- Home

- »

- Clinical Diagnostics

- »

-

HbA1c Testing Devices Market Size & Share Report, 2030GVR Report cover

![HbA1c Testing Devices Market Size, Share & Trends Report]()

HbA1c Testing Devices Market Size, Share & Trends Analysis Report By Type of Device (Point-of-care (POC) Testing Devices, Laboratory-based Testing Devices), By Technology, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-251-6

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

HbA1c Testing Devices Market Size & Trends

The global HbA1c testing devices market size was estimated at USD 2.04 billion in 2023 and is projected to grow at a CAGR of 6.48% from 2024 to 2030. The market growth is attributed to the increasing diabetes prevalence, technological advancement in clinical diagnostics, and an increasing focus on research for development of novel diagnostics. Moreover, increasing investment by public and private organizations is further propelling growth.

The prevalence of diabetes is a significant driver of the growing demand for HbA1c testing devices. Diabetes, particularly type 2 diabetes mellitus (T2DM), is a chronic condition that affects millions of people worldwide. The incidence of diabetes is increasing, with projections indicating that the number of people affected by this condition is estimated to reach 643 million by 2030. According to the IDF Diabetes Atlas, as of 2021, 537 million adults, which is approximately 1 in 10 of the global adult population, were living with diabetes. This number is projected to rise to 643 million by 2030 and even further to 783 million by 2045. This trend is driven by factors such as increasing obesity rates, aging populations, and lifestyle changes that contribute to the onset of T2DM.

A study published in the Egypt Heart Journal in December 2020 highlighted the significant positive correlation between HbA1c levels and the Gensini score, a widely used method for assessing the severity of coronary artery disease (CAD). The study found that patients with higher HbA1c levels also had higher Gensini scores, indicating a higher burden of CAD. This correlation highlights the importance of HbA1c testing in the early detection and management of diabetes, as it can be a marker for CAD and help in predicting coronary artery disease risks.

Glycemic control is essential in diabetes management, and the market for HbA1c testing devices plays a crucial role in ensuring its effectiveness. HbA1c tests assess average blood glucose levels over 2-3 months, guiding treatment adjustments. A study at Kenyatta National Hospital in Kenya confirmed HbA1c's relevance in monitoring glucose control, even in low-income countries. It showed a strong correlation between HbA1c and continuous glucose monitoring (CGM), indicating its reliability despite coexisting medical conditions.

Technological advancements in device design have significantly improved the ease of use, efficiency, and accuracy of diabetes management. These advancements are driven by the need for faster, more reliable testing methods that can be integrated into routine clinical practice. One of the key advancements is the development of "walk-away" devices, which allow technicians to perform other clinic-related duties during sample analysis, thus increasing efficiency. For instance, the A1CNow, a point-of-care (POC) device, is designed to automatically turn on when a cartridge is inserted, facilitating a streamlined process for sample collection and analysis. This device requires minimal interaction from the technician. In addition, the A1CNow provides results within 5 minutes, significantly reducing the time taken to obtain test results compared to traditional methods.

Market Concentration & Characteristics

The degree of innovation in the market is characterized by a dynamic landscape driven by advancements in technology, shifts in healthcare practices, and the increasing global burden of diabetes. The market is marked by a growing importance on research and development to improve the accuracy, speed, and ease of use of HbA1c testing devices. Point-of-care devices offer rapid results, aligning with decentralized healthcare trends. Integration with digital health platforms enhances data management and personalized diabetes care with innovations such as portable analyzers and rapid point-of-care tests.

Several companies engage in mergers & acquisitions to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve competency. For instance, in February 2024 , HemoCue collaborated with Novo Nordisk to enhance point-of-care diagnostic testing for children with type 1 diabetes in low- and middle-income countries. HemoCue HbA1c 501 Systems will be deployed across 30 countries to improve diabetes management and reach 100,000 children by 2030.

The regulatory framework for product approvals has always been one of the major restraining factors. The approval process for devices, especially those developed by universities or research centers, can be lengthy, ranging from 4 to 14 years, and may require specialized consulting to navigate the regulatory procedures. This lengthy time frame and the costs associated with compliance can pose significant challenges for manufacturers. Ensuring patient adherence and awareness also adds to its complexity.

The level of substitution is generally moderate for the market; alternative biomarkers such as fructosamine, glycated albumin, and 1,5-AG offer advantages in detecting short-term glucose changes. Continuous glucose monitoring (CGM) systems provide real-time monitoring, while nonprescription HbA1c monitors offer convenience for home use, providing options for diabetes management beyond traditional HbA1c testing devices.

The HbA1c testing devices industry is experiencing a shift towards point-of-care (POC) devices due to increased demand for rapid disease identification. This trend, accelerated by the COVID-19 pandemic, is supported by technological advancements and projected market growth. POC devices offer convenience and accessibility, driving their adoption in various healthcare settings and regions with a high incidence of diabetes.

Type of Device Insights

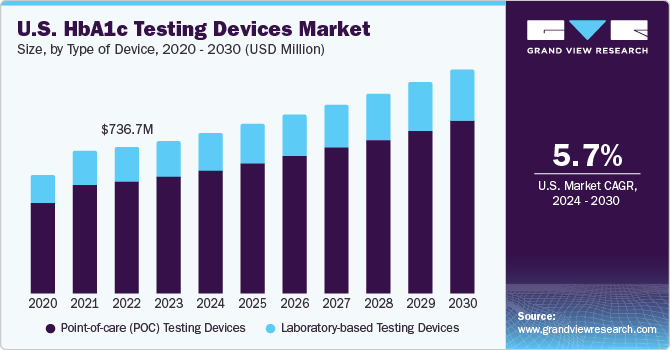

Point-of-care (POC) testing devices segment led the market in 2023 with a market share of 76.53% and is anticipated to witness the fastest CAGR over the forecast period. The demand for POC testing devices, including HbA1c testing, has been increasing due to several factors, such as the growing need for rapid diagnostic results in clinical settings, the shift towards healthcare decentralization, and the increasing prevalence of diabetes, which are driving the adoption of these devices. The rapid microfluidic assay technology, such as that used in LumiraDx's HbA1c test, addresses the growing clinical need for accessible and reliable diagnostic tools that can provide immediate feedback, facilitating faster decision-making in patient care.

Moreover, the growth can be attributed to key factors, including the strategic acquisitions and product launches that have enhanced the market's competitive landscape. For instance, In January 2024, Roche announced a contract to acquire LumiraDx's point-of-care testing technology for USD 295 million, with an additional up to USD 55 million allocated to support Lumira's point-of-care technology platform until the completion of the acquisition. Moreover, in May 2022, LumiraDx received CE Marking for its HbA1c test, enhancing diabetes screening and monitoring on its point-of-care LumiraDx Platform. The rapid microfluidic assay provides results in under seven minutes, aiding patient risk identification.

Laboratory-based HbA1c testing devices segment is anticipated to grow at lucrative growth over the forecast period, owing to their accuracy, reliability, and operation by trained professionals. They are widely used for their precise measurement of glycated hemoglobin levels and informed decision-making in diabetes management. The involvement of skilled professionals ensures adherence to stringent testing standards, enhancing credibility. Moreover, these devices offer advanced features such as automation and integration with information systems, streamlining processes, and facilitating efficient data management. Healthcare providers rely on them for accurate and reliable results, strengthening their preference and widespread adoption across various healthcare settings.

Technology Insights

Immunoassays led the technology segment with a share of 35.39% in 2023. Immunoassay technology allows specific quantification with the use of antibodies to bind to HbA1c. This method is widely adopted in point-of-care testing due to its time-efficient nature and simplicity of results. In diabetology, immunoassays play a pivotal role in assessing crucial biomarkers such as HbA1c, C-peptide, insulin, and autoantibodies to beta cell proteins. These biomarkers are indispensable for diagnosing and categorizing diabetes mellitus accurately. For instance, the LumiraDx HbA1c test is a user-friendly and efficient microfluidic immunoassay tailored for swift quantification of HbA1c in both fingerstick and venous whole blood samples. When paired with the LumiraDx Platform, this test ensures speedy and dependable results, delivered in under 7 minutes directly at the point of care.

High-Performance Liquid Chromatography (HPLC) is anticipated to register a significant CAGR over the forecast period due to its accuracy, sensitivity, wide range of detection capabilities, reproducibility, consistency, efficiency, and compliance with clinical standards. HPLC detects even minute amounts of HbA1c, facilitating early diagnosis and precise monitoring of diabetes. Its broad detection range assesses diabetes severity, formulating tailored treatment plans. Renowned for reproducibility and consistency, HPLC provides reliable results across different laboratories and instruments, crucial for clinical decision-making. It efficiently analyzes multiple samples simultaneously, enhancing workflow efficiency. Advancements in particle technology have enhanced the efficiency and speed of HPLC systems used for HbA1c testing. These improvements contribute to faster and more accurate analysis of HbA1c levels, aiding in diabetes management.

End-use Insights

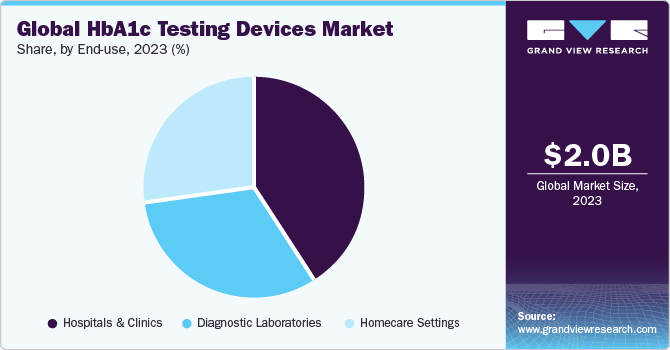

Hospitals led the end-use segment in 2023 with a market share of 41.38%. Equipped with advanced technology and infrastructure, hospitals and clinics are well-positioned to handle these devices effectively. These facilities require efficient methods for monitoring glycemic control in patients with diabetes, making HbA1c testing devices indispensable. Point-of-care testing capabilities allow for immediate access to patient data, facilitating timely interventions. Despite initial investment costs, the cost-effectiveness of these devices, driven by their ability to perform multiple tests and reduce testing time, is attractive to healthcare facilities. Moreover, the high accuracy and reliability of advanced testing methods, such as ion-exchange HPLC and TINIA, meet the stringent quality standards and regulatory requirements of hospitals and clinics.

The homecare settings segment is projected to witness the fastest CAGR over the forecast period. With the global surge in diabetes cases, continuous monitoring becomes essential, making homecare settings conducive to convenient and personalized care delivery. The escalating preference for home-based diagnostic testing, propelled by factors such as convenience and cost-effectiveness, increases the demand for HbA1c testing devices in these settings. Moreover, advancements in diagnostic technology ensure accuracy, reliability, and user-friendliness, augmenting patient safety and comfort. This shift towards home care is fueled by a desire for convenience and comfort, supported by technological innovations that streamline testing processes. The cost-effectiveness and remote monitoring capabilities of home testing devices further propel demand.

Regional Insights

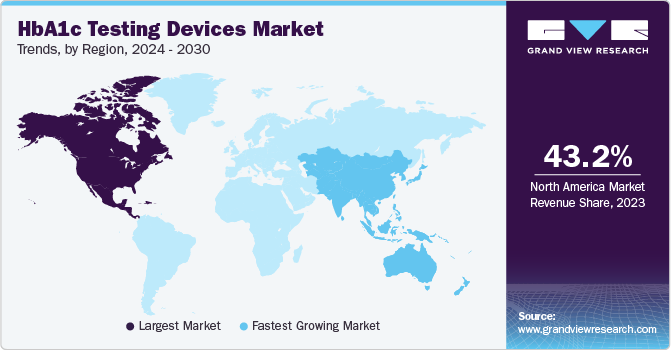

North America HbA1c testing devices industry accounted for 43.16% of the global share in 2023 owing to several key factors, including increasing incidence and prevalence of diabetes, the presence of established market players, and the availability of reimbursements for certain diabetes care products, including HbA1c testing devices. For instance, the announcement by the US Centers for Medicare and Medicaid Services in December 2021 covering all continuous glucose monitoring systems (CGMs) under Medicare has positively impacted the U.S. market, leading to increased usage of HbA1c testing devices.

U.S. HbA1c Testing Devices Market Trends

The HbA1c testing devices market in the U.S. is projected to grow over the forecast period due to the development of healthcare infrastructure, coupled with the rising prevalence of diabetes and a favorable environment for market expansion in the country.

Europe HbA1c Testing Devices Market Trends

The HbA1ctesting devices marketin Europewas identified as a lucrative region in this industry. The market's growth in the country is attributed to an increasing prevalence of diabetes aided by an increase in research funding and the local presence of key market players.

The HbA1c testing devices market in the UK is projected to grow over the forecast period due to the presence of well-established healthcare infrastructure, high disposable income, and rising awareness pertaining to early disease diagnosis.

The France HbA1c testing devices market is expected to grow over the forecast period due to technological advancements and increased awareness about the importance of early disease diagnosis and prevention. These factors have led to more patients seeking out HbA1c testing devices.

The HbA1c testing devices market in Germany is expected to grow over the forecast period due to the rising number of initiatives being taken by the government to help spread awareness regarding diagnosis and innovative diagnostic solutions.

Asia Pacific HbA1c Testing Devices Market Trends

The HbA1c testing devicesmarket inAsia Pacific is anticipated to witness the fastest CAGR over the forecast period. The presence of a large target population, high unmet clinical needs, and developing healthcare infrastructure is anticipated to provide high growth potential for the market in the region. Major players operating in the region are constantly focusing on the development of novel point-of-care solutions owing to the rising prevalence of the aging population and the prevalence of diabetes. Moreover, there is a high focus on geographic expansion with the launch of new manufacturing facilities in the region. For instance, in October 2023, Tosoh Bioscience Inc., a Japan-based company, partnered with Sysmex America to connect HLC723G8 analyzers to Sysmex XN-9000 and XN-9100 hematology systems, aiming to enhance A1c testing automation in the U.S., Latin America, and Canada.

The China HbA1c testing devices market is expected to grow over the forecast period due to the growing focus on improving healthcare R&D aided by the development of novel technologies.

The HbA1c testing devices market in Japan is anticipated to experience growth over the forecast period, driven by several key factors, such as its well-established healthcare system, coupled with a high adoption of advanced diagnostic tests and therapies, forming the backbone of its growth potential. This environment encourages the use of HbA1c testing devices for effective diagnosis and management of diabetes, a prevalent condition that requires regular monitoring.

Latin America HbA1c Testing Devices Market Trends

The HbA1c testing devices market in Latin America is identified as a lucrative region in this industry. Technological advancements and increasing awareness regarding testing devices in the region are anticipated to fuel market growth.

The Brazil HbA1c testing devices market is expected to grow over the forecast period due to the rising prevalence of target diseases aided by the rising use of POC diagnostics.

MEA HbA1c Testing Devices Market Trends

The HbA1c testing devices market in MEAis identified as a lucrative region in this industry. The market in this region is driven by the high prevalence of diabetes, aided by improvements in healthcare infrastructure.

The Saudi Arabia HbA1c testing devices market is expected to grow over the forecast period owing to the need for better diagnostics and improvements in treatment options due to the rising prevalence of target diseases.

Key HbA1c Testing Devices Company Insights

Some of the leading players operating in the HbA1c testing devices industry include Siemens Healthineers AG, Abbott, and Trinity Biotech. Key players are using existing regional customer bases to prioritize maintenance of high-quality standards and gain high market size access. This strategy is useful for brands that have already built trust in the market. These players are heavily investing in advanced technology and infrastructure, allowing them to process & analyze a large volume of samples efficiently. Moreover, companies undertake various strategic initiatives with other companies and distributors to strengthen their market presence.

ARKRAY, Inc. and Tosoh Corporation are some of the emerging market participants in the HbA1c testing devices industry. These companies focus on receiving funding support from government bodies and healthcare organizations, aided with novel product launches to capitalize on untapped avenues.

Key HbA1c Testing Devices Companies:

The following are the leading companies in the HbA1c testing devices market. These companies collectively hold the largest market share and dictate industry trends.

- Bio-Rad Laboratories, Inc.

- Abbott

- F. Hoffmann-La Roche Ltd

- Siemens Healthineers AG

- HUMAN

- Trinity Biotech

- Menarini Diagnostics s.r.l

- SAKAE CO. LTD.

- Ceragem Medisys Inc

- SEKISUI MEDICAL CO., LTD.

Recent Developments

-

In April 2023 , FIND has partnered with Abbott, i-SENS Inc, and Siemens Healthineers to offer discounted point-of-care HbA1c test kits for low- and middle-income countries, aiming to improve diabetes diagnosis and management in underserved regions.

-

In November 2022 , LumiraDx expanded its HbA1c test's commercial reach, addressing diabetes management needs in various care settings. The test, run on the LumiraDx Platform, offers rapid results, aiding in screening and monitoring, with potential benefits for patient outcomes.

-

In May 2022 , Labcorp introduced an at-home collection kit for diabetes risk testing, utilizing a new device from Weavr Health. This innovative approach offers convenience and accessibility, aiming to empower individuals to monitor their health status from home.

HbA1c Testing Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.16 billion

Revenue forecast in 2030

USD 3.15 billion

Growth rate

CAGR of 6.48% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type of device, technology, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Brazil; Mexico; Argentina; South Africa; UAE; Kuwait; Saudi Arabia

Key companies profiled

Bio-Rad Laboratories, Inc.; Abbott; F. Hoffmann-La Roche Ltd; Siemens Healthineers AG; HUMAN; Trinity Biotech; Menarini Diagnostics S.R.L.; SAKAE CO. LTD.; Ceragem Medisys Inc; SEKISUI MEDICAL CO., LTD.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global HbA1c Testing Devices Market Report Segmentation

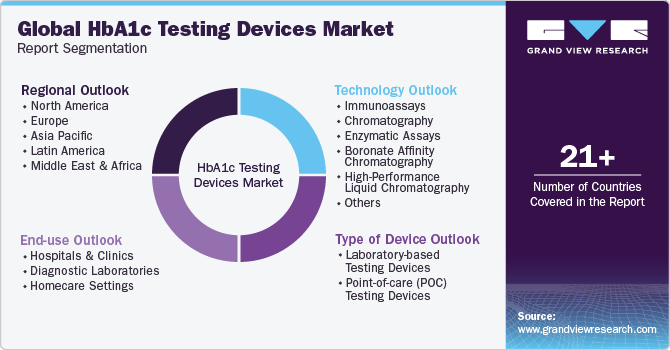

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global HbA1c testing devices market report based on type of device, technology, end-use, and region:

-

Type of Device Outlook (Revenue, USD Million, 2018 - 2030)

-

Laboratory-based Testing Devices

-

Point-of-care (POC) Testing Devices

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Immunoassays

-

Chromatography

-

Enzymatic Assays

-

Boronate Affinity Chromatography

-

High-Performance Liquid Chromatography

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Diagnostic Laboratories

-

Homecare Settings

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global HbA1c testing devices market size was estimated at USD 2.04 billion in 2023 and is expected to reach USD 2.16 billion in 2024.

b. The global HbA1c testing devices market is expected to grow at a compound annual growth rate of 6.48% from 2024 to 2030 to reach USD 3.15 billion by 2030.

b. North America dominated the HbA1c testing devices market with a share of 43.16% in 2023. This is attributable to increasing Incidence and prevalence of diabetes, presence of established market player and the availability of reimbursements for certain diabetes care products, including HbA1c testing devices, has significantly contributed to the market's growth in the U.S.

b. Some key players operating in the HbA1c testing devices market include Bio-Rad Laboratories, Inc., Abbott, F. Hoffmann-La Roche Ltd, Siemens Healthineers AG, HUMAN, Trinity Biotech, Menarini Diagnostics s.r.l, SAKAE CO. LTD., Ceragem Medisys Inc, and SEKISUI MEDICAL CO., LTD.

b. Key factors that are driving the market growth include increasing diabetes prevalence, technological advancement in clinical diagnostics, and an increasing focus on research for development of novel diagnostics in the market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."