- Home

- »

- Specialty Glass, Ceramic & Fiber

- »

-

Glass Facade Market Size & Share Report, 2021-2028GVR Report cover

![Glass Facade Market Size, Share & Trends Report]()

Glass Facade Market (2021 - 2028) Size, Share & Trends Analysis Report By Product (Insulated, Tempered, Laminated), By Application (Residential, Non-Residential), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-719-7

- Number of Report Pages: 116

- Format: PDF

- Historical Range: 2017 - 2019

- Forecast Period: 2021 - 2028

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

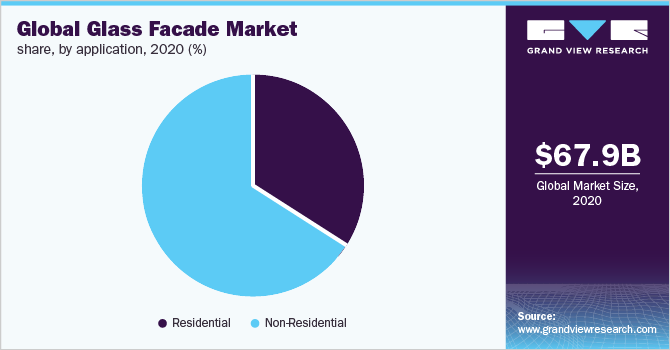

The global glass facade market size was valued at USD 67.9 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 3.9% from 2021 to 2028. Growing investments in green building construction projects are anticipated to propel product usage over the forecast period. The adoption of glass is rising as a preferred construction material. Factors such as plenty of natural daylight, good ambiance, and energy efficiency are propelling the use of glass in Facade architecture. Other advantages include the strength to withstand harsh weather elements, flexibility in terms of transparency or translucency, aesthetic benefits, and cost-effectiveness.

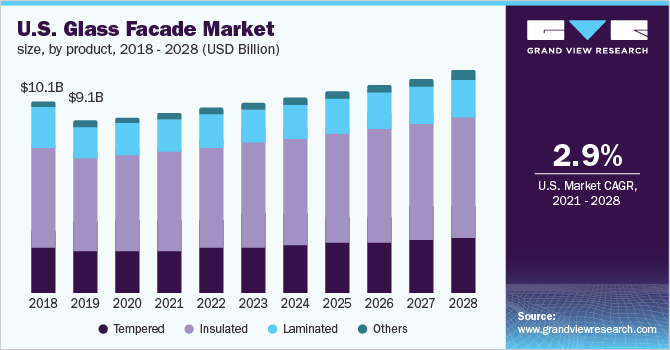

The U.S. was a major market for glass Facade in 2020. The increasing popularity of the green building concept, growing awareness regarding environmental protection, and supporting government policies related to sustainable energy usage are expected to augment the use of glass facades in the country.

Furthermore, the growing demand for high-rise buildings owing to rapid urbanization is anticipated to positively influence market growth. The application of glass as a material in Facade is becoming popular owing to its lightweight, which reduces the dead load of the buildings. Most of the tallest buildings in the world have glass facades, for example, Jeddah Tower in Dubai, Merdeka 118 in Malaysia, and DeKALB in Brooklyn.

Glass in the exteriors brings out the aesthetic appeal of commercial buildings, thus, positively impacting the brand value. Growing commercial construction activities owing to the increasing demand for office space and corporate hubs are positively impacting market growth. For instance, in July 2021, My Home Constructions, an Indian real-estate builder, announced to invest USD 2 billion to construct a hub of IT companies.

Despite its advantages, glass is not suitable for use in places with hot climates as it traps heat and acts as a greenhouse. Buildings with glass Facade have high temperatures inside, resulting in increased usage of air-conditioners and fans. Higher usage of air-conditioners lead to an increase in electricity cost and also impact carbon footprint. Glass Facade is suitable for places with a temperate climate and not apt for cities with hot climates.

Product Insights

Based on product, the insulated segment dominated the market for glass Facade and held the largest revenue share of over 54.0% in 2020. The major factor driving the insulated glass segment is high energy efficiency in buildings as it reduces the energy power consumption needed for cooling or heating the area. Moreover, it helps in providing sound insulation, thus improving the acoustic of the space.

IGUs are extensively preferred in green buildings as it minimizes ecological footprint and is made from multiple glass panes, which reduces the heat transfer. The space between the panes is filled with inert gases such as argon, which is mostly used owing to its low thermal insulation. The thermal insulation offered by IGUs reduces artificial heating and minimizes the overall cost.

Tempered, also referred to as toughened glass usually breaks into small blunt pieces instead of big shards, which makes it less likely to injure a person. These properties make it applicable for use as a safety glass. Versatility, optical distortion, and high impact resistance are a few features propelling the product demand over the forecast period.

Application Insights

Based on application, the non-residential segment dominated the market for glass Facade and accounted for the largest revenue share of more than 66.0% in 2020. The high share is attributable to the scope of the segment, which includes commercial space, hotels, restaurants, shopping centers, and other such huge buildings. As countries come out of the pandemic, workspaces are under plans to reopen.

Growing investments in commercial construction are anticipated to propel the consumption of glass Facades over the forecast period. Increasing emphasis on energy efficiency and offering a comfortable workspace to employees with natural daylight is being observed in the commercial sector, which is propelling the incorporation of glass as a key construction material.

The penetration of glass Facade is propelling in the residential segment as well. Glazing helps in bringing daylight for a longer period, saving on the cost of external lighting. Furthermore, technological advancements have made glass a high-strength material, which keeps the indoors safe from extreme weather conditions such as wind and heavy rains and it does not rust or wither over time and compared to a masonry wall.

Regional Insights

Asia Pacific dominated the glass Facade market and accounted for the largest revenue share of 56.1% in 2020. The segment is anticipated to register the fastest growth rate over the forecast period. Rising construction activities in the region, along with increasing penetration of glass-based architecture in residential and non-residential applications are likely to further fuel the demand for glass Facades, especially from emerging economies of the region.

An increase in infrastructure spending is being observed post the outbreak of the COVID-19 pandemic, which is expected to escalate the demand product demand in the construction industry. Factors such as rapid economic growth, rising disposable income, and subsequent increase in the demand for residential housing and commercial projects are expected to benefit the demand for glass Facades in the region.

InNorth America, the market for glass Facade is anticipated to register a CAGR of 2.9%, in terms of revenue, over the forecast period. Increasing infrastructural developments coupled with rising demand for multifamily housing projects is anticipated to fuel product demand in the region. For instance, in November 2020, Pepper Construction began the construction of a new multifamily residential project in Wisconsin, U.S.

Europe holds vital significance in the global market. The region is anticipated to witness investments in businesses as well as infrastructure in order to meet its climate goals and push economic recovery. For instance, in December 2020, Skanska AB, completed the Prisma Project with 592 unitized glass Facades in Helsingborg.

Key Companies & Market Share Insights

The market for glass Facadeis highly competitive in nature owing to the presence of numerous established players. With growth in the facade industry, various new developments are being witnessed as the players are indulging themselves in adopting different strategic initiatives to gain a higher market share and widen their customer base. They are engaged in R&D, new product developments, mergers & acquisitions, partnerships and collaborations, and capacity expansions.

For instance, in March 2021, KGC announced to invest around EUR 10 million (~USD 11.6 million) in a new plant in MoletuPlentas in Vilnius. The new plant will be region’s first aluminum-glass structure plant, which is expected to commence in 2022. This new plant aims at fulfilling growing customer demand for quality products, i.e., Facade constructions. Some of the prominent players in the glass Facade market include:

-

AGC Inc.

-

Asahi India Glass Limited

-

Euroglas GmbH

-

GUARDIAN INDUSTRIES

-

Nippon Sheet Glass Co., Ltd.

-

Saint-Gobain

-

Sisecam Group

-

Vitro

Glass Facade Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 70.08 billion

Revenue forecast in 2028

USD 92.6 billion

Growth Rate

CAGR of 3.9% from 2021 to 2028

Market size volume in 2020

26.6 Million tons

Volume forecast in 2028

35.0 Million tons

Growth Rate

CAGR of 3.5% from 2021 to 2028

Base year for estimation

2020

Historical data

2017 - 2019

Forecast period

2021 - 2028

Quantitative units

Volume in Kilotons, revenue in USD million, and CAGR from 2021 to 2028

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; Russia; France; Italy; China; India; Japan; Australia; Brazil; Mexico; South Africa

Key companies profiled

AGC Inc.; GUARDIAN INDUSTRIES; Nippon Sheet Glass Co., Ltd.; Saint-Gobain;sisecam Group; Vitro

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Segments Covered in the ReportThis report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2028. For the purpose of this study, Grand View Research has segmented the glass Facade market report on the basis of product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2028)

-

Tempered

-

Insulated

-

Laminated

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2028)

-

Residential

-

Non-Residential

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2017 -2028)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

Russia

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The glass façade market size was estimated at USD 67.98 billion in 2020 and is expected to reach USD 70.08 billion in 2021.

b. The glass façade market is expected to grow at a compound annual growth rate of 3.9% from 2021 to 2028 to reach USD 92.60 billion by 2028.

b. Based on application segment, non-residential held the largest revenue share of more than 66.0% in 2020 owing to increasing spending in commercial construction across countries where the impact of COVID-19 is reducing.

b. The key players operating in the glass façade market include AGC Inc., Vitro, Saint-Gobain, Şişecam Group, and Nippon Sheet Glass Co., Ltd.

b. Factors such as plenty of natural daylight, good ambiance, and energy efficiency are propelling the use of glass in façade architecture. Furthermore, increasing investments in the construction industry is expected to positively influence market growth over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.