- Home

- »

- Advanced Interior Materials

- »

-

HDPE And LLDPE Geomembrane Market Size Report, 2030GVR Report cover

![HDPE And LLDPE Geomembrane Market Size, Share & Trends Report]()

HDPE And LLDPE Geomembrane Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (HDPE, LLDPE), By Application (Waste Management, Water Management, Mining), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-412-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

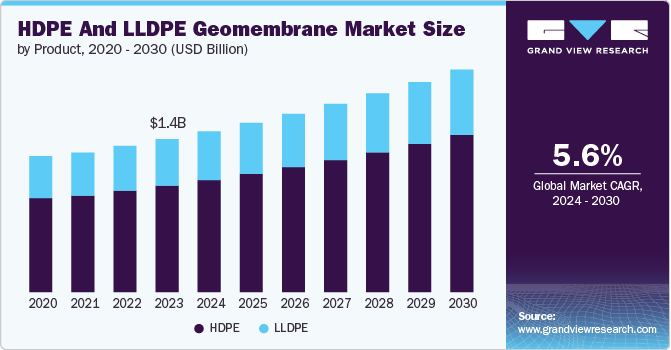

The global HDPE and LLDPE geomembrane market size was estimated at USD 1.36 billion in 2023 and is expected to grow at a CAGR of 5.6% from 2024 to 2030. The market is expected to grow over the forecast period as HDPE and LLDPE geomembranes are used as solution ponds and heap leach pads to provide containment control in the mining industry. Moreover, they are also used in pond liners to identify leaks and prevent the migration of effluents and gases.

Regulatory bodies, including the U.S. EPA and the European Commission, have framed numerous acts and rules that mandate waste management and disposal practices to control environmental pollution in the mining industry. HDPE and LLDPE geomembranes are expected to be among the most important tools for solid waste management in the mining industry in the coming years. The flourishing mining industry is expected to remain a major driver for the market growth over the forecast period.

Moreover, HDPE and LLDPE geomembrane are used to line fracking chemical tanks and well pads during shale gas exploration and production on account of product properties such as good chemical resistance and excellent stress crack resistance. Over the past few years, the hydraulic fracturing process has played a crucial role in increasing the production output of shale gas and tight oil in countries including the U.S. and Canada. Therefore, growing shale gas production on a global level is expected to promote the application of hydraulic fracturing, which, in turn, is expected to fuel the product demand.

The expanding civil engineering industry, especially in emerging economies such as India, China, Brazil, Mexico, and South Africa, is expected to offer key opportunities for market growth over the forecast period. HDPE and LLDPE geomembranes are mostly used in landfills and waste management projects owing to their ability to prevent leachate from contaminating the surrounding soil and groundwater.

Rising awareness regarding the environmental effects of HDPE and LLDPE geomembranes manufactured using synthetic raw materials is likely to boost the need for biodegradable and environment-friendly raw materials. This has resulted in technological advancements in using bio-based polymers in the geomembranes' manufacturing process. However, the high cost of utilizing these polymers is anticipated to challenge product demand.

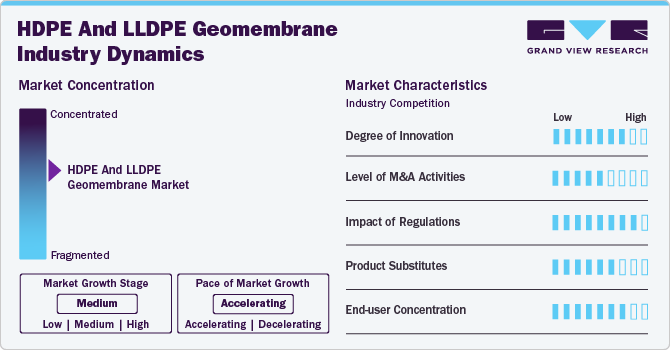

Market Concentration & Characteristics

The market growth stage is medium, and the pace of growth is accelerating. In recent years, a new method called Selective Laser Sintering (SLS) has emerged as a promising alternative for producing geomembranes with unique features and enhanced performance. This explores the benefits and potential of producing geomembranes using SLS technology, leading to a high degree of innovation.

The market is characterized by a moderate level of mergers & acquisitions. For instance, in December 2022, Terrafix Geosynthetics Inc. acquired Nilex, Inc. It was a manufacturer of geosynthetics for environmental and civil projects. This acquisition will allow the company to increase its customer base and help consumers by offering innovative solutions.

Several regulations and standards related to their use and minimum thickness govern the market. Several agencies, such as the Bureau of Indian Standards, the U.S. Environmental Protection Agency, and the Environment Agency, have formulated HDPE and LLDPE geomembrane regulations. These regulations have also been implemented regarding the requirements and test methods for producing HDPE and LLDPE geomembranes.

The presence of bitumen-based waterproofing membranes for construction applications is expected to pose a credible threat to the geomembrane market. Civil engineers' high dependency on conventional raw materials, such as bricks, cement, and steel, has led to high procurement and logistics costs. As a result, HDPE and LLDPE geomembrane have gained importance over the aforementioned materials, thereby leading to a moderate threat of substitution.

Product Insights

HDPE accounted for the largest market share of 69.56% in 2023 as it offers a wide range of chemical resistance during exposure in the construction, water treatment, mining, and oil and gas sectors. Moreover, these polymeric materials are capable of offering properties such as high welding strength and efficient low-temperature performance. In addition, the robust presence of HDPE resin manufacturing units in China is expected to impact market growth positively. Furthermore, increasing expenditures on developing bio-based polymers due to rising concerns over greenhouse gas emissions are estimated to boost the demand for bio-polyethylene as a raw material for manufacturing geomembranes.

LLDPE is projected to grow at a CAGR of 5.0% over the coming years. LLDPE geomembranes are favored for their exceptional flexibility, high tensile strength, and resistance to chemicals & UV radiation. These properties are ideal for containment and lining applications in landfills, mining, and wastewater treatment plants. Moreover, growing emphasis on environmental sustainability and stringent waste management and water conservation regulations in regions such as North America and Europe are propelling the demand for LLDPE geomembranes.

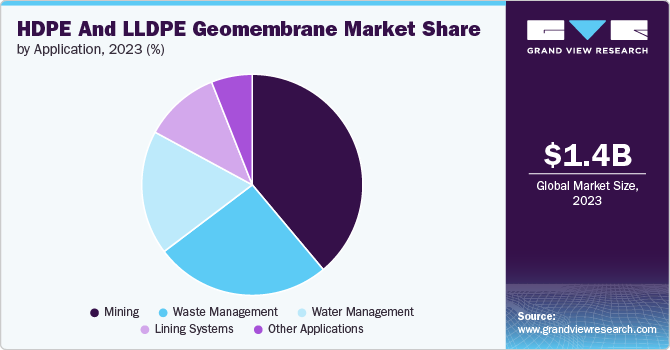

Application Insights

Mining accounted for the largest revenue share in 2023, with 38.88%. HDPE and LLDPE geomembranes prevent leakage of leachates where metal dissolution takes place. Moreover, the product provides a drainage solution and protects soil from contamination. The rising output of the mining industry in Peru, Chile, and South Africa is expected to promote the use of HDPE and LLDPE geomembranes over the forecast period. HDPE and LLDPE geomembrane act as agents for providing lining and covering for landfills in municipal waste, hazardous waste, and coal ash containment. Sanitary landfills usually utilize single-liner geomembranes. Furthermore, the product is applied as double liners in hazardous waste management applications such as landfills and leachate collection and removal systems.

HDPE and LLDPE geomembrane is used as a lining medium for preserving water, solar ponds, and golf course ponds and preventing water infiltration into sensitive areas. In addition, the product is used as a containment solution in crude oil production sites, exploration fields, stormwater management ponds, and recreational ponds.Rising awareness towards water conservation in manufacturing and construction sectors globally is expected to promote the importance of HDPE and LLDPE geomembrane as containment solutions over the forecast period.

Lining systems revenue is anticipated to grow at a CAGR of 6.1% from 2024 to 2030. HDPE and LLDPE geomembranes are lining medium and waterproofing solutions in tunnels, highways, airport bases, and shipping terminals because they can mitigate liquid and gas. Due to rising government construction spending, infrastructure improvement in emerging markets of China, India, and countries in the Middle East is likely to fuel product demand over the forecast period further.

Regional Insights

The HDPE and LLDPE geomembrane market in Asia Pacific accounted for the fastest and largest revenue market share, with 56.54% in 2023. The robust presence of mining processing facilities in China, India, and Australia, due to the abundant availability of minerals such as coal, diamond, and steel, is expected to promote product use in the Asia Pacific over the forecast period. Moreover, the sanction and commencement of infrastructure development projects in emerging economies, such as China and India, are expected to drive the demand for construction materials in the region in the coming years.

India HDPE And LLDPE Geomembrane Market Trends

The HDPE and LLDPE geomembrane market in India is growing at a CAGR of 6.6% over the forecast period. Wastewater treatment infrastructure is an essential part of wastewater management in India. However, the country has a shortage of wastewater treatment infrastructure. This presents an opportunity for major geomembrane manufacturers to flourish in the market and expand their geographical presence in India.

China HDPE And LLDPE geomembrane market accounted for the region's largest revenue share of 45.51% in 2023, owing to the abundance of reserves of rare earth elements, copper, steel, and aluminum. This is further expected to increase mining expenditures in the country. This, in turn, is anticipated to boost the application of geosynthetic products, including geomembranes, in China over the forecast period.

North America HDPE And LLDPE Geomembrane Market Trends

The HDPE and LLDPE geomembrane market in North America comprises an extensive and highly developed network of waste and water management systems. Furthermore, North America has a highly developed mining industry, Canada's largest potash producer, and one of the world’s top 5 countries for aluminum. Hence, the growing use of geomembrane as a lining solution for evaporation ponds, heap leach pads, and tailing impoundments is expected to boost product demand in North America.

The U.S. HDPE And LLDPE geomembrane marketrevenueis expected to grow at a CAGR of 4.5% over the forecast period. More than 80% and 75% of the U.S. population receive portable drinking water and sanitary sewerage treated through public wastewater treatment systems. Thus, the product must be used to prevent the contamination of potable water from the soil and other pollutants.

Europe HDPE And LLDPE Geomembrane Market Trends

The HDPE and LLDPE geomembrane market in Europe was estimated at USD 183.4 million in 2023. Europe comprises many developed economies, such as Germany, the UK, Russia, Italy, and France, with well-established mining and construction sectors and a high regard for sustainable practices. Moreover, the region is experiencing a rapid rise in the generated waste, causing environmental degradation and thereby boosting product demand.

Turkey HDPE And LLDPE geomembrane market dominated the European market and accounted for the highest revenue share in 2023. Turkey has an abundance of 70 different types of natural resources, including boron, marble, feldspar, trona, gypsum, barite, and chromium. Hence, the Turkish government is expected to invest heavily in developing the country's mining sector, thereby propelling product demand over the forecast period.

The HDPE And LLDPE geomembrane market in the UKis expected to grow at a CAGR of 4.0% in terms of revenue in the European market. The UK has a diverse range of construction aggregates, industrial, metal, and energy minerals. These minerals are essential to the country's economy as they help improve housing stocks, transportation networks, commercial and industrial buildings, energy and water infrastructures, schools, and hospitals.

Poland HDPE And LLDPE geomembrane market accounted for a revenue share of 9.0% in Europe for the year 2023, driven by waste processing facilities in the country that need to be modernized and urbanized. Moreover, around 259 projects have been started in the waste management industry in Poland since 2019. These factors are projected to propel the country's product demand in the coming years.

Central & South America HDPE And LLDPE Geomembrane Market Trends

The HDPE and LLDPE geomembrane market in Central & South America is growing at a CAGR of 5.0% over the forecast period. The civil engineering industry in the region is expected to witness substantial growth in the coming years owing to increasing investments in various infrastructure development projects by foreign and domestic private players in Central & South America. This, in turn, is anticipated to propel the demand for geomembranes to reinforce regional construction projects over the forecast period.

Middle East & Africa HDPE And LLDPE Geomembrane Market Trends

The HDPE and LLDPE geomembrane market in the Middle East & Africa is expected to reach USD 86.7 million by the end of 2030. Ongoing investments in exploration & production (E&P) activities by various companies, including National Drilling Co. and Abu Dhabi National Oil Co. (ADNOC), are expected to boost the growth of the oil & gas industry in the region over the forecast period, thereby supporting product growth.

Key HDPE And LLDPE Geomembrane Company Insights

Some of the key players operating in the market include agru Kunststofftechnik GmbH,Juta Ltd., Plastika Kritis S.A., and Solmax:

-

Solmax manufactures geomembranes and fluid transportation systems. The company processes resins such as HDPE, LLDPE, and PVC to produce geomembranes.As of 2023, the company had a production facility spread across an area of 1,331 square feet in Quebec, Canada. It also owns a manufacturing unit and a piping division in Malaysia and Chile. The company has been granted quality certificates, including ISO 9001, ISO 14001, GAI-LAP, and OHSAS 18001.

-

agru Kunststofftechnik GmbH is engaged in producing and distributing plastic products, including piping systems, concrete protection lining systems, and geomembranes. The company caters to a wide range of application segments, including mining, water & gas supply, semiconductor, chemical, pharmaceutical, and building engineering. Besides the main plant in Austria, the company operates production plants in the U.S., Germany, Poland, and China.

Naue GmbH & Co. KG, ATARFIL S.L., Global Synthetics, SKAPS Industries, and Layfield Group Ltd are some of the emerging market participants.

-

Naue GmbH & Co. KG and a few other companies operate under the NAUE group umbrella. The company's role as part of the NAUE group involves the global production, management, administration, sales, and marketing of geosynthetic products used in applications such as landfill engineering, road building, groundwater protection, civil engineering, tunnel construction, shoreline stabilization, waterproofing, mining, and hydraulic engineering.

-

ATARFIL, S.L. manufactures plastic geomembrane products using polyolefins such as High-Density Polyethylene (HDPE), linear low-density polyethylene (LLDPE), Very Low-Density Polyethylene (VLDPE), and Polypropylene (PP). The company has commercial offices in Spain, the UAE, the U.S., Mexico, Turkey, India, South Africa, and Australia and operations in more than 60 countries.

Key HDPE And LLDPE Geomembrane Companies:

The following are the leading companies in the hdpe and lldpe geomembrane market. These companies collectively hold the largest market share and dictate industry trends.

- Solmax

- agru Kunststofftechnik GmbH

- Geofabrics Australasia Pty Ltd.

- Naue GmbH & Co. KG

- Juta Ltd.

- Plastika Kritis S.A.

- ATARFIL S.L.

- Global Synthetics

- SKAPS Industries

- Layfield Group Ltd.

Recent Developments

-

In March 2024, AGRU America, Inc., a branch of agru Kunststofftechnik GmbH, announced that it is expanding operations in Williamsburg County, South Carolina, U.S. The company is expected to invest around USD 7.8 million in the expansion. Adding new machinery and equipment to the new manufacturing plant is expected to help the company fulfill customer demand efficiently.

-

In December 2022, Terrafix Geosynthetics Inc. acquired Nilex, Inc., a geosynthetics manufacturer for environmental and civil projects. This acquisition will allow the company to increase its customer base and help consumers by offering innovative solutions.

HDPE And LLDPE Geomembrane Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.42 billion

Revenue forecast in 2030

USD 1.97 billion

Growth rate

CAGR of 5.6% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; France; Italy, Spain; Turkey, China; India; Japan; Australia; Indonesia; Brazil; Saudi Arabia

Key companies profiled

Solmax; agru Kunststofftechnik GmbH; Geofabrics Australasia Pty Ltd.; Naue GmbH & Co. KG; Juta Ltd.; Plastika Kritis S.A.; ATARFIL S.L.; Global Synthetics; SKAPS Industries; Layfield Group Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global HDPE And LLDPE Geomembrane Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global HDPE and LLDPE geomembrane market report based on product, application, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

HDPE

-

LLDPE

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Waste Management

-

Water Management

-

Mining

-

Lining Systems

-

Other Applications

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Italy

-

Spain

-

Turkey

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

Indonesia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global HDPE and LLDPE geomembrane market size was estimated at USD 1.36 billion in 2023 and is expected to reach USD 1.42 billion in 2024.

b. The global HDPE and LLDPE geomembrane market is expected to grow at a compound annual growth rate of 5.6% from 2024 to 2030 to reach USD 1.97 billion by 2030.

b. HDPE geomembrane market dominated the market with a share of 72.4% in 2023, owing to its chemical resistance during their exposure in construction, water treatment, mining and oil & gas sectors.

b. Some of the key players operating in the HDPE and LLDPE geomembrane market are Solmax, agru Kunststofftechnik GmbH, Geofabrics Australasia Pty Ltd., Naue GmbH & Co. KG, Juta Ltd., Plastika Kritis S.A., ATARFIL S.L., Global Synthetics, SKAPS Industries, and Layfield Group Ltd.

b. The key factors that drive HDPE and LLDPE geomembrane include the rapidly development of untapped mining resources in emerging economies such as China, India, Peru, and Chile.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.