- Home

- »

- IT Services & Applications

- »

-

Grant Management Software Market Size, Share Report, 2033GVR Report cover

![Grant Management Software Market Size, Share & Trends Report]()

Grant Management Software Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Solution, Services), By Deployment Mode, By Function, By Platform, By Organization, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-542-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Grant Management Software Market Summary

The global grant management software market size was estimated at USD 2.66 billion in 2024 and is projected to reach USD 6.19 billion by 2033, growing at a CAGR of 10.0% from 2025 to 2033, as government bodies, philanthropic foundations, and international development agencies are launching more grant programs to address social issues, economic development, education, healthcare, and environmental sustainability. With increasing regulatory scrutiny and the need for accountability in fund allocation, organizations are prioritizing tools that help them meet compliance requirements.

Key Market Trends & Insights

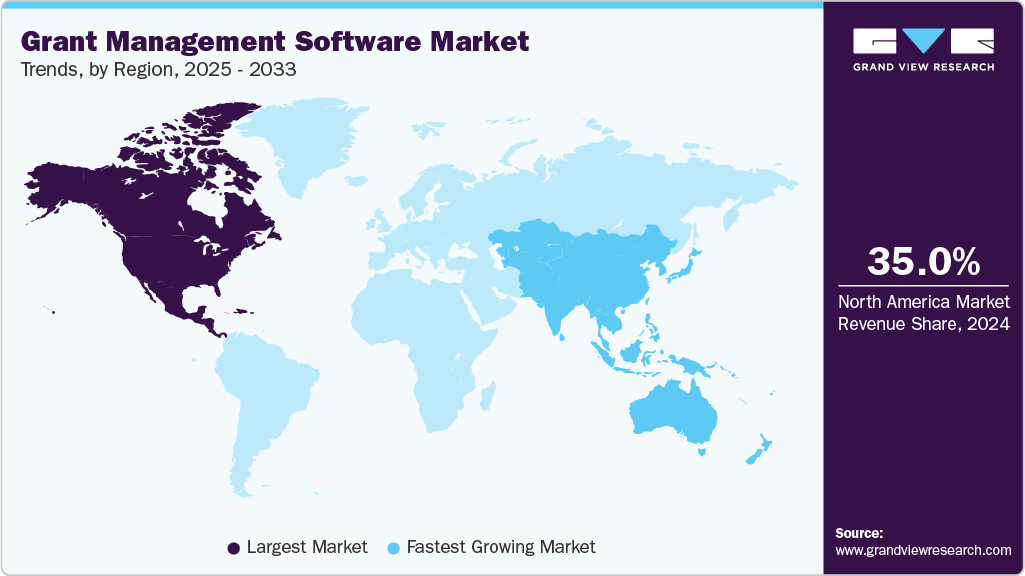

- North America grant management software dominated the global market with the largest revenue share of 35.0% in 2024.

- The grant management software industry in U.S. is expected to grow significantly over the forecast period.

- By type, solution segment led the market and held the largest revenue share of 60.2% in 2024.

- By deployment, on-premise segment led the market and held the largest revenue share in 2024.

- By end use, the corporations segment is expected to expand significantly over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 2.66 Billion

- 2033 Projected Market Size: USD 6.19 Billion

- CAGR (2025-2033): 10.0%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Grant management software provides a centralized system that ensures documentation, audit trails, and financial reporting are accurate and easily accessible. This feature is especially critical for nonprofits and educational institutions that must comply with strict donor or government regulations.The ongoing digital transformation trend across nonprofit organizations, universities, research institutions, and public agencies is also a significant driver. These entities are seeking to replace manual, spreadsheet-based processes with automated, cloud-based solutions. Grant management software helps reduce administrative burden, improve collaboration between stakeholders, and enhance data-driven decision-making, leading to increased operational efficiency.

The shift toward cloud-based grant management solutions is accelerating due to their scalability, lower upfront costs, and remote accessibility. Cloud-based platforms also offer easier integration with other enterprise systems like finance, HR, and CRM tools, enabling seamless workflows and data sharing. This flexibility is attractive to both large and small organizations looking for tailored and scalable grant management ecosystems. For instance, in July 2024, Euna Solutions, a U.S.-based provider of cloud solutions for the public sector, joined the AWS Partner Network as a Public Sector Partner.

The adoption of AI-driven automation and predictive analytics is expected to improve the efficiency of grant management by handling repetitive tasks, enhancing decision-making, and delivering real-time insights into funding outcomes. Tools such as AI chatbots and virtual assistants will simplify communication with applicants, easing the administrative load. Moreover, blockchain technology is poised to boost transparency and security in grant processes by creating tamper-proof transaction records, reducing fraud, and strengthening accountability. The growing use of cloud-based, mobile-first platforms will further support remote collaboration and ensure accessible, cross-device functionality for a distributed workforce.

Component Insights

The solution segment dominated the market and accounted for the revenue share of 60.2% in 2024. Compliance with evolving government regulations, donor guidelines, and international standards is becoming more complex. Grant recipients and grant-makers face increasing pressure to maintain transparent audit trails and provide detailed reports on fund usage. The solution segment is growing as software providers embed powerful compliance tracking, real-time reporting, audit-ready documentation, and role-based access features into their platforms. These capabilities are crucial in sectors like education, public health, and research, where grant misuse can lead to legal and reputational risks

The services segment is anticipated to grow at a significant CAGR during the forecast period. Many grant-receiving organizations such as smaller nonprofits or academic institutions lack in-house technical expertise to use new software effectively. This has created significant demand for training services that cover system navigation, reporting tools, compliance features, and administrative functions. Vendors are responding with on-site workshops, virtual training programs, and certification modules to improve user adoption and productivity.

Function Insights

The application tracking segment dominated the market and accounted for the largest revenue share in 2024. Grant administrators and program managers increasingly require real-time visibility into the application pipeline. Application tracking tools with dashboard analytics and workflow visualization features are helping organizations gain operational clarity, allocate review resources effectively, and shorten approval cycles, thus enhancing the overall efficiency of the grant process.

The reporting segment is expected to grow at a significant CAGR over the forecast period, driven by the growing need for transparency in how grants are used. Donors, funding agencies, and regulatory bodies increasingly require detailed reports outlining how funds were allocated, spent, and what outcomes were achieved. Grant Management Software with robust reporting modules enables grant recipients and administrators to generate accurate, real-time reports that enhance credibility and ensure continued funding, making reporting capabilities a central component in software adoption.

Deployment Insights

The on-premise segment dominated the market and accounted for the largest revenue share in 2024 due to its ability to offer customized features and meet strict regulatory requirements. Government bodies, nonprofits, and large organizations often have unique audit, reporting, and security needs that demand tailored systems. On-premise setups enable full control over workflows, security settings, and compliance with standards like GDPR, HIPAA, and financial regulations. Universities and research institutions also prefer on-premise solutions, valuing their secure data storage, audit trail capabilities, and integration with legacy systems. These features support long-term data retention and regulatory compliance, essential for managing complex and sensitive research funding.

The cloud segment is expected to grow at a significant CAGR over the forecast period. Cloud-based grant management solutions provide real-time, remote access, allowing smooth collaboration between grant managers, funders, and applicants, suitable for organizations with dispersed teams or global programs. These platforms also deliver automatic updates, security enhancements, and new features without relying on internal IT teams, helping organizations stay current with technology and compliance standards while boosting efficiency and minimizing downtime.

Platform Insights

The web segment dominated the market and accounted for the largest revenue share in 2024. Web-based grant management solutions eliminate the need for extensive IT support, hardware installations, or complex updates. Software providers can deploy updates, security patches, and new features directly through the web interface without user-side disruption. For many nonprofits, academic institutions, and public sector organizations operating under tight budgets, this low-maintenance, subscription-based model is both economical and efficient, supporting demand for web platform-based solutions.

The mobile segment is expected to grow at a significant CAGR during the forecast period. NGOs, educational institutions, and small organizations operating in remote or underdeveloped areas often rely heavily on mobile internet connectivity. To support these users, grant management software vendors are developing responsive mobile interfaces and dedicated apps. This rising smartphone penetration, particularly in Asia, Africa, and Latin America, is fueling the adoption of mobile-first grant management software platforms tailored to low-bandwidth environments and multilingual access.

Organization Insights

The large enterprises segment dominated the market and accounted for the largest revenue share in 2024. Large organizations are increasingly adopting AI-powered grant management platforms to improve fund distribution, application review, and fraud prevention. These solutions automate manual tasks, enhance data accuracy, and use predictive analytics to support informed decision-making. Integration with ERP, CRM, and financial systems further streamlines workflows, ensures real-time tracking of funding, and supports regulatory compliance. By combining AI with enterprise system integration, organizations can optimize grant operations, boost transparency, and reduce the risks of fraud and mismanagement.

The SMEs segment is expected to grow at a significant CAGR during the forecast period. SMEs often working within tight budgets benefit from cost-effective and scalable grant management solutions. Cloud-based platforms with subscription-based pricing reduce initial costs and offer flexibility as funding needs evolve. With growing support from government and private grant programs targeting startups and innovative projects, SMEs need efficient tools to manage applications, maintain compliance, and enhance their chances of securing funding through streamlined processes.

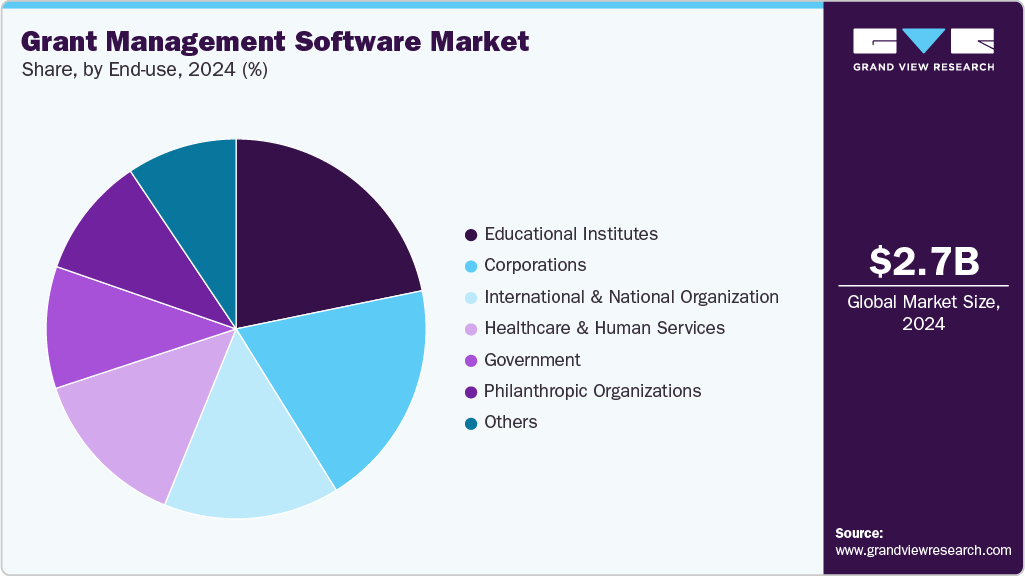

End Use Insights

The educational institutes segment dominated the market and accounted for the revenue share of 21.8% in 2024. Educational institutions, particularly universities and research colleges, receive significant funding from government agencies, philanthropic foundations, and private industry for research, scholarships, and innovation programs. As the volume and complexity of these grants increase, managing them through manual systems becomes inefficient and error-prone. This drives the adoption of specialized grant management software that helps institutions streamline application tracking, fund allocation, and compliance reporting.

The corporations segment is expected to grow at a significant CAGR over the forecast period. Corporations worldwide are expanding their Corporate Social Responsibility (CSR) and Environmental, Social, and Governance (ESG) initiatives, many of which involve grant-making and funding community projects, education programs, and sustainability efforts. As these programs grow in complexity and scale, companies require grant management software to track applications, ensure transparency, and measure the impact of their investments. GMS platforms help corporate foundations and CSR departments automate workflows, standardize application reviews, and improve stakeholder engagement-making them a valuable tool for mission-driven corporate giving

Regional Insights

The grant management software market in North America dominated the global market with the largest revenue share of over 35.0% in 2024, driven by the widespread adoption of digital technologies by nonprofit organizations and federal agencies aiming to enhance transparency, automate workflows, and reduce grant-related fraud. The region benefits from mature infrastructure and high R&D investments in sectors like healthcare and education, which require robust grant lifecycle management solutions.

U.S. Grant Management Software Market Trends

The grant management software market in the U.S. is expected to grow significantly at a CAGR of 8.4% from 2025 to 2033 due to a large volume of federal and state-level grant disbursements under initiatives such as NIH, NSF, and Department of Education programs. These agencies mandate compliance with strict reporting and audit requirements, which is pushing organizations to adopt advanced GMS platforms with built-in compliance, document control, and budget management functionalities.

Europe Grant Management Software Market Trends

The grant management software market in Europe is anticipated to register considerable growth from 2025 to 2033 due to increasing cross-border funding programs, such as Horizon Europe and EU Cohesion Policy Funds, which demand standardized, multilingual, and interoperable grant management tools. The focus on sustainability, social innovation, and public-private partnerships also amplifies the need for collaborative grant platforms that support complex stakeholder ecosystems.

The UK grant management software market is expected to grow rapidly in the coming years, owing to the restructuring of funding sources and greater independence in setting domestic grant agendas, which has increased the demand for flexible GMS tools. The growth is supported by strong philanthropic networks and government-backed research grants, especially in areas such as AI, net-zero initiatives, and higher education, requiring performance tracking and outcome reporting

The Germany grant management software market held a substantial market share in 2024, driven by research institutions and industrial innovation programs backed by both federal and EU-level grants. The need for software that can handle multilingual, multicurrency, and multi-project grant environments while ensuring strict GDPR compliance drives adoption among research bodies and foundations.

Asia Pacific Grant Management Software Market Trends

Asia Pacific held a significant share in the global market in 2024, due to increasing government focus on rural development, education, and public health programs. Countries across the region are investing in modernizing their grant allocation systems to ensure transparency and reduce corruption, encouraging the adoption of cloud-based GMS with mobile access and multilingual interfaces suitable for diverse populations.

The Japan grant management software market is expected to grow rapidly in the coming years driven by the need to manage government-backed innovation and technology grants in sectors such as robotics, green energy, and healthcare. The country’s push toward administrative digitization and e-governance is increasing the adoption of automated systems that enable efficient grant tracking and inter-agency coordination.

The China grant management software market held a substantial market share in 2024, due to rapid digital transformation in the public sector and an increasing number of state-sponsored grants for science, technology, rural revitalization, and education are spurring GMS adoption. Emphasis on real-time tracking, fraud prevention, and centralized grant allocation in a tightly regulated environment is driving local governments and institutions toward domestic and customized GMS solutions.

Key Grant Management Software Company Insights

Key players operating in the grant management software industry are Blackbaud, Inc., Benevity, Oracle, Salesforce, Inc., and Salesforce, Inc., among others. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In August 2024, Submittable announced its acquisition of WizeHive, a U.S.-based company that provides a cloud-based platform. This move follows WizeHive’s recent acquisitions of Bright Funds and WeHero, bringing together four prominent social impact brands. The combined entity aims to deliver best-in-class grants management software, strengthen corporate social responsibility (CSR) offerings, and help organizations drive greater social change.

-

In June 2024, Euna Solutions announced a strategic partnership with Funkhouser & Associates (F&A), a U.S.-based consulting firm. Specializing in strategic planning for state and local governments, F&A worked with Euna Solutions to combine its expertise with Euna’s advanced budgeting software. This collaboration aims to help local governments create data-driven, sustainable budgets and strategic plans to serve their communities.

Key Grant Management Software Companies:

The following are the leading companies in the grant management software market. These companies collectively hold the largest market share and dictate industry trends.

- Altum, Inc.

- AmpliFund

- Benevity

- Blackbaud, Inc.

- Bonterra

- Euna Solutions

- Fluxx

- Foundant Technologies, Inc.

- Fundingportal

- Goodstack

- Oracle

- Salesforce, Inc.

- SmartSimple Software Inc.

- Submittable

- SurveyMonkey

Grant Management Software Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.88 billion

Revenue forecast in 2033

USD 6.19 billion

Growth rate

CAGR of 10.0% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2033

Report enterprise size

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, function, deployment mode, platform, organization, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

Altum, Inc.; AmpliFund; Benevity; Blackbaud, Inc.; Bonterra; Euna Solutions; Fluxx; Foundant Technologies, Inc.; Fundingportal; Goodstack; Oracle; Salesforce, Inc.; SmartSimple Software Inc.; Submittable; SurveyMonkey

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Grant Management Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the grant management software market report based on component, function, deployment mode, platform, organization, end use, and region:

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Solution

-

Services

-

-

Function Outlook (Revenue, USD Billion, 2021 - 2033)

-

Performance and Outcomes Measurement

-

Application Tracking

-

Collaboration

-

Document Management

-

Reporting

-

Others

-

-

Deployment Mode Outlook (Revenue, USD Billion, 2021 - 2033)

-

Cloud

-

On-premise

-

-

Platform Outlook (Revenue, USD Billion, 2021 - 2033)

-

Web

-

Mobile

-

-

Organization Outlook (Revenue, USD Billion, 2021 - 2033)

-

Large Enterprises

-

SMEs

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Government

-

Healthcare and Human Services

-

Educational Institutes

-

Corporations

-

International and National Organization

-

Philanthropic Organizations

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global grant management software market size was estimated at USD 2.66 billion in 2024 and is expected to reach USD 2.88 billion in 2025.

b. The global grant management software market is expected to grow at a compound annual growth rate of 10.0% from 2025 to 2033 to reach USD 6.19 billion by 2033.

b. The solution segment dominated the market and accounted for the revenue share of 60.2% in 2024. Compliance with evolving government regulations, donor guidelines, and international standards is becoming more complex.

b. The key market players in the global grant management software market include Altum, Inc., AmpliFund, Benevity, Blackbaud, Inc., Bonterra, Euna Solutions, Fluxx, Foundant Technologies, Inc., Fundingportal, Goodstack, Oracle, Salesforce, Inc., SmartSimple Software Inc., Submittable, and SurveyMonkey.

b. The grant management software market is witnessing significant growth as government bodies, philanthropic foundations, and international development agencies are launching more grant programs to address social issues, economic development, education, healthcare, and environmental sustainability.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.