- Home

- »

- Medical Devices

- »

-

Heart-lung Machine Market Size And Share Report, 2030GVR Report cover

![Heart-lung Machine Market Size, Share & Trends Report]()

Heart-lung Machine Market (2023 - 2030) Size, Share & Trends Analysis Report, By Component (Oxygenators, Pumps, Cannula), By Application, By End-use (Hospitals, Cardiac Centers), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-084-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Heart-lung Machine Market Summary

The global heart-lung machine market size was valued at USD 2.18 billion in 2022 and is projected to grow at a CAGR of 6.9% from 2023 to 2030. The cardiopulmonary bypass (CPB) machine, also known as the heart-lung machine, is a device utilized in cardiac surgeries to take over the functions of the heart and lungs temporarily.

Key Market Trends & Insights

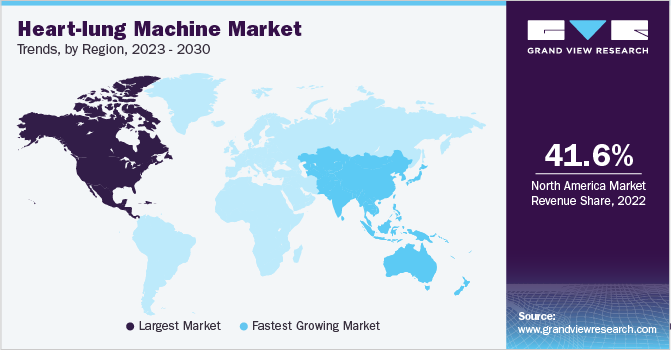

- North America dominated the global heart-lung machine market with the largest revenue share of 41.62% in 2022.

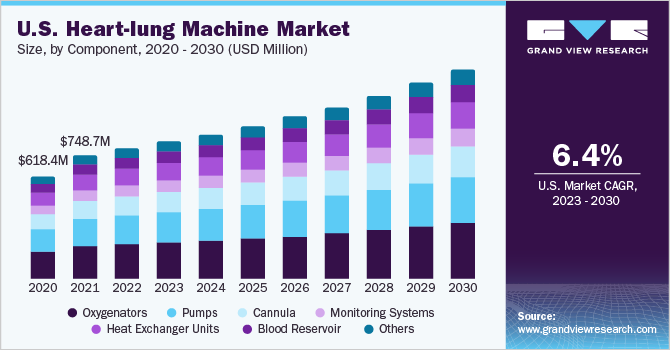

- The heart-lung machine market in the U.S. led the North America market and held the largest revenue share in 2022.

- By component, the oxygenators segment led the market, holding the largest revenue share of 25.87% in 2022.

- By application, the heart valve surgeries segment is expected to grow at the fastest CAGR from 2023 to 2030.

- By end use, the radio hospitals segment held the dominant position in the market in 2022.

Market Size & Forecast

- 2022 Market Size: USD 2.18 Billion

- 2030 Projected Market Size: USD 3.66 Billion

- CAGR (2023-2030): 6.9%

- North America: Largest market in 2022

The market is expected to experience growth due to several factors, including the rising incidence of cardiovascular diseases (CVD), advancements in surgical techniques, and the growing geriatric population. According to the National Heart, Lung, and Blood Institute (NIH), over 2 million individuals worldwide yearly undergo open-heart surgery to address a range of heart-related conditions.

The demand for cardiovascular surgeries is increasing due to factors like an aging population, a higher prevalence of CVDs, advancements in surgical procedures, and improved healthcare accessibility. As a result, there is a growing market demand for CPB machines, which include heart-lung machines, cannulas, oxygenators, pumps, tubing sets, and monitoring systems.

However, the rising producer price indexes for medical equipment and supplies manufacturers in the U.S., along with the associated factors of increased material costs, component shortages, and higher transportation expenses, significantly impact the growth of the cardiopulmonary bypass machine market. The U.S. Bureau of Labor Statistics reported that producer price indexes for medical equipment and supplies manufacturers in the U.S. significantly rose in 2022. The average increase was 3.4%, surpassing the previous (2021) year. The latest price index reached a record high of 4.2% in November 2022. These challenges intensified by the effects of the Covid-19 pandemic and the Russo-Ukrainian war might restrict growth during the forecast period.

A recent study by the University of Alabama at Birmingham reveals a 36% decline in patients undergoing CABG during the COVID-19 pandemic. CABG is a crucial and frequently performed surgery for patients with heart attacks and severe heart vessel disease, as delaying or avoiding the procedure can lead to heart failure and death. In the U.S., approximately 350,000 CABG surgeries are performed annually.

The increasing number of organ transplants, including liver, heart, and lung procedures, is a major driving factor in the market. In 2022, 42,887 organ transplant procedures were performed in the U.S., which indicates a growing demand for these life-saving surgeries. Notably, liver transplants accounted for 9,528 procedures, while heart and lung transplants reached record-breaking numbers of 4,111 and 2,692, respectively. These complex procedures often require CPB machines, crucial in maintaining vital functions during surgery. As the demand for organ transplants continues to rise, the need for advanced CPB machines and related equipment will increase, driving growth during the forecast period.

Hospitals and healthcare facilities serve as catalysts in driving the adoption of technological advancements in the CPB machine market. They actively integrate these advancements into their cardiac surgery practices to enhance patient outcomes and increase access to advanced treatment options. For instance, in April 2023, LivaNova PLC introduced the Essenz Heart-Lung Machine (HLM) and Essenz Patient Monitor to enhance clinical efficiency and elevate patient care during CPB procedures. These advanced devices have obtained FDA clearance and are implemented at the Franciscan Health Heart Center in Indianapolis. As a result, they play a significant role in driving the market's growth.

Components Insights

Based on component, the oxygenators segment accounted for the largest revenue share of 25.87% in 2022. Oxygenators play a critical role in CPB procedures by removing carbon dioxide and adding oxygen to the blood, effectively replacing the lungs' respiratory function. This crucial function of oxygenators in ensuring adequate blood oxygenation, thereby sustaining life throughout the body and organs, is a major driving factor in the market. As a result of this demand, the market for oxygenators has seen the launch of new advanced products. Manufacturers and companies continually develop and introduce innovative oxygenator designs and technologies to enhance safety, efficiency, and patient outcomes during CPB procedures. In November 2021, the Vitasprings Spiral Diversion Integrated Membrane Oxygenator, developed by Micropart Kewei, a subsidiary of MicroPort Scientific Corporation, received approval from the National Medical Products Administration (NMPA) of China to enter the 'Green Path' special approval procedure for innovative medical devices.

The monitoring systems segment is also expected to grow significantly over the forecast period. The monitoring systems segment in the cardiopulmonary bypass machine market drives growth by providing real-time data and feedback during cardiac surgeries, emphasizing patient safety, and benefiting from technological advancements. The demand for continuous monitoring, adherence to regulatory standards, and the increasing volume of cardiac surgeries also contribute to its expansion, making monitoring systems crucial for patient well-being and surgical success.

Application Type Insights

Based on application type, the coronary artery bypass grafting (CABG) segment accounted for the largest revenue share of 31.07% in 2022. The CABG segment plays a significant role in driving the growth of the CPB machine market, primarily due to the rising incidence of CVD and the increasing demand for bypass surgeries. CPB machines are essential tools in assisting surgeons during CABG procedures by temporarily assuming the functions of the heart and lungs. Furthermore, the market is propelled by advancements in surgical techniques, the expanding aging population, and the continuous development of CPB machine technologies.

The heart valve surgeries segment is also expected to grow significantly over the forecast period. Heart valve surgery is a significant procedure for repairing or replacing damaged heart valves. The field of heart valve surgery and CPB machines have experienced advancements due to factors like the increasing prevalence of heart valve disorders. According to the Texas Heart Institute, surgeons in the U.S. perform approximately 106,000 heart valve operations each year.

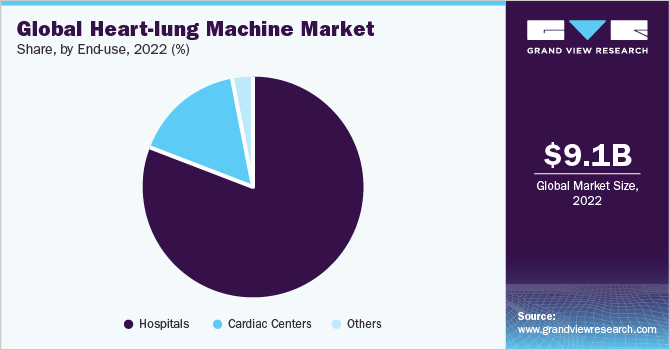

End-use Insights

On the basis of end-use, the hospital's segment accounted for the largest revenue share of 81.07% in 2022 owing to factors such as the increasing prevalence of CVD, advancements in surgical procedures, and the rising demand for cardiac surgeries. The aging population contributes to the market's growth, increasing the likelihood of developing heart valve diseases and other cardiovascular conditions. According to a recent report from the UN, the global population of individuals aged 65 years or older is projected to double in the next 30 years. By 2050, the elderly population is estimated to reach 1.6 billion, representing over 16% of the global population. This demographic trend drives the demand for heart valve surgeries and fuels the market's growth for CPB machines.

The cardiac center segment is expected to experience substantial growth in the market over the forecast period. The increasing demand for specialized cardiac care, advancements in CVD procedures, and the rising number of cardiac surgeries are factors driving the growth of the cardiac center segment. As cardiac centers play a crucial role in providing comprehensive cardiovascular care and performing complex surgeries, the demand for CPB machines in these facilities is anticipated to rise, contributing to the market's growth.

Regional Insights

North America accounted for the largest revenue share of 41.62% in 2022. This was primarily driven by factors such as a high prevalence of heart disease, a substantial aging population, and a robust healthcare infrastructure, all contributing to the region's growth. Research suggests that the general U.S. population is expected to experience an increase in all four cardiovascular risk factors from 2025 to 2060. Notably, stroke and heart failure are projected to have the highest rate increases, impacting 15 million and 13 million individuals, respectively. Ischemic heart disease is expected to affect 29 million people, with a significant rise of 30.7%, while heart attack rates are projected to increase by 16.9%, impacting 16 million individuals. These findings underscore the growing burden of CVD in the country, indicating a potential increase in demand for cardiopulmonary bypass machines during the forecast period.

The Asia Pacific region is expected to witness significant market growth during the forecast period. This growth can be attributed to various factors, such as an aging population, a high prevalence of CVD, and advanced healthcare infrastructure. In addition, favorable government policies, increased awareness of CPB machines, and substantial investments in research and development activities contribute to the expansion of the market. These factors collectively drive the adoption and demand for CPB machines, leading to the overall growth of the market in the Asia Pacific region.

Key Companies & Market Share Insights

Key players are introducing advanced products at affordable prices to increase their market share and implementing strategic initiatives, such as acquisitions, mergers, and collaborations, to maximize their market dominance.

For instance, in September 2022, LivaNova received FDA 510(k) clearance for its Essenz heart-lung machine (HLM), allowing the company to launch it commercially in the U.S. Essenz HLM has also been approved by Health Canada and the Japanese PMDA. Earlier, LivaNova introduced Essenz in Europe through a limited commercial launch. These regulatory clearances and commercial launches signify LivaNova's global expansion and increased accessibility of the Essenz heart-lung machine. Some of the prominent key players in the global heart-lung machine market include:

-

Medtronic

-

Terumo Europe NV

-

LivaNova, Inc.

-

Getinge

-

Braile Biomédica

-

NIPRO

-

Tianjin Welcome Medical Equipment Co., Ltd.

-

ELITE LIFECARE

-

Hemovent GmbH

-

MERA (Senko Medical Instrument Mfg. Co., Ltd.)

-

Technowood International Pte. Ltd.

Heart-lung Machine Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2.30 billion

Revenue forecast in 2030

USD 3.66 billion

Growth rate

CAGR of 6.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Medtronic; Terumo Europe NV; LivaNova, Inc.; Getinge; Braile Biomédica; NIPRO; Tianjin Welcome Medical Equipment Co., Ltd.; ELITE LIFECARE; Hemovent GmbH; MERA (Senko Medical Instrument Mfg. Co., Ltd.); Technowood International Pte. Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Heart-lung Machine Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the global heart-lung machine market report on the basis of component, application, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Oxygenators

-

Pumps

-

Cannula

-

Monitoring Systems

-

Heat Exchanger Units

-

Blood Reservoir

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Coronary Artery Bypass Grafting (CABG)

-

Heart Valve Surgeries

-

Heart Transplant

-

Lung Transplant

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Cardiac Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global heart-lung machine market size was estimated at USD 2.18 billion in 2022 and is expected to reach USD 2.30 billion in 2023.

b. The global heart-lung machine market is expected to grow at a compound annual growth rate of 6.9% from 2023 to 2030 to reach USD 3.66 billion by 2030.

b. North America region dominated the global heart-lung machine market in 2022 with the largest market share of 41.62%. This significant market share is primarily attributed to factors such as a high incidence of heart disease, a sizable aging population, and a strong healthcare infrastructure. These factors collectively contributed to the growth of the North American region.

b. Some key players operating in the heart-lung machine market include Medtronic, Terumo Europe NV, LivaNova, Inc., Getinge, Braile Biomédica, NIPRO, Tianjin Welcome Medical Equipment Co., Ltd., ELITE LIFECARE, Hemovent GmbH, MERA (Senko Medical Instrument Mfg. Co., Ltd.), Technowood International Pte. Ltd.

b. Key factors that are driving the heart-lung machine market growth include increasing demand for cardiac surgeries and continuous technological advancements in the cardiopulmonary bypass machine.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.