- Home

- »

- Plastics, Polymers & Resins

- »

-

Plastic Packaging Market Size, Share & Growth Report, 2030GVR Report cover

![Plastic Packaging Market Size, Share & Trends Report]()

Plastic Packaging Market (2024 - 2030) Size, Share & Trends Analysis Report By Material, By Product (Rigid, Flexible), By Technology (Injection Molding, Extrusion, Blow Molding, Thermoforming), By Application, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-516-8

- Number of Report Pages: 215

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Plastic Packaging Market Summary

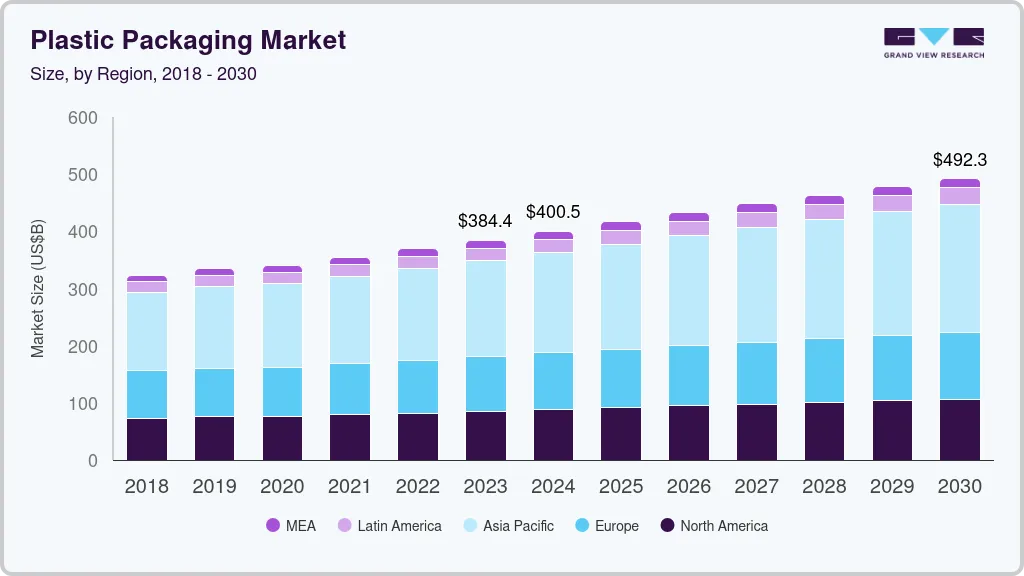

The global plastic packaging market size was estimated at USD 384.35 billion in 2023 and is projected to reach USD 492.29 billion by 2030, growing at a CAGR of 3.5% from 2024 to 2030. Expanding the size of key application industries including personal and household care, pharmaceuticals, food & beverages, and growing penetration of e-retail across the globe are primarily fueling growth of plastic packaging.

Key Market Trends & Insights

- Asia Pacific led the plastic packaging market and accounted for a revenue share of over 43.0% of the global revenue share in 2023.

- China dominated the Asia Pacific market in terms of both production and demand.

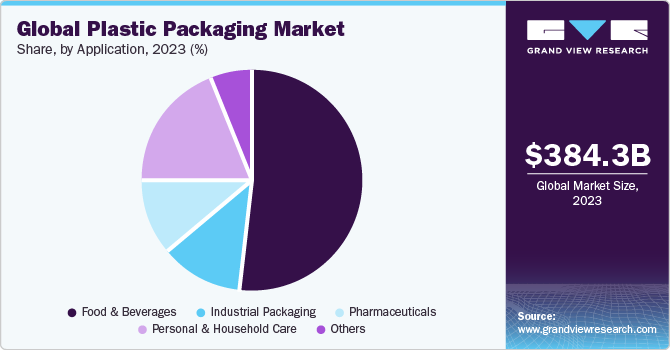

- Based on application, the food and beverage application segment led the industry and accounted for revenue share of over 51.0% in 2023.

- Based on technology, the extrusion technology in the technology segment accounted for the largest share of over 39.0% in 2023.

- Based on product, the rigid segment dominated the market for plastic packaging and accounted for the largest revenue share of over 60.0% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 384.35 Billion

- 2030 Projected Market Size: USD 492.29 Billion

- CAGR (2024-2030): 3.5%

- Asia Pacific: Largest market in 2023

Plastic offers both rigid & flexible, lightweight, and transparent forms of packaging on account of which the key industries such as food and beverage, household & personal care, and industrial primarily prefer it as a substitute over its counterparts such as glass or metal. Furthermore, engineered plastic exhibit’s ability to endure extreme environmental conditions and not degrading in extreme temperatures, thereby, preserving the integrity of products such as cosmetics and food & beverages. Moreover, the low cost and excellent printability associated with plastic make it a lucrative packaging material.

The extrusion technology segment is expected to witness robust growth in the U.S. market from 2024 to 2030. Extrusion-based plastic packaging products such as wraps & films, pouches, and plastic packaging bags are widely employed in most consumer as well as industrial applications in the country owing to their performance benefits and sustainability. The high penetration of organized retail across the U.S. has been a significant contributing factor to the large share of plastic packaging demand in the U.S.

The packaged food & beverage sector is witnessing robust growth globally for the past several years. Growing urban populations, changing lifestyles, rising economical activities in emerging countries, and increasing penetration of e-retail across the globe are expected to significantly drive the demand for packaged food. Besides, the demand for food is poised to grow as the world population is expected to increase from 7.3 billion in 2015 to 9.7 billion in 2050 and 10.4 billion in mid-2080’s based on United Nations projections, which in turn is anticipated to fuel the consumption of plastic packaging products for packaged food segment.

The robust growth of the e-commerce sector is also likely to open new avenues for industry growth. E-commerce companies prefer flexible and lightweight packaging solutions to reduce the transportation cost. The growth of online shopping for daily fresh foods, FMCG products, and electronic gadgets as well as clothing is expected to spur the industry growth.

Furthermore, the increasing introduction of innovative packaging solutions such as active packaging, modified atmosphere packaging, edible packaging, and bioplastic packaging is also expected to open newer avenues for plastic packaging in the coming years. Rising sustainability awareness and a stringent ban on single-use plastic to curb plastic pollution are likely to pose threat to the growth of the industry in the coming years.

The disruption of the material supply chain due to COVID-19 pandemic severely impacted the packaging industry. The lockdown in China in the first quarter of 2020, which is one of the key plastics manufacturer and supplier, with more than 30% of the global share, and closure of the trade boundaries among the global countries has impacted plastic packaging manufacturers globally. The shortage in supply of plastics from Chinese manufacturers increased the demand-supply gap since major manufacturing plants were shut down to curtail the pandemic spread. However, the demand-supply gap was majorly observed in the first quarter of 2020.

Manufacturers of plastic packaging products use various raw materials, including virgin plastics, recycled plastics, and biobased plastics, as well as other combinations such as plastics with paper and aluminum, to develop desired packaging products. Virgin plastics account for a significant share of the global plastic packaging market; however, the popularity of recycled plastics and biobased plastics has significantly increased worldwide over the past several years owing to their sustainability.

Market Concentration & Characteristics

Market growth stage is medium and is growing at an accelerating pace. The plastic packaging market is characterized by a moderate degree of innovation owing to the development of new products such as biodegradable plastics. Consumers prefer products that are offered in recycled containers or made from biodegradable material. There is also an increasing preference towards brands produced using sustainable practices.

The plastic packaging market is also characterized by a moderate level of merger and acquisition (M&A) activity. This is being undertaken to strengthen critical success parameters such as the plastic packaging portfolio, manufacturing capability, and geographical footprint. It also helps in improving cash flow, optimizing efficiency, and enabling better profitability.

The market is also subject to increasing regulatory scrutiny. International organizations such as the United Nations (UN) and the European Union (EU) have laid down specific regulations and guidelines for the production, harvesting and processing of flowers and aromatic crops.

Product substitutes are moderately available in the plastic packaging market. Certain plastic packaging can be substituted with a range of alternative materials such as aluminum, tin, glass, and paper & paperboard, among others. However, due to the high production costs associated with other forms of packaging, plastic is preferred and is anticipated to remain over the forecast period.

End-user concentration is a significant factor in the plastic packaging market. The food & beverage industry is its largest end-user. The changing lifestyle, growing urban population, rising economical activities in emerging countries, and increasing penetration of organized and e-commerce across the world have been driving the plastic packaging industry.

Material Insights

Based on material, the plastic packaging market is segmented into polyethylene (PE), polyethylene terephthalate (PET), polypropylene (PP), polystyrene (PS), expanded polystyrene (EPS), polyvinyl chloride (PVC), bio-based plastics, and others.

The polyethylene terephthalate (PET) material segment accounted for the market share above 33.0% in 2023. This positive outlook is due to its excellent properties, such as transparency, lightweight, and strong barrier against moisture and gases. PET is extensively used for packaging various beverages including water, vegetable oils, soft drinks, juices, energy drinks, and other food & beverages. In addition, it is used for packaging fresh and dried fruits, nuts, and snacks owing to its ability to maintain product freshness and integrity.

Polypropylene is also the major segment of the market, as it is known for its mechanical robustness and resistance to chemical solvents such as acids and bases. It is extensively used for manufacturing several plastic packaging products such as bottles, caps, containers, and packaging films, which are used in the food & beverage and dairy industries.

Product Insights

The rigid segment dominated the market for plastic packaging and accounted for the largest revenue share of over 60.0% in 2023 owing to their high aesthetic appeal and sturdiness. Besides, factors such as a high barrier to oxygen, moisture, and light provided by rigid packaging also contributed to the higher share of the segment in 2023. The reusability of rigid packaging products such as intermediate bulk containers, pallets, and other industrial packaging products is likely to favor the growth of rigid plastic products.

The rigid plastic-type segment is bifurcated into bottles and jars, cans, trays and containers, caps, and closures, etc. Plastic bottles are extensively utilized in beverage packaging owing to their low cost, convenience, and superior performance. Whereas trays and containers are utilized in foodservice and packaged food sectors owing to their lower weight and aesthetics. Flexible packaging type is further divided into four sub-segments, namely, wraps and films, bags, pouches, and others. Pouches are gaining significant popularity in the market as they demand lower plastic material to make as compared to rigid products such as bottles and jars.

Moreover, the convenience of multiple closure choices in pouches, such as a zipper, tear notch, and spout support the easy opening and closing of the packaging, which attracts the consumers to this packaging format. Growing demand for food on account of the increasing population in the Asia Pacific, particularly in India and China, is expected to boost the growth of the flexible packaging segment over the forecast period. Bioplastics have seen a growing demand due increasing adoption of sustainable materials by the manufacturers of flexible packaging solutions. Rising demand for bio-based PLA films in snack, food, confectionary, and bakery packaging applications, on account of their biodegradability and recyclability, is anticipated to be a major factor augmenting the segment growth over the forecast period.

Technology Insights

The extrusion technology in the technology segment accounted for the largest share of over 39.0% in 2023 in terms of revenue as the majority of the flexible packaging products such as bags, pouches, and films are produced by extrusion technology. The growing popularity of flexible packaging products owing to their higher sustainability and lower cost than their rigid counterparts is expected to advance the demand of the extrusion segment in the coming years.

The thermoform technology segment is anticipated to witness the highest CAGR of 4.4% from 2024 to 2030. Rigid packaging products such as blisters, clamshells, trays, containers, lids, bowls, plates, and others are manufactured using a thermoforming process. The growing demand for lightweight and thin-gauge packaging on account of a rising focus on sustainable packaging is expected attributed to the high growth of the thermoforming technology segment in the coming years.

A large number of food and beverage items such as dairy products, bakery products, meat, and others are packaged in thermoformed packaging as it acts as an excellent barrier to oxygen, air contaminants, and chemicals and increases the shelf life of the product. Moreover, thermoform packaging improves the aesthetic appeal of packed products and comes at a lower cost; such factors contributed to the higher adoption of thermoformed packaging in food and beverage applications. Injection molding technology is typically employed to produce rigid or sturdy plastic packaging products such as industrial containers, crates, caps, and closures.

However, higher lead time and tooling costs involved in injection molding technology are likely to hamper the growth of the segment over the forecast period. Blow molding is a popular plastic molding process, which is designed to create hollow parts such as bottles, liquid containers, drums, and storage tanks. There are three key types of blow molding technology namely, extrusion, injection, and injection stretch blow molding. Among these, extrusion blow molding is the most common process and is primarily utilized to create complex product shapes such as bottles or containers.

Application Insights

The food and beverage application segment led the industry and accounted for revenue share of over 51.0% in 2023. The segment is expected to witness a substantial growth during the forecast period. Changing consumer lifestyles and food preferences have led to the growth of the packaging and processed food manufacturing sector, which in turn is likely to propel the demand for plastic packaging. Also, increasing consumption of alcoholic and non-alcoholic beverages especially amongst the young population is expected to support the industry growth.

Single-serve consumer packaging has been witnessing significant growth in the past few years owing to its convenience. Growing consumer attention towards health and well-being, an increase in awareness regarding waterborne diseases coupled with rising spending capacities have propelled the demand for packaged drinking water across the globe, which is expected to impact them positively.

The personal and household care application segment is expected to witness a CAGR of over 3.7% in terms of revenue over the forecast period. This industry has witnessed significant growth owing to increasing consumer awareness of grooming and hygiene. Growing attentiveness about health and wellness in developing countries along with mounting consumer interest in plant-based or clean label cosmetics is also expected to play a key role in segment growth over the forecast period.

Favorable demographic trends in the European and North American regions due to the aging population are expected to create additional demand for pharmaceutical products, which in turn is expected to benefit the market. Moreover, expanding the production of generic medicines is anticipated to augment the demand for plastic packaging in the pharmaceutical application segment.

Moreover, growth in the utilization of shipping containers and import/export activities has fueled the growth of the industrial packaging segment. Shipping container liners are primarily used for the mass shipment of goods and commodities. However, stringent regulations and policies to curb the consumption of non-degradable packaging may restrain the growth of the industrial packaging segment over the forecast period.

Regional Insights

Asia Pacific led the plastic packaging market and accounted for a revenue share of over 43.0% of the global revenue share in 2023 and is projected to expand further at the fastest CAGR from 2024 to 2030. Rapidly growing application industries in key economies, such as China, India, Vietnam, South Korea, and Thailand are expected to drive the regional demand over the forecast period.

China dominated the Asia Pacific market in terms of both production and demand. The high population in the country supports the expansion of food and beverages, personal care, automotive, construction, and consumer electronics industries are anticipated to act as key drivers for the growth of the plastic packaging industry growth in the country.

Europe Plastic Packaging Market:

Europe emerged as the second-largest regional market for plastic packaging after the Asia Pacific; however, it is anticipated to witness a sluggish growth rate over the forecast period. Stringent regulations on the use of plastic packaging coupled with significant sustainable awareness among consumers are primarily attributed to the slow growth of the market in the region.

Furthermore, the European Parliament has set a plastic bottles collection target to 90% by 2029. Furthermore, the growing recycling content inclusion policies by the European Commission has mandated that by 2025, plastic bottles will contain at least 25% of recycled content which is expected to increase 30% by 2030. Such stringent regulations on the use of plastic are anticipated to lead to the development and adoption of alternative packaging products, thereby hampering the market growth.

Key Companies & Market Share Insights

The market is highly fragmented in nature with the presence of medium-sized and small-sized domestic players as well as large-sized international companies. The stringent regulations on excessive plastic packaging usage coupled with the growing sustainability awareness among consumers is driving the plastic packaging market to adopt sustainable packaging materials steadily. Key companies operating in the global plastic packaging market are majorly adopting acquisition strategies to expand their geographical presence and manufacturing capabilities. Some of the key players operating in the market include Amcor plc and Constantia Flexibles.

-

In October 2023, Greif Inc., a U.S. manufacturer of industrial packaging products and services, acquired PACKCHEM Group SAS, a French manufacturer of small plastic containers and barrier & non-barrier jerrycans and for a transaction value of USD 538 Billion, thereby enhancing its product portfolio through horizontal expansion.

-

In March 2023, SK Chemicals acquired the chemically recycled BHET and PET business division of Shuye, a Chinese company specializing in green materials for a value of USD 100 Billion.

-

Amcor plc operates through two business segments, namely flexible and rigid. The primary offerings of this segment include plastic, paper, and aluminum-based packaging products. The company mainly operates through two business segments, namely flexible and rigid. The primary offerings of this segment include plastic, paper, and aluminum-based packaging products.

-

Constantia Flexibles operates through two business segments, namely Consumers and Pharma. The company operates through two business segments, namely Consumers and Pharma.

-

Coveris and Alpha Packaging. Ltd are some of the emerging participants in the plastic packaging market.

-

Coveris offers an extensive range of plastic packaging products including films, pouches, bags, trays, and barrier films. It caters to a wide range of industries including food & beverage, household & personal care, healthcare, agricultural & chemical, and pet care.

Key Plastic Packaging Companies:

- Amcor plc

- Sealed Air Corporation

- Coveris Holdings SA

- Berry Global Inc.

- Mondi

- Sonoco Products Company

- WINPAK LTD

- CCL Industries, Inc

- Constantia Flexibles

- Alpha Packaging

- Pactive LLC

- Silgan Holdings Inc.

- DS Smith Plc

- Huhtamaki Oyj

- Takween Advanced Industries

- Transcontinental Inc.

- Bischof + Klein SE & Co. KG

- Uflex Ltd

- American Packaging Corporation

- Sigma Plastics Group

- Plastipak Holdings Inc.

- ES-Plastic GmbH

- Pact Group

- Anchor Packaging LLC

- Dart Container Corporation

- Novolex

- Printpack Inc.

- Reynolds Consumer Products Inc.

- Quadpack Industries SA

- Tetra Pak International SA (Tetra Laval Group)

- Toppan Inc.

- Plastic Packaging Technologies (PPT)

Plastic Packaging Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 400.49 billion

Revenue forecast in 2030

USD 492.29 billion

Growth rate

CAGR of 3.5% from 2024-2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative Units

Revenue in USD billion, Volume in Kilotons; and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, product, technology, application, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; China; India; Japan; South Korea; Australia; Southeast Asia; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Amcor plc; Sealed Air; Coveris; Berry Global Inc.; Mondi; Sonoco Products Company; WINPAK LTD.; CCL Industries, Inc.; Constantia Flexibles; Alpha Packaging

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Plastic Packaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global plastic packaging market report on the basis of material, product, technology, application, and region:

-

Material Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030))

-

Polyethylene (PE)

-

Polyethylene Terephthalate (PET)

-

Polypropylene (PP)

-

Polystyrene (PS)

-

Expanded Polystyrene (EPS)

-

Polyvinyl Chloride (PVC)

-

Bio-based plastics

-

Others

-

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Rigid

-

Bottles & Jars

-

Cans

-

Trays & Containers

-

Caps & Closures

-

Others

-

Flexible

-

Wraps & Films

-

Bags

-

Pouches

-

Others

-

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030))

-

Injection Molding

-

Extrusion

-

Blow Molding

-

Thermoforming

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030))

-

Food & Beverages

-

Industrial Packaging

-

Pharmaceuticals

-

Personal & Household Care

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Southeast Asia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global plastic packaging market size was estimated at USD 369.21 billion in 2022 and is expected to reach USD 384.4 billion in 2023.

b. The plastic packaging market is expected to grow at a compound annual growth rate of 3.6% from 2023 to 2030 to reach USD 492.3 billion by 2030.

b. Rigid product segment dominated the plastic packaging market with a share of over 61.0% in 2022, owing to the robust strength, performance benefits, and high aesthetic appeal of the rigid plastic product such as trays & containers, bottles & jars, and others.

b. Some of the key players operating in the plastic packaging market include Amcor plc, Sealed Air, Coveris, Berry Global Inc., Mondi, Sonoco Products Company, WINPAK LTD., CCL Industries, Inc., Constantia Flexibles, and Alpha Packaging

b. The key factors that are driving the plastic packaging market include expanding size of key application industries such as food & beverages and pharmaceuticals. Besides, expanding manufacturing and e-commerce activities across the world are also driving the global plastic packaging market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.