- Home

- »

- Advanced Interior Materials

- »

-

Glass Manufacturing Market Size, Industry Report, 2030GVR Report cover

![Glass Manufacturing Market Size, Share & Trends Report]()

Glass Manufacturing Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Container Glass, Flat Glass, Fiber Glass), By Application (Packaging, Construction, Transportation), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-699-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Glass Manufacturing Market Summary

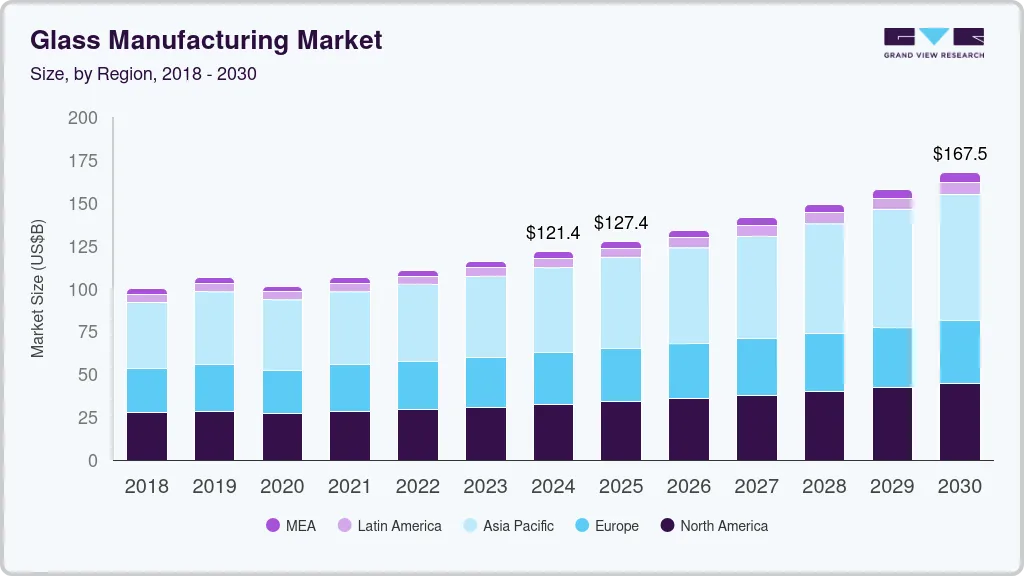

The global glass manufacturing market size was valued at USD 121.4 billion in 2024 and is projected to reach USD 167.5 billion by 2030, growing at a CAGR of 5.6% from 2025 to 2030. This growth is attributed to the rising demand from the construction sector for energy-efficient and sustainable glass products is significant, fueled by urbanization and infrastructure development, particularly in emerging economies.

Key Market Trends & Insights

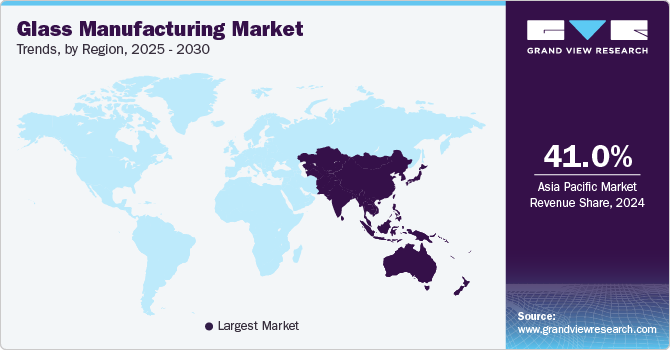

- The Asia Pacific dominated the global market and accounted for the largest revenue share of 41.0% in 2024.

- The China led the Asia Pacific market and accounted for the largest revenue share in 2024.

- Based on material, the container glass segment dominated the global glass manufacturing industry with the largest revenue of 47.1% in 2024.

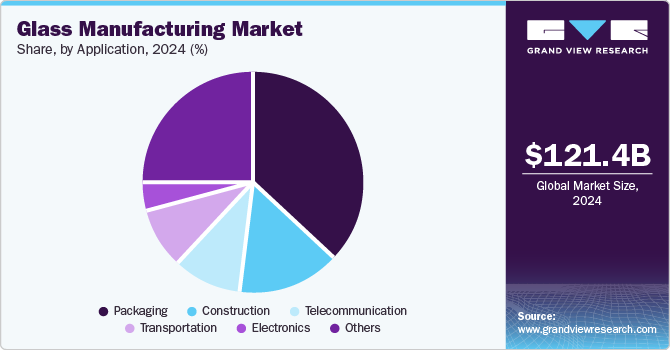

- In terms of application, the packaging application segment led the market and accounted for the largest revenue share of 37.3% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 121.4 billion

- 2030 Projected Market Size: USD 167.5 billion

- CAGR (2025-2030): 5.6%

- Asia Pacific: Largest market in 2024

In addition, the automotive industry's shift towards lighter, advanced glass materials for safety and efficiency is boosting production. Furthermore, innovations in smart glass technology and increased recycling efforts are also contributing to market expansion, as consumers and industries prioritize sustainability and energy efficiency in their choices.Glass manufacturing refers to the process of producing glass products through the melting of raw materials such as silica, soda ash, and limestone, followed by shaping and cooling. The growth of the glass manufacturing market is significantly influenced by the increasing sales of electronic display devices, including smartphones, tablets, and televisions. As these devices require high-quality glass for their displays, the rising demand for improved resolution, durability, and scratch resistance is prompting manufacturers to innovate with ultra-thin and flexible glass options.

In addition, advancements in technology, particularly with the advent of 5G, artificial intelligence, and virtual reality, are further propelling the need for high-quality displays in electronic devices. This trend indicates a sustained increase in demand for glass products within the electronics sector. Furthermore, investments in new manufacturing facilities are becoming a notable trend as companies seek to enhance production efficiency and sustainability to meet growing consumer needs.

The market is also benefiting from an uptick in smartphone production and a decrease in consumer electronics costs. Moreover, infrastructure development and construction activities are expected to drive demand for glass in various applications. Governments are increasingly advocating for the use of biodegradable materials over non-biodegradable alternatives, boosting glass's appeal as an environmentally friendly option, thereby reinforcing its significance in the global glass manufacturing industry.

Material Insights

The container glass dominated the global glass manufacturing industry with the largest revenue of 47.1% in 2024. This growth is attributed to the increasing demand from the food and beverage industry, where glass is favored for its durability, recyclability, and ability to preserve product integrity. Furthermore, rising environmental awareness is prompting a shift towards sustainable packaging solutions, further boosting container glass usage. Moreover, the pharmaceutical sector's reliance on glass for vials and ampoules due to its chemical inertness also significantly contributes to market expansion.

Fiber glass market is expected to grow at the fastest CAGR of 6.4% over the forecast period, owing to its extensive applications across various industries, including construction, automotive, and aerospace. In addition, the lightweight and high-strength properties of fiber glass make it an ideal material for enhancing energy efficiency and reducing emissions in vehicles. Furthermore, advancements in manufacturing technologies are enabling the production of more durable and versatile fiber glass products. Moreover, the increasing focus on sustainability and energy conservation in construction projects is also driving demand for fiber glass insulation materials, contributing to the overall growth of this segment in the glass manufacturing market.

Application Insights

The packaging application led the market and accounted for the largest revenue share of 37.3% in 2024, primarily driven by the increasing demand for sustainable and eco-friendly packaging solutions. In addition, glass is favored for its recyclability and ability to preserve product integrity, making it a preferred choice in the food, beverage, and pharmaceutical industries. Furthermore, as consumer awareness regarding environmental issues rises, brands are shifting towards glass packaging to enhance their sustainability credentials, driving innovation and expansion in this sector.

Telecommunication segment is expected to grow at a CAGR of 6.6% from 2025 to 2030, owing to the rising demand for advanced electronic devices that utilize high-quality glass components. In addition, the proliferation of smartphones, tablets, and other communication devices necessitates durable and high-performance glass for displays. Furthermore, the advent of new technologies such as 5G is increasing the need for enhanced optical fibers and glass materials that support faster data transmission.

Regional Insights

The Asia Pacific glass manufacturing market dominated the global market and accounted for the largest revenue share of 41.0% in 2024. This growth is attributed to the rapid industrialization and robust infrastructure development in countries such as China and India. In addition, the increasing urban population drives demand for various glass products, particularly in construction and automotive sectors. Furthermore, rising disposable incomes lead to a preference for high-quality glass items, enhancing consumption across multiple applications, including consumer electronics and home appliances, thereby solidifying the region's position as a leader in glass manufacturing.

The China glass manufacturing market led the Asia Pacific market and accounted for the largest revenue share in 2024, driven by its booming economy and ongoing urbanization. As one of the largest producers of flat glass globally, China benefits from abundant raw materials and advanced manufacturing technologies. Furthermore, the government's focus on sustainable construction practices and energy-efficient buildings further propels demand for glass products, particularly in the construction and automotive industries, ensuring continued growth in this sector.

Middle East & Africa Glass Manufacturing Market Trends

The Middle East and Africa glass manufacturing market is expected to grow at a CAGR of 4.9% over the forecast period, owing to increasing investments in infrastructure projects and urban development. The demand for container glass is rising as the region's food and beverage industry expands. Furthermore, growing awareness of environmental sustainability is driving a shift towards recyclable glass packaging solutions. Moreover, the construction sector's expansion also fuels demand for architectural glass products, enhancing the overall market landscape in this region.

North America Glass Manufacturing Market Trends

The North Americaglass manufacturing market is expected to grow significantly over the forecast period, primarily driven by increased investments in construction and infrastructure development. In addition, the rise in demand for eco-friendly packaging solutions is also significant, as consumers become more aware of their environmental impact. Furthermore, major manufacturers are expanding production capacities to meet this demand, particularly in the food and beverage sectors, while innovations in smart glass technology are opening new avenues for growth across various applications.

U.S. Glass Manufacturing Market Trends

The U.S. glass manufacturing market led the North American market and held the largest revenue share in 2024, owing to a strong focus on sustainability and innovative packaging solutions. The construction sector's recovery post-pandemic is contributing to increased spending on glass products for residential and commercial buildings. Furthermore, the growing trend towards environmentally friendly materials encourages manufacturers to invest in advanced production techniques that minimize waste and enhance recyclability, supporting overall market expansion.

Europe Glass Manufacturing Market Trends

The glass manufacturing market in Europe generated a significant revenue share in 2024, driven by stringent regulations promoting sustainability and recycling initiatives. In addition, the increasing demand for high-quality packaging solutions in the food and beverage industry significantly boosts container glass production. Furthermore, advancements in technology are leading to innovations in flat and specialty glass products, catering to diverse applications such as automotive and construction.

The growth of the Germany glass manufacturing market is expected to be driven by strong technological advancements and a commitment to sustainability. Furthermore, the country's emphasis on energy-efficient building practices drives demand for high-performance architectural glass products. Moreover, Germany's robust automotive industry relies heavily on specialized glass components, further fueling market growth.

Key Glass Manufacturing Company Insights

Key companies in the global glass manufacturing industry include AGC Inc., Saint-Gobain, AGI glaspac, and others. These players employ various strategies to enhance their competitive edge. These strategies include mergers and acquisitions, that are utilized to expand market reach and consolidate resources. In addition, strategic alliances with technology firms facilitate innovation in product development. Furthermore, new product launches are adopted by the companies to focus on sustainability and advanced features to meet evolving consumer demands.

-

Guardian Industries specializes in the production of high-performance float glass and value-added glass products. The company operates primarily through its Guardian Glass division, which supplies a wide range of glass solutions for architectural, residential, automotive, and technical applications. In addition to glass manufacturing, the company also focuses on fiberglass insulation and building materials, catering to diverse industries and enhancing its position in the global market.

-

Saint-Gobain company operates across various segments, including flat glass for construction, automotive glass, and specialized glass solutions for industrial applications. By integrating advanced technologies into its manufacturing processes, the company continues to meet the evolving demands of customers in both residential and commercial markets worldwide.

Key Glass Manufacturing Companies:

The following are the leading companies in the glass manufacturing market. These companies collectively hold the largest market share and dictate industry trends.

- AGC Inc.

- Fuyao Glass Industry Group Co. Ltd.

- Guardian Industries

- Saint-Gobain

- O-I Glass Inc.

- AGI glaspac

- Nihon Yamaura Glass Co., Ltd.

- Vitro

- 3B- the fiberglass company

Recent Developments

-

In January 2025, AGC Glass Europe is set to invest a significant amount in a new production line at its Lodelinsart facility in Belgium for FINEO ultra-thin insulating vacuum glass. This initiative aims to enhance glass manufacturing capabilities, responding to increasing customer demand for innovative solutions. Set to begin operations in mid-2026, the line is expected to boost production of FINEO.

-

In June 2023, Saint-Gobain India has launched the production of India's first low-carbon glass, aiming to meet the growing demand for sustainable building materials in the construction industry. This innovative glass manufacturing process is expected to reduce carbon emissions by approximately 40% compared to existing products, utilizing two-thirds recycled content and renewable energy sources. The new glass is expected to maintain the quality and aesthetic appeal of traditional glass while contributing to significant reductions in both embodied and operational carbon footprints.

Glass Manufacturing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 127.4 billion

Revenue forecast in 2030

USD 167.5 billion

Growth rate

CAGR of 5.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

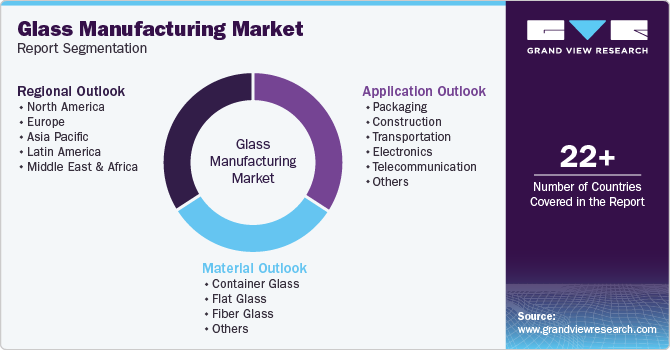

Segments covered

Material, application, region

Regional scope

North America, Asia Pacific, Europe, Latin America, Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, Italy, France, UK, China, India, Japan, South Korea, Brazil, Qatar

Key companies profiled

AGC Inc.; Fuyao Glass Industry Group Co. Ltd.; Guardian Industries; Saint-Gobain; O-I Glass Inc.; AGI glaspac; Nihon Yamaura Glass Co., Ltd.; Vitro; 3B- the fiberglass company

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Glass Manufacturing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global glass manufacturing market report based on material, application, and region.

-

Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Container Glass

-

Flat Glass

-

Fiber Glass

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Packaging

-

Construction

-

Transportation

-

Electronics

-

Telecommunication

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Italy

-

France

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

Qatar

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.