- Home

- »

- Healthcare IT

- »

-

Healthcare Cloud Infrastructure Market, Industry Report 2030GVR Report cover

![Healthcare Cloud Infrastructure Market Size, Share & Trends Report]()

Healthcare Cloud Infrastructure Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Services), By End Use (Healthcare Providers, Healthcare Payers), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-812-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

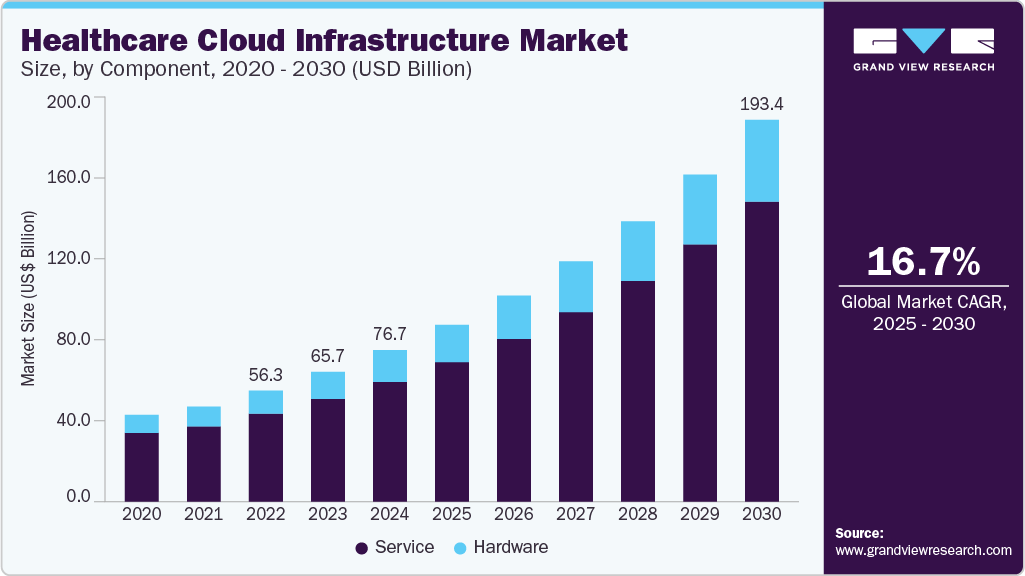

The global healthcare cloud infrastructure market size was estimated at USD 76.72 billion in 2024 and is expected to expand at a CAGR of 16.66% from 2025 to 2030. The market is driven by the rising adoption of digital health technologies, demand for scalable IT solutions, government support for digital health, and a need for secure data management.

Key Highlights:

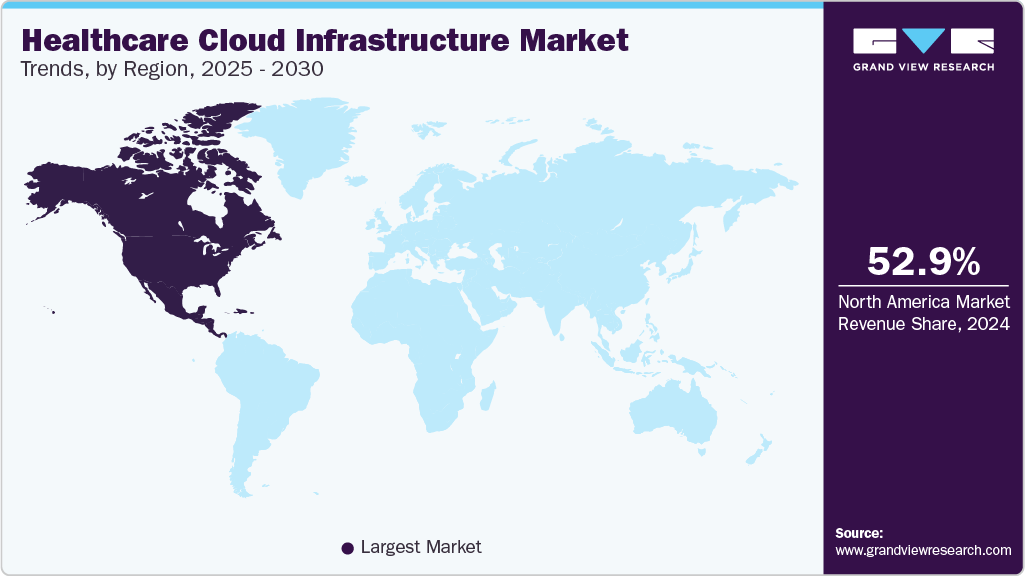

- North America held the largest share of 52.98% in 2024, attributable to the rapidly rising care expenditure and growing advancements in the IT infrastructure

- The healthcare cloud infrastructure market in the U.S. dominated the North American market

- Based on component, the services segment held the largest revenue share of 79.08% in 2024.

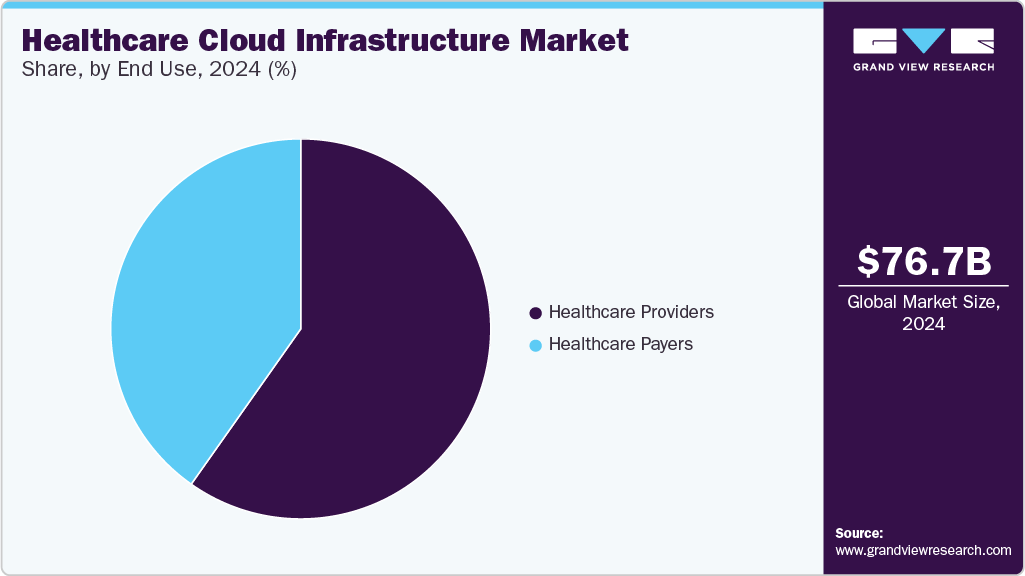

- Based on end use, healthcare providers dominated the market with the largest revenue share in 2024

Advancements in cloud, AI, and interoperability are driving growth. For instance, in October 2024, Oracle unveiled a next-generation Electronic Health Record (EHR) system that integrates advanced cloud and AI capabilities.

This EHR features intuitive design elements such as conversational search, voice-driven navigation, and AI-supported summaries to enhance clinician workflows and improve patient care efficiency. Another key driver is integrating cloud and AI solutions into healthcare systems through strategic collaboration. For instance, in January 2024, Eviden and Microsoft entered a five-year strategic partnership, enhancing their collaboration by integrating Microsoft Cloud and AI solutions across various industries. This aligns with Eviden's strategy to reinforce and expand its global network of alliances.

“Organizations today seek to apply generative AI responsibly and securely to help them solve their most pressing business challenges. I am pleased to expand our collaboration with Eviden-a leading digital transformation partner-to deliver innovative AI solutions built upon the Microsoft Cloud and Azure OpenAI Service. Together, we will help customers across industries realize the full potential of their data to unlock business growth and accelerate AI transformation.”

- Judson Althoff, Executive Vice President and Chief Commercial Officer at Microsoft

Healthcare organizations seek cost-effective, scalable IT solutions to manage their complex operations and vast data. Cloud infrastructure offers significant benefits, including reduced capital expenditure, flexibility, and scaling services based on demand. For instance, in October 2023, the U.S. Department of Veterans Affairs (VA), the second-largest federal agency and largest healthcare provider, is using cloud technology to support the Cloud Smart strategy, enhancing service delivery speed and improving IT system agility for over 19.2 million Veterans.

Governments worldwide are pushing for digital health transformation through various initiatives and funding programs, which serve as significant drivers for the market. For instance, India’s National Digital Health Mission (NDHM) seeks to establish a nationwide digital health infrastructure, incorporating cloud-based platforms for health data exchange. In the U.S., initiatives such as HITECH and ONC’s funding for healthcare IT solutions increased the expansion of cloud-based health IT infrastructure in hospitals and clinics.

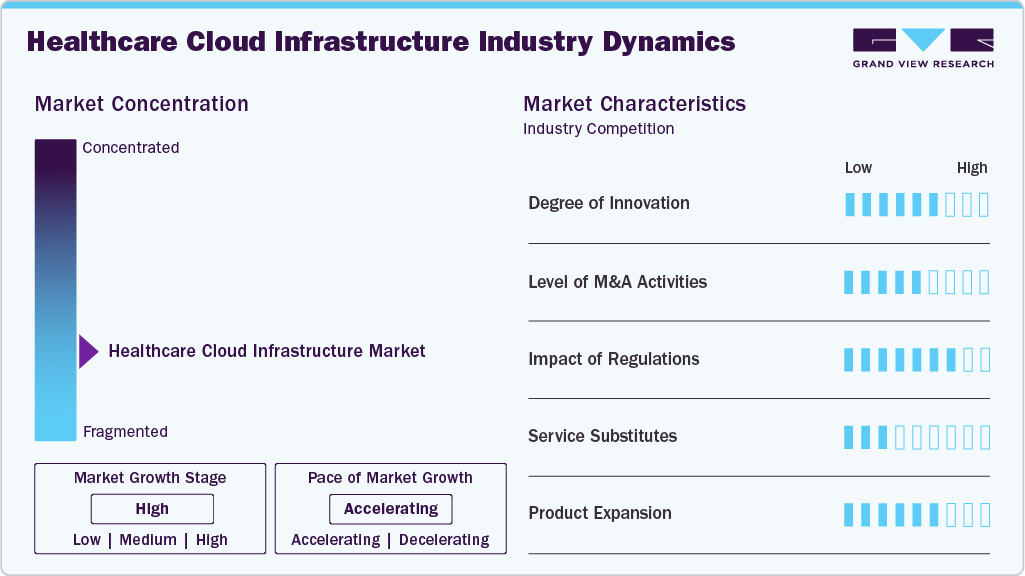

Market Concentration & Characteristics

The market experienced high innovation driven by integrating AI, machine learning, 5G, and advanced analytics. For instance, in October 2024, Microsoft collaborated with NVIDIA to elevate health and life sciences research through cloud computing. AI-powered tools such as Amazon’s HealthScribe streamline clinical workflows by capturing real-time patient visit data. These advancements enable more efficient, secure, and intelligent healthcare delivery.

M&A activities in the market are moderate, with large players acquiring niche companies to expand their offerings. For instance, in February 2022, IBM and SAP strengthened their collaboration to support clients in transferring workloads from SAP solutions to cloud platforms. Healthcare providers and systems can benefit from enhanced cloud-based data integration, scalability, and real-time analytics.

Regulations are critical in shaping the healthcare cloud infrastructure industry by enforcing data privacy, security, and interoperability standards. Compliance with frameworks like HIPAA in the U.S. and GDPR in Europe drives investment in secure, scalable solutions. These regulations ensure patient data protection, promote trust in cloud adoption, and encourage vendors to develop compliant, innovative platforms, ultimately accelerating market growth while maintaining strict oversight of health information handling.

Regional expansion in the healthcare cloud infrastructure industry is high, with significant growth in Asia-Pacific and Latin America. This is driven by increasing healthcare digitization and government investments in eHealth initiatives. For instance, in December 2024, Alibaba Cloud advanced its AI capabilities across various Asian industries. The region is seeing rapid adoption due to expanding internet access, rising healthcare needs, and government support for digital health transformation.

Component Insights

The services segment held the largest revenue share of 79.08% in 2024 due to the growing need for cloud migration, system integration, and ongoing support across healthcare organizations. As providers shift from legacy systems to cloud-based environments, demand for consulting, implementation, and managed services has surged. As clinical trials are increasingly digitized, cloud infrastructure is essential to support virtual site selection, remote patient recruitment, and global trial coordination. For instance, in October 2024, Oracle Life Sciences launched Oracle Patient Recruitment Cloud Services and Oracle Site Feasibility to support life sciences organizations in speeding up clinical trials, lowering costs and complexity, and efficiently bringing lifesaving treatments to market.

The hardware segment is expected to grow fastest at 17.10% for the forecast period, driven by secure storage systems, increasing demand for high-performance servers, and networking equipment to support expanding volumes of healthcare data. As hospitals and research institutions adopt cloud-based solutions, they require vital on-premise data processing, backup, and interoperability infrastructure. The rise in telehealth, remote monitoring, and AI applications accelerates hardware investments.

End Use Insights

Healthcare providers dominated the market with the largest revenue share in 2024. The growing number of hospitals adopting cloud infrastructure has increased demand for the SaaS model. Healthcare providers are adopting cloud infrastructure to enhance data management, patient care, and operational efficiency. Healthcare providers adopt cloud infrastructure to enhance data management, patient care, and operational efficiency. For instance, in November 2024, Hackensack Meridian Health partnered with Google Cloud to migrate its Epic electronic health records (EHR) system to the cloud. This transition aims to optimize patient care, improve data security, and enhance operational efficiency.

Healthcare payers are expected to grow fastest for the forecast period. Payers use cloud computing for secure data handling, insurance claim processing, risk analysis, and fraud detection. Managing high-risk and high-usage patient groups has long been a challenge, and these advanced technologies help address that by streamlining operations and controlling healthcare costs. In addition, cloud solutions enable payers to scale their services, improve care quality, and lower administrative expenses.

Regional Insights

North America held the largest share of 52.98% in 2024, attributable to the rapidly rising care expenditure and growing advancements in the IT infrastructure. The presence of top market players in North America involved in providing installation & training facilities and developing healthcare cloud infrastructure products & solutions is one of the major factors expected to contribute significantly to market growth. The healthcare facilities of North America are rapidly adopting cloud infrastructure facilities to streamline their workflows, drive their operational, clinical, and financial outcomes, and eliminate data siloes, also fueling the growth of this market in this region.

U.S. Healthcare Cloud Infrastructure Market Trends

The healthcare cloud infrastructure market in the U.S. dominated the North American market due to its advanced healthcare IT ecosystem, significant investments in digital health, and early adoption of cloud technologies. Major players, including Amazon (AWS), Microsoft, and IBM, are U.S.-based and heavily integrated into hospital networks and payer systems. Government initiatives such as the HITECH Act and the 21st Century Cures Act further encourage cloud adoption. In addition, U.S. providers’ focus on AI, interoperability, and patient-centric care fuels continuous demand for scalable cloud infrastructure solutions.

Asia Pacific Healthcare Cloud Infrastructure Market Trends

The healthcare cloud infrastructure market in Asia Pacific is driven by rapid digital transformation, increasing healthcare investments, and growing demand for accessible, technology-enabled medical services across densely populated countries. In addition, government initiatives such as India's Ayushman Bharat Digital Mission and China's Health Informatization Plan accelerate cloud adoption, positioning the region as a significant global growth hub.

China healthcare cloud infrastructure market is driven by improved infrastructure, strong government support, and a large customer base, including a rapidly aging population and rising lifestyle-related health issues such as obesity. The government’s policies promoting electronic health records (EHRs), which are linked with unique patient identifiers and the integration of insurance and hospital systems, support growth. China’s geriatric population is significantly intensifying healthcare demands and fueling cloud adoption to enhance hospital efficiency and patient care capacity.

Europe Healthcare Cloud Infrastructure Market Trends

The healthcare cloud infrastructure market in Europe is driven by the increasing digital health adoption and regulatory push for interoperable health systems. Eurostat estimated that in January 2024, the European Union's population was 449.3 million, with individuals aged 65 and over accounting for more than 21.6% of the total population. Cloud infrastructure supports this need by enabling remote monitoring, electronic health records, and data sharing across borders. The European Commission's eHealth strategy and GDPR compliance have accelerated investments in secure, cloud-based platforms. These factors collectively position Europe as a key contributor to global market growth in healthcare cloud infrastructure.

Latin America Healthcare Cloud Infrastructure Market Trends

The healthcare cloud infrastructure market in Latin America is experiencing steady growth due to increasing investments in digital health and growing awareness of cloud benefits among healthcare providers. The region is implementing cloud-based electronic health records and telemedicine platforms, driven by the need to improve healthcare accessibility and system efficiency. In addition, government-led eHealth strategies and public-private partnerships encourage healthcare modernization despite ongoing infrastructure and data privacy regulations challenges.

Middle East & Africa Healthcare Cloud Infrastructure Market Trends

The healthcare cloud infrastructure market in MEA is gaining momentum with rising government initiatives and smart health investments, particularly in the Gulf Cooperation Council (GCC) countries. For instance, Saudi Arabia’s Vision 2030 and the UAE’s national digital health strategies fueled cloud technology adoption in hospitals and clinics. In addition, the growing burden of chronic diseases and demand for remote care solutions are also key drivers, though challenges remain in cybersecurity and workforce training.

Key Healthcare Cloud Infrastructure Company Insights

Key players that leverage advanced technology to innovate and enhance healthcare delivery. These players hold significant market shares through their diverse product offerings, including wearable devices, remote monitoring solutions, and mobile health applications. Their strategic partnerships and investments in research and development further strengthen their positions, driving competition and facilitating growth within the rapidly evolving eHealth landscape.

Key Healthcare Cloud Infrastructure Companies:

The following are the leading companies in the healthcare cloud infrastructure market. These companies collectively hold the largest market share and dictate industry trends.

- Dell, Inc.

- Hewlett-Packard Enterprise Development LP

- Microsoft

- Oracle

- IBM

- Amazon

- Dexcom, Inc.

- PHC Holdings Corporation

- Fujitsu

- Cognizant

- Eviden

- CloudWave

- Salesforce, Inc.

Recent Developments

-

In May 2025, Oracle Health, G42, and the Cleveland Clinic entered into a strategic alliance to co-develop an advanced AI-driven healthcare delivery platform. The collaboration is focused on enhancing patient outcomes and optimizing public health management by harnessing the power of AI, large-scale data analytics, and intelligent clinical solutions. The goal is to build secure, scalable, and accessible care models that drive meaningful improvements in health and longevity.

“This venture represents a bold leap forward in our collective mission to transform how healthcare is delivered. As a leader in healthcare, it is morally imperative to create solutions that benefit the health and wellness of people. An AI-enabled model of care could positively impact global health systems-a flagship example of how data-driven, tech-powered healthcare can deliver better outcomes, lower costs, and expand access worldwide.”

-Tom Mihaljevic, MD, President and CEO, and Morton C. Mandel CEO Chair of the Cleveland Clinic.

-

In March 2023, Fujitsu introduced a new cloud-based platform in Japan to advance personalized healthcare and support drug development in the healthcare sector.

“Wellbeing in the health and medical field is one of the most important goals within Japan’s super-aging society, and for all people worldwide living in the “VUCA era.” We believe that the launch of this new cloud-based platform will enable us to make our vision of a new health and medical society that provides wellbeing to people become reality.”

- Masaaki Mizuno, MD, PhD, Director of the Center for Research, Education, and Development for Healthcare Life Design (C-REX)

-

In January 2022, Francisco Partners, also from the US, made a deal with IBM to buy several healthcare data and analytics resources that were part of IBM's Watson Health division. These resources include Health Insights, MarketScan, Clinical Development, Social Program Management, Micromedex, and imaging software.

“Today’s agreement with Francisco Partners is a clear next step as IBM becomes even more focused on our platform-based hybrid cloud and AI strategy. IBM remains committed to Watson, our broader AI business, and to the clients and partners we support in healthcare IT. Through this transaction, Francisco Partners acquires data and analytics assets that will benefit from a healthcare industry-focused portfolio's enhanced investment and expertise.”

- Tom Rosamilia, Senior Vice President, IBM Software

Healthcare Cloud Infrastructure Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 89.52 billion

Revenue forecast in 2030

USD 193.44 billion

Growth rate

CAGR of 16.66% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Dell, Inc.; Hewlett-Packard Enterprise Development LP; Microsoft; Oracle; IBM; Amazon; Dexcom Inc.; PHC Holdings Corporation; Fujitsu; Cognizant;

Eviden; CloudWave; Salesforce, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Healthcare Cloud Infrastructure Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global healthcare cloud infrastructure market report based on component, end use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Service

-

Software-as-a-Service (SaaS)

-

Infrastructure-as-a-Service (IaaS)

-

Platform-as-a-Service (PaaS) Payers

-

-

Hardware

-

Server

-

Storage

-

Network

-

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Healthcare Providers

-

Hospitals

-

Diagnostic & Imaging Centers

-

Ambulatory Centers

-

-

Healthcare Payers

-

Private Payers

-

Public Payers

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global healthcare cloud infrastructure market size was estimated at USD 76.72 billion in 2024 and is expected to reach USD 89.52 billion in 2025.

b. The global healthcare cloud infrastructure market is expected to grow at a compound annual growth rate of 16.66% from 2025 to 2030 to reach USD 193.44 billion by 2030.

b. The services segment held the largest revenue share of 79.08% in 2024 due to the growing need for cloud migration, system integration, and ongoing support across healthcare organizations. As providers shift from legacy systems to cloud-based environments, demand for consulting, implementation, and managed services surged.

b. Key players operating in the healthcare cloud infrastructure market include Dell, Inc., Hewlett Packard Enterprise Development LP, Microsoft, Oracle, IBM, Salesforce, Amazon, Dexcom, Inc., PHC Holdings Corporation, Fujitsu, Cognizant, Eviden, CloudWave, Salesforce, Inc.

b. Key factors that are driving the healthcare cloud infrastructure market growth include the rising adoption of digital health technologies, demand for scalable IT solutions, government support for digital health, and a need for secure data management. Advancements in cloud, AI, and interoperability are driving growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.