- Home

- »

- Next Generation Technologies

- »

-

Healthcare Mobile Applications Market Size Report, 2020-2027GVR Report cover

![Healthcare Mobile Application Market Size, Share & Trends Report]()

Healthcare Mobile Application Market Size, Share & Trends Analysis Report By Type (Fitness Products Training, Appointment Booking & Construction), By Platform, By Technology, By End User, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68039-109-7

- Number of Report Pages: 104

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Technology

Report Overview

The global healthcare mobile application market size was valued at USD 17.92 billion in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 45.0% from 2020 to 2027. The emergence of digitalization has revolutionized how industries run their business. The healthcare sector stands immensely impacted by the digitalization system, driven by the expanded usage of smartphones and more accessible internet connectivity. Consequently, the introduction and rapid penetration of mHealth technologies have skyrocketed over the last few years, fueled by the extensive usage by patients and physicians. Fitness and medical apps continue to dominate the mobile healthcare apps market. The expansion of digital healthcare, which has gained traction due through the e-prescription system, wearable device manufacturers, and mobile health app providers, has contributed significantly to the market growth.

The healthcare industry exhibits strong growth potential for the IT industry, supported by proactive government initiatives across the globe. For instance, the Cures Act is designed to increase the speed of medical product development (such as drugs, devices, and biological products) and bring new advances and innovations to patients who are in need of them.

The paradigm shift in the healthcare sector towards preventive strategies and increase in funding for mHealth start-ups remain major driving forces for the market growth. In addition, the increased consumer awareness towards fitness, wellness, and technical knowledge is also a notable growth-booster in the market. The recent technological advancements in healthcare applications, which can provide accurate health statistics to people on-the-go, remains a crucial attraction for consumers. Besides technological advancements and an alarming rise in the prevalence of chronic diseases, strategic alliances and a stainable business model remain two critical and indispensable aspects for companies to create structured revenue channels. However, inadequate network coverage and data security concerns are few factors that are likely to impede market growth.

The penetration of smartphones and tablets is rising across the globe through all age groups. The adoption of smartphones is massively increasing, particularly in developing economies such as Brazil, Mexico, India, and other countries. These countries have witnessed a remarkable shift in penetration from 2015 till now. While India still has a low smartphone penetration rate of 30%, the ownership of the smartphone is increasing among many young adults.

Over the last couple of decades, the use of smartphones has witnessed a significant rise all over the world. However, amidst the COVID-19 pandemic, smartphones are increasingly being used for numerous medical and healthcare applications. The use of healthcare applications helps avoid the doctors’ face-to-face contact with their patients, thus maintaining social distance and preventing the transmission of the virus. These apps are helpful in clinical diagnosis and evaluation, timely advice, medicine prescription, and the remote monitoring of patients from various areas.

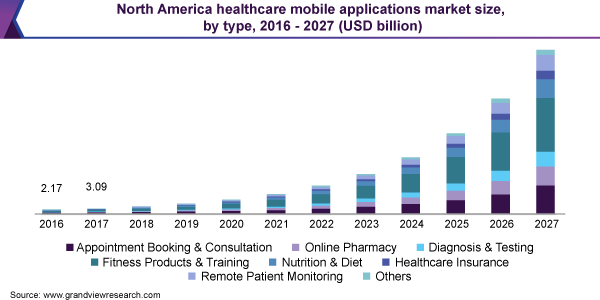

Type Insights

Fitness products and training led the healthcare mobile applications market and accounted for more than 36% share of the global revenue in 2019. The other types of mobile healthcare applications include appointment booking and consultation, online pharmacy, diagnosis and testing, nutrition and diet, healthcare insurance, remote patient, and monitoring. Application categories such as appointment booking and consultation and nutrition and diet have also gained momentum in the last few years and holding significant market share. The online pharmacy apps segment is expected to register the highest CAGR over the forecast period.

Over the past few years, the market has developed into a vibrant ecosystem due to its dynamic nature and substantial future potential. Due to the increasing usage of smartphones in the healthcare industry, the business and growth opportunities for mHealth apps are immense. Increasing the adoption of new business models, new technologies, and new workflows are transforming the mHealth application market. The majority of healthcare apps are general wellness related; however, the number of condition management apps is increasing rapidly.

Technology Insights

Non-AI-enabled mHealth apps led the market and accounted for more than 80% share of the global revenue in 2019. The segment is anticipated to continue growing and lead the market in terms of revenue over the estimated duration. However, the AI-enabled based mHealth apps are projected to exhibit a robust growth rate over the forecast period. The segment is subjected to grow at with CAGR of more than 50% from 2020 to 2027. This considerable growth of the segment is attributable to the growing adoption of Artificial Intelligence (AI) in smartphones.

Mobile application developers are using AI to make cutting-edge competition and providing a hassle-free process to its consumers. The introduction of AI in the healthcare industry has benefited both consumers as well as retailers. For instance, AI-enabled mHealth apps improve the problem-solving capabilities of its users and provide higher operational efficiency. These apps help users to track (collect), monitor (analyze), control, optimize (train), and automate their routines and activities. This comprehensive data will help healthcare professionals to diagnose, treat, and monitor their patients effectively—even from remote locations.

End-user Insights

The consumer segment led the market and accounted for more than a 38% share of the global revenue in 2019. The other types of end-users include hospitals/ healthcare providers, healthcare payers, and others. The consumer segment is anticipated to continue growing and lead the market in terms of revenue over the forecast period. However, the healthcare payers segment is projected to exhibit a robust growth rate over the forecast period. The segment is subjected to expand at with CAGR of more than 46% from 2020 to 2027.

The healthcare industry across the world has significantly expanded over the last decade. However, the end-users in rural areas of many developing countries still lack access to necessary healthcare facilities. There is just one doctor for around 1,700 people in India, whereas the World Health Organization (WHO) specifies a minimum ratio of 1:1,000. The situation is much worse in developing African countries such as Zimbabwe with just one doctor per 10,000 people. Apart from doctors' unavailability, their unwillingness to work in rural areas is also a major obstacle. While 70% of the population is in rural areas, about 60% of the healthcare infrastructure is in cities.

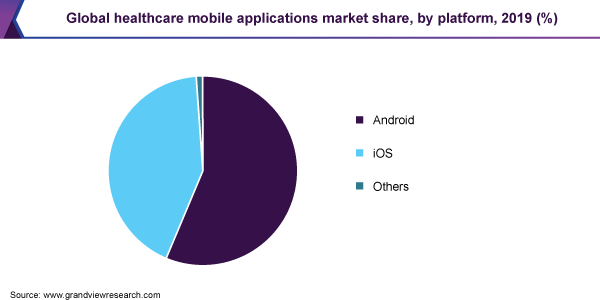

Platform Insights

Android Operating System (OS) led the market and accounted for around 56% share of the global revenue in 2019. The segment is anticipated to continue growing and leading the market in terms of revenue over the estimated duration. The iOS-based mHealth apps are projected to exhibit a robust CAGR over the forecast period. The segment is subjected to register a CAGR of more than 40.0% from 2020 to 2027. This considerable growth of the segment is attributable to the rising adoption of Apple smartphones.

iOS

Android

Devices

The Apple iPhone and iPad

Variety of mobile devices and tablets

Operating System (OS)

A single OS with more streamlined development and a dedicated user base

Upgrades of iOS systems via iTunes

Android users own different devices. Developers face challenges to make apps for different screen sizes, different OS version, and devices with different technical capabilities

Market Share

Relatively restricted global reach Hence a smaller demographic of the audience

Wide global presence and reach hence a wider demographics which can reach more potential customers

Language

Objective-C or Swift

Java

Quality Assurance

Firmer and fewer bugs

Android apps are more susceptible to bugs and early bug-fixes can affect apps success in the app store

Number of Healthcare Apps Available on App Store (2019)

~45,478

~43,285

Regional InsightsThe North America region held the largest market share of over 35% in terms of revenue in 2019, owing to the high concentration of market players. The user base is solid in the country as people are actively engaging in healthcare applications. Smartphone penetration of more than 70% plays a crucial role in the region’s high share. The Asia Pacific region, on the other hand, is estimated to register the highest CAGR of over 50% from 2020 to 2027. The growth is attributed to increasing user engagement from across the region during the COVID-19 pandemic. The use of apps, including Practo, 1mg, and cure.fit has grown significantly in 2020, and the market is expected to flourish over the forecast period.

The emergence of 3G and 4G networks across the globe is expected to further increase the use of smartphones. The high penetration and widespread usage, smartphone dependency is increasing for various purposes, including communication, entertainment, infotainment, and education. Along with it, people are extensively using their smartphones for healthcare purposes and wellbeing. Along with developing economies, developed countries, such as the U.K., Germany, the U.S., and Canada are on the pinnacle of the smartphone penetration scale. Approximately two-thirds of the North American population owns a smartphone; thus, more people can monitor and manage their health on the go in a convenient way. In the U.S., 95% of adults aged 18 to 29, 90% adults aged 30 to 49, 80% adults aged 50 to 64, and 55% adults aged 65 and more use smartphones.

Key Companies & Market Share Insights

The market is highly fragmented with thousands of healthcare applications, more than 90% of the revenue share is divided among all the other market players from various subsets of healthcare industry applications, including appointment booking and consultation, online pharmacy, diagnosis and testing, fitness products and training, nutrition and diet, insurance, and remote patient monitoring. The following are some of the notable companies from each subset of healthcare applications. Several key market players are increasingly undergoing mergers and acquisitions along with the new industry entrants to expand their geographic presence and capture the escalating market potential. For instance, in September 2017, 1mg announced the acquisition of Dawailelom, a Varanasi based healthcare platform. The acquisition aimed at increasing the geographic presence of the company pan-India. Some of the prominent players in the healthcare mobile application market include:

-

Epocrates, Inc.

-

8FIT

-

Fitbit, Inc.

-

Nike, Inc.

-

Johnson & Johnson Health and Wellness Solutions, Inc.

-

MyFitnessPal

-

myCigna

-

1mg

Healthcare Mobile Application Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 25.92 billion

Revenue forecast in 2027

USD 348.98 billion

Growth Rate

CAGR of 45.0% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD million and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, platform, technology, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

The U.S.; Canada; The U.K.; Germany; France; China; Japan; India; Brazil; Mexico

Key companies profiled

Epocrates, Inc.; 8FIT; Fitbit, Inc.; Nike, Inc.; Johnson & Johnson Health and Wellness Solutions, Inc.; MyFitnessPal; myCigna; 1mg

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global healthcare mobile applications market report on the basis of type, platform, technology, end-user, and region:

-

Type Outlook (Revenue, USD Million, 2016 - 2027)

-

Appointment Booking and Consultation

-

Online Pharmacy

-

Diagnosis and Testing

-

Fitness Products and Training

-

Nutrition & Diet

-

Healthcare Insurance

-

Remote Patient Monitoring

-

Others

-

-

Platform Outlook (Revenue, USD Million, 2016 - 2027)

-

Android

-

iOS

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2016 - 2027)

-

AI-enabled

-

Non-AI-enabled

-

-

End-user Outlook (Revenue, USD Million, 2016 - 2027)

-

Consumer

-

Hospitals/ Healthcare Providers

-

Healthcare Payers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2027)

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

The U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

Mexico

-

-

The Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global healthcare mobile application market size was estimated at USD 17.92 billion in 2019 and is expected to reach USD 25.92 billion in 2020.

b. The global healthcare mobile application market is expected to grow at a compound annual growth rate of 45.0% from 2020 to 2027 to reach USD 348.98 billion by 2027.

b. North America dominated the healthcare mobile application market with a share of 35.02% in 2019. This is attributable to the high concentration of market players, increasing smartphone penetration, and strong user base as people are actively engaging in healthcare applications.

b. Some key players operating in the healthcare mobile application market include Epocrates, Inc., 8FIT, Fitbit, Inc., Nike, Inc., Johnson & Johnson Health and Wellness Solutions, Inc., MyFitnessPal, myCigna, and 1mg.

b. Key factors that are driving the healthcare mobile application market growth include expanded usage of smartphones, more accessible internet connectivity, expansion of digital healthcare, and increased consumer awareness towards fitness, wellness, and technical knowledge.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."