- Home

- »

- Consumer F&B

- »

-

Hard Kombucha Market Size, Share & Growth Report, 2030GVR Report cover

![Hard Kombucha Market Size, Share & Trends Report]()

Hard Kombucha Market (2022 - 2030) Size, Share & Trends Analysis Report By ABV Content (Up to 5.0% ABV, 6.0 to 10.0% ABV), By Distribution Channel (On-trade, Off-trade), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-946-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

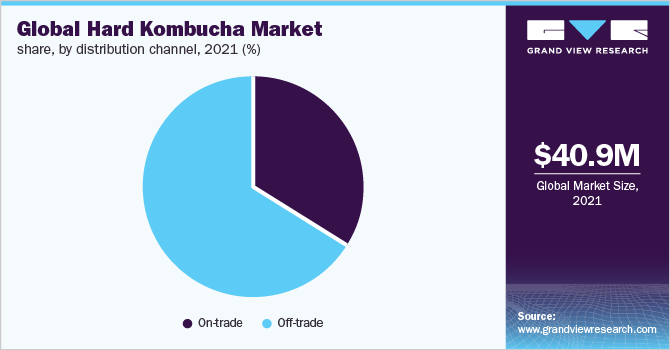

The global hard kombucha market size was valued at USD 40.9 million in 2021 and is expected to grow at a compound annual growth rate (CAGR) of 23.5% from 2022 to 2030. The rising adoption of moderate alcohol content beverages among consumers, especially millennials and the younger generation, is driving market demand. According to an article published in PennState Extension, in January 2020, approximately 64% of millennials prefer new beverages including kombucha compared to only 29% of baby boomers. Moreover, the reduction in alcohol consumption and the rise in sober-curious consumers have further increased the demand for low-alcohol beverages.

The outbreak of the COVID-19 pandemic has drastically impacted the consumption pattern of alcoholic beverages from high alcohol content to low alcohol content due to rising health consciousness among consumers. The sale of hard kombucha during the pandemic rose significantly through e-commerce channels due to stay-at-home orders around the world. For instance, in May 2020, Dubai-based organic kombucha company, Saba Kombucha, reported a 30% jump in online orders, owing to the unavailability of these beverages at retail stores. Furthermore, consumer shift towards ready-to-drink forms including kombucha will integrate well with the market growth in the forecast period.

Shifting consumer preference towards health-based fermented drinks/beverages is expected to drive the product demand. These drinks contain probiotic bacteria, which help consumers overcome various issues, such as digestion and inflammation. Hence, key players in the market are launching products to cater to such requirements. For instance, in June 2020, JuneShine, a San Diego-based brand, launched JuneShine100, a ‘better-for-you’ alcoholic beverage with 100 calories, 1 gram of sugar per can, and an alcohol content of 4.2%. The company claims its product to be gluten-free, made with real fruit, and containing probiotics and antioxidants.

Moreover, the increasing consumer preference for multifunctional healthy halo beverages that not only fulfill their demands but also align with their keto and vegan diets will adapt well to the market growth. Many manufacturers have been offering products in this category. For instance, in July 2020, Flying Embers in partnership with Stick Figure launched a hard kombucha flavor – Mango Coconut with 7% ABV. The product claims to contain zero sugar and carbs, USDA-certified organic ingredients, and live probiotics. In addition, the drink is gluten-free, vegan, and keto-friendly, referring to the dietary requirements of the consumers.

According to a survey conducted by the International Wines and Spirits Record (IWSR), in January 2019, 52% of consumers in the U.S. and 65% of consumers in the U.K. surveyed were trying to reduce their alcohol consumption. Moreover, hard kombucha contains low amounts of alcohol, ranging from 1 to 10% ABV, and has low calories as compared to beer, with most versions having around 100 calories. Thus, moderate drinkers prefer to consume these products as a substitute for beer. These properties are anticipated to boost the sales of the product across the globe over the forecast period.

Furthermore, various initiatives, such as mergers & acquisitions and investments, by key players in the market will integrate well with the upward growth trend. For instance, in January 2022, Beam Suntory, a beverage company invested USD 20 million in Flying Embers, plant-based hard kombucha. The response was made to steam up the company’s market share. In addition, continuous product improvement and a better understanding of the specific health outcomes that are provided by regular consumption of kombucha among consumers are expected to support the market in the foreseeable future.

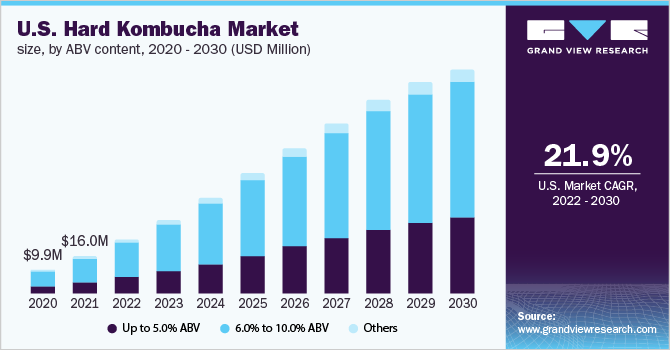

ABV Content Insights

The 6.0to 10.0% ABV segment dominated the global market in 2021 and accounted for the largest share of 64.3% of the overall revenue. The segment is expected to maintain its leading position throughout the forecast period. The concept of moderation is a flourishing trend, especially in the U.S., which is propelling segment growth. Many alcoholic beverage companies have been extending their offerings with ABV content of 6.0 to 10.0%. For instance, in April 2022, Boochcraft, an organic hard kombucha launched its limited-edition flavors. The range includes Hibiscus Lemonade (6% ABV), and Passionfruit Blood Orange (7% ABV) made with fruit, natural ingredients, and live cultures.

However, the up to 5.0% ABV segment is projected to register the fastest CAGR during the forecast period owing to the rising consumer focus on overall health and wellness. Consumers of all ages are trying to limit the consumption of alcoholic beverages, which is expected to bode well for the segment’s growth. According to an article published by What’s Next Media & Analytics, in April 2021, 25% of consumers in the U.S. are drinking less, compared to only 22% who are drinking more. Over the last two years, there has been a significant increase in online discussions about low- and no-alcohol drinking and a noteworthy decrease in conversations about casual and heavy drinking occasions, which is expected to drive the segment growth.

Distribution Channel Insights

The off-trade distribution channel segment dominated the market in 2021 and accounted for the largest revenue share of 66.0%. The segment includes all retail outlets, such as hypermarkets, supermarkets, convenience stores, grocery stores, and wine & spirit shops. People prefer these stores as they provide huge discounts and offers. Furthermore, the majority of the brands launch their products through big retail chains to reach maximum customers. For instance, in April 2022, Anheuser-Busch launched Neon Burst (8% ABV) in C-stores across the U.S. The product is available in pineapple, passionfruit, orange, raspberry, cherry, and apple flavors.

The on-trade channel segment is anticipated to register the fastest growth rate during the forecast period. The on-trade category includes outlets, such as restaurants, bars, clubs, hotels, and lounges. The opening of the abovementioned outlets post-pandemic and the addition of a range of beverages including hard kombucha on the menu will boost the segment growth. For instance, in May 2022, Shorebirds, a new hard kombucha brewery and bar was launched in Rancho Cordova near Sacramento, California.

Regional Insights

North America accounted for the largest share of more than 45.00% of the global revenue in 2021. The region has been witnessing high demand from including baby boomers, millennials, and Gen Z consumers. The key market players are promoting their products in ingenious ways. For instance, in November 2020, Colony promoted their hard kombucha by developing a brand identity and packaging system that clearly and quickly communicated product attributes. Furthermore, the mass appeal of these drinks has made them acceptable to both male and female consumers, which, in turn, is likely to further increase the consumption of these beverages in the coming years.

The Asia Pacific is estimated to be the fastest-growing regional market from 2022 to 2030. The growing awareness and product visibility among consumers of countries, such as China, Japan, and Australia, are expected to boost the market growth in this region. For instance, Zestea, a Chinese beverage brand offers hard kombucha in various flavors, such as peach pie, blueberry, strawberry, mint lime mojito, pumpkin spice, and apple cinnamon, and ginger pepper. Furthermore, the availability of a variety of flavors will further increase product penetration, thereby supporting regional market growth.

Key Companies & Market Share Insights

-

The market is fragmented with the presence of many global and regional players. These players are engaging in major acquisition and promotional activities to increase their customer base and brand loyalty. For instance:

-

In April 2022, Hooch Booch, a hard kombucha brand based out of Denver, Colo., was launched in Minnesota

-

In June 2021, Sierra Nevada Brewery Co. expanded its line of “Strainge Beast” hard kombuchas, available in ginger, lemon, and hibiscus flavors

-

In May 2021, North KC’s Brewery launched a new line of alcoholic kombucha, Lucky Booch, which is available in four flavors, namely peach blossom (4% ABV), lavender lemon (4% ABV), tart raspberry (7% ABV), and hops & passion (7% ABV)

Some of the prominent key players operating in the global hard kombucha market include:

-

Remedy Drinks

-

Jiant

-

Flying Embers

-

JuneShine

-

Boochcraft

-

Kyla

-

Unity Vibration

-

Dr Hops

-

Ventura Brewing Company

-

Allkind

Hard Kombucha Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 59.7 million

Revenue forecast in 2030

USD 273.2 million

Growth rate

CAGR of 23.5% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD 000’/million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

ABV content, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; The Netherlands; Switzerland; China; Japan; Australia; Brazil; Argentina; UAE; South Africa

Key companies profiled

Remedy Drinks; Jiant; Flying Embers; JuneShine; Boochcraft; Kyla; Unity Vibration; Dr. Hops; VenturaBrewing Company; Allkind

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global hard kombucha market report on the basis of ABV content, distribution channel, and region:

-

ABV Content Outlook (Revenue, USD 000’, 2017 - 2030)

-

Up to 5.0% ABV

-

6.0% to 10.0% ABV

-

Others

-

-

Distribution Channel Outlook (Revenue, USD 000’, 2017 - 2030)

-

On-trade

-

Off-trade

-

-

Regional Outlook (Revenue, USD 000’, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

The Netherlands

-

Switzerland

-

-

Asia Pacific

-

China

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global hard kombucha market is expected to grow at a compound annual growth rate of 23.5% from 2022 to 2030 to reach USD 273.2 million by 2030.

b. North America dominated the hard kombucha market with a share of 45.6% in 2021. The region has been witnessing high demand, from consumers including, baby boomers, millennials and Gen Z. Key market players are promoting their products in ingenious ways.

b. Some key players operating in the hard kombucha market includebRemedy Drinks, Jiant, Flying Embers , JuneShine, Boochcraft , Kyla, UNITY VIBRATION , Dr Hops, VENTURA BREWING COMPANY, and allkind

b. The global hard kombucha market size was estimated at USD 40.9 million in 2021 and is expected to reach USD 59.7 million in 2022.

b. Key factors that are driving the market growth include growing popularity of hard kombucha as low-calorie, low-carbs and low-sugar alternative alcoholic drinks to traditional alcoholic beverages among the health-conscious demographics across the world, is expected to accelerate the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.