- Home

- »

- Medical Devices

- »

-

Heart Pump Device Market Size And Share Report, 2030GVR Report cover

![Heart Pump Device Market Size, Share & Trends Report]()

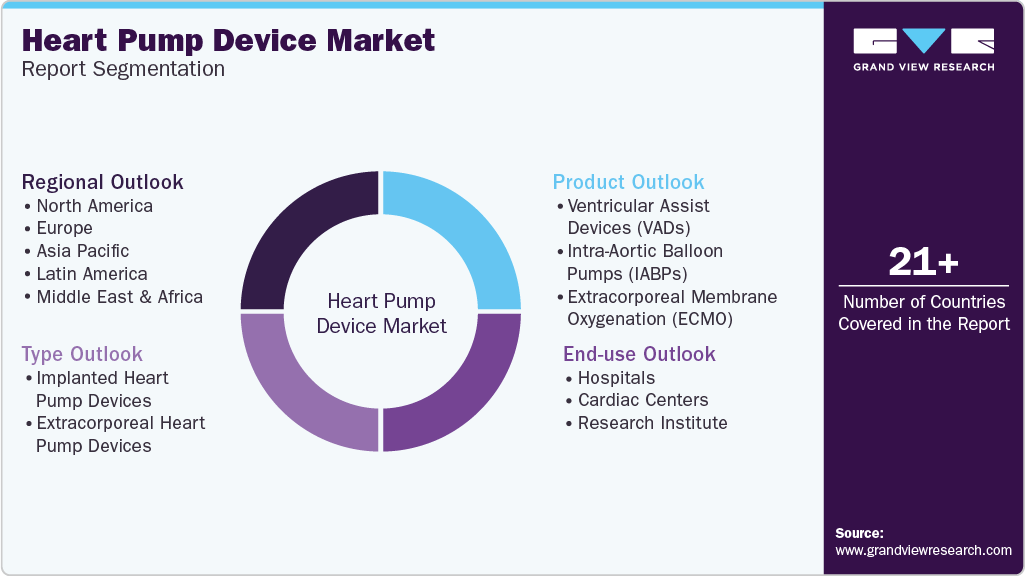

Heart Pump Device Market Size, Share & Trends Analysis Report By Type, By Product (Ventricular Assist Devices, Total Artificial Hearts, Intra-Aortic Balloon Pumps, Extracorporeal Membrane Oxygenation), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-071-5

- Number of Pages: 147

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Healthcare

Heart Pump Device Market Size & Trends

The global heart pump devices market size was estimated at USD 2.65 billion in 2023 and is expected to grow at a CAGR of 13.5% from 2024 to 2030. The increasing prevalence of heart diseases, such as coronary heart diseases and cardiovascular diseases, growing demand for technologically advanced products, and growing approval from the regulatory bodies are propelling the industry's growth. According to the CDC, approximately 12.1 million Americans will be suffering from atrial fibrillation by 2030.

The increasing regulatory approval of heart pump devices is expected to boost market growth. For instance, in October 2023, Anumana, Inc., a cutting-edge AI-driven health technology firm and a constituent of the reference portfolio, formally announced the receipt of U.S. FDA 510(k) clearance for its revolutionary medical advancement - ECG-AI LEF. This AI-powered medical device is meticulously tailored for the identification of low ejection fraction in individuals flagged as susceptible to heart failure development. The collaboration with Mayo Clinic highlights Anumana's commitment to pioneering solutions at the intersection of Artificial Intelligence (AI) and healthcare. Such initiatives boost market growth.

Collaborative efforts allow the merging of knowledge and technical know-how from various participants in the industry. By combining insights from different organizations, researchers gain a more comprehensive understanding of the complex challenges associated with heart pump devices. This shared knowledge leads to more effective solutions, improved device designs, and enhanced patient outcomes.

For instance, in January 2024, Ultromics, a health technology enterprise centered on patient outcomes and propelled by AI, originating from the University of Oxford, UK, forged a collaborative agreement with Pfizer. The objective was to bolster the validation process and secure FDA clearance for Ultromics' AI-driven technology dedicated to detecting cardiac amyloidosis. Within this alliance, Ultromics will undertake research efforts to achieve FDA clearance for its EchoGo Amyloidosis algorithm, a medical device with Breakthrough Device Designation specifically designed to identify cardiac amyloidosis. Leveraging deep learning techniques, the algorithm analyses routine echocardiograms, revealing cardiac amyloidosis cases that often evade detection during standard assessments.

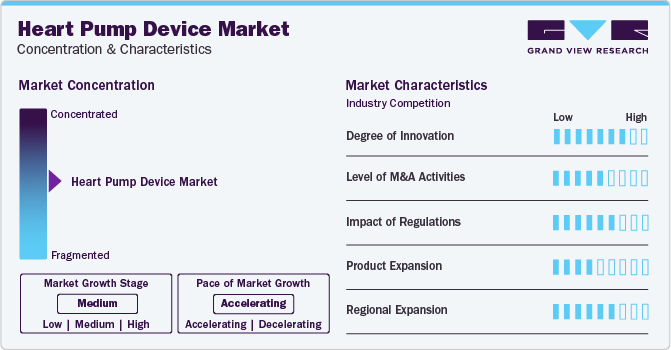

Market Characteristics & Concentration

The heart pump device market is moderately consolidated, with leading players introducing novel products. The market growth stage is high, and the pace of market growth is accelerating. For instance, in December 2022, the Impella ECP Pivotal clinical trial, designed to evaluate the impact of Impella ECP on major adverse cardiovascular and cerebrovascular events (MACCE) in high-risk percutaneous coronary intervention (PCI) procedures, received approval from the U.S. FDA for a new version of the device.

The market is witnessing continuous research and development aimed at advancing cardiac care. For instance, in August 2023, Abbott presented a clinical trial of MOMENTUM 3 regarding the assessment of the HeartMate 3 heart pump devices at the 2022 European Society of Cardiology Congress in Barcelona, Spain. It showed that this device extended the survival of advanced heart failure patients by at least five years.

A moderate level of M&A activities characterizes the heart pump device market. The key reason for the frequent acquisitions in this market is the technological strength of small players with their robust product pipelines. It allows the key players to improve their market share, expand their product portfolio, and provide opportunities to be the first entrant into a niche market segment. For instance, in December 2023, Johnson & Johnson Service Inc. acquired Abiomed, Inc. with an aim to expand its cardiovascular portfolio. This acquisition is expected to have a positive impact on market growth.

The stringent regulatory framework for the approval and commercialization of heart pump devices s impedes market growth. Furthermore, compliance with regulatory standards further results in product recall, which reduces patient and healthcare participant confidence. For instance, in December 2022, Teleflex Incorporated recalled Arrow AutoCAT 2 and AC3 Intra-Aortic Balloon Pumps were recalled by Arrow International, LLC, a part of Telex Incorporated, due to battery power issues such as the battery draining fast and showing inaccurate indications.

Key companies in the heart pump devices market are also focusing on market expansion. For instance, in October 2023, CorWave SA opened a new production facility to support its commercial and clinical trial phase activities on the banks of the Seine in Clichy, next to Paris.

Type Insights

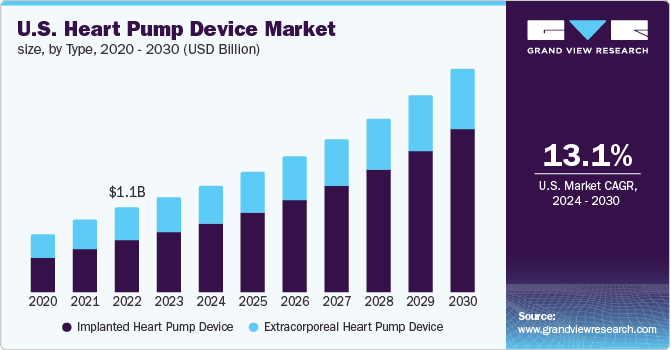

Implanted heart pump devices dominated the revenue market share and accounted for 68.3% in 2023. These devices assume the heart's pumping function by continuously circulating blood from the ventricles throughout the body. The rising prevalence of heart failure and technological advancements in implanted heart pump devices drives market growth. Improved durability, smaller sizes, and enhanced control systems are making these devices more accessible & effective for a wider range of patients. For instance, in January 2022, IIT-Kanpur, India, introduced Hridyantra, an initiative focused on creating advanced implanted heart pump devices, including artificial hearts, to aid individuals suffering from end-stage heart failure.

The extracorporeal heart pump devices segment is also expected to grow significantly over the forecast period. Extracorporeal heart pump products are external devices that temporarily support the heart by pumping blood outside the body and returning it to the circulatory system. They effectively treat acute HF and are used as a bridge to transplantation. The rising prevalence of heart disease and the shortage of donor hearts have driven the demand for extracorporeal products.

Product Insights

The ventricular assist device (VAD) segment dominated the market in 2023 and accounted for the maximum revenue share of 66.8%. VADs are mechanical devices that assist with pumping blood from the heart's ventricles to the rest of the body. They are typically used as a temporary solution while awaiting a heart transplant but are also increasingly being used as a long-term treatment option for HF patients who are not candidates for transplantation.

Market players' introduction of new and advanced VADs is a key factor driving the segment's growth. These products are designed to be more effective, user-friendly, and affordable, which is expected to increase the demand for VADs even further. For instance, in August 2022, Abbott Laboratories disclosed data revealing that patients with advanced heart failure who received its HeartMate 3 LVAD had higher survival rates after five years than those who received the older HeartMate II LVAD. The HeartMate 3 demonstrated a 58% survival rate over the five years, compared to the HeartMate II's 44% survival rate. This is mainly due to decreased deaths related to stroke, clotting, and bleeding associated with the newer device.

The total artificial hearts (TAH) segment is anticipated to register the fastest CAGR growth over the forecast period. The TAHs have been growing due to advancements in technology and their ability to offer a viable solution for patients with end-stage HF who are awaiting a heart transplant. For instance, as of February 2024, a notable expansion in the artificial heart implantation landscape occurred, a total of 60 centers, approximately 40 in the U.S. and an additional 20 internationally, have received the necessary training to perform these life-saving procedures.

End-use Insights

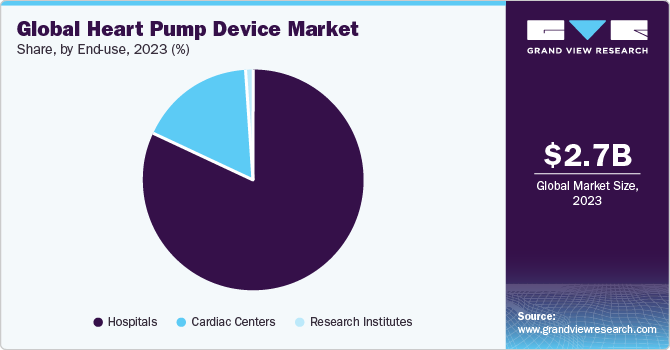

The hospital segment accounted for the highest share of 81.4% of the global revenue in 2023. This growth can be attributed to the increasing number of surgical procedures being performed globally due to the rising incidence of cardiovascular diseases and the availability of skilled professionals and novel heart pump products.

The cardiac centers segment is expected to grow at the fastest CAGR over the forecast period owing to the increasing preference of individuals to undergo surgical interventions in cardiac centers. Leading cardiac centers, such as the Cleveland Clinic in the U.S., St. Thomas' Hospital in the UK, and the German Heart Center Munich in Germany, exemplify the demand for heart pump devices. These centers are renowned for their expertise in treating complex cardiac conditions and are often early adopters of cutting-edge technologies, driving the adoption of heart pump devices and shaping the market landscape.

Regional Insights

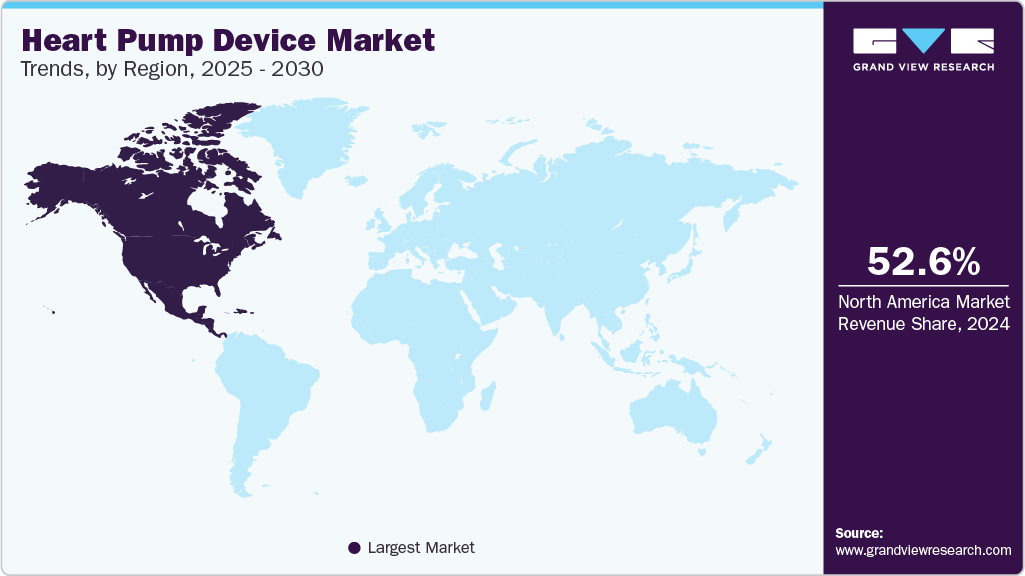

North America heart pump device market dominated and accounted for 52.7% of the total market share in 2023. The rising incidence of cardiovascular disease, advanced healthcare infrastructure, and the presence of key players. In addition, the increasing number of patients undergoing surgeries and the rising awareness about minimally invasive surgeries are expected to propel market growth in North America.

U.S. Heart Pump Device Market Trends

U.S. heart pump devices market dominated the market with a revenue share of 90.78% in 2023 and is expected to grow at significant CAGR during the forecast period. In the U.S., advanced healthcare infrastructure and the growing patient pool, and the increasing number of new product launches are some of the major factors expected to propel market growth over the forecast period.

Europe Heart Pump Device Market Trends

Heart Pump devices market in Europe held the second largest revenue market share during the year 2023.Heart failure is a significant healthcare challenge globally, with Europe having more than 15 million people living with the condition. This number is expected to rise in the coming years, indicating a growing need for advanced treatment options such as heart pumps.

Germany heart pump device market dominated the market with the highest revenue share of 21.4% in 2023. Coronary Heart Disease (CHD) remains the leading cause of death in Germany, with 121,172 deaths attributed to it in 2021, including 45,181 from acute heart attacks, according to Deutscher Herzbericht 2022.

Heart pump device market in UK held the second largest market share in 2023. The prevalence of cardiovascular diseases, such as coronary artery disease, ischemic heart disease, and other heart-related disorders in the UK is expected to increase the demand for heart pump devices.

France heart pump device market is anticipated to witness significant CAGR of 14.0% during the forecast period. Growth in France is likely to be driven by rising incidence of cardiovascular diseases, growing number of hospitals & clinics, and lifestyle changes in the population.

Asia Pacific Heart Pump Device Market Trends

Asia Pacific Heart Pump Devices Market is projected to register the fastest CAGR of 14.0% during the forecast period. The increasing health awareness, a developing private hospital sector, growing government support & spending, the rising prevalence of cardiovascular diseases, and the growing availability of insurance policies are likely to contribute to market growth over the coming decade.

Heart pump device market in China held the largest revenue market share of 22.9% in 2023. The Annual Report on Cardiovascular Health and Diseases in China (2021) estimated that approximately 8.9 million patients in China suffer from heart failure. In addition, in March 2023, Yongrenxin Medical Instrument Co. Ltd. secured nearly USD 100 million in a series A funding to develop a platform for treating heart failures.

Japan heart pump device market held the second largest market share in the Asia Pacific region. Heart disease is the second-leading cause of mortality in Japan, with CHD accounting for about half of heart disease-related deaths. In October 2023, the Icahn School of Medicine at Mount Sinai announced a collaboration with the Chiba Institute of Technology (CIT) to use Artificial Intelligence (AI) for cardiovascular disease research.

Heart pump device market in India is expected to grow at the significant CAGR of 14.1% during the forecast period. Hospital-based studies conducted in Trivandrum and the All-India Institute of Medical Sciences (AIIMS) indicate that rheumatic heart disease (RHD) and coronary artery disease (CAD) are significant contributors to heart failure cases in India. Heart failure stands out as the most common reason for cardiac-related hospitalizations, affecting approximately 1% of the general population annually, which translates to an estimated 8 to 10 million patients.

Central & South America Heart Pump Device Market Trends

In Latin America, the heart pump device market is driven by several factors. One key driver is the increasing prevalence of cardiovascular diseases in the region, particularly among the aging population. The rise in lifestyle-related risk factors such as obesity and diabetes also contribute to the growing demand for heart pump devices.

The heart pump device market in Mexico is expected to grow due to various factors, such as the high incidence of chronic heart diseases, a growing population and increasing prevalence of cardiovascular diseases, there is a rising demand for advanced cardiac therapies. The market is witnessing a shift toward more innovative and efficient devices, driven by advancements in technology and increasing awareness among healthcare providers & patients.

Middle East & Africa Heart Pump Device Market Trends

MEA heart pump devices market is expected to grow at a lucrative growth. The region faces a significant burden of cardiovascular diseases, including heart failure, which has led to an increased demand for advanced cardiac therapies. With a rising aging population and an increase in lifestyle-related risk factors, such as hypertension & diabetes, the need for innovative solutions in cardiac care is becoming more pronounced.

Heart pump device market in South Africa held the largest revenue market share of 33.3% during 2023. Another trend driving the market is the growing prevalence of cardiovascular diseases in South Africa, particularly among the aging population. This has created a higher demand for advanced cardiac therapies, including heart pump devices and artificial hearts, to improve patient care & outcomes.

Key Heart Pump Device Company Insights

Leading companies in the heart pump devices market are enhancing their offerings and incorporating new technologies to expand their customer reach, secure a greater market share, and diversify their application range. For example, Evaheart, Inc. launched a Lunch-and-Learn program for the Penn State staff in Hershey, Pennsylvania involved in the competence clinical trial. This program facilitates staff to seek clarifications and discuss the prospects of the EVA2 LVAD

Key Heart Pump Device Companies:

The following are the leading companies in the heart pump device market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott

- ABIMOD (Johnson & Johnson Services, Inc.)

- Getinge AB.

- LivaNova PLC

- Berlin Heart

- Picard Medical, Inc. (SynCardia Systems, LLC)

- Jarvik Heart

- BiVACOR Inc.

- Leviticus Cardio

- Teleflex Incorporated.

Recent Developments

-

In November 2023, BiVACOR Inc. received USD 13 million as a grant from the Australian Government's Medical Research Future (MRFF) under the Artificial Heart Frontiers Program (AHFP) to support clinical trials for total artificial heart devices.

-

In April 2023, Abbott obtained two new authorizations from the U.S. FDA for its leading life support system, CentriMag Blood Pump. With this clearance, the CentriMag Blood Pump can be used longer-term in adults during ECMO procedures. Furthermore, the company also obtained FDA authorization for its CentriMag Preconnected Pack for urgent.

-

In April 2022, Abimod Inc. announced that the first heart failure patient in Japan has been treated with Impella 5.5 SmartAssist. This move is anticipated to drive market growth.

Heart Pump Device Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.01 billion

Revenue forecast in 2030

USD 6.44 billion

Growth rate

CAGR of 13.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type, product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Mexico; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Abbott; ABIMOD; Getinge AB;LivaNova PLC; Berlin Heart; Picard Medical Inc. (SynCardia Systems LLC); Jarvik Heart; BiVACOR Inc.; Leviticus Cardio; Teleflex Incorporated

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Heart Pump Device Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global heart pump device market report based on type, product, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Implanted Heart Pump Devices

-

Extracorporeal Heart Pump Devices

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Ventricular Assist Devices (VADs)

-

Left Ventricular Assist Devices (LVADs)

-

Right Ventricular Assist Devices (RVADs)

-

BiVAD Ventricular Assist Devices (BiVADs)

-

Percutaneous Ventricular Assist Devices (PVADs)

-

-

Total Artificial Hearts (TAH)

-

Intra-Aortic Balloon Pumps (IABPs)

-

Extracorporeal Membrane Oxygenation (ECMO)

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Cardiac Centers

-

Research Institutes

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Mexico

-

Brazil

-

Argentina

-

-

Middle East & Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global heart pump devices market size was estimated at USD 2.65 billion in 2023 and is expected to reach USD 3.01 billion in 2024.

b. The global heart pump devices market is expected to grow at a compound annual growth rate of 13.5% from 2024 to 2030 to reach USD 6.44 billion by 2030.

b. The ventricular assist devices (VADs) segment accounted for the largest share of the market in 2023, and it is estimated to register the fastest CAGR of 14.8% during the forecast period. VADs are mechanical devices that assist with pumping blood from the heart’s ventricles to the rest of the body. They are typically used as a temporary solution while awaiting a heart transplant but are also increasingly being used as a long-term treatment option for HF patients who are not candidates for transplantation.

b. Some key players operating in the heart pump devices market include Abbott, ABIOMED; CorWave SA; LivaNova PLC; Berlin Heart; SynCardia Systems, LLC; Jarvik Heart; BiVACOR Inc.; Leviticus Cardio; Evaheart, Inc.; Teleflex Incorporated; Getinge AB., CARMAT, Fresenius SE & Co. KGaA

b. Key factors that are driving the market growth include the increasing prevalence of cardiovascular diseases, the growing aging population, and advancements in technology leading to the development of more efficient and effective heart pump devices.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."