- Home

- »

- Renewable Chemicals

- »

-

Green Propellants Market Size, Share, Industry Report, 2033GVR Report cover

![Green Propellants Market Size, Share & Trends Report]()

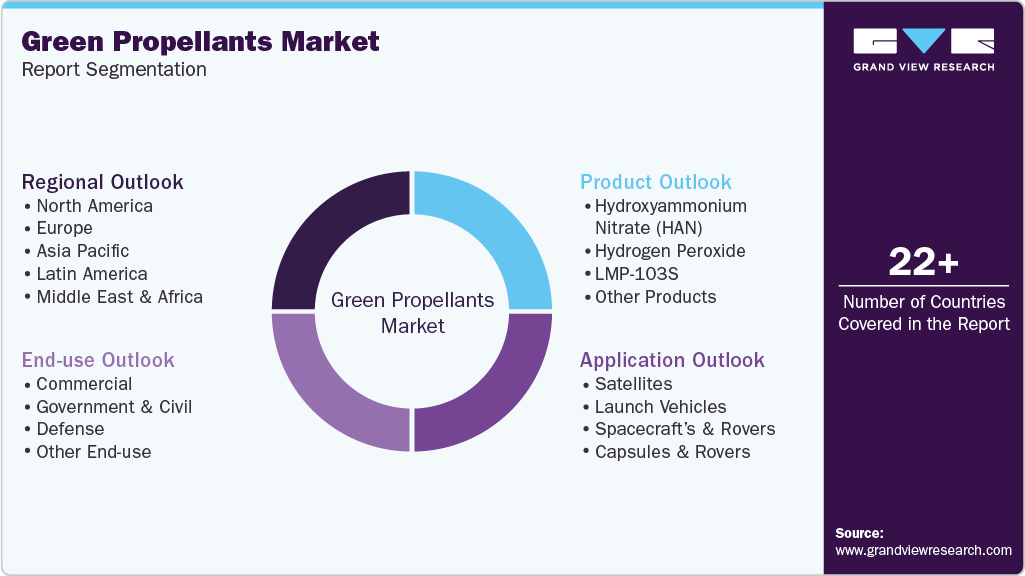

Green Propellants Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Hydroxyammonium Nitrate, Hydrogen Peroxide), By Application (Satellites, Launch Vehicles), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-774-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Green Propellants Market Summary

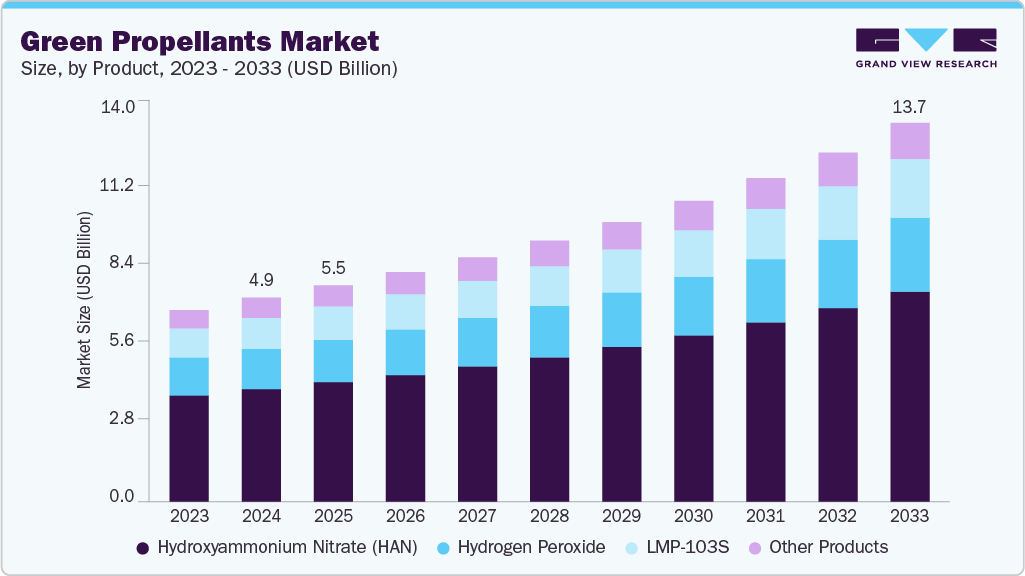

The global green propellants market size was estimated at USD 4.96 billion in 2024 and is projected to reach USD 13.72 billion by 2033, growing at a CAGR of 12.2% from 2025 to 2033. The green propellants are used specifically in rockets.

Key Market Trends & Insights

- North America dominated the global green propellants market with the largest revenue share of 39.9% in 2024.

- The green propellants market in the U.S. accounted for the largest market revenue share in North America in 2024.

- By product, the hydrogen peroxide segment led the market with the largest revenue share of 34.1% in 2024.

- By application, the satellites segment is expected to grow at the fastest CAGR of 12.3% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 4.96 Billion

- 2033 Projected Market Size: USD 13.72 Billion

- CAGR (2025-2033): 12.2%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The market is driven by increasing regulatory and safety pressure to replace toxic, legacy hypergolic propellants (e.g., hydrazine-based fuels). Governments, space agencies and commercial operators increasingly prioritize crew and ground-station safety, lower handling and disposal costs, and stricter environmental controls, all of which favor low-toxicity, less volatile alternatives.A second major driver is mission performance and lifecycle economics. Modern green propellants deliver comparable or improved specific impulse, storability, and thermal stability for many in-space maneuvers (attitude control, station-keeping, orbital transfer) while reducing the cost and complexity of ground support, fueling infrastructure, and PPE. When the total cost of ownership is modeled, including handling, transportation, environmental remediation, and mission risk, green propellants increasingly show attractive payback for small-sat constellations, geostationary satellites, and in-orbit servicing vehicles, encouraging broader commercial adoption.

Governments, space agencies, and commercial operators increasingly prioritize crew and ground-station safety, lower handling and disposal costs, and stricter environmental controls, all of which favor low-toxicity, less volatile alternatives. These regulatory and institutional shifts shorten procurement lead times for demonstrator and operational programs that commit to green propellants. This creates near-term demand from agencies and prime contractors seeking lower compliance risk and insurance exposure.

The accelerating commercialization of space and the rise of small satellites, rideshare launches and distributed constellations are expanding the addressable market for green propellants. Commercial satellite operators prefer solutions that simplify launch integration, reduce hazardous-material restrictions at launch sites, and enable rapid turnaround between missions. Coupled with active R&D, successful flight demonstrations, and growing supplier ecosystems (propellant manufacturers, thruster makers, fuel handling equipment), these market dynamics are driving rapid technology maturation and scaling, which in turn feed further adoption across government and private space programs

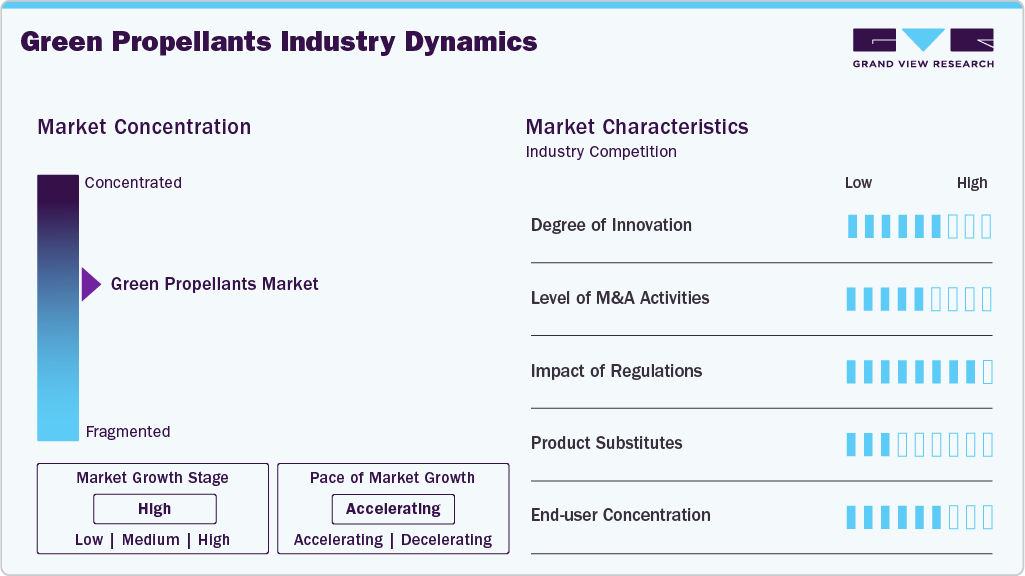

Market Concentration & Characteristics

The green propellant industry is defined by a small set of technically differentiated chemistries (e.g., HAN-based monopropellants, LMP-103S, concentrated H₂O₂) that trade higher specific impulse and density against easier handling, lower toxicity and reduced ground-support costs compared with legacy hydrazine systems. These propellants are supplied both as fuels and as integrated thruster systems (HPGP/LMP-103S, HAN monopropellant thrusters) and are evaluated for compatibility with existing feed systems, materials and thermal architectures, a key technical gating factor for adoption.

Flight demonstrations and agency assessments have validated performance and handling benefits (reduced PPE and range constraints) while highlighting mission-integration considerations (pre-heat needs, materials compatibility) that buyers weigh during procurement.

From a market standpoint, green propellants sit in an early-commercial / scaling phase: uptake is driven by regulatory and safety pressures to replace toxic hypergols, the economics of lifecycle handling and launch-site constraints, and expanding demand from small-sat constellations, in-orbit servicing and some defense uses. Suppliers range from specialist propellant manufacturers and thruster OEMs to systems integrators; value is realized not only in fuel sales but in thruster hardware, loading services and ground-support simplification.

Product Insights

The hydrogen peroxide segment led the market with the largest revenue share of 34.1% in 2024. This growth is because it is a proven, readily available oxidizer with established handling and storage practices from decades of aerospace and industrial use. Its benign decomposition (water + oxygen), lower chronic toxicity versus hydrazine, and compatibility with simpler thruster architectures make it attractive for reaction-control and small monopropellant systems, especially where flight heritage and low program risk matter.

The LMP-103S segment is anticipated to grow at the fastest CAGR of 14.9% during the forecast period. This is because it delivers a step-change in performance (higher density and specific impulse close to or exceeding hydrazine) while still offering much lower toxicity and easier ground handling than hydrazine. This performance / lifecycle-cost tradeoff makes LMP-103S especially attractive to commercial small-sat constellations and missions where mass efficiency and reduced ground infrastructure costs materially improve mission economics

Application Insights

The satellites segment led the market with the largest revenue share of 55.8% in 2024. This is due to the most operational adoption has occurred in satellite propulsion systems, particularly for small and medium sized spacecraft used in Earth observation and communications. Green propellants such as hydrogen peroxide and HAN-based blends provide safer handling, lower toxicity, and reduced launch-site restrictions compared to hydrazine, making them ideal for reaction control and orbit maintenance.

The spacecraft and probes segment is projected to grow at the fastest CAGR during the forecast period, driven by the need for high-performance, long-duration propulsion systems for deep-space and interplanetary missions. Green propellants like LMP-103S and HAN-based formulations offer superior thermal stability and higher specific impulse, enhancing mission range and payload efficiency.

End Use Insights

The government & civil segment led the market with the largest revenue share of 45.4% in 2024. This is due to national space agencies and research institutions being the earliest adopters of environmentally safer propulsion technologies. Programs led by NASA, ESA, and national defense departments have driven early R&D, flight validation, and standardization of green propellants for satellites and space missions.

The commercial segment is anticipated to grow at the fastest CAGR of 12.4% from 2025 to 2033. This is due to the rapid expansion of private satellite constellations, small-satellite launches, and new space ventures. Commercial operators are increasingly turning to green propellants to lower handling costs, minimize launch-site restrictions, and enhance turnaround times between missions.

Regional Insights

North America dominated the green propellants market with the largest revenue share of 39.9% in 2024. The region benefits from established space infrastructure, strong government and defense programs, and early adoption of safer, environmentally friendly propellants. NASA and the U.S. Air Force have been key drivers, conducting extensive R&D, flight demonstrations, and integrating green propulsion into satellite and spacecraft programs.

U.S. Green Propellants Market Trends

The green propellants market in the U.S. accounted for the largest market revenue share in North America in 2024, due to high government spending, private space ventures, and the growing small-satellite sector. Initiatives supporting HAN- and LMP-103S-based systems, coupled with active aerospace startups, accelerate commercialization and adoption.

Asia Pacific Green Propellants Market Trends

The green propellants market in Asia Pacific is expected to grow at the fastest CAGR of 12.8% from 2025 to 2033. This is due to rising space programs in China, India, Japan, and South Korea. Rapid satellite deployment, smallsat constellations, and emerging commercial operators are driving demand for green propulsion systems. Government-led missions focusing on lunar, interplanetary, and Earth observation projects are also supporting adoption

The China green propellants market accounted for the largest market revenue share in APAC in 2024, driven by national space missions, government-backed satellite constellations, and increasing interest in low-toxicity propulsion solutions. HAN- and LMP-103S-based green propellants are being tested and gradually integrated into operational spacecraft.

Europe Green Propellants Market Trends

The green propellants market in Europe is a prominent market, driven by ESA-led programs and commercial satellite manufacturers in Germany, France, and the UK. European agencies emphasize safety, environmental compliance, and sustainable propulsion, supporting hydrogen peroxide and HAN-based adoption in satellites and spacecraft missions. Regulatory frameworks and research collaborations among universities and private companies further promote market growth.

Germany green propellants market is a key European hub, combining advanced chemical engineering expertise and aerospace capabilities. National programs, research institutions, and collaborations with ESA foster early adoption of green propellants, particularly for small satellites and in-orbit technology demonstrations

Latin America Green Propellants Market Trends

The green propellants market in Latin America is smaller, with limited adoption primarily through research collaborations and satellite demonstration projects. Brazil and Argentina are leading early-stage use, focusing on environmental compliance and safer propellants for small satellites and technology demonstration missions. Growth is moderate due to slower industrialization of space programs.

Middle East And Africa Green Propellants Market Trends

The green propellants market in the MEA is an emerging market, with adoption concentrated in government-led satellite programs and defense applications. Countries like UAE and South Africa are investing in space infrastructure and small-satellite capabilities, which drive early green propulsion deployments. The market remains nascent but shows potential as regional space initiatives expand.

Key Green Propellants Company Insights

Some of the key players operating in the market include ISRO, NASA, Bellatrix Aerospace and others

-

The Indian Space Research Organisation (ISRO) is India’s national space agency, responsible for the development and deployment of space technology and satellite-based services. The organization conducts a wide range of activities, including satellite design and manufacturing, launch vehicle development, space exploration, and remote sensing applications for communication, weather forecasting, navigation, and scientific research. ISRO also offers technology transfer and consultancy services in satellite-based applications to domestic and international partners.

Key Green Propellants Companies:

The following are the leading companies in the green propellants market. These companies collectively hold the largest market share and dictate industry trends.

- Bellatrix Aerospace

- Mitsubishi Heavy Industries

- Aerojet Rocketdyne

- Ariane Group

- ISRO

- NASA

- Deutsches Zentrum Fur Luft-und Raumfahrt (DLR)

- L3Harris Technolgies

- Ball Aerospace

Recent Development

-

In February 2024, ISRO and DRDO’s green propulsion system successfully demonstrated in-orbit functionality on a payload launched by the Polar Satellite Launch Vehicle (PSLV) - C58 Mission. The Green Propulsion System was developed by a Bengaluru-based start-up Bellatrix Aerospace Pvt Ltd (Development Agency).

Green Propellants Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.46 billion

Revenue forecast in 2033

USD 13.72 billion

Growth rate

CAGR of 12.2% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in kilotons, Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Bellatrix Aerospace; Mitsubishi Heavy Industries; Aerojet Rocketdyne; Ariane Group; ISRO; NASA; Deutsches Zentrum Fur Luft-und Raumfahrt (DLR); L3Harris Technolgies; Ball Aerospace

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Green Propellants Market Report Segmentation

This report forecasts volume & revenue growth at a global level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global green propellants market report based on product, application, end use, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Hydroxyammonium Nitrate (HAN)

-

Hydrogen Peroxide

-

LMP-103S

-

Other Products

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Satellites

-

Launch Vehicles

-

Spacecraft’s & Rovers

-

Capsules & Rovers

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Commercial

-

Government & Civil

-

Defense

-

Other End Use

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global green propellants market size was estimated at USD 4.96 billion in 2024 and is expected to reach USD 5.46 billion in 2025.

b. The global green propellants market is expected to grow at a compound annual growth rate of 12.2% from 2025 to 2033 to reach USD 13.72 billion by 2033.

b. North America market accounted for the largest revenue share of 39.9% in 2024. The region benefits from established space infrastructure, strong government and defense programs, and early adoption of safer, environmentally friendly propellants. NASA and the U.S. Air Force have been key drivers, conducting extensive R&D, flight demonstrations, and integrating green propulsion into satellite and spacecraft programs.

b. Some key players operating in the green propellants market include Bellatrix Aerospace, Mitsubishi Heavy Industries, Aerojet Rocketdyne, Ariane Group, ISRO, NASA, Deutsches Zentrum Fur Luft-und Raumfahrt (DLR), L3Harris Technolgies, and Ball Aerospace

b. The market is driven by increasing regulatory and safety pressure to replace toxic, legacy hypergolic propellants (e.g., hydrazine-based fuels). Governments, space agencies and commercial operators increasingly prioritize crew and ground-station safety, lower handling and disposal costs, and stricter environmental controls, all of which favor low-toxicity, less volatile alternatives.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.