- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Greece Dietary Supplements Market, Industry Report, 2030GVR Report cover

![Greece Dietary Supplements Market Size, Share & Trends Report]()

Greece Dietary Supplements Market (2025 - 2030) Size, Share & Trends Analysis Report By Ingredients (Vitamins, Botanicals, Minerals), By Form, By Type, By Application, By End-use, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-683-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Greece Dietary Supplements Market Summary

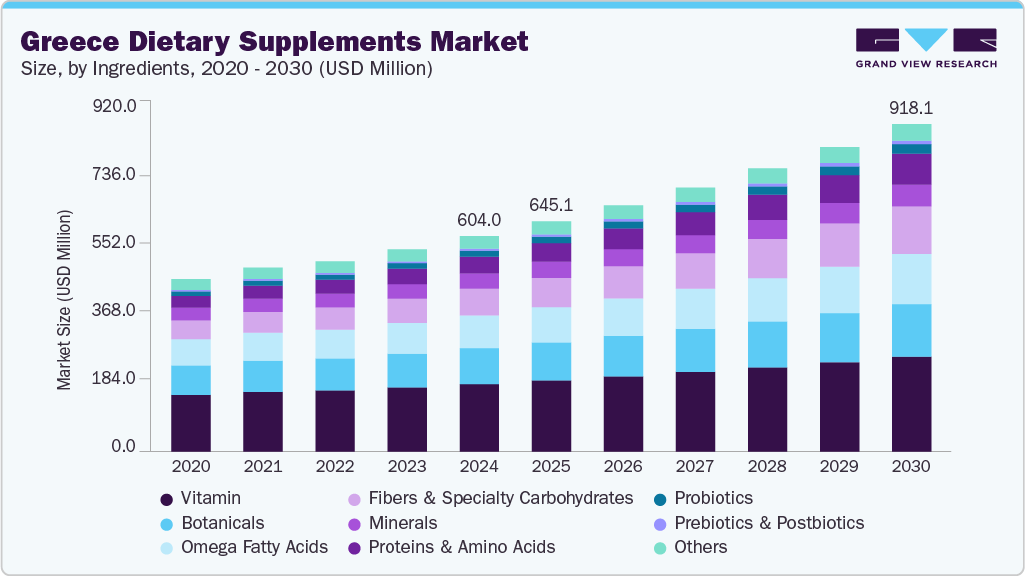

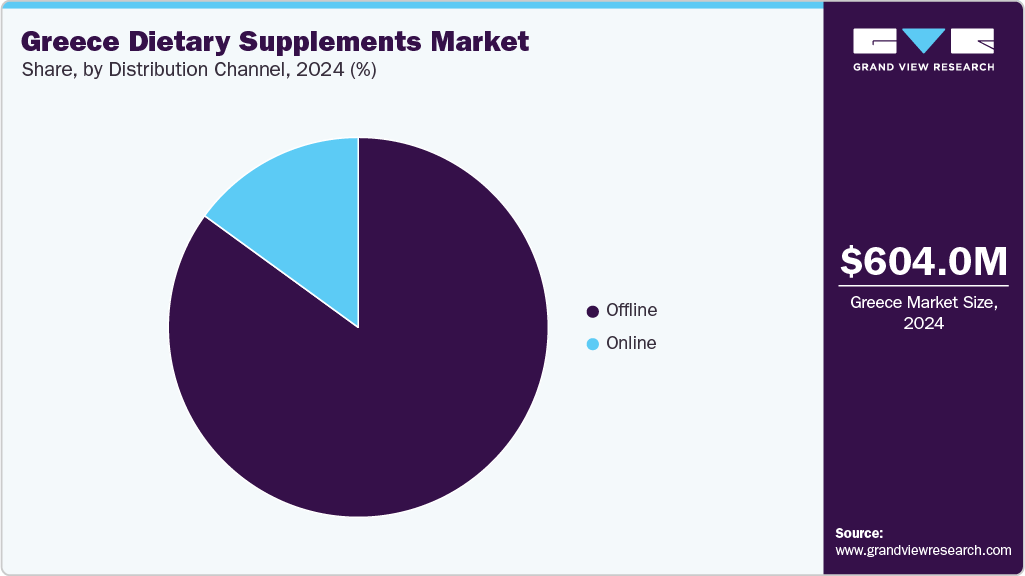

The Greece dietary supplements market size was estimated at USD 604.0 million in 2024 and is projected to reach USD 918.1 million by 2030 grow at a CAGR of 7.3% from 2025 to 2030. This is owing to rising health awareness and a steadily aging population. More individuals are adopting preventive health measures and seeking products that support immunity, energy, and long-term wellness.

Key Market Trends & Insights

- By ingredients, the vitamin supplements market accounted for a share of 31.3% in 2024.

- By form, tablet supplements accounted for the largest revenue share of 31.4% in 2024.

- By end use, dietary supplements for adults dominated the market, with a share of 62.2% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 604.0 Million

- 2030 Projected Market Size: USD 918.1 Million

- CAGR (2025-2030): 7.3%

Older adults, in particular, are turning to supplements that address bone health, cognitive function, and chronic disease prevention. Increased access to health information and education has encouraged proactive wellness habits. This combination of informed consumers and aging demographics fosters sustained market growth, especially for scientifically supported vitamins, minerals, and targeted nutritional solutions.

E-commerce growth and the rising popularity of probiotics and herbal supplements are transforming Greece dietary supplements industry. Online platforms provide consumers with improved accessibility, diverse product selections, and personalized options, making purchasing easier and more tailored. Furthermore, interest in natural health solutions is growing, with probiotics aiding gut health and herbal products aligning with holistic wellness lifestyles. This reflects a broader trend toward informed and health-aware consumer behavior. These evolving preferences and digital advancements are expanding the market’s reach and fueling steady growth across various consumer segments.

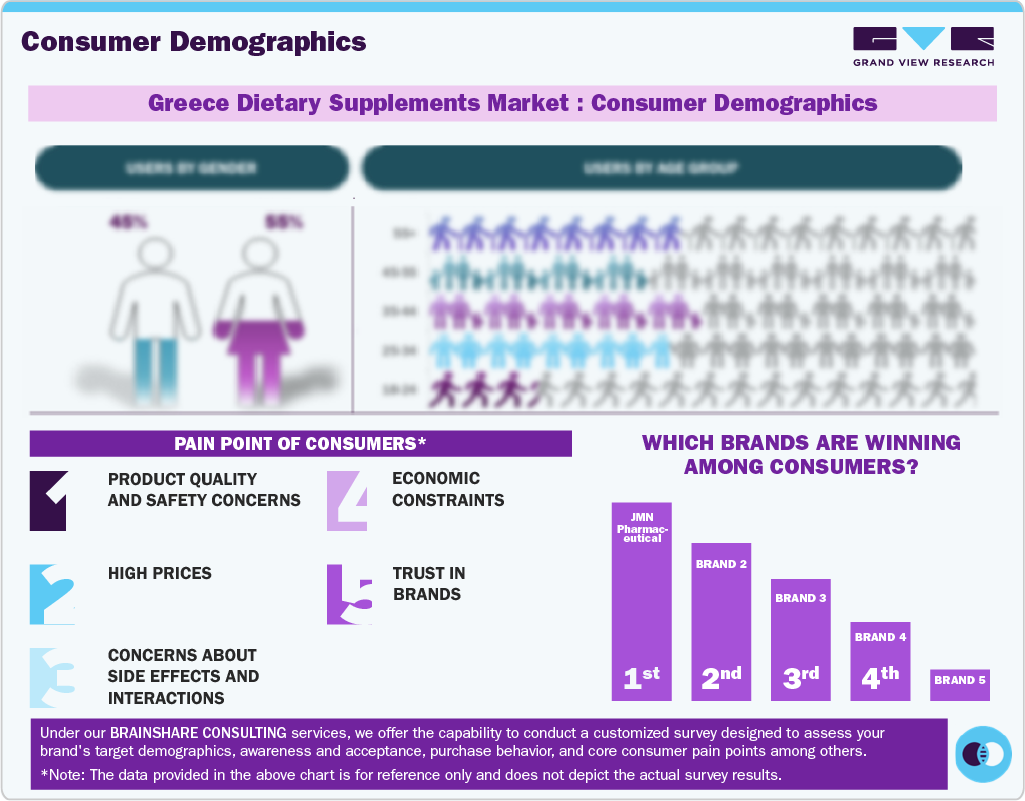

Consumer Insights

Greek consumers are increasingly embracing dietary supplements as part of daily health routines, driven by a mix of preventive health goals and targeted wellness needs. Older adults are seeking bone and cognitive support, while younger users focus on immunity, energy, and gut health. Probiotics and herbal products are gaining popularity, reflecting a preference for natural, holistic solutions. Pharmacies remain the most trusted purchase point, but e-commerce is rising due to its accessibility and variety. Consumers value transparency, scientifically backed claims, and clean-label formulations when selecting supplements.

When choosing dietary supplements, Greek consumers are increasingly influenced by lifestyle trends and digital engagement. Social media platforms and wellness influencers are growing in shaping preferences and introducing new products. Seasonal demand spikes-particularly during flu season-drive interest in immunity-related supplements. Many consumers are also seeking supplements that align with fitness goals, plant-based diets, or holistic wellness routines. Environmental awareness is growing, leading to greater interest in sustainably packaged and ethically sourced products. These evolving expectations are shaping how brands position and market their offerings in Greece.

Ingredient Insights

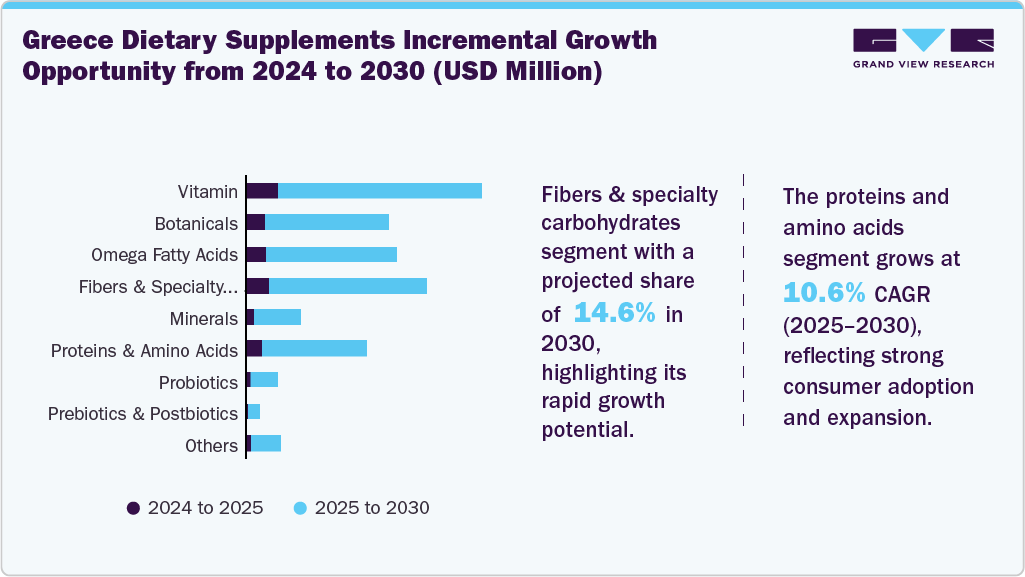

The vitamin segment dominated the market with the largest share of 31.3% in 2024, attributed to widespread consumer awareness and consistent demand across age groups. Daily vitamin intake is seen as a foundation of preventive health, particularly for boosting immunity, energy, and overall well-being. Products containing vitamin D, C, and multivitamins remain especially popular. Their availability in convenient formats and trust built through pharmacy recommendations further support strong sales. Continued focus on nutrition and wellness ensures the vitamin category maintains its leading position in the Greek market.

The proteins and amino acids segment is projected to be the fastest-growing segment with a CAGR of 10.6% from 2025 to 2030, propelled by growing interest in fitness, muscle recovery, and active lifestyles. An increasing number of consumers-particularly younger adults and athletes-are integrating protein powders, BCAAs, and other amino-based products into daily routines. The rising popularity of gym culture, plant-based protein alternatives, and sports nutrition drives demand. New product innovations and expanding retail availability are expected to accelerate growth, making this segment a key opportunity for brands targeting performance-oriented consumers.

Form Insights

The tablets segment held the largest revenue share in 2024 due to their convenience, longer shelf life, and accurate dosage. Greek consumers prefer tablets for their portability and ease of consumption, particularly vitamins and multivitamins. Manufacturers have also focused on innovations in tablet formulations, including chewable and fast-dissolving options, further boosting demand. Widespread availability in pharmacies and online platforms contributed to their dominance. In addition, tablets are often more cost-effective to produce and distribute, making them a preferred choice across various consumer demographics.

The powders segment is anticipated to grow at a rapid CAGR over the forecast period, fueled by growing interest in fitness, sports nutrition, and personalized wellness. Consumers increasingly favor powders for their versatility, faster absorption, and ease of mixing with liquids or food. Rising demand for protein supplements, especially among gym-goers and athletes, has significantly fueled this trend. The segment also benefits from clean-label trends, offering products with fewer additives. Expansion of online retail and influencer marketing has further accelerated powder supplement adoption, particularly among younger populations.

Type Insights

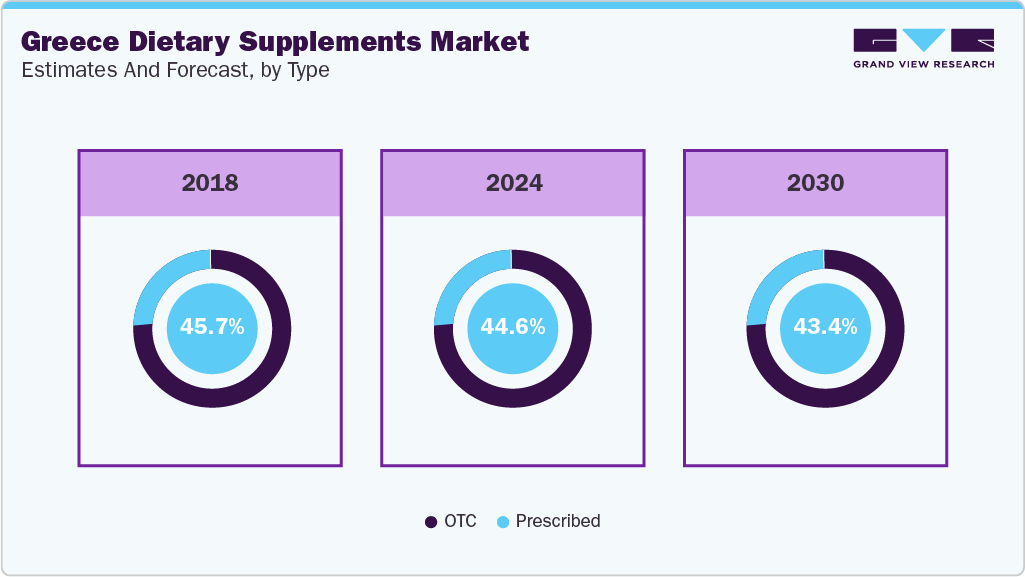

The prescribed segment dominated the market in 2024, driven by increasing recommendations by healthcare professionals for managing specific health conditions. Consumers tend to trust prescribed supplements for their proven efficacy and safety, which boosts demand. Furthermore, rising awareness about chronic diseases and preventive healthcare has driven the prescription of targeted supplements. Government initiatives promoting health and wellness further support this growth. The segment benefits from strong distribution channels through pharmacies and clinics, ensuring wide accessibility and reinforcing consumer confidence in prescribed dietary supplements.

The OTC segment is expected to grow at a significant rate during the forecast period, propelled by rising consumer inclination toward self-care and wellness. Easy availability of OTC supplements without a prescription encourages spontaneous purchases for general health maintenance. Increased health consciousness and growing preference for natural, immunity-boosting products contribute to this surge. The expanding retail footprint, including supermarkets and online platforms, enhances convenience. Marketing efforts highlighting benefits and safety also attract a broader audience, positioning OTC supplements for significant growth in Greece.

Application Insights

The immunity segment dominated the market in 2024, attributed to heightened consumer awareness about health and disease prevention, especially following the COVID-19 pandemic. Increased demand for vitamins, minerals, and herbal supplements that boost immune function has driven market growth. Growing preference for natural and preventive healthcare solutions further fuels this trend. Moreover, supportive government initiatives and widespread availability of immune-boosting products across pharmacies and online platforms have strengthened the segment’s dominance, making it the leading category in Greece’s dietary supplements landscape.

The prenatal health segment is anticipated to grow at the fastest CAGR from 2025 to 2030, fueled by growing awareness about maternal and fetal well-being. Increasing focus on nutrition during pregnancy drives demand for specialized supplements that support healthy development. Healthcare providers actively recommend prenatal vitamins rich in folic acid, iron, and DHA to prevent complications. Rising birth rates and improving healthcare infrastructure further boost market growth. Enhanced consumer education on pregnancy health and easy access to prenatal supplements through pharmacies and online channels contribute significantly to the segment’s expanding popularity.

End Use Insights

The adult segment dominated the market with the largest share in 2024, driven by increasing health concerns and proactive wellness habits among the adult population. A growing number of individuals between 25 and 60 are seeking supplements for immunity, energy, digestion, and chronic disease prevention. Lifestyle-related stress and poor dietary habits further drive demand. High purchasing power and greater health awareness among adults enable them to invest in quality supplements. Widespread availability and recommendations from healthcare professionals also contribute to this segment’s dominant market position.

The infants segment is projected to be the fastest-growing segment over the forecast period. Increasing awareness among parents about the importance of early childhood nutrition is driving demand for supplements tailored to infants' specific needs. Factors such as rising disposable incomes, a growing preference for preventive healthcare, and advancements in pediatric nutrition are contributing to this trend. In addition, the availability of specialized products through pharmacies and online platforms is expected to further propel the growth of the infant dietary supplements segment in Greece.

Distribution Channel Insights

Offline distribution channels led the market with the largest share in 2024 due to consumer preference for in-person purchases and professional advice. Pharmacies, health stores, and supermarkets offer immediate product access and trusted guidance, especially for first-time buyers. Many consumers value the ability to verify product authenticity physically and consult pharmacists about usage. Strong relationships between manufacturers and retail outlets ensure a consistent product supply.

Online distribution channel is anticipated to witness the fastest CAGR over the forecast period, owing to growing internet penetration and digital literacy. Consumers increasingly prefer the convenience of ordering supplements from home, supported by secure payment options and quick delivery services. Competitive pricing, product variety, and access to customer reviews enhance buyer confidence. E-commerce platforms and brand websites also offer personalized promotions and subscriptions. Shifting consumer behavior toward digital shopping, especially among younger and tech-savvy populations, is set to drive significant growth in online supplement sales.

Key Greece Dietary Supplements Company Insights

Some key companies operating in the market include GSK plc.; Amway; NOW Foods; GAP , VIAN SA ; among others.

- Amway provides health, wellness, beauty, and home care products through direct selling. Its offerings include dietary supplements, skincare, personal care, and cleaning products, with a strong focus on nutrition and sustainable living solutions.

Key Greece Dietary Supplements Companies:

- GSK plc.

- Amway

- NOW Foods

- GAP

- VIAN SA

Greece Dietary Supplements Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 645.1 million

Revenue forecast in 2030

USD 918.1 million

Growth rate

CAGR of 7.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Ingredients, form, type, application, end use, distribution channel

Key companies profiled

GSK plc., Amway, NOW Foods, GAP, VIAN SA

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Greece Dietary Supplements Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Greece dietary supplements market report based on ingredients, form, type, application, end use, and distribution channel:

-

Ingredients Outlook (Revenue, USD Million, 2018 - 2030)

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (Selenium, Chromium, Copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

OTC

-

Prescribed

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Adults

-

Millennials

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen X

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen Z

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Boomers

-

Male

-

Female

-

-

-

Geriatric

-

Children

-

Infants

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Hypermarkets/Supermarkets

-

Pharmacies

-

Specialty Stores

-

Practitioner

-

Others (Direct to Consumer, MLM)

-

-

Online

-

Amazon

-

Other Online Retail Stores

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.