- Home

- »

- Plastics, Polymers & Resins

- »

-

Flexible Packaging Market Size, Share, Growth Report, 2030GVR Report cover

![Flexible Packaging Market Size, Share & Trends Report]()

Flexible Packaging Market Size, Share & Trends Analysis Report By Material (Plastic, Paper, Metal, Bioplastic), By Product (Pouches, Bags, Films & Wraps, Rollstock), By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-504-5

- Number of Report Pages: 220

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Flexible Packaging Market Size & Trends

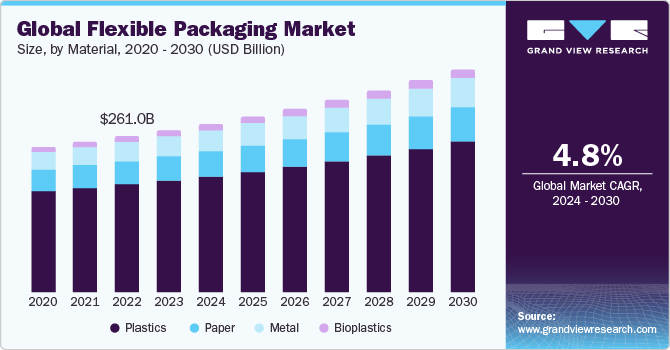

The global flexible packaging market size was estimated at USD 270.96 billion in 2023 and is expected to expand at a CAGR of 4.8% from 2024 to 2030. Increasing consumption of flexible packaging products in medical and pharmaceutical sectors is driving their demand. These products offer various advantages, such as container variety, need for less raw materials, ease of disposal, and lightweight nature, which are expected to fuel their demand over the forecast period.

According to the Flexible Packaging Association, nearly 34.7 million tons of all produced food is sent to landfills annually. Food waste generates 27.0 million tons of carbon dioxide. In addition, there are other indirect effects of food production on the environment, which include the greenhouse gases generated from cattle breeding, farm machinery, vehicles that transport food, and nutrient runoff from fertilizers that often lead to water pollution.

Extending food shelf life is necessary to reduce the amount of food waste dumped in landfills. Oxygen and moisture affect the freshness of food products, thereby rendering them unsafe for consumption due to mold formation on food products. The shelf life of food products depends on factors such as storage conditions, packaging material, and exposure to microorganisms, oxygen, light, and moisture.

The flexible packaging consists of plastic films with high barrier properties. The high-barrier properties efficiently block the transmission of moisture, light, and oxygen from contacting sensitive foods. Furthermore, the reseal closure products featured by flexible packaging allow users to securely close the bags or pouches, ensuring the freshness of the packaged food products over several uses.

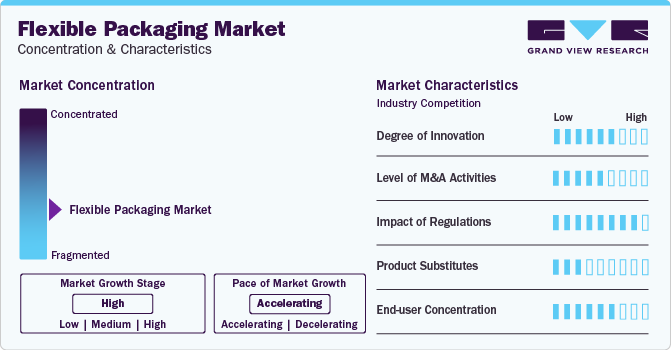

Market Concentration & Characteristics

The market is characterized by a considerable number of small and medium-sized market players, thereby leading to a fragmented market environment, especially in the downstream segment. Major players use product differentiation as a key strategy to increase demand for their products in the market. Furthermore, strategies including economies of scale, pricing, enhanced quality of products, and extension of product portfolios have given major market players a competitive edge over small and medium-sized regional players operating in different regions.

Companies are increasingly focusing on introduction of sustainable packaging material in flexible packaging space. For instance, in April 2024, Sealed Air and Ossid launched a new global partnership to provide case-ready processors a total solution for their tray overwrapping machinery and material needs. Under this new partnership, customers will be able to purchase a complete tray overwrap solution that includes machinery from Ossid and trays and film from SEE. This collaboration combines SEE’s expertise in sustainable food packaging material and Ossid’s deep portfolio of packaging machinery.

In February 2024, Amcor signed a deal with Cadbury to source 1,000 tons of post-consumer recycled plastic to wrap its core Cadbury chocolate range, accelerating Cadbury’s ambitions to reduce its virgin plastic needs. Cadbury aims to use 50% recycled plastic for its wrappers across its chocolate blocks, bars, and pieces range produced in Australia.

Material Insights

Based on material, plastics dominated the market with the largest revenue share of 69.08% in 2023. The demand for plastic in flexible packaging industry is expected to increase over the next seven years. Plastic is widely used in the food & beverage industry as they can take various forms and shapes which is a crucial advantage in this industry.

The paper segment is expected to grow at a significant growth rate over the forecast period. The growing demand for sustainable packaging materials has driven the demand for paper in flexible packaging applications. It is manufactured from wood pulp and is known for its lightweight, high tear resistance, thickness, and strength. Its coarse texture, due to highly oriented fibers, helps provide better protection than many packaging materials. Its biodegradable nature also allows it to be disposed of or recycled easily.

Key manufacturers are investing in recycled materials to accompany the regulations governed by regulating authorities. For instance, in October 2023, Amcor signed a Memorandum of Understanding (MOU) with SK Geo Centric (SK), a leading petrochemical company based in South Korea, to source advanced recycled material primarily in Asia Pacific region beginning in 2025. This MOU will enable the company to provide access to packaging solutions using recycled content for food and healthcare customers in key markets in Asia Pacific, as well as globally. This partnership is expected to take the company toward achieving its target of 30% recycled content across its portfolio by 2030.

Product Insights

Based on product, the pouches segment dominated the market with the largest revenue share in 2023. Pouches are small-sized single-use bags commonly made of plastic, aluminum foil, and occasionally of paper. They consist of two or more plastic films that are laminated together using heat and pressure or adhesives. Pouches are resealable and are considered a cost-effective alternative to metal, cardboard, and glass containers. Most pouches available in the market are multilayered.

The films & wraps segment is anticipated to grow at the fastest CAGR over the forecast period. Flexible films for packaging applications consist of multiple layers of plastic films that stick to each other. They are produced by extrusion. Flexible film packs are composed of multiple layers, each of them comprising a different kind of polymer.

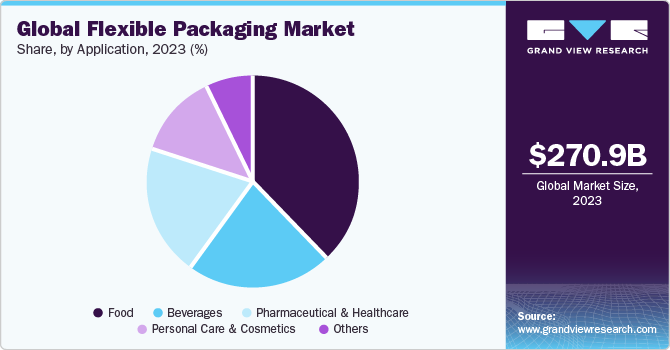

Application Insights

Key applications for flexible packaging products include food, beverages, pharmaceutical & healthcare, and personal care & cosmetics among others. The food segment dominated the market with the largest revenue share in 2023. Growing demand for packaged foods, including ready-to-eat meals, frozen meals, snack foods, and cake mixes, is expected to force flexible packaging manufacturers to increase production capacity, thus augmenting flexible packaging market demand over the forecast period.

In the context of pharmaceuticals, flexible packaging refers to non-rigid packaging forms used to package and protect a variety of drug items for medical use, including powders, tablets, and capsules. The most common types of flexible packaging in pharmaceuticals are pouches, blister packages, and strip packages. Some examples of flexible packaging for the pharmaceutical sector include ointments, creams, wipes, and medical swabs.

Regional Insights

North America has several flexible packaging manufacturers such as Amcor plc, ProAmpac, Mondi, American Packaging Corporation, Cheer Pack North America, and Eagle Flexible Packaging. These players are constantly engaged in developing sustainable flexible packaging options for various end-use industries to strengthen their market presence which can increase the penetration of flexible packaging solutions in North America. The government programs focused on increasing the labeling and traceability of the packaging circulating in the region are driving end-use industry companies to adopt flexible packaging solutions. In April 2023, Cheer Pack North America developed a new flexible packaging solution for packaging ScottsMiracle-Gro’s weed and grass killer concentrate. The company developed 5-ounce flexible spouted pouches that are the first of their kind in the lawn care market.

U.S. Flexible Packaging Market Trends

The flexible packaging market in the U.S. is expected to grow significantly over the forecast period due to the growing demand for packaging of food & beverage and healthcare products. This market is driven by the steady growth of the healthcare, food & beverage, and personal care industries. Lifestyle and demographic factors are also expected to propel demand for cosmetic products. The application of flexible plastic packaging products in numerous applications has encouraged manufacturers of rigid plastic packaging to shift towards flexible plastic packaging. The consumption of less energy and a significant decrease in the production of waste have prompted this shift.

Asia Pacific Flexible Packaging Market Trends

Asia Pacific dominated the global flexible packaging market and accounted for the largest revenue share of around 43.0% in 2023. The region has witnessed a significant increase in disposable income among consumers, thereby enabling them to buy products from a sizable number of retail locations. Key manufacturers operating in region have started investing in improving production processes to protect product integrity. For instance, in September 2023, Sealed Air collaborated with Sparck Technologies's for automated packaging systems to improve its packaging products operations. It is a provider of 3D automated packaging solutions, in Australia, New Zealand, Japan, and South Korea.

China flexible packaging market has shown rapid development in demand from end-use industries, such as food & beverage, pharmaceutical & medical, cosmetics, and household care, which is likely to create a large need for flexible packaging goods in China over the forecast period. Furthermore, the stringent regulations introduced by the government to reduce packaging waste and promote sustainability in packaging can support the growth of flexible packaging in China.

The flexible packaging market in India is anticipated to grow at a CAGR of over 6.5%. Rapidly changing food habits in the country coupled with increasing demand for convenience packaging has fueled demand for consumption of flexible packaging products such as stand-up pouches and flat pouches.

Europe Flexible Packaging Market Trends

Europe region is expected to witness increasing demand for flexible packaging products owing to the high growth of food & beverage sector. In food category, the industry has benefited from a substantial sale of ready-to-eat food products along with fruit compotes. Packaging requirements for these products are driven by increasing replacement of substitutes for flexible packaging such as glass and metal packaging.

Germany flexible packaging market held over 25% share of the European market in 2023, as Germany is the largest food producer in Europe and has encouraged the manufacturers of Flexible Packaging to target the consumers in the county.

The flexible packaging market in the UK is driven by growing innovation in packaging forms and materials. The presence of a large number of industries is contributing to the market growth in this country. The growing emphasis on quality healthcare is expected to drive the demand for packaging products as it would directly impact the demand for medical devices and pharmaceuticals.

Central & South America Flexible Packaging Market Trends

The countries in Central & South America such as Brazil, Argentina, and Chile have a well-established tomato puree processing industry. Brazil has a strong presence in the fruit juice market and is one of the leading exporters of fruits. The Central & South American countries export and import food & beverage products among themselves and to other regions. The tomato puree and fruit juice concentrates require adequate barrier against oxygen and moisture to prevent spoilage. For export, the processed food & beverage items are packed in liners that have an EVOH coating on the inner side.

Brazil flexible packaging market is driven by several companies engaged in scaling up the production of flexible packaging for various end-use industries such as food & beverage, pharmaceutical, and others. For instance, in March 2023, Heineken collaborated with Valgroup to develop shrink films with 30% recycled resins for alcoholic beverages across the country.

Middle East & Africa Flexible Packaging Market Trends

The flexible packaging market in the Middle East & Africa is undergoing a major transition owing to increasing consumer awareness and the introduction of a large number of soft drinks. These factors have led to an increasing inclination for natural and cleaner diets and a growing preference for packaged natural food which are expected to increase the demand for flexible packaging solutions over the forecast period.

Saudi Arabia flexible packaging market is witnessing growth due to the growing demand for meat, juices, milk, and dairy products. The juice, milk, and dairy products are packed in plastic bottles and containers. The waste generates due to rigid plastic packaging is driving the demand for flexible packaging products. To reduce waste, the government can drive the initiatives to promote sustainable packaging which can support the growth of flexible packaging in Saudi Arabia.

Key Flexible Packaging Company Insights

The market is highly fragmented with the presence of a sizable number of small and medium-sized companies. Key players mainly cater to food and beverage, pharmaceuticals, and cosmetics industries. Flexible packaging industry has been witnessing a significant number of mergers & acquisitions and new product launches over the past few years.

Key Flexible Packaging Companies:

The following are the leading companies in the flexible packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Amcor plc

- Mondi Group

- Huhtamaki Flexible Packaging

- Sonoco Products Company

- Sealed Air

- DS Smith

- Berry Global

- Constantia Flexibles

- Bemis Manufacturing Company

- UkrMetal

- ProAmpac

- Wipak Group

- FlexPak Services

- Transcontinental Inc.

- Coveris Holdings

- American Packaging Corporation

- InterFlex Group

- FLEX-PACK ENGINEERING, INC.

- Innovia Films

- Cosmo Films

- Novolex

- Sigma Plastics Group

- Graphic Packaging International, LLC

- Bischof+Klein SE & Co. KG

- Südpack

Recent Developments

-

In May 2024, Amcor and AVON both combinedly launch the AmPrima Plus refill pouch for the AVON Little Black Dress classic shower gels in China. The recycle-ready packaging will result in an 83% reduction in carbon footprint, and 88% and 79% reduction in water consumption and renewable energy respectively when it's recycled.

-

In August 2023, Amcor acquired Phoenix Flexibles, expanding its capacity in Indian market. Phoenix Flexibles is situated in Gujarat, India, and generates revenue of approximately USD 20 Mn per year from the sale of flexible packaging for food, home care and personal care applications. The acquisition also adds advanced film technology, enabling local production of a broader range of more sustainable packaging solutions, and brings capabilities allowing Amcor to expand its product offering in attractive high-value segments.

-

In February 2023, Sealed Air acquired Liquibox for a purchase price of USD 1.15 Bn on a cash and debt-free basis. Liquibox is a pioneer, innovator and manufacturer of Bag-in-Box sustainable fluids & liquids packaging and dispensing solutions for fresh food, beverage, consumer goods and industrial end-markets.

Flexible Packaging Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 281.80 billion

Revenue forecast in 2030

USD 373.34 billion

Growth rate

CAGR of 4.8% from 2024 to 2030

Base year

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

June 2024

Quantitative units

Volume in kilotons; revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors and trends

Segments covered

Material, product, application, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; Australia; South Korea; Indonesia; Malaysia; Philippines; Thailand; Vietnam; Myanmar; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Sonoco Products Company, Amcor plc; Mondi Group; Huhtamaki Flexible Packaging; Sealed Air; DS Smith; Berry Global; Constantia Flexibles; Bemis Manufacturing Company; UkrMetal; ProAmpac; Wipak Group; FlexPak Services; Transcontinental Inc.; Coveris Holdings; American Packaging Corporation; InterFlex Group; Innovia Films; Novolex; Sigma Plastics Group; Graphic Packaging International, LLC; Bischof+Klein SE & Co. KG; Südpack

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Flexible Packaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global flexible packaging market report based on material, product, application, and region:

-

Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Plastics

-

Polyethylene (PE)

-

Polypropylene (PP)

-

Polyamide (PA)

-

Polyvinyl Chloride (PVC)

-

Polystyrene (PS)

-

Others

-

-

Paper

-

Metal

-

Bioplastics

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Bags

-

Pouches

-

Retort Pouches

-

Refill Pouches

-

-

Rollstock

-

Films & Wraps

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food

-

Beverages

-

Pharmaceutical & Healthcare

-

Personal Care & Cosmetics

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Indonesia

-

Malaysia

-

Philippines

-

Thailand

-

Vietnam

-

Myanmar

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global flexible packaging market size was estimated at USD 270.96 billion in 2023 and is expected to reach USD 281.80 billion in 2024.

b. The global flexible packaging market is expected to grow at a compound annual growth rate of 4.8% from 2024 to 2030 to reach USD 373.34 billion by 2030.

b. The plastic segment accounted for over 69.08% share in 2023 owing to its property of keeping products fresher for a longer duration and offering strong resistance to moisture, dust, oxygen, and UV light; along with being cost effective.

b. The key market players in the flexible packaging market include Amcor plc, Mondi Group, Huhtamaki Flexible Packaging, Sonoco Products Company, SEE, Constantia Flexibles, Bemis Manufacturing Company, UkrMetal, ProAmpac, Wipak Group, Berry Global Inc, FlexPak Services, Transcontinental Inc., Coveris, DS Smith, American Packaging Corporation, InterFlex Group, FLEX-PACK ENGINEERING, INC., Innovia Films, Cosmo Films, Novolex, Sigma Plastics Group, Graphic Packaging International, LLC, Bischof+Klein SE & Co. KG, and Südpack

b. The key factors that are driving the growth for flexible packaging market include rising demand for low-cost, convenient, shelf appealing, and lightweight packaging by application industries, including food & beverages, pharmaceutical, personal care & cosmetics, and home care, among others.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."