- Home

- »

- Medical Devices

- »

-

Healthcare Supply Chain BPO Market, Industry Report, 2030GVR Report cover

![Healthcare Supply Chain BPO Market Size, Share & Trends Report]()

Healthcare Supply Chain BPO Market (2025 - 2030) Size, Share & Trends Analysis Report By Payer Service (Order Management),By End-use (Biotechnology & Pharmaceutical Companies, Medical Device Companies),By Region, And Segment Forecasts

- Report ID: GVR-4-68038-829-9

- Number of Report Pages: 95

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Healthcare Supply Chain BPO Market Trends

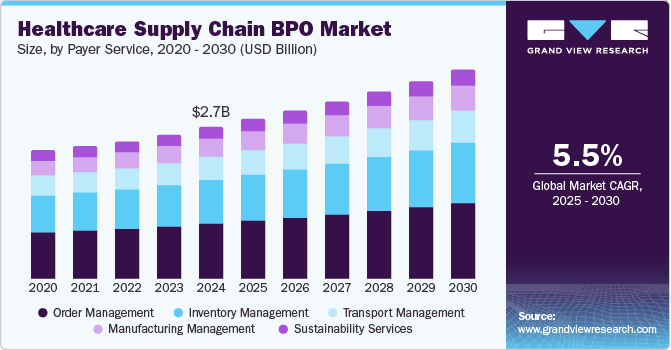

The global healthcare supply chain BPO market size was valued at USD 2.68 billion in 2024 and is anticipated to grow at a CAGR of 5.5% from 2025 to 2030. This growth can be attributed to the rising need for cost-effective operations and the increasing demand for advanced Supply Chain Management (SCM) practices. Healthcare organizations are seeking ways to optimize their supply chains, reduce costs, and enhance operational efficiency. Outsourcing supply chain functions allows these organizations to leverage specialized expertise, advanced technology, and scalable solutions, enabling them to better manage inventory, procurement, and distribution processes.

The evolving healthcare industry is propelling the demand for streamlined, cost-efficient, and data-driven SCM solutions, which in turn is expanding the market.

Moreover, the need to minimize the overall cost of healthcare supply chain BPO services is likely to boost market growth during the forecast period. Furthermore, due to inventory management, the demand for healthcare supply chain business process outsourcing is increasing. Hence, the market is expected to grow during the forecast period. Other factors responsible for the growth of the healthcare supply chain BPO market are a decrease in healthcare delivery costs, implementation of ICD-10 codes, and patent cliffs faced by pharmaceutical companies.

The increase in prevalence of chronic diseases is driving greater demand for medical supplies, pharmaceuticals, and healthcare services, which in turn amplifies the complexity of supply chain management. Healthcare organizations need efficient, scalable solutions to meet this demand, fueling the growth of the healthcare supply chain BPO industry. In addition, the rise in healthcare investments, particularly in emerging markets, is expanding healthcare infrastructure and services. This growth necessitates streamlined supply chain operations, further boosting the adoption of BPO services to manage logistics, inventory, procurement, and distribution effectively.

Payer Service Insights

The order management segment dominated the market with the largest revenue share of 36.1% in 2024, propelled by its critical role in optimizing inventory, improving order accuracy, and ensuring timely deliveries. The surging demand for efficient and cost-effective solutions is leading healthcare organizations to outsource order management functions, helping streamline operations. Outsourcing these processes helps reduce errors, improve patient care, and ensure compliance with regulatory standards. Moreover, advancements in technology, such as automation and Artificial Intelligence (AI), have further enhanced the effectiveness of order management, driving its market dominance in the healthcare sector.

The manufacturing management segment is anticipated to be the fastest-growing segment, with a CAGR of 6.1% from 2025 to 2030, driven by the increasing demand for streamlined production and distribution processes. Healthcare companies face growing pressure to ensure timely delivery, maintain quality standards, and control costs. Outsourcing manufacturing management tasks such as procurement, production planning, and inventory management enables organizations to focus on core activities while improving efficiency. The rise in complex regulatory requirements and the need for scalability further contribute to the demand for specialized BPO solutions in this segment.

End-use Insights

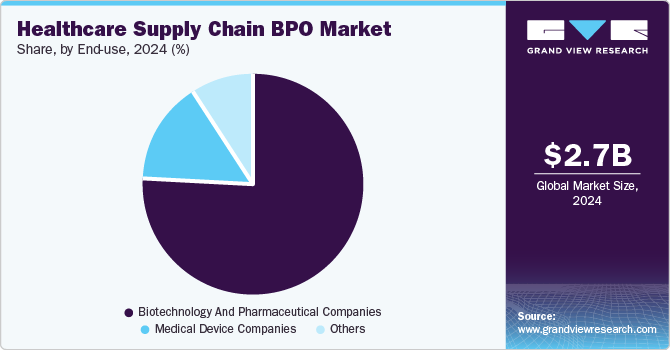

Biotechnology and pharmaceutical companies segment held the largest market share in 2024, attributed to their complex supply chains, regulatory requirements, and the need for efficient distribution of sensitive products. These companies rely heavily on outsourcing to manage logistics, inventory, procurement, and compliance. BPO services enable them to streamline operations, reduce costs, ensure regulatory adherence, and maintain timely delivery of critical medications. Moreover, the growing demand for biotech innovations and pharmaceutical products further drives the need for specialized supply chain solutions, reinforcing the prominence of this segment in the healthcare supply chain BPO industry.

The medical device companies segment is projected to grow at significant rate from 2025 to 2030, fueled by the growing complexity of global regulations, product innovation, and supply chain management. Outsourcing supply chain functions allows medical device companies to focus on core activities such as research and development while improving efficiency in procurement, distribution, and inventory management. The increasing demand for medical devices, coupled with the need for regulatory compliance and cost optimization, propels the adoption of BPO services, driving the segment.

Regional Insights

North America healthcare supply chain BPO market dominated the global market with the largest revenue share of 38.0% in 2024. This share is attributable to the focus on cost reduction and the shift toward digitalization. Healthcare organizations increasingly seek efficient, cost-effective solutions to streamline supply chain operations, prompting a rise in outsourcing. Digital technologies, such as automation, AI, and data analytics, enable real-time tracking, predictive analysis, and improved decision-making, which further enhance operational efficiency. These advancements reduce costs and improve accuracy and service delivery, contributing to the expanding demand for BPO services in the North American healthcare sector.

U.S. Healthcare Supply Chain BPO Market Trends

TheU.S. healthcare supply chain BPO market accounted for the largest share in 2024. The growing emphasis on data analytics and the shift toward end-to-end solutions are projected to fuel the healthcare supply chain BPO industry across the U.S. Healthcare organizations are increasingly leveraging advanced analytics to optimize inventory management, reduce costs, and improve decision-making. Furthermore, there is a strong move toward integrated, end-to-end supply chain solutions offering seamless procurement, logistics, and compliance management. These advancements allow for greater efficiency, real-time visibility, and better resource allocation, making BPO services essential for healthcare providers aiming to enhance their supply chain operations.

Europe Healthcare Supply Chain BPO Market Trends

Europe healthcare supply chain BPO market is projected to witness significant expansion over the forecast period, owing to regulatory compliance and the increasing focus on eco-friendly practices. Healthcare organizations must adhere to strict regulations, such as GDPR and environmental standards, making outsourcing an attractive solution for ensuring compliance. The increasing pressure to adopt sustainable practices in supply chains encourages healthcare providers to find BPO partners who can assist in minimizing waste, reducing carbon footprints, and implementing eco-friendly initiatives. This shift toward compliance and sustainability is anticipated to drive the regional market.

Asia Pacific Healthcare Supply Chain BPO Market Trends

Asia Pacific healthcare supply chain BPO market is set to experience the fastest growth at a CAGR of 7.3% from 2025 to 2030 due to the integration of advanced technologies such as AI, automation, and blockchain, along with the growth of e-health services. These technologies enhance efficiency, reduce errors, and improve supply chain transparency, allowing healthcare providers to offer better services while minimizing costs. The rise of e-health platforms, which require seamless supply chain operations for the timely delivery of services and products, further boosts the demand for outsourcing, accelerating healthcare supply chain BPO industry growth in the region.

China healthcare supply chain BPO market is projected to grow at the fastest CAGR over the forecast period. Outsourcing non-core functions such as procurement, logistics, and inventory management is becoming increasingly popular among healthcare organizations in China, driving the market demand. By outsourcing these tasks, they can focus on the core function of healthcare delivery while reducing operational costs. In addition, the growing emphasis on chronic disease management necessitates a more efficient and integrated supply chain to ensure consistent delivery of medications and treatments. This demand for specialized services in chronic disease care is expected further to fuel the growth of the market across the country.

Key Healthcare Supply Chain BPO Company Insights

Some of the key companies in the healthcare supply chain BPO industry includeFirstsource;GeBBS (Gebbs Healthcare Solutions); WNS (Holdings) Ltd.; Xerox Corporation; SAP SE; Tecsys Inc.; MCKESSON CORPORATION; Cognizant; Accenture; Genpact; and TATA Consultancy Services Limited.

-

Firstsource offers a range of outsourcing services, including customer management, healthcare BPO, finance and accounting, and digital transformation solutions. It helps businesses enhance operational efficiency, reduce costs, and improve customer experiences across various industries.

-

GeBBS Healthcare Solutions specializes in revenue cycle management, medical coding, billing, payer services, and healthcare analytics. Its solutions enable healthcare organizations to streamline processes, ensure compliance, and improve financial performance across various operational stages.

Key Healthcare Supply Chain BPO Companies:

The following are the leading companies in the healthcare supply chain BPO market. These companies collectively hold the largest market share and dictate industry trends.

- Firstsource

- GeBBS (Gebbs Healthcare Solutions)

- WNS (Holdings) Ltd.

- Xerox Corporation

- SAP SE

- Tecsys Inc.

- MCKESSON CORPORATION

- Cognizant

- Accenture

- Genpact

- TATA Consultancy Services Limited

Recent Developments

-

In November 2024, Blue Ocean Corporation introduced a comprehensive Global Healthcare Training and Consulting Program to transform India’s healthcare sector. This initiative seeks to enhance healthcare delivery, improve operational efficiency, and align industry practices with global standards.

-

In May 2023, Celonis launched its End-to-End Lead Times App designed to help supply chain leaders optimize lead times across procurement, manufacturing, and distribution. The app identifies bottlenecks, highlights process impacts, and accelerates cash conversion while improving service levels.

Healthcare Supply Chain BPO Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.82 billion

Revenue forecast in 2030

USD 3.68 billion

Growth rate

CAGR of 5.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Payer service, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S., Canada, Mexico, U.K., Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, Thailand, South Korea, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Firstsource;GeBBS (Gebbs Healthcare Solutions); WNS (Holdings) Ltd.; Xerox Corporation; SAP SE; Tecsys Inc.; MCKESSON CORPORATION; Cognizant; Accenture; Genpact; and TATA Consultancy Services Limited.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Healthcare Supply Chain BPO Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global healthcare supply chain BPO market report on the basis of payer service, end-use, and region:

-

Payer Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Order Management

-

Inventory Management

-

Transport Management

-

Manufacturing Management

-

Sustainability Services

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Biotechnology and Pharmaceutical Companies

-

Medical Device Companies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global healthcare supply chain BPO market size was estimated at USD 2.68 billion in 2024 and is expected to reach USD 2.82 billion in 2025.

b. The global healthcare supply chain BPO market is expected to grow at a compound annual growth rate of 5.46% from 2025 to 2030 to reach USD 3.68 billion by 2030.

b. North America dominated the healthcare supply chain BPO market with a share of 38.0% in 2024. This is attributable to the growing demand for healthcare BPO services and the rising number of recovery audits.

b. Some key players operating in the healthcare supply chain BPO market include Accenture,, Genpact, Capgemini, Tata Consultancy Services (TCS), HCL Technologies, WNS Global Services, Firstsource Solutions, Xerox Corporation, and GeBBS Healthcare Solutions

b. Key factors that are driving the market growth include a growing number of healthcare organizations, increasing patient inflow, and rising demand for niche services.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.