- Home

- »

- Display Technologies

- »

-

Healthcare Digital Signage Market Size & Share Report 2030GVR Report cover

![Healthcare Digital Signage Market Size, Share & Trends Report]()

Healthcare Digital Signage Market Size, Share & Trends Analysis Report By Component (Hardware, Software), By Display Type (LCD, LED), By Type, By Location, By Display Size, By Application, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-145-2

- Number of Report Pages: 134

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

Healthcare Digital Signage Market Trends

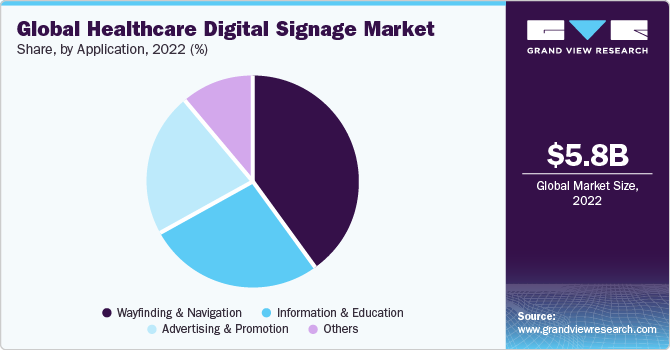

The global healthcare digital signage market size was estimated at USD 5.82 billion in 2022. It is anticipated to grow at a compound annual growth rate (CAGR) of 13.6% from 2023 to 2030. The growth is expected to be driven by the growth of the healthcare industry across the globe. As per a study conducted by Delloite, the aggregate count of healthcare investment transactions between the United States and global markets reached its zenith in 2018, amounting to 196 deals with a collective worth of USD 26.1 billion. These facilities require effective communication tools to disseminate information, educate patients, and enhance the overall patient experience. Digital signage provides a dynamic and engaging platform for delivering important messages and information within healthcare facilities.

Furthermore, with the growth of the industry, there is a greater need for efficient and effective communication between healthcare providers and patients. Digital signage can be used to display important announcements, directions, wait times, and other relevant information, improving communication and reducing confusion for patients. Additionally, Digital signage can contribute to this by creating a welcoming and informative environment for patients. It can display personalized messages, educational content, and entertainment options, making the waiting areas more engaging and reducing perceived wait times.

Digital signage can help reduce hallway congestion by providing a clear and efficient way to communicate important information. Instead of relying on traditional methods like paper signs or verbal communication, digital signage can display real-time updates, directions, and announcements, allowing staff, patients, and visitors to quickly and easily access the information they need. This can help prevent overcrowding in hallways as people can find the information they need without gathering in one area. Such benefits associated with digital signage are propelling the adoption within the hospital industry.

COVID-19 Impact

COVID-19 had a significant impact on the healthcare sector. One of the foremost impacts of COVID-19 on the healthcare digital signage industry is the increased emphasis on communication and information dissemination. With hospitals and clinics facing unprecedented challenges in managing patient flow, implementing safety protocols, and providing timely updates, digital signage has emerged as a vital tool. These displays are being used to broadcast real-time information on safety guidelines, preventive measures, and changes in healthcare policies. They help create awareness among patients, visitors, and staff, ensuring compliance with safety protocols and minimizing the risk of virus transmission.

Moreover, the demand for telemedicine and remote healthcare services has surged during the pandemic. Healthcare digital signage has played a crucial role in facilitating remote patient engagement, enabling virtual consultations, and delivering health-related information to patients in their homes. By incorporating video conferencing capabilities and interactive touch screens, digital signage has bridged the gap between healthcare providers and patients, ensuring continuity of care and reducing the burden on overloaded healthcare systems.

Component Insights

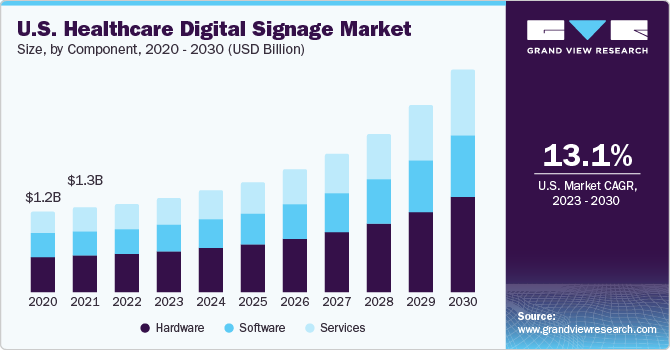

Based on component, the market is classified into hardware, software, and services segments. The hardware segment dominated with a revenue share of 44.7% in 2022. The segment is anticipated to be driven by the growing demand for remote management and maintenance within the healthcare industry. The hardware focuses on developing displays that can be remotely managed and monitored, reducing the need for on-site maintenance and troubleshooting. This remote management capability ensures that displays are always up-to-date, minimizing downtime and improving the overall efficiency of digital signage systems.

Healthcare businesses often require assistance implementing and integrating healthcare digital signage systems into their infrastructure. Service providers offer expertise in system configuration, data migration, and integration with other business systems, such as ERP or CRM. This support ensures smooth implementation and minimizes disruptions to healthcare operations. Additionally, they provide insights, best practices, and industry expertise to improve efficiency, reduce costs, and enhance patient experience. The services segment is anticipated to grow at the fastest CAGR of 15.0% from 2023 to 2030.

Display Type Insights

Based on display type, the market is classified into LCD, LED, and OLED segments. The LCD segment dominated with a revenue share of 44.3% in 2022. LCDs are relatively cost-effective compared to other display technologies, such as LED or OLED. This makes them a popular choice for healthcare facilities that require multiple displays across various locations within their premises. The cost-effectiveness of LCDs allows healthcare providers to implement digital signage solutions within their budget constraints. LCDs have a long lifespan and are known for their reliability. This is crucial in healthcare environments where displays may be subjected to constant use, handling, and cleaning. The durability and reliability of LCDs ensure that they can withstand the demands of the healthcare industry and provide consistent performance over time.

The OLED segment is anticipated to grow at the fastest CAGR of 15.5% from 2023 to 2030. OLED displays offer deep blacks and vibrant colors, providing excellent contrast and visual appeal. This makes them ideal for displaying important information and engaging content that can capture the attention of patients, visitors, and staff. In addition, OLED displays are thin and lightweight compared to other display technologies, making them easy to install and integrate into various healthcare environments, including patient rooms, waiting areas, and corridors.

Type Insights

Based on type, the video-walls segment dominated the market with a revenue share of 23.7% in 2022. Video walls offer a large and immersive display that can capture the attention of viewers. In healthcare settings, video walls can be used to showcase important information, educational content, patient testimonials, or even live feeds of medical procedures. The enhanced visual impact of video walls can effectively engage patients, visitors, and professionals. Additionally, video walls are often equipped with features such as high brightness, anti-glare coatings, and robust construction to ensure optimal performance and longevity. The reliability and durability of video walls make them suitable for the demanding requirements of healthcare facilities.

The transparent LED screen segment is anticipated to grow at the fastest CAGR of 14.9% from 2023 to 2030. Transparent LED screens can be integrated into existing windows, glass partitions, or other transparent surfaces, allowing healthcare facilities to maximize their use of space. By utilizing these screens, healthcare providers can eliminate the need for traditional signage or displays, freeing up valuable space for other purposes. This is particularly beneficial in areas with limited space, such as waiting rooms or corridors. These factors contribute to the growing adoption of transparent LED screens within the healthcare digital signage industry, as they offer a visually appealing, interactive, and efficient solution for communication, patient engagement, and space utilization in healthcare facilities.

Application Insights

Based on application, the market is classified into wayfinding & navigation, information & education, advertising & promotion, and others. The wayfinding & navigation segment dominated the market with a revenue share of 39.8% in 2022. Digital signage with wayfinding capabilities can help patients find their way to appointments, procedures, or waiting areas more efficiently. Wayfinding & navigation solutions can be integrated with other healthcare systems, such as electronic health records (EHR) or appointment scheduling systems. This integration enables personalized wayfinding based on patient information, appointment schedules, or specific services, further enhancing the overall patient experience.

The information & education segment is anticipated to grow at a significant CAGR of 13.4% from 2023 to 2030. With a growing emphasis on patient-centered care, healthcare providers are increasingly using digital signage to educate patients about their conditions, treatment options, and post-treatment care. This empowers patients to make informed decisions about their health, improving overall patient satisfaction and outcomes. Moreover, healthcare professionals are using digital signage for medical training and continuing education. It offers a dynamic and interactive platform for disseminating knowledge, ensuring that medical staff stays updated with the latest practices and information.

Location Insights

Based on location, the indoor segment dominated the market with a revenue share of 75.4% in 2022. The dominant share of the segment can be ascribed to the substantial demand from the healthcare industry, making it the most favorable application field for digital displays in advertising. Furthermore, this segment is projected to uphold its position in the global market and demonstrate a consistent growth rate throughout the forecast period due to sustained demand.

The outdoor location segment is anticipated to grow at the fastest CAGR of 15.4% from 2023 to 2030. Outdoor digital signage is designed to withstand various weather conditions and environmental factors. It can be equipped with features like high-brightness displays, weatherproof casings, and temperature control systems to ensure optimal performance in outdoor settings.

Display Size Insights

Based on display size, the below-32-inch segment dominated with a revenue share of 43.8% in 2022. The dominant share of the segment can be ascribed to the cost-effectiveness of the display size. Furthermore, below-32-inch displays can be strategically placed in specific areas to deliver targeted messaging to patients, visitors, and staff. For example, they can be used to display important announcements, health tips, appointment reminders, or wayfinding information in a localized manner.

The more-than-52-inch segment is anticipated to grow at the fastest CAGR of 14.9% from 2023 to 2030. Larger displays can create a more immersive and impactful visual experience. They can be used to display high-resolution images, videos, or animations that effectively convey healthcare messages, promote health campaigns, or showcase patient success stories. Moreover, larger displays can facilitate collaborative and interactive applications in healthcare settings. For instance, these can be used for telemedicine consultations, interactive patient education sessions, or collaborative discussions among healthcare teams.

Regional Insights

North America accounted for the highest revenue share of 34.3% in 2022. The regional market is anticipated to grow at a CAGR of over 13.5% from 2023 to 2030. The region is at the forefront of technological advancements and digital transformation. Moreover, as preventive health and wellness programs gain momentum, healthcare digital signage is being used to promote health-conscious behaviors through the dissemination of educational content, exercise routines, dietary guidance, and more. According to a study conducted by McKinsey & Company, spending on wellness products and services in the United States is projected to surpass USD 450 billion, with an annual growth rate exceeding 5%.

The Asia Pacific region is anticipated to grow at the fastest CAGR of 14.3% from 2023 to 2030. Healthcare providers in the region are increasingly adopting patient-centric approaches. Digital signage is being employed to educate patients about their health, treatment options, and post-treatment care, empowering individuals to make informed decisions about their well-being and enhancing overall patient satisfaction and outcomes. Countries such as India, China, and Japan, are making substantial investments in their healthcare infrastructure. According to Invest India, investment prospects in India's hospital and medical infrastructure sub-sector are estimated to exceed USD 32 billion. Digital signage is integral to this transformation, facilitating communication, information dissemination, and efficient healthcare service delivery.

Key Companies & Market Share Insights

The market is characterized by intense competition, with numerous large and small players offering software and services to domestic and international markets. The market is currently moderately fragmented and is moving toward a more fragmented state. Major players are adopting strategies such as innovating their products and services and engaging in mergers and acquisitions to expand the functionality of their product portfolios and maintain competitiveness.

In August 2023, LG Business Solutions introduced a new series termed "Patient Engagement Boards." These LCDs are designed to convey essential information in patient care zones, enhancing the experience for both medical staff and patients. LG envisions potential applications for these boards in long-term care facilities as well. The product lineup includes a 32-inch FHD model and a 43-inch UHD model, both of which are UL-listed for Health Care and equipped with PoE capability. The screens are powered by LG webOS.

Key Healthcare Digital Signage Companies:

- Panasonic

- LG Electronics

- Philips

- Samsung Electronics

- Sony

- Sharp Electronics

- Daktronics

- Elo Touch Solutions

- Cisco Systems

- Keywest Technology

Healthcare Digital Signage Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 6.23 billion

Revenue forecast in 2030

USD 15.21 billion

Growth rate

CAGR of 13.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Component, display type, type, location, display size, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; China; India; Japan; Brazil; Mexico;United Arab Emirates (UAE); Kingdom of Saudi Arabia (KSA); South Africa

Key companies profiled

Panasonic; LG Electronics; Philips; Samsung Electronics; Sony; Sharp Electronics; Daktronics; Elo Touch Solutions; Cisco Systems; Keywest Technology

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Healthcare Digital Signage Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global healthcare digital signage market report based on component, display type, type, location, display size, application, and region:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Software

-

Services

-

-

Display Type Outlook (Revenue, USD Million, 2017 - 2030)

-

LCD

-

LED

-

OLED

-

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Video Walls

-

Video Screen

-

Transparent LED Screen

-

Digital Poster

-

Kiosks

-

Others

-

-

Location Outlook (Revenue, USD Million, 2017 - 2030)

-

Indoor

-

Outdoor

-

-

Display Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Below 32 Inches

-

32 to 52 Inches

-

More than 52 Inches

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Wayfinding and Navigation

-

Information and Education

-

Advertising and Promotion

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

United Arab Emirates (UAE)

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global healthcare digital signage market size was estimated at USD 5.82 billion in 2022 and is expected to reach USD 6.23 billion in 2023.

b. The global healthcare digital signage market is expected to grow at a compound annual growth rate of 13.6% from 2023 to 2030 to reach USD 15.21 billion by 2030.

b. North America accounted for the highest revenue share of 34.3% in 2022. The regional market is anticipated to grow at a CAGR of over 13.5% from 2023 to 2030. The region is at the forefront of technological advancements and digital transformation. Moreover, as preventive health and wellness programs gain momentum, healthcare digital signage is being used to promote health-conscious behaviors through the dissemination of educational content, exercise routines, dietary guidance, and more.

b. Some key players in this market include Panasonic, LG Electronics, Philips, Samsung Electronics, Sony, Sharp Electronics, Daktronics, Elo Touch Solutions, Cisco Systems, and Keywest Technology.

b. The market is expected to be driven by the growth in the healthcare industry across the globe. Furthermore, with the growth of the industry, there is a greater need for efficient and effective communication between healthcare providers and patients. Digital signage can be used to display important announcements, directions, wait times, and other relevant information, improving communication and reducing confusion for patients.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."