- Home

- »

- Next Generation Technologies

- »

-

Smart Building Market Size & Share, Industry Report, 2033GVR Report cover

![Smart Building Market Size, Share & Trends Report]()

Smart Building Market (2026 - 2033) Size, Share & Trends Analysis Report By Component (Solution, Service), By Solution, By Service, By End-use (Residential, Commercial, Industrial), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-964-3

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Building Market Summary

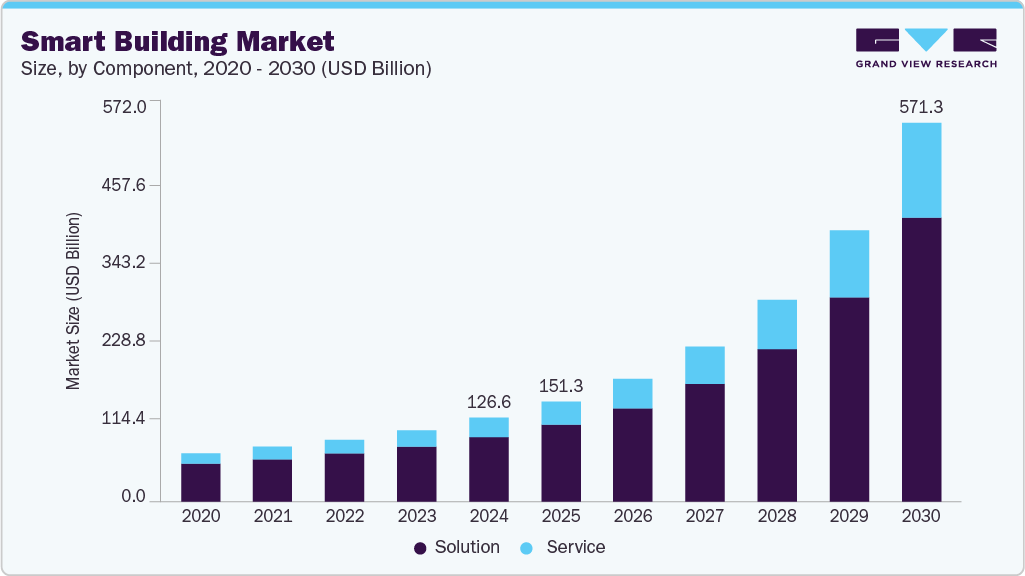

The global smart building market size was estimated at USD 141.79 billion in 2025 and is projected to reach USD 554.02 billion by 2033, growing at a CAGR of 18.9% from 2026 to 2033. The market growth is driven by the increasing adoption of IoT-enabled building management systems, rising demand for energy efficiency, and heightened awareness of sustainability.

Key Market Trends & Insights

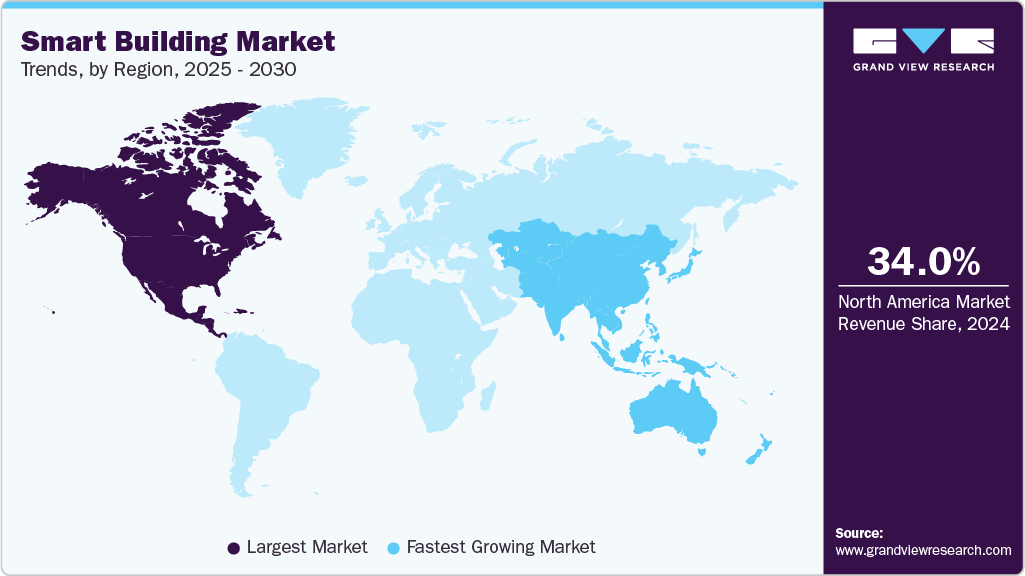

- The smart building market in North America accounted for the largest revenue share of over 35% in 2025.

- The U.S. smart building market dominated the market with a share of over 74% in 2025.

- By component, the solution segment accounted for the largest revenue share of over 77% in 2025.

- By solution, the safety & security management segment accounted for the largest market share in 2025.

- By end use, the commercial segment accounted for the highest market share over 53% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 141.79 Billion

- 2033 Projected Market Size: USD 554.02 Billion

- CAGR (2026-2033): 18.9%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Technological advancements in automation, data analytics, and AI-driven energy management solutions enable predictive maintenance, real-time monitoring, and optimized climate control, further accelerating smart building industry growth. The increasing adoption of advanced automation, IoT, and AI technologies to enhance energy efficiency, occupant comfort, and operational performance is significantly driving the market growth. Smart buildings integrate interconnected systems such as lighting, HVAC, security, and facility management into a centralized platform, enabling real-time monitoring and data-driven decision-making. Urbanization, sustainability mandates, and the growing demand for energy conservation are encouraging both private and public sectors to invest in these solutions. Furthermore, government initiatives and green building certifications are boosting the adoption rate worldwide, thereby expanding the smart building industry expansion.

In addition, technological advancements are redefining the smart building industry, with AI-powered analytics, edge computing, and digital twins becoming core enablers of operational excellence. Building management systems (BMS) are evolving from traditional monitoring tools to predictive and adaptive platforms, reducing costs and improving efficiency. The integration of renewable energy systems and smart grids enhances sustainability goals, aligning with global carbon reduction commitments. The rise of hybrid work models is prompting organizations to optimize space utilization through occupancy sensors and intelligent workspace management tools, thereby driving the market growth.

Furthermore, growing environmental concerns and stronger net-zero commitments are driving governments to intensify measures to cut energy consumption. Policies are being reshaped to focus on clean energy use, large-scale retrofits, and low-carbon technologies. These approaches aim to fight climate change, lower operating costs, and generate green jobs. By promoting renewable energy adoption and efficient systems, governments are speeding up decarbonization across multiple sectors.

Moreover, the competitive landscape is marked by the entry of innovative startups alongside established technology and construction firms, intensifying market rivalry. Vendors are increasingly focusing on interoperability, cybersecurity, and scalable solutions to address diverse customer needs. Partnerships between technology providers, real estate developers, and energy management firms are enabling holistic smart building ecosystems. As investment in infrastructure modernization accelerates, the smart building market is poised to become a cornerstone of future-ready urban environments, offering both environmental and economic value,

Component Insights

The solution segment accounted for the largest revenue share of over 77% in 2025. This segment includes advanced technologies such as AI-enhanced access control, biometric systems, video surveillance, emergency communication, and cybersecurity solutions, where occupant safety and threat prevention are critical. The market is driven by the rising adoption of IoT and AI for predictive building management, increasing integration of safety and operational systems, growing demand for mobile-based access credentials, and stringent building safety and sustainability regulations.

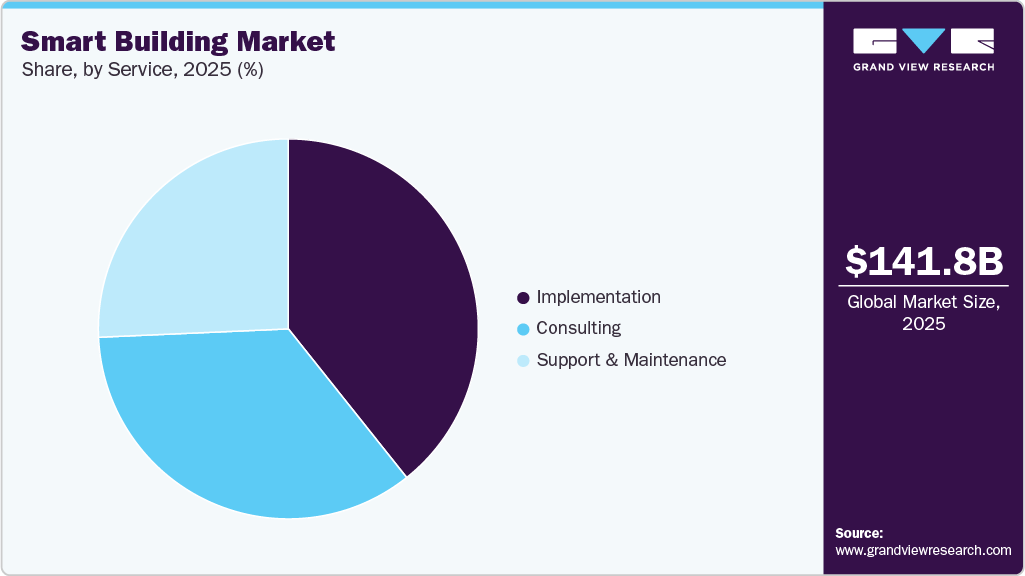

The service segment is expected to register the fastest CAGR of 20.7% from 2026 to 2033. This segment encompasses services such as predictive maintenance, commissioning, energy audits, and remote monitoring. The growing need for smart building services such as consulting, implementation, support, and maintenance is expected to boost the demand for the market. Smart building services are mainly driven by the growing need among the occupants to experience enhanced services such as smart lighting, personalized climate control, and indoor air quality monitoring.

Solution Insights

The safety & security management segment accounted for the largest market share in 2025. This segment encompasses technologies such as AI-enhanced access control, biometric systems, video surveillance, emergency communication, and cybersecurity solutions, where occupant protection and threat mitigation are paramount. Drivers include increasing regulatory emphasis on building safety standards, adoption of AI and IoT for predictive security intelligence, the rise of mobile credentials for seamless access, and growing demand for integrated systems that unify safety, security, and emergency response.

The energy management segment is expected to register the fastest CAGR from 2026 to 2033. This segment involves technologies such as AI-enhanced HVAC control, lighting management, energy optimization, demand-response systems, and smart metering, where operational efficiency and sustainability are paramount. The segmental growth is driven by tightening energy efficiency regulations, rising emphasis on net-zero and decarbonization goals, integration of IoT and AI for predictive energy analytics, and growing adoption of demand-side management and smart tariff schemes.

Service Insights

The implementation segment accounted for the largest market share in 2025, driven by the installation and deployment of advanced building technology systems, including actuators, sensors, and microchips, to collect and manage data for optimizing building operations. This infrastructure enables owners, operators, and facility managers to enhance asset reliability, ensure occupant comfort and safety, improve energy efficiency, and minimize operational costs. These factors drive the growth of the implementation segment in the market.

The support and maintenance segment is expected to register the fastest CAGR from 2026 to 2033. The growth is driven by the involvement of providing ongoing services after solution deployment to ensure optimal performance, system upgrades, and operational efficiency. Vendors conduct routine evaluations to implement technological enhancements and process improvements, enabling intelligent automation for cost-effective building operations in the smart building industry.

End Use Insights

The commercial segment accounted for the largest market share in 2025. The commercial segment encompasses smart solutions deployed in offices, retail spaces, hospitality facilities, and other commercial establishments, focusing on enhancing energy efficiency, operational performance, and occupant well-being. Growing concerns over rising energy consumption, coupled with stringent government regulations, are prompting the real estate sector to adopt advanced technologies that reduce operational costs and environmental impact.

The residential segment is expected to register a significant growth at a CAGR from 2026 to 2033, owing to HVAC management, smart door lock security systems, smart home lighting, and smart meters to manage and monitor mechanical and electrical systems within homes, enhancing energy efficiency, safety, and convenience through automation and remote operation. These factors collectively strengthen the segment’s growth, supported by the expansion of the consumer electronics sector, ongoing advancements in power-line communication technologies, rising disposable incomes, and increasing awareness of smart grid integration.

Regional Insights

North America smart building market dominated the global market with a revenue share of over 35% in 2025, driven by increasing public and private investments, coupled with the rapid adoption of digitalization across commercial, industrial, and residential sectors. The expanding integration of Internet of Things (IoT) technologies and advancements in digital infrastructure are enhancing building automation, energy efficiency, and security systems across the North America region.

U.S. Smart Building Market Trends

The U.S. smart building market dominated the market with a share of over 74% in 2025, driven by substantial government investments in digital infrastructure aimed at accelerating the country’s transition toward a digital economy. The U.S. government is actively focusing on digitizing commercial buildings to enhance citizen experiences and ensure service transparency. Various industries are converting their conventional offices into smart buildings to leverage advanced technologies for energy efficiency and operational excellence.

Europe Smart Building Market Trends

Smart building market in Europe is expected to grow at a CAGR of over 17% from 2026 to 2033, owing to the rising adoption of Industry 4.0 technologies and the growing integration of big data analytics, IoT, artificial intelligence (AI), and machine learning (ML) in building operations. Governments across countries are increasingly prioritizing digitalization initiatives to improve occupant safety, enhance operational efficiency, enable predictive maintenance, and support long-term sustainability goals in the smart building industry.

The Germany smart building market is expected to grow significantly in the coming years, owing to the rising need to reduce energy consumption amid increasing energy costs, prompting building owners and operators to adopt innovative solutions for efficiency and cost savings. Smart buildings in Germany leverage advanced energy management systems to optimize heating, ventilation, air conditioning, lighting, and other electrical operations.

Smart building market in the UK is rapidly expanding, driven by substantial growth as building owners and operators increasingly adopt connected technologies to improve energy efficiency, reduce operational costs, and meet stringent national sustainability targets. Government initiatives promoting digital infrastructure and decarbonization are catalyzing market adoption. The integration of cloud computing, analytics, and real-time data systems is enabling UK buildings to operate more sustainably, improve occupant experience.

Asia Pacific Smart Building Market Trends

The Asia Pacific market is expected to grow at the fastest CAGR of 21.6% from 2026 to 2033, owing to the rapid urbanization, increasing internet penetration, and a rising preference for remote building management services powered by IoT technology. Governments are making substantial investments in smart building infrastructure, fostering large-scale adoption across commercial and residential sectors. The shift in consumer focus toward upgrading existing properties into smart-enabled facilities is further accelerating regional demand.

The China smart building market is driven by the increasing digitalization of building systems, widespread rollout of 5G-powered IoT networks, and strong government backing for green and intelligent infrastructure initiatives. Tech giants such as Huawei and ZTE are advancing cloud-integrated building management platforms that enhance energy optimization, predictive maintenance, and occupant comfort.

Smart building market in Japan is rapidly expanding, driven by the country’s emphasis on disaster-resilient infrastructure and strict building codes, fueling demand for advanced smart building solutions. The expanding deployment of 5G networks supports real-time data communication and remote monitoring capabilities.

Key Smart Building Company Insights

Some of the key players operating in the market include ABB Ltd. and Johnson Controls, among others.

-

ABB Ltd. operates in four business segments: motion, robotics & discrete automation, electrification, and process automation. The company offers its products to 24 industries, including marine, automotive, smart cities, data centers, power generation, and ports. It has invested in various technology companies through its ABB Technology Ventures (ATV), such as AFC Energy, CMR Surgical, Element Analytics, Graphmatech, IMSystems, Natron Energy, Numocity, Spear Power Systems, Vicarious, Vion Technologies, and Stellapps. The company has established its service and dealer network in over 100 countries.

-

Johnson Controls designs and develops control and automation systems. Its product portfolio includes fire suppression, HVAC equipment, security, industrial refrigeration, smart home, fire detection, digital solutions, building automation & controls, distributed energy storage, and oil & gas products. The company serves data centers, academic institutions, sports & entertainment, residential, healthcare, industrial manufacturing, marine & navy, federal & state government, transportation, and urban markets.

Cisco Systems, Inc. and Emerson Electric Co. are some of the emerging market participants in the smart building market.

-

Cisco Systems, Inc. specializes in developing and distributing hardware and software solutions. The company serves industries such as mining, oil & gas, smart buildings, retail, education, financial services, government, transportation, utilities, healthcare, insurance, and entertainment. It offers various technological solutions, including cloud, data center, network infrastructure, mobility, IoT, security, AI, and analytics & automation.

-

Emerson Electric Co. designs, develops, and distributes automation and commercial & residential technological solutions. The company’s product portfolio includes fluid controls & pneumatics, automation & control modules, measurement instruments, control & safety systems, assembly & cleaning equipment, electrical components and lighting, HVAC, tools & vacuum systems, valves, actuators, regulators, and other service kits.

Key Smart Building Companies:

The following are the leading companies in the smart building market. These companies collectively hold the largest market share and dictate industry trends.

- ABB Ltd.

- BOSCH

- Cisco Systems Inc.

- Emerson Electric Co.

- Hitachi, Ltd.

- Honeywell International Inc.

- Intel Corporation

- Johnson Controls

- KMC Controls

- LG Electronics Inc.

- Legrand

- Schneider Electric Corporation

- Siemens AG

- Sierra Wireless (Semtech)

- Telit

Recent Developments

-

In December 2025, Cisco Systems Inc. announced its Advisor Select partnership with Environments to enhance network integration and automation in smart buildings, targeting offices, education, healthcare, retail spaces, industrial facilities, and data centers through IoT ecosystems of cameras, sensors, thermostats, lighting controls, speakers, security devices, and shades. This partnership underscores Cisco's strategic push in the smart building market, bolstering IoT-driven efficiency and interoperability across diverse sectors.

-

In November 2025, ABB Ltd. launched the ABB Ability BuildingPro platform, a cybersecure integration platform designed to connect, manage, and optimize building operations across commercial real estate, education, healthcare, hospitality, and government sectors. The solution unifies data from building systems to improve performance, reduce energy use, and enhance occupant experience, with open architecture for future AI-driven tools.

-

In July 2025, Siemens AG announced a collaboration with Microsoft to enable interoperability between Siemens' digital building platform, Building X, and Microsoft Azure IoT Operations. This partnership aims to revolutionize how Internet of Things (IoT) data is accessed and utilized in buildings, particularly across commercial buildings, data centers, and higher education facilities.

Smart Building Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 164.67 billion

Revenue forecast in 2033

USD 554.02 billion

Growth rate

CAGR of 18.9% from 2026 to 2033

Base Year of Estimation

2025

Actual rata

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, solution, service, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; South Korea; Australia; Brazil; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

ABB Ltd.; BOSCH; Cisco Systems Inc.; Emerson Electric Co.; Hitachi, Ltd.; Honeywell International Inc.; Intel Corporation; Johnson Controls; KMC Controls; LG Electronics Inc.; Legrand; Schneider Electric Corporation; Siemens AG; Sierra Wireless (Semtech); Telit.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Smart Building Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global smart building market report based on component, solution, service, end use, and region:

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Solution

-

Service

-

-

Solution Outlook (Revenue, USD Million, 2021 - 2033)

-

Safety & Security Management

-

Access Control System

-

Video Surveillance System

-

Fire and Life Safety System

-

-

Energy Management

-

HVAC Control System

-

Lighting Management System

-

Others

-

-

Building Infrastructure Management

-

Parking Management System

-

Water Management System

-

Others

-

-

Network Management

-

Wired Technology

-

Wireless Technology

-

-

Integrated Workplace Management System (IWMS)

-

Real Estate Management

-

Capital Project Management

-

Facility Management

-

Operations and Services Management

-

Environment and Energy Management

-

-

-

Service Outlook (Revenue, USD Million, 2021-2033)

-

Consulting

-

Implementation

-

Support & Maintenance

-

-

End Use Outlook (Revenue, USD Million, 2021-2033)

-

Residential

-

Commercial

-

Healthcare

-

Retail

-

Academic

-

Others

-

-

Industrial

-

-

Regional Outlook (Revenue, USD Million, 2021-2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global smart building market size was estimated at USD 141.79 billion in 2025 and is expected to reach USD 164.67 billion in 2026.

b. The global smart building market is expected to grow at a compound annual growth rate of 18.9% from 2026 to 2033 to reach USD 554.02 billion by 2033.

b. The North America regional market dominated the smart building market in 2025 and accounted for a market share of 35%. The regional smart building market growth can be attributed to the advancements in digital infrastructure solutions and rising public & private investments in smart city solutions.

b. Key players operating in the smart building market include ABB Ltd.; BOSCH; Cisco Systems Inc.; Emerson Electric Co.; Hitachi, Ltd.; Honeywell International Inc.; INTEL Corporation; Johnson Controls; KMC Controls; LG Electronics Inc.; Legrand; Schneider Electric SE; Siemens; Sierra Wireless; and Telit.

b. The growing adoption of Business Information Modeling (BIM), Artificial Intelligence (AI), Internet-of-Things (IoT), Virtual Reality (VR), cloud computing and data analytics is driving the growth of the smart building market. Further, the growing popularity of home automation, and rising preference towards working from home is further propelling the smart building market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.