- Home

- »

- Pharmaceuticals

- »

-

Hearing Loss Disease Treatment Market Size Report, 2030GVR Report cover

![Hearing Loss Disease Treatment Market Size, Share & Trends Report]()

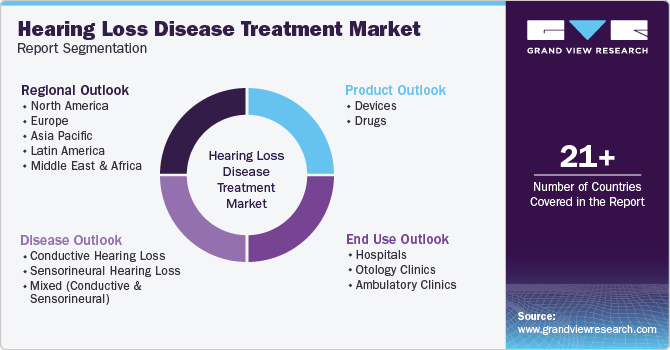

Hearing Loss Disease Treatment Market Size, Share & Trends Analysis Report By Product (Devices, Drugs), By Disease Type (Conductive, Sensorineural), By End-user (Hospitals, Otology Clinics), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-019-9

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

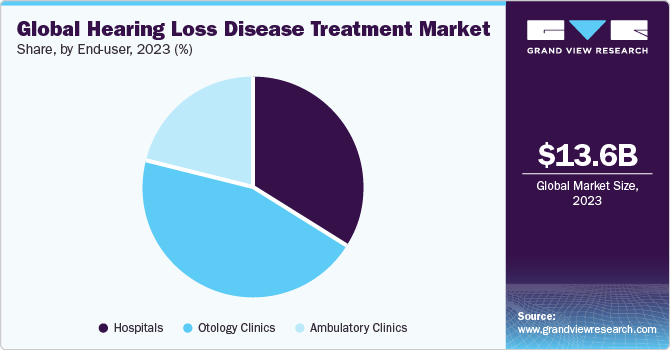

The global hearing loss disease treatment market size was valued at USD 13.62 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 5.25% from 2024 to 2030. Increasing prevalence, rising age-related sensorineural degeneration, and rising awareness among people about the disease are key factors driving the industry's growth. In addition, rising technological advancements in devices and robust pipeline drugs boost industry growth. Realizing the market potential, companies have focused on developing efficient devices and drugs to gain maximum advantage in terms of revenue.

According to WHO, as of 2023, hearing loss is the fourth major disability with nearly 1.5 billion people suffering from it. Increasing prevalence of auditory impairment is one of the major factors boosting the sale of aids. Moreover, increasing noise pollution and growing geriatric population are expected to boost market growth. According to WHO, in 2023, the global prevalence rate is estimated to be nearly 5.0%, of which 93% of patients are adults. Moreover, due to unsafe listening practices, over 1 billion young age people are at risk of permanent but avoidable auditory impairment. Therefore, the global rising prevalence of the disease is driving industry growth.

The research and development pipeline for treatment is active, with various promising technologies and therapies in the works. One of the most promising areas of research is the use of gene therapy to repair or regenerate hair cells in the inner ear. For instance, in February 2023, Sensorion announced R&D day to spread information and give update of their novel gene therapy program.

Another promising area of research is the use of stem cells to regenerate damaged hair cells. Researchers are working on developing techniques to generate functional hair cells from stem cells and transplant them into the inner ear. For instance, in February 2023, Lineage Cell Therapeutics, Inc. is involved in development of allogeneic cell therapies for the treatment. The company is a clinical-stage biotechnology company working on auditory neuronal cell therapy program (ANP1) for the treatment of deafness as well as auditory neuropathy spectrum disorders.

Market Dynamics

The highly technology-driven marketplace has seen the emergence of novel products, including invisible aids, smart-linked aids, and AI-enabled auditory products that can be connected to iOS or Android. For instance, in October 2021, a health-technology company, Audibel, launched an AI hearing aid, Arc-AI, which enables automatic adjustment of audio volume and is available in various styles. Similarly, Phonak introduced the world's first waterproof rechargeable, Audéo Life hearing aid in August 2021. Therefore, such new features and technology are improving patients' experiences, which is anticipated to boost the industry's growth over the forecast period.

According to the WHO, globally, unaddressed hearing loss costs an estimated USD 980 billion annually. This involves health sector costs, societal costs, loss of productivity, and cost of educational support. Low- and middle-income countries incurred 57% of this cost. Such factors create opportunities for companies to solve an unmet need in the region. The government and private organizations continuously strive to raise awareness through various campaigns. For instance, in March 2023, WS Audiology A/S announced the launch of its new campaign to raise awareness about tinnitus. The company introduced a free e-book, which offers information about better management of tinnitus and its treatment.

Along with governments, insurance companies are also emphasizing on new strategies to improve healthcare access to patients with hearing loss. For instance, in March 2021, UnitedHealthcare Hearing announced launch of its Right2You, a virtual care capability for employer-sponsored and Medicare Advantage beneficiaries in the U.S. This new healthcare model is designed to minimize support visits for in-person hearing aids

Product Insights

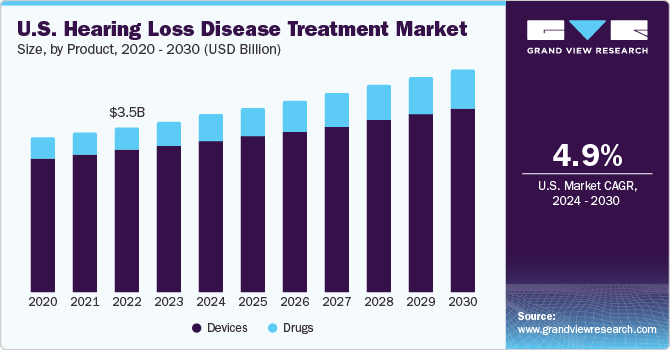

The devices segment dominated the industry in 2023 and accounted for the maximum share of more than 90.65% of the overall revenue. This can be attributed to technological advancements in devices, high prevalence coupled with the rising benefits of devices. Furthermore, in recent years, several innovations in devices have expanded the emerging market across various countries. The devices are widely used for hearing-impaired individuals to reduce hearing problems to improve communication. With developments in technology, the devices offer better sound quality, and noise reduction capabilities. These devices focus on making sounds available in the environment and audible speech for hearing-impaired individuals. In October 2022, Sony Electronics announced the launch of its first over-the-counter hearing aids for the U.S. market. The company developed products in partnership with WS Audiology.

The drugs segment is estimated to register the fastest CAGR over the forecast period due to the launch of new therapeutic products. Drugs are available for several types of hearing problems. This includes standard treatments, such as antibiotic products for ear infections and steroids for sudden auditory loss or inflammation. Systemic steroids are the most prescribed drugs and may help reduce the inflammation and swelling in the inner ear and protect the hair cells and auditory nerve from damage. The ongoing research to investigate new and innovative approaches such as drug delivery systems, stem cell therapy, and gene therapy to prevent or treat hearing loss associated with systematic steroid use is likely to drive the market for drugs.

Disease Type Insights

The sensorineural hearing loss segment dominated the industry in 2023 and accounted for the maximum share of more than 57.04% of the total revenue and is estimated to be the fastest growing segment over the forecast period. This can be attributed to the most common condition observed among patients and the rising number of treatment options. According to NCBI, the incidence of sensorineural hearing loss varies according to country. For example, in the U.S., sudden SNHL affects between 5 and 27 per 100,000 people each year, with approximately 66,000 new annual cases. This type can be mild to profound and is often permanent.

Several types of devices are available for the treatment of sensorineural hearing loss, such as hearing aids, cochlear implants, and bone conduction devices, among others. These products are widely adopted by patients based on individual specific needs and the severity of hearing loss. Sensorion’s SENS-401 is in phase 3 clinical investigation as of September 2023.

End-user Insights

The otology clinics end-user segment, in 2023, accounted for the second-highest share of 45.18% of the overall revenue. The clinics offer evidence-based as well as customized treatment solutions for ear ailments affecting all age groups. These clinics are well-equipped to treat different diseases like acute otitis media, conductive, and sensorineural hearing loss, mixed hearing loss, mastoiditis, and ear disorders. Clinics are cost-effective audiology units with the latest audiometry, tympanoplasty, and hearing aid advice. Thereby, otology clinics play a critical role in the care of a patient with ear-related disorders, improving the quality of life by restoring or preserving the hearing and balance function

Hospitals is estimated to grow at a fastest CAGR over the forecast period as people have access to multiple facilities, such as counseling, medical and surgical treatment, rehabilitation, and follow-up care at hospitals, fueling the segment's growth over the forecast period. In addition, hospitals offer 24/7 services and also hold the patient and family’s loyalty for education, training, and guidance related to medication and post-management of the condition. Furthermore, investments in the automating process of medical and pharmacy insurance information have contributed to easy clearances for patients and payers, offering lucrative opportunities for segment growth in the hearing loss disease treatment market.

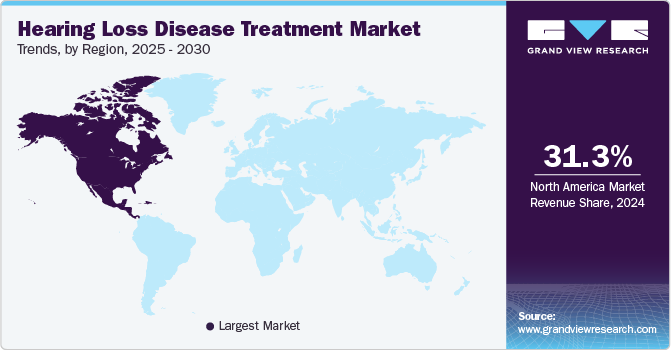

Regional Insights

Europe accounted for the highest share of 38.73% of the overall revenue in 2023 owing to the high consumer awareness about early diagnosis, well-established healthcare system, and favorable reimbursement structures. Presence of a substantial number of providers offering new therapies and devices is fueling market growth in the country. For instance, in May 2022, Acousia Therapeutics GmbH presented its new investigational treatment, ACOU085, for hearing loss at Inner Ear Therapeutics Summit in Boston.

Asia Pacific is expected to be the fastest-growing region from 2024 to 2030 due to the rising number of target patients and funding support to major players in the region.Increased need for novel technologies coupled with presence of market players is likely to have positive impact on the market growth. In September 2022, Tencent Holdings announced launch of its new hearing aid equipped with AI technology in China market. Furthermore, continuous R&D activities in developing countries of Asia Pacific such as China and India are also expected to offer lucrative environment for hearing loss treatment market by 2030.

Key Companies & Market Share Insights

Key players are undertaking strategic initiatives, such as product launches and opting for geographical expansion, strategic collaborations, and partnerships through mergers and acquisitions, which are boosting industry growth.

-

In March 2023, the world’s first bone-conduction nonsurgical hearing aid was launched in India by a startup company WeHear. The company has launched this new hearing aid for the treatment of conductive hearing loss.

-

In February 2023, United Kingdom’s Medicines and Healthcare products Regulatory Agency (MHRA) approved UK clinical trial application for Decibel Therapeutics’ DB-OTO for hearing loss.

-

In January 2023, Inventis and GSI Grason-Stadler entered into strategic partnership to consolidate their distribution network in Italy audiological space.

Key Hearing Loss Disease Treatment Companies:

- Novartis AG

- Acousia Therapeutics GmbH

- Otonomy, Inc.

- Sensorion

- Frequency Therapeutics

- Audifon GmbH & Co. KG

- Pipeline Therapeutics

- Audina Hearing Instruments, Inc.

- Astellas Pharma, Inc.

- WS Audiology A/S

Hearing Loss Disease Treatment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 14.24 billion

Revenue forecast in 2030

USD 19.36 billion

Growth rate

CAGR of 5.25% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, disease type, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Spain; Italy; Denmark; Sweden, Norway; Japan; China; India; Australia; South Korea;Thailand Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Novartis; Otonomy, Inc.; Acousia Therapeutics GmbH; Sensorion; Pipeline Therapeutics; Frequency Therapeutics; Astellas Pharma, Inc.; Audina Hearing Instruments, Inc.; WS Audiology A/S; audifon GmbH & Co. KG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hearing Loss Disease Treatment Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global hearing loss disease treatment market report on the basis of product, disease type, end-user, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Devices

-

Drugs

-

Systemic steroids

-

Antiviral medication

-

Vasodilators

-

Others

-

-

-

Disease Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Conductive Hearing Loss

-

Sensorineural Hearing Loss

-

Mixed (Conductive and Sensorineural)

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Otology clinics

-

Ambulatory clinics

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global hearing loss disease treatment market size was estimated at USD 13.62 billion in 2023 and is expected to reach USD 14.24 billion in 2024.

b. The global hearing loss disease treatment market is expected to grow at a compound annual growth rate of 5.25% from 2024 to 2030 to reach USD 19.36 billion by 2030.

b. Europe dominated the market for hearing loss disease treatment and accounted for the largest revenue share of 38.73% in 2023 owing to the high consumer awareness about early diagnosis, well-established healthcare system, and favorable reimbursement structures.

b. Some key players in the space include Novartis AG; Otonomy, Inc.; Acousia Therapeutics GmbH; Sensorion; Pipeline Therapeutics; Frequency Therapeutics; Astellas Pharma Inc; Audina Hearing Instruments, Inc.; WS Audiology A/S; audifon GmbH & Co. KG and others.

b. Key factors that are driving the hearing loss disease treatment market growth include robust late stage product pipeline, rising prevalence of hearing loss, and technological advancement in hearing aid devices.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."