- Home

- »

- Healthcare IT

- »

-

mHealth Apps Market Size & Share, Industry Report, 2030GVR Report cover

![mHealth Apps Market Size, Share & Trends Report]()

mHealth Apps Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Medical Apps, Fitness Apps), By Platform (Android, iOS), By Region (Asia Pacific, Middle East & Africa), And Segment Forecasts

- Report ID: GVR-1-68038-555-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

mHealth Apps Market Summary

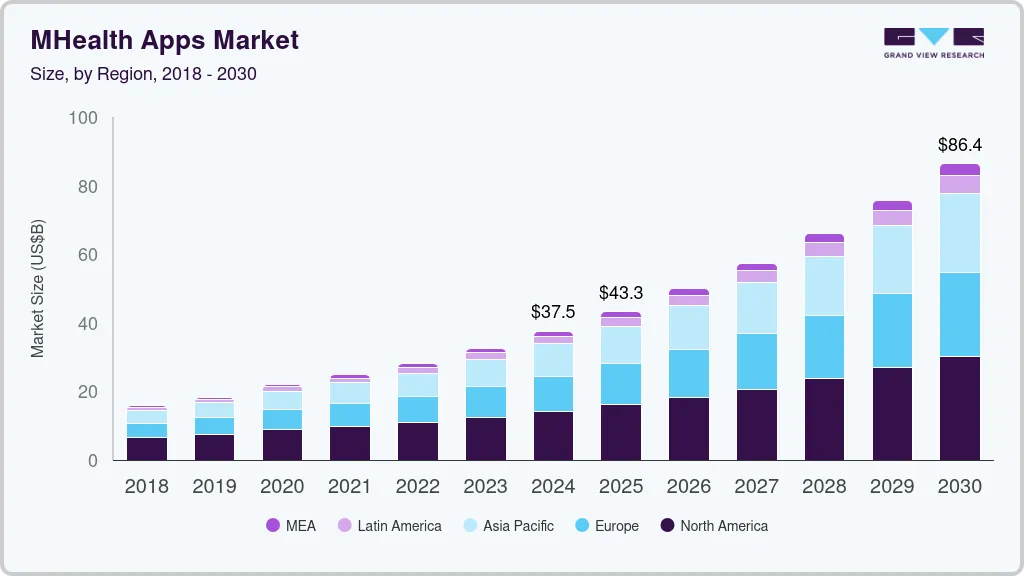

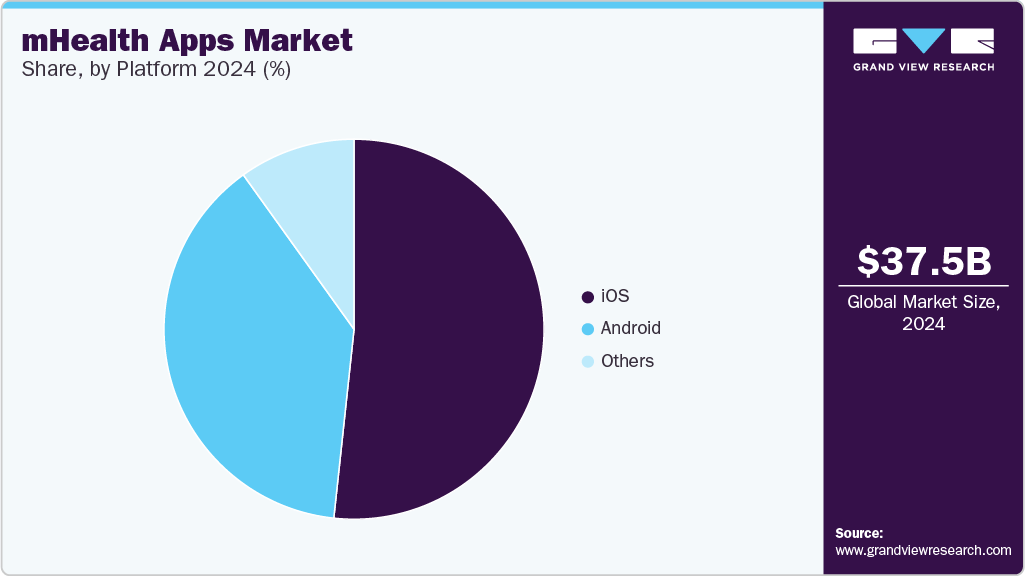

The global mHealth apps market size was estimated at USD 37.5 billion in 2024 and is projected to reach USD 86.37 billion by 2030, growing at a CAGR of 14.8% from 2025 to 2030. The growing adoption of fitness and medical applications to collect and track individuals’ well-being-related data and to improve the overall fitness of patients using smartphones is the major factor driving market growth.

Key Market Trends & Insights

- North America mHealth apps market dominated the global industry with a revenue share of 37.7% in 2024.

- The mHealth apps market in the U.S. led the North American region owing to the presence of a large number of companies operating in various areas, such as mobile & network operations, healthcare management, and software development.

- By type, the medical segment accounted for the largest revenue share of 73.0% in 2024 and is expected to register the fastest CAGR over the forecast period.

- By Platform, the iOS platform segment accounted for the largest revenue share of 39.7% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 37.5 Billion

- 2030 Projected Market Size: USD 86.37 Billion

- CAGR (2025-2030): 14.8%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

In addition, increasing internet and smartphone penetration and growing awareness of maintaining physical healthcare and lifestyle improvement further boost the adoption, thereby supporting market growth. For instance, as per The Mobile Economy 2025, there were 5.8 billion unique mobile subscribers with a penetration of 71% in 2024.

Market Drivers

Increasing Smartphone Usage and Growing Adoption of mHealth Applications

The global penetration of smartphones facilitates widespread access to mobile healthcare solutions, enabling broader outreach for health management tools. For instance, the establishment of the mHealth Application Modernization and Mobilization Alliance (MAMMA) in 2023represents a significant step towards integrating mobile technology into healthcare delivery systems effectively. The initiative emphasizes research-driven strategies and cross-sector collaboration to improve public well-being through mobile health solutions. MAMMA focuses on evidence-based practices for developing user-friendly and clinically effective apps, which enhance trust among providers and patients. This scientific validation is expected to boost adoption rates and attract more investment in technologies, stimulating market growth.

Growth Of Wearable Technology

Wearables such as smartwatches, fitness trackers, and biosensors have become integral to mHealth. These devices enable continuous, real-time monitoring of vital signs such as heart rate, blood pressure, and oxygen levels, making them highly effective tools for managing chronic diseases remotely. According to PatentPC, currently, about 80% of U.S. hospitals use wearables to support remote patient monitoring, reducing the need for frequent in-person consultations and enabling better follow-up care. This trend is contributing significantly to the scalability and efficiency of healthcare services.

Top Wearable Tech in 2024/2025 for mHealth

Device Name

Key Features

Target Use Case

Samsung Galaxy Ring

Biometric health monitoring, accelerometer, PPG, skin temperature sensors, IP68 & 10ATM rated

Continuous health tracking

Amazfit Helio Ring

Titanium alloy build, 10ATM water resistance, heart rate, SpO₂, stress, sleep tracking, electrodermal activity sensor

Athlete recovery monitoring

Oura Ring Gen 4

Advanced sleep and recovery tracking, heart rate variability, and early illness detection

Sleep optimization, stress management

Fitbit Sense 3.0

Continuous ECG, AI-powered stress assessment, real-time health feedback

Cardiovascular health monitoring

Xiaomi Smart Band 9 Series

AMOLED display, heart rate, SpO₂, sleep tracking, GPS, lightweight design

General health and fitness tracking

These devices represent the latest advancements in wearable technology, offering a range of features from continuous health monitoring to specialized diagnostics. Their integration into the mHealth ecosystem is enhancing personalized care, chronic disease management, and overall patient engagement.

Growing Shift Toward Patient-Centric Care

The rising demand for patient-centric care drives the adoption of mobile health applications and services globally. The healthcare industry is shifting its focus from provider-centric care to patient-centric care solutions that empower patients to actively participate in managing their lifestyle and wellbeing by providing them with access to their medical records, medication reminders, wellness programs, and remote consultations. The demand for personalized, convenient, and accessible services drives the adoption of mHealth solutions globally. The growing utilization of mobile health applications for diverse purposes is significantly fueling the expansion of the industry.

Market Restraints

Data Privacy and Security Concerns in mHealth

Data privacy and cybersecurity remain significant barriers to the widespread adoption of mHealth and telehealth services. As healthcare providers increasingly rely on mobile and connected devices to store and transmit sensitive patient data, the risk of data breaches, malware, and unauthorized access has grown substantially.

-

Mobile device vulnerabilities expose patient data to risks such as malicious software installation, configuration tampering, and unauthorized data access.

-

Cyberattacks are rising: According to IBM’s 2021 report, healthcare breaches cost an average of USD 9.23 million, the highest across industries. Major breaches can cost up to USD 13 million.

Despite the growth of smart devices and telemedicine, many healthcare organizations-especially smaller ones-lack robust cybersecurity infrastructure, trained personnel, and consistent regulations. These concerns have led to:

-

52% of telehealth providers reporting patient refusals due to data privacy fears.

-

81% expressing concern about potential data leaks.

-

Notable breaches, such as the Trinity Health breach (586,869 patients affected via third-party vendor Accellion), highlighting ongoing risks.

Inconsistent global regulations and limited cybersecurity budgets further impede the large-scale adoption of mHealth technologies.

Industry Opportunities

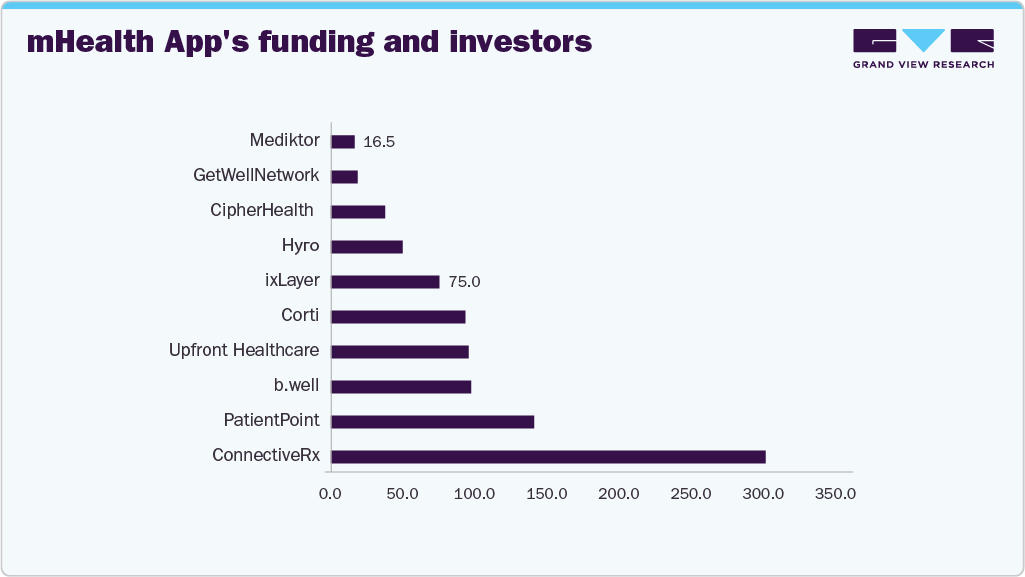

Increased Funding and Investment in the mHealth Apps Market

Furthermore, increasing funds and rising collaboration activities between various healthcare institutions are expected to drive market growth over the forecast period. The digital health landscape is rapidly evolving, with several innovative companies competing in the patient engagement and healthcare IT space. According to Tracxn, the following are the top competitors of mHealth App, ranked by company performance based on funding.

mHealth App's Funding And Investors

Company

Stage

Key Investors

Total Funding (USD Million)

ConnectiveRx

Acquired

Foresite Capital, SLR Investment Corp & 8 others

300

Hyro

Series B

Macquarie Group, Spider Capital & 12 others

140

PatientPoint

Acquired

L Catterton, Littlejohn & 4 others

96.3

Upfront Healthcare

Acquired

Baird Capital, Echo Health Ventures & 5 others

95.5

CipherHealth

Series A

JMI Management, CIBC & 2 others

93

Source: Tracxn Technologies Limited

Rising Prevalence of Chronic Diseases

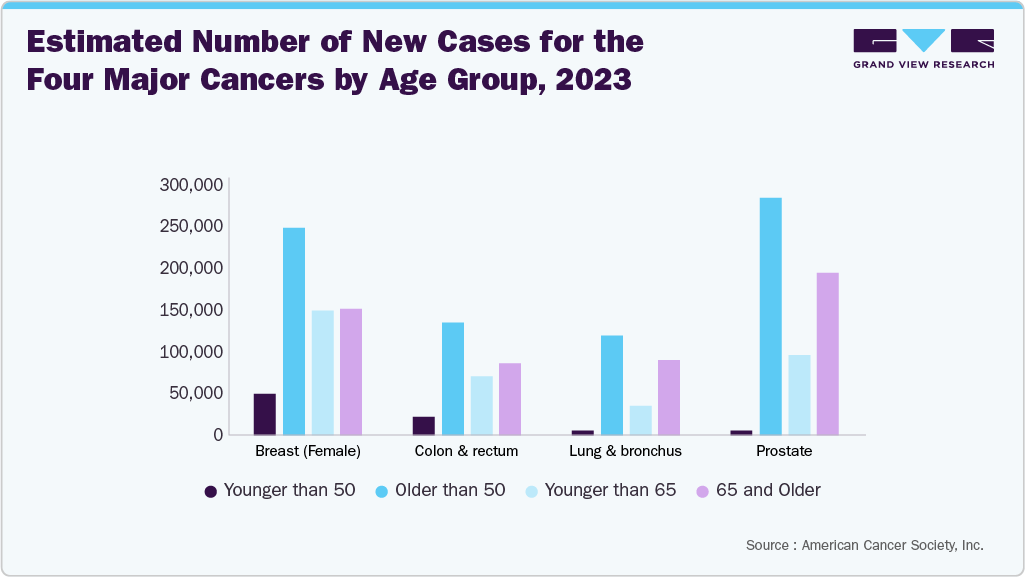

Globally, chronic diseases such as diabetes, hypertension, cardiovascular diseases, and respiratory disorders are becoming increasingly prevalent. A World Health Organization report (2024) revealed over 20 million new cancer cases, and more than 53.5 million survivors living at least five years post-diagnosis. mHealth apps are being leveraged to assist patients in tracking symptoms, monitoring progress, adhering to medication, and communicating with providers, all of which are crucial for effective long-term disease management.

Furthermore, the mHealth applications for chronic disease management offer a comprehensive suite of tools & features for self-monitoring, medication adherence, lifestyle tracking, and remote consultation, enabling individuals to manage their conditions more effectively and improve their quality of life.

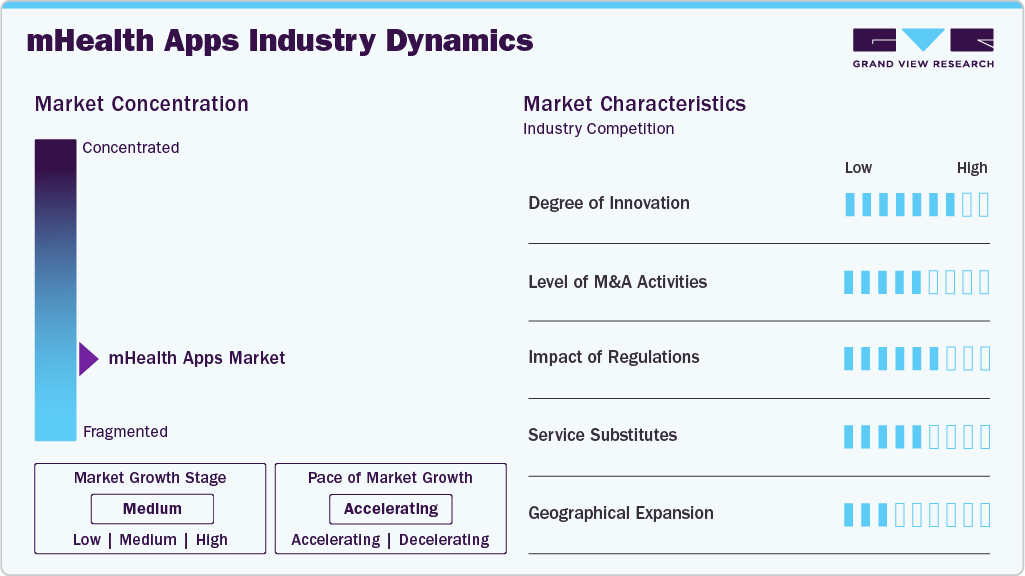

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, characteristics, and participants. The x-axis represents the level of market concentration, ranging from low to high. The y-axis represents various market characteristics, including degree of innovation, industry competition, service substitutes, impact of regulations, level of merger and acquisition activities, product substitutes, and geographical expansion. For instance, the market is fragmented, with many small players entering the market and launching new innovative applications. The degree of innovation is high, the level of merger & acquisition activities is medium, the impact of regulations on the market is high, the impact of product substitutes is low, and the geographical expansion of the market is high.

The industry is characterized by a high degree of innovation, with new applications and technologies being developed and introduced regularly. Many people are adopting these applications as they enable patients to monitor their health-related activities and maintain an updated health record. Thus, industry players invest in new technologies and methods to meet the growing demand. For instance, in August 2023, Suniel Shetty, an Indian Bollywood actor, collaborated with Veda Rehabilitation & Wellness to launch Let’s Get Happi, a mental health app. The app provides features, such as assessment tests & meditation, and 24/7 access to therapy from psychologists.

The industry is characterized by a moderate level of mergers and acquisitions (M&A) activities by leading players. Market players are adopting this strategy to gain access to new technologies and advancements, and the need to consolidate in a rapidly growing market. In June 2024, NeuroFlow announced its acquisition of Owl to significantly enhance its capabilities in the behavioral health sector. This strategic acquisition positions NeuroFlow as the largest end-to-end platform for behavioral health measurement and engagement across the care continuum.

The FDA is responsible for ensuring that medical devices, including MMAs, comply with safety and efficacy standards to safeguard public health. Furthermore, mHealth software must comply with HITECH, HIPAA, FDA regulations for Medical Devices, and GDPR to ensure the security, privacy, and integrity of patient information. To facilitate the FDA approval process of mHealth apps, the FDA suggests using the STRIDE framework, which helps market players ensure the safety, efficacy, and security of their apps. This framework can streamline the FDA approval process.

STRIDE framework:

-

S - Spoofing

-

T - Tampering

-

R - Repudiation

-

I - Information Disclosure

-

D - Denial of Service

-

E - Elevation of Privileges

Apart from mHealth, several other options are available that rely on conventional services and interventions. These include standard medical treatments, traditional practices such as face-to-face consultations, and paper-based health records, which can also be used in the healthcare sector. In addition, wearables, including smartwatches and fitness trackers, offer more comprehensive health data collection, including heart rate, sleep patterns, activity levels, and more.

Many companies are strengthening their market positions by expanding geographically. This can be achieved by partnerships, collaborations, launching new facilities, and acquiring & merging with companies based in different locations. In June 2024, Ryde Group Ltd announced a partnership with Mobile-health Network Solutions (Nasdaq: MNDR), a prominent telehealth provider in the Asia-Pacific region. This collaboration aims to enhance healthcare access for Ryde's driver-partners and their families, addressing significant challenges they face in obtaining affordable healthcare services.

Type Insights

The medical segment accounted for the largest revenue share of 73.0% in 2024 and is expected to register the fastest CAGR over the forecast period. This growth is attributed the increasing awareness of adopting medical applications among patients and healthcare professionals for better communication and healthcare outcomes. Moreover, an increase in the number of new applications and easy availability of many medical apps in the market is anticipated to boost their demand. Some popular medical apps are Epocrates, Medscape, MedPage Today, 3D4Medical, AHRQ ePSS, and Airstrip Cardiology.

The fitness segment is anticipated to grow lucratively during the forecast period due to the rising adoption of fitness-related applications and increasing awareness of self-health management. Growing emphasis on adopting a healthy lifestyle and increasing usage of wearable devices, tablets, and smartphones to access fitness applications are driving the segment growth. For instance, as per devtechnosys.com, MyFitnessPal had over 200 million registered users worldwide as of 2021. There were 560 million health users in 2022, a 22.5% increase from 2021. Moreover, rising awareness regarding diet-related diseases is anticipated to propel segment growth over the forecast period.

Platform Insights

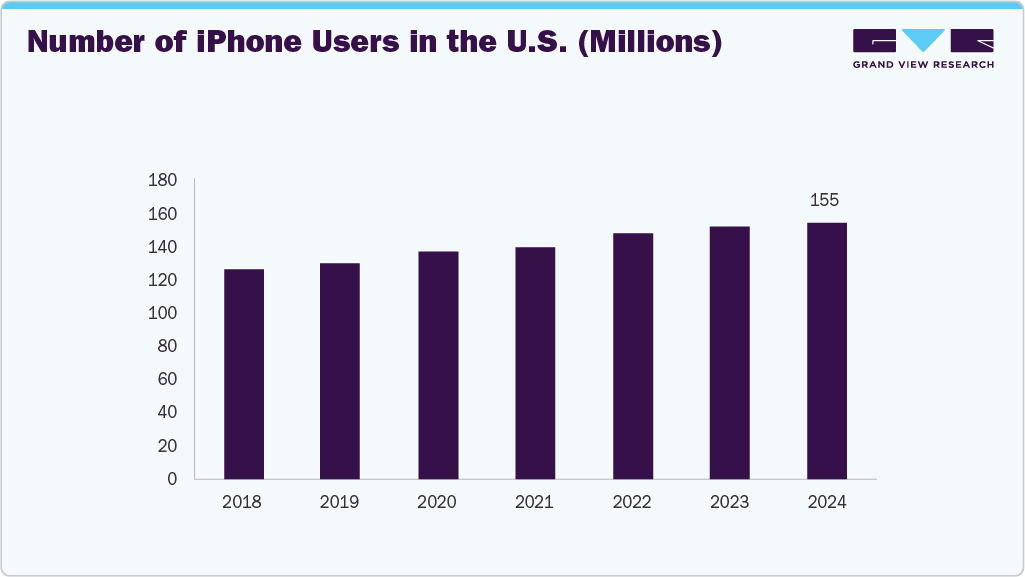

The iOS platform segment accounted for the largest revenue share of 39.7% in 2024. The growth of this segment can be attributed to the high adoption and popularity of the iOS platform among consumers across the globe. According to data published by Business of Apps in 2021, market share of iOS in the UK increased from 47% in Q3 of 2020 to 51.6% in Q3 of 2021.

The Android segment is anticipated to grow at the fastest CAGR over the forecast period, owing to the increasing adoption of Android-based smartphones on account of their cost-effectiveness. For instance, according to BankMyCell.com, there are 3.9 billion Android smartphone users across the globe. Similarly, in the U.S., 43.8% of residents use Android smartphones. Thus, such a rise in the number of smartphone users is expected to drive segment growth in the coming years.

To stand out among the multitude of mHealth applications available on the App Store and Google Play Store, an app should possess the following features, regardless of the platform it is designed for:

-

Streamlined, user-friendly UX

-

Cybersecurity infrastructure

-

Reminder integration for appointments, routines, and medication

-

Integration for health goals with related mHealth apps and infrastructure

-

Engaging prompts for health promotion

-

Document management

-

Telehealth communications

-

AR/VR for appointments and health management

-

Back-up options to track and store data

-

Educational features

Region Insights

North America mHealth apps market dominated the global industry with a revenue share of 37.7% in 2024. Increasing mobile usage & healthcare expenditure, growing 5G networks, and a rising number of government initiatives & funding are driving the regional market growth. As per the NHE Fact Sheet, in North America, specifically in the U.S., national health expenditures increased by 7.5% in 2023, totaling USD 4.9 trillion, which is approximately USD 14,570 per person. Furthermore, rising chronic disease prevalence and increasing geriatric population in the region are expected to support market growth. For instance, as per the Population Reference Bureau, the U.S. population aged 65 years and above was estimated to grow from 58 million in 2022 to 82 million by 2050.

U.S. mHealth Apps Market Trends

The mHealth apps market in the U.S. led the North American region owing to the presence of a large number of companies operating in various areas, such as mobile & network operations, healthcare management, and software development. Market players are involved in introducing innovative healthcare applications, building network infrastructure, and increasing the adoption of various mHealth apps in the U.S. For instance, in August 2023, MedWorks, a Canadian tech company, brought its health and wellness service app to the U.S., starting with Florida.

Asia Pacific mHealth Apps Market Trends

The mHealth apps market in Asia Pacific is expected to grow at the fastest CAGR from 2024 to 2030, owing to increasing usage of smartphones & smart wearables and high adoption of mHealth apps. Factors, such as increasing incidence of chronic & infectious diseases, rising healthcare expenditure, ineffective hospital service management, and a growing elderly population, are compelling governments & healthcare providers to develop new healthcare delivery models. For instance, in January 2024, JD Health introduced a new elderly care channel on its app to provide a comprehensive platform for the various healthcare needs of China's aging population.

India mHealth apps market holds a significant share of the Asia Pacific regional market revenue. The rising use of smartphones and the launch of new healthcare apps are expected to drive the adoption of mobile platforms for various healthcare services. For instance, in February 2024, the “Health On Us” app was introduced, offering two primary services such as care at home and care at the center.

Middle East & Africa mHealth Apps Market Trends

The mHealth apps market in the Middle East & Africa is expected to see significant growth in the coming years. The mHealth solutions are transforming healthcare in this region, driven by the growing internet connectivity and government initiatives. Telemedicine, mHealth apps, wearable integration devices, and AI mHealth apps are the major trends revolutionizing healthcare accessibility, costs, & outcomes in the region. For instance, the UAE aims to leverage advanced technologies, such as AI and big data analytics, to improve healthcare outcomes & patient experiences.

Saudi Arabia mHealth apps market is undergoing substantial growth. The adoption of mHealth technologies in Saudi Arabia is in its nascent stage. Increasing smartphone penetration and improving internet connectivity are some of the major drivers boosting the adoption rate. According to Ubuy estimates, approximately 92% of the Saudi population either has access to or owns a smartphone. The number of smartphone users has significantly increased from 14.31 million individuals in 2013 to 33.55 million individuals in 2024.

Key mHealth Apps Companies Insights

Key players operating in the mHealth apps market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key mhealth Apps Companies:

The following are the leading companies in the mHealth apps market. These companies collectively hold the largest market share and dictate industry trends.

- Apple Inc.

- Google Inc.

- AirStrip Technologies, Inc.

- Samsung Electronics Co. Ltd.

- Veradigm LLC (Allscripts Healthcare Solutions)

- Qualcomm Technologies, Inc.

- AT&T

- Orange

- Teladoc Health, Inc.

- AstraZeneca

- Abbott

- Sanofi

- Johnson & Johnson Services, Inc.

- Novartis AG

- Pfizer Inc.

Some examples of mHealth applications are as follows:

Unmind, Ovia Health, Nutrimedy, Sony’s mSafety Mobile Health, Sony’s mSafety Mobile Health, and MDCalc mHealth apps are revolutionizing the healthcare sector.

mHealth Apps Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 43.28 billion

Revenue forecast in 2030

USD 86.37 billion

Growth rate

CAGR of 14.8% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, platform, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Norway; Sweden; China; India; Japan; Australia; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Apple Inc.; Google Inc.; AirStrip Technologies, Inc.; Samsung Electronics Co., Ltd.; Veradigm LLC (Allscripts Healthcare Solutions); Qualcomm Technologies, Inc.; AT&T; Orange; Teladoc Health, Inc.; AstraZeneca; Abbott; Sanofi; Johnson & Johnson Services, Inc.; Novartis AG; Pfizer Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global mHealth Apps Market Report Segmentation

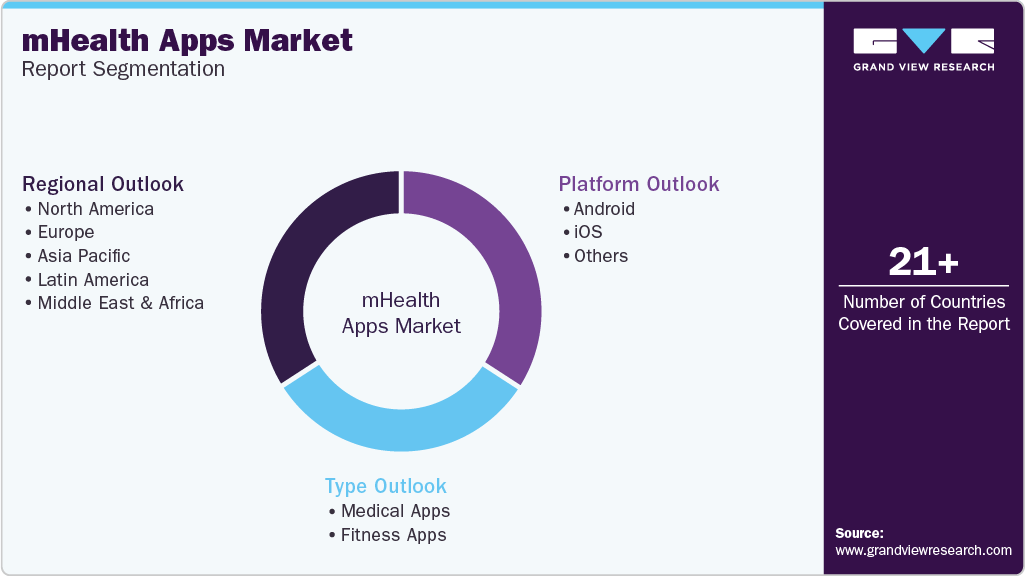

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global mHealth apps market report on the basis of type, platform, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Medical Apps

-

Women's Health

-

Fitness & Nutrition

-

Menstrual Health

-

Pregnancy Tracking & Postpartum Care

-

Disease Management

-

Menopause

-

Others

-

-

Chronic Disease Management Apps

-

Obesity Management Apps

-

Mental Health Management Apps

-

Diabetes Management Apps

-

Blood Pressure and ECG Monitoring Apps

-

Cancer Management Apps

-

Other Chronic Disease Management Apps

-

-

Personal Health Record Apps

-

Medication Management Apps

-

Diagnostic Apps

-

Remote Monitoring Apps

-

Others (Pill Reminder, Medical Reference, Professional Networking, Healthcare Education)

-

-

Fitness Apps

-

-

Platform Outlook (Revenue, USD Million, 2018 - 2030)

-

Android

-

iOS

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.