- Home

- »

- Plastics, Polymers & Resins

- »

-

Halal Packaging Market Size, Share & Growth Report, 2030GVR Report cover

![Halal Packaging Market Size, Share & Trends Report]()

Halal Packaging Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Rigid, Flexible), By Product, By End-use (Pharmaceutical, Food & Beverage, Cosmetics, Modest Fashion), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-086-0

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Halal Packaging Market Summary

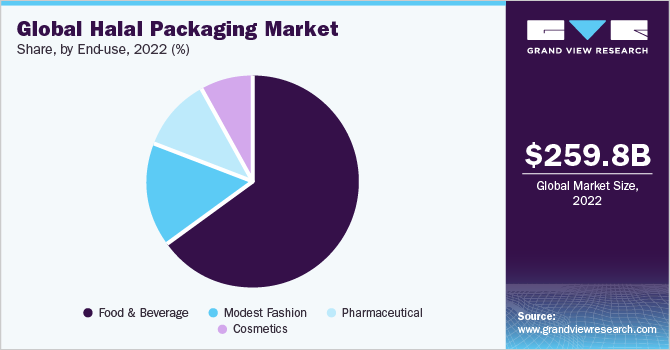

The global halal packaging market size was valued at USD 259.80 billion in 2022 and is projected to reach USD 437.89 billion by 2030, growing at a compound annual growth rate (CAGR) of 7.2% from 2023-2030. This market growth is attributed to the growing consumer awareness regarding Halal-Certified packaging products and increased consumer demand for organic packaging solutions.

Key Market Trends & Insights

- The Asia Pacific region accounted for a significant market share of over 39.0% 2022.

- Indonesia plays a significant role in the halal packaging market in the Asia Pacific region.

- Based on type, the rigid packaging segment accounted for a significant share of over 54.0% in the base year 2022.

- Based on product, the bottles & jars segment recorded the highest market share of over 26.0% in 2022.

- Based on end-use, the food & beverage segment recorded a higher market share of over 65.0% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 259.80 billion

- 2030 Projected Market Size: USD 437.89 billion

- CAGR (2023-2030): 7.2%

- Asia Pacific: Largest market in 2022

Halal packaging refers to packaging solutions that are manufactured using halal raw ingredients which exclude animal derivatives from its composition. The materials are not just limited to raw material used for packaging but also the lubricants used in the equipment used for manufacturing of the packaging. The implementation of halal certification in the U.S. traces back to 1915 in New York, following the issuance of the Kosher Certificate, which certifies compliance with Jewish kosher dietary requirements and laid the foundation for the development of halal certification in the country.

The halal packaging market in the country is dominated by major certification bodies such as the Islamic Society of North America (ISNA), Islamic Food and Nutrition Council of America (IFANCA), American Halal Foundation (AHF), and Islamic Services of America (ISA), which play a significant role in providing halal certifications to ensure compliance with Islamic dietary laws and regulations for products.

Furthermore, the growing exports of products to countries such as Dubai, Oman, United Arab Emirates, Qatar, Pakistan, Malaysia, and Indonesia have increased the demand for halal packaging certified by regulatory bodies in the U.S. These countries have their own specific regulatory standards for halal products, and the certification helps U.S. packaging manufacturers to meet those halal standards and access these export markets.

Type insights

Based on type, the halal packaging market is categorized into rigid and flexible packaging. Among which rigid packaging accounted for a significant share of over 54.0% in the base year 2022. This is attributed to the fact that rigid packaging ensures that the packaged products remain uncontaminated and maintain their integrity throughout the supply chain. Rigid packaging materials like bottles, jars, cans, and blister packs provide protection against external factors, such as moisture, light, and physical damage, which could compromise the halal status of the products.

The flexible packaging segment is expected to grow owing to its lightweight, portability, and easy-to-handle features. Flexible packaging often requires less material and transportation space, resulting in lower production and shipping costs. This cost efficiency is appealing to both producers and consumers, which further contributes to the growing demand for flexible halal packaging market.

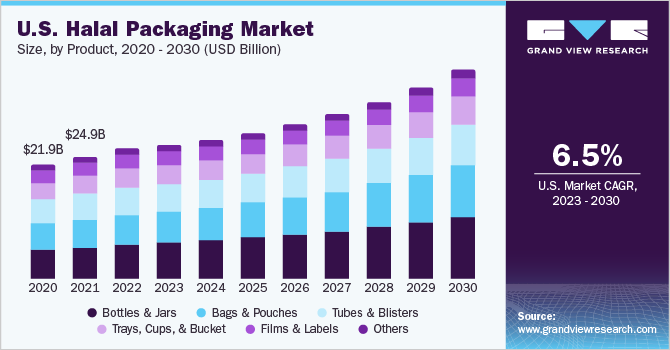

Product Insights

Based on product, the halal packaging market is further segmented into bottles & jars, bags & pouches, films & labels, trays, pails & bucket, tubes & blisters, and others. Among these, the bottles & jars recorded the highest market share of over 26.0% in 2022. This can be attributed to their extensive application in various end-use industries, including food & beverage, personal care, and pharmaceutical products that comply with halal requirements. Packaging manufacturers are focusing on meeting the evolving demands of consumers seeking halal-compliant products by offering halal-certified packaging materials and investing in innovative designs. For instance, Albéa Services S.A.S., a cosmetics and personal care packaging solutions manufacturer, provides halal-certified bottles & jars to cater to the growing consumer demand for halal cosmetic packaging solutions.

The bags and pouches segment is driven by additional features that enhance product protection and user-friendliness, such as resealable zippers, spouts, tear notches, and handles. These features provide convenience and ensure the integrity of halal-certified products. Several companies, including Rootree, Core Pax (M) Sdn. Bhd, and Nsix Industry Sdn. Bhd, offer halal bags and pouches to cater to the food & beverage, and pharmaceuticals sectors. Halal certified bags can be used for packaging of Modest Fashion falling under modest fashion.

The films & labels segment is driven by a wide demand in the personal care and food & beverages industry. Halal-certified films are extensively used in the packaging of food & beverage items including meats, snacks, and frozen foods. These films provide essential barrier properties that effectively preserve the freshness and quality of these products. They offer protection against moisture, oxygen, and other external factors that can potentially compromise the halal status of the packaged food, thereby driving the demand for halal packaging in the market.

End-use Insights

Based on end-use, the halal packaging market is classified into food & beverages, pharmaceutical, cosmetics, and Modest Fashion. Among these, the food & beverage recorded a higher market share of over 65.0% in 2022 owing to the increasing popularity of halal food & beverages among Muslim consumers. The rise in consumer awareness regarding packaging adhesives that may contain animal fats has led to a shift in demand towards halal-certified food packaging solutions. Consequently, food packaging manufacturers are actively pursuing halal certifications to meet the requirements of a large population of halal food & beverages consumers.

The pharmaceutical packaging market in Malaysia is experiencing significant growth, driven by regulatory bodies such as the Department of Islamic Development in Malaysia (JAKIM), Malaysian Standards Department, and the Halal Development Corporation. These bodies set halal standards for manufacturing halal pharmaceutical packaging, ensuring that it does not contain animal derivatives or other impure ingredients. Additionally, the adoption of serialization and track-and-trace technologies is increasing in the halal pharmaceutical packaging sector as they help ensure the authenticity and integrity of halal-certified products throughout the supply chain. By implementing these technologies in halal packaging, manufacturers can enhance consumer trust, improve product safety, and contribute to the growth of the halal packaging market.

The demand for halal cosmetic packaging is driven by various government regulations implemented in different countries. For instance, the GCC countries, including Saudi Arabia, United Arab Emirates, Qatar, Oman, Bahrain, and Kuwait, have their own regulations for halal cosmetics. Regulatory bodies like the Emirates Authority for Standardization and Metrology (ESMA) in theUAE require cosmetic companies to obtain halal certification to market their products as halal. These government regulations have led to the emergence of packaging companies, such as Albéa and Meiyume, that specialize in offering halal cosmetic packaging solutions, thereby driving the demand for halal packaging in the market cosmetics segment.

The demand for halal Modest Fashion is experiencing significant growth due to the increasing consumer awareness regarding halal principles and the rising number of vegan consumers. Halal Modest Fashion excludes materials such as cashmere, silk, leather, and wool, which are derived from animals and may involve animal cruelty. Instead, halal Modest Fashion products focus on using synthetic fibers that are entirely man-made and serve as suitable substitutes for non-halal Modest Fashion materials. This shift towards synthetic fibers allows for the production of Modest Fashion items that align with halal standards and cater to the preferences of ethical and environmentally conscious consumers.

Regional Insights

The Asia Pacific region accounted for a significant market share of over 39.0% 2022 owing to several countries in the region such as Indonesia, Malaysia, Singapore, and Thailand, have established halal certification bodies or government agencies to oversee and regulate halal products, including packaging. Packaging manufacturers need to obtain halal certification to ensure their products meet the required standards. For instance, the Islamic Religious Council of Singapore (MUIS) is responsible for regulating, certifying, and providing guidelines for halal products, including packaging, through its Halal Certification Program. This proactive approach by regulatory bodies drives the growth of the halal packaging market in the region.

Indonesia plays a significant role in the halal packaging market in the Asia Pacific region. This is attributed to the Indonesian government implementing strict policies and regulations, such as the Halal Product Law introduced in 2019. According to this law, all consumer goods entering the country must obtain halal certification for sale and distribution without which the products could lead to bans and legal actions. For instance, a Korean instant noodles brand, Samyang entered the Indonesian market without clear labeling of its non-halal contents on the packaging. This led to the product being pulled off the shelves until it obtained the necessary halal certification and added the halal logo on its packaging to regain consumer trust in the country.

The Middle East & Africa with its predominantly Islamic culture drives significant demand for halal packaging. The rise in disposable income among consumers in the region has led to a substantial demand for cosmetics and personal care products. Consumers are increasingly willing to spend more on organic and halal-certified cosmetics and their packaging. To meet this growing demand, cosmetic manufacturers are adopting halal certification for their products and packaging. Companies such as Clara International Beauty Group, LLC, FX Cosmetics, Inika, One Pure, LLC, and Samina Pure Minerals Makeup Ltd are actively contributing to the halal packaging in the region.

Moreover, several government regulations in the regions varying from country-to-country fuel the market growth for halal packaging market. For instance, the Saudi Food and Drug Authority (SFDA) oversees the regulation of halal products, including packaging, in Saudi Arabia. The SFDA ensures that products meet halal requirements, and packaging materials and processes are in accordance with halal principles.

The demand for halal packaging is on the rise in North America due to growing consumer awareness and recognition of the benefits it offers. Consumers in the region are increasingly valuing halal-certified products, which provide assurance of quality, safety, and ethical production practices. Furthermore, North America is one of the major exporters of halal meat to the Middle East which further drives the demand for halal packaging in the region. Packaging manufacturers in North America such as Rootree and Cardia Bioplastics are obtaining halal certifications and adopting standardized labeling practices to clearly communicate the halal status of their products. This strategic approach not only ensures compliance with consumer preferences but also provides a competitive edge in the market. As a result, the market for halal packaging continues to grow steadily in North America.

The demand for halal packaging in Europe is experiencing significant growth as consumers prioritize the reliability and hygiene of products. This trend has prompted renowned food manufacturers like Nestlé and Ferrero to obtain halal certification for their products, thereby meeting the increasing consumer demand for halal packaging. To ensure compliance with European halal standards, regulatory bodies such as Halal Certification Europe (HCE) play a crucial role. HCE acts as a certification body, providing halal certification for various products, including packaging. Their certification process ensures that packaging materials and processes adhere to the required halal criteria, bolstering the growth of the halal packaging market in Europe.

The Central & South America market for halal packaging is driven by regulatory bodies and certification organizations across the region actively involved in setting standards and guidelines for halal certification, including packaging regulations. For instance, in Brazil, Instituto Halal is a halal certification and inspection body that offers certification services for various industries, including food & beverage, cosmetics & personal care, and pharmaceuticals. They ensure that the packaging solutions and its materials comply with halal standards. Moreover, the Halal Institute of Argentina promotes and regulates halal certification in Argentina. They work closely with various end-user industries to certify their products, including packaging, ensuring they meet halal standards and requirements.

Key Companies & Market Share Insights

Key Companies resort to multiple mergers and acquisitions in a bid to gain market share in a particular region. In some cases, the companies build technological collaborations to produce an advanced product with superior performance characteristics to increase revenue. For instance, in May 2023, Rootree announced an expansion in its halal pouch product portfolio by launching halal spout pouches for liquid packaging to cater to the food & beverage and cosmetics & personal care products. Some prominent players in the global halal packaging market include:

-

Amcor plc

-

Pacmoore Products Inc.

-

AIE Pharmaceuticals, Inc.

-

Rootree

-

Cardia Bioplastics

-

Albea Indonesia

-

Asia Pulp and Paper (APP) Indonesia

-

PT Champion Pacific Indonesia Tbk

-

Avesta Continental Pack

-

MM Karton

-

Huhtamaki Group

-

Constantia Flexibles

Halal Packaging Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 268.90 billion

Revenue forecast in 2030

USD 437.89 billion

Growth rate

CAGR of 7.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Turkey; Germany; France; Italy; U.K.; Spain; Indonesia; Malaysia; Philippines; India; Australia; Brazil; Argentina; GCC Countries; Egypt.

Key companies profiled

Amcor plc; Pacmoore Products Inc.; AIE Pharmaceuticals, Inc.; Rootree; Cardia Bioplastics; Albea Indonesia; Asia Pulp and Paper (APP) Indonesia; PT Champion Pacific Indonesia Tbk; Avesta Continental Pack; MM Karton; Huhtamaki Group; and Constantia Flexibles

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Halal Packaging Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global halal packaging market report on the basis of type, product, end-use, and region:

-

Type Outlook (Revenue, USD Billion; 2018 - 2030)

-

Flexible

-

Rigid

-

-

Product Outlook (Revenue, USD Billion; 2018 - 2030)

-

Bottles & Jars

-

Bags & Pouches

-

Tubes & Blisters

-

Trays, Cups, and Bucket

-

Films & Labels

-

Others

-

-

End-use Outlook (Revenue, USD Billion; 2018 - 2030)

-

Food & Beverage

-

Pharmaceutical

-

Cosmetics

-

Modest Fashion

-

-

Regional Outlook (Revenue, USD Billion; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

U.K.

-

Italy

-

Spain

-

Turkey

-

-

Asia Pacific

-

Indonesia

-

Malaysia

-

Philippines

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

GCC Countries

-

Egypt

-

-

Frequently Asked Questions About This Report

b. The halal packaging market was valued at USD 259.80 billion in the year 2022 and is expected to reach USD 268.90 billion in 2023

b. The halal packaging market is expected to grow at a compound annual growth rate of 7.2% from 2023 to 2030 to reach USD 437.89 billion by 2030.

b. Asia Pacific under the regional segment accounted for the largest market share of over 39.0% of the halal packaging market for the base year 2022. This is attributed to the high demand for halal products in Indonesia, Malaysia, Philippines, and other Asia Pacific countries.

b. The key players in the halal packaging market include Amcor plc, Pacmoore Products Inc., AIE Pharmaceuticals, Inc., Rootree, Cardia Bioplastics, Albea Indonesia, Asia Pulp and Paper (APP) Indonesia, and PT Champion Pacific Indonesia Tbk among others.

b. The growing muslim population and the mandatory halal certification regulations imposed by major Islamic countries are expected to drive the demand for halal packaging market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.