- Home

- »

- Medical Devices

- »

-

Glucose Biosensors Market Size And Share Report, 2030GVR Report cover

![Glucose Biosensors Market Size, Share & Trends Report]()

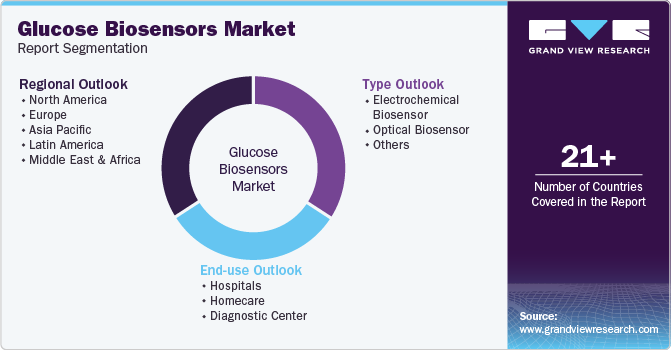

Glucose Biosensors Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Electrochemical Biosensors, Optical Biosensors), By End Use (Hospitals, Homecare, Diagnostic Centers), By Region, And Segment Forecasts

- Report ID: 978-1-68038-739-1

- Number of Report Pages: 190

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Glucose Biosensors Market Summary

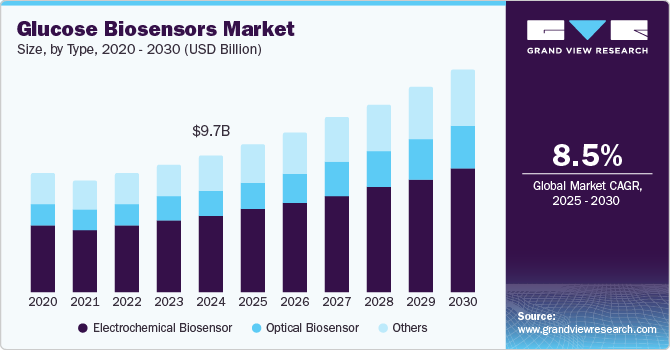

The global glucose biosensors market size was estimated at USD 9.68 billion in 2024 and is projected to grow at a CAGR of 8.5% from 2025 to 2030. The increasing prevalence of diabetes worldwide, rising awareness about self-monitoring blood glucose levels, and technological advancements in biosensor technology is driving market growth.

Key Market Trends & Insights

- North America glucose biosensors market dominated the overall global market and accounted for 32.62% of revenue share in 2024.

- By type, the electrochemical biosensor segment held the largest market share of 56.45% in 2024.

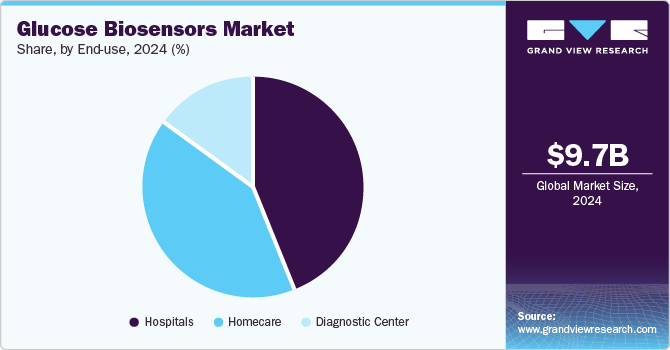

- By end use, the hospitals segment held the largest market share of 43.71% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 9.68 Billion

- 2030 Projected Market Size: USD 15.68 Billion

- CAGR (2025-2030): 8.5%

- North America: Largest market in 2024

For instance, an article published in the Lancet Journal in July 2023 stated that in 2021, the global population living with diabetes was approximately 529 million individuals, with an age-standardized prevalence of diabetes estimated at 6.1%.

It is projected that over 1.31 billion individuals globally may have diabetes by 2050, affirming its status as a prominent cause of mortality and morbidity worldwide, impacting individuals across nations, age groups, and genders indiscriminately.

Rising awareness about the importance of self-monitoring blood glucose levels, especially among diabetic patients, is driving market expansion. Continuous glucose monitoring systems (CGMS) have gained popularity due to their ability to provide real-time data, enabling better glycemic control and reducing the risk of complications associated with diabetes.

Growing demand for self-monitoring devices has augmented the use of biosensors, especially in portable forms. For instance, according to a study published by Springer Nature in June 2023, the newly created biosensor presents an alternative to electrochemical sensors, with its stable fabrication process making it a prime choice for lab-on-chip applications. Moreover, it is suitable for use as a portable and wearable blood glucose sensor. The golden standard method for diabetes diagnosis and management is still blood glucose detection. Apart from blood, saliva, urine, sweat, interstitial fluids, and tears, there are other bodily fluids in which glucose is present in various concentrations. For instance, in November 2021, Penn State University researchers invented a novel technique to assess glucose in sweat rather than blood, removing the need for a needle stick.

The market is also benefiting from the increasing adoption of telemedicine and digital health platforms, which facilitate remote monitoring of glucose levels and data management. For instance, according to a study published by SAGE Publications in June 2021, mobile health (mHealth) management demonstrated notable decreases in FBG, 2hPG, BMI, and HbA1c levels, along with enhanced patient quality of life and self-management. This may have been attributed to real-time feedback from an implanted glucose sensor and guidance from general practitioners via a mobile app. This approach holds great promise for promoting the management of Type 2 diabetes mellitus (T2DM) in China, and the study offers valuable insights for mHealth management internationally.

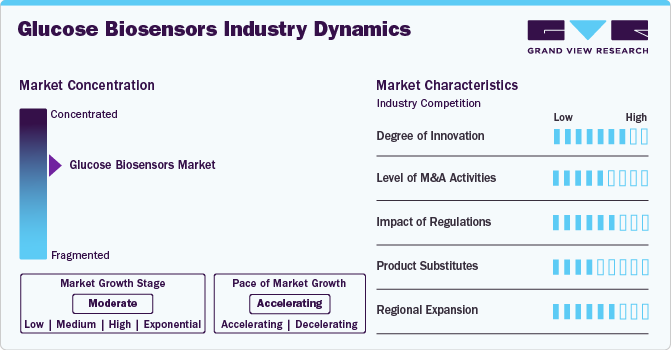

Market Concentration & Characteristics

The glucose biosensors industry exhibits a moderate level of concentration, with several key players dominating the industry. Market drivers include the increasing prevalence of diabetes globally, technological advancements in biosensor technology, and rising demand for continuous glucose monitoring systems. In addition, the industry benefits from favorable reimbursement policies and the development of innovative products by key players. Portable and wearable glucose monitoring devices are gaining traction, driven by the growing focus on remote patient monitoring and digital health solutions.

The glucose biosensors industry is characterized by a high degree of innovation, driven by advancements in sensor technology, miniaturization, and integration with digital health platforms. For instance, according to Science X Network in March 2024, TMOS researchers at RMIT University have advanced glucose monitoring by uncovering its infrared signature, leading to a 5mm optical sensor for potential non-invasive diabetes management.

Regulations play a crucial role in shaping the glucose biosensors industry, ensuring product safety, efficacy, and adherence to standards. For instance, the FDA in the U.S. regulates glucose monitoring devices, requiring rigorous clinical trials and premarket approvals. Compliance with regulatory requirements is essential for market entry and maintaining consumer trust. Stringent regulations also foster innovation by encouraging companies to invest in research and development to meet regulatory standards.

Mergers and acquisitions in the glucose biosensors industry are rising due to the need for research and development, reflecting the industry's dynamic nature. Companies are leveraging M&A activities to innovate and offer advanced solutions that meet the evolving needs of healthcare professionals. For instance, in January 2024, Trinity Biotech plc finalized an agreement to purchase the Continuous Glucose Monitoring assets and biosensor from Waveform Technologies, Inc., for USD 12.5 million in cash.

In the glucose biosensors industry, substitutes such as fingerstick glucose meters, continuous glucose monitoring systems (CGMS), implantable monitors, and non-invasive devices offer alternatives to traditional biosensors. For instance, CGMS provides real-time glucose data without frequent fingersticks, enhancing convenience and glycemic control. Emerging technologies aim to improve patient experience and may impact demand for traditional biosensors.

The glucose biosensors industry is expanding regionally due to rising global demand. This expansion may encompass efforts to enhance healthcare infrastructure, provide specialized training to healthcare professionals, and increase awareness among patients and referring physicians about the benefits of biosensors. For instance, in August 2020, Glucose Biosensor Systems (Greater China) Holdings Inc. intends to list its shares on the Nasdaq under GBSG. It proceeds to develop Saliva Glucose Biosensor and expand into the Asia-Pacific region.

Type Insights

The electrochemical biosensor segment held the largest market share of 56.45% in 2024. This substantial share reflects the increasing adoption of electrochemical biosensors in various applications, including medical diagnostics, environmental monitoring, and food safety. The growth of this segment can be attributed to several factors. For instance, electrochemical biosensors are known for their high sensitivity and specificity, which make them particularly effective for detecting glucose levels in diabetes management. In addition, technological advancements have enhanced the performance of these biosensors, leading to more widespread use in point-of-care testing. The electrochemical biosensor segment's significant market share reflects its crucial role in healthcare innovation and the increasing demand for reliable and efficient diagnostic tools.

The optical biosensor segment is expected to witness the fastest CAGR over the forecast period. The rising prevalence of chronic diseases and the need for effective monitoring solutions in personalized medicine are key drivers of this growth. In addition, the integration of optical biosensors with smartphone technology is making these devices more accessible and user-friendly, further enhancing their appeal in both clinical and home settings. Research institutions also increasingly utilize optical biosensors for high-throughput screening and drug discovery, contributing to their rapid adoption in various sectors. As innovation continues and new applications emerge, the optical biosensor segment is poised to lead the market expansion in the coming years.

End Use Insights

The hospitals segment held the largest market share of 43.71% in 2024. This dominance can be attributed to the high demand for glucose biosensors in hospitals. For instance, as per a publication by MJH Life Sciences in October 2023, employing continuous glucose monitoring (CGM) within noncritical care hospital environments could enhance glycemic management and potentially shorten hospital stays for individuals diagnosed with either type 1 or type 2 diabetes mellitus. In addition, hospitals often collaborate with manufacturers and researchers to drive innovation in glucose biosensors, ensuring that they remain at the forefront of diabetes management. Overall, hospitals serve as hubs of innovation, education, and clinical application in the market, ultimately improving the quality of care for individuals living with diabetes.

The homecare segment is projected to experience the fastest growth over the forecast period owing to the rising preference for managing diabetes at home. This trend reflects a broader shift towards patient-centric care, where individuals seek greater control over their health and lifestyle. Several factors contribute to this growth. Firstly, the increasing prevalence of diabetes globally, which is expected to reach 700 million cases by 2045, drives the demand for convenient home monitoring solutions.

Patients are increasingly utilizing devices such as continuous glucose monitors (CGMs) and smart insulin pens, which allow for real-time tracking of glucose levels and more informed decision-making regarding insulin administration and dietary choices. As awareness of diabetes management options continues to rise, along with advancements in technology that enhance usability and connectivity, the homecare segment is well-positioned for significant growth in the coming years.

Regional Insights

North America glucose biosensors market dominated the overall global market and accounted for 32.62% of revenue share in 2024. With a significant prevalence of diabetes in the region, there is a growing demand for accurate and efficient glucose monitoring devices. Continuous glucose monitors (CGMs) and point-of-care testing devices dominate the market, offering patients real-time monitoring and convenient patient testing options. Key players in the industry, including Abbott Laboratories, Dexcom, Inc., and Medtronic, continually strive to enhance product offerings and expand market presence.

U.S. Glucose Biosensors Market Trends

The glucose biosensors market in the U.S. held a significant share in the North America region in 2024. Several key drivers propel the glucose biosensors market in the U.S. Firstly, the escalating prevalence of diabetes necessitates reliable monitoring solutions. For instance, according to SingleCare Administrators, in January 2024, every 17 seconds, a new diabetes diagnosis is made in an American individual. Secondly, continuous technological advancements, particularly in continuous glucose monitors (CGMs), enhance accuracy and user experience. Thirdly, the convenience and accessibility of glucose biosensors empower patients to self-manage. Moreover, supportive regulatory policies and reimbursement systems encourage adoption. In addition, increasing awareness about the importance of glycemic control drives the demand.

Europe Glucose Biosensors Market Trends

The glucose biosensors market in Europe is experiencing notable growth due to its status as one of the most advanced regions globally, characterized by technological progress and robust infrastructure, facilitating ample healthcare facilities and high-quality patient care. For instance, the European Innovation Council (EIC) awarded Afon Technology USD 2.56 million in July 2023. Based in Wales, Afon is developing a non-invasive glucose sensor poised to revolutionize blood glucose monitoring. Scheduled for launch in 2024, the sensor has attracted significant interest for its potential to transform diabetes management.

The glucose biosensors market in the UK is witnessing dynamic trends driven by technological innovations, increasing diabetes prevalence, and shifting consumer preferences. For instance, according to The Independent, in January 2024, a novel wearable sensor, the Lingo device by health tech company Abbott, is set to launch in the UK. This innovative device, attached to the user's arm, tracks glucose levels in real-time and assists in cultivating healthier habits through its integration with a smartphone app, monitoring glucose fluctuations.

The France glucose biosensors market is poised for growth due to its robust healthcare system, with significant spending and quality services. This, coupled with technological advancements and government support, is expected to drive market expansion. For instance, Zimmer and Peacock, a prominent ISO13485 contract developer, hosted a workshop in France in September 2022, focusing on Continuous Glucose Monitoring and other wearable biosensors. The workshop offered technical insights and hands-on sessions for biosensor construction and testing.

The glucose biosensors market in Germany has a lucrative environment for technologically innovative startups. Around 80% of the medical device manufacturers, including companies of diabetes devices, in the country, are SMEs. The presence of major market players, such as B Braun Melsungen AG and Abbott Laboratories, is anticipated to create lucrative opportunities in Germany.

Asia Pacific Glucose Biosensors Market Trends

The glucose biosensors market in the Asia Pacific region is projected to experience notable expansion. This can be attributed to the presence of major market players and the increasing prevalence of diabetes. In addition, technological advancements in blood glucose monitoring devices, the increasing geriatric population, and the growing prevalence of lifestyle diseases, such as obesity, are among the factors anticipated to promote the growth of the glucose biosensors market.

The glucose biosensors market in Japan is experiencing growth by innovative technological advancements. For instance, according to Waseda University, in April 2023, researchers introduced a groundbreaking wireless bioresonator based on parity-time symmetry, capable of detecting tiny levels of tear glucose and blood lactate. This highly sensitive and adaptable bioresonator has the potential to transform personalized health monitoring and digitized healthcare systems, offering a new dimension to glucose monitoring and disease management. The development represents a significant leap forward in biosensor technology, positioning Japan as a leader in the field and paving the way for improved healthcare.

The glucose biosensors market in China is expected to grow, driven by increasing partnerships and private players' partnerships to promote adopting safer and cost-effective healthcare solutions. For instance, in January 2024, Trinity Biotech revealed its intention to collaborate with Bayer through a Letter of Intent to introduce a Continuous Glucose Monitoring (CGM) biosensor device in China and India. This partnership signals a strategic move towards addressing the growing demand for innovative diabetes management solutions in the region.

The India glucose biosensors market is witnessing several trends. Firstly, there is a growing demand for continuous glucose monitors (CGMs) and point-of-care testing devices due to the increasing prevalence of diabetes in the country. For instance, as Bennett, Coleman & Co. Ltd. reported in November 2023, India has over 100 million diagnosed or undiagnosed diabetes cases, with forecasts suggesting doubling this number within the next two decades. Secondly, technological advancements are leading to the development of more accurate and user-friendly biosensors, making them more accessible to a wider population. Additionally, there is a shift towards home-based monitoring solutions, empowering patients to monitor their glucose levels conveniently.

Latin America Glucose Biosensors Market Trends

The glucose biosensors market in Latin America is primarily driven by Brazil, Mexico, Argentina, and Colombia markets. Growing investments by market players in the region, proximity to North America, and free-trade agreements with major countries such as the U.S., Canada, Japan, & several European countries are among the factors anticipated to boost the Latin America market during the forecast period.

MEA Glucose Biosensors Market Trends

The glucose biosensors market in the Middle East and Africa (MEA) is experiencing notable growth. Rising rates of diabetes, fueled by lifestyle factors and urbanization, have led to increasing demand for glucose monitoring solutions across countries such as South Africa, Saudi Arabia, and the UAE. Government initiatives aimed at improving healthcare infrastructure and increasing diabetes awareness have significantly supported the adoption of biosensors, especially as these nations seek to address the growing burden of chronic diseases. Technological advancements, such as non-invasive and continuous glucose monitoring systems, are further enhancing market growth by offering more accurate, patient-friendly solutions, which are increasingly preferred by both patients and healthcare providers. Opportunities for market expansion lie in the development of portable and cost-effective glucose biosensors, which can enhance accessibility in rural and underserved areas within these countries. Moreover, strategic collaborations between global healthcare companies and local players, alongside an increasing adoption of telemedicine and mobile health platforms, are expected to further drive the glucose biosensor market in South Africa, Saudi Arabia, and the UAE.

The glucose biosensors market in Saudi Arabia is experiencing notable trends driven by factors such as increasing diabetes prevalence, product approvals, technological advancements, and growing healthcare infrastructure. For instance, in August 2023, Nemaura Medical's sugarBEAT, a non-invasive wearable glucose sensor, obtained approval from the Saudi Food and Drug Authority (SFDA) for distribution and use in Saudi Arabia. Saudi Arabia is poised to witness continued expansion in the glucose biosensors market, focusing on enhancing patient outcomes and quality of care.

The glucose biosensors market in Kuwait is expected to grow over the forecast period due to increasing awareness about health issues, medical technology advancements, and skilled healthcare professionals' availability. Additionally, supportive regulatory policies and increasing awareness about the importance of glycemic control are driving market expansion.

Insights From The Key Industry Experts

The biosensors typically consist of a biorecognition element (such as enzymes or antibodies) and a transducer that converts the biochemical reaction into a measurable signal. Glucose biosensors are widely used in diabetes management, providing real-time monitoring of blood sugar levels for timely intervention and treatment adjustments. Insights from industry experts provide valuable perspectives on the market, offering in-depth product analysis and forecasts on emerging trends, technological advancements, regulatory landscapes, and market dynamics.

Some of the industry insights are:

- “When coupled with One Drop’s telehealth platform and predictive capabilities, our biosensors will have the power to deliver personalized, preventative care to millions of more people worldwide,”

- Rachel Yap Martens, Senior Vice President of Commercial Strategy and Innovation.

- “Dexcom continues to lead innovation in the CGM market with a long list of first-in-market advances. Dexcom was the first to connect CGM to multiple insulin delivery devices, the first to connect CGM to a smartphone, the first to replace fingersticks for treatment decisions, and now is creating a new category by bringing the first glucose biosensor cleared for use over the counter”

- Jake Leach, Executive Vice President and Chief Operating Officer at Dexcom.

- “These simple tests will become more widely available for people to do at home. They’re going to talk to our phones, and they’re going to communicate with our doctors. The future of decentralized and democratized testing will enable us to have the right test at the right place at the right time and will give everyone actionable next steps.”

- CEO Robert Ford

- When someone is early in a workout - and they're exercising at high intensity - they'll actually see a rise in glucose. That's the body responding to the stress of the event. Later in exercise - and especially in endurance exercise - as glycogen stores are depleted, glucose will begin to lower. And that’s especially important in long-distance endurance events

- - Jim McCarter, Medical Affairs Director for Abbott.

- “Our breakthrough sensing technology has the potential to go beyond glucose and provide a lens into what's happening in the human body that could provide meaningful insights into other conditions, treatments and ultimately improve health. FreeStyle Libre changed the way millions of people manage their diabetes to get and stay healthier, and now we're bringing that same proven technology to empower athletes to help them reach their athletic performance goals,"

- - Jared Watkin, Senior Vice President of Abbott’s Diabetes Care Business.

Key Glucose Biosensors Company Insights

The scenario in the glucose biosensors industry is highly competitive, with mature players such as Abbott, Dexcom, F. Hoffmann-La Roche Ltd., and emerging players such as PalmSens and Biolinq incorporated. holding significant positions. The major companies are undertaking various organic and inorganic strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion for serving the unmet needs of their customers.

Key Glucose Biosensors Companies:

The following are the leading companies in the glucose biosensors market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott.

- Dexcom Inc.

- Ascensia Diabetes Care Holdings AG.

- Nova Diabetes Care

- F. Hoffmann-La Roche Ltd.

- Sanofi

- GlySens Incorporated

- Trividia Health, Inc.

- Bayer AG

- LifeScan IP Holdings,

- PalmSens

- Biolinq Incorporated.

- SB Solutions

- Nutrix AG

Recent Developments

-

In August 2024, Dexcom Inc. announced the launch of its over-the-counter continuous glucose monitoring (CGM) sensors in the United States. This new product aims to make glucose monitoring more accessible to individuals managing diabetes. The CGM sensors are available for up to USD 99, allowing consumers to purchase them without a prescription. This initiative reflects a growing trend toward empowering patients with the tools needed for effective diabetes management at home.

-

In March 2024, Dexcom's Stelo, the initial glucose biosensor authorized by the FDA for non-prescription use in the U.S., is intended for individuals aged 18 and above not undergoing insulin treatment.

-

In September 2023, Dexcom Canada and RxFood Corporation have announced a partnership in Canada to launch an advanced digital health solution for people with diabetes.

-

In September 2023, Abbott's acquisition of Bigfoot Biomedical advances its commitment to developing personalized, connected solutions for individuals with diabetes.

Glucose Biosensors Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 10.43 billion

Revenue forecast in 2030

USD 15.68 billion

Growth Rate

CAGR of 8.5% from 2025 to 2030

Actual Data

2018 - 2023

Forecast period

2025 - 2030

Report updated

October 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Abbott.; Dexcom Inc.; Ascensia Diabetes Care Holdings AG.; Nova Diabetes Care; F. Hoffmann-La Roche Ltd.; Sanofi; GlySens Incorporated; Trividia Health, Inc.; Bayer AG; LifeScan IP Holdings,; PalmSens; Biolinq Incorporated.; SB Solutions; Nutrix AG

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Glucose Biosensors Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global glucose biosensors market report based on type, end use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Electrochemical Biosensor

-

Optical Biosensor

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Homecare

-

Diagnostic Center

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global glucose biosensors market size was estimated at USD 9.68 billion in 2024 and is expected to reach USD 10.43 billion in 2025.

b. The global glucose biosensors market is expected to grow at a compound annual growth rate of 8.5% from 2025 to 2030 to reach USD 15.68 billion by 2030.

b. North America dominated the glucose biosensors market with a share of 32.62% in 2024. This is attributable to the growing burden of diabetes and the rising geriatric population.

b. Some key players operating in the glucose biosensors market include Abbott Laboratories; Dexcom; Ascenia Diabetes Care; Nova Diabetes Care; F. Hoffmann-La Roche Ltd.; Sanofi; GlySens Incorporated; Trividia Health; Bayer, Lifescan.

b. Key factors that are driving the glucose biosensors market growth include increasing incidence of diabetes and raising awareness about diabetes preventive care.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.