- Home

- »

- Advanced Interior Materials

- »

-

Glass Fiber Reinforced Plastic Piping Systems Market Report, 2030GVR Report cover

![Glass Fiber Reinforced Plastic Piping Systems Market Size, Share & Trends Report]()

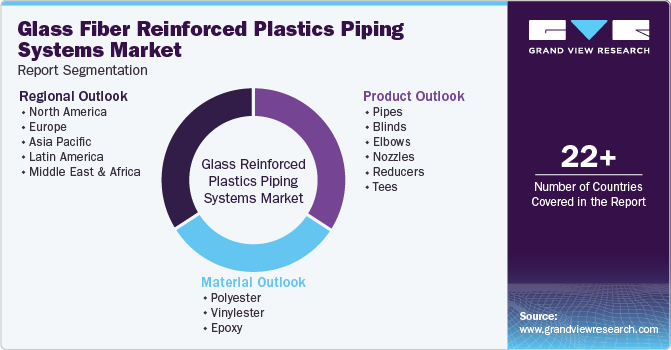

Glass Fiber Reinforced Plastic Piping Systems Market Size, Share & Trends Analysis Report By Material (Polyester, Vinylester, Epoxy), By Product (Pipes, Blinds, Elbows, Nozzles, Reducers), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-3-68038-038-5

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

Market Size & Trends

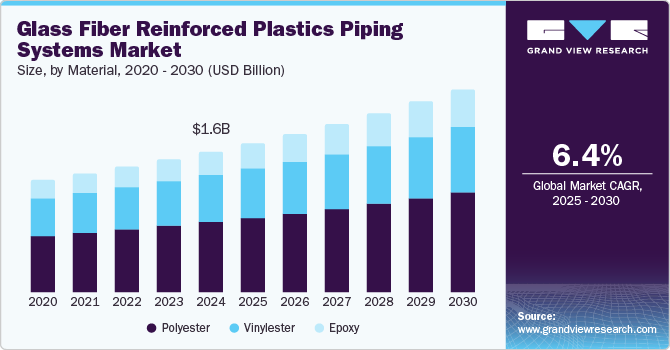

The global glass fiber reinforced plastic piping systems market size was estimated at USD 1.64 billion in 2024 and is projected to grow at a CAGR of 6.4% from 2025 to 2030. This growth is attributed to the increasing demand for lightweight, corrosion-resistant, and durable piping solutions across various industries, including oil and gas, water supply, and wastewater management. In addition, rapid urbanization and infrastructure development in developed and developing economies also propel market expansion. Furthermore, the shift towards sustainable materials and manufacturing innovations further enhances GRP pipes' appeal, thereby expanding the market’s growth.

The increasing use of glass fiber reinforced plastic (GRP) piping systems in both onshore and offshore oilfields is expected to boost demand for these products significantly. In the oil and gas sector, GRP pipes are utilized in various applications, including subsea and offshore platform piping, injection lines for water and gas, gas transmission lines, crude oil transmission, and refinery systems. The hydrocarbon exploration and production activity surge is expected to elevate this demand further.

The growth in the production of crude oil in regions such as the Middle East, Africa, and North America is anticipated to enhance market growth. Furthermore, expanding oil and gas reserves globally will positively impact demand. The industry must adhere to stringent regulations regarding construction and automotive applications, with GRP systems required to meet U.S. Leadership in Energy and Environmental Design (LEED) standards for green buildings.

Manufacturing GRP pipes involves key raw materials like soda ash, polyacrylonitrile fibers (PAN), pitch resins, rayon, and silica sand. However, fluctuations in raw material prices can affect end-product costs, potentially hindering market expansion. Despite these challenges, GRP pipes' favorable characteristics, such as high corrosion resistance and durability, position them as preferred over traditional materials like steel. The ongoing advancements in GRP technology and its applications are expected to sustain its growth trajectory in the coming years.

Material Insights

Polyester dominated the market and accounted for the largest revenue share of 49.8% in 2024. This growth is driven by its advantageous properties. Polyester resin enhances GRP pipes' corrosion resistance and mechanical strength, making them suitable for various applications, including water supply and wastewater management. In addition, polyester's cost-effectiveness compared to other resins also contributes to its popularity among manufacturers. Furthermore, as industries seek durable and efficient piping solutions, the demand for polyester-based GRP systems is expected to rise significantly, particularly in infrastructure projects worldwide.

Epoxy is expected to grow at the fastest CAGR of 7.7% from 2025 to 2030. This growth is attributed to its superior performance characteristics. These materials are known for their excellent adhesion and low moisture absorption, epoxy resins enhance the durability and longevity of GRP pipes. In addition, their resistance to chemical attacks and abrasion makes them particularly valuable in demanding environments, such as the oil and gas sector. As industries increasingly prioritize high-performance materials for infrastructure and industrial applications, the demand for epoxy-based GRP piping systems is anticipated to grow substantially.

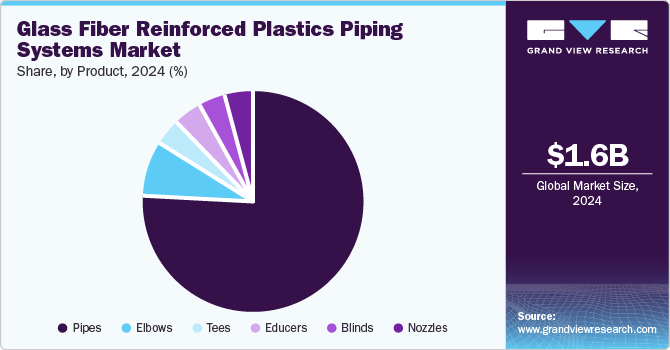

Product Insights

Pipes led the market and accounted for the largest revenue share of 76.2% in 2024. This growth is attributed to their lightweight, corrosion-resistant, and durable properties. Due to their ability to withstand harsh environments, these pipes are increasingly favored in various industries, particularly in oil and gas, water supply, and wastewater management. In addition, the ongoing infrastructure development and urbanization worldwide further fuel the need for reliable piping solutions. Furthermore, the ease of installation and low maintenance requirements make GRP pipes an attractive option for long-term applications.

Elbows are expected to grow at a CAGR of 6.9% over the forecast period, owing to their critical role in facilitating smooth flow transitions in piping networks. Elbows are essential components that allow for directional changes in pipelines, making them indispensable in various applications, including oil and gas, water distribution, and industrial processes. In addition, the increasing focus on efficient fluid transport systems, combined with the advantages of GRP materials such as resistance to corrosion and reduced weight-boosts the demand for GRP elbows, contributing to the overall market growth.

Regional Insights

The Middle East and Africa glass fiber reinforced plastic piping systems market dominated the global market and accounted for the largest revenue share of 26.4% in 2024. This growth is attributed to large-scale infrastructure projects and the region's focus on water management solutions. In addition, the increasing demand for durable and corrosion-resistant piping in applications such as petrochemical plants and desalination facilities is significant. Furthermore, government initiatives to enhance water supply and wastewater treatment systems propel market expansion. The region's harsh environmental conditions necessitate reliable piping solutions, making GRP an attractive option for various industries.

Asia Pacific Glass Fiber Reinforced Plastic Piping Systems Market Trends

The glass fiber reinforced plastic piping systems market in the Asia Pacific is expected to grow at a CAGR of 6.9% over the forecast period, owing to rapid urbanization and industrialization. Countries such as India and China are investing heavily in infrastructure development, leading to increased demand for lightweight, durable, and corrosion-resistant pipes. In addition, the agricultural sector's need for efficient irrigation systems further drives GRP pipe adoption. Furthermore, favorable government regulations supporting sustainable construction practices enhance the appeal of GRP pipes, positioning Asia Pacific as a dominant player in the global market.

China glass fiber reinforced plastic piping systems market dominated the Asia Pacific market and accounted for the largest revenue share in 2024. This growth is attributed to its robust chemical manufacturing sector and increasing investments in infrastructure. In addition, the government's focus on reducing import dependency has led to a surge in domestic production of GRP pipes for various applications, including irrigation and industrial processes. Moreover, the rising population density also necessitates effective water management solutions, further driving demand. China's emphasis on sustainable practices and innovative materials positions GRP pipes as vital in meeting its growing infrastructure needs.

North America Glass Fiber Reinforced Plastic Piping Systems Market Trends

The glass fiber reinforced plastic piping systems market in North America is expected to grow substantially over the forecast period due to significant government investments in water treatment and infrastructure modernization. In addition, the rise in shale gas exploration activities necessitates durable piping solutions that can withstand harsh conditions. Furthermore, increasing awareness of environmental sustainability prompts industries to adopt GRP pipes for their corrosion resistance and lightweight properties. As urban areas expand, the demand for efficient water supply systems continues to boost the GRP market in this region.

The U.S. glass fiber reinforced plastic piping systems market is expected to grow significantly due to ongoing investments in water infrastructure and treatment facilities. As exploration activities increase, the need for reliable and durable piping solutions in various sectors, including oil and gas, is significant. Furthermore, stringent environmental regulations encourage industries to adopt GRP pipes for their sustainability benefits. Moreover, the combination of technological advancements in manufacturing processes and a growing emphasis on efficient resource management further supports the expansion of the GRP piping market across the country.

Europe Glass Fiber Reinforced Plastic Piping Systems Market Trends

The glass fiber reinforced plastic piping systems market in Europe accounted for a revenue share of 23.0% in 2024. This growth is attributed to an increasing emphasis on sustainable construction practices and infrastructure resilience. The region's commitment to reducing carbon footprints drives demand for corrosion-resistant materials like GRP pipes in wastewater management and industrial applications. In addition, ongoing investments in renewable energy projects require reliable piping solutions that can withstand challenging conditions.

Germany glass fiber reinforced plastic piping systems market is expected to grow at the fastest CAGR of 6.5% over the forecast period in the European market. This growth is characterized by strong demand stemming from its advanced industrial sector and commitment to sustainability. Furthermore, the country's focus on innovative water management solutions drives the adoption of GRP pipes in sewage treatment facilities and chemical processing plants. Moreover, Germany's rigorous environmental regulations encourage industries to utilize durable materials that minimize ecological impact. As infrastructure projects expand across urban areas, the need for reliable and efficient piping solutions further fuels the growth of the GRP market within Germany.

Key Glass Fiber Reinforced Plastic Piping Systems Company Insights

Some of the key companies in the market include Plasticon Composites, STEULER-KCH GmbH, HOBAS, and others. These companies are adopting various strategies, such as new product launches and strategic partnerships, to enhance their brand presence and gain a competitive edge in the market. In addition, the companies utilize mergers and acquisitions to expand market presence and capabilities, while continuous investments in technology and quality improvement ensure sustained growth and customer satisfaction.

STEULER-KCH GmbH develops and manufactures advanced materials, including glass fiber reinforced plastic (GRP) piping systems. The company operates across various sectors, providing corrosion-resistant solutions tailored for industries such as chemical processing, power generation, and waste management. Their product offerings include GRP pipes and linings designed to withstand aggressive environments, making them suitable for highly durable and reliable applications.

HOBAS manufactures glass fiber reinforced plastic (GRP) pipes, renowned for their strength and durability. Operating primarily in the water and wastewater management sectors, HOBAS provides innovative piping solutions for various applications, including sewage systems, stormwater management, and industrial processes. The company is committed to sustainability, producing lightweight and corrosion-resistant pipes that reduce environmental impact while ensuring long-lasting performance.

Key Glass Fiber Reinforced Plastic Piping Systems Companies:

The following are the leading companies in the glass fiber reinforced plastic piping systems market. These companies collectively hold the largest market share and dictate industry trends.

- Plasticon Composites

- STEULER-KCH GmbH

- HOBAS

- Protecciones Plásticas S.A. (Protesa)

- Saudi Arabian Amiantit Co.

- PPG Industries, Inc.

- FIBREX

- Abu Dhabi Pipe Factory (ADPF)

- Hedley Industrial Group

- Hengrun Group Co., Ltd.

- Borealis

- Toray Resins GmbH

Recent Developments

-

In October 2023, Borealis announced the launch of Borcycle GD3600SY, a glass-fiber reinforced polypropylene (PP) compound featuring 65% post-consumer recycled (PCR) content. Initially utilized in automotive interiors, this innovative material contains 30% glass fibers, enhancing its strength and sustainability.

-

In June 2023, Toray Resins Europe GmbH (a subsidiary of Toray Industries) introduced a recycling procedure for glass fiber-reinforced polyphenylene sulfide (PPS) resin waste. This innovative process utilizes proprietary technology and collaboration with MKV GmbH, allowing for the production of PPS with 50% recycled content while maintaining over 90% of the original mechanical strength. Notably, this recycled PPS has a carbon footprint approximately 45% lower than traditional PPS, addressing the growing demand for eco-friendly materials in applications like glass fiber reinforced plastic piping systems and electric vehicles.

Glass Fiber Reinforced Plastic Piping Systems Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.74 billion

Revenue forecast in 2030

USD 2.36 billion

Growth rate

CAGR of 6.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD Billion/Million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, product, and region

Regional scope

North America, Europe, and Asia Pacific,

Country scope

U.S., Canada, Mexico, China, India, Japan, Australia, Germany, UK, Italy, Spain, France.

Key companies profiled

Plasticon Composites; STEULER-KCH GmbH; HOBAS; Protecciones Plásticas S.A. (Protesa); Saudi Arabian Amiantit Co.; PPG Industries, Inc.; FIBREX; Abu Dhabi Pipe Factory (ADPF); Hedley Industrial Group; Hengrun Group Co., Ltd.; Borealis; Toray Resins GmbH

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fiber Reinforced Plastic Piping Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the glass fiber reinforced plastic piping systems market report based on material, product, and region.

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Polyester

-

Vinylester

-

Epoxy

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Pipes

-

Blinds

-

Elbows

-

Nozzles

-

Reducers

-

Tees

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Russia

-

-

Asia Pacific

-

India

-

Japan

-

China

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."