- Home

- »

- Homecare & Decor

- »

-

Smart Bed Market Size, Share, Trends, Industry Report 2033GVR Report cover

![Smart Bed Market Size, Share & Trends Report]()

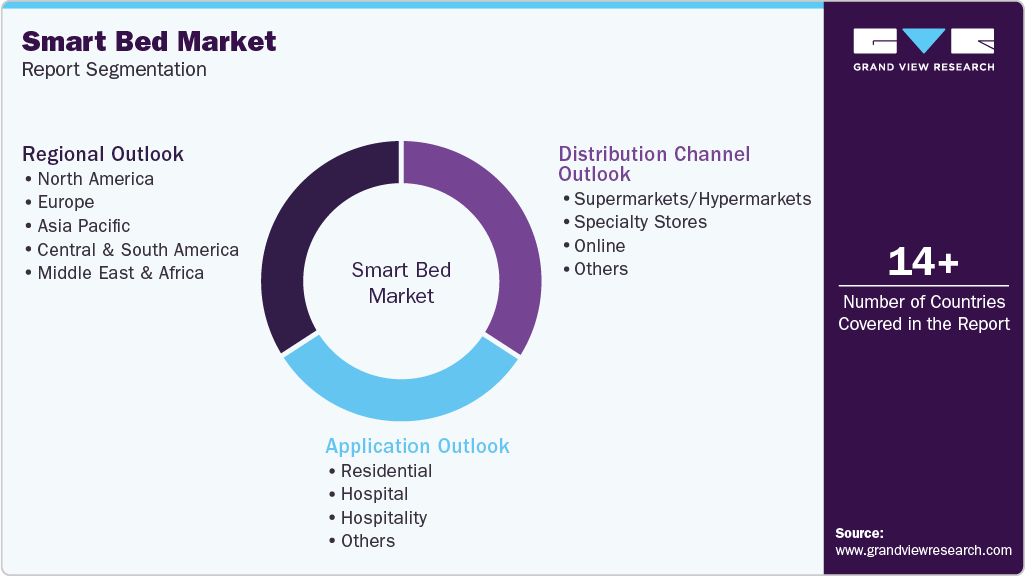

Smart Bed Market (2026 - 2033) Size, Share & Trends Analysis Report By Application (Residential, Hospital, Hospitality), By Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-825-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Bed Market Summary

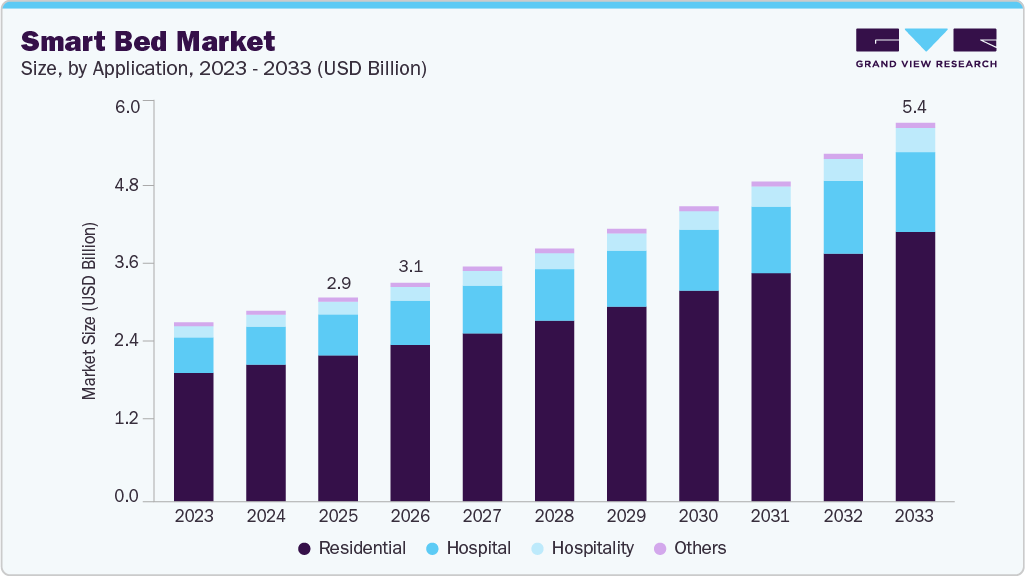

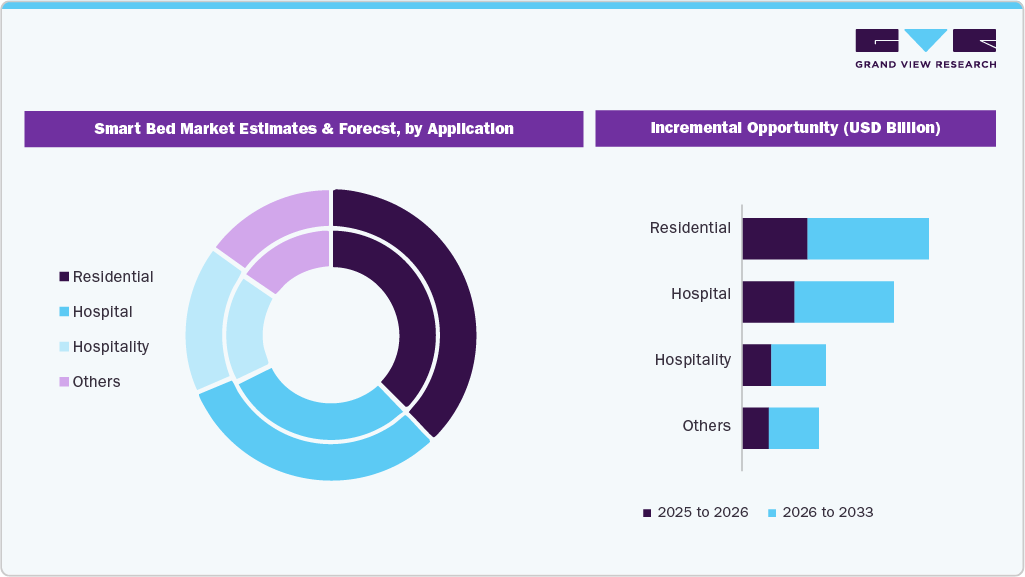

The global smart bed market size was estimated at USD 2.91 billion in 2025 and is projected to reach USD 5.41 billion by 2033, growing at a CAGR of 6.3% from 2026 to 2033. The demand for smart beds is increasing primarily due to a growing consumer focus on health, wellness, and the quality of sleep.

Key Market Trends & Insights

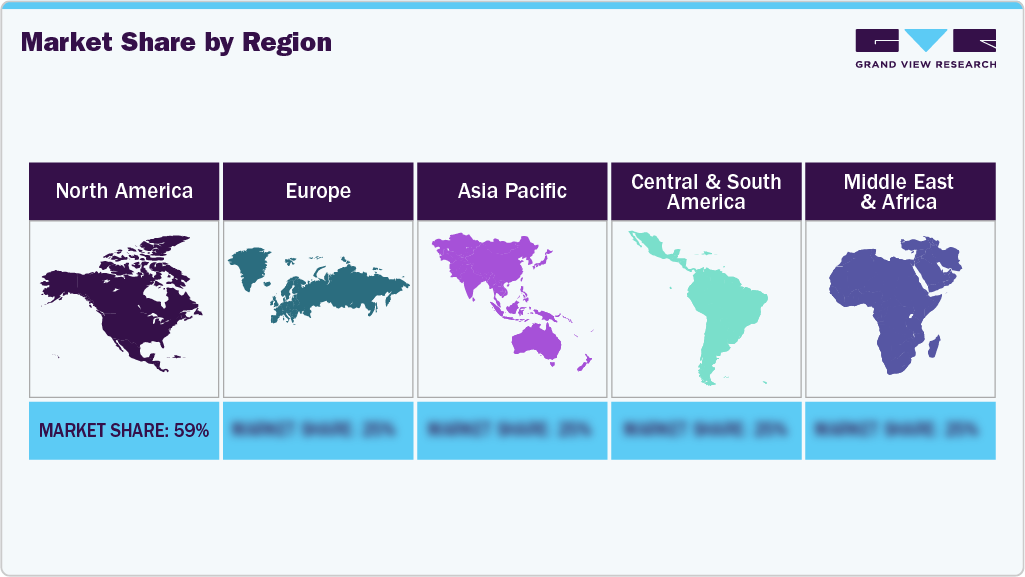

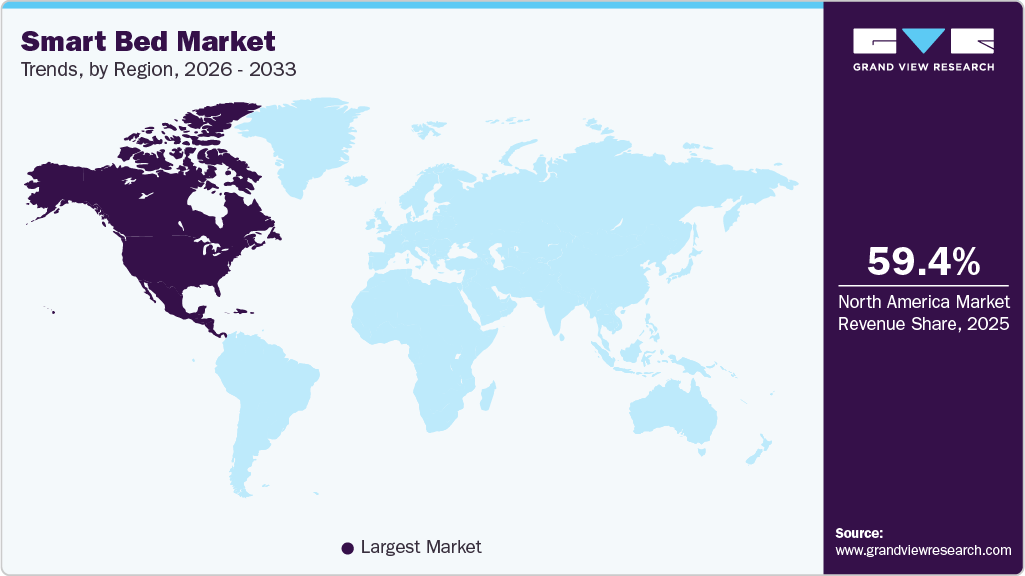

- North America dominated the global smart bed market with the largest revenue share of 59.4% in 2025.

- By application, the residential segment led the market with the largest revenue share of 71.7% in 2025.

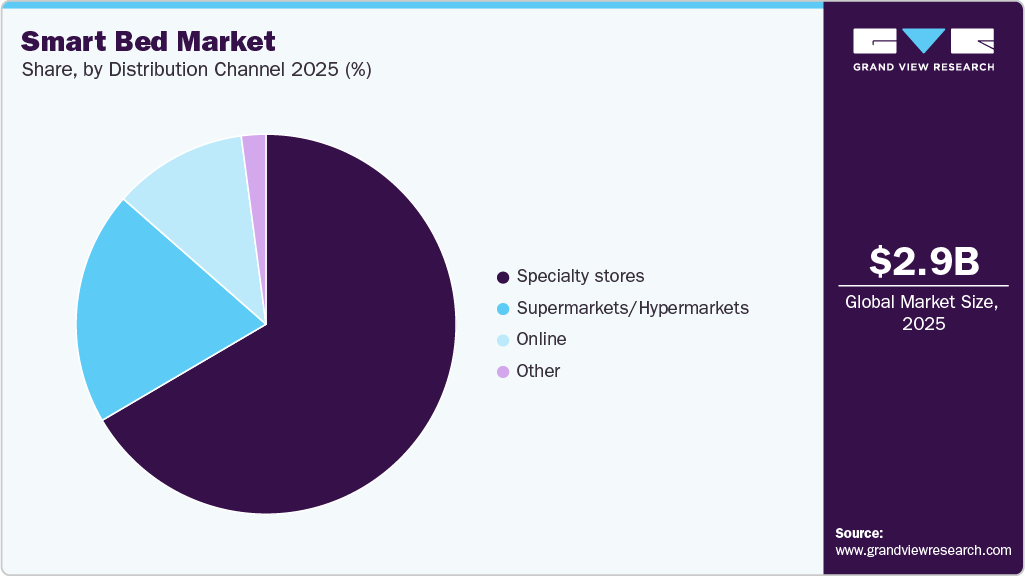

- By distribution channel, the specialty stores segment led the market with the largest revenue share of 66.7% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 2.91 Billion

- 2033 Projected Market Size: USD 5.41 Billion

- CAGR (2026-2033): 6.3%

- North America: Largest market in 2025

As awareness about the importance of adequate, restorative sleep rises, more consumers are willing to invest in technologies that help them monitor and improve their sleep patterns. Smart beds equipped with sensors for tracking heart rate, breathing patterns, movement, and sleep cycles appeal to a population that is increasingly health-conscious and data-driven. These beds offer measurable insights and personalized sleep adjustments, making them more attractive than traditional bedding solutions.As consumers adopt connected devices such as smart lighting, thermostats, and voice-controlled assistants, the smart bed becomes a natural extension of the connected lifestyle. The ability to integrate a bed with sleep apps, home automation systems, or environmental controls adds convenience and a sense of modernity. Technological advancements have also made features like adjustable firmness, automatic anti-snore adjustments, climate control, and personalized positioning more accessible, enhancing comfort and functionality.

Demographic and lifestyle changes also play a role. Urbanization, higher stress levels, increased screen time, and shifts in daily routines have contributed to more people experiencing sleep disturbances, motivating them to seek advanced solutions. Ageing populations in many regions prefer beds with health-monitoring capabilities and adjustable bases for pain reduction and mobility support. Furthermore, rising disposable incomes and the premiumization trend in home furnishings encourage consumers to upgrade to high-end, feature-rich bedding.

The increasing availability of smart beds through online and direct-to-consumer channels is also supporting market growth. E-commerce platforms provide better price transparency, detailed product information, and reviews that reduce purchase hesitation. As logistics and fulfilment models improve, consumers find it easier to purchase large, complex products like smart beds online.

Buyer Insights

Consumers are increasingly prioritizing high-quality sleep as part of their broader wellness and lifestyle goals, and this shift is directly influencing the demand for smart beds. Modern buyers are looking for personalized solutions that adapt to their individual comfort needs, and smart beds fulfil this expectation through features such as adjustable firmness, pressure-zoned support, and posture-responsive mechanisms. This level of personalization aligns with the growing consumer preference for products that enhance daily well-being rather than offering a one-size-fits-all experience.

Another major trend shaping consumer interest is the integration of embedded health and sleep monitoring technologies. Smart beds equipped with sensors that track heart rate, breathing rhythms, restlessness, and sleep stages appeal to consumers who want data-driven insights into their sleep performance. As wearables become mainstream, consumers are becoming more comfortable with continuous health monitoring, and smart beds offer a seamless, hands-free alternative that requires no wearable device. This passive data collection approach is valued especially by wellness-focused and tech-savvy consumers.

The growing emphasis on pain relief, recovery, and ergonomic support is another key driver of adoption. Consumers suffering from back pain, circulation issues, or general muscular discomfort are showing strong interest in smart beds that offer targeted support, micro-adjustments, and pressure-relief technologies. This is especially appealing to older adults, wellness-oriented individuals, and those seeking to enhance their daily functioning through improved sleep. The perception of smart beds as health-enhancing products rather than traditional furniture has significantly improved willingness to pay in the mid- to premium price segments.

Application Insights

The residential segment led the market with the largest revenue share of 71.7% in 2025. Modern households are adopting smart beds for their ability to automatically adjust firmness, track sleep quality, regulate temperature, and integrate with home automation systems. As people spend more time at home and place greater emphasis on wellness and restorative sleep, smart beds offer a personalized and technology-enabled solution that enhances sleep quality and overall lifestyle comfort. This growing focus on convenience, health insights, and premium home upgrades is fueling strong adoption across the residential segment.

The hospital segment is projected to register at the fastest CAGR of 6.8% from 2026 to 2033. The demand for smart beds in hospitals is rising as healthcare providers increasingly prioritize patient safety, operational efficiency, and real-time clinical monitoring. Smart beds enable the continuous tracking of vital parameters, such as heart rate, movement, and weight, allowing for the early detection of patient deterioration and reducing the risk of falls or pressure injuries. They also support automated bed adjustments, integrated nurse-call systems, and remote monitoring, which significantly reduce staff workload and improve workflow efficiency, an important advantage amid ongoing staffing shortages.

Distribution Channel Insights

The specialty stores segment led the market with the largest revenue share of 66.7% in 2025.The demand for smart beds sold through specialty stores is rising as consumers increasingly seek personalized comfort, advanced sleep-tracking features, and expert in-store guidance. Specialty retailers provide a curated environment where shoppers can physically test smart beds, compare features such as pressure sensors, adjustable settings, temperature control, and sleep analytics, and receive professional consultation, something online channels cannot fully replicate. As smart beds involve higher price points and complex technology, consumers prefer specialty stores for demonstrations and reassurance, driving stronger adoption through this channel.

The online segment is anticipated to grow at the fastest CAGR of 6.7% over the forecast period. Due to the presence of well-known manufacturers of smart home electronics on online platforms, the online market is expected to experience substantial growth. The rapid accessibility of goods across various platforms, the abundance of discounts with cashback offers, and the ease of returns will all contribute to the growth of the online segment.

Regional Insights

North America dominated the global smart bed market with the largest revenue share of 59.4% in 2025. The growing awareness of sleep quality as a key component of overall wellness, driven by stress, sedentary lifestyles, and chronic sleep disorders, has accelerated its adoption. Smart beds offering features such as adjustable firmness, automatic posture correction, temperature regulation, and integrated sleep tracking appeal to consumers seeking both convenience and improved health outcomes. In addition, the expansion of IoT-enabled home environments and rising interest in connected, tech-enhanced living support stronger uptake across households and premium hospitality settings.

Europe Smart Bed Market Trends

Thesmart bed market in Europe held the second-largest revenue share in 2025. As the region’s population ages and chronic conditions such as sleep disorders, hypertension, and mobility limitations become more common, households increasingly prefer beds equipped with sensors, automated adjustments, and real-time health monitoring. European consumers are also highly receptive to wellness technologies, driving adoption of features such as sleep-quality tracking, anti-snore functions, pressure-relief adjustments, and app-based controls.

Asia Pacific Smart Bed Furniture Market Trends

The smart bed market in the Asia Pacific is expected to witness at the fastest CAGR of 7.1% from 2026 to 2033. Consumers are seeking advanced sleep solutions that offer personalized comfort, posture adjustment, and real-time health monitoring, features that align well with the region’s expanding middle-class lifestyle expectations. In addition, the prevalence of sleep disorders, urban stress, and aging populations in countries such as Japan, China, South Korea, and Australia is driving interest in smart, connected bedding that supports better rest and proactive health management.

Central & South America Smart Bed Furniture Market Trends

The smart bed market in Central & South America is expected to witness a significant CAGR of 5.4% from 2026 to 2033. As more consumers experience urban lifestyles with higher stress levels, sleep quality has become a key wellness priority, driving interest in beds equipped with sensors, automatic adjustments, and sleep-tracking features. In addition, the expansion of private healthcare facilities and home-care services in the region is accelerating the adoption of smart beds in clinical and home settings, supported by improving digital infrastructure and rising disposable incomes.

Middle East & Africa Smart Bed Furniture Market Trends

The smart bed market in the Middle East & Africa is expected to witness growth from 2026 to 2033. The demand for smart beds is rising across the Middle East & Africa due to growing investments in premium healthcare infrastructure, increasing adoption of hospital automation, and a strong shift toward patient-centered care. Hospitals and long-term care facilities are prioritizing advanced beds equipped with features such as automatic positioning, patient monitoring sensors, fall-prevention alerts, and integrated nurse-call systems to improve clinical efficiency and reduce staff workload. In addition, the region’s expanding private healthcare sector, higher spending on medical technology, and a growing elderly population with mobility and chronic-disease needs are accelerating the uptake of smart, connected hospital beds.

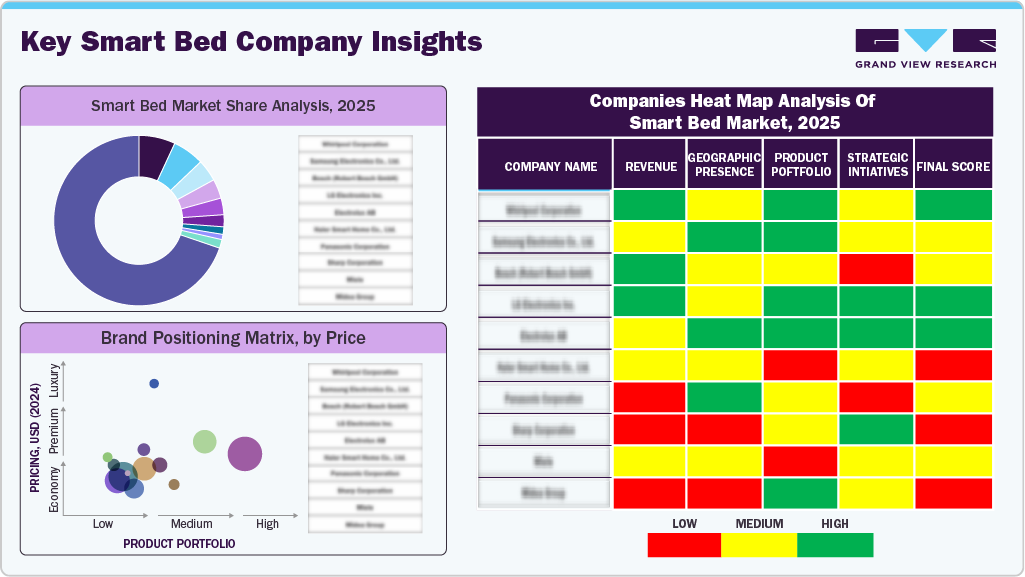

Key Smart Bed Company Insights

The market is characterized by the presence of a few established players and new entrants. Many big players are increasing their focus on the growing trend of smart beds. Players in the smart bed industry are diversifying their service offerings in order to maintain market share.

Key Smart Bed Companies:

The following are the leading companies in the smart bed market. These companies collectively hold the largest market share and dictate industry trends.

- PARAMOUNT BED CO., LTD.

- ReST

- Sleep Number Corporation

- Ascion, LLC.

- Hi-Interiors srl.

- Ultimate Smart Bed

- The BodiTrak

- Hill Rom Holdings Inc.

- Invacare Corporation

- Stryker Corporation.

Recent Developments

-

In June 2025, Paramount Bed Co., Ltd. announced the launch of the ParaDrive, a new motorized patient transport system for its ALiUS electric ICU beds. This innovation makes ICU bed moving easier and safer by enabling not only forward and reverse but also lateral movement, a first in medical beds. The system utilizes mecanum wheels for smooth, multi-directional movement and provides electric assistance at the push of a button, helping healthcare providers transport patients with reduced physical strain.

-

In January 2024, Joerns Healthcare launched new 2024 models of their EasyCare and UltraCare long-term care beds, featuring enhancements for personalized care, improved caregiver usability, and new accessories. Key updates include personalized AutoTransfer height settings, clinical comfort pauses for improved respiration and wound care, faster repositioning, an energy-saving sleep mode, and smart network connectivity for enhanced operational efficiency.

Smart Bed Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 3.12 billion

Revenue forecast in 2033

USD 5.41 billion

Growth rate

CAGR of 6.3% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; UAE

Key companies profiled

PARAMOUNT BED CO., LTD.; ReST; Sleep Number Corporation; Ascion, LLC.; Hi-Interiors srl.; Ultimate Smart Bed; The BodiTrak; Hill Rom Holdings Inc.; Invacare Corporation; Stryker Corporation.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart Bed Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global smart bed market report based on the application, distribution channel, and region.

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Residential

-

Hospital

-

Hospitality

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Supermarkets/Hypermarkets

-

Specialty Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global smart bed market was estimated at USD 2.91 billion in 2025 and is expected to reach USD 3.12 billion in 2026.

b. Some of the key players operating in the smart bed market include PARAMOUNT BED CO., LTD., ReST, Sleep Number Corporation, Ascion, LLC., Hi-Interiors srl., Ultimate Smart Bed, The BodiTrak, Hill Rom Holdings Inc., Invacare Corporation, and Stryker Corporation.

b. Key factors that are driving the smart bed market growth are due to growing expenditures in sleep technology as a result of the greater adoption of well-being are what is driving the need for smart beds and also the sector is also being propelled by the rising popularity of smart homes.

b. The global smart bed market is expected to grow at a compound annual growth rate of 6.3% from 2026 to 2033 to reach USD 5.41 billion by 2033.

b. Smart beds for residential segment dominated the market with a share of 71.7% in 2025. Modern households are adopting smart beds for their ability to automatically adjust firmness, track sleep quality, regulate temperature, and integrate with home automation systems.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.