- Home

- »

- Plastics, Polymers & Resins

- »

-

Conductive Polymers Market Size And Share Report, 2030GVR Report cover

![Conductive Polymers Market Size, Share & Trends Report]()

Conductive Polymers Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (ABS, Polyphenylene-based Resins, Polycarbonates, ICP), By Application (Actuators & Sensors, Solar Energy), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-252-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Conductive Polymers Market Summary

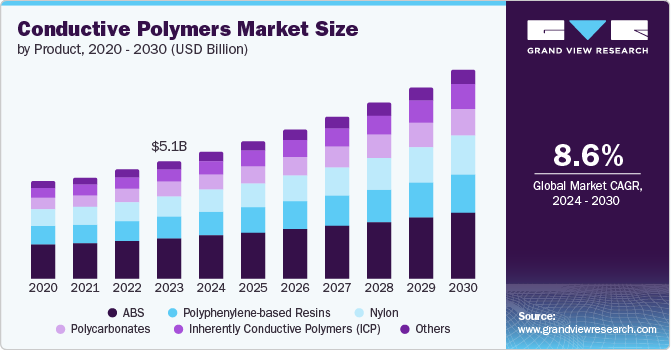

The global conductive polymers market size was estimated at USD 5.08 billion in 2023 and is projected to reach USD 9.03 billion by 2030, growing at a CAGR of 8.6% from 2024 to 2030. The growing demand in the electronics industry for smartphones, wearables, and automotive electronics has driven the need for lightweight and high-performance materials such as conductive polymers.

Key Market Trends & Insights

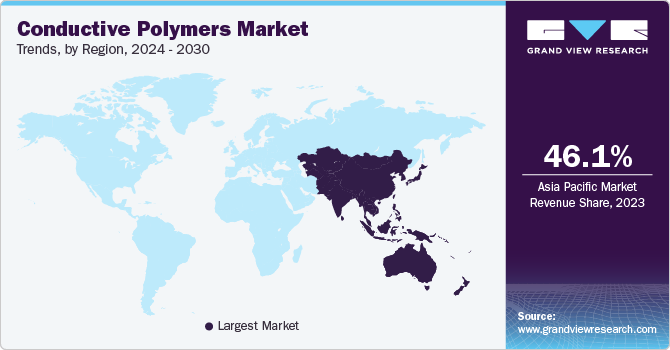

- In terms of region, Asia Pacific was the largest revenue generating market in 2023.

- The conductive polymers market in North America held a lucrative share of 20.8% in 2023.

- In terms of product, the Acrylonitrile-Butadiene-Styrene (ABS) segment accounted for the largest market share of 34.3% in 2023.

- Inherently conductive polymers (ICPs) are expected to emerge as the fastest-growing segment during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 5.08 Billion

- 2030 Projected Market Size: USD 9.03 Billion

- CAGR (2024-2030): 8.6%

- Asia Pacific: Largest market in 2023

These materials contribute to energy-saving devices while minimizing energy consumption and aligning with the industry's emphasis on efficiency.

Furthermore, the increasing demand for renewable energy sources, such as solar panels and energy storage systems, has fueled the adoption of conductive polymers. Conductive polymers play a crucial role in enhancing the efficiency and performance of renewable energy technologies.

Moreover, ongoing R&D efforts have focused on developing conductive polymers, which has further propelled market growth. Researchers explored novel applications, improved material properties, and optimized production processes, which expanded the scope of conductive polymers and made them more commercialized. Additionally, conductive polymers offer design flexibility, which allows manufacturers to create customized solutions to address specific market needs.

Despite their benefits, the conductive polymer market faced significant challenges, such as high production costs and environmental regulations. Balancing cost-effectiveness with performance remained a critical consideration for manufacturers. However, they attempt to overcome such barriers through continued research, collaboration, and investment in sustainable production methods.

Product Insights

The Acrylonitrile-Butadiene-Styrene (ABS) segment accounted for the largest market share, with 34.3% in 2023, owing to its excellent mechanical properties, such as high tensile strength and impact resistance. Such qualities make it suitable for various applications, including electronic components, automotive parts, and consumer goods. Furthermore, ABS has a relatively low melting point, allowing easy processing and molding, which helps manufacturers to shape complex designs. The material's convenient processability resulted in widespread applications such as wiring systems, transmission cables, and connectors. It is also applied to lightweight automotive components that further contribute to fuel efficiency and emission reduction and drive market growth.

The inherently conductive polymers (ICPs) are expected to emerge as the fastest-growing segment during the forecast period. The projected growth can be credited to the rapid adoption of technological advancements such as graphene-enhanced polymers. Graphene's large surface area, high electrical conductivity, and ease of manufacturing drove significant demand. Manufacturers have innovated advancements in material properties, processing techniques, and applications to expand the product utility across industries. Furthermore, ICPs offer lightweight, corrosion-resistant, and easy-to-process alternatives to metallic additives. Their eco-friendly nature aligns with the growing demand for sustainable materials in various sectors such as supercapacitors, aerospace, automotive, sports, energy, and biomedicine.

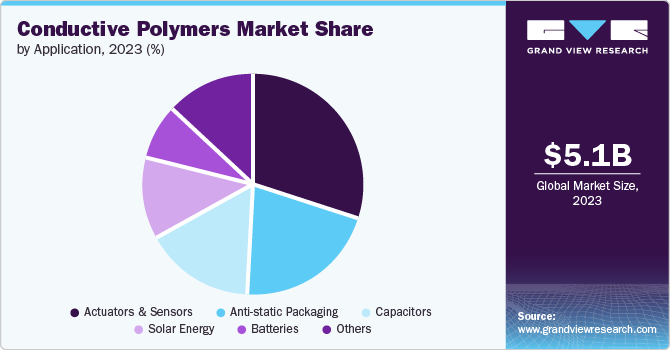

Application Insights

Actuators & sensors have secured the dominant market share in 2023. This can be attributed to the alarming demand for conductive polymer-based sensors in the automotive, aerospace, and electronics industries owing to their lightweight and versatile nature. These materials are also utilized to enhance fuel efficiency and reduce carbon emissions. Moreover, these polymers offer extensive design flexibility, which helps manufacturers create customized solutions for specific applications, including actuators and sensors. Furthermore, advancements in functional nanofillers, such as graphene, carbon nanotubes, and silver nanowires, further enhanced the performance of conductive polymers in actuators and sensors.

The solar energy segment is expected to grow exponentially at a CAGR of 11.2% during the forecast period. The rising adoption of solar panels globally fueled the demand for conductive polymers. These materials play a crucial role in photovoltaic cells, enhancing their efficiency and performance. Solar panels made with conductive polymers have become increasingly suitable for various installations, including residential, commercial, and utility-scale projects. In addition, conductive polymers gained major prominence in transparent solar cells with the emergence of nanoscience. These cells allow light to pass through while generating electricity, making them ideal for building-integrated photovoltaics (BIPV).

The solar energy segment is expected to grow exponentially at a CAGR of 11.2% during the forecast period. The rising adoption of solar panels globally fueled the demand for conductive polymers. These materials play a crucial role in photovoltaic cells, enhancing their efficiency and performance. Solar panels made with conductive polymers have become increasingly suitable for various installations, including residential, commercial, and utility-scale projects. In addition, conductive polymers gained significant prominence in transparent solar cells with the emergence of nanoscience. These cells allow light to pass through while generating electricity, making them ideal for building-integrated photovoltaics (BIPV).

Regional Insights

The conductive polymers market in North America held a lucrative share of 20.8% in 2023, owing to the emphasis on innovation, expansive R&D activities, and rapid growth in intelligent fabrics and electronics. Technological advancements in conductive polymers, including interactive textile surfaces and innovative processing techniques such as plating, printing, and coating, played a pivotal role in driving adoption. Additionally, the rising trend of miniaturized electronic devices, such as integrated circuits (ICs) and rechargeable batteries, has also driven market growth in this region.

U.S. Conductive Polymers Market Trends

Technological innovation in the electronics sector significantly propelled the U.S. conductive polymer market, including smartphones, wearables, and automotive electronics. Lightweight materials made with conductive polymers gained prominence in the U.S. automotive industry due to their impact on fuel efficiency and emissions reduction. Furthermore, the emphasis on renewable energy adoption in solar panels and energy storage systems fueled the market growth.

Asia pacific Conductive Polymers Market Trends

The Asia Pacific conductive polymer market dominated the global revenue share with 46.1% in 2023. As the region continues to be a manufacturing hub for electronic components, the need for lightweight, efficient materials, including conductive polymers, surged. Such materials are extensively applied in applications such as smartphones and wearable devices. Furthermore, the region hosted significant manufacturers and suppliers of conductive polymers, such as KEMET Corporation and Celanese Corporation. Their production facilities and research centers contributed to market growth.

The conductive polymer market in China was significantly augmented by the booming electronics industry. These materials, known for their versatility and conductivity, were applied to various electronic devices such as smartphones, wearables, and automotive electronics. In addition, the rising trend of miniaturization in the electronics sector has further fueled demand for conductive polymers. These materials were extensively applied to manufacture smaller and more compact devices.

Europe Conductive Polymers Market Trends

The Europe conductive polymer market led the market with 18.0% of the share in 2023, owing to the region's increasing emphasis on environmentally sustainable solutions. Bio-based and renewable polymers have gained major prominence in the market. Conductive polymers, derived from natural sources, offer an alternative to traditional petroleum-based plastics, aligning with sustainability goals.

Key Conductive Polymers Company Insights

Leading companies including 3M, Solvay, and SABIC maintain their strong presence in the market by strategically engaging in mergers, acquisitions, and collaborations. These partnerships provide access to cutting-edge technologies, broader product offerings, and improved distribution networks, enhancing their competitive advantage.

-

Solvay is a global chemical company with a strong presence in the conductive polymers sector across various industries. The company invests in R&D activities to develop advanced conductive polymer solutions. Their expertise in materials science and polymer chemistry drives product development.

-

SABIC (Saudi Basic Industries Corporation) is a global diversified chemicals company. The company actively operates in industries such as petrochemicals, plastics, and agri-nutrients.

Key Conductive Polymers Companies:

The following are the leading companies in the conductive polymers market. These companies collectively hold the largest market share and dictate industry trends.

- 3M

- Solvay

- SABIC

- PolyOne Corporation

- Lehmann&Voss&Co.

- RTP Company

- Parker Hannifin

- Sumitomo Chemical

- Premix OY

- Heraeus Group

- The Lubrizol Corporation

- Covestro

Recent Development

-

In October 2023, Solvay announced the launch of SolvaLite 716 FR, an innovative fast-curing epoxy prepreg system designed for a wide range of structural parts and reinforcements in premium battery electric vehicles (BEVs).

Conductive Polymers Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.50 billion

Revenue forecast in 2030

USD 9.03 billion

Growth rate

CAGR of 8.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Brazil, Argentina, Saudi Arabia, UAE

Key companies profiled

3M; Solvay; SABIC; PolyOne Corporation; Lehmann&Voss&Co.; RTP Company; Parker Hannifin; Sumitomo Chemical; Premix OY; Heraeus Group; The Lubrizol Corporation; Covestro

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

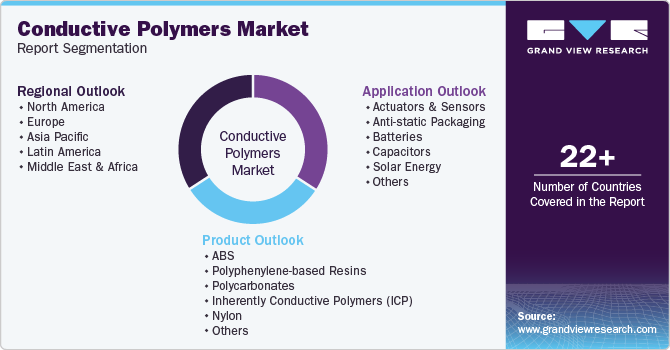

Global Conductive Polymers Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global conductive polymers market report based on product, application, and region.

-

Product Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

ABS

-

Polyphenylene-based Resins

-

Polycarbonates

-

Inherently Conductive Polymers (ICP)

-

Nylon

-

Others

-

-

Application Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Actuators & Sensors

-

Anti-static Packaging

-

Batteries

-

Capacitors

-

Solar Energy

-

Others

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Russia

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Vietnam

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.