- Home

- »

- Healthcare IT

- »

-

Healthcare Reimbursement Market Size, Share Report, 2030GVR Report cover

![Healthcare Reimbursement Market Size, Share & Trends Report]()

Healthcare Reimbursement Market (2025 - 2030) Size, Share & Trends Analysis Report By Claim (Underpaid, Full Paid), By Payer, By Service Provider (Physician Office, Diagnostic Laboratories), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-675-2

- Number of Report Pages: 165

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Healthcare Reimbursement Market Summary

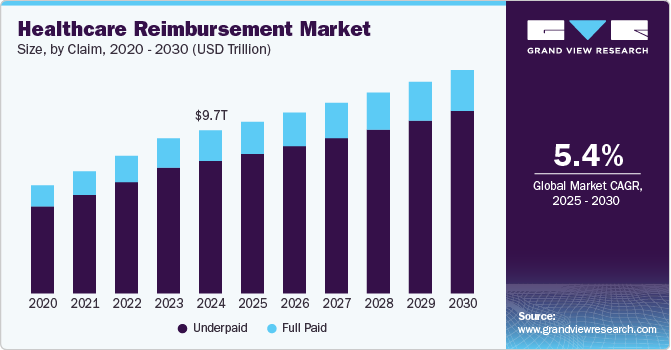

The global healthcare reimbursement market size was estimated at USD 9,720,529.3 million in 2024 and is projected to reach USD 13,315,000.0 million by 2030, growing at a CAGR of 5.4% from 2025 to 2030. The growth of this market is primarily influenced by factors such as rising costs of healthcare services, in-patient treatments, and medical equipment.

Key Market Trends & Insights

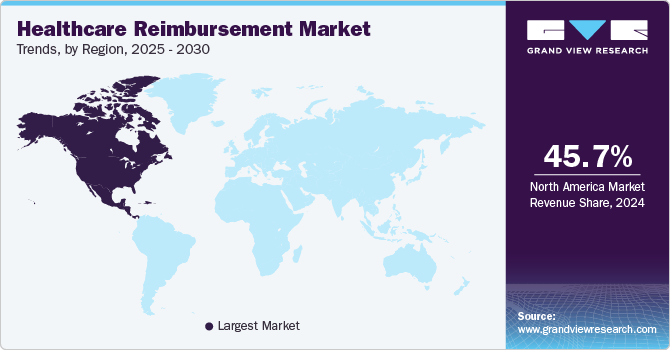

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, Saudi Arabia is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, underpaid accounted for a revenue of USD 8,070,066.7 million in 2024.

- Underpaid is the most lucrative claim segment, registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 9,720,529.3 Million

- 2030 Projected Market Size: USD 13,315,000.0 Million

- CAGR (2025-2030): 5.4%

- North America: Largest market in 2024

The growing demand for insurance-based healthcare reimbursement is driven by the rising adoption of technology tools and innovation in the design and development of reimbursement models. Integration of patient health data, medical records, and treatment patterns have also contributed to the growth of this market.

The rise in the prevalence of multiple chronic diseases, the increase in new incidents of trauma injuries and accidents of all sorts, and the growing need for enhanced healthcare infrastructure and services supported by technological advancements and improved resources are playing vital roles in driving the growth of the healthcare reimbursement market. According to the Centers for Medicare & Medicaid Services’ (CMS) Office of the Actuary National Health Expenditure Projections, healthcare spending share of GDP in the U.S. is expected to reach nearly one fifth of GDP by 2032.

The rapid rate of digital transformation in the healthcare reimbursement industry, the increasing shift from traditional paper-based documentation and processes to computerized, internet connectivity-based advanced systems, and the availability of multiple software solutions and services for streamlining numerous processes in the insurance industry are expected to influence this market during the forecast period.

The emergence and increasing penetration of cloud technology in multiple areas of the healthcare reimbursement and insurance industry, such as claim application processing, billing, and real-time monitoring and analysis, has been helping businesses address issues such as revenue leakage and process administration. The increasing digitization of the healthcare industry, the emergence of technologies such as telehealth, the growing acceptance of virtual care services, and remote patient monitoring are also impacting the reimbursement scenario.

Regulations regarding claims and reimbursement, changes in fee-for-service approach, and evolving compliance strategies to align with regulations in each country have also influenced the growth of this market. As the healthcare service industry increases its adoption of innovation and scientifically advanced care alternatives, costs of healthcare services increase at a rapid rate. This necessitates effective healthcare reimbursements for better patient outcomes.

Healthcare insurance and reimbursement benefits provided by private organizations to their employees, government healthcare assistance programs, and increasing concentration on value-based healthcare delivery are expected to significantly influence the healthcare reimbursement market during the forecast period.

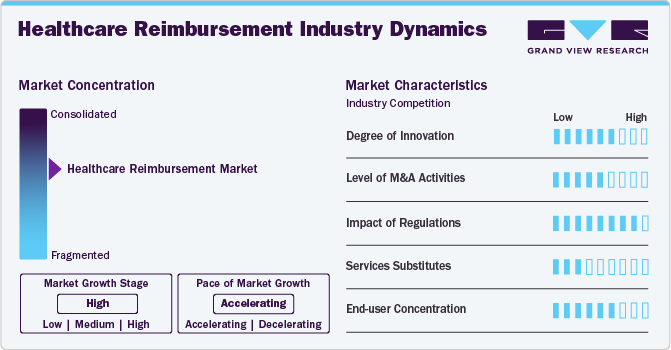

Market Concentration & Characteristics

The market growth stage is high, and the pace of growth is accelerating. The healthcare reimbursement market is characterized by a high degree of innovation. Key trends in innovation include automation of administrative tasks, enhancing efficiency and minimizing errors; digitalization through Electronic Health Records (EHRs) and online patient portals, improving accuracy and patient experience; value-based care models promoting better health outcomes; and AI applications for claims processing and fraud detection, ultimately fostering a more efficient, transparent, and patient-centered system.

The market is also characterized by moderate mergers and acquisitions to aid consolidation trends toward comprehensive revenue cycle management (RCM) solutions, technological advancements such as AI and data analytics, and private equity investment in high-growth companies. The shift to value-based care and the outsourcing of RCM functions are further driving this consolidation as providers seek improved efficiency and compliance with regulatory changes. For instance, in March 2025, Blue Cross and Blue Shield of Texas acquired Cigna Healthcare’s Medicare Advantage and related businesses, aiming to streamline services while maintaining member benefits and regularly communicating operational updates.

The regulatory landscape in healthcare reimbursement includes stringent data privacy laws such as HIPAA and GDPR, necessitating compliance when handling sensitive data. Accurate medical coding to standards such as ICD-10 and HCPCS is essential, while regulations aim to prevent fraud. Reimbursement models are shifting toward value-based care (VBC), influencing payer policies and driving demand for cost-effective, technologically integrated solutions.

Alternative reimbursement models such as value-based care and direct patient payments pose moderate substitution threats. Although traditional insurance remains dominant, slow adoption of new models due to regulatory complexities and provider resistance keeps traditional reimbursement structures relevant in the healthcare sector.

Healthcare providers, including hospitals and clinics, utilize reimbursement solutions for revenue cycle management, while payers such as insurance companies process claims and ensure compliance. Moreover, patients engage through portals for billing transparency. The outsourcing of RCM functions is increasingly concentrating end-user reliance on specialized RCM companies.

Claim Insights

The underpaid segment dominated the market with a revenue share of 81.2% in 2024. Underpaid claims often result from billing and filing errors, contract discrepancies, insurance processing or calculating errors, and more. Patients who fail to provide the necessary documentation and legitimate evidence regarding healthcare services availed under contracts are underpaid in reimbursements. This has led to serious conflicts in the healthcare industry. As a result, out-of-pocket (OOP) healthcare expenditures in the U.S. have increased significantly in the last few decades. According to the American Health Association, payments for inpatient and outpatient behavioral health services were 34% & 43%, respectively, on average, respectively, below cost across all payers.

The full paid segment is expected to experience significant CAGR during the forecast period, owing to increasing adoption of digitization and cloud technology, leading to reduced errors, availability of effective claim management systems, and a proactive approach of insurance companies to present supportive policy structures. Government support, strict regulations, and framework changes in line with digital claims are expected to assist this growth during the forecast period.

Payer Insights

The public payers dominated the global market for healthcare reimbursements in 2024. This is attributed to rooted trust regarding full payments by public payers in multiple countries, especially in nations with mid or low-income levels, history of full payments, government’s involvement in multiple public insurance businesses and more. Amendments of newly developed policies and acts to ensure growing full payments by insurers also influence the growth of this market. For instance, the Affordable Care Act permitted states in the U.S. to expand the coverage for Medicaid, to adults with income levels up to 138 % of the determined poverty levels.

The private payers segmentis expected to experience the fastest CAGR of 6.6% during the forecast period. Effective engagement strategies of private businesses, enhanced portfolios offering a range of alternatives in insurance, and the presence of skilled professionals working in the industry are influencing this segment. Growing competition in the private insurance market and technology innovation adopted by multiple companies for comprehensive coverage and quick claim settlements through digitized platforms are expected to fuel the growth of this segment during the forecast period.

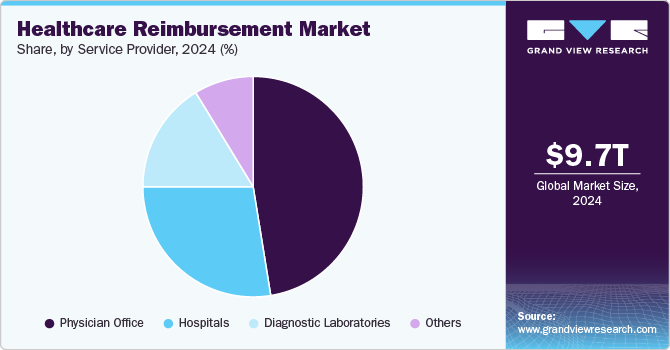

Service Provider Insights

The physician office segment held the largest revenue share of 47.4% in 2024. This is attributed to increased hospital admissions due to the growing prevalence of chronic diseases, enhanced hospital infrastructures in multiple countries with growing economies, a rising number of specialty hospitals, and more. Costs associated with hospitals equipped with advanced healthcare technologies, such as emergency care services, inpatient care, specialized surgeries, and others, necessitate reimbursements.

The physician office segment is expected to witness the fastest CAGR from 2025 to 2030. This segment is primarily influenced by an inclination towards outpatient care and ambulatory services and growing preferences for avoiding hospital admissions as long as possible. The higher costs associated with in-patient treatments and specialty hospital admissions encourage individuals and patients to avail of healthcare services from physician’s offices. In addition, the availability of personalized services and value-based care approaches are also attracting many patients for this segment. The availability of affordable diagnostic technologies and the inclination towards early diagnosis and treatments are expected to develop a growing demand for this market in the approaching years.

Regional Insights

North America dominated the global market of healthcare reimbursement and accounted for a revenue share of 45.7% in 2024. The region’s positive regulatory scenario regarding reimbursements and healthcare insurance primarily drives this market. The presence of multiple public payers also influences its growth. In addition, government support and encouragement for ensuring a rise in healthcare-insured individuals contribute to the development.

U.S. Healthcare Reimbursement Market Trends

The U.S. healthcare reimbursement market dominated the regional industry in 2024. This is attributed to multiple factors, such as rising healthcare costs, the high prevalence of chronic diseases such as cancer and cardiovascular diseases, and the increase in technological innovations adopted by the key companies in the market. According to the National Cancer Institute at the National Institutes of Health, 2,001,140 new cancer cases in the U.S. were estimated to be diagnosed in 2023.

Europe Healthcare Reimbursement Market Trends

Europe was identified as a lucrative region in 2024. This market is mainly influenced by factors such as the large geriatric population, rising prevalence of chronic diseases such as diabetes and respiratory diseases, effective penetration of public healthcare assistance and funding, and more.

Healthcare reimbursement market in Germany held a significant revenue share in 2024. The country's robust healthcare system, regulations such as mandating health insurance for all residents, and rising healthcare innovations are expected to assist the growth of this market in the approaching years.

Latin America Healthcare Reimbursement Market Trends

Latin America healthcare reimbursement market is expected to experience the fastest CAGR of 19.7% over the forecast period. This is attributed to the rise in healthcare expenditures and increased costs associated with healthcare services, advancements and adoption of technologies such as Health Technology Assessment (HTA), and growing focus on ensuring enhanced availability of healthcare insurance by public and private sector companies in the region.

Key Healthcare Reimbursement Company Insights

Some of the key companies in the healthcare reimbursement market include United HealthCare Services, Inc., Allianz Care, CVS Health, Reliance Nippon Life Insurance Company Limited, and others. To address the growing competition, major companies in the market are adopting strategies such as streamlining reimbursement processes through technology adoption, increasing focus on collaborations with hospitals and organizations, and more.

-

CVS Health, one of the prominent healthcare services organizations, provides multiple offerings, including commercial health coverage, condition management, health and wellness products, mental health services, and others. It also offers prescription drug coverage and pharmacy services.

-

United HealthCare Services, Inc., a major health insurance and services organization in the U.S., offers a range of services, including Medicare, individual & family plans for short terms, self-employed plans, student plans, all supplement plans, dental plans, vision plans, and others.

Key Healthcare Reimbursement Companies:

The following are the leading companies in the healthcare reimbursement market. These companies collectively hold the largest market share and dictate industry trends.

- United HealthCare Services, Inc.

- Allianz Care

- CVS Health

- Reliance Nippon Life Insurance Company Limited

- Cigna Healthcare

- Aviva

- BNPP Paribas Cardif

- Wellcare Health Plans, Inc.

- Agile Health

- Blue Cross Blue Shield Association

Recent Developments

-

In March 2025, Cigna Healthcare’s Global Health Benefits announced a new solution supported by Carrot Fertility. This initiative intended to introduce a comprehensive program supporting fertility, family-building, and hormonal health for globally mobile customers and their partners.

-

In November 2024, KindlyMD partnered with UnitedHealth care Insurance, the largest health insurer in the U.S., to expand the former’s coverage and access to Utah-based hospitals, enhancing patient service.

-

In September 2024, Cigna Healthcare introduced E-Treatment option through MDLIVE (Evernorth). This has made MDLIVE virtual care available for individuals who have Cigna Healthcare insurance derived from the Affordable Care Act.

Healthcare Reimbursement Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 10,238.7 billion

Revenue forecast in 2030

USD 13,315.0 billion

Growth rate

CAGR of 5.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Claim, payer, service provider, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

United HealthCare Services, Inc.; Allianz Care; CVS Health; Reliance Nippon Life Insurance Company Limited; Cigna Healthcare; Aviva; BNPP Paribas Cardif; Wellcare Health Plans, Inc.; Agile Health; Violet Cross Blue Cover Association

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Healthcare Reimbursement Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global healthcare reimbursement market report based on claim, payer, service provider, and region

-

Claim Outlook (Revenue, USD Billion, 2018 - 2030)

-

Underpaid

-

Full Paid

-

-

Payer Outlook (Revenue, USD Billion, 2018 - 2030)

-

Private Payers

-

Public Payers

-

-

Service Provider Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospitals

-

Physician Office

-

Diagnostic Laboratories

-

Other Service Providers

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global healthcare reimbursement market size was estimated at USD 9,720.5 billion in 2024 and is expected to reach USD 10,238.7 billion in 2025.

b. The global healthcare reimbursement market is expected to grow at a compound annual growth rate of 5.4% from 2025 to 2030 to reach USD 13,315.0 billion by 2030.

b. The underpaid segment dominated the market with a revenue share of 81.2% in 2024. Underpaid claims often result from billing and filing errors, contract discrepancies, insurance processing or calculating errors, and more.

b. Some key players operating in the healthcare reimbursement market include United HealthCare Services, Inc.; Allianz Care; CVS Health; Reliance Nippon Life Insurance Company Limited; Cigna Healthcare; Aviva; BNPP Paribas Cardif; Wellcare Health Plans, Inc.; Agile Health; Violet Cross Blue Cover Association

b. Key factors that are driving the market growth include increasing cost of healthcare, and supportive government programs.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.