- Home

- »

- Pharmaceuticals

- »

-

Hair Thinning Market Size & Share, Industry Report, 2030GVR Report cover

![Hair Thinning Market Size, Share & Trends Report]()

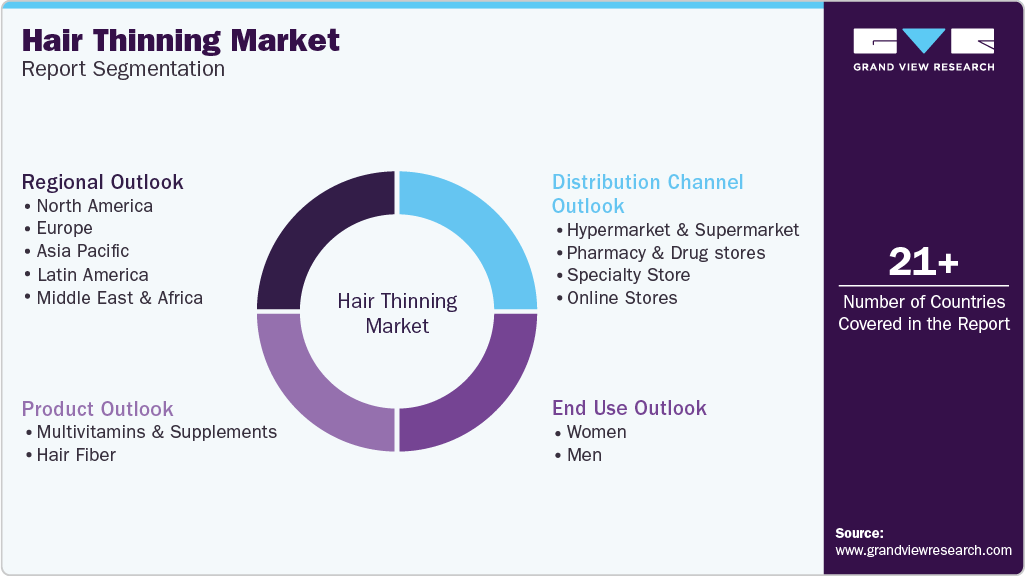

Hair Thinning Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Multivitamins & Supplements, Hair Fiber), By End Use (Women, Men), By Distribution Channel (Hypermarket & Supermarket), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-296-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Hair Thinning Market Summary

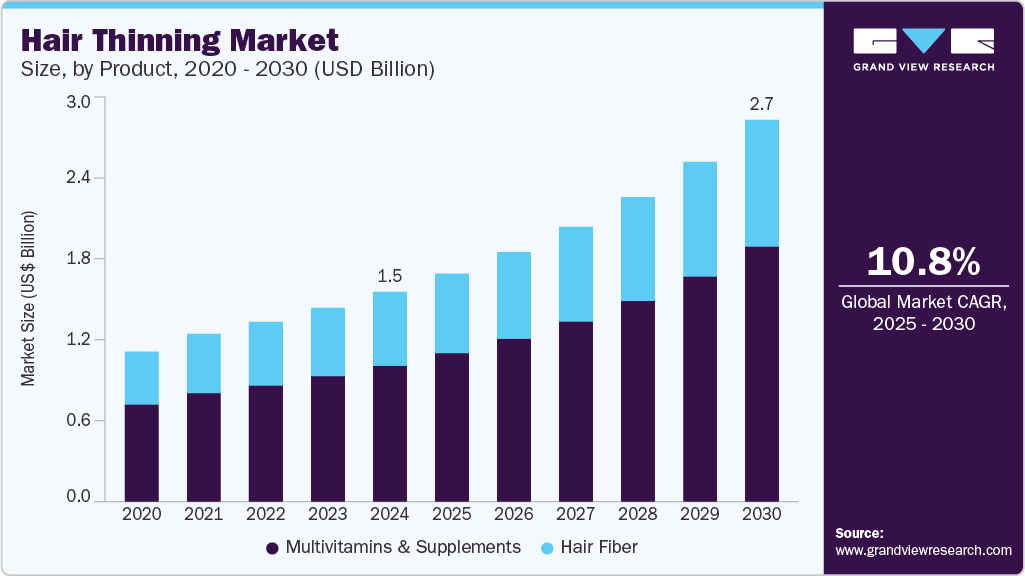

The global hair thinning market size was estimated at USD 1.51 billion in 2024 and is projected to reach USD 2.75 billion by 2030, growing at a CAGR 10.85% from 2025 to 2030. The increasing awareness about hair wellness, the growing risk of alopecia & other hair-related problems, and innovation in hair growth treatment & supplement products are among the major factors anticipated to fuel the market growth over the forecast period.

Key Market Trends & Insights

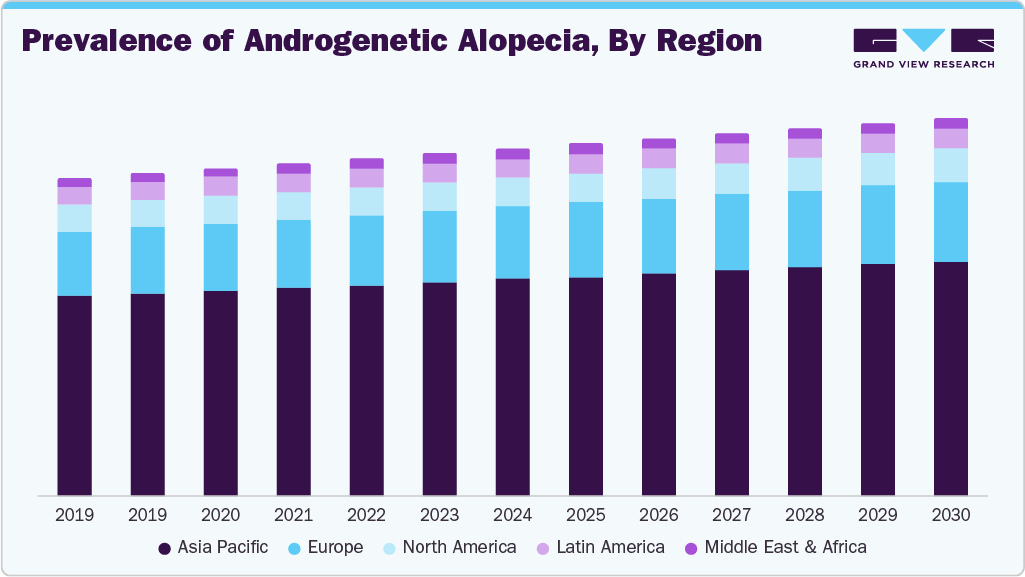

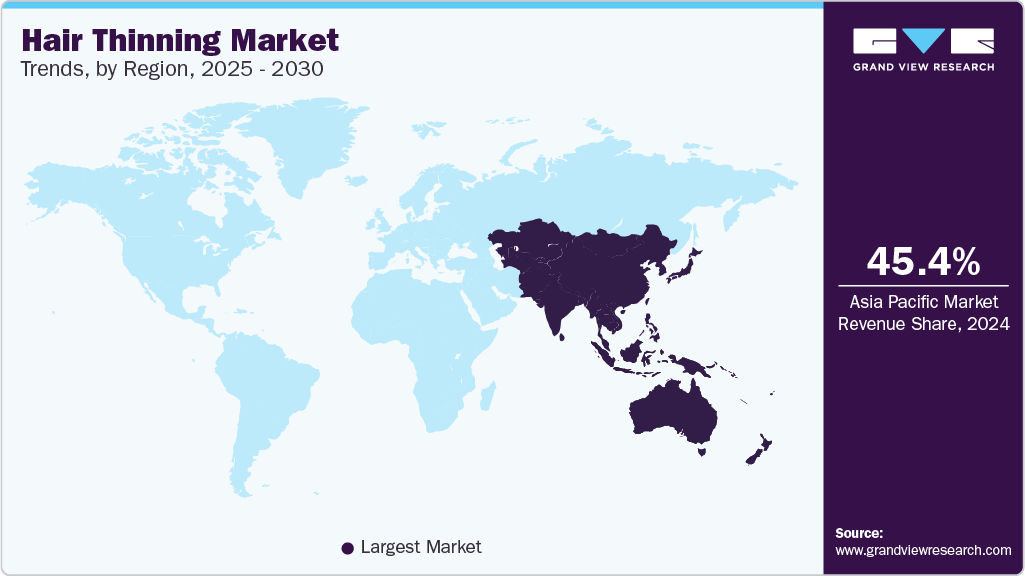

- Asia Pacific dominated the market with a revenue share of 45.41% in 2024.

- The hair thinning market in the U.S. is expected to grow over the forecast period.

- Based on Product, the multivitamins & supplements segment held the largest market share of 64.92% in 2024.

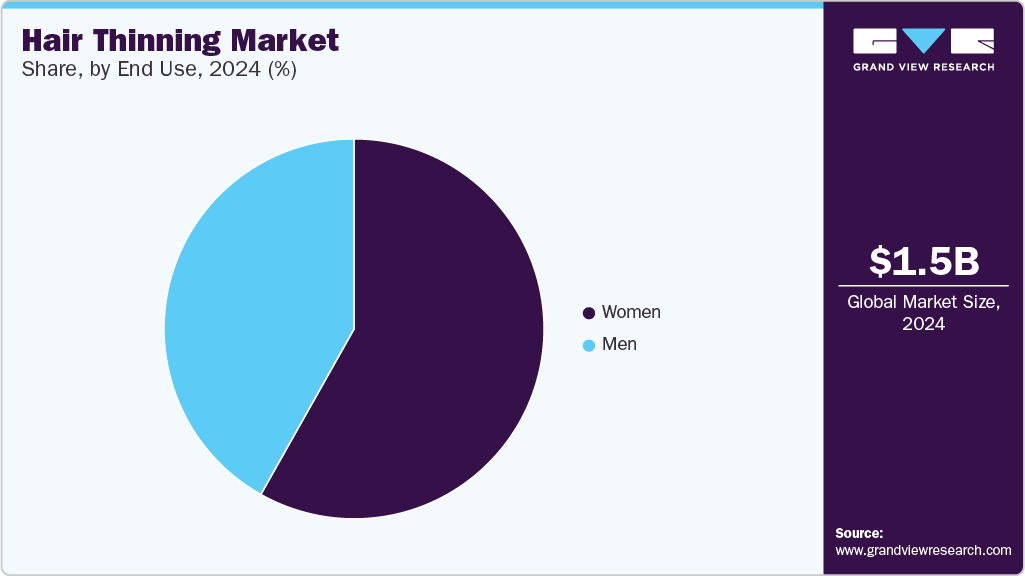

- On the basis of end use, the market is segmented into women and men. The women segment held the largest market share of 58.17% in 2024.

- On the basis of distribution channel, the hypermarkets & supermarkets segment held the largest market share of 36.39% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.51 billion

- 2030 Projected Market Size: USD 2.75 billion

- CAGR (2025-2030): 10.85%

- Asia Pacific: Largest market in 2024

According to National Alopecia Areata Foundation August 2023 statistics, nearly 160 million people suffer from alopecia, including 6.7 million people in the U.S. Furthermore, the introduction of advanced technologies & innovative formulations in the hair care industry has encouraged consumers to choose cutting-edge solutions for their hair problems. This has fueled the development of a wide range of hair growth products, from multivitamins & supplements to hair fiber, which is contributing to market expansion.

The COVID-19 pandemic had a notable impact on the hair thinning market and presented several growth opportunities for the market. As individuals became increasingly conscious of their health, the desire to maintain healthy hair while salons were closed led to a surge in interest in at-home hair care solutions, including supplements & hair fibers. This heightened interest prompted companies to focus on marketing their products as convenient & effective options for maintaining hair health in the absence of salon visits. The pandemic accelerated trends toward eCommerce and online shopping. With physical retail spaces restricted or closed during lockdowns, consumers turned to online platforms to purchase hair growth supplements & hair fibers. This shift in buying behavior prompted companies to strengthen their online presence, optimize eCommerce experiences, and explore direct-to-consumer channels.

The hair thinning market is likely to witness a significant boost due to the increasing prevalence of hair loss disorders, driving the demand for innovative hair treatments. Genetics, hormonal imbalances, stress, poor nutrition, and environmental pollutants contribute to hair problems, making them widespread & persistent. Moreover, the increasing prevalence of hair loss disorders is not limited to a specific age group or gender; it affects men & women across various age brackets, making it a global concern. According to the National Library of Medicine, androgenetic alopecia impacts approximately 50 million men and 30 million women across the U.S. This condition can commence as early as an individual’s teenage years, and the likelihood of experiencing it increases with age.

The National Library of Medicine's statistics show that over 50% of men aged 50 years & above exhibit some level of hair loss. Among women, the likelihood of hair loss tends to increase postmenopause. This broad demographic reach has made the hair thinning market highly lucrative and diverse, catering to a wide range of customer needs. As a result, the market is expected to witness substantial growth in the near future.

Furthermore, the increasing prevalence of hair loss has also led several customers to seek natural, science-based, and advanced solutions to address hair-related issues. This has prompted companies to develop & market hair growth supplements & treatments that promise efficacy and safety. Advancements in research and technology have enabled the development of innovative hair growth supplements. Companies are investing heavily in R&D to create novel & innovative products. For instance, in January 2023, Curallux, LLC launched the Nurish products line made from Cynatine HNS (Hair, Nails, and Skin), a cosmeceutical component sourced from proteins naturally occurring in the human body.

Hair Transplant Global Procedure Volume Trends

Year

Global Procedure Volume

2015

1.9 million procedures

2016

2.0 million procedures

2017

2.3 million procedures

2018

2.5 million procedures

2019

2.6 million procedures

2020

3.1 million procedures

2021

3.4 million procedures

2022

4.0 million procedures

2023

4.2 million procedures

Source: veraclinic.net

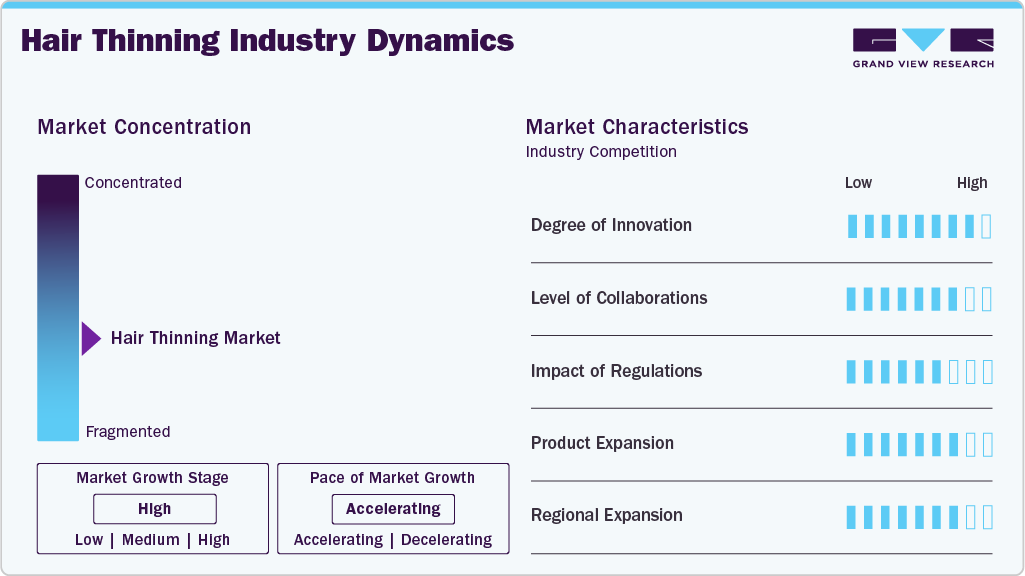

Market Concentration & Characteristics

Degree of Innovation: Innovation in the hair thinning industry is thriving, fueled by advancements in ingredient formulations, delivery systems, and technology integration. Companies continuously invest in research and development to improve efficacy, safety, and consumer satisfaction in this ever-evolving sector.

Level of Collaboration and Partnership Activities: The level of collaboration and partnership in hair thinning industry remains moderate, as companies form strategic partnerships and acquisitions to strengthen their market presence and capitalize on the emerging trends in health and wellness. For instance, in June 2022, Unilever signed an agreement to acquire a majority stake in the company. Nutrafol by Nutraceutical Wellness, Inc. is the most recommended hair growth brand in the U.S.

Impact of Regulations: Regulation significantly impacts the North American hair thinning market by ensuring product safety, efficacy, and accurate labeling. Stringent regulations, such as those from the FDA and FTC, shape product development, marketing strategies, and consumer trust, driving industry compliance and safeguarding public health.

Product Expansion: Product expansion in the hair thinning market is evident through the introduction of innovative formulations targeting diverse consumer needs, including hair reduction, rough & dry hair, metabolism support, and hair thinning control. For instance, In January 2023, GNC, Curallux, LLC, launched Cynatine HNS supplements for both men and women to promote hair growth.

Regional Expansion: The hair thinning market demonstrates significant regional expansion, with companies strategically targeting diverse geographical areas to capitalize on varying consumer preferences, health trends, and regulatory environments, thereby driving market penetration and growth.

Product Insights

On the basis of product, the market is segmented into multivitamins & supplements and hair fiber. The multivitamins & supplements segment held the largest market share of 64.92% in 2024. The rapidly aging population is a significant growth driver for this segment. As people age, they are more likely to experience hair thinning and loss, creating a consistent demand for pharmaceutical interventions. In addition, changing beauty standards and the increasing desire for healthy hair have contributed to segment expansion.

The multivitamins & supplements segment is expected to grow at the fastest CAGR from 2025 to 2030. Multivitamins & treatment supplements offer a range of benefits that have contributed to substantial growth in their popularity. They provide a convenient and holistic approach to hair health by combining various vitamins, minerals, and herbal extracts in one easy-to-consume form. These supplements often contain nutrients such as vitamins A & C, biotin, and minerals such as iron & zinc, which are essential for promoting hair growth & strength. By addressing multiple factors that influence hair health simultaneously, these supplements can potentially deliver more comprehensive results than single-ingredient products.

End Use Insights

On the basis of end use, the market is segmented into women and men. The women segment held the largest market share of 58.17% in 2024. Hair thinning is a common concern among women and can have multiple causes, such as genetics, hormonal changes, stress, nutritional deficiencies, and certain medical conditions. The prevalence of hair thinning in women may vary based on age group, ethnicity, and other factors. Hormonal fluctuations, experienced during menopause or pregnancy, can lead to hair thinning in women, thus boosting the segment growth.

The women segment is expected to grow at a faster CAGR rate during the forecast period. Furthermore, hair loss is one of the symptoms of PCOS, which is a health disorder specifically affecting women. PCOS results in abnormal production of male hormones, especially androgens. The increase in the level of androgens affects the ovulation process in women, resulting in acne, obesity, and androgenetic alopecia. As per the U.S. Department of Health and Human Services, nearly 5 million women in the U.S. are affected by PCOS. Thus, rising prevalence of PCOS is boosting the market.

Distribution Channel Insights

On the basis of distribution channel, the market is segmented into hypermarkets & supermarkets, pharmacy & drug stores, specialty stores, and online stores. The hypermarkets & supermarkets segment held the largest market share of 36.39% in 2024. The competitive pricing & occasional promotions offered by hypermarkets and supermarkets make it a preferred choice for customers seeking cost-effective hair growth solutions. The wide geographic presence of these retail outlets ensures easy access for consumers in various regions, contributing to the continued growth of this segment in hair thinning market.

The online distribution channel segment is expected to record the fastest CAGR over the forecast period. Online retailers are providing attractive discounts on product prices, thereby stimulating sales through digital channels. Moreover, online platforms are formulating and executing various strategies to rival offline competitors. The convenience offered by online distribution channels is favorably influencing segment expansion. In addition, with the increasing prevalence of e-commerce, there is a gradual transition towards online distribution channels for hair supplements. The increase in self-directed consumers is also a significant driver of segment growth.

Regional Insights

Asia Pacific dominated the market with a revenue share of 45.41% in 2024. The growing prevalence of hair-related issues such as hair loss and thinning among both men & women in the region has increased the demand for hair growth solutions. The rising awareness of hair health is boosting the consumption of hair growth supplements and treatments. Moreover, the rise in disposable income in many Asia Pacific countries, including China and India, has increased access to hair care products and treatments. This has resulted in a greater willingness to invest in hair growth products, further boosting market growth.

South Korea Hair Thinning Market Trends

The hair thinning market in South Korea is experiencing significant growth, driven by factors such as increasing health consciousness. In South Korea, the elderly and adults are focusing on adopting supplements specifically tailored for maintaining a healthy life. With the rise in hair thinning concerns, consumers have become aware of healthy aging and disease prevention. As a result, the demand for supplements related to maintaining healthy hair is increasing.

Vietnam hair thinning market is witnessing notable growth. The demographic landscape in Vietnam is evolving, with an expanding population of young individuals with disposable income. Such individuals are increasingly investing in personal care and grooming products, including those related to hair care. Changing lifestyle characterized by stress, poor nutrition, and exposure to pollution also drive the incidence of hair thinning, thereby boosting the market for related products.

North America Hair Thinning Market Trends

Increased disease burden, research collaborations, and government initiatives such as organizing awareness campaigns & research funding are anticipated to fuel the market growth. The presence of government and nonprofit organizations, such as National Alopecia Areata Foundation (NAAF), Canadian Alopecia Areata Foundation, & Cicatricial Alopecia Research Foundation, which provide guidelines and create awareness, is likely to have a positive impact on the market. Furthermore, competition in the North America hair growth supplement is expected to increase due to the emergence of alternative treatments & growing market penetration of privately labeled supplement brands. The presence of small as well as established players increases the availability of products in the market, thereby augmenting the penetration of hair growth products in this region.

The hair thinning market in the U.S. is expected to grow over the forecast period, driven by factors such as, the U.S. population, especially in the age group of 19 to 50 years, is increasingly becoming health-conscious owing to the growing incidence of various disorders, such as alopecia, tinea capitis, etc., which is one of the significant factors boosting the adoption of supplements in the country. The high rate of multi-nutrient deficiency among people of different age groups is further boosting the demand for hair supplements and effective treatment in the country. In addition, the usage of supplements among Americans has steadily increased over the past 20 years, and as of 2021, 80% of adults in the U.S. were consuming dietary supplements. Thus, the increased demand for supplements & growing consumption patterns are other factors projected to drive global hair growth supplement and treatment market during the forecast period.

Europe Hair Thinning Market Trends

The hair thinning inddustry in Europe is projected to grow significantly due to rising health concerns, increasing awareness, and consumer preference for hair thinning products. Key growth factors include a higher demand for personalized nutrition. Most Europeans are increasingly adopting dietary & nutritional supplements to reduce the effects of aging and improve their overall well-being. A growing number of dietary supplements are being formulated and launched in Europe to cater to the increasing demand from end users. Thus, above mentioned factors are projected to support regional market growth.

The hair thinning market in the Italy held a significant share in 2023. Increasing demand for dietary supplements & rising incidence of hair thinning disorders in the country are driving the hair thinning market in Italy. In addition, rapidly aging population and increased demand for hair growth supplements & treatment among young & middle-aged individuals are other factors fueling the market. Thus, the increasing consumption of supplements by Italian population is anticipated to fuel the market.

Spain hair thinning market is experiencing growth, Spain is one of the countries with highest consumption rates of supplements with a significant range consumption rate of vitamin and mineral supplements. Market in the region is anticipated to witness growth in the coming years due to rising popularity of personalized nutrition among women and aging population in the country.

The hair thinning industry in Sweden is flourishing due to a combination of factors such as a health-conscious population, advanced healthcare infrastructure, and the availability of high-quality products. The increasing prevalence of lifestyle-related issues has led to a rising trend in the consumption of health and dietary supplements among consumers. The key driving force behind this market growth is the shift toward preventive health management practices, fueled by increased healthcare spending and rising burden of lifestyle-related ailments.

MEA Hair Thinning Market Trends

The MEA hair thinning market has experienced considerable growth in recent years, driven by several factors. There is a growing demand for hair thinning supplements in the Middle East & Africa as consumers increasingly seek solutions to address hair loss and promote hair growth. The market for hair thinning supplements in this region is driven by various factors, such as the desire for healthier & fuller hair, concerns related to hair thinning & balding, changing lifestyle, and increasing awareness about the importance of hair care.

Saudi Arabia hair thinning industry has experienced steady growth in recent years. Supplement usage significantly increased among the population of Saudi Arabia over the last 2 decades. For instance, according to PLOS, around 47% of individuals used at least one supplement in 2019. Furthermore, a study published by NIH in October 2023 found that 71.3% of participants experienced hair loss, a common issue among women. The study also revealed that stress and other psychological factors were significant contributors to hair loss. These factors further propel market growth.

The hair thinning market in Kuwait is experiencing notable growth. Kuwait emerged as a potential hub for supplements due to the presence of a large network of distribution channels. Moreover, high penetration of supplement manufacturers supported the market in the country.

Key Hair Thinning Company Insights

The market players operating in the hair thinning industry are adopting product approval to increase the reach of their products in the market and improve the availability of their products, along with expansion as a strategy to enhance production/research activities. In addition, several market players are acquiring smaller players to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve their competencies.

Key Hair Thinning Companies:

The following are the leading companies in the hair thinning market. These companies collectively hold the largest market share and dictate industry trends.

- Church & Dwight Co, Inc

- Keranique

- Unilever (Nutraceutical Wellness, Inc.)

- Nanogen

- Lexington International, LLC (Hairmax)

- Help Hair, Inc.

- KeraFiber

- Vitabiotics, Ltd.

- Nestlé Health Science (Nature’s Bounty)

- GNC Holdings, Inc. (Harbin Pharmaceutical Group)

Recent Development

-

In November 2023, Hairmax announced its expansion into the European Union (EU), with a strategic alliance with Johnbeerens.com, which helped Hairmax deliver its products to customers in the EU.

-

In December 2023, Hairmax announced a long-term partnership with Pattern Inc., an e-commerce accelerator, which will help Hairmax drive brand sales on the Amazon platform.

-

In April 2023, Nutrafol, a leading recommended hair growth supplement brand, partnered with Sid Lee, a creative agency, to create a campaign named Grow on.

-

In August 2021, Nestlé Health Science acquired the core brands of The Bountiful Company, including Solgar, Osteo Bi-Flex, Ester-C, Puritan’s Pride, and Nature's Bounty. This acquisition strengthened the company's existing product portfolio.

Hair Thinning Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.64 billion

Revenue forecast in 2030

USD 2.75 billion

Growth rate

CAGR of 10.85% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Italy; Spain; Sweden; Netherlands; Portugal; Poland; Turkey; Baltic Countries; South Korea; Vietnam; Singapore; Taiwan; Hongkong; Brazil; Argentina; Peru; Colombia; Chile; Saudi Arabia; UAE; Kuwait

Key companies profiled

Church & Dwight Co, Inc; Keranique; Unilever (Nutraceutical Wellness, Inc.); Nanogen; Lexington International, LLC (Hairmax); Help Hair, Inc.; KeraFiber; Vitabiotics, Ltd.; Nestlé Health Science (Nature’s Bounty); GNC Holdings, Inc. (Harbin Pharmaceutical Group)

Customization scope

Free report customization (equivalent up to 8 analyst's working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Hair Thinning Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global hair thinning market based on product, end use, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Multivitamins & Supplements

-

Gummies & Soft Gels

-

Capsules

-

Powder

-

Tablets

-

-

Hair fiber

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Women

-

Men

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarket & Supermarket

-

Pharmacy & Drug stores

-

Specialty Store

-

Online Stores

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Italy

-

Spain

-

Sweden

-

Netherlands

-

Portugal

-

Poland

-

Turkey

-

Baltic Countries

-

-

Asia Pacific

-

South Korea

-

Vietnam

-

Singapore

-

Taiwan

-

Hong Kong

-

-

Latin America

-

Brazil

-

Argentina

-

Peru

-

Colombia

-

Chile

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global hair thinning market size was estimated at USD 1.51 billion in 2024 and is expected to reach USD 1.64 billion in 2025.

b. The global hair thinning market is expected to grow at a compound annual growth rate of 10.85% from 2025 to 2030 to reach USD 2.75 billion by 2030.

b. Asia Pacific dominated the market with a revenue share of 45.41% in 2025. The growing prevalence of hair-related issues such as hair loss and thinning among both men & women in the region has increased the demand for hair growth solutions.

b. Some key players operating in the hair thinning market include Church & Dwight Co, Inc, Keranique, Unilever (Nutraceutical Wellness, Inc.), Nanogen, Lexington International, LLC (Hairmax), Help Hair, Inc., KeraFiber, Vitabiotics, Ltd., Nestlé Health Science (Nature’s Bounty), GNC Holdings, Inc. (Harbin Pharmaceutical Group)

b. The increasing awareness about hair wellness, the growing risk of alopecia & other hair-related problems, and innovation in hair growth treatment & supplement products are among the major factors anticipated to fuel the market growth over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.