- Home

- »

- Healthcare IT

- »

-

Healthcare Interoperability Solutions Market Report, 2030GVR Report cover

![Healthcare Interoperability Solutions Market Size, Share & Trends Report]()

Healthcare Interoperability Solutions Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Solutions, Services), By Level (Foundational), By Application, By Deployment Method, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-576-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Healthcare Interoperability Solutions Market Summary

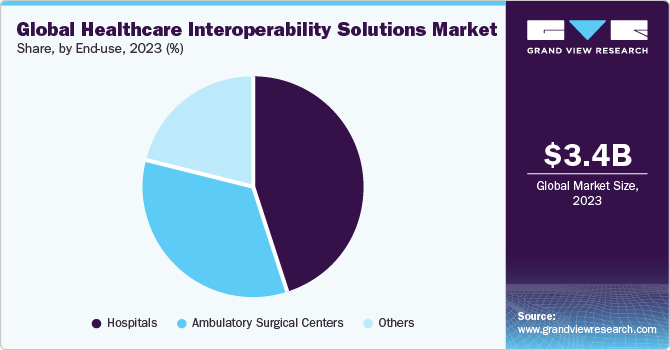

The global healthcare interoperability solutions market size was estimated at USD 3.4 billion in 2023 and is projected to reach USD 8.57 billion by 2030, growing at a CAGR of 14.15% from 2024 to 2030. An increase in the adoption of interoperability solutions by healthcare authorities, a rise in investments to enhance healthcare facilities, favorable government initiatives to improve patient care, high government funding, and a focus on patient-centric care are some major factors propelling the market growth.

Key Market Trends & Insights

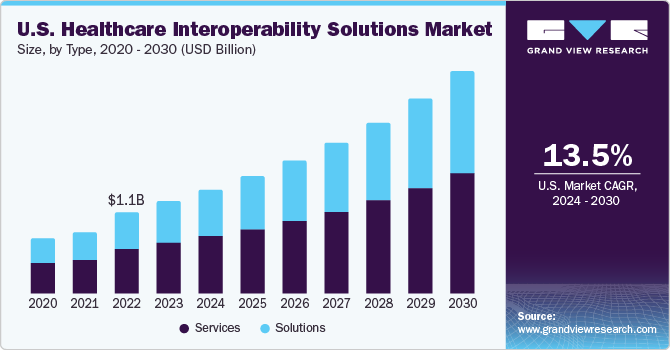

- North America dominated the market with a revenue share of a 41.58% in 2023.

- The U.S. market is expected to grow at the fastest CAGR over the forecast period.

- Based on type, the services segment led the market with the largest revenue share of 55.2% in 2023.

- Based on level, the structural segment led the market with the largest revenue share in 2023.

- Based on end-use, the hospital segment dominated the market with the largest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 3.4 Billion

- 2030 Projected Market Size: USD 8.57 Billion

- CAGR (2024-2030): 14.15%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

In February 2023, the federal government provided USD 505 million to federal data partners and Canada Health Infoway to advance digital health tools and an interoperability roadmap. Thus, the rising investments and funding from government bodies are anticipated to drive the industry growth.

Several governments are promoting information interoperability through campaigns and programs as the demand for high-quality healthcare increases. For instance, in May 2023, the Government of Canada announced the plan of connecting you to Modern Health Care. This plan drafts the Interoperability Roadmap, which can help to secure access to electronic health information. Such efforts and programs by the Government and public organizations are anticipated to support the market.

Furthermore, interoperability is also expected to reduce the overall cost associated with delayed diagnosis and treatment by providing on-time access to data. However, the increase in complexity due to lack of reliable data and privacy concerns are a few other key factors expected to impede the adoption of interoperability solutions in the short term over the forecast period.

Moreover, interoperability in healthcare has several benefits. According to the article published by RevenueXL Inc. In March 2023, the seamless exchange of information between healthcare systems brings multiple advantages to patients and healthcare providers. Some of the benefits associated with interoperability include informed decision-making, efficient care delivery, aid in complying with privacy and security regulations, facilitated sharing of patient data among healthcare organizations, and swift and easy access to patient information. Thus, a wide range of benefits associated with interoperability is expected to boost its adoption in healthcare.

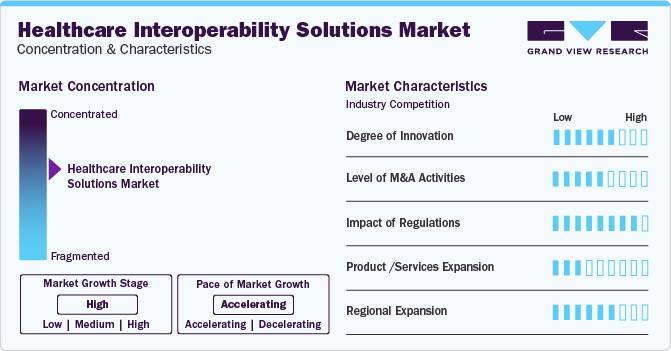

Market Concentration & Characteristics

Market growth stage is high, and the pace of the market growth is accelerating. The market is characterized by a moderate degree of innovation due to rapid technological advancements such as adoption of artificial intelligence, and machine learning in healthcare. Companies are bringing novel solutions by adopting artificial intelligence, which is expected to drive innovation in the industry. For instance, in January 2023, WELL Health Technologies Corp. partnered with Simon Fraser University (“SFU”), Tali AI, and ORX Surgical to advance interoperability via a project called Health Compass. Under this collaboration, the organizations will use WELL’s open and FHIR-based apps. Health ecosystem to seamlessly integrate the Health Compass credentials into the electronic medical records (EMR). These organizations are using AI capabilities during this project.

The market is also characterized by the leading players focus on merger and acquisition (M&A) activity. This is due to several factors, including the desire to gain a competitive advantage in the industry and the need to consolidate in a rapidly growing market. Major industry participants are acquiring firms operating across the industry. For instance, in September 2023, Enovacom, a leading healthcare data interoperability solutions provider based in France, acquired two subsidiaries of the MNH group, Xperis and NEHS Digital. Xperis is a data interoperability specialist. Such acquisitions are expected to propel industry growth in the coming years.

Furthermore, numerous authorities are focusing on regulations about interoperability. For instance, the Centers for Medicare & Medicaid Services (CMS) has issued rules related to interoperability. It includes CMS-0057-P and CMS-9115-F rules. These rules underscore the necessity to enhance health information exchange to achieve proper and necessary access to complete health records for healthcare providers, patients, and payers. Thus, the rising focus of regulatory bodies is expected to impact the industry demand significantly.

Type Insights

Based on type, the services segment led the market with the largest revenue share of 55.2% in 2023. This can be attributed to the paradigm shift toward cloud computing & cloud-based platforms to reduce operational costs for better and faster performance of business applications & processes. Furthermore, repetitive purchases of services, including software updates and maintenance, further contribute toward segment growth. In addition, organizations are expanding their collaborations to increase access to their services. For instance, in June 2023, Dedalus expanded its collaboration with Australia’s national science agency, CSIRO to deliver healthcare terminology services to customers worldwide. The partnership between these two organizations offers critical healthcare solutions and the knowledge and expertise that CSIRO has invested in health data interoperability development and research. Such collaborations undertaken by service providers are expected to boost the segment growth.

The solutions segment is anticipated to witness the fastest CAGR over the forecast period. The solutions segment is further bifurcated into EHR interoperability, HIE interoperability, enterprise interoperability, and others. The demand for the segment is anticipated to increase due to the rising need for greater access to patient health information and the growing implementation of healthcare IT solutions to improve care quality &enhance patient satisfaction.

Level Insights

Based on level, the structural segment led the market with the largest revenue share in 2023, owing to the high adoption of technology such as e-prescribing, wherein prescribers and pharmacists use the same data. Moreover, as per the article published by TechTarget, Inc. in September 2023, HL7 Fast Healthcare Interoperability Resources (FHIR) has become the popular standard for structural interoperability. Numerous prominent EHR vendors have implemented FHIR, which has assisted in enforcing the internet-based data standard as a major health information exchange (HIE) method. Thus, the rising adoption of such platforms is expected to boost the segment growth.

The foundational segment is projected to witness the fastest CAGR over the forecast period. It enables basic data exchange between systems. This level is vital for establishing the interconnectivity requirements necessary for one system to send and acquire data from another securely.

Deployment Methods Insights

Based on deployment methods, the on-premise segment led the market with largest revenue share in 2023, owing to increasing demand for data exchange. The key providers operating in industry are offering novel on-premises solutions. For instance, in April 2023, . Orion Health Group of companies introduced the Orchestral health intelligence platform. This platform can be hosted on-premise, and its features include terminology service, data integration, patient indexing, data de-identification, and data analytics capabilities. Such developments are expected to support the segment growth.

The cloud-based segment is projected to witness the fastest CAGR over the forecast period. This software enables safe and efficient data exchange in less time. Broader information exchange is possible with this cloud-based software. Moreover, the increasing focus of industry participants on cloud-based platforms is expected to propel the segment growth. Several industry players are launching cloud-based platforms for exchanging health care data. For instance, in March 2023, NextGen Healthcare, an EHR vendor, introduced the cloud-based interoperability solution Mirth Cloud Connect to address clinical data exchange challenges. This platform is useful for resolving healthcare interoperability challenges, including high costs and concerns about accessing health data exchanges. Thus, the increasing launches of cloud-based platforms are expected to boost the segment growth.

Application Insights

In terms of application, the diagnosis segment held the market in 2023 with the largest revenue share. This can be attributed to the increasing need for effective information flow to diagnose diseases. Accurate and timely diagnoses enable healthcare professionals to completely gauge patients’ conditions, which includes assessing information such as medical history & allergies.

The other segment is projected to witness the fastest CAGR over the forecast period. The demand for the segment is expected to increase due to the increasing focus on the digitalization of the healthcare infrastructure and the rising adoption of interoperability products and services by market participants.

End-use Insights

Based on end-use, the hospital segment dominated the market with the largest revenue share in 2023, due to the rising adoption of interoperability platforms by hospitals. According to the article published by the Office of the National Coordinator for Health Information Technology (ONC), in January 2023, in 2021 over 60% of hospitals engaged in electronically sharing health information (receive, send, query) and integrating summary of care records into EHRs which represents a 51% increase within four years, i.e., from 2017 to 2021. Thus, the increasing demand from hospitals for industry solutions is expected to boost segment growth.

The ambulatory surgical centers segment is projected to witness the fastest CAGR over the forecast period. As ambulatory surgical centers conduct more complex procedures, they are increasingly focusing on digital tools. For instance, in October 2023, Texas Partners Center adopted the eClinicalWorks unified cloud-based solution to improve its Ambulatory Surgery Centers (ASC) functions by automating critical operations such as billing, scheduling, and clinical documentation. The eClinicalWorks is a major ambulatory cloud HER. Thus, the rising focus of ASCs on digital platforms coupled with the growing adoption of healthcare data exchange solutions by them is expected to boost the segment growth.

Regional Insights

North America dominated the market with a revenue share of a 41.58% in 2023. The rise in demand for efficient healthcare services, the need to decrease healthcare expenditure, and effective EHR implementation by healthcare organizations are some major factors driving the adoption of interoperability solutions in this region.

The U.S. market is expected to grow at the fastest CAGR over the forecast period due to the U.S. government's several initiatives to increase access to interoperability solutions. For instance, in August 2023, the Office of the National Coordinator for Health IT (ONC) awarded USD 2 million to Boston Children’s Hospital, and HEALTHeLINK for their initiatives in USCDI data quality improvement and advanced FHIR capabilities. Boston Children’s Hospital designs an open-source platform, CumulusQ, to enhance FHIR data quality, and HEALTHeLINK focuses on advanced FHIR. Thus, favorable government initiatives are expected to support the regional market expansion.

Europe market was identified as a lucrative region in this industry. This growth is attributable to the increasing focus of industry participants on the regional market and rising favorable initiatives launched by the European government authorities. In addition, the industry stakeholders are arranging events and conferences that can improve awareness and knowledge about healthcare interoperability systems. For instance, in June 2023, HIMSS23 European Health Conference was conducted in Portugal for two days. In this conference, industry leaders and professionals demonstrated how data use and exchange can improve healthcare. Such events organized by various European countries are anticipated to propel the regional market.

The UK market is expected to grow at the fastest CAGR over the forecast period due to the presence of major industry players like Oracle (Cerner), and the increasing focus of government bodies on improving interoperability in the medical field. Authorities like NHS England are providing interoperability framework and Data Standards Directory, which can help propel the country's market.

The market in France is expected to grow over the forecast period due to the increasing concerns.Over growing healthcare costs and rising adoption of healthcare interoperability solutions and digital platforms.

Asia Pacific is anticipated to witness the fastest CAGR over the forecast period. The regional market is expected to be driven by the rising demand for quality healthcare and increasing government expenditure on healthcare facilities.

The China market is expected to grow at the fastest CAGR over the forecast period due to the large patient pool in this highly populated country, which generates a large amount of data every year, crafting a need for effective data exchange among pharmacies and hospitals.

The Japan market is expected to grow at the fastest CAGR during the forecast period due to the increasing launches of digital healthcare platforms in the country market. In addition, the presence of major players like FUJITSU and increasing strategies like partnerships and product launches undertaken by them are expected to propel the country's growth.

Key Healthcare Interoperability Solutions Company Insights

Some of the leading players operating in the global market include Veradigm Inc., Epic Systems Corporation, Infor (Koch Industries, Inc), Koninklijke Philips N.V, Orion Health group of companies, NXGN Management, LLC, and InterSystems Corporation, among others. The key players are undertaking various strategies to strengthen their position in the industry. Companies are involved in launching new products and acquiring other industry participants to strengthen their position in the market.

Emerging players such as OSP, Jitterbit, ViSolve.com, and iNTERFACEWARE Inc. are also undertaking numerous strategies to compete in the rapidly growing market. Emerging players are collaborating with other industry stakeholders and introducing novel solutions in the industry.

Key Healthcare Interoperability Solutions Companies:

The following are the leading companies in the healthcare interoperability solutions market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these healthcare interoperability solutionscompanies are analyzed to map the supply network.

- Infor (Koch Industries, Inc)

- Koninklijke Philips N.V.,

- Cerner (Oracle)

- Orion Health group of companies.

- NXGN Management, LLC.

- OSP

- Epic Systems Corporation

- ViSolve.com

- InterSystems Corporation

- iNTERFACEWARE Inc.

- Jitterbit

- Veradigm Inc.

Recent Developments

-

In August 2023, KMS Healthcare, a major provider of healthcare technology products and services, introduced a Healthcare Technology (HIT) interoperability solution, CONNECT, developed to streamline how healthcare institutions exchange and integrate data

-

In July 2023, the World Health Organization (WHO) collaborated with HL7 to jointly design guidelines and promote the adoption of open interoperability standards critical to developing unbiased and evidence-based digital health

-

In February 2023, Google Cloud and Redox entered into a partnership to simplify healthcare data exchange so organizations can make better and faster decisions

Healthcare Interoperability Solutions Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.87 billion

Revenue forecast in 2030

USD 8.57 billion

Growth rate

CAGR of 14.15% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

February 2024

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, level, deployment methods, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Russia; Norway; China; Japan; India; South Korea; Australia; Singapore; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Infor (Koch Industries, Inc); Koninklijke Philips N.V.; Cerner (Oracle) ,Orion Health group of companies.; NXGN Management; LLC.; OSP; Epic Systems Corporation; ViSolve.com; InterSystems Corporation; iNTERFACEWARE Inc.; Jitterbit; Veradigm Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Healthcare Interoperability Solutions Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global healthcare interoperability solutions market report based on type, level, deployment methods, application, end-use, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Solutions

-

EHR Interoperability

-

HIE Interoperability

-

Enterprise Interoperability

-

Others

-

-

Services

-

-

Level Outlook (Revenue, USD Million, 2018 - 2030)

-

Foundational

-

Structural

-

Semantic

-

-

Deployment Methods Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud Based

-

On-premise

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnosis

-

Treatment

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Russia

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Singapore

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global healthcare interoperability solutions market size was estimated at USD 3.42 billion in 2023 and is expected to reach USD 3.87 billion in 2024.

b. The global healthcare interoperability solutions market is expected to grow at a compound annual growth rate of 14.15% from 2024 to 2030 to reach USD 8.57 billion by 2030.

b. North America dominated the healthcare interoperability solutions market with a share of 41.6% in 2023. This is attributable to a rise in demand for efficient healthcare services, an increase in the need to reduce healthcare expenditure, and effective EHR implementation by healthcare organizations.

b. Some key players operating in the healthcare interoperability solutions market include Allscripts Healthcare Solutions; Epic Systems Corporation; Cerner Corporation, Inc.; Infor, Inc.; Koninklijke Philips NV; Orion Health Group Limited; Quality Systems, Inc.; OSP Labs; ViSolve, Inc.; InterSystems Corporation; iNTERFACEWARE; and Jitterbit.

b. Key factors that are driving the healthcare interoperability solutions market growth include increase in the adoption of interoperability solutions by healthcare authorities, rise in investments to enhance healthcare facilities, favorable government initiatives to improve patient care, high government funding, and focus on patient-centric care.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.