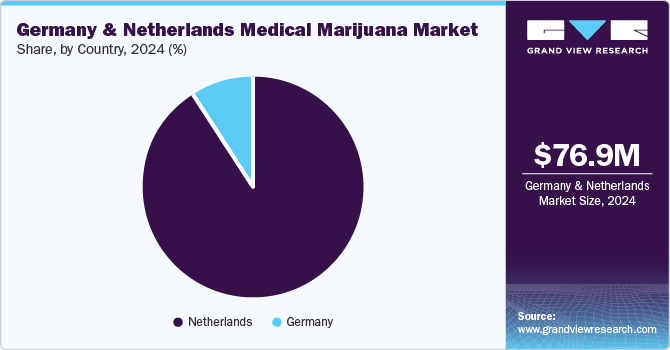

The Netherlands medical marijuana market dominated the market and accounted for the largest revenue share of 91.2% in 2024. This growth is attributed to its long-standing history of cannabis use and progressive regulatory framework. The country has been a pioneer in legalizing medical cannabis, which has fostered a culture of acceptance among both healthcare providers and patients. In addition, rising awareness of the therapeutic benefits of cannabis for conditions such as chronic pain and mental disorders is driving demand. Moreover, ongoing research and clinical trials are validating its efficacy, encouraging more patients to consider medical marijuana as a viable treatment option.

The growth of the medical marijuana market in Germany is driven by significant regulatory changes and increasing patient acceptance. The recent removal of cannabis from the Narcotics List has made it easier for healthcare providers to prescribe medical cannabis, leading to a surge in patient numbers. Furthermore, integrating cannabis into health insurance coverage further enhances accessibility, supporting the market's expansion.

Key Germany & Netherlands Medical Marijuana Company Insights

Some of the key companies in the market include Aphria, Inc., Aurora Cannabis, Tilray, and others. These companies adopt various strategies, including strategic collaborations and new product launches, to gain a competitive edge and enhance their market presence. Furthermore, mergers and acquisitions are being pursued to consolidate resources and expertise, enabling companies to expand their product offerings and market reach effectively.

-

GW Pharmaceuticals, plc manufactures products that include Epidiolex, an FDA-approved oral solution for treating seizures associated with specific epilepsy syndromes, and Sativex, a plant-derived cannabinoid prescription drug to alleviate spasticity in multiple sclerosis patients. The company focuses on the medical segment of the cannabis market, leveraging extensive research and clinical trials to create innovative therapeutic options for patients with serious medical conditions.

-

Organigram Holdings, Inc. offers a diverse range of products, such as dried flowers, oils, and pre-rolls, catering to both medical and recreational markets. The company is committed to quality and innovation within the cannabis sector, focusing on developing high-quality strains and products that meet patients' needs. Operating in the medical marijuana segment, Organigram emphasizes research and development to enhance its product offerings and expand its therapeutic applications.

Key Germany & Netherlands Medical Marijuana Companies:

- ADREXpharma GmbH

- Canopy Growth Corporation

- Aphria, Inc

- Aurora Cannabis

- Tilray

- GW Pharmaceuticals, plc

- Organigram Holdings, Inc

- The Cronos Group

- Demecan GmbH

- Cannamedical Pharma GmbH

Recent developments

- In September 2023, Cronos Group Inc. officially launched its PEACE NATURALS brand in the German medical marijuana market, marking a significant step in its expansion efforts. The company successfully shipped its first bulk cannabis order as part of this initiative, facilitated by a distribution agreement with Cansativa Group, which serves about 300,000 patients through a network of approximately 2,000 pharmacies.

Germany & Netherlands Medical Marijuana Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 96.8 million

Revenue forecast in 2030

USD 299.4 million

Growth Rate

CAGR of 25.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD Million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, application, and country

Country scope

Germany, and Netherlands

Key companies profiled

ADREXpharma GmbH; Canopy Growth Corporation; Aphria, Inc; Aurora Cannabis; Tilray; GW Pharmaceuticals, plc; Organigram Holdings, Inc; The Cronos Group.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Germany & Netherlands Medical Marijuana Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global Germany & Netherlands medical marijuana market report based on product type, application, and country.

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Flower

-

Oil

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Chronic Pain

-

Mental Disorders

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Germany

-

Netherlands

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."