- Home

- »

- Medical Devices

- »

-

Hair Restoration Market Size, Share & Trends Report, 2030GVR Report cover

![Hair Restoration Market Size, Share & Trends Report]()

Hair Restoration Market (2024 - 2030) Size, Share & Trends Analysis Report By Procedure (Follicular Unit Extraction, Follicular Unit Transplantation), By Therapy (Low-level Laser Therapy, Platelet-rich Plasma), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-298-0

- Number of Report Pages: 145

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Hair Restoration Market Summary

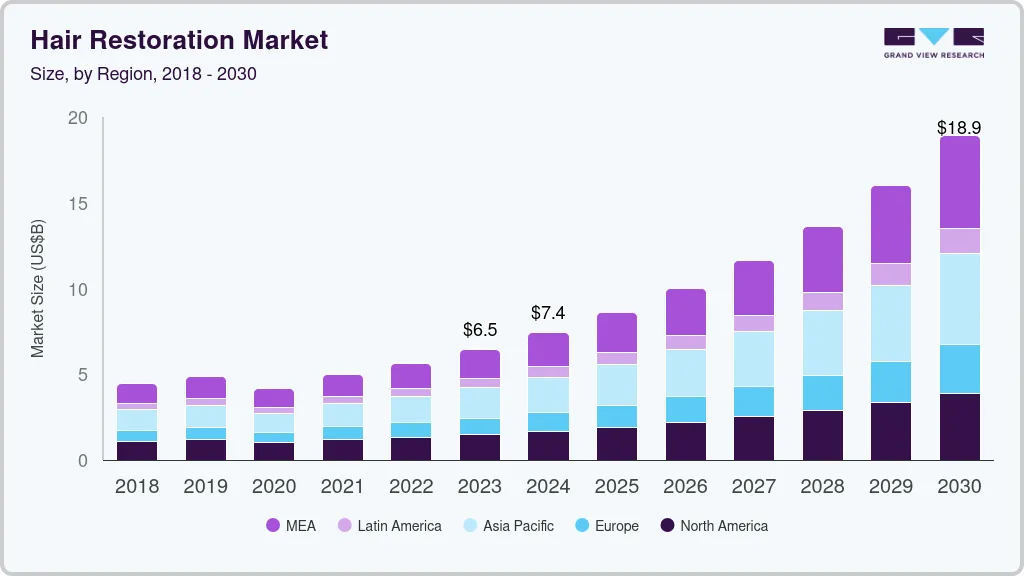

The global hair restoration market size was estimated at USD 6,463.0 million in 2023 and is projected to reach USD 18,923.4 million by 2030, growing at a CAGR of 16.6% from 2024 to 2030. This growth is primarily attributed to the increasing prevalence of androgenetic alopecia, a key driver for the hair transplant system market.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2023.

- Country-wise, Norway is expected to register the highest CAGR from 2024 to 2030.

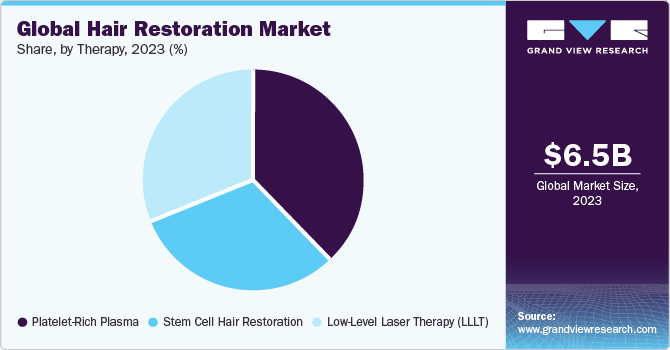

- In terms of the therapy segment, platelet-rich plasma accounted for a revenue of USD 2,461.1 million in 2023.

- By procedure, the follicular unit extraction (FUE) segment dominated the revenue market share and accounted for 70.29% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 6,463.0 Million

- 2030 Projected Market Size: USD 18,923.4 Million

- CAGR (2024-2030): 16.6%

- North America: Largest market in 2023

Lifestyle factors like excessive tobacco and alcohol consumption, along with rising stress levels, are considered significant triggers for this condition. While the exact cause of androgenetic alopecia remains unknown, genetic factors have been associated with several cases. Additionally, factors such as rising disposable incomes and a growing emphasis on aesthetics are expected to further drive market growth.

The market is experiencing significant growth, largely propelled by the increasing success rates of procedures like follicular unit extraction (FUE) and follicular unit transplantation (FUT). These methods have demonstrated their efficacy in hair transplant, driving market expansion. Moreover, a growing number of hair restoration experts are adopting hybrid techniques, combining FUE and FUT, to achieve more pronounced and natural-looking results. An example of this trend is VATANMED hair transplantation clinic in Istanbul, which introduced Sapphire FUE in December 2023, representing a notable advancement in hair restoration technology. This less invasive and more effective approach has garnered interest among individuals seeking hair transplant system, further stimulating market demand.

Aging and hormonal imbalances are significant factors contributing to alopecia, with conditions like thyroid imbalances and menopause leading to hair loss due to decreased estrogen levels. Androgen hormones such as testosterone and Dehydroepiandrosterone (DHEA) also play crucial roles in hair growth, and imbalances can affect hair health. Recent data indicates that an estimated 20 million Americans have some form of thyroid disease, with up to 60% unaware of their condition, highlighting the prevalence of hormonal issues. Gender also influences disease susceptibility, with over 95% of hair loss in men attributed to androgenetic alopecia, as reported by the American Hair Loss Association. The market is expected to benefit from increasing consumer awareness of alopecia therapeutic options, suggesting a positive outlook for the future.

According to the International Society of Hair Restoration Surgery, around 703,000 surgical hair restoration procedures were performed globally in 2021. Of these, 87.3% were male and 12.7% were female, indicating a higher prevalence among men, likely due to genetic sensitivity to dihydrotestosterone (DHT), a byproduct of testosterone. Social media platforms have emerged as significant catalysts in the promotion of hair restoration procedures. Sagapixel, a specialized digital marketing group, excels in marketing hair restoration, transplants, and other cosmetic procedures for clinics across the U.S., Europe, and the Middle East. Their comprehensive services, including SEO, Google and Facebook ads, web design, and social media marketing, are meticulously tailored to cater to the specific needs of hair restoration clinics.

Market Concentration & Characteristics

The market is highly fragmented, due to the industry requires moderate expertise and resources, leading to a higher number of growing and established players in the market. Additionally, the development and approval process for hair restoration products and procedures can be lengthy and costly, creating barriers to entry for new competitors.

The market is experiencing ongoing research and development activities aimed at enhancing existing procedures and developing innovative solutions. This focus on R&D is driven by the increasing demand for more effective and minimally invasive hair restoration treatments. Companies in the market are investing in advanced technologies, such as robotic-assisted hair transplant systems, to improve procedure outcomes and patient experience. Additionally, research is being conducted to explore new treatment options, including stem cell therapy and gene therapy, which have the potential to revolutionize the field of hair restoration. Overall, the emphasis on research and development is expected to drive further growth and innovation in the hair transplant system market.

The market is characterized by a low-to-moderate level of merger and acquisition (M&A) activities, indicating a dynamic landscape driven by strategic collaborations and consolidations.

The regulatory scenario in the global hair transplant system market is complex and varies across regions. In the United States, hair restoration procedures are typically regulated as medical devices by the FDA, ensuring their safety and effectiveness. However, regulations can differ for products such as topical solutions or oral medications used for hair loss treatment.

In Europe, hair restoration procedures are subject to regulations set by the European Medicines Agency (EMA) and individual country regulations. In Asia, regulations can vary widely, with countries like Japan having stringent regulations, while others may have less stringent oversight. Overall, regulatory compliance is crucial for companies operating in the hair transplant system market to ensure the safety and efficacy of their products and procedures.

Key product companies in the hair transplant system market are also focusing on market expansion. For instance, in August 2023, DHI International, a renowned leader in hair restoration, introduced Activa Regenera, a new treatment for hair loss. This innovative approach promises efficient stimulation of new hair growth, bringing advanced solutions to individuals in India experiencing hair loss. Activa Regenera represents DHI's commitment to providing high-quality care and remarkable results in hair restoration and loss prevention.

Procedure Insights

The follicular unit extraction (FUE) segment dominated the revenue market share and accounted for 70.29% in 2023. FUE was the most carried out surgical procedure for hair transplant in 2022, comprising nearly three-quarters of procedures according to the International Society of Hair Restoration Surgery, followed by follicular unit transplant technique (FUT)/ STRIP at 21.3%, with 3.3% being combinations of both techniques. The increasing popularity of FUE can be linked to its less invasive nature and quicker recovery times compared to traditional methods FUT.

Additionally, advancements in FUE technology, such as robotic-assisted procedures with a survival rate of 100%, have improved the precision and efficiency of the treatment, leading to a higher yield of hair. With the increasing success rate of FUE procedures and the less-invasive nature of the technique, FUE is expected to exponentially grow during the forecast period, further solidifying its dominance in the market.

Therapy Insights

The platelet-rich plasma segment dominated the market with the largest revenue share in 2023. PRP therapy's popularity stems from its non-invasive nature and ability to stimulate hair growth using the patient's own platelets. According to NCBI, research on PRP's effectiveness found that more than 75.0% of hair regrowth was noticed at 6 months, leading to a reduced fall of transplanted hair. This natural treatment option's appeal lies in its minimal side effects and effectiveness, often used alongside other hair restoration procedures to enhance results. The widespread adoption of PRP therapy among both patients and practitioners has solidified its position as a dominant segment in the market.

Stem cell therapy has demonstrated potential in stimulating hair growth by rejuvenating hair follicles and promoting new hair growth. Likewise, low-level laser therapy (LLLT), known for its non-invasive nature and ability to enhance blood flow to the hair follicles, is gaining popularity as an effective treatment for hair loss. These factors, along with increasing research and development efforts to improve the efficacy of these treatments, are expected to drive the growth of these segments in the market. The market has seen a notable acceptance of LLLT, with 29 FDA-cleared devices for treating pattern hair loss. Stem cell therapy has also shown promise in stimulating hair cells and generating new follicles when transplanted onto the scalp, resulting in new hair growth. However, research on stem cell therapy for hair restoration is still in its early stages, and evidence of its effectiveness is limited. Nonetheless, both segments are projected to significantly contribute to the market's growth in the coming years.

Regional Insights

North America's dominance in the market, accounting for the largest revenue share of 32.24% in 2023, can be attributed to several factors. The region boasts a large target population base, making it an attractive market for hair restoration services. Technological advancements in hair transplant procedures, such as Follicular Unit Extraction (FUE) and Follicular Unit Transplantation (FUT), have made these treatments more accessible and less invasive, contributing to their popularity. The presence of numerous market players in North America, including renowned clinics and innovative product launches, also supports the region's market dominance. These factors combined have positioned North America as a significant player in the global market, with a strong potential for continued growth in the coming years.

U.S. Hair Restoration Market Trends

The hair transplant market in the U.S. dominated the industry with a revenue share of 80.33% in 2023 due to high prevalence of hair loss, leading to a strong demand for hair transplant treatments. Additionally, the country boasts a well-developed healthcare infrastructure and a high level of disposable income, allowing more people to afford hair transplant procedures. Moreover, the U.S. is home to many key players in the hair restoration industry, leading to a competitive market with a wide range of treatment options.

Europe Hair Transplant Market Trends

The hair transplant market in Europe is growing due to the large population of the continent, including a significant number of individuals experiencing hair loss, which drives the demand for hair restoration procedures. Additionally, countries in Europe have well-established healthcare systems and high standards of medical care, which attract patients seeking quality treatment options.

The Germany hair transplant market dominated the industry with the highest revenue share of 31.08% in 2023 as Germany is known for its technological advancements and innovation in the field of healthcare, including hair transplant system technologies and techniques. These factors, combined with increasing disposable income and growing awareness about hair loss treatments, have contributed to Germany's dominant position in the hair transplant system market.

The hair restoration market in UK held the second largest market share in 2023. The UK has a significant population that is concerned about hair loss, leading to a substantial demand for hair transplant system treatments. The country also has a well-established healthcare system with high standards of medical care, making it an attractive destination for individuals seeking hair transplant procedures.

The Italy hair restoration market is anticipated to witness significant CAGR of 17.4% during the forecast period. Italy has a large population that is increasingly concerned about hair loss, leading to a growing demand for hair restoration treatments. Additionally, the country's well-developed healthcare infrastructure and high standards of medical care make it an attractive destination for individuals seeking quality hair transplant procedures. Moreover, Italy is known for its fashion and beauty industries, with a strong emphasis on personal appearance and grooming, which further drives the demand for hair restoration treatments.

Asia Pacific Hair Restoration Market Trends

The hair restoration market in Asia Pacific is anticipated to witness significant CAGR of 17.1% during the forecast period. This is due to significant number of individuals experiencing hair loss, which drives the demand for hair restoration procedures. Additionally, countries in Asia Pacific, such as China and India, have seen rapid economic growth, leading to an increase in disposable income and affordability of hair restoration treatments.

The China hair restoration held the largest revenue market share of 25.35% in 2023. China has a large population, including a significant number of individuals experiencing hair loss, driving the demand for hair restoration procedures. Additionally, the country's rapidly growing economy has led to an increase in disposable income, making hair restoration treatments more affordable and accessible to a larger segment of the population.

The hair restoration market in India held the second largest market share in the Asia Pacific region. This is due to its rapidly growing lifestyle, increasing awareness of personal appearance, and the development of advanced medical facilities. The country's cost-effective surgical care and adoption of high-quality surgical facilities by experts make it an attractive destination for hair transplantation services, especially for the middle-income group.

Latin America Hair Restoration Market Trends

The market in Latin America is expected to witness a lucrative growth during the forecast period. Due to the increasing prevalence of hair loss conditions, rising awareness about hair transplant procedures, and technological advancements in hair restoration surgery. These factors, coupled with the region's growing healthcare infrastructure and disposable income, contribute to the market's expansion.

The Brazil hair restoration market is expected to grow due to the increasing prevalence of hair loss conditions, rising awareness about hair restoration procedures, and the development of advanced medical facilities. These factors, combined with the country's growing healthcare infrastructure and disposable income, contribute to the market's expansion.

MEA Hair Restoration Market Trends

MEA hair restoration market is expected to grow at a lucrative growth, due to the driving demand and advancements in hair restoration technologies. Factors such as the rising prevalence of androgenetic alopecia, lifestyle changes leading to hair loss triggers, increased disposable income, and a growing emphasis on aesthetics are key drivers propelling market expansion.

The hair restoration market in South Africa held the largest revenue market share of 31.65% during 2023. This is due to the increasing demand for hair restoration services driven by factors like the rising prevalence of hair loss conditions, lifestyle changes, and a growing emphasis on aesthetics in the region.

Key Hair Restoration Company Insights

Major players in the hair restoration market are expanding their product & service offerings while incorporating innovative technologies to broaden their customer base, capture a larger market share, and diversify their applications. For example, in April 2022, ExoCoBio Inc. introduced ASCE HRLV, a product designed for scalp rejuvenation and hair loss treatment. ASCE+ HRLV aims to rapidly increase its market presence by offering four key benefits: scalp rejuvenation, hair loss treatment, anti-aging hair improvement, and prevention of hair problems. This product is designed to cater to scalp and hair care needs for people of all ages and genders.

Key Hair Restoration Companies:

The following are the leading companies in the hair restoration market. These companies collectively hold the largest market share and dictate industry trends.

- Bosley

- Fue Hair Transplant

- Hair Restoration Network

- New York Hair Restoration Centers

- Shapiro Medical Group

- The Harley Street Hair Clinic

- The Maitland Clinic (UK)

- Chung Hospital

- CS Hair Clinic

Recent Developments

-

In December 2022, HairClub expanded its facility in Florida, United States, to cater to residents seeking hair loss solutions. The new center in Wildwood provides access to HairClub's services, offering personalized solutions for hair loss.

-

In April 2022, HermestHair Clinic (HHC) in Turkey introduced a cost-effective and innovative follicular unit extraction (FUE) method for hair transplants. This new service offers patients a unique and affordable option for hair restoration procedures.

Hair Restoration Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.44 billion

Revenue forecast in 2030

USD 18.67 billion

Growth rate

CAGR of 16.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Procedure, therapy, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Mexico; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Bosley; Fue Hair Transplant; Hair Restoration Network; New York Hair Restoration Centers; Shapiro Medical Group; The Harley Street Hair Clinic; The Maitland Clinic (UK); Chung Hospital; CS Hair Clinic

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hair Restoration Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global hair restoration market report based on procedure, therapy and region:

-

Procedure Outlook (Revenue, USD Million, 2018 - 2030)

-

Follicular unit extraction

-

Follicular unit transplantation

-

-

Therapy Outlook (Revenue, USD Million, 2018 - 2030)

-

Low-Level Laser Therapy (LLLT)

-

Stem Cell hair restoration

-

Platelet-Rich Plasma

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Mexico

-

Brazil

-

Argentina

-

-

Middle East & Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global hair restoration market size was estimated at USD 6.46 billion in 2023 and is expected to reach USD 7.44 billion in 2024.

b. The global hair restoration market is expected to grow at a compound annual growth rate of 16.6% from 2024 to 2030 to reach USD 18.67 billion by 2030.

b. North America dominated the hair restoration market with a share of 32.2% in 2023, owing to the technological advancement and increase in the number of individuals opting for procedures involved in the hair restoration market.

b. Some key players operating in the hair restoration market include Bosley, Fue Hair Transplant, Hair Restoration Network, New York Hair Restoration Centers, Shapiro Medical Group, The Harley Street Hair Clinic, The Maitland Clinic (UK), Chung Hospital,and CS Hair Clinic.

b. Key factors that are driving the market growth include rising incidence of alopecia, rising global disposable income, and lifestyle shifts among the global population. This surge can also be due to the increased success rate of hair transplantation procedures and technological advancement in the field of less invasive hair restoration.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.