- Home

- »

- Electronic & Electrical

- »

-

Healthcare Smart Beds Market Size Report, 2021-2028GVR Report cover

![Healthcare Smart Beds Market Size, Share & Trends Report]()

Healthcare Smart Beds Market (2021 - 2028) Size, Share & Trends Analysis Report By Application (Hospitals, Outpatient Clinics, Medical Nursing Homes, Medical Laboratory & Research), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-421-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2016 - 2019

- Forecast Period: 2021 - 2028

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

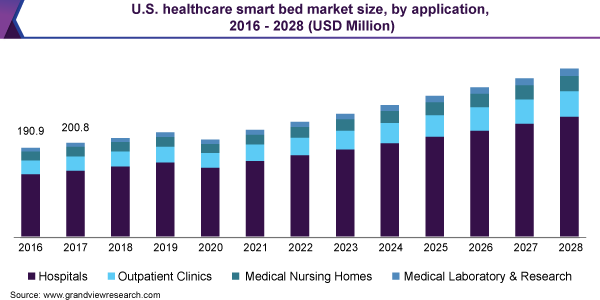

The global healthcare smart beds market size was valued at USD 411.2 million in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 7.6% from 2021 to 2028. Smart beds are connected to electronic medical records (EMR) or electronic health records (EHR), which offer a wide range of medical data, including personal statistics like weight, body temperature, heartbeat, blood, oxygen, and other vital signs, medication, laboratory test results, allergies, and immunization status. Equipped with relevant data pertaining to a patient’s medical history, doctors can decide the future course of action, and nursing staff can help improve patient care. With the increasing prevalence of chronic diseases and the rising number of life-saving surgeries, the frequency, as well as duration of hospital stays, have been increasing. Moreover, the outbreak of COVID-19 has generated a significant demand for smart beds in hospitals across the globe.

According to statistics provided by the ArcGIS, a system software maintained by the Environmental Systems Research Institute, the total number of staffed beds in the U.S. till September 2020 was 816,554, and with the increasing requirement of hospital beds across the country due to COIVD-19 and other life-saving surgeries, an estimated 158,848 increase in bedding capacity is expected in hospitals across the U.S. in the near future. Such scenarios are anticipated to boost the uptake of smart beds over the forecast period.

According to the Ambulatory Surgery Center Association (ASCA), on average, Medicare saves more than USD 4.2 billion every year when surgical procedures are performed at ASCs instead of hospital outpatient departments (HOPDs) in the U.S. This significant cost reduction in diagnosis, surgical procedures, and preventive treatment is expected to promote ASCs and subsequently increase demand for smart beds over the forecast period.

Governments across the globe have been increasingly spending on the development and deployment of ambulatory facilities. This has resulted in increased accessibility and reduced treatment costs, which in due course is expected to propel the growth of the market. For instance, the U.S. government began a program named Medicare's Hospital Readmissions Reduction Program (HRRP) under the Affordable Care Act. This initiative is directed to provide patients with primary care at all accessible point-of-care centers and reduce avoidable costs such as that hospital stays and other related expenses. These supportive government initiatives are anticipated to promote the demand for smart healthcare beds across ASCs over the forecast period.

Application Insights

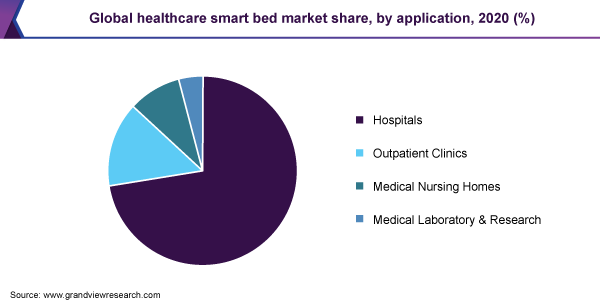

The hospitals segment dominated the market with a revenue share of over 70.0% in 2020. This is attributed to the rising incidences of in-patient admissions due to chronic ailments, such as cancer, kidney failure, and heart diseases. This application segment is projected to witness the highest growth over the forecast period. According to the U.S. Centers for Disease Control and Prevention (CDC), in-patient bed occupancy due to COVID-19 increased from 416,064 in April 2020 to 543,132 in July 2020. According to the Global Cancer Observatory, an estimated 19.3 million new cancer cases have been diagnosed, globally, during 2020, signifying an increasing rate of incidences across the globe. These prevalent patterns are expected to further drive the demand for smart hospital beds as they are capable of increasing nurse workflow efficiencies and help reduce the overall in-patient times.

The outpatient clinics segment is projected to expand at a revenue-based CAGR of 7.3% from 2021 to 2028. Improving healthcare standards in Asian, African, and South American countries has been crucial in the growth of primary healthcare facilities and their consequent prevalence across rural areas in these regions. Outpatient clinics form the primary care centers for diagnosis and preliminary point of care for consumers across the globe. Furthermore, the prevalence of acute diseases such as flu, fevers, and bronchitis has been a crucial factor in driving the global population to contact outpatient clinics. According to the World Health Organization (WHO) statistics, outpatient contacts per person ranged between 1.9 - 13.1 in 2011 across Europe, thereon peaking at 2.6 - 13.5 in 2018.

Regional Insights

North America dominated the market by accounting for over 55.0% share in terms of revenue in 2020. This is attributed to the fact that healthcare smart beds are used in acute care or long-term care facilities. Smart beds are known to help medical teams since they help to continuously monitor the patients’ health in a non-invasive way. Health care smart beds can increase patients’ safety by automatically transferring all data in real-time over the wireless network, allowing medical teams to instantly review and monitor patients’ vitals. Besides, these beds can send alerts to the medical team if there are any sudden changes in a patient’s health or movement, allowing medical personnel to intervene before the patient’s health deteriorates. The Harvard Medical School in one of its recent studies highlighted that the use of respiratory rate sensing technology and heart-rate sensing technology, when incorporated in smart beds such as bedside monitor and EarlySense’s under-the-mattress, can help in reducing the rate of code blue events by 86%. Factors such as these are foreseen to drive the demand for health care smart beds during the forecast years.

Europe is projected to expand at the fastest revenue-based CAGR of 7.8% from 2021 to 2028. According to an article published by Hospital Healthcare Europe in January 2020, hospitals have been required to act more efficiently and to increase productivity for a number of years now. The European healthcare system has been experiencing contradictory trends such as short and long-term impacts of financial and economic restrictions. Along with this, an increasing demand for better healthcare among the aging population, which turn out to be more chronic patients has also been observed. Furthermore, the growing need for and availability of technological innovations are also a major trend in the market. To overcome such conflicting scenarios, several hospitals in the region are moving away from traditional hospital-centric models to more innovative and flexible models. They are investing in smart technologies to accurately treat patients and expedite medical treatment and recovery. This ongoing trend is expected to bode well for the growth of the market in the coming years.

Key Companies & Market Share Insights

The market for healthcare smart beds is characterized by the presence of several well-established players. These players account for a considerable market share and have a strong presence across the globe. The market also comprises small-to-midsized players that offer a selected range of smart bed products and mostly serve regional customers. The impact of established players on the market is quite high as a majority of them have vast distribution networks across the globe to reach out to their large customer bases. Some prominent players in the global healthcare smart beds market include:

-

Stryker Corporation

-

Hill-Rom Holdings, Inc.

-

Invacare Corporation

-

Paramount Bed Holdings Co., Ltd.

-

LINET

-

Joerns Healthcare LLC

-

Stiegelmeyer GmbH & Co. KG

-

Arjo

-

Völker GmbH

-

Favero Health Projects SpA

Healthcare Smart Beds Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 452.7 million

Revenue forecast in 2028

USD 740.6 million

Growth Rate

CAGR of 7.6% from 2021 to 2028 (Revenue-based)

Market demand in 2021

27.26 thousand units

Volume forecast in 2028

42.44 thousand units

Growth Rate

CAGR of 6.9% from 2021 to 2028 (Volume-based)

Base year for estimation

2020

Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million, volume in thousand units, and CAGR from 2021 to 2028

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe

Country scope

U.S.; Germany; U.K.; France; Italy; Spain

Key companies profiled

Stryker Corporation; Hill-Rom Holdings, Inc.; Invacare Corporation; Paramount Bed Holdings Co., Ltd.; LINET; Joerns Healthcare LLC; Stiegelmeyer GmbH & Co. KG; Arjo; Völker GmbH; Favero Health Projects SpA

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research has segmented the global healthcare smart beds market report on the basis of application and region:

-

Application Outlook (Volume, Thousand Units; Revenue, USD Million, 2016 - 2028)

-

Hospitals

-

Outpatient Clinics

-

Medical Nursing Homes

-

Medical Laboratory and Research

-

-

Regional Outlook (Volume, Thousand Units; Revenue, USD Million, 2016 - 2028)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Frequently Asked Questions About This Report

b. The global healthcare smart beds market size was estimated at USD 411.2 million in 2020 and is expected to reach USD 452.7 million in 2021.

b. The global healthcare smart beds market is expected to grow at a compound annual growth rate of 7.6% from 2021 to 2028 to reach USD 740.6 million by 2028.

b. North America region dominated the global healthcare smart beds market with a share of over 55% in 2020. This is attributable to the healthcare smart beds being increasingly used in acute care or long-term care facilities.

b. Some key players operating in the global healthcare smart beds market include Stryker Corporation; Hill-Rom Holdings, Inc; Invacare Corporation, and Paramount Bed Holdings Co., Ltd.

b. The key factor that is driving the healthcare smart beds market growth include increasing prevalence of chronic diseases, the rising number of life-saving surgeries, and intensifying frequency as well as the duration of hospital stays.

b. The hospital segment dominated the healthcare smart beds market with a revenue share of over 70.0% in 2020. This is attributed to the rising incidences of in-patient admissions due to chronic ailments such as cancer, kidney failure, and heart diseases.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.