- Home

- »

- Specialty Polymers

- »

-

Rigid Packaging Market Size & Share, Industry Report, 2030GVR Report cover

![Rigid Packaging Market Size, Share & Trends Report]()

Rigid Packaging Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (Plastic, Metal, Paper, Glass, Bioplastic), By Product (Bottles & Jars), By Application, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-233-4

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Rigid Packaging Market Summary

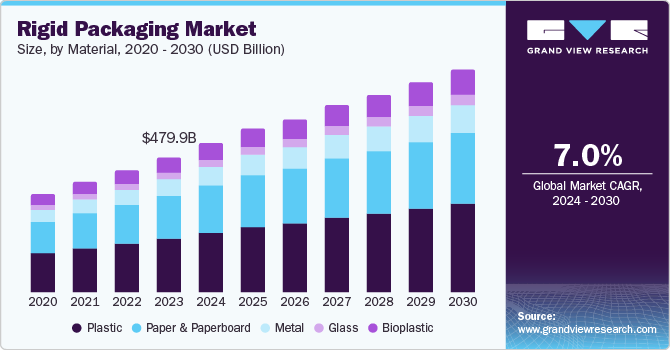

The global rigid packaging market size was estimated at USD 479.9 billion in 2023 and is projected to reach USD 796.7 billion by 2030, growing at a CAGR of 7.0% from 2024 to 2030. The increasing demand for durable and protective packaging solutions across various industries, including food and beverages, pharmaceuticals, personal care, and electronics, has primarily fueled the market.

Key Market Trends & Insights

- Asia Pacific chlorine market dominated the global market with a market share of 48.2% in 2023.

- China chlorine market is expected to grow significantly.

- By application, the Ethylene Dichloride/ Polyvinyl Chloride (EDC/PVC) segment dominated the market and accounted for the largest revenue share of 33.4% in 2023.

- By application, the isocyanate segment is expected to experience a significant CAGR during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 479.9 Billion

- 2030 Projected Market Size: USD 796.7 Billion

- CAGR (2024-2030): 7.0%

- North America: Largest market in 2023

Rigid packaging, known for its strength and durability, is essential for protecting products during transportation and storage, ensuring they reach consumers in optimal condition.

The food and beverage industry is one of the major consumers of rigid packaging products. Accelerated by rising disposable incomes, the market saw a growing consumption of convenience and ready-to-eat food products such as sausages, bread, and potato chips. These have collectively worked to favor the overall market in emerging economies, including China, India, and the Middle East. In addition, the growing number of food retail outlets and new product launches are estimated to augment the growth of the rigid packaging market.

Furthermore, technological advancements and innovations have been a major market driver. The development of advanced materials, such as biodegradable plastics and lightweight composites, is enhancing the performance and sustainability of rigid packaging. Innovations in packaging design, such as tamper-evident and child-resistant features, have improved product safety and consumer confidence.

Moreover, environmental concerns and sustainability trends played a crucial role in shaping the rigid packaging market. Consumers and manufacturers have become more environmentally conscious, surging demand for recyclable and eco-friendly packaging materials. This shift is particularly evident in the growing preference for paper-based rigid packaging solutions, which offer a sustainable alternative to traditional plastic packaging. Governments and regulatory bodies worldwide have implemented stringent regulations to reduce plastic waste and promote recycling, further boosting the adoption of sustainable rigid packaging options.

Material Insights

Plastics dominated the market and accounted for the largest revenue share of 39.7% in 2023, owing to their versatility, durability, adaptability, and cost-effectiveness. Plastic packaging provides excellent protection for products during transportation and storage while being lightweight, which reduces shipping costs and carbon emissions. In addition, plastics such as PET (polyethylene terephthalate), PE (polyethylene), and PP (polypropylene) are widely used due to their ability to be molded into various shapes and sizes. These make them suitable for multiple applications across industries, including food and beverages, pharmaceuticals, and personal care sectors. Furthermore, the combination of strength and lightness is particularly advantageous for the e-commerce sector, where the demand for robust yet lightweight packaging solutions is high.

Bioplastics are expected to grow substantially at a CAGR of 8.8% during the forecast period credited to their environmental benefits and increasing consumer awareness about the detrimental effects of conventional plastics on the environment. Bioplastics derived from renewable resources such as corn starch, cellulose, or sugarcane offer eco-friendly alternatives, reducing the reliance on fossil fuels and decreasing carbon footprints. Furthermore, this shift is supported by regulatory initiatives worldwide, as governments implement stringent policies to curb plastic waste and promote the use of biodegradable and compostable materials.

Product Insights

Bottles & jars dominated the market and accounted for the largest revenue share of 51.5% in 2023 attributed to their versatility and widespread use across various industries, including food and beverages, pharmaceuticals, and personal care. Bottles & jars offer excellent protection and preservation for liquids, powders, and solids, which makes them indispensable for packaging a wide range of products. These are designed for easy handling, storage, and dispensing, enhancing the user experience. Features, including resealable lids and ergonomic shapes, cater to modern consumer preferences for convenience and functionality, including freshness and safety.

Drums & barrels are expected to grow at a CAGR of 7.2% during the forecast period, primarily stimulated by industrial demand. These containers are widely used for storing and transporting bulk liquids and solids in chemicals, pharmaceuticals, and food and beverages. Their robust construction and ability to withstand harsh conditions make them ideal for handling hazardous and non-hazardous materials, ensuring product safety and integrity during transit and storage. In addition, with increasing environmental awareness, the market witnessed a growing demand for recyclable and reusable packaging solutions. Drums and barrels made from steel and high-density polyethylene (HDPE) are highly durable and can be reused multiple times, reducing the need for single-use packaging.

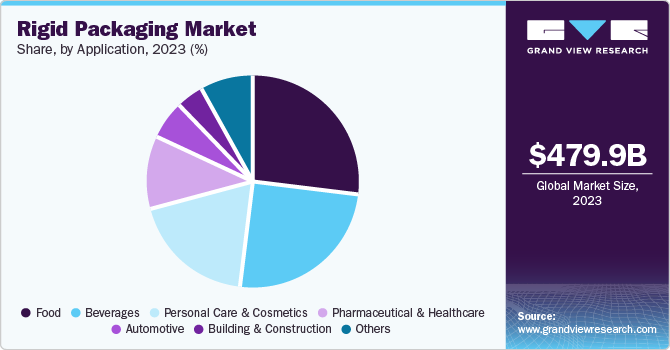

Application Insights

The food application led the market and accounted for the largest revenue share of 26.9% in 2023. Busy lifestyles drive this growth, so consumers have increasingly sought easy-to-use, portable, and ready-to-eat food options. Packaging solutions, such as cans, bottles, and trays, provide the necessary durability and protection for these products, ensuring they remain fresh and intact during transportation and storage. In addition, awareness about foodborne illnesses and contamination risks has increased demand for rigid packaging solutions that can effectively protect food from external contaminants with excellent barrier protection.

The pharmaceutical & healthcare sector is expected to emerge as the fastest-growing segment at a CAGR of 7.5% over the forecast period. The pharmaceutical industry is highly regulated to ensure the safety and efficacy of medications. This necessitates packaging solutions that meet rigorous standards for protection, tamper evidence, and traceability. Rigid packaging, such as bottles, vials, and blister packs, provides the necessary durability and security to comply with these regulations. In addition, innovations such as pre-filled syringes, auto-injectors, and single-dose packaging require specialized rigid packaging to ensure precise dosing and ease of use.

Regional Insights

The Asia Pacific rigid packaging market dominated the global market and accounted for the largest revenue share of 43.7% in 2023, driven by rapid industrialization and urbanization in countries including China, India, and Southeast Asia, with the increased demand for packaged goods across food and beverages, pharmaceuticals, and personal care sectors. Moreover, the region has seen a tremendous surge in online shopping, necessitating robust and reliable packaging solutions to protect products during transit.

China Rigid Packaging Market Trends

The rigid packaging market in China is expected to grow substantially during the forecast period. The increasing demand from the food and beverage sector drives this growth. With a rapidly urbanizing population and rising disposable incomes, consumers are leaning towards packaged food products for convenience and quality assurance. In addition, the Chinese government's push for sustainable packaging solutions has led to a surge in the use of materials such as rigid plastics and paperboard, which are favored for their durability and environmental benefits. Regulatory measures promoting sustainability further bolster this trend, enhancing the overall market landscape.

The India rigid packaging market is experiencing significant growth due to the expansion of the e-commerce sector and changing consumer lifestyles. The rising middle class and urban population drive demand for packaged goods, particularly in food and beverages, where rigid packaging ensures product safety and extends shelf life. Furthermore, innovations in packaging technology, including introducing bioplastics and sustainable materials, are attracting attention from manufacturers. This focus on sustainability, alongside increased online shopping, is expected to propel the market forward in the coming years.

Central & South America Rigid Packaging Market Trends

The Central & South American rigid packaging market is expected to grow at a CAGR of 7.2% over the forecast period. This growth is attributed to the increasing demand for packaged food and beverages. The expanding export trade in these sectors necessitates robust packaging solutions that ensure product quality during transportation. In addition, rising consumer awareness regarding sustainability prompts manufacturers to adopt eco-friendly materials, such as recyclable plastics and paperboard. The growth of e-commerce further enhances the demand for durable packaging options that can withstand online retail logistics, solidifying the market expansion.

Europe Rigid Packaging Market Trends

The rigid packaging market in Europe held a lucrative share of 24.9% in 2023. This growth can be attributed to the end-use industries, including food and beverages, personal care, and pharmaceuticals. These industries require durable and protective packaging solutions to ensure product safety and integrity during transportation and storage. The food and beverage sector, in particular, benefits from rigid packaging’s ability to preserve freshness and extend shelf life, which is crucial for perishable goods.

The UK rigid packaging market is experiencing growth due to the increasing demand for packaged food and beverages, which is a significant driver as consumers prioritize convenience and product safety. In addition, e-commerce has boosted the need for durable packaging solutions that protect products during transit. Furthermore, environmental concerns are also influencing the market, with a shift towards sustainable materials and practices, prompting manufacturers to innovate and adopt eco-friendly packaging options to meet consumer expectations and regulatory standards. Moreover, advancements in packaging technology are enabling the development of more efficient and sustainable rigid packaging solutions, driving market expansion and aligning with consumer preferences for environmentally friendly options.

North America Rigid Packaging Market Trends

The rigid packaging market in North America is expected to grow significantly over the forecast period. Technological advancements in packaging materials drive this growth. This included lightweight designs that reduce material usage without compromising strength and the development of advanced materials with sustainability and cost-effectiveness. These advancements align with the growing emphasis on environmental sustainability and regulatory requirements for reducing plastic waste. Furthermore, the rise of e-commerce has led to the need for robust and protective rigid packaging to ensure the safe delivery of goods. The region's strong manufacturing capabilities and the presence of major industry players have further contributed to the market growth.

The growth of the U.S. rigid packaging market is driven by the rise of online shopping. Rigid packaging protects a wide range of products, from electronics to cosmetics, ensuring intact transit. Furthermore, consumers and manufacturers have increasingly become more environmentally conscious, driving the demand for recyclable and eco-friendly packaging solutions. In addition, rigid packaging made from materials including glass and certain plastics has gained considerable traction as it aligns with global sustainability goals.

Key Rigid Packaging Company Insights

The market is fragmented and dominated by key players such as AVERY DENNISON CORPORATION, CCL Industries, and R.R. Donnelley & Sons Company. These companies have adopted numerous strategies, including expansions, mergers and acquisitions, collaborations, and joint ventures, to expand their global footprint and, consequently, their market shares.

-

AVERY DENNISON CORPORATION is a manufacturer of diverse products and services in the material science and labeling industries. Their portfolio comprises various sectors: retail, food and beverages, healthcare, and logistics. The company's materials are extensively used to create durable and visually appealing product labels, branding solutions, and identification systems.

-

CCL Industries Inc. is a specialty packaging company. The organization is divided into several key segments: CCL Label, CCL Container, Avery, Checkpoint, and Innovia. Each division specializes in different aspects of packaging and labeling solutions. CCL Label, the largest segment, provides innovative package decorating solutions and specialty label applications for global customers. The company serves a diverse range of markets, including home and personal care, premium food and beverage, healthcare, automotive, electronics, and consumer durables.

Key Rigid Packaging Companies:

The following are the leading companies in the rigid packaging market. These companies collectively hold the largest market share and dictate industry trends.

- AVERY DENNISON CORPORATION

- CCL Industries Inc.

- Constantia Flexibles

- Coveris

- R.R. Donnelley & Sons Company

- Lecta Adestor

- 3M

- Bemis Manufacturing Company

- Flexcon Company, Inc.

- NORAH Plastics

Recent Developments

-

In March 2024, 3M unveiled a groundbreaking innovation aimed at transforming shipping and packaging. This new product is designed to enhance sustainability and efficiency in logistics, addressing the growing demand for environmentally friendly solutions. By integrating advanced materials and technologies, 3M's innovation promises to reduce waste and improve the overall shipping process. This initiative reflects the company's commitment to sustainability while providing businesses with practical tools to meet modern packaging challenges effectively.

-

In May 2022, Lecta announced the expansion of its Adestor line of self-adhesive materials with the introduction of new Adestor Standard Films. This product range includes both polypropylene and polyethylene films designed for various labeling applications across the food, industrial, and hygiene sectors. The new films offer high transparency and flexibility, catering to diverse packaging needs. In addition, Lecta enhances its service offerings with customizable roll products through the Exact Cut program, all manufactured in compliance with stringent environmental and quality standards.

Rigid Packaging Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 530.9 billion

Revenue forecast in 2030

USD 796.7 billion

Growth rate

CAGR of 7.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, product, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Australia, Brazil, Argentina, UAE, Saudi Arabia, South Africa

Key companies profiled

AVERY DENNISON CORPORATION; CCL Industries Inc.; Constantia Flexibles; Coveris; R.R. Donnelley & Sons Company; Lecta Adestor; 3M; Bemis Manufacturing Company; Flexcon Company, Inc.; NORAH Plastics

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Rigid Packaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global rigid packaging market report based on material, product, application, and region.

-

Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Plastic

-

Metal

-

Paper & Paperboard

-

Glass

-

Bioplastic

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Bottles & Jars

-

Trays & Clamshells

-

Tubs, Cups, and Pots

-

Pallets

-

Drums & Barrels

-

Crates

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food

-

Beverages

-

Pharmaceutical & Healthcare

-

Personal Care & Cosmetics

-

Automotive

-

Building & Construction

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.