- Home

- »

- Consumer F&B

- »

-

Goat Milk Products Market Size & Share Analysis Report, 2030GVR Report cover

![Goat Milk Products Market Size, Share & Trends Report]()

Goat Milk Products Market Size, Share & Trends Analysis Report By Type (Liquid Milk, Powdered Milk), By Distribution Channel (B2B, B2C), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-916-2

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Report Overview

The global goat milk products market size was estimated at USD 12.45 billion in 2022 and is expected to expand at compounded annual growth rate (CAGR) of 4.7% from 2023 to 2030. The growth is driven by the growing lactose intolerant population, increasing number of health-conscious consumers, rising infant population, and developments in technology. Goat milk is a rich source of proteins, calories, and fats. It is thicker, creamier, easy to digest, and embeds a lesser risk of allergies as it has a slightly lower lactose content. It is loaded with potassium, calcium, magnesium, vitamin A, and phosphorus.

The COVID-19 pandemic significantly affected various industries across the globe. The pandemic had a moderate impact on the goat milk products industry. It resulted in the uncertainty of raw material prices, shortage of goat feed, pandemic restrictions affecting the supply chain, and increased dependency on e-commerce platforms that negatively affected the market. During the confinement and post-confinement months, the economic impact of the pandemic on goat milk pricing was negative.

Furthermore, the trend of lower goat milk prices was maintained in the months that followed, corresponding to the post-confinement period. Few countries in the world are responsible for the majority of global goat milk production. This includes countries such as India, Turkey, Sudan, Bangladesh, Pakistan, and France, among a few others. Due to transportation restrictions, a slight hindrance was observed in the supply chain from these countries.

Various end-products such as cheese, butter, ice cream, yogurt, etc. are made using goat milk. It is extensively used to make cheese, a special cheese made using goat milk, which is popular in Europe and North America. The demand for goat milk products was high during the period of lockdown. Various companies launched new products with a long shelf-life, in response to increasing consumer demand for such products during quarantine. In 2020, Delamere Dairy launched a new whole milk powder made up of goat’s milk in response to consumer demand during the COVID-19 pandemic.

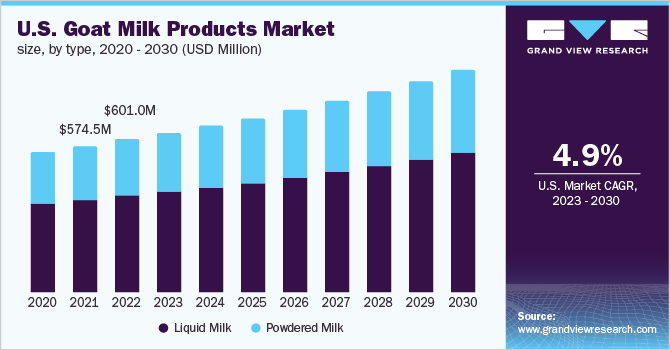

Type Insights

The liquid milk segment accounted for 63.7% of the global revenue share in 2022. It is sold directly to customers as well as end-product manufacturers such as cheesemakers. Goat milk cheese has many nutritional values and is low in fats and calories. It is available in different types and flavors such as cheddar, chevre, feta, mold, and morel. Health benefits associated with goat milk are influencing people to opt for these products.

Consumption is high in countries such as India, Pakistan, Bangladesh, and Turkey, among some European countries. Many types of goats are used to extract liquid milk. Some of the popular goats are Alpines, La Machas, Nigerian Dwarf, Oberhaslis, Saanens, and Nubians, among others. The consumption of goat milk has been increasing in recent years owing to the numerous health benefits it offers, such as healthy weight gain, easy digestion, increased platelet count, prevention of insulin resistance, and reduction of cholesterol levels.

Goat milk contains a substantial amount of A2 casein. For instance, 100ml of goat milk contains about 3.6 grams of A2 casein. A2 casein has a high protein level, like in human breast milk, and as a result, it helps in the prevention of inflammatory diseases like colitis and irritable bowel syndrome. After breastmilk, infants are typically given goat milk as their first protein source. This makes them less prone to milk allergies than cow’s milk.

The powdered milk segment is expected to grow at a CAGR of 4.9% over the forecast period. It is gaining popularity among infant formulae manufacturers. According to National Center for Biotechnology Information (NCBI), China is the largest importer of dairy products and imports powdered goat milk, especially for baby formula manufacturing. Powdered goat milk is costlier than liquid goat milk and can be stored longer than liquid milk.

One of the major factors driving the demand for powdered goat milk in recent years is its long shelf life and this was especially evident during the pandemic-induced lockdown. A shortage of fresh milk drove hordes of consumers to opt for powdered milk as this was easier to stock up for longer periods. The demand for powdered goat milk has also been increasing among manufacturers of infant formula due to its high beta-casein content, high nutritional value, lower alpha S1-casein, and low sugar content.

Distribution Channel Insights

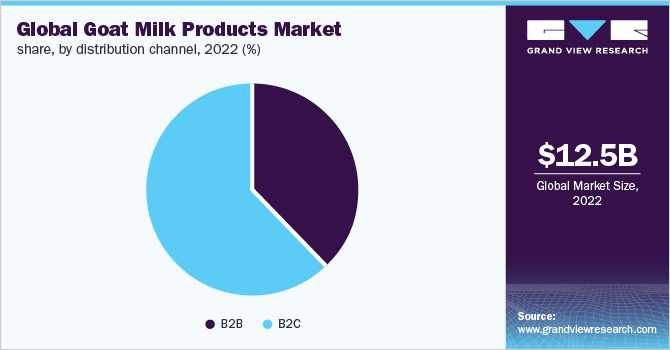

The B2C segment dominated the market and accounted for 61.6% of the global revenue share in 2022. The B2C channel provides goat milk products directly to customers. The segment is further divided into hypermarkets/supermarkets, speciality stores, convenience stores, and online retail, among other sales channels. The majority of these products are sold through dairies or specialty stores. Milk producers/farmers deliver their goat milk to dairies which is then processed into packaged liquid milk or powdered milk. Similarly, numerous hypermarkets/supermarkets are offering goat milk and its products. A few of these are Whole Foods Market, Walmart, Kroger, Costco, Tesco, Auchan, Argos, Star Market, Wegmans, and Carrefour.

Due to the ongoing pandemic, consumers are shifting toward e-commerce. This trend has influenced e-commerce companies to sell groceries through their online retail channels. Some of the companies that are offering goat milk products through the online-retail channel are Supermarket Grocery Supplies Pvt Ltd (Big Basket), Aadvik Foods and Products Pvt. Ltd, Courtyard farms, Farm fresh, Nutragoat, Amazon, Flipkart, Wellversed, Cora Health & Wellness, and Vistara Farms Private Limited.

Producer sells goat milk cheese individually or together with other products. For instance, the Feuille du Limousin, a French goat's milk cheese made from raw and whole milk is sold fresh, medium-aged, and fully ripened. It is sold through commercial networks like dairy dealers, local markets, retailers, supermarkets, and hypermarkets in various areas, including Limousine, Paris, and Toulouse.

The B2B segment is expected to grow at a CAGR of 4.9% over the forecast period. This segment includes the sale of goat milk products i.e., liquid milk and powdered milk to the end-products manufacturers. The manufacturers then make different products such as butter, cheese, flavored milk, and yogurt, among other products. It is expected to witness robust growth over the forecast period owing to the increasing demand for chevre and baby formulae. Goat milk is easy to digest and contains an adequate amount of nutrients, thus infant formulae manufacturers are utilizing it in manufacturing baby formulae.

Goat milk producers prefer to sell their products in local markets. B2B distribution channels are preferred for long-distance sales within the state and surrounding states. According to the Atlantic Corporation for the Northeast Dairy Business Innovation Center (NE-DBIC), most producers handle their distribution. 35% of respondents seek the help of a distribution company, many of which use Farm Connex or Provisions International. Others indicated using Saxelby Cheese, Black River Produce, Milk Mavens, and Pumpkin Village North.

Regional Insights

Asia Pacific dominated the market and accounted for a 52.7% share of global revenue in 2022. India, Pakistan, Bangladesh, and China are the largest goat milk producers and consumers in the world. India ranks first in its production and consumption in the world with around 25% of the global output. According to NCBI, around 60% of the global goat are found in the Asia Pacific only.

Dairy product consumption continues to increase at a significant rate in the U.S. owing to the increasing awareness regarding the health and benefits of milk and milk products among consumers. According to the United States Department of Agriculture (USDA), per capita consumption of dairy products was 655 pounds in 2020, an increase of 26 pounds from 2015’s per capita consumption i.e., 628 pounds.

Europe is anticipated to grow at a CAGR of 5.1% over the forecast period in terms of revenue. Growing consumer inclination towards healthy foods due to the rising health and wellness trend is a major factor driving the goat milk demand in the region. Countries such as Germany, Italy, and France are the major contributors to the regional market. Germany is the largest importer and exporter of goat milk in the world. France is the largest producer of goat milk in Europe and Italy is estimated as the largest consumer of goat milk in the region.

Key Companies & Market Share Insights

The global goat milk products industry is characterized by the presence of numerous players such as Ausnutria Dairy Corporation Ltd., Emmi Group, Goat Partners International Inc., Holle Baby Food AG, St Helen’s Farm, Hewitt’s Dairy, Woolwich Dairy Inc., Xi'an Baiyue Goat Dairy Group Co.Ltd., HiPP, and Courtyard Farms.

Companies are increasingly focusing on producing new products to gain global market share. For instance, in 2021, Ausnutria Dairy Corporation Ltd launched CBM Goat Power, a range of protein-rich goat milk ingredients. Similarly, in 2020, Delamere Dairy launched goat milk powder in the U.K. It is available in a 400 grams pack which can be used to produce 3.8 liters of goat milk. Some prominent players in the global goat milk products market include:

-

Ausnutria Dairy Corporation Ltd.

-

Emmi Group

-

Goat Partners International Inc.

-

Holle baby food AG

-

St Helen’s Farm

-

Hewitt’s Dairy

-

Woolwich Dairy Inc.

-

Xi'an Baiyue Goat Dairy Group Co.Ltd.

-

HiPP

-

Courtyard Farms

Goat Milk Products Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 12. 98 billion

Revenue forecast in 2030

USD 17.95 billion

Growth Rate

CAGR of 4.7% from 2023 to 2030 in terms of revenue

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; U.K.; Italy; China; Japan; India; Australia; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Ausnutria Dairy Corporation Ltd.; Emmi Group; Goat Partners International Inc.; Holle baby food AG; St Helen’s Farm; Hewitt’s Dairy; Woolwich Dairy Inc.; Xi'an Baiyue Goat Dairy Group Co.Ltd.; HiPP; Courtyard Farms

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Goat Milk Products Market Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global goat milk products market report based on type, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030 )

-

Liquid Milk

-

Powdered Milk

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

B2B

-

B2C

-

Hypermarkets/Supermarkets

-

Convenience Stores

-

Specialty Stores

-

Online Retail

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

U.K.

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Asia Pacific dominated the goat milk products market with a revenue share of 52.7% in 2022, on account of several factors including the large production of goat milk in the countries such as India, China, Pakistan and Bangladesh. In addition, goat milk products are readily available in the local market of the region which further drives the regional market.

b. Some of the key players operating in the goat milk products market include Ausnutria Dairy Corporation Ltd., Emmi Group, Goat Partners International Inc., Holle baby food AG, St Helen’s Farm, Hewitt’s Dairy, Woolwich Dairy Inc., Xi'an Baiyue Goat Dairy Group Co.Ltd., HiPP, and Courtyard Farms

b. The key factors that are driving the goat milk products market include growing health and wellness trend among consumers and increasing lactose intolerants population globally

b. The global goat milk products market size was estimated at USD 12.45 billion in 2022 and is expected to reach USD 12.98 billion in 2023

b. The goat milk products market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.7% from 2023 to 2030 to reach USD 17.95 billion by 2030

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."