- Home

- »

- Next Generation Technologies

- »

-

Ground-based Air Defense Systems Market Report, 2033GVR Report cover

![Ground-based Air Defense Systems Market Size, Share & Trends Report]()

Ground-based Air Defense Systems Market (2025 - 2033) Size, Share & Trends Analysis Report By Platform (Fixed Ground-based Platforms, Mobile Platforms), By Component, By Range, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-648-9

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Ground-based Air Defense Systems Market Summary

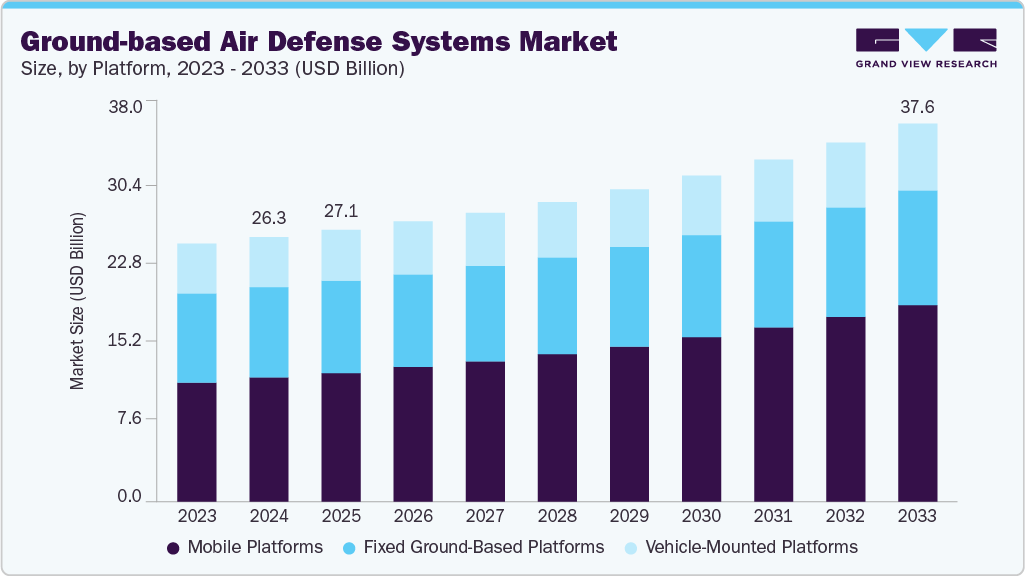

The global ground-based air defense systems market size was estimated at USD 26.27 billion in 2024 and is projected to reach USD 37.56 billion by 2033, growing at a CAGR of 4.2% from 2025 to 2033. The market growth is primarily driven by rising geopolitical tensions, increased defense spending by major economies, and the growing threat of aerial attacks, including drones and cruise missiles, which ground-based air defense (GBAD) systems can counter effectively through rapid detection, tracking, and interception capabilities.

Key Market Trends & Insights

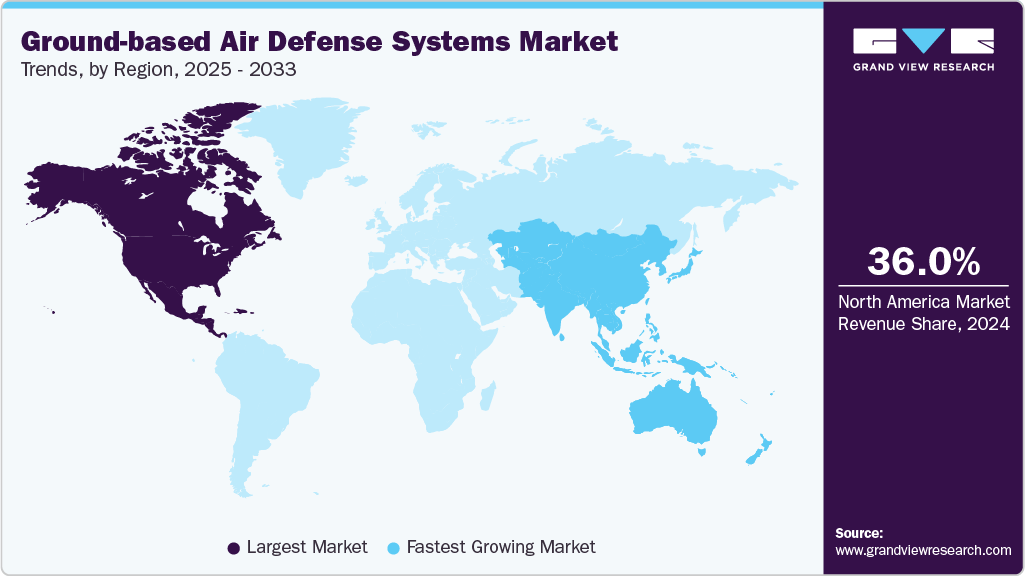

- North America dominated the global ground-based air defense systems market with the largest revenue share of over 36.0% in 2024.

- The U.S. ground-based air defense systems industry dominated with a revenue share of over 77% in 2024.

- By platform, the mobile platforms segment led the market, holding the largest revenue share of over 46% in 2024.

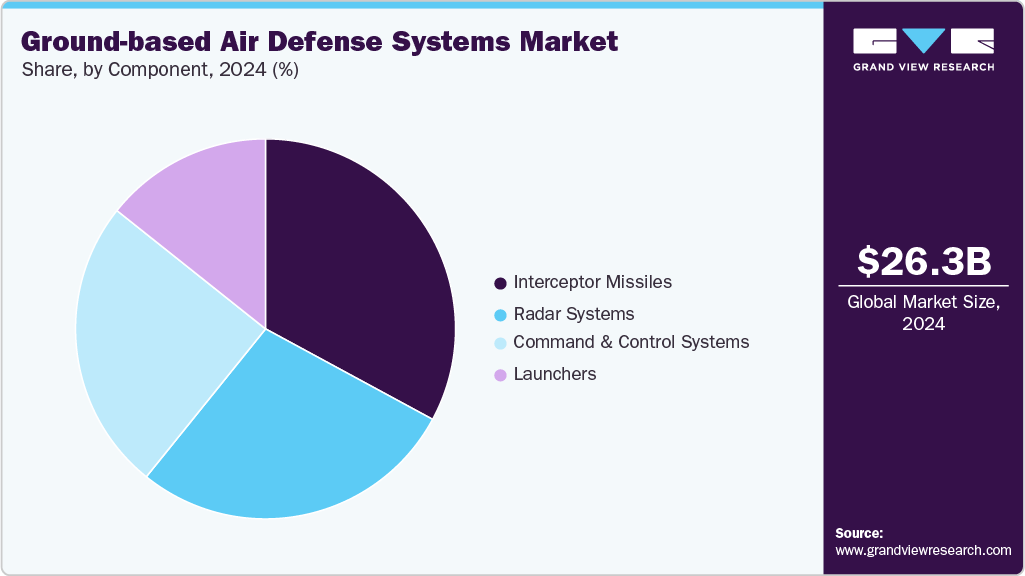

- By component, the interceptor missiles segment held the dominant position in the market and accounted for the leading revenue share in 2024.

- By range, medium range (10-100 km) led the market, holding the largest revenue share of over 52.6% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 26.27 Billion

- 2033 Projected Market Size: USD 37.56 Billion

- CAGR (2025-2033): 4.2%

- North America: Largest market in 2024

The rising threat of aerial attacks from unmanned aerial vehicles (UAVs), cruise missiles, and hypersonic weapons is significantly driving growth in the ground-based air defense systems industry. Modern aerial threats have become increasingly stealthy, faster, and more complex, compelling nations to invest in advanced and layered air defense solutions. As a result, defense ministries worldwide are enhancing procurement of integrated radar, interceptor missiles, and command-and-control systems capable of detecting and neutralizing multiple threats simultaneously. Rapid technological advancements such as artificial intelligence, automation, and network-centric warfare integration are improving response times and interception accuracy, further accelerating demand for GBAD systems.ion)The integration of artificial intelligence (AI) and machine learning (ML) technologies into ground-based air defense systems is revolutionizing threat detection and response time, significantly driving the growth of the ground-based air defense systems industry. These technologies enable real-time data processing, pattern recognition, and automated decision-making, which drastically improve situational awareness and reduce operator workload. AI-powered systems can analyze incoming aerial threats, prioritize them based on severity, and recommend optimal interception strategies. This capability is particularly critical in complex multi-threat environments, such as those involving drones, cruise missiles, and manned aircraft. Defense organizations seek faster and more autonomous systems, and the adoption of AI-enhanced ground-based air defense systems is expanding.

Additionally, the growing threat posed by unmanned aerial vehicles (UAVs), including weaponized drones and swarm attacks, is compelling nations to invest heavily in the responsive ground-based air defense systems industry. Drones are increasingly being used in both state and non-state warfare, posing challenges to traditional radar and missile systems due to their small size, high maneuverability, and low radar signature. Modern air defense systems now incorporate advanced radar sensors, electro-optical tracking, and directed-energy weapons to effectively counter UAV threats. This evolving threat is encouraging the rapid deployment of ground-based defense solutions, thereby contributing to robust market expansion.

The increasing frequency of regional conflicts, border skirmishes, and asymmetric warfare is fueling the procurement of mobile ground-based air defense units by both developed and developing nations. Mobile systems such as truck-mounted launchers and radar units are favored for their flexibility in conflict zones, enabling on-the-fly repositioning and rapid engagement. These mobile air defense solutions offer strategic deterrence and are particularly valued by countries with disputed borders or critical infrastructure close to hostile territories.

Furthermore, the Modernization of legacy defense infrastructure and aging missile defense systems is prompting global defense agencies to invest in next-generation ground-based air defense technologies. Many nations are overhauling outdated Cold War-era systems with newer, interoperable platforms that can be integrated into multi-domain command structures. Upgraded systems feature enhanced tracking ranges, faster response times, and superior resilience against jamming and cyberattacks. This modernization wave is expected to generate consistent demand over the coming decade.

Platform Insights

The mobile platforms segment dominated the market with a share of over 46% in 2024, driven by its exceptional flexibility, rapid deployability, and ability to provide on-demand air defense coverage in diverse terrains and conflict zones. Modern warfare increasingly involves asymmetric threats, drone swarms, and short-range missile attacks. Mobile air defense units offer the agility needed to respond quickly and protect moving assets or remote locations. Their compatibility with modular interceptors, radars, and command-and-control systems enhances operational efficiency and battlefield survivability. The integration of advanced communication networks and AI-enabled threat detection further amplifies their effectiveness, making mobile platforms the preferred choice for dynamic defense operations worldwide.

The vehicle-mounted platforms segment is expected to register a significant CAGR of over 3% from 2025 to 2033. This growth is primarily driven by the rising demand for highly mobile and rapidly deployable air defense solutions capable of protecting critical assets in dynamic and contested environments. Vehicle-mounted ground-based air defense systems offer flexibility and speed, making them ideal for tactical operations, border security, and urban defense scenarios. Their integration with advanced radar, missile launchers, and command-and-control units enables autonomous threat detection and engagement while on the move. The ability to reposition quickly and support layered defense architectures enhances operational readiness, fueling their adoption across both military and homeland security applications.

Range Insights

The medium range (10-100 km) segment dominated the ground-based air defense systems industry in 2024, driven by the growing need to defend against evolving aerial threats. These threats often operate within medium-range corridors, making this segment critical for protecting urban centers, military bases, and strategic infrastructure. The versatility and mobility of medium-range systems allow for rapid deployment and flexible response in both peacetime and conflict scenarios. Increasing defense modernization programs and multi-layered air defense strategies across NATO and Asia-Pacific countries are further boosting demand. Technological advancements in radar precision, interceptor agility, and networked command-and-control systems have enhanced the effectiveness of this range class, solidifying its dominance in the global market.

The long range (>100 km) segment is expected to grow at a significant CAGR from 2025 to 2033, driven by escalating global security threats and the increasing demand for extended-range threat detection and interception capabilities. Adversaries develop advanced ballistic and cruise missile technologies, and nations are prioritizing investments in long-range ground-based air defense systems to protect strategic assets and urban centers. These systems offer superior radar coverage and engagement zones, enabling interception at greater distances and providing critical reaction time. The integration of long-range systems with multi-layered defense networks and space-based surveillance enhances operational effectiveness, positioning this segment as a cornerstone of modern air and missile defense strategies.

End Use Insights

The military segment dominated the market with the largest market share in 2024, driven by the escalating need for advanced threat detection, airspace control, and missile interception capabilities. Increasing global defense budgets and modernization programs have prioritized the deployment of integrated ground-based air defense systems to counter emerging threats such as hypersonic missiles, UAVs, and stealth aircraft. Rising geopolitical tensions, border conflicts, and the proliferation of long-range missile technologies have further intensified demand for real-time, multi-layered defense systems. These factors have solidified the military segment’s leadership in the ground-based air defense systems industry, with sustained investment expected over the coming years.

The defense contractors segment is expected to grow at the fastest CAGR from 2025 to 2033, driven by the rising demand for integrated, multi-domain air defense systems that combine kinetic and non-kinetic countermeasures. Defense firms are actively innovating in areas like AI-powered tracking, autonomous target recognition, and modular system integration, enabling faster deployment and enhanced operational flexibility. Government-backed R&D initiatives and long-term procurement contracts provide financial stability and foster rapid technological advancement, further fueling growth in this high-performing segment of the ground-based air defense systems industry.

Component Insights

The interceptor missiles segment dominated the ground-based air defense systems market in 2024, driven by the escalating threat of advanced aerial attacks, including ballistic missiles, cruise missiles, and unmanned aerial vehicles (UAVs). Modern interceptor technologies are increasingly being integrated into multi-layered defense architectures to ensure precision targeting and rapid response capabilities. Military modernization programs emphasize the deployment of mobile and versatile interceptor platforms, reinforcing the segment’s leadership in the component landscape of the GBAD systems industry.

The launchers segment is expected to grow at a significant CAGR from 2025 to 2033, driven by increasing investments in mobile and modular air defense solutions to counter evolving aerial threats. Modern launchers are being designed with multi-missile compatibility, faster reload times, and enhanced mobility to support dynamic battlefield requirements. Growing cross-border tensions and the need for flexible, quick-response air defense mechanisms are prompting defense forces to procure highly mobile and truck-mounted launcher systems. These developments are fueling substantial growth in the launcher segment within the ground-based air defense systems industry.

Regional Insights

North America dominated the ground-based air defense systems market with a share of over 36% in 2024, driven by substantial investments in defense modernization and aerospace innovation. The Department of Defense continues to prioritize the development and deployment of advanced air defense systems to counter emerging threats such as hypersonic missiles, UAV swarms, and cruise missiles. The region’s strong industrial base, combined with robust R&D funding and strategic initiatives like the Integrated Air and Missile Defense (IAMD) framework, further accelerates market adoption. Public-private collaborations and favorable procurement policies also enable rapid system upgrades and domestic production scalability.

U.S. Ground-Based Air Defense Systems Market Trends

The U.S. ground-based air defense systems industry dominated with a revenue share of over 77% in 2024. The U.S. market continues to lead globally, driven by increasing defense budgets, advanced military modernization programs, and rising geopolitical tensions. Growing concerns over drone incursions and cruise missile threats have accelerated the deployment of mobile and layered air defense solutions across key military bases and critical infrastructure. The U.S.'s focus on homeland security, border protection, and integrated multi-domain command systems further solidifies its dominance in the global market.

Europe Ground-Based Air Defense Systems Market Trends

The Europe ground-based air defense systems industry is expected to grow at a CAGR of 3% from 2025 to 2033, fueled by rising geopolitical tensions, increased NATO defense commitments, and a surge in modernization initiatives across member states. The European Defense Fund and joint procurement programs are fostering regional collaboration, standardization, and interoperability. The threat of drone incursions and hypersonic weapons has prompted strategic investments in layered and networked air defense systems, further accelerating the market demand for ground-based air defense systems across Europe.

The ground-based air defense systems market in Germany is expected to experience steady growth from 2025 to 2033, driven by increased government spending on national defense modernization and border security. Germany is actively upgrading its air defense infrastructure to counter rising threats from UAVs, missiles, and electronic warfare. The integration of AI-enhanced radar systems and mobile missile platforms is a key focus. Germany is investing in interoperable command-and-control systems to ensure seamless coordination across joint defense operations. Heightened geopolitical tensions in Germany and its commitment to collective defense are further propelling the market forward.

The UK ground-based air defense systems market is expected to grow in the coming years, fueled by rising investments in national security and defense modernization programs. The Ministry of Defense (MoD) is prioritizing the upgrade and expansion of missile defense and radar tracking systems to counter emerging aerial threats, including drones and hypersonic weapons. Increased collaboration with NATO allies and domestic defense firms is fostering the development of next-generation mobile and AI-enabled air defense platforms. These efforts are aligned with the UK’s broader objective to strengthen homeland defense and strategic deterrence across critical infrastructure and border regions.

Asia Pacific Ground-Based Air Defense Systems Market Trends

The Asia Pacific ground-based air defense systems industry is expected to grow at the fastest CAGR of 6% from 2025 to 2033, driven by escalating regional tensions, rapid military modernization, and the proliferation of aerial threats. The emphasis on strengthening national security amid evolving threats from neighboring states is prompting the deployment of indigenous and joint-venture systems. Increased focus on protecting critical infrastructure, military bases, and urban centers from asymmetric threats is propelling the adoption of mobile and AI-integrated air defense platforms. Regional collaborations and defense technology transfers are also accelerating capability development and domestic manufacturing in the region.

The ground-based air defense systems market in China is driven by the nation's strategic focus on integrated air and missile defense capabilities and escalating regional security concerns. China's push to develop indigenous technologies has led to the rapid advancement of radar systems, command and control infrastructure, and anti-aircraft missile platforms. China's investment in dual-use technologies and military-civil fusion initiatives has enabled the development of more cost-effective and scalable air defense solutions. These factors collectively reinforce China’s growing influence in the global ground-based air defense systems industry.

The Japan ground-based air defense systems market is experiencing robust growth, fueled by increasing geopolitical tensions in the region. Japan’s strategic initiatives to modernize its Self-Defense Forces and strengthen its missile defense shield have accelerated investments in advanced radar and interceptor technologies. The government's substantial defense budget allocation and recent security policy shifts, including the development of counterstrike capabilities, are further boosting market momentum. These factors collectively position Japan as a key player in the evolving ground-based air defense market.

Key Ground-based Air Defense Systems Company Insights

Some of the key players operating in the market include Lockheed Martin Corporation and RTX.

-

Lockheed Martin Corporation is a global defense and aerospace leader recognized for its critical role in shaping the ground-based air defense systems industry. The company is the prime contractor for the Terminal High Altitude Area Defense (THAAD) system and a key partner in the Medium Extended Air Defense System (MEADS), providing cutting-edge radar, interceptors, and command-and-control capabilities. Lockheed Martin’s integration of AI, hypersonic defense research, and multi-domain operations makes it a strategic force in defending against modern aerial threats. With a broad portfolio and strong international partnerships, the company remains a top-tier supplier of integrated air and missile defense systems worldwide.

-

RTX (formerly Raytheon Technologies) is a dominant force in the global ground-based air defense systems industry, renowned for its Patriot missile defense system, used by over 15 countries. RTX delivers full-spectrum air defense solutions, from radar surveillance and command-and-control systems to interceptors capable of engaging ballistic and cruise missiles. The company’s ongoing modernization of the Patriot and development of next-generation systems like the Lower Tier Air and Missile Defense Sensor (LTAMDS) underline its commitment to innovation. RTX’s global footprint, decades of defense expertise, and continuous investment in next-gen technologies place it among the elite in the market.

Hanwha Group and Diehl Stiftung & Co. KG are some of the emerging participants in the ground-based air defense systems market.

-

Hanwha Group is an emerging South Korean defense player rapidly gaining traction in the ground-based air defense systems domain. Through its subsidiary Hanwha Aerospace, the company has developed systems like the KM-SAM (Cheongung), aimed at countering ballistic missile threats. Hanwha is also investing in new technologies, including radar systems and integrated battle management solutions. With growing exports and partnerships across Asia and the Middle East, Hanwha is expanding its presence and positioning itself as a competitive player in the evolving global air defense landscape.

-

Diehl Stiftung & Co. KG is a German defense firm steadily rising as a key provider in the ground-based air defense systems market. Known for its IRIS-T SL missile system, Diehl has contributed to establishing mobile and scalable air defense capabilities across Europe. The company focuses on precision-guided missiles and modular air defense systems, supporting NATO-aligned forces and expanding into new regional markets. Diehl’s emphasis on interoperability and its role in European defense collaborations positions it as a promising emerging player in the sector.

Key Ground-based Air Defense Systems Companies:

The following are the leading companies in the ground-based air defense systems market. These companies collectively hold the largest market share and dictate industry trends.

- RTX

- Lockheed Martin Corporation.

- Northrop Grumman

- BAE Systems

- Rheinmetall AG

- Saab AB

- Israel Aerospace Industries

- RAFAEL Advanced Defense Systems Ltd.

- Hanwha Group.

- Diehl Stiftung & Co. KG

Recent Developments

-

In June 2025, Lockheed Martin approached the UK government with a proposal to deploy its integrated missile defense infrastructure, including THAAD systems, PAC-3 interceptors, advanced sensors, and space-based surveillance technologies. Lockheed Martin partnered with Rheinmetall and Kongsberg to enable European-based production of ATACMS and Patriot missiles, reinforcing its commitment to strengthening regional capabilities in the ground-based air defense systems market.

-

In May 2025, RTX (Raytheon Technologies) delivered its upgraded AN/TPY‑2 radar system to the U.S. Missile Defense Agency, incorporating advanced Gallium Nitride (GaN) technology and CX6 computing software. This next-generation radar enhances hypersonic missile tracking and strengthens integrated air defense capabilities. The development supports joint U.S.-Japan defense initiatives, including the Glide Phase Interceptor and the proposed “Golden Dome” missile shield, reinforcing the strategic role of advanced radar technologies in the global ground-based air defense systems industry.

-

In April 2025, Diehl Stiftung & Co. KG and Switzerland’s Armasuisse reached an advanced agreement for the procurement of four to five IRIS-T SLM medium-range air defense systems under the European Sky Shield Initiative. The acquisition aims to enhance Europe’s integrated ground-based air defense capabilities. This collaboration underscores Diehl’s growing role in strengthening regional defense networks and advancing interoperable air defense infrastructure across the continent.

Ground-based Air Defense Systems Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 27.01 billion

Revenue forecast in 2033

USD 37.56 billion

Growth rate

CAGR of 4.2% from 2025 to 2033

Base year of estimation

2024

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Platform, component, range, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

RTX; Lockheed Martin Corporation; Northrop Grumman; BAE Systems; Rheinmetall AG; Saab AB; Israel Aerospace Industries; RAFAEL Advanced Defense Systems Ltd; Hanwha Group; Diehl Stiftung & Co. KG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ground-based Air Defense Systems Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global ground-based air defense systems market report based on platform, component, range, end use, and region:

-

Platform Outlook (Revenue, USD Million, 2021 - 2033)

-

Fixed Ground-Based Platforms

-

Mobile Platforms

-

Vehicle-Mounted Platforms

-

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Radar Systems

-

Command & Control Systems

-

Launchers

-

Interceptor Missiles

-

-

Range Outlook (Revenue, USD Million, 2021 - 2033)

-

Short Range (<10 km)

-

Medium Range (10-100 km)

-

Long Range (>100 km)

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Military

-

Defense Contractors

-

Government

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global ground-based air defence systems market was estimated at USD 26,271.2 million in 2024 and is expected to reach USD 27,013.5 million in 2025.

b. The global ground-based air defence systems market is expected to grow at a compound annual growth rate of 4.2% from 2025 to 2033 to reach USD 37,566.3 million by 2033.

b. North America dominated the market with a share of over 36% in 2024, driven by substantial investments in defense modernization and aerospace innovation. The Department of Defense continues to prioritize the development and deployment of advanced air defence systems to counter emerging threats such as hypersonic missiles, UAV swarms, and cruise missiles. The region’s strong industrial base, combined with robust R&D funding and strategic initiatives like the Integrated Air and Missile Defense (IAMD) framework. Public-private collaborations and favorable procurement policies also enable rapid system upgrades and domestic production scalability.

b. The key players in the ground-based air defence systems market are RTX, Lockheed Martin Corporation., Northrop Grumman, BAE Systems., Rheinmetall AG, Saab AB, Israel Aerospace Industries, RAFAEL Advanced Defense Systems Ltd. , Hanwha Group., Diehl Stiftung & Co. KG

b. Key drivers of ground-based air defence systems market include the rising geopolitical tensions, increased defense spending by major economies, and the growing threat of aerial attacks including drones and cruise missiles, which ground-based air defence systems can counter effectively through rapid detection, tracking, and interception capabilities.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.